This article is supposed to serve as a guidebook in the world of staking, to which you decide to take the first step. Be it any reason - passive income, participation in network security, or merely interest in knowing more about cryptocurrencies, this article is going to help you understand the nuances of the crypto sphere.

Key Takeaways

- Learn about popular terminology in the areas of blockchain, decentralized finance, and cryptocurrency staking.

- Have an overview of the different types of staking and ideas providing justification for their use.

- Empower yourself with the basic know-how to start your staking journey with confidence.

The Basics: Blockchain Fundamentals

Before we dive deep into staking, let's get a quick grasp of the basic blockchain concepts. Since staking is a core part of how some blockchains work, understanding the basics first is key.

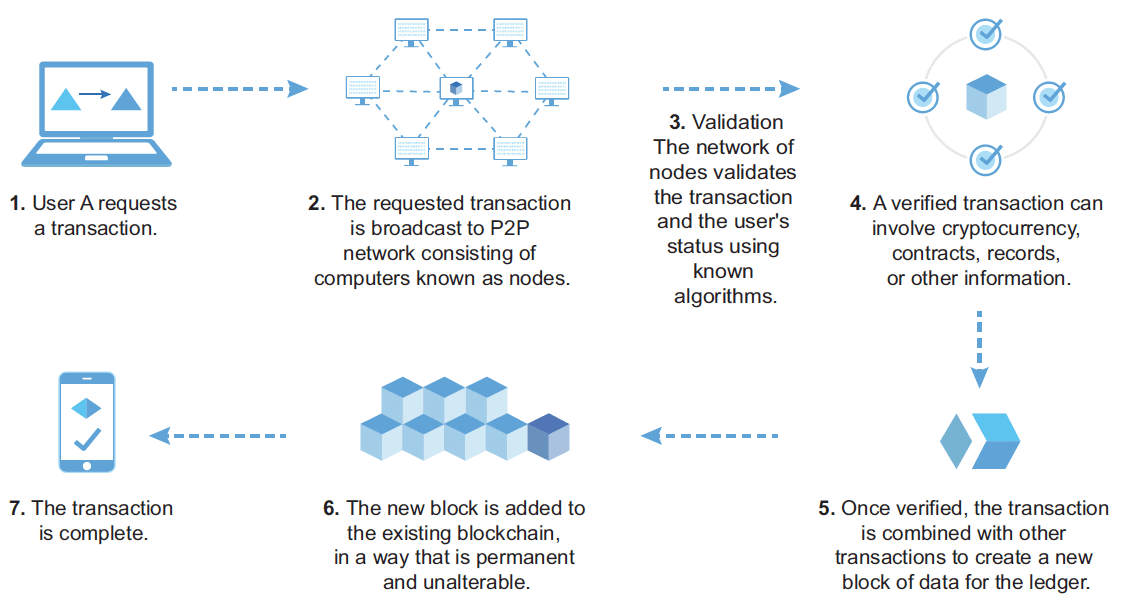

Blockchain

Imagine a digital notebook, shared by many people, where every transaction is recorded with maximum meticulousness and everyone has access to. Well, that's what in fact is a blockchain: a kind of public, decentralized ledger that provides security and immutability by default. Every new transaction gets packaged into a so-called "block" and linked with the previous one, thus creating an unbreakable chain of information that can never be changed. This technology enables transparency and trust since everyone is able to see and verify the data recorded within.

Source - How blockchain works

Block

Blocks are the individual records that store batches of valid transactions. Each block builds on the hash of the previous block, thereby connecting them in a continuous series. This series confirms the blocks in chronological order and hence forms an unchangeable blockchain.

Transaction

Transactions are the fundamental units of activity on the blockchain, representing the transfer of value between parties. All transactions are recorded and are irreversible once confirmed.

Gas

Gas is the fee you pay for an action to be executed in the network. It's like paying for gas to keep your car running – it ensures things get done.

Node

Nodes are the individual computers that form the backbone of the blockchain network. Each node keeps a copy of the whole blockchain, participates in the validation of each transaction, and helps to keep the health and security of the network.

- Miner - node that validate transactions and add new blocks to the blockchain, using computing power.

- Validator key player in blockchain network who stake his cryptocurrency to secure the network.

Consensus

Within the blockchain context, consensus represents the method or process by which all participants in the network agree on what the current state of the ledger is. Consensus resembles a collective decision-making function whereby confirmation occurs regarding which sets of transactions are valid and thus form part of the blockchain. This agreement is crucial for maintaining the integrity and security of the network.

For example, Proof of Work (PoW) consensus is used by Bitcoin, miners compete to solve complex puzzles to validate transactions and add blocks. In Proof of Stake (PoS) validators are chosen based on the amount of cryptocurrency they hold. More stake means higher chances of being selected to validate a block.

Validator

Validator is the key player within the blockchain ecosystem, guaranteeing network integrity and security. He takes part in a consensus process by creating new blocks and ensuring that all the transactions are correctly recorded in the network. In a Proof of Stake blockchains, validators are elected based on stake, in other words, some amount of cryptocurrency that is locked in a network. Thus, the higher stake a validator has, the higher the chance to participate in a consensus and get rewarded. In this case, staking serves as a guarantee of good validators' behavior, as any manipulation of the blockchain network could result in losing a stake.

Learn more about Validators in our blog post: "Blockchain Validators: The Cornerstone of Decentralized Trust"

Validator Set

The validator set is the group of validators allowed to take part in a blockchain consensus process, such as Proof of Stake and its variants. Validators are supposed to validate the transactions, propose new blocks, and, in general, keep the blockchain secure. The concrete rules for how to join or leave the validator set depend on the blockchain.

Slashing

The blockchain's way of keeping things remain fair. If validators misbehave or try to cheat, they are likely to lose a portion of their staked coins. It's worth noting that a validator can lose both its investment and the stake of the individuals who decided to delegate to him.

Epoch

An epoch is like one chapter in the continuing saga of the blockchain. It represents a certain length in time where such a particular staking activity could occur, like rewarding validators or choosing a new set of validators to create new blocks.

Coin

A coin is a type of cryptocurrency that operates on its own blockchain, such as Bitcoin or Ethereum. These digital assets can be used for peer-to-peer payments, held as a store of value, or utilized within decentralized applications (dApps) built on the blockchain.

Crypto Address

It's a special address that is used to send and receive the cryptocurrency. Like your bank account number, it consists of a long string of letters and numbers.

Staking: Leveraging Your Crypto

Staking

Staking can be looked upon as a form of commitment on the part of participants of a blockchain network. Participants lock up some part of their cryptocurrency for a period of time to contribute to the seamless functioning of the network. A shared investment enhances the general welfare and reliability of the entire system.

Learn more about Staking in our blog post: "Staking Beyond Rewards: Unlocking Value for Prudent Investors"

Staking Rewards

Participation in the network, either as a validator or delegator, offers the opportunity to earn rewards. The amount of such rewards is determined by the participants' role in the ecosystem and according to the conditions set up by the network.

If you want to learn more about how to calculate your staking rewards, check out our blog post: “How to Calculate Staking Rewards: Tools and Tips”

Delegators

Delegators play a significant role in the Proof of Stake blockchains, especially those following the concepts of delegated models such as Delegated Proof of Stake (DPoS). A delegator refers to any stakeholder in cryptocurrency who delegates their tokens to a validating node that takes part in the network and receives rewards as a result. In turn, the delegators enhance the possibility of the selected validator getting chosen to create blocks and validate a blockchain. This collaboration therefore allows both the delegator and the validator to benefit from staking rewards. Often in DPoS blockchains, delegators have voting rights that give them a say in governance decisions about the future of the projects.

Lockup Period

The duration for which staked tokens must be locked without the possibility for its owner to withdraw or use them, usually required as a part of staking protocols.

Unbonding Period

The unbonding period is the time it takes to withdraw staked tokens, which a user has initiated. In this period, the tokens are still technically staked and cannot be utilized for transactions or acquire further rewards. The unbonding period is a preventive measure against sudden withdrawals that can affect network security.

Annual Percentage Rate

APR is the approximate yearly reward you are likely to get from staking, and it is expressed in percentage form. It basically gives you the ability to compare the different staking opportunities with regard to the possible returns.

Total Value Locked (TVL)

The concept of TVL in cryptocurrency landscape is the sum value of assets that are being staked, deposited, or "locked" either in one particular protocol or throughout the whole of DeFi (Decentralized Finance). It serves as a key metric for measuring the size and growth, generally showing health in a blockchain project or the whole market.

Governance Rights

Staking often comes with the privilege of participating in the decision-making processes within the blockchain network. This can be through voting on protocol upgrades, changes, or other vital matters.

Market Capitalization

Market capitalization refers to the total market value of a cryptocurrency. It is determined by multiplying the current price of a coin by the total number of coins in circulation. The market capitalization provides an insight into the general size and popularity of a cryptocurrency.

Volatility

Volatility defines the degree of fluctuation of a cryptocurrency's price. Crypto markets are known for their price swings, so be prepared for potential ups and downs.

Liquidity

Liquidity means the possibility of an asset being bought or sold without significantly altering its price.

Auto-compound

Auto-compounding is a feature that automatically reinvests your staking rewards, and in time, your earnings would grow exponentially. It's a "set it and forget it" approach that maximizes your staking yields, supercharging your rewards with absolutely no manual intervention.

Types of Staking

Cross-chain Staking

Cross-chain staking enables the token holders to lock value in multiple blockchain networks simultaneously, maximizing their earning possibilities. This approach offers greater flexibility and diversification opportunities for those seeking to optimize their staking rewards.

Staking Pools

Staking pools offer a collective opportunity for small-scale holders to be involved in the validation process. Their chances of being selected for validation, thereby earning reward opportunities, are greater when participants pool resources together, democratizing access to staking benefits.

Liquid Staking

Liquid staking represents an entirely new approach whereby staked tokens are represented through derivative tokens maintaining their liquidity and can be used in various DeFi protocols.

Learn more about Liquid Staking in our blog post: "Liquid Staking Explained: How it Works, Benefits & Risks"

Yield Farming

Yield farming is a somewhat more sophisticated strategy of investing by staking and lending cryptocurrency in return for interest or additional tokens.

Restaking

Restaking is a process where the staked asset can be restaked, often in another context or on another platform, with the purpose of receiving extra rewards or benefits.

Conclusion

And the last term for today is Whale, large cryptocurrency holder that can have a significant impact on the market. Observing Whales moves can offer insights into market trends. Perhaps, in the future, you'll join their ranks!

To embark on your staking journey, explore our Beginner's Guide to Staking Cryptocurrency: Everything You Need to Know.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.