Staking Stats

- Reward Rate (APR)

- ≈ 7%

- Reward Frequency

- every block

- Lockup Period

- 21d

- DAIC Commission

- 5%

- Staked with us

- 4.7K KAVA

KAVA Rewards

The staking reward for KAVA is currently estimated at 7% per year. KAVA rewards are awarded every block by the Kava network. The minimum lockup period is 21d.

KAVA Staking Calculator

- Staked KAVA

- 1.5K KAVA

- $999.6

- Earnings at

- 7% APR

- Monthly

- 8.1 KAVA equals $5.5

- Yearly

- 97.4 KAVA equals $66.5

Stake Now

How to Stake KAVA

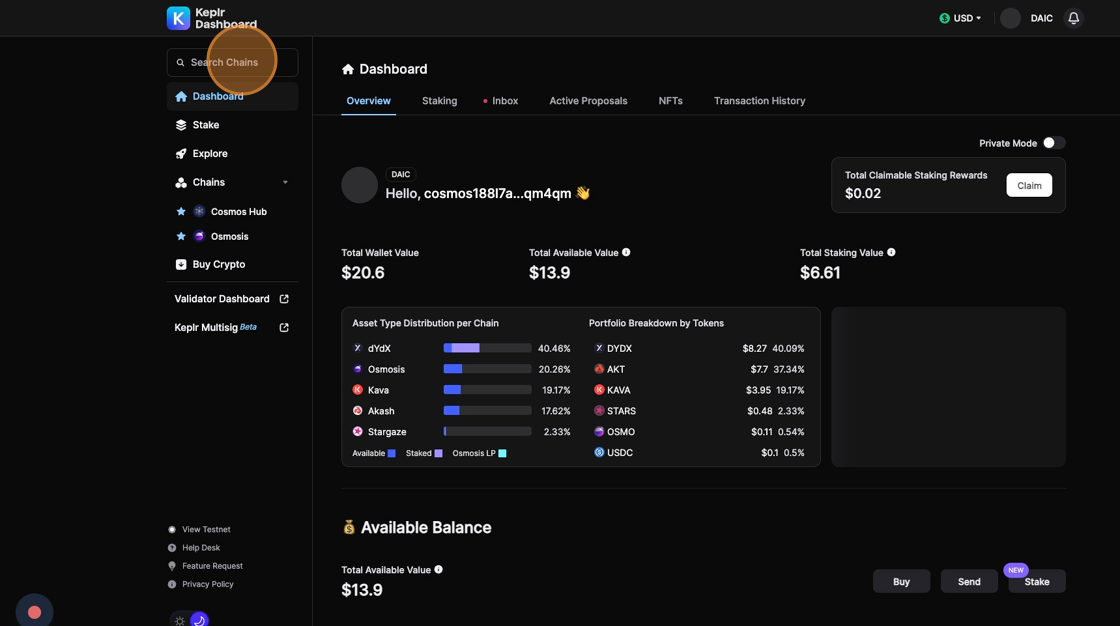

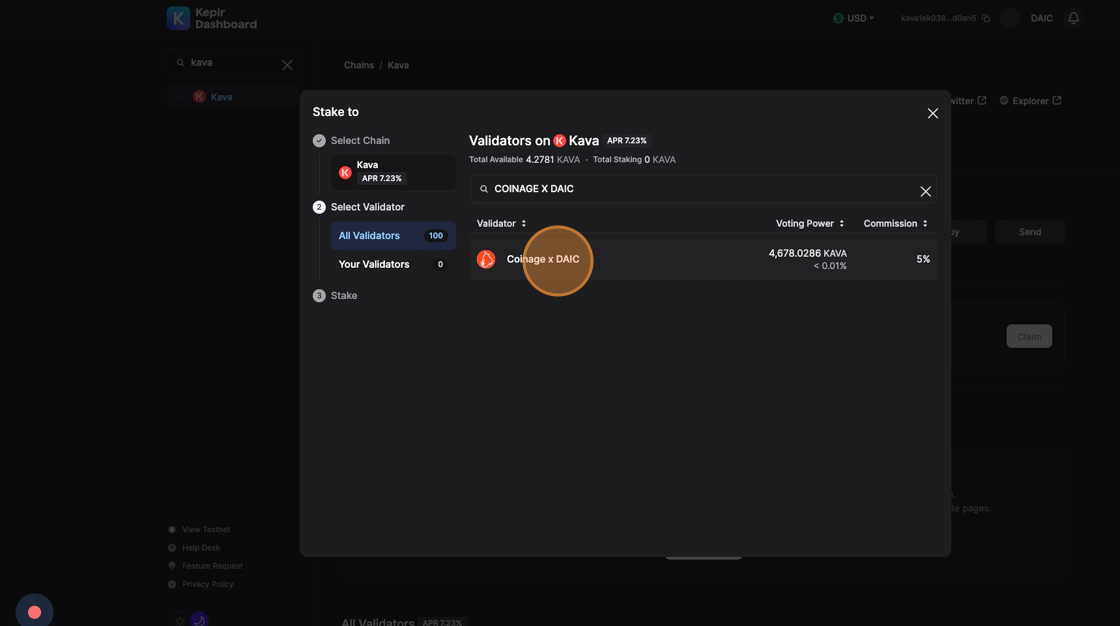

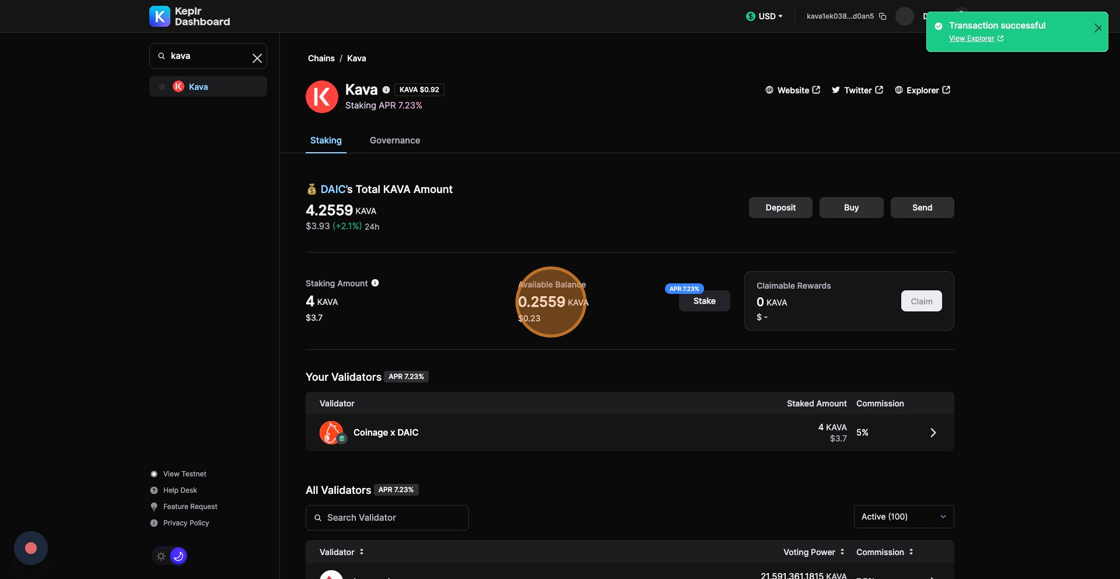

1. Navigate to https://wallet.keplr.app/

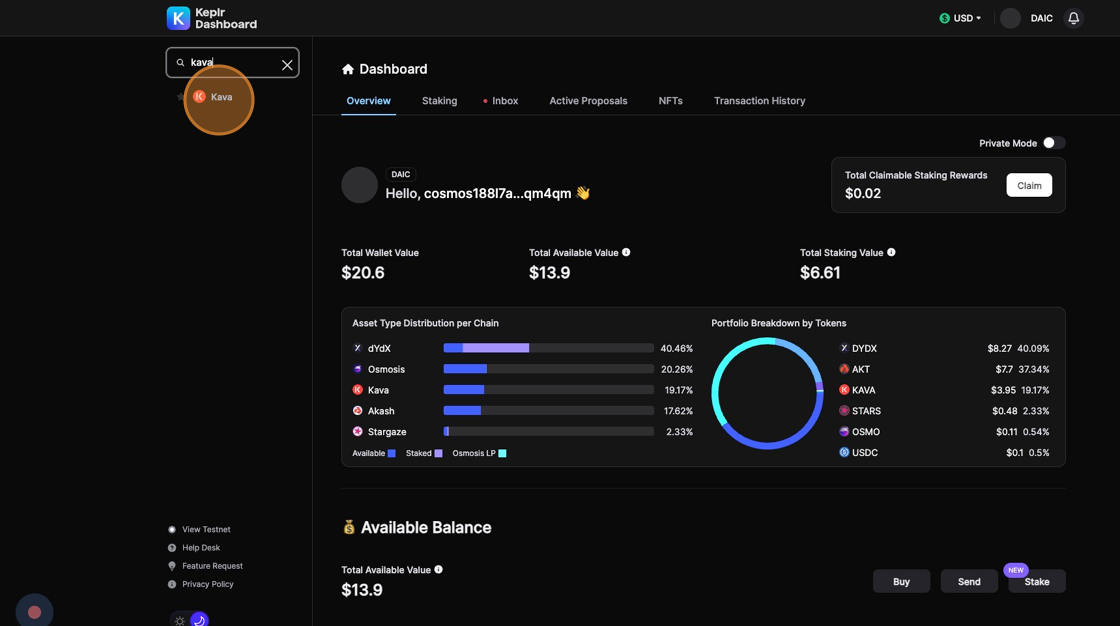

2. Click the Search Chains field and type KAVA

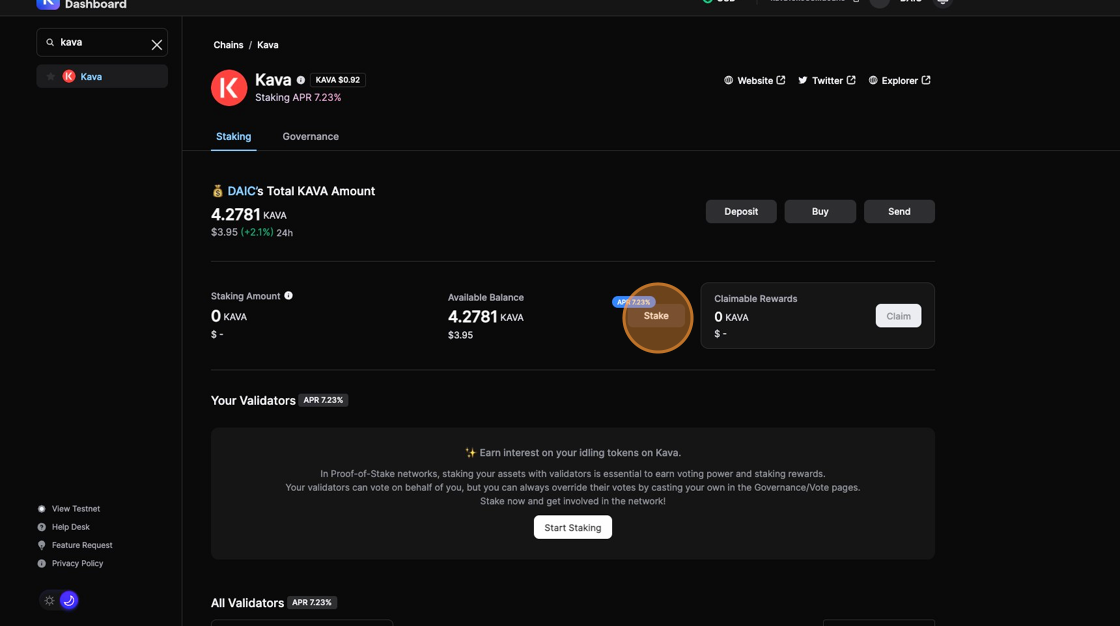

3. Click KAVA

4. Click Stake

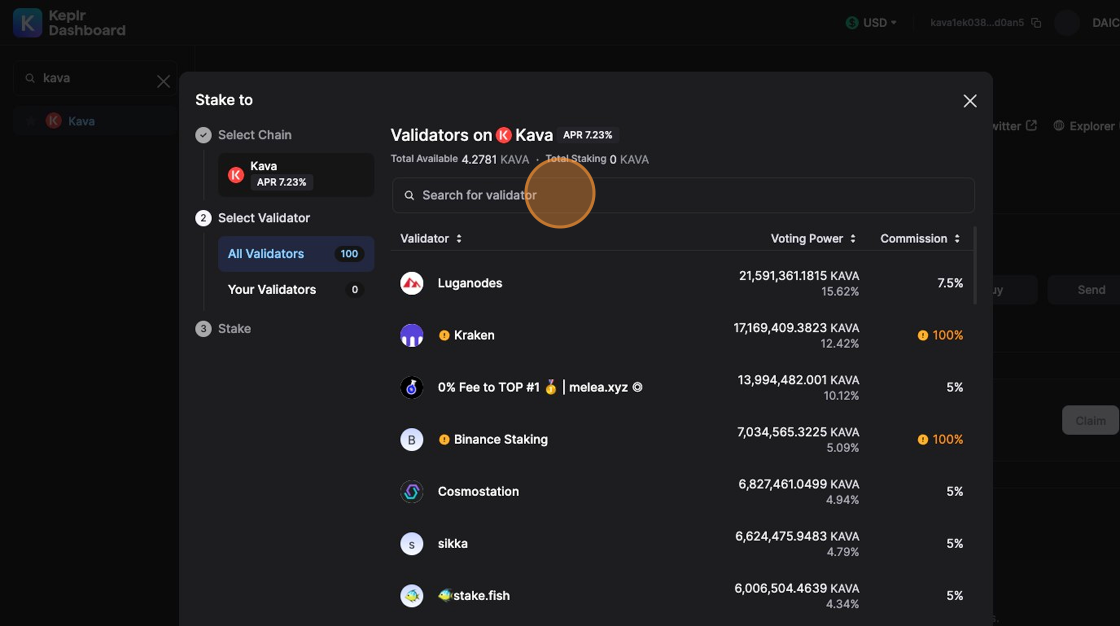

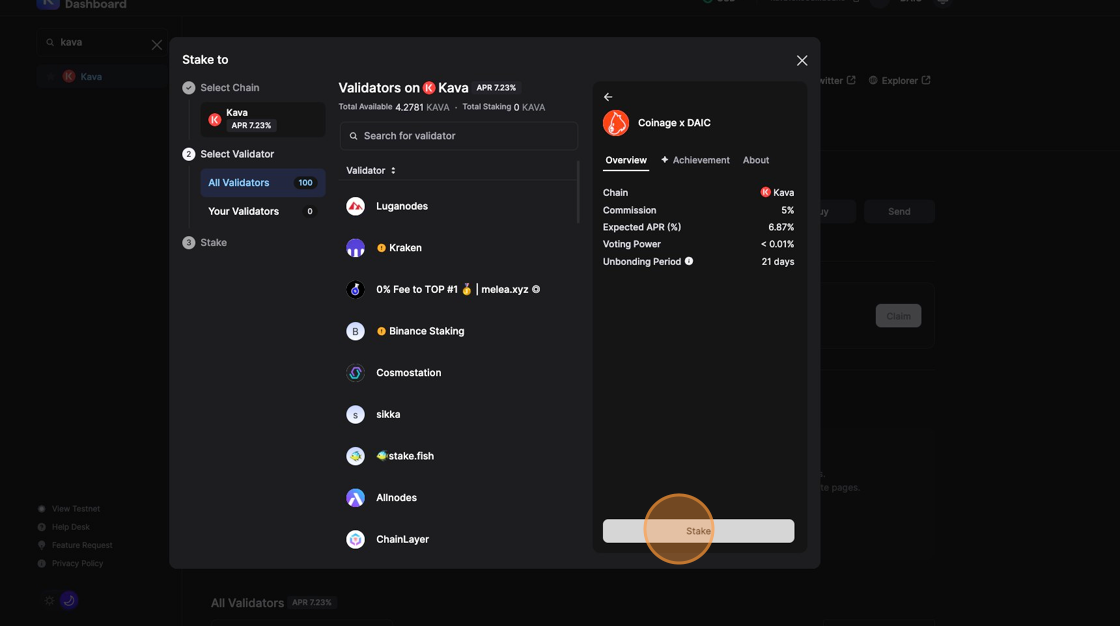

5. Click the Search for validator field and type Coinage X DAIC

6. Click Coinage x DAIC

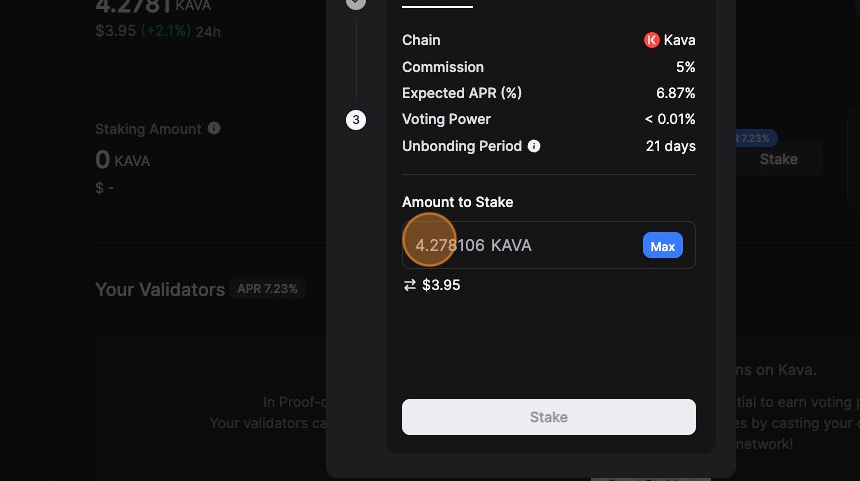

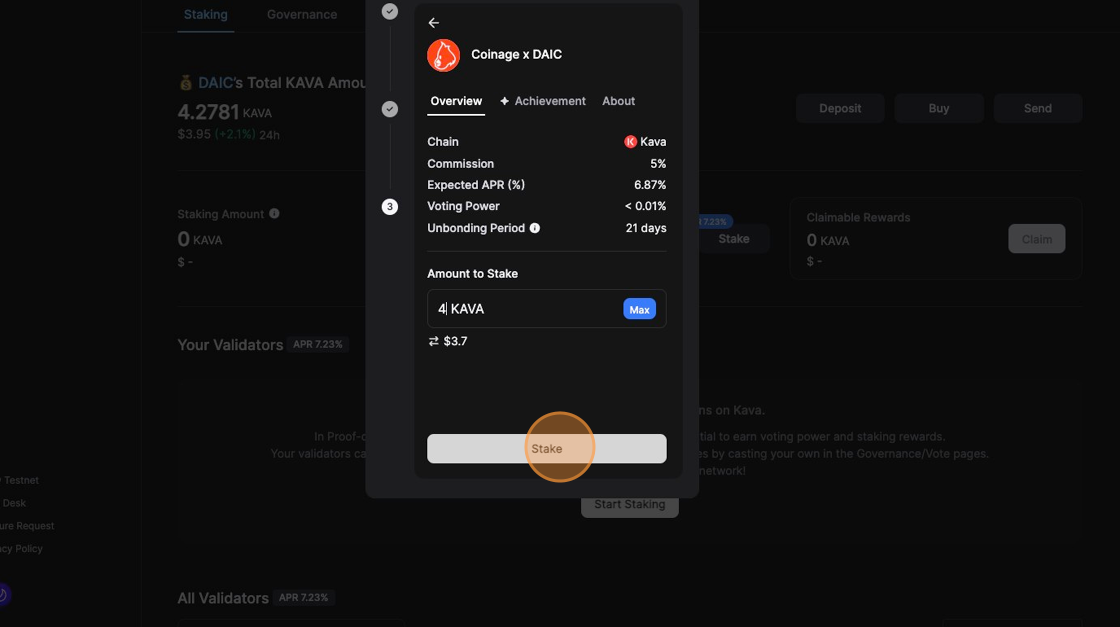

7. Click Stake

8. Click the Amount field, enter the number of KAVA tokens you want to stake

9. Click Stake

10. Approve the Keplr wallet transaction pop-up

11. Congratulations! Your KAVA tokens have been staked

About Kava (KAVA)

Kava Network is the first Layer-1 blockchain to combine the speed and scalability of the Cosmos SDK with the developer support of Ethereum. The Kava Network will empower developers to build for Web3 and next-gen blockchain technologies through its unique co-chain architecture. KAVA is the native governance and staking token of the Kava Network, enabling its decentralization and security.

Links:

Learn More About Kava

Kava Staking FAQ

How much can I make staking KAVA?

The return from staking KAVA varies based on the network's overall staking participation, real yield, and specific validator commission.

How do I receive my KAVA rewards?

KAVA rewards need to be claimed. Visit the Keplr dashboard to claim your staking rewards

When can I start earning rewards with KAVA?

You can start earning staking rewards once your tokens are successfully delegated to a validator

Can I sell KAVA while it is locked up?

Staked KAVA tokens cannot be sold, they need to be unstaked first. The unstaking period for KAVA is 21 days.

What are the risks around staking KAVA?

Staking KAVA comes with risks like slashing (penalty for the validator), price volatility, and liquidity risk (inability to sell during the lock-up period).

What consensus algorithm does Kava use?

Kava uses a decentralized Proof of Stake (PoS) consensus algorithm.

What are the tokenomics of KAVA?

Read all about KAVA tokenomics here

Stake KAVA with Coinage x DAIC

Stake your KAVA with Coinage x DAIC, a leading validator with a proven track record of successfully managing blockchain infrastructure over several years, DAIC.capital has securely attracted over 31,279 unique stakers and holds more than $175M in total value staked across 44 chains. This impressive milestone not only demonstrates our wide-ranging expertise but also reflects the deep trust the community places in our stewardship.