For over a decade, the financial world has been in a tricky spot with blockchain. Everyone saw the amazing potential for things like instant settlement and lower risk, but a big problem stood in the way. The total transparency of public blockchains just doesn't work for regulated institutions that need to keep their information private. The Canton Network was created to finally solve this dilemma, offering a public network that provides the privacy and control that institutions need, without asking them to give up the powerful connectivity that makes a public blockchain so valuable.

Key Takeaways

- Canton offers a safe ground for institutions to transact on blockchain yet retain confidentiality as well as conform to regulation.

- The network's built-in privacy ensures that sensitive information will be shared only with need-to-know parties.

- Its unique consensus model separates transaction validation and ordering, thus securing the network but keeping private data hidden from all validators.

- Canton connects previously siloed financial applications, enabling them to settle transactions atomically without risky bridges.

- The network is already used by hundreds of major financial institutions for production-level applications at a multi-trillion-dollar scale.

An Overview of the Canton Network for Institutional Finance

The core design of public blockchains represents a great challenge for business and banks. While these networks offer a revolutionary level of efficiency in the form of immediate, cross-border payments, they also put sensitive financial planning and commercial strategies out in the open for anyone who uses a block explorer. The dangers of this transparency are real.

In one case, attackers have used public on-chain data to analyze a firm’s internal transaction patterns before launching a sophisticated, targeted attack, while corporate treasury strategies and sensitive investment positions have been publicly exposed despite measures taken to ensure confidentiality.

This inherent transparency has been a primary barrier preventing the large-scale institutional adoption of on-chain finance. The Canton Network was specifically designed to solve this problem. By combining the tight controls of private networks with the connectivity of public ones, Canton allows institutions to tokenize assets and interoperate without sacrificing the confidentiality required for financial operations or incurring punitive regulatory capital charges.

What is Canton Network?

The Canton Network is a blockchain specifically built to provide a new foundation for finance. Its core is a "public permissioned" architecture, which combines the open connectivity of a public network with the necessary privacy and access controls of a private system. This design is crucial because it allows financial assets on the network to meet strict regulatory standards, avoiding the heavy penalties that banks would face on more transparent blockchains.

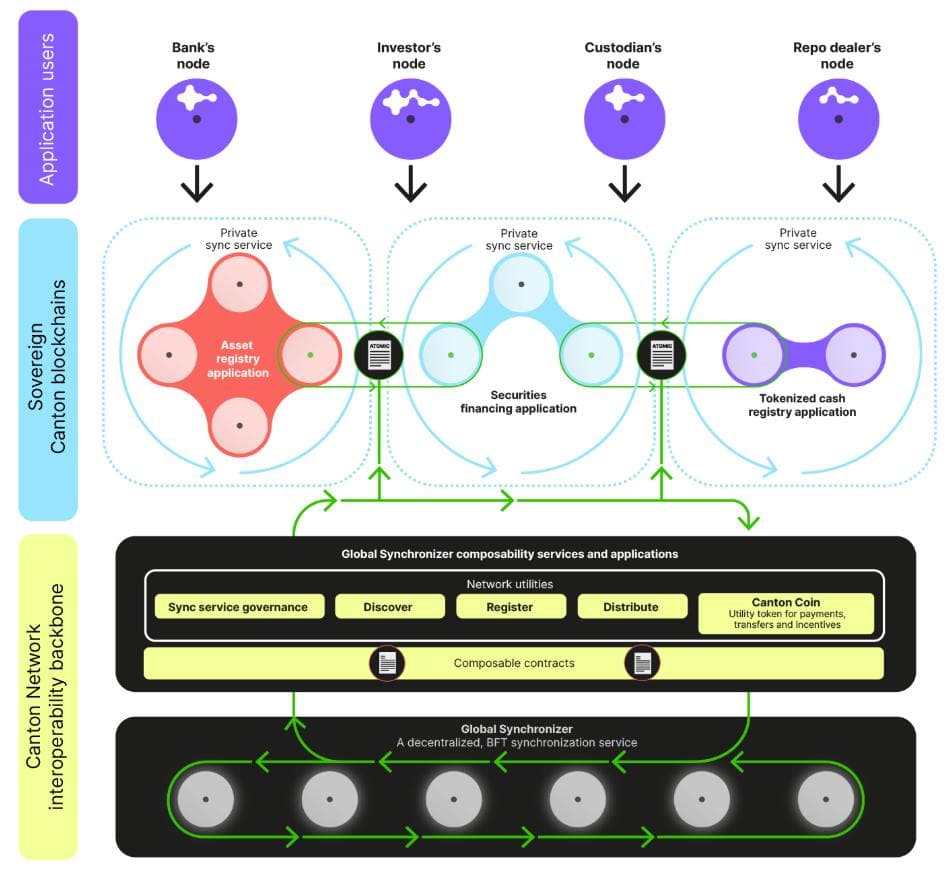

The network uses a purpose-built smart contract language called Daml, that's designed especially to safely automate multi-party financial workflows. Differing from other smart contract frameworks, Daml bases agreements around the real-world concepts of "rights and obligations", making it a natural fit for complex financial transactions. The system enables varied financial apps to safely interoperate and make so-called atomic transactions. In fact, this guarantees that a complex agreement, e.g., the exchange of a tokenized bond against digital currency, occurs simultaneously or not at all and thereby avoids the risk that can slow down business operation.

This powerful interconnectivity is made possible by the Global Synchronizer, a decentralized service that acts as the network's interoperability hub. In order to power this ecosystem, the network has established Canton Coin (CC), a utility token that is used for the payment of network fees as well as to drive participation by the builders and operators that bring the network to life.

The network is designed for a broad spectrum of uses, including the issuance of tokenized assets, trading, custody, clearing and settlement, and trade finance. It is already operating at significant scale, with over $6 trillion in tokenized assets processed on the underlying technology and daily U.S. Treasury repo trades exceeding $280 billion.

The project began with a company called Digital Asset Holdings, LLC, which was founded in 2015 to tackle these kinds of complex financial challenges. Co-founders Yuval Rooz and Eric Saraniecki are leading the effort to build an infrastructure tailored to the needs of financial markets. After years of dedicated work, the Canton Network officially went live in 2024. Today, an independent organization called the Canton Foundation helps guide its growth, ensuring it remains a neutral and open platform for all participants. Reflecting its collaborative nature, the network's core software is open source.

The development of the Canton network is supported by investments totaling over $397 million from leaders in both traditional finance and crypto. A recent example of this strong backing is the June 2025 strategic funding round, where the company secured $135 million. The raise was led by DRW Venture Capital and Tradeweb Markets, with participation from other prominent firms including BNP Paribas, Circle Ventures, Citadel Securities, Paxos, and The Depository Trust & Clearing Corporation (DTCC).

How it works?

To understand what makes Canton different, it’s necessary to look at its core mechanics. It’s not just one feature, but a combination of several that create a secure and connected environment for finance. This architecture was created to mirror the complex realities of the financial industry, where confidentiality and interoperability are equally important.

At the heart of Canton's design is a sophisticated approach to privacy called sub-transaction level privacy. Instead of treating confidentiality as an add-on, it is a core function built directly into the protocol. A simple way to understand this is with a classic financial trade. When a tokenized asset is exchanged for digital cash on Canton, the privacy is automatically enforced. The bank handling the payment only sees the data for the cash transfer, not the specific asset being sold. At the same time, the securities registrar responsible for the asset only sees it changing hands, not the payment details.

In this single, seamless transaction, each party validates only their piece of the puzzle, preserving confidentiality for the buyer and seller. Even the network operators who ensure transactions are processed in the right order cannot see the contents, they only handle limited, encrypted metadata to keep things running smoothly.

This powerful privacy is secured by a unique two-part model for reaching agreement, or "consensus". The first part is the validation model, formally called "Proof-of-Stakeholder". In this model, each institution manages its own independent, private ledger through a Participant Node. Instead of all transactions being validated by the entire network, only the Participant Nodes directly involved in a transaction are responsible for checking its validity.

The second part of the process is sequencing. This is handled by Synchronization Domains, which provide secure, end-to-end encrypted messaging between Participant Nodes to prevent data leakage. A synchronizer acts like a traffic controller, assigning a timestamp to each encrypted transaction without ever seeing its contents. For transactions that need to connect different, independent applications, the Global Synchronizer, a decentralized domain, links these separate Synchronization Domains. It uses a two-phase commit protocol to enable atomic settlement across multiple networks. This entire process creates a virtual global ledger - a single, consistent source of truth for all participants, but one where no single party ever holds all the private data.

This combination of consensus and privacy facilitates powerful capabilities. Canton was built for real interoperability so that atomic cross-app transactions could be made without the security risks of the multifaceted bridges that other chains use for cross-chain action.

In addition, the network has been designed for scale with a modular "network of networks" architecture. Unlike monolithic blockchains where every application compete for the same limited resources, Canton enables applications to operate on their own subnetworks. This implies that the overall system capacity increases as more participants onboard, such that the network stays fast as well as efficient.

Built for a Different Purpose: Canton vs. Other Layer 1s

Canton Network was not created to solve a single blockchain challenge in isolation but was purpose-built for institutions, where privacy, composability, and scalability must work together without compromise. This integrated design, aligned with the operational realities of financial markets, sets it apart from other Layer 1 networks that were designed for more general-purpose use.

The main target is not to replace the existing DeFi ecosystem, but to digitize and connect the vast traditional finance market. Its potential lies in becoming an industry standard for real-world asset (RWA) tokenization, bridging traditional finance with institutional DeFi.

| Feature | Canton Network | Ethereum | Solana | Hyperledger Fabric / Corda |

| Privacy | Built-in at sub-transaction; set by contract | Layered on (like zero-knowledge); often open | Open records; few privacy options | Strong; restricted access, but isolated |

| Scalability | Expands with subnetworks; handles over $6 trillion assets | Boosted by secondary layers; prone to network overload | Up to 65,000 transactions per second possible; single setup limits | Fits business needs; not built for open expansion |

| Interoperability | Complete across apps and subnetworks (atomic composability); no bridges required | Via L2 bridges and cross-chain protocols (with associated risks) | Basic built-in; depends on add-ons and bridges | Centered inside; weak with open chains |

| Target Use | Tokenized assets for organizations, rule-heavy finance | Broad decentralized finance, digital collectibles | Quick trades, user apps | Closed business groups |

| Adoption Metrics | 400+ organizations, with the network recording over 3.5 million Canton Coin-related events in a single day | Leading in DeFi TVL and user count | Quick rise in novelty tokens | Primarily in permissioned, non-interoperable enterprise pilots |

From Theory to Reality: Canton's Real-World Use Cases

The Canton Network's sophisticated architecture is not just a blueprint, it's a live foundation for a new generation of financial services. Major institutions are already using its unique capabilities to solve long-standing challenges in capital markets, derivatives, and day-to-day business operations.

The End of the 9-to-5 Market: 24/7 Financing

A primary challenge in traditional finance is the inefficiency caused by settlement delays and market closures. These gaps create overnight and weekend risks, forcing institutions to hold large, costly liquidity buffers. Canton addresses this by creating an "always-on" capital market.

This is already happening at a massive scale. Broadridge's Distributed Ledger Repo (DLR) platform, built on the same underlying technology, processes over $4 trillion in on-chain U.S. Treasury repo financing monthly, a success enabled by the network's privacy-preserving workflows. In a significant milestone, a group including Bank of America, Circle, Citadel Securities, and Tradeweb executed the first-ever on-chain funding transaction in August 2025, swapping tokenized U.S. Treasuries for USDC. This landmark event demonstrates the Canton Network's capability to eliminate settlement gaps and enable true 24/7 operations.

Securing the World of Derivatives and Collateral

In the derivatives market, confidentiality is paramount. On transparent blockchains, posting collateral for margin calls would publicly expose a firm's trading positions, inviting predatory trading and front-running. Canton's native privacy makes secure, real-time collateral management possible.

The network facilitates bilateral, private margin management so institutions can automate margin calls, make optimal use of capital, and lower costs without exposing strategies. This boosts confidence and trade velocity, as a counterparty can call for more collateral and see it settle in minutes. Participants can use a sophisticated mix of assets, such as leveraging yield-bearing tokenized U.S. Treasuries for initial margin and stablecoins for variation margin, all with the assurance of complete privacy.

Modernizing Business Payments and Treasury

Canton also addresses the "Venmo problem" for business ventures, in that the visibility of public blockchains can cause sensitive competitive and operating information to leak out. It supports a new generation of enterprise financial workflows.

- Private B2B Payments: Companies can make on-chain payments, keeping commercially sensitive information safe. For instance, vendor payments can be made without revealing contract rates to competitors.

- Secure Global Payroll: The network eliminates the "salary visibility problem" by allowing organizations to pay global teams in stablecoins with full confidentiality, avoiding internal workplace tensions.

- Corporate Treasury Optimization: The ability to create and redeem tokenized money market funds at any time 24/7 allows company treasurers to earn interest on money that is not being used, even for very short periods like weekends. This is not possible in today's market structure.

Conclusion: Benefits for Financial Institutions

The Canton Network represents a breakthrough in the field of blockchain that looks beyond ideals to offer a pragmatic foundation suited to the realities of global finance. For financial institutions, its value goes beyond savings on operating expenses and provides a viable, strategic path toward a more efficient and interconnected future.

The network’s main achievement is creating economic potential by turning static assets into dynamic, high-utility capital. By permitting 24/7 financing and the instant mobility of collateral, Canton allows institutions to put idle assets to work, improving capital efficiency and reducing the multi-billion dollar cost of liquidity buffers. This creates a clear business case for tokenization, moving it from a theoretical concept to a practical tool for generating new revenue.

Canton accomplishes this without considering compliance an afterthought but rather as a native aspect. The system was designed to function under preexisting models of regulation and offer the nuanced permissions over data and privacy that regulated institutions need. This design allows tokenized assets on the network to meet the strict criteria set by global standard-setters like the Basel Committee, making large-scale adoption economically feasible for banks.

It also resolves the central problem that has kept institutional finance in a state of pilot projects, offering the network effects and interoperability of a public ecosystem without forcing a compromise on the security, sovereignty, and control of a private one. By providing this balanced foundation, the Canton Network offers a clear path for institutions to not just participate in the future of finance, but to actively build it.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.