The traditional way of investing in cryptocurrency usually follows the "buy and hold" strategy, patiently waiting for appreciation in prices. However, a paradigm shift is at work, enabling crypto holders to move from being passive observers to active earners through the use of staking. In the following guide, we'll delve into the depths of the staking reward by exploring how it is calculated, risks associated therewith, and how such can be optimized strategically.

Key Takeaways

- Learn the most important factors that affect your rewards.

- Discover different tools that will help you make more informed decisions.

- Learn how to get the most out of your investments by using different methods and solutions.

- Evaluate the risks and identify opportunities for long-term success.

Crunching the Numbers: Staking Rewards Calculation

Staking is the power of collaboration and aligned incentives in the crypto world: it is a win-win where every individual contributes to the growth and security of the network while reaping rewards for their participation. By staking your tokens, you become a part of the network's infrastructure, helping it be more stable and efficient.

Staking rewards come from a really interesting formula that involves your personal contribution combined with the contribution of the whole network. It's like some sort of shared effort where everyone benefits from the thriving ecosystem.

The Reward Rate, within the context of staking, refers to the rate at which participants (validators/stakers) are rewarded for their contributions to the network. These rewards are based on the total rewards, block rewards plus transaction fees, that are earned over a specific period relative to the amount staked or invested. It can be dynamic and will change with factors such as network congestion, the total number of stakers, the total value staked, and the protocol-specific rules.

Here's a detailed look at these components:

Total Staked Amount: The total amount staked on the network is a key factor in reward distribution. The higher the total staked amount, the wider the distribution of rewards, reflecting the effort of the staking community as a whole.

Block Reward: Every block added in the blockchain has a set reward, sort of interest generated by the network itself. This reward is shared among stakers in direct proportion to their contribution.

Transaction Fees: Validators get a portion of their rewards through the transaction fees, which users have to pay. In addition, the fees offer incentives to the validators for putting transactions in the block being validated. In networks such as Ethereum, where the network is congested with too many users, these fees could go higher, reaping significantly high earnings during peak demand periods.

Annual Percentage Rate (APR): This metric provides a standardized measure to show the annualized return that a staker can expect to achieve. It reflects the yield made on staked assets and thus provides a comparable insight into different staking opportunities. APR may change depending on the conditions of the network, the rate of participation in staking, and other dynamic factors.

The calculation of staking rewards involves several key factors, including the amount staked. Here is a formula for calculating staking rewards:

Understanding the Variables

R: Node reward per epoch (This includes both transaction fees and block rewards)

C: Validator's commission fee (as a percentage, e.g., 5% or 20%)

S: User's stake amount

TS: Total stake amount across all delegators to the validator (the reward is distributed in proportion to the delegates' stakes)

UR: User's reward per epoch (a period of time during which the reward is earned)

Formula

UR = R * (1 - C/100) * (S / TS)

1. Validator's Cut: (R * (1 - C/100))

First, we calculate the reward remaining after the validator takes their commission. We divide C by 100 to convert the percentage into a decimal.

2. User's Share: (S / TS)

This calculates the proportion of the total stake that belongs to the user.

3. Combined Calculation:

Finally, we multiply the remaining reward after the validator's commission by the user's share of the total stake.

Example

Let's say:

R (Node reward) = 100 tokens per epoh

C (Validator fee) = 10%

S (User stake) = 500 tokens

TS (Total stake) = 10,000 tokens

Then:

UR = (100 * (1 - 10/100)) * (500 / 10000)

UR = (100 * 0.9) * (0.05)

UR = 90 * 0.05

UR = 4.5 tokens per epoh

That is a very simple and generalized formula to calculate the stake rewards. Each blockchain network has its own set of reward terms, tokenomics, and inflation system to consider as well. The good thing is you don't have to do this by hand: there are several services that can provide calculations without cumbersome math.

Tools to Make Staking Easier

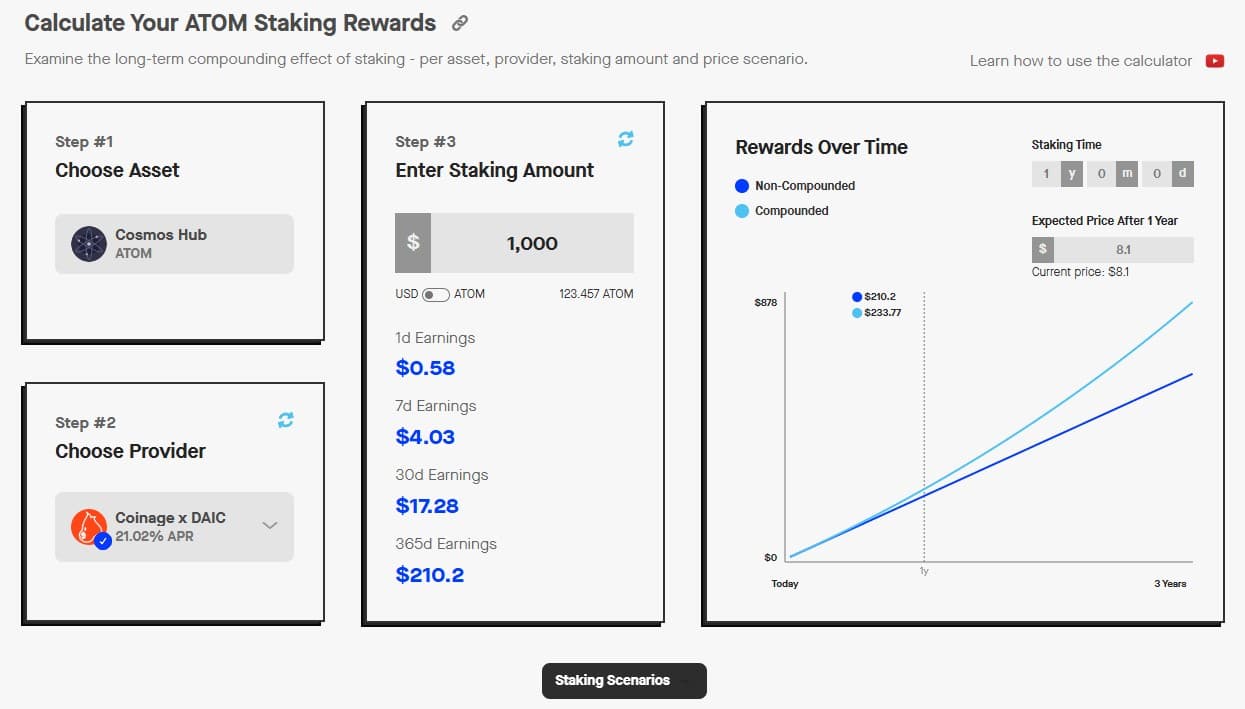

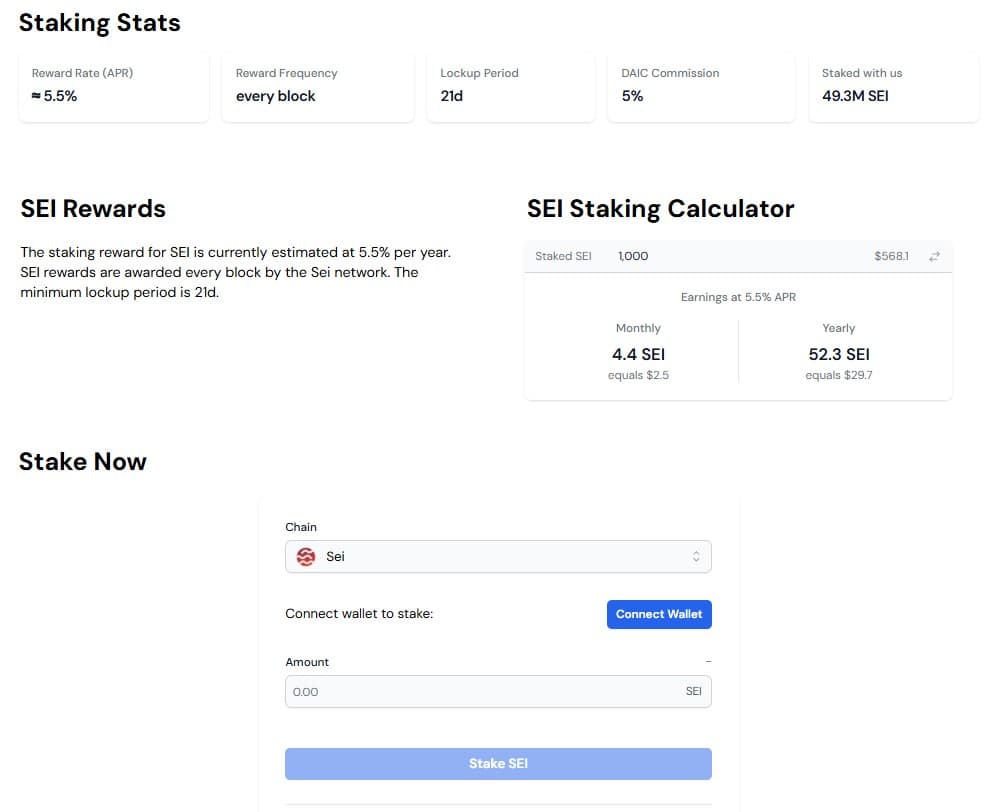

Services such as Staking Calculators show the probable return, while blockchain explorers offer insight into the network dynamic. Combined, they make it possible to realize an educated approach to optimizing your staking strategy and gaining full potential over your crypto assets.

Some of the most important and helpful tools in the armamentarium of a staker include the following:

Staking Rewards: Great and versatile platform that covers more than 100 different stakeable assets. The user-friendly interface and calculator, with a few changeable inputs, allows exploring variations in staking scenarios to project returns with ease.

DAIC Capital: While you are reading this article, you might be familiar with our platform, which offers specialized services tailored for staking within the Cosmos ecosystem. We provide valuable information about staking such as current APR, lockup periods, reward frequency. Moreover, you are able to stake your assets directly from the page of the chosen network (we support more than 40 blockchains) by connecting via your wallet.

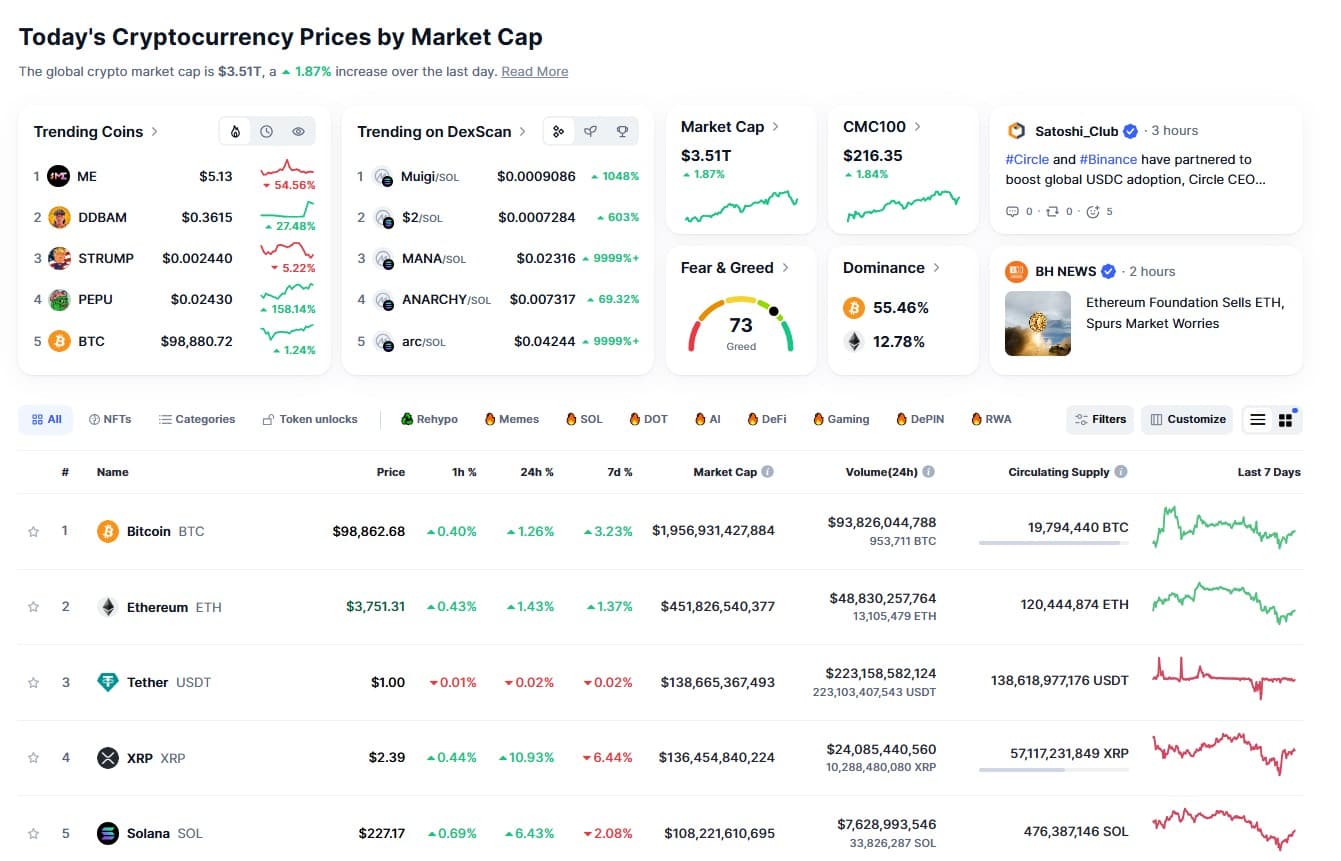

CoinMarketCap: This is the very useful website that provides a listing of some of the valuable cryptocurrencies and tokens. Market capitalization lists them, from largest to smallest. It's intuitive in design, makes presenting the results very clear, which should please many novices and experienced stakers alike.

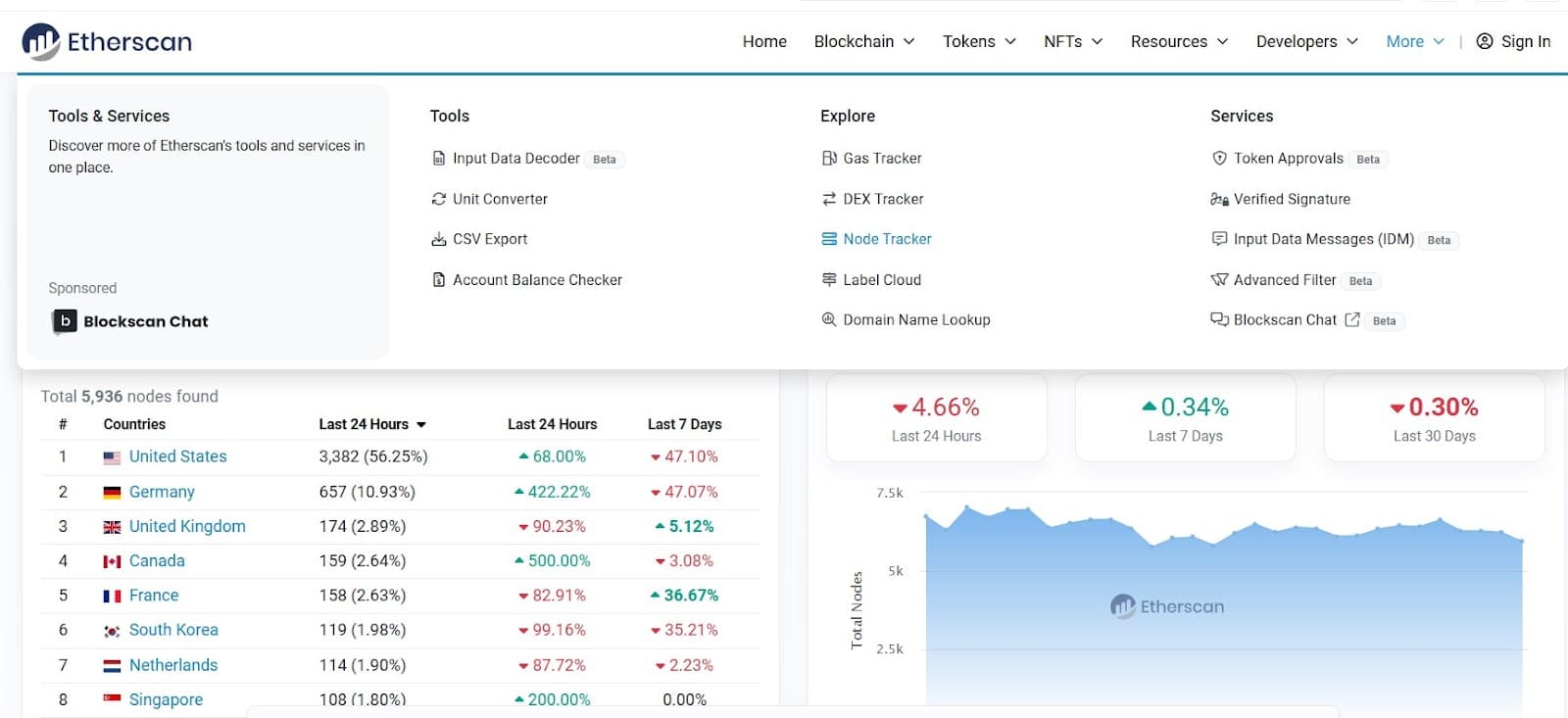

Blockchain Explorers: Etherscan-like tools offer unequaled insight into network activity, from tracking total staked amounts and reward rates to assessing validator performance. Such granular data empowers you to fine-tune your staking strategy.

By integrating these tools into your staking arsenal, you are significantly better equipped to navigate the complexities of the crypto staking landscape.

Limitations of Using Online Staking Calculators

While online staking calculators can be an excellent tool for estimating probable rewards from staking, a few limitations exist that you need to consider.

- Calculators rely on assumptions and estimates, therefore may not reflect current, real-time conditions.

- In general, calculators are dependent on data feeds from external sources, which may not be very accurate or timely at all times.

- Some online calculators may well host on untrustworthy websites, which could compromise their customers' data.

- These services usually don't account for slashing, fees, and lock-up periods.

- Most calculators lack personalization and may not take your particular staking situation into consideration.

- Some of these calculators have limited scope and might not be designed to support all cryptocurrencies or platforms.

- Tax implications, which differ from country to country, might also be something they do not consider.

- Some calculators are at a disadvantage due to user interface limitations that make it hard to enter data accurately.

- Poor investment decisions can result from overdependence on calculators in lieu of independent research.

Factors that can Boost or Bust Your Rewards

Amount Staked: The more you stake, the higher the rewards you have. Your stake acts like a weighted influence on the potential rewards you receive.

Staking Protocol: Not all blockchains are the same, and neither is their staking mechanism, whether Proof of Stake or Delegated Proof of Stake. Each has its own different reward system, and you need to understand how these mechanisms work.

Validator Performance: Most often, you will be required to select a validator to stake your crypto with. If they are reliable and perform well, you will earn more rewards.

Fees: Most of these platforms and validators have fees, which reduce the profit made from this action. They always need to be considered while calculating your returns.

Lock-up Periods: Most staking protocols do impose lock-up periods whereby a staked asset cannot be used or traded within the said duration. The lock-up duration varies among the networks but can take as low as a few days or extend for several months. The introduction of lock-up periods assures network stability and avoids short-term speculation.

Market Conditions: In the same way as the stock market, the value of cryptocurrency can fluctuate up or down. This can affect the general value of your staking rewards.

Impact on Network Participation: The higher the reward rate, the more participants could be attracted to stake or mine because the potential rewards increase. The result will be a network that has greater security from this increased participation. However, very high reward rates may raise concerns of inflation if too many new tokens are minted as rewards.

Adjustments and Governance: Most networks have governance mechanisms allowing for adjustments in reward structures that assure the long-term sustainability and goal alignment of the network.

Strategies for Maximizing Staking Returns

Smart investors can take several ways to optimize their staking outcome, such as diversification across different platforms and cryptocurrencies.

- Longer periods of staking are usually better-rewarded, though at the same time, it severely reduces your liquidity.

- The best thing to do would be to explore reinvesting your earned rewards every time since, over a period of time, compounding would definitely lead to greater increases in holdings.

- Go for reputable staking platforms that have lower fees and higher APRs for maximum return.

- Keep tabs on market trends, platform updates, and changes in regulation that can impact staking rewards and strategies.

- Staking rewards may have tax implications depending on your jurisdiction. Develop a tax-efficient staking strategy that optimizes your after-tax returns and minimizes potential liabilities.

- Be ready to change strategy at any moment based on key performance metrics or changes in the cryptocurrency landscape.

As you begin your journey in staking, keep in mind that the only truly powerful tool you will ever have is knowledge. Understand how rewards for staking work, explore different types of platforms and protocols, and keep yourself updated with the dynamic world of cryptocurrencies. Diversify your staking portfolio, dive into advanced strategies, and connect with the active community of stakers worldwide.

Come and be part of the spirit of innovation that's building a more decentralized, transparent, and inclusive future of finance!

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.