If you're interested in Berachain, explore our dedicated section filled with blog posts and comprehensive guides: https://daic.capital/blog/category/Berachain

Introduction to Berachain

Berachain is not just another Layer 1 blockchain - it’s a revolutionary project tailored to redefine decentralized finance (DeFi) with a community-first approach. With its focus on innovation, community collaboration, and developer accessibility, Berachain is making waves in the DeFi ecosystem. Let’s dive into what sets it apart and why it’s gaining so much attention.

What is Berachain?

Berachain is a cutting-edge Layer 1 blockchain designed to enhance DeFi through its unique Proof-of-Liquidity (PoL) consensus mechanism. Unlike traditional consensus models such as Proof-of-Work or Proof-of-Stake, PoL rewards users for providing liquidity to the network, making participation both profitable and essential to the network’s stability. This consensus model ensures that liquidity providers play a vital role in securing the system and earning rewards.

The platform is Ethereum Virtual Machine (EVM)-compatible, enabling developers familiar with Ethereum to easily build or migrate their decentralized applications without extensive modifications. Berachain’s modular design promotes innovation by fostering a flexible development environment, encouraging a wide range of projects to flourish on the platform.

Berachain’s community-driven foundation traces back to its origins with the "Bong Bears" NFT collection, which attracted a devoted following. The project quickly evolved, fueled by the vision of creating a blockchain that integrates community participation with cutting-edge financial tools. Early 2024 marked the launch of its testnet, backed by $142 million in funding from prominent investors, underscoring the industry’s confidence in its potential.

Find out more about the history of Berachain in our blog post: Berachain (BERA): Redefining Liquidity Accrual for DeFi

Why Berachain?

Berachain’s appeal lies in its innovative approach to DeFi, blending financial incentives with community involvement. The Proof-of-Liquidity consensus mechanism stands out because it creates a seamless relationship between liquidity provision and blockchain security - ensuring sustainable growth while rewarding users for participation.

Developers are drawn to Berachain due to its EVM compatibility, which eliminates friction when building or porting projects. This compatibility provides access to established tools, smart contracts, and infrastructure from the Ethereum ecosystem, making development faster and more efficient.

Furthermore, Berachain places a strong emphasis on decentralized governance, giving its community a voice in shaping key aspects of the network. This combination of technical innovation, developer accessibility, and community engagement makes Berachain a game-changer in DeFi - an ecosystem designed not only to compete but to lead.

If you still don’t get why you should care about berachain - read our blog post: What is Berachain and Why Should I Care?

What Makes Berachain Unique?

Proof-of-Liquidity Consensus

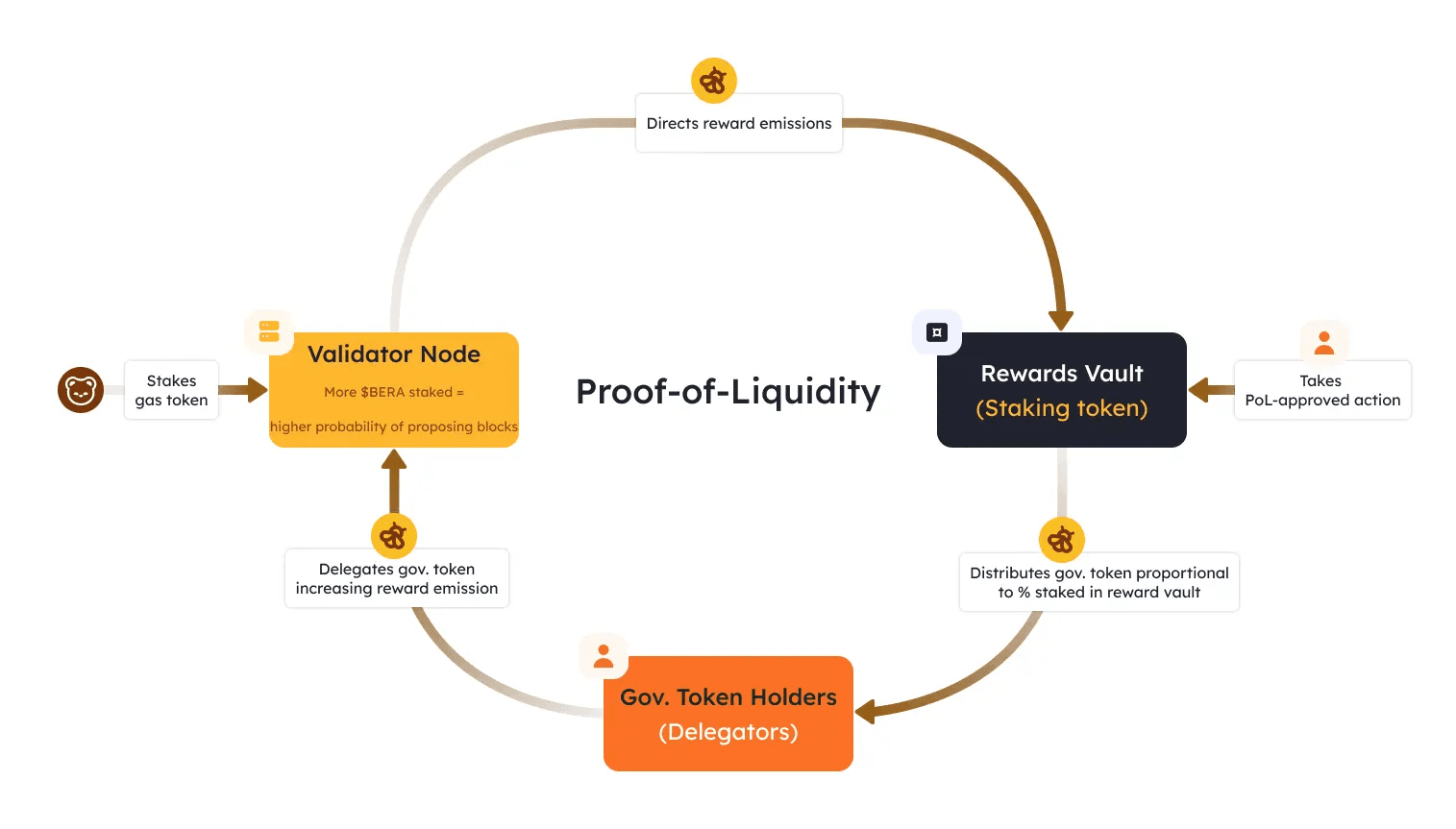

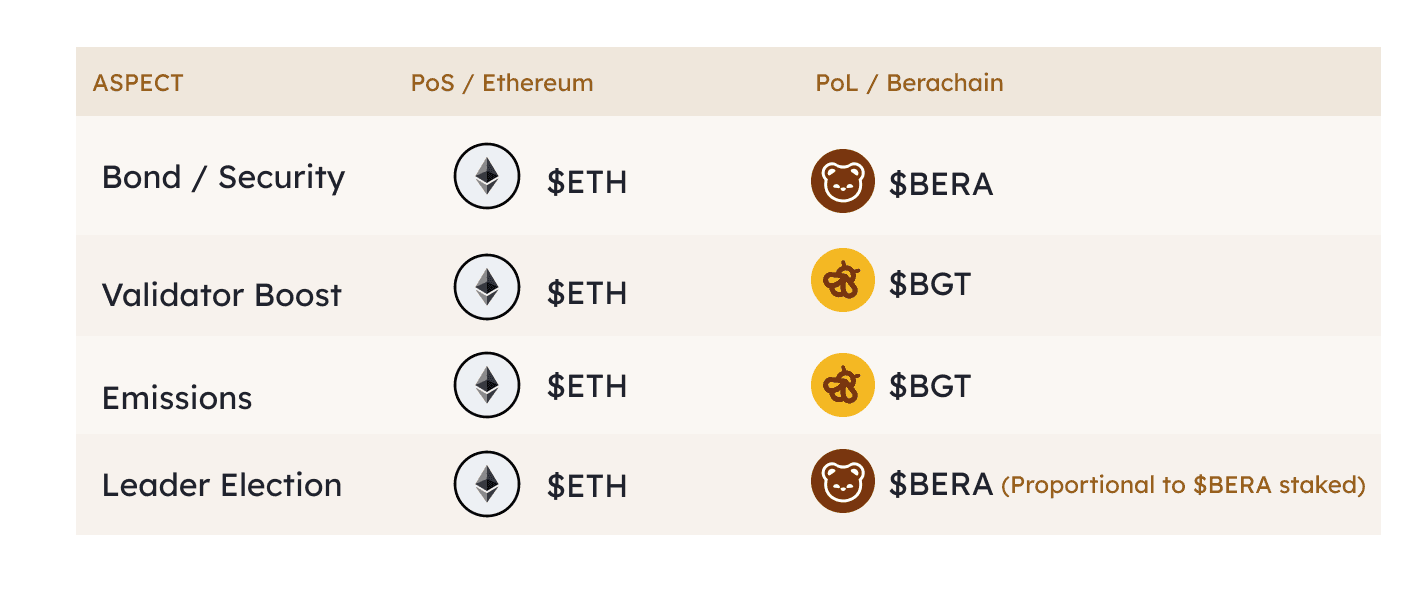

Berachain's Proof-of-Liquidity (PoL) consensus mechanism is a groundbreaking approach that redefines how blockchain networks incentivize participation and maintain security. Unlike traditional Proof-of-Stake (PoS) systems, PoL aligns the interests of validators, users, and decentralized applications (dApps) by fostering a symbiotic relationship among all participants.

In the PoL framework, validators secure the network by staking Berachain's native gas token, $BERA. The process involves two primary tokens:

- $BERA: Used by validators to stake and secure the chain.

- $BGT: A soulbound governance token distributed by validators for proposing new blocks, ultimately rewarded to users providing ecosystem liquidity.

This dual-token model ensures that validators are incentivized to act in the network's best interest, as their $BGT emissions - and consequently, their rewards - are directly linked to the amount of $BGT delegated to them by liquidity providers. This structure creates a feedback loop where validators who maximize value for their delegators attract more delegations, thereby enhancing network security and liquidity.

A key innovation of PoL is the separation of the gas and security token ($BERA) from the governance and rewards token ($BGT). This distinction allows for a more nuanced and effective incentive structure, promoting active participation across all layers of the ecosystem. By decoupling these roles, Berachain ensures that economic incentives are aligned without compromising the network's security or governance integrity.

Our blog post “Berachain's Proof-of-Liquidity: A New Era of DeFi Collaboration” provides you more insights about how PoL works.

Tri-Token Model (100 words)

Berachain's innovative tri-token model comprises $BERA, $BGT, and $HONEY, each serving distinct roles to foster a balanced and dynamic ecosystem. $BERA functions as the gas token, facilitating transactions and enabling validators to stake and secure the network. $BGT is the governance token, earned exclusively through active participation, such as providing liquidity; it empowers holders to influence network decisions and can be burned to obtain $BERA. $HONEY, a stablecoin pegged to the US dollar, is designed for everyday transactions within Berachain's decentralized applications, offering stability and ease of use. This tri-token system ensures a synergistic relationship among all participants, promoting a healthy and liquid ecosystem.

Learn more about the tri-token model in our blog post “Berachain Tokens: $BERA, $BGT, and $HONEY”

BERA (Utility Token)

$BERA functions as Berachain's native gas token, essential for transaction fees across the network. Users pay $BERA to execute operations, ensuring efficient processing. Additionally, validators stake $BERA to secure the network, with their selection frequency for proposing new blocks proportional to their staked amount. This staking mechanism underpins the network's security and operational integrity.

BGT (Governance Token)

$BGT, or Bera Governance Token, is non-transferable and earned through active participation within the ecosystem, such as providing liquidity in designated reward vaults. Holders of $BGT wield influence over governance decisions, including protocol upgrades and parameter adjustments. They can vote directly on proposals or delegate their voting power. Moreover, $BGT can be burned at a 1:1 ratio to obtain $BERA, offering flexibility in token utility.

HONEY (Stablecoin)

$HONEY is Berachain's native stablecoin, soft-pegged to the US Dollar and fully collateralized. Users can mint $HONEY by depositing approved collateral, such as $USDC, into specialized vaults via the HoneySwap dApp. This process ensures that $HONEY maintains its stability, facilitating reliable transactions within the ecosystem. Beyond serving as a medium of exchange, $HONEY can be utilized in various DeFi applications, including lending and borrowing platforms, enhancing its utility.

Modular Design with BeaconKit

Berachain's modular design is exemplified by its innovative framework, BeaconKit. BeaconKit serves as a customizable consensus layer tailored for Ethereum-based blockchains, enabling seamless integration with various execution environments. By leveraging the CometBFT consensus algorithm, BeaconKit ensures compatibility with unmodified EVM execution clients, facilitating the development of EVM-identical chains.

The modular architecture of BeaconKit offers several advantages:

- Single Slot Finality: Achieves instant transaction finality, a significant improvement over Ethereum's approximate 13-minute finality time.

- Optimistic Payload Building: Executes block proposals in parallel with voting, reducing block times by up to 40%.

- Eth2 Modularity Compliance: Adheres to the separation of execution and consensus, promoting execution client diversity and supporting EVM upgrades without the need for custom forks.

- Full EIP Compatibility: Ensures support for Ethereum Improvement Proposals, maintaining alignment with Ethereum's evolving standards.

This modularity extends to potential implementations of custom block builders, rollup layers, and data availability solutions, making BeaconKit a versatile framework for both Layer 1 and Layer 2 solutions.

By integrating BeaconKit, Berachain provides developers with a flexible and efficient environment to build scalable and high-performance decentralized applications, reinforcing its commitment to innovation within the blockchain ecosystem.

Ethereum Virtual Machine (EVM) Compatibility

Berachain's Ethereum Virtual Machine (EVM) compatibility ensures that developers can seamlessly deploy and manage Ethereum-based smart contracts within its ecosystem. This compatibility is achieved through the integration of the BeaconKit framework, which allows Berachain to support unmodified EVM execution clients. As a result, developers can utilize familiar tools and languages, such as Solidity and Vyper, to build decentralized applications (dApps) on Berachain without the need for extensive code modifications. This seamless integration not only streamlines the development process but also fosters a more inclusive and expansive DeFi environment by enabling the migration and interoperability of existing Ethereum dApps onto the Berachain platform.

Exploring the Berachain Ecosystem

Native Berachain dApps

Berachain's ecosystem features a suite of native decentralized applications (dApps) designed to enhance user engagement and streamline decentralized finance (DeFi) activities. These dApps provide users with intuitive interfaces and robust functionalities, contributing to a seamless DeFi experience.

BeraHub

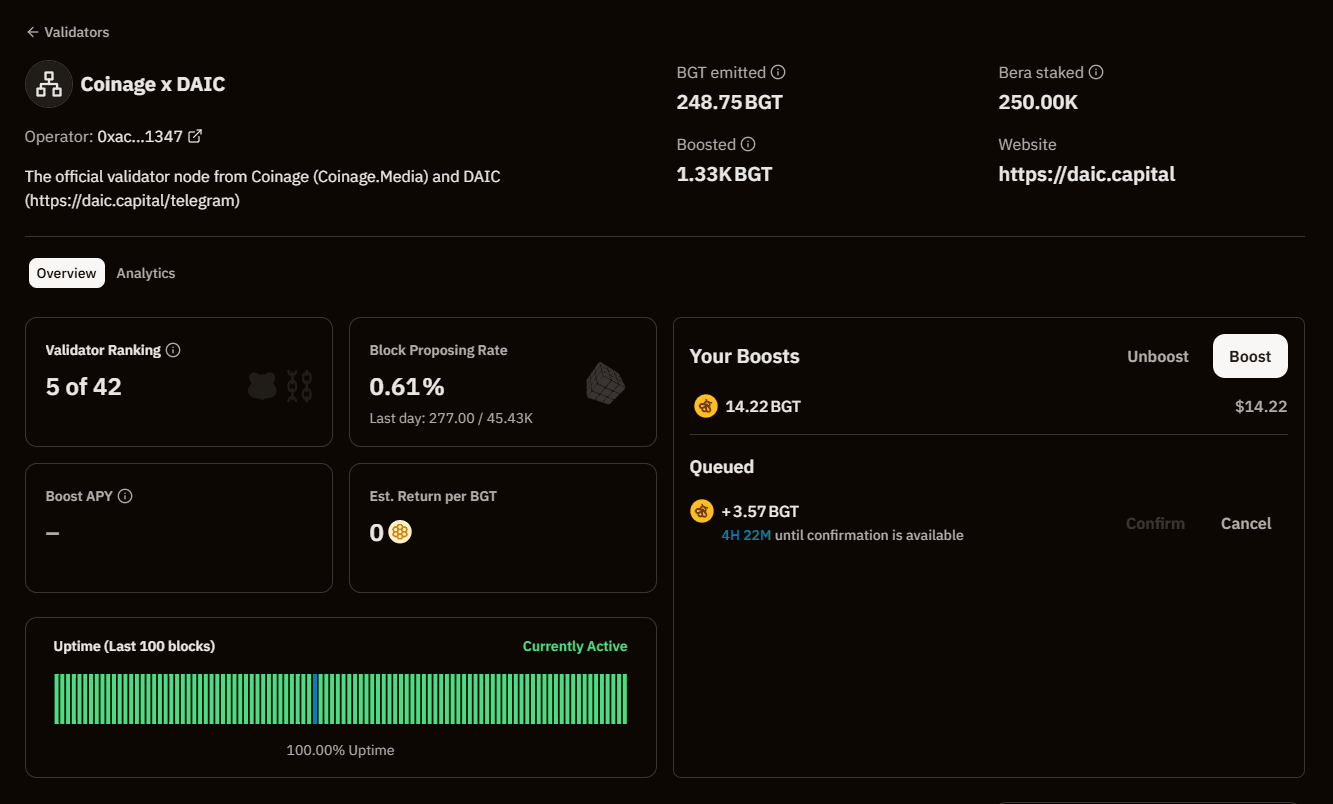

BeraHub is your center for Berachain - especially for managing $BGT. It embodies Berachain's commitment to community governance and Proof-of-Liquidity, bringing the collective strength of the "Beras" (the Berachain community) to life.With $BGT holders wielding full governance control, Berachain ensures that the platform’s evolution remains in the hands of those most invested in its success. Your $BGT grants you a direct voice in shaping the protocol’s parameters and long-term development.

Read more about BeraHub in “Stake, Delegate, Govern: Your Guide to BeraHub”.

BeraSwap

BeraSwap is Berachain's decentralized exchange (DEX), enabling users to swap tokens and provide liquidity. By participating in liquidity pools, users can earn rewards, thereby promoting ecosystem liquidity and facilitating efficient token exchanges.

Get more insights about Berachain’s native dApps in our Blog post “https://daic.capital/blog/berachain-defi-dapps”.

DeFi Applications

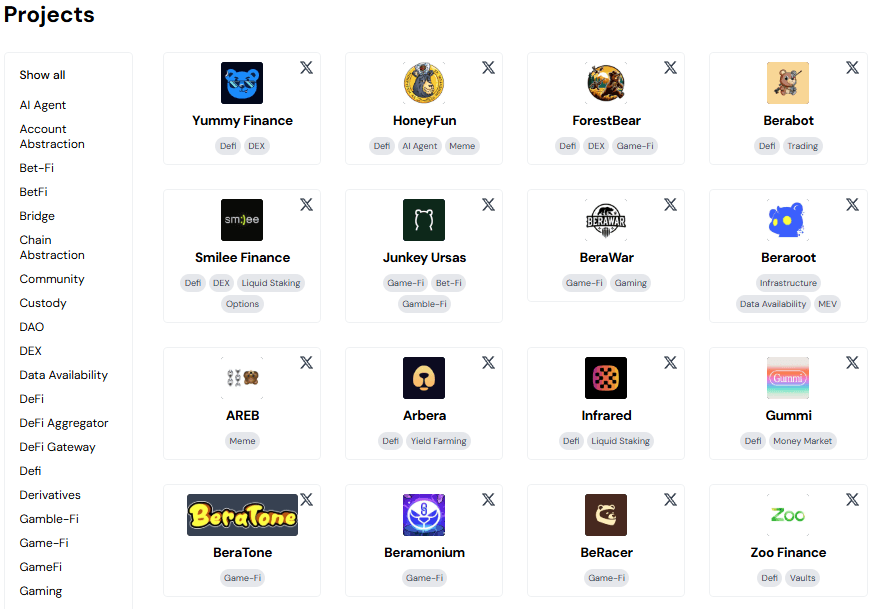

Berachain's decentralized finance (DeFi) ecosystem is rapidly expanding, offering a diverse array of applications that cater to various financial needs. These platforms leverage Berachain's unique Proof-of-Liquidity (PoL) consensus mechanism to enhance liquidity, security, and user engagement. Below are just a few of the many innovative applications within the ecosystem.

1. Liquid Staking Protocols

Liquid staking allows users to stake their assets to secure the network while maintaining liquidity for other DeFi activities. Two key protocols facilitating this on Berachain include:

- Infrared: Provides liquid staking solutions for native tokens ($BGT, $BERA), enabling users to earn staking rewards while retaining liquidity for DeFi.

- BeraPaw: Converts BGT into Liquid BGT ($LBGT), allowing users to utilize their staked assets across the ecosystem.

2. Decentralized Exchanges (DEXs)

Berachain hosts several innovative DEXs:

- Kodiak Finance: A dual AMM platform with liquidity management vaults and token deployment features.

- BurrBear: Optimized for stablecoin trading, offering high capital efficiency and minimal price impact.

3. DeFi Aggregators

- Ooga Booga: A DeFi aggregator integrating multiple liquidity sources with Smart Order Routing for efficient trading.

4. Lending and Borrowing Platforms

- Beraborrow: Enables users to borrow against collateralized assets without selling them by minting Nectar ($NECT) stablecoins.

5. Restaking and Liquidity Marketplaces

- Beradrome: A native restaking and liquidity marketplace providing innovative solutions for sustainable liquidity.

These applications highlight the vibrant, interconnected nature of Berachain’s ecosystem, but they are only the beginning. The network continues to expand, with numerous projects under development and more opportunities for users and developers to explore.

We created an overview of dApps deployed or interacting with Berachain. Don’t hesitate to check out our ecosystem overview of Berachain.

NFT Ecosystem

Berachain’s NFT ecosystem is a thriving, community-centric space that seamlessly blends digital art, utility, and financial innovation. At its core, this ecosystem leverages Berachain’s unique blockchain infrastructure to create NFTs that go beyond traditional collectibles. These NFTs are designed to interact with DeFi protocols, governance systems, and even GameFi platforms, providing holders with tangible utilities.

Unlike standard NFTs, many within Berachain offer dynamic properties such as yield generation, staking opportunities, and in-game functionalities. For instance, holders can utilize their NFTs to access exclusive staking rewards or participate in governance decisions, blurring the line between ownership and financial utility. Additionally, Berachain’s emphasis on community-driven development means that new projects are continuously emerging, introducing fresh concepts and engaging utilities for participants.

Built on an EVM-compatible architecture, Berachain allows for seamless interoperability between NFT-based dApps, marketplaces, and gaming ecosystems. This structure enables NFTs minted within Berachain to be easily integrated into cross-chain environments or adapted for use in broader DeFi applications. With strong developer resources and a vibrant community, Berachain’s NFT landscape is expanding rapidly, offering creators, collectors, and developers an ecosystem rich with creative potential, financial opportunities, and long-term value.

Check out our “The Ultimate Berachain NFT Guide: Explore, Compare, and Gain Insights” to find out more about Berachain related NFT collections.

Community

Berachain has cultivated a vibrant community over several years, blending meme culture with innovative blockchain initiatives. Originating from the Bong Bears NFT collection in 2021, the community embraced humor and creativity, fostering a unique cultural identity. This foundation led to the development of a dedicated following, often referred to as a "cult-like" community, characterized by its enthusiasm and engagement.

Central to this community are projects like The Honey Jar (THJ) and ApiologyDAO (apDAO). THJ serves as a collaborative studio, uniting various Berachain projects and communities. It offers initiatives such as the Honeycomb perks aggregator, which provides users with exclusive benefits across the ecosystem, and CubQuests, an interactive platform designed to drive engagement through gamified experiences.

ApiologyDAO, incubated by THJ, operates as a decentralized autonomous organization aiming to foster growth within the Berachain ecosystem. It strategically directs investments and resources to emerging protocols, enhancing liquidity and promoting synergistic relationships among projects. Membership in apDAO offers participants governance rights, revenue sharing, and early access to new initiatives, further strengthening community involvement. If you want to join the ApiologyDAO, you need one Honey Comb NFT and all Honey Jar NFTs (Gen 1 - Gen 6).

Through these initiatives, Berachain has built a robust and engaged community, intertwining humor, innovation, and collaborative governance to drive the ecosystem's ongoing development.

Berachain performed a huge airdrop for their mainnet. Find out how to claim your Berachain Airdrop with our post: “How to Claim Your Berachain BERA Airdrop”

Getting Started with Berachain

Setting Up Your Wallet

To interact with the Berachain ecosystem, selecting a compatible cryptocurrency wallet is essential. Given Berachain's Ethereum Virtual Machine (EVM) compatibility, several wallets can be utilized:

MetaMask: A widely-used browser extension and mobile app, MetaMask allows users to manage Ethereum-based tokens, including those on Berachain. It offers features like token storage, transaction management, and seamless connection to decentralized applications (dApps).

Rabby Wallet: Supporting over 100 EVM-compatible chains, Rabby Wallet emphasizes security with pre-transaction risk assessments. It automatically switches to the appropriate network for each dApp, enhancing user experience.

Coinbase Wallet: Developed by the Coinbase exchange, this non-custodial wallet supports a vast array of cryptocurrencies. Users can explore dApps, manage NFTs, and participate in staking activities.

When choosing a wallet, consider factors such as security features, user interface, and compatibility with your devices. Opting for a self-custody wallet ensures you maintain control over your private keys, enhancing the security of your assets. Always safeguard your private keys and seed phrases, as they are crucial for accessing and managing your funds.

We create the blog post “Choosing Your Berachain Wallet” to guide you through the wallet selection. Check it out!

Staking and Earning Rewards

Engaging with Berachain's ecosystem offers opportunities to earn rewards through its unique Proof-of-Liquidity (PoL) consensus mechanism. Here's how you can participate:

Earning $BGT Rewards

To earn $BGT, users can provide liquidity to decentralized exchanges like BeraSwap. By depositing assets into liquidity pools, users receive LP tokens representing their contribution. These LP tokens can be staked in Reward Vaults within BeraSwap, allowing users to accumulate $BGT over time. This process not only rewards users for supporting liquidity but also enables broader participation in Berachain’s governance ecosystem.

Check out “How to Earn $BGT on Berachain: Your BeraSwap Liquidity Guide” to learn more!

Staking $BGT

Once you’ve earned $BGT, staking it provides ongoing benefits. Staking $BGT secures the network while allowing participants to earn additional rewards. The staked tokens empower users to participate in governance, vote on proposals, and help shape the future of Berachain. By staking, you actively contribute to maintaining the network’s decentralization and security while maximizing your returns.

Earn Incentives for staking your BGT

Staking your $BGT not only contributes to the governance of the Berachain network but also allows you to earn a share of the ecosystem’s incentives. Through Berachain’s unique Proof-of-Liquidity (PoL) model, validators receive emissions of $BGT, which they then allocate to Reward Vaults associated with various decentralized applications (dApps). By staking with a validator, you gain access to these vaults and earn incentives based on their distribution strategy.

The rewards you receive are influenced by factors such as:

- Validator Performance: Choosing an efficient and well-managed validator can maximize your returns.

- dApp Integration: Validators allocate rewards to different dApp vaults, enabling you to earn incentives from protocols you support.

- Network Activity: As more users participate in Berachain, the demand for staking and vault incentives grows, potentially increasing yields.

By strategically selecting where to stake your $BGT, you not only secure the network but also position yourself to earn sustainable and compounding rewards over time.

More details about Berachain incentives can be found in our blog post: ”Berachain Incentives: Proof-of-Liquidity Takes Center Stage”

Participating in the Ecosystem

Berachain’s thriving ecosystem offers numerous ways for users to engage in DeFi, NFTs, and governance. By interacting with decentralized applications (dApps), providing liquidity, and utilizing $HONEY, users can fully unlock the platform’s potential.

Interacting with dApps

Berachain features a variety of native dApps, including BeraSwap for token swaps, BEND for lending and borrowing, and BERPS for trading perpetual futures. To get started, connect an EVM-compatible wallet like MetaMask and explore dApps via the Berachain dashboard. Whether trading, lending, or gaming, each dApp integrates seamlessly with Berachain’s infrastructure to provide a smooth experience.

Providing Liquidity

Providing liquidity is essential to the ecosystem’s functionality. On platforms like BeraSwap, users can deposit tokens into liquidity pools and receive LP tokens in return. These LP tokens can be staked in Reward Vaults to earn $BGT, incentivizing long-term liquidity provision. Participating in liquidity pools not only earns rewards but also strengthens the ecosystem by facilitating efficient token swaps.

Using $HONEY Stablecoins

$HONEY, Berachain’s stablecoin, is central to stable and low-risk transactions within the ecosystem. Users can mint $HONEY by depositing collateral through supported dApps. It is widely accepted for trading, lending, and borrowing, offering a reliable means to transact without the volatility of traditional cryptocurrencies. Many dApps, including BeraSwap and BEND, support $HONEY to ensure seamless ecosystem participation.

If you want to know more about the Honey Stablecoin: check out our blog post “HONEY: Berachain's Stablecoin - Understanding How It Works”

Joining the Community

Become part of the vibrant Berachain community by joining the official Berachain Discord for discussions, updates, and support. For tailored guidance, connect with Coinage x DAIC’s Discord, where we provide expert answers to your Berachain questions and run exclusive giveaways for NFT whitelists. Our Telegram channel also keeps you updated with ecosystem news. Coinage x DAIC supports users through in-depth blog posts, tutorials, and video guides, making your journey through Berachain smoother and more rewarding.

Use Cases and Applications

Decentralized Finance (DeFi) Innovations

Berachain’s DeFi ecosystem is defined by its diverse, innovative dApps and protocols, designed to optimize liquidity, enhance capital efficiency, and maximize user rewards. With a focus on seamless integration, Berachain’s DeFi landscape allows users to interact with lending, staking, trading, and derivative markets all within a connected infrastructure.

DEXs and Trading Innovations

Berachain hosts multiple decentralized exchanges (DEXs) to cater to various user needs. BeraSwap facilitates token swaps and liquidity provision for general assets, while BurrBear optimizes stablecoin trading through highly efficient liquidity pools. Emerging DEXs like Yummy Finance and Smilee Finance introduce liquid staking and innovative AMM mechanics for specialized trading pairs. Additionally, Azex provides access to perpetual derivatives, giving traders leverage without centralized risks.

Lending and Borrowing Protocols

Berachain’s lending ecosystem offers flexibility and multi-asset support through platforms like BEND and Roots Protocol, where users can deposit collateral and borrow $HONEY. Dolomite extends this functionality by combining money markets with trading services, and Zoo Finance integrates yield optimization vaults to maximize capital returns while participating in liquidity pools.

Derivatives and Advanced Products

To address more sophisticated financial needs, Berachain supports derivatives through protocols like D2 Finance and IVX Options, enabling users to hedge risk, speculate on asset movements, and enhance capital efficiency through structured products.

MEV and Liquidity Efficiency

BeraRoot enhances data availability and manages miner extractable value (MEV) to ensure transparent transaction sequencing and fair liquidity management, further optimizing DeFi protocol efficiency.

Berachain’s expansive DeFi innovations ensure that users, traders, and developers benefit from a highly liquid and user-focused ecosystem capable of handling both everyday financial needs and advanced trading strategies.

NFT-Integrated Finance

Berachain’s NFT ecosystem goes beyond traditional art collectibles, offering practical financial utilities through key projects. Several NFT collections enable holders to participate in staking, governance, and DeFi activities.

Honeycomb (by Honeyjar)

Get Aidrops from several Berachain projects. It’s also one part which you need to join the Apiology DAO.

BurrBera

BurrBera Tokens will be dropped to NFT holders.

Dirac Finance

BeracPOL2 NFT holders enhance their yield while depositing in Dirca vaults. It also gives acces to governance votes.

Beramonium

The Beramonium Cronicles NFT has a staking possibility / rewards can be earned from the protocol.

IVX

The Vol Surfers NFT boostes the rewards on the plattform and holders get a fee discount in the IVX tranding terminals

Yield Optimization and Staking

Berachain’s yield optimization and staking mechanisms offer users multiple avenues to maximize their returns through efficient liquidity deployment and token rewards. By leveraging platforms like Zoo Finance, WeBera, and various staking protocols, users can passively grow their holdings while participating in the ecosystem.

Staking for Network Security: Staking $BERA and $BGT ensures network security while rewarding participants. Validators secure the blockchain by staking $BERA, while liquidity providers earn $BGT by staking LP tokens in Reward Vaults. These vaults, available on platforms like BeraSwap, provide steady yields based on liquidity contributions.

Liquid Staking and Flexible Yield: Protocols like Infrared, BeraPaw and Smilee Finance enable liquid staking, where users receive tokenized staking derivatives (such as $LBGT) after staking assets. These derivatives can be redeployed across other dApps for additional yield, creating layered earning opportunities.

Automated Yield Optimization: WeBera abstracts complex DeFi strategies by routing user assets automatically to the highest-yielding staking pools, optimizing returns with minimal user intervention. Meanwhile, Zoo Finance vaults optimize LP staking by auto-compounding rewards, ensuring users benefit from maximizing their liquidity contributions.

Together, these innovations make Berachain’s ecosystem a prime destination for yield farming and staking enthusiasts.

Liquidity Aggregation and Management

Berachain’s ecosystem focuses on efficient liquidity management by integrating advanced aggregation tools and protocols that optimize capital allocation across various DeFi platforms.

Liquidity Aggregators

Kodiak Finance and BeraSwap play pivotal roles in aggregating liquidity. Kodiak’s dual AMM model automates liquidity distribution through dynamic vaults, while BeraSwap enables users to earn trading fees and staking rewards by contributing to liquidity pools.

Restaking and Bonding Solutions

Beradrome provides restaking mechanisms and token-owned liquidity (ToL), allowing users to maximize the utility of LP tokens by redeploying them for additional rewards. This restaking optimizes ecosystem-wide liquidity without requiring users to withdraw or reposition assets frequently.

Future of DeFi on Berachain

Berachain is on track to become a major force in DeFi by fostering innovations that address liquidity fragmentation, user rewards, and governance participation. Its unique Proof-of-Liquidity (PoL) mechanism ensures sustained network security and incentivized liquidity provision. The tri-token system ($BERA, $BGT, and $HONEY) will continue to drive user engagement, balancing ecosystem growth with governance and stable value transactions.

The future expansion of Berachain is tied to its modular, developer-friendly infrastructure, which enables seamless integration of complex dApps and cross-chain solutions. This modularity, paired with EVM compatibility, makes Berachain ideal for scaling global decentralized applications.

As native DeFi services grow - yield farming, staking, lending, and derivatives trading - Berachain will evolve to accommodate advanced financial instruments and NFT-integrated finance. Further community-driven governance through $BGT ensures users play a crucial role in guiding its growth. By solving liquidity inefficiencies through aggregation and optimization tools, Berachain is positioned to redefine DeFi sustainability and cross-chain connectivity, making it a core pillar of decentralized financial ecosystems globally.

Tokenomics

Berachain's tokenomics are designed to foster a robust and participatory ecosystem through a structured allocation and release of its native token $BERA.

Tokenomics of $BERA

- Token Name: BERA

- Total Supply at Genesis: 500,000,000 BERA

- Inflation Schedule: Approximately 10% annually (via $BGT emissions), subject to governance

- Decimals: 18

$BERA serves as the native gas and staking token of Berachain, facilitating transactions and network security. Complementing $BERA, the Bera Governance Token ($BGT) is utilized for governance and economic incentives within the ecosystem.

Distribution and Allocation

The initial supply of 500 million $BERA is allocated as follows:

- Initial Core Contributors: 84,000,000 BERA (16.8%)

- Investors: 171,500,000 BERA (34.3%)

- Community Allocations: 244,500,000 BERA (48.9%)

Token Release Schedule of $BERA

All allocated tokens adhere to the following vesting schedule:

- Initial Unlock: After a one-year cliff, 1/6th of allocated tokens are unlocked.

- Linear Vesting: The remaining 5/6ths vest linearly over the subsequent 24 months.

This structured allocation and release strategy ensures a balanced distribution of $BERA, promoting long-term commitment and active participation within the Berachain ecosystem.

Advantages and Challenges

Key Advantages of Berachain

Innovative Consensus Mechanism (Proof-of-Liquidity)

Berachain’s Proof-of-Liquidity combines security with active liquidity by allowing staked assets to remain usable in DeFi applications. Validators stake $BERA, and liquidity providers earn rewards while securing the network, solving liquidity lockup inefficiencies found in traditional staking models.

Tri-Token Model

Berachain’s $BERA (utility), $BGT (governance), and $HONEY (stability) create a balanced system. $BERA enables transactions and staking, $BGT powers decentralized governance, and $HONEY ensures stable value for DeFi applications. This separation fosters sustainable ecosystem growth.

EVM Compatibility

EVM compatibility ensures easy migration of dApps from Ethereum without significant modifications. Developers can use familiar tools, broadening Berachain’s appeal and enabling cross-platform functionality while expanding the ecosystem efficiently.

Scalability and Efficiency

With a modular blockchain architecture and optimized liquidity, Berachain ensures high throughput, low transaction latency, and support for resource-intensive dApps. Its design balances scalability and performance without sacrificing cost efficiency.

Modular Blockchain Design

Berachain’s modular infrastructure, powered by BeaconKit, allows the creation of tailored solutions such as staking, liquidity tools, and advanced DeFi protocols while maintaining cross-chain interoperability and scalability.

Developer-Friendly Ecosystem

With extensive SDKs, pre-built modules, and comprehensive developer documentation, Berachain fosters rapid dApp innovation. Community-driven hubs, toolkits, and liquidity solutions support developers from concept to deployment.

Sustainable Liquidity Incentives

Berachain optimizes liquidity through mechanisms like Beradrome’s restaking and Zoo Finance’s auto-compounding vaults. These innovations incentivize liquidity providers while ensuring efficient capital utilization and reduced fragmentation.

Community-Driven Governance

$BGT empowers users to influence protocol evolution through decentralized governance. Proposals for upgrades, features, and ecosystem expansion are driven by the community, ensuring user-focused growth and long-term adaptability.

Challenges and Considerations

Adoption Barriers

As a newer blockchain, Berachain competes with established networks like Ethereum. Success will require proving its scalability and reliability through strong partnerships, dApp adoption, and user engagement. Educating users on its unique advantages is key to overcoming trust barriers.

Ecosystem Maturity

The ecosystem is still in its growth phase, with key dApps and infrastructure maturing. Ensuring strong liquidity, active projects, and cross-chain integrations will be crucial. Building sustainable partnerships and incentivizing early adopters are key steps toward long-term success.

Educational Curve for New Users

Understanding concepts like Proof-of-Liquidity and the tri-token system may be challenging for beginners. Community-driven resources, tutorials, and support from Coinage x DAIC play a major role in making onboarding easier and accessible for new participants.

Market Volatility

As with any blockchain, token values can be affected by external factors like market trends and liquidity shifts. Stablecoin collateralization and diversified yield strategies within Berachain aim to reduce risks for users, promoting stability despite market fluctuations.

Decentralization vs. Efficiency

Maintaining the balance between decentralization and performance is essential as Berachain scales. Its modular architecture and adaptive governance mechanisms ensure low latency and network security, with protocol adjustments made through community-driven decision-making.

Ecosystem Competition

Berachain faces ongoing competition from blockchains offering similar features. Staying competitive requires continuously evolving its technology, supporting developer innovation, and securing strategic partnerships that can drive unique DeFi applications and user growth.

Conclusion

Why Berachain is the Future

Berachain is designed to address fundamental challenges in DeFi through innovations like its Proof-of-Liquidity consensus, tri-token model, and EVM compatibility. Unlike traditional blockchains that lock assets during staking, Berachain allows staked liquidity to remain active in DeFi applications, creating a dynamic and sustainable ecosystem. Its modular architecture supports scalability while ensuring flexibility for developers to build and deploy cutting-edge decentralized applications. The ecosystem's separation of utility ($BERA), governance ($BGT), and stability ($HONEY) ensures optimal performance and sustainable growth.

With its focus on liquidity aggregation, governance participation, and community-driven development, Berachain is well-positioned to redefine the future of decentralized finance. As the ecosystem matures, its dApps and DeFi protocols will unlock advanced use cases like derivatives trading, yield optimization, and NFT finance, creating a comprehensive, interconnected financial system.

Next Steps

Get started by exploring Berachain’s ecosystem through key dApps, such as decentralized exchanges and lending platforms. Stake your $BERA to support network security and earn $BGT, enabling governance participation. Developers are encouraged to leverage Berachain’s modular infrastructure and developer resources to build next-generation applications. Join the community on Discord and Telegram to stay informed, ask questions, and access guides provided by Coinage x DAIC. Whether you’re a user or builder, Berachain offers endless opportunities to engage in its dynamic DeFi landscape.

If you still have some open questions checkout our article: "Berachain: Your Questions Answered”.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.