We live in a financial world that has always been dominated by large structures, labyrinthine processes, and intermediary layers. Change is afoot, however, in the form of a revolution that shifts the balance of power back toward your pocket. Amongst such changes are decentralized exchanges (DeXs) disrupting traditional financial infrastructure with something rather radically different: transparency, security, and user empowerment.The following article will take you into the core of this financial revolution and show how DEXs work, their advantages, and why they represent a sea change in the way we think about money and trading.

Key Takeaways

- DEXs are decentralized trading platforms with no intermediary or central authority.

- DEXs empower users with higher control over their assets compared to traditional exchange platforms, plus increased transparency.

- DEXs use blockchain technology and smart contracts to enable trading securely.

- The DEX ecosystem is developing fast, with new platforms and innovative features emerging all the time.

What is a DEX?

A DEX is basically a decentralized platform where digital assets can be exchanged directly without any middleman. But before we jump into the deep tech, it is important we outline what truly differentiates a DEX.

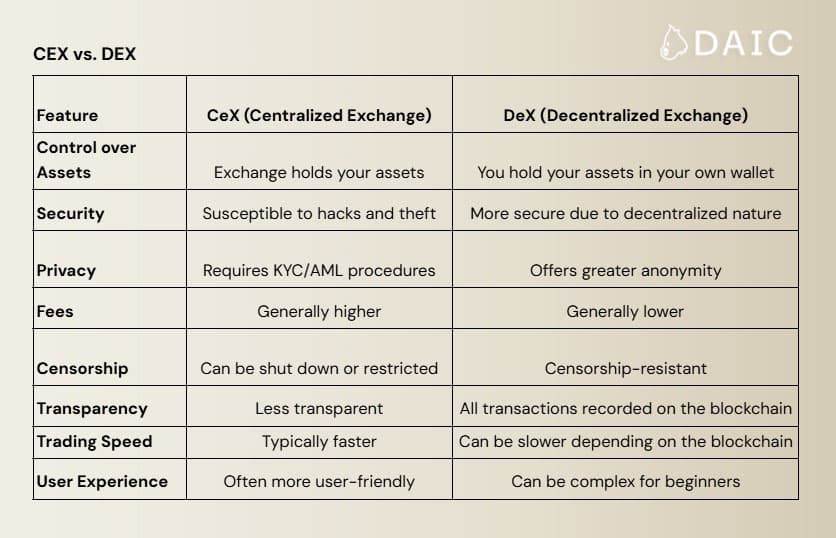

In the conventional financial world, exchanges are those that interconnect buyers with sellers. In such centralized entities - at least in concept, those noisy old trading floors - your assets and your trades are controlled by them.

Then came the digital era, and along with it came centralized digital exchanges (CEX). Dealing in digital assets, they work just like their traditional counterparts because there is a central authority: they hold your funds, handle your orders, and apply their rules.

While a CEX acts like a virtual exchange center, a DEX is more like an online market that vibrantly links traders directly to each other. There is no central authority that calls the shots. The rules are encoded in smart contracts, and the transactions are recorded on the blockchain. This peer-to-peer structure gives you greater control, enhanced security, and increased privacy.

Moreover, DEXs are the cornerstone of DeFi and the foundation upon which increasingly complex financial products are built.

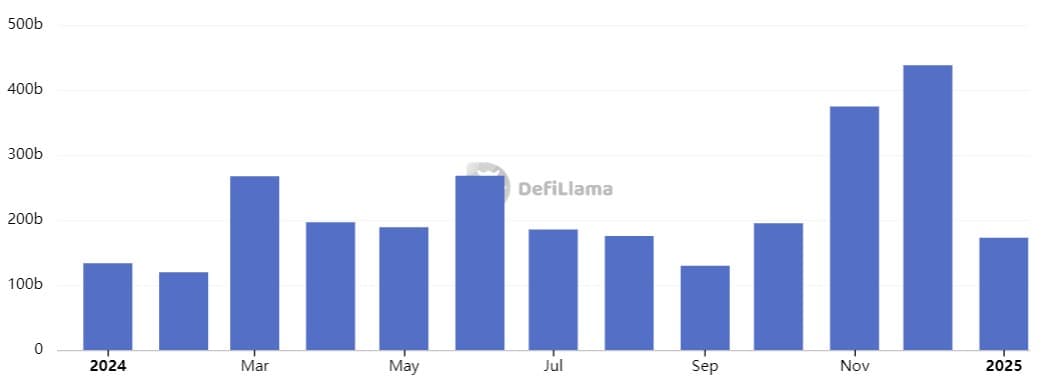

DeX Volume

The Tech Powering DEXs

Behind every DEX, there is an innovative technology that performs the function of digital storage in the shape of a ledger, recording each transaction in a tamper-proof, transparent manner. While traditional exchange platforms are centralized and located on controlled servers, this ledger is designed to be decentralized and distributed across a network of computers. This gives it a superlative resistance to tampering and censorship.

The building blocks of a DEX are as follows:

- Blockchain: It is the backbone of any DEX, providing a secure and transparent ledger where all transactions are stored, ensuring immutability and trust.

- Smart Contracts: Self-executing contracts that automate the trading process itself by removing intermediaries and guarantee fairness.

- Liquidity pools: These are pools of funds supplied by users that enable trading. They represent a source of liquidity whereby traders can buy and sell assets without the need for traditional order books. Most DEXs have integrated liquid staking, further enhancing the effectiveness of these pools by enabling users to contribute assets while simultaneously earning staking rewards. This is a great way to maximize returns and be part of the DeFi ecosystem on many levels.

- Order Book: The order book is a continuously updated list of the open buy and sell orders in a market; it is one base for electronic exchanges. The order books allow an exchange's internal systems to match buy and sell orders.

- Automated Market Makers: These algorithms calculate the asset prices in a liquidity pool based on supply and demand. They make sure of efficient price discovery and smooth trade execution.

- Digital Wallets: A digital wallet is required for users in order to store and manage their crypto assets, as well as interact with the DEX.

All of this together creates a self-managed and autonomous trading space where control over assets and trading is in the hands of the users themselves.

What Sets DEXs Apart?

The security is one of the most crucial advantages of DEXs: your funds are not kept centrally, which drastically reduces the chances of being hacked or stolen. This should be an important factor in the consideration of any serious investor, let alone in the volatile world of cryptocurrencies.

With DEXs, there is also a level of privacy not found with traditional exchanges. DEXs are like an asylum for traders who wish to maintain privacy, avoiding KYC/AML procedures that have come to characterize traditional finance. Your identity is yours, hidden behind the cryptographic armor of the blockchain.

You can trade without necessarily showing your identity, hence shield your personal information and financial activities from prying eyes. This is a welcome benefit for the more prudent investor in these times of frequent data breaches and surveillance.

But probably the most attractive thing with DEXs is the amount of control involved: your assets are kept in your digital wallet, and you have full control over your money. You are not at the mercy of some centralized authority or weaknesses in traditional financial systems. This is real freedom, and a game-changer for investors looking to enjoy more independence.

Real-World Examples

Ready to plunge into the universe of DEX? Well, here are a few platforms where you can get started:

Think of a DEX where you are allowed to trade tokens and even go ahead to customize very pools where those trades take place. That is Osmosis Zone, DeX operating on the Osmosis blockchain. It allows the creation of liquidity pools with their unique parameters, such as the adjustment of fees or the quantity of each asset in the pool. With Superfluid Staking option, your LP tokens have now been empowered to do double duty in earning both trading fees and staking rewards. Besides, it is all interconnected with other blockchains in the Cosmos ecosystem, opening up whole new avenues of possibility for cross-chain trading.

Sui blockchain is fast becoming a hotbed for DEX innovations. For example, Cetus spearheads concentrated liquidity on Sui and thus offers unparalleled optimization strategies and returns to its providers. In addition to the fee tier customization and range orders, this is something setting it in a different league in giving back control of assets and trading experience to the users. Turbos Finance brings to Sui speed and efficiency, traditionally present in the order book, while assuring speed-of-light trades with a familiar interface for professional traders.

For more sophisticated traders, OraiDEX, powered by Oraichain, brings a layer of artificial intelligence to the platform by offering AI-powered price feeds and trading signals. Just think of a DEX that can help you make smarter decisions in trading! It is cross-chain capable and is integrated with other products from Oraichain, hence the future of AI-powered finance.

From pools to AI-powered tools, the examples we have looked at here only scratch the surface of the burgeoning DEX ecosystem. Whether you're a professional trader in need of advanced order book functionality or just a beginner willing to provide liquidity in the easiest way, the decentralized world has a DEX in store for you.

This is quintessentially Web3-diversity of options. As the space continues to evolve, traders can only expect an even wider array of specialized platforms to choose from.

DEXs and the Future of Finance

DEXs are a huge leap into a much more decentralized and user-empowered financial system. It is not only about trading in crypto, rather, it is about building an even more inclusive and accessible financial future. Over the last couple of years, DEXs have gained significant traction because of their ability to provide immediate liquidity for newly launched tokens, seamless onboarding, and democratized access to trading and liquidity provision.

Whether the majority of the trading activity will shift to DEXs, and if the current design of DEXs will bear the long-term growth and institutional adoption, remains yet to be seen. However, DEX is foreseen to remain very critical infrastructure for the cryptocurrency ecosystem, while ongoing improvement in transaction scalability, smart contract security, governance infrastructure, and user experience remain crucial.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.