Staking Stats

- Reward Rate (APR)

- ≈ 14.07%

- Reward Frequency

- every block

- Lockup Period

- 30d

- DAIC Commission

- 5%

- Staked with us

- 1.1M DYDX

DYDX Rewards

The staking reward for DYDX is currently estimated at 14.07% per year. DYDX rewards are awarded every block by the dYdX network. The minimum lockup period is 30d.

DYDX Staking Calculator

- Staked DYDX

- 460 DYDX

- $998.2

- Earnings at

- 14.07% APR

- Monthly

- 5.1 DYDX equals $11.1

- Yearly

- 61.5 DYDX equals $133.4

Stake Now

How to Stake DYDX

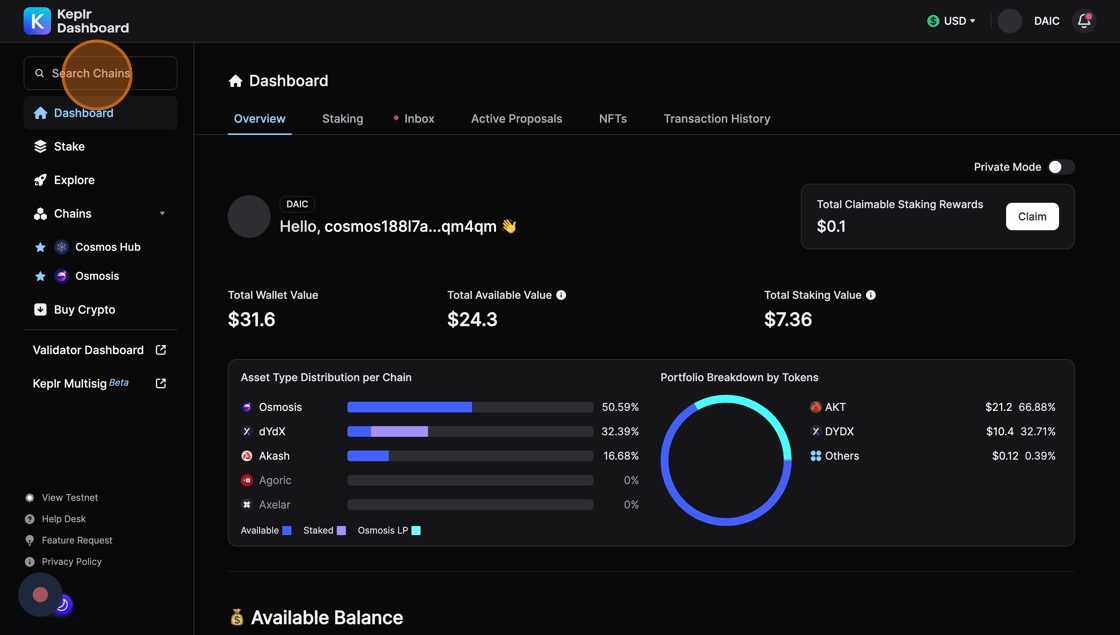

1. Navigate to https://wallet.keplr.app/

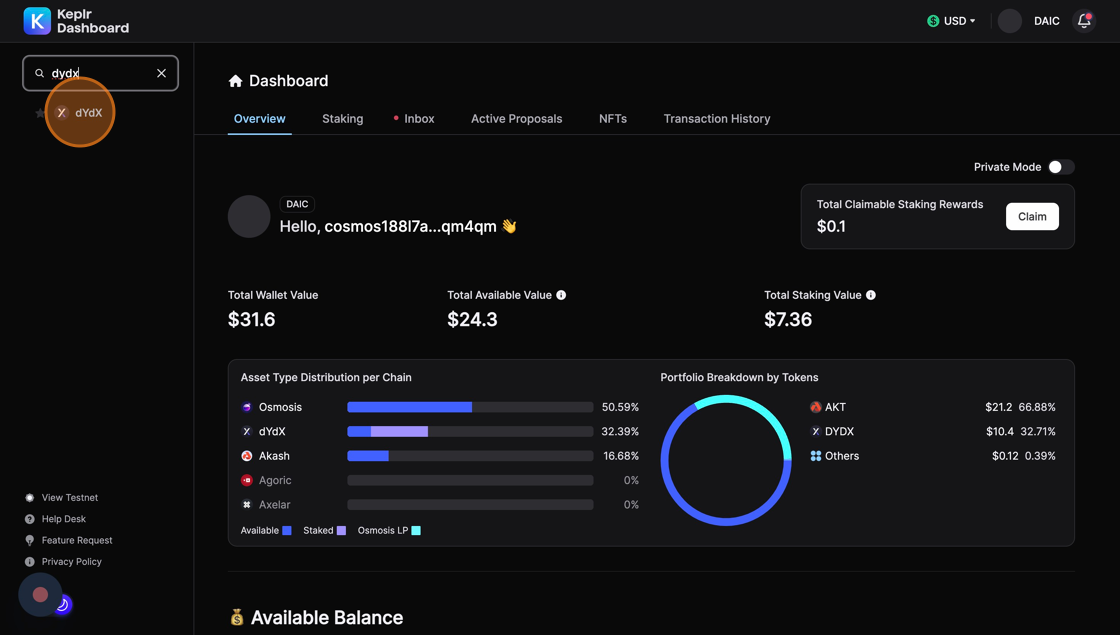

2. Click the Search Chains field and type dYdX

3. Click dYdX

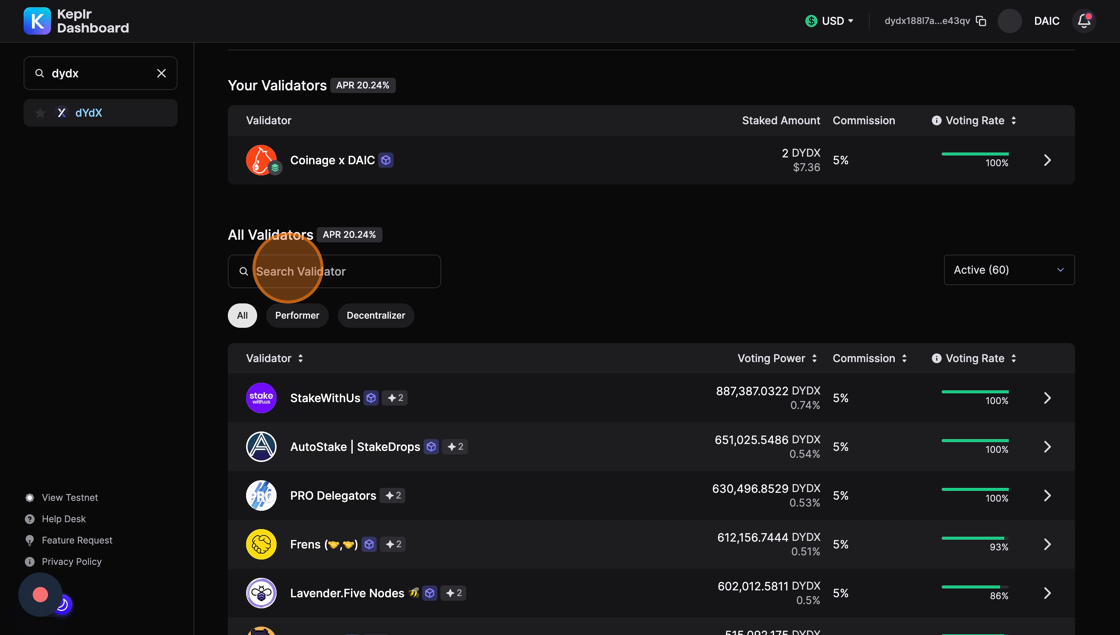

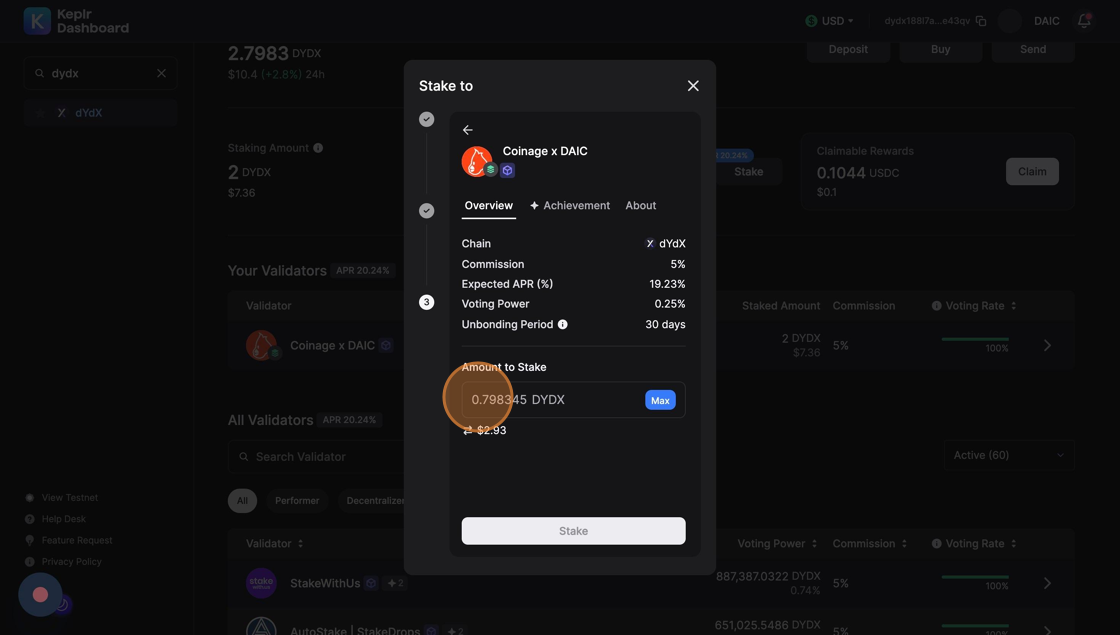

4. Click the Search Validator field and type Coinage x Daic

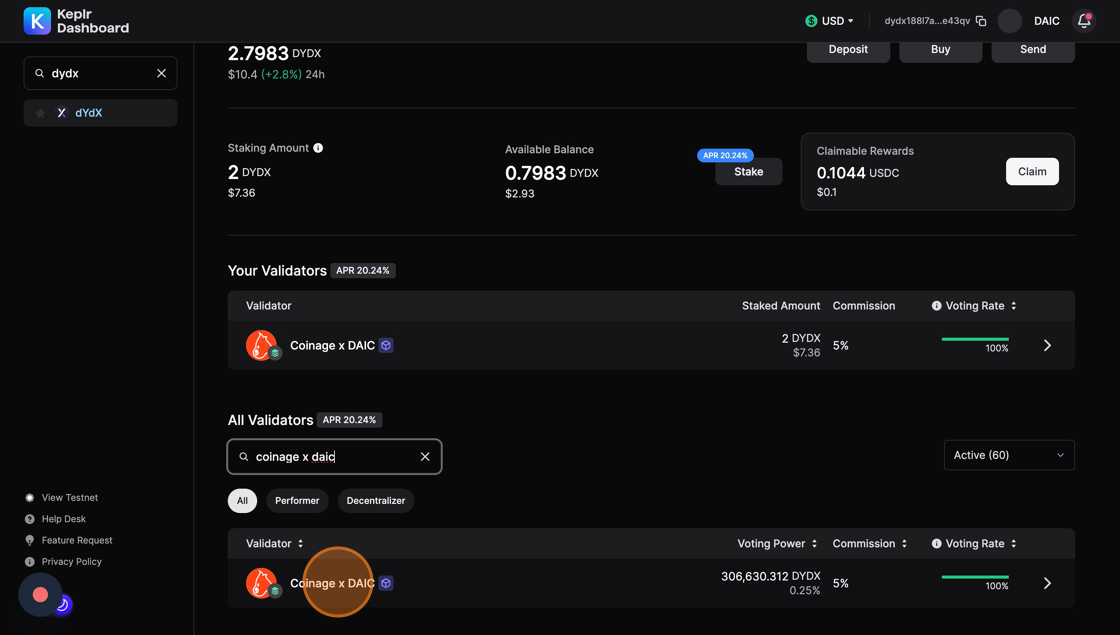

5. Click Coinage x DAIC

6. Click Stake

- Click the Amount field, enter the number of dYdX tokens you want to stake and Click Stake

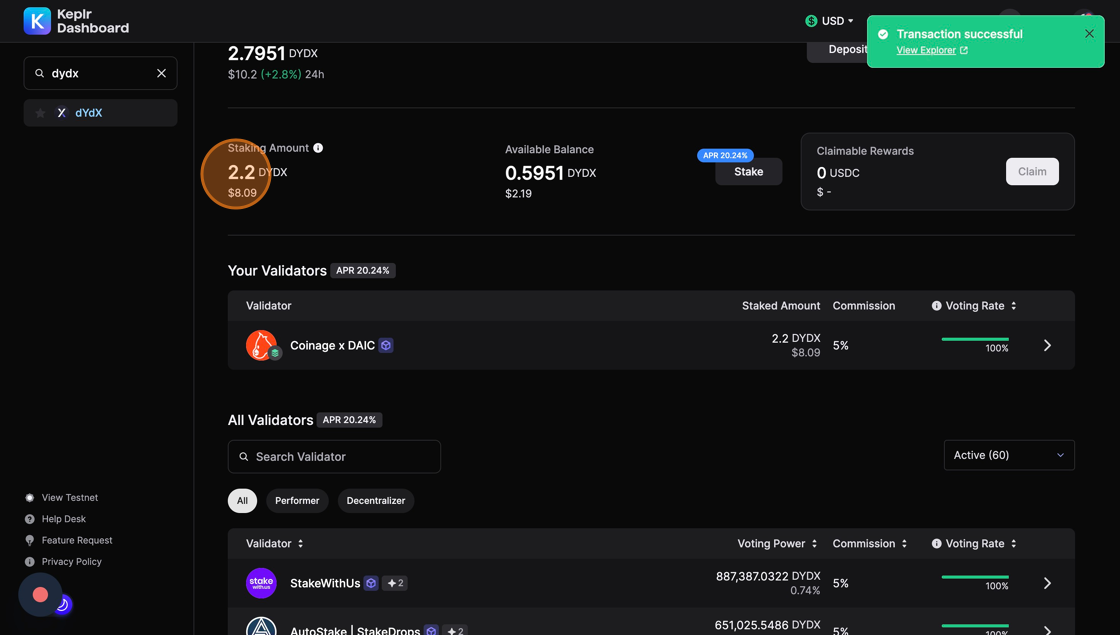

10. Approve the Keplr wallet transaction pop-up

11. Congratulations! Your KUJI tokens have been staked

About dYdX (DYDX)

The dYdX Exchange is a powerful, decentralized trading platform specializing in perpetual contracts for cryptocurrencies. It emphasizes low fees, deep liquidity, and leveraged trading up to 20×. Key features include self-custody of funds, a variety of tradable markets with frequent new listings, rewards for trading, quick onboarding with existing crypto wallets, governance participation, and a competitive fee structure.

Links:

Learn More About dYdX

dYdX Staking FAQ

How much can I make staking dYdX?

The return from staking dYdX varies based on the network's overall staking participation, real yield, and specific validator commission. Rewards are paid in USDC tokens.

How do I receive my dYdX rewards?

dYdX rewards need to be claimed. Visit the Keplr dashboard to claim your staking rewards

When can I start earning rewards with dYdX?

You can start earning staking rewards as soon as your tokens are successfully delegated to a validator.

Can I sell dYdX while it is staked?

Staked dYdX tokens cannot be sold,they need to be unstaked first. The unstaking period for dYdX is 30 days.

What are the risks around staking dYdX?

Staking dYdX comes with risks like slashing (penalty for the validator), price volatility, and liquidity risk (inability to sell during the lock-up period).

What consensus algorithm does dYdX use?

dYdX chain is based on the Cosmos SDK and CometBFT proof-of-stake consensus protocol.

What are the tokenomics of dYdX?

Read all about dYdX tokenomics here

Stake DYDX with Coinage x DAIC

Stake your DYDX with Coinage x DAIC, a leading validator with a proven track record of successfully managing blockchain infrastructure over several years, DAIC.capital has securely attracted over 31,279 unique stakers and holds more than $176.2M in total value staked across 44 chains. This impressive milestone not only demonstrates our wide-ranging expertise but also reflects the deep trust the community places in our stewardship.