This article offers an end-to-end guideline for choosing a validator. We'll discuss the key factors you should consider when it comes to validator reputation, community engagement, and more in making a decision to better optimize your staking journey.

Key Takeaways

- The uptime of a validator is the heartbeat - strong and steady wins the race.

- Choose validators that embrace open communication and active engagement with their delegators.

- A Validator should be a fortress for your crypto, with robust security measures.

- Research the reputation of a validator in the community, taking great care about user feedback.

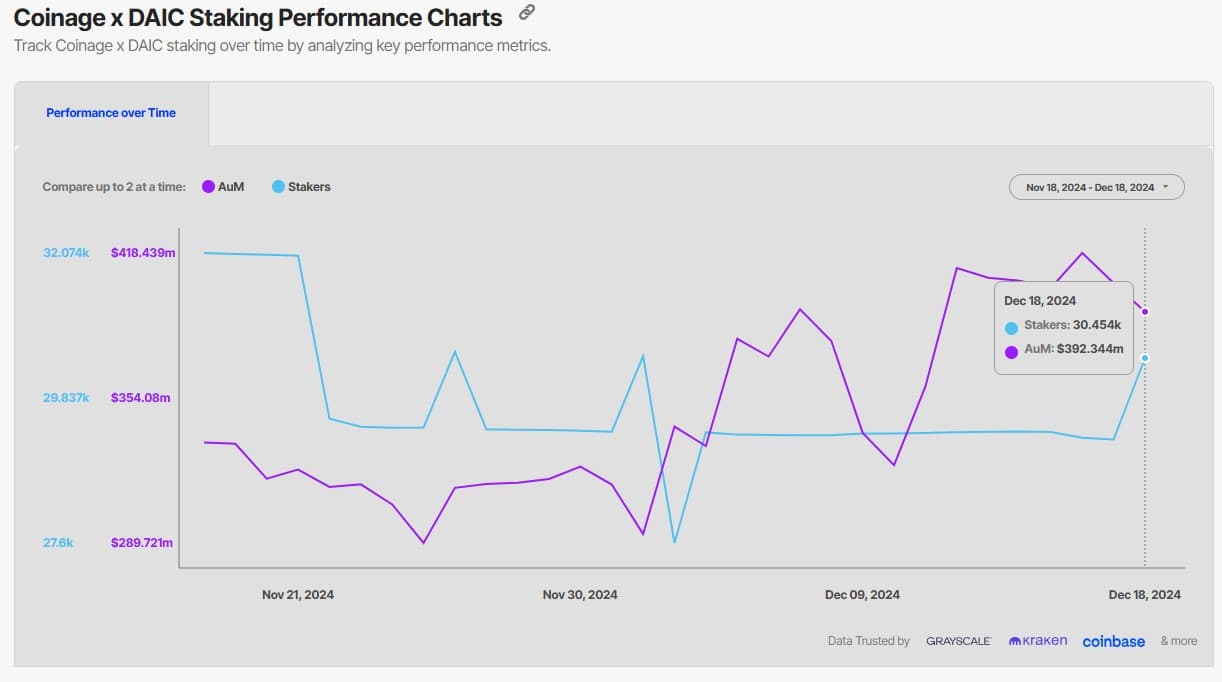

- Unleash the power of analytics platforms to compare validators side-by-side and make data-driven decisions.

- Diversify your stake to multiple validators to minimize risks and contribute to a healthy, resilient network.

Staking 101: The Essentials

Staking means the process of locking up crypto assets in support of the network and earn rewards in return. Validators are guardians of the blockchain, which are responsible for keeping it safe and efficient, enabling the validation of transactions, creation of new blocks, and generally participating in governance.

You can delegate your tokens to a validator and share in their rewards without running your own validator node. It's a simple way to participate in staking and earn passive income.

Key Roles of Validators:

- Ensuring that only valid transactions are added to the blockchain.

- Proposing new blocks to the blockchain.

- The security of the network, keeping bad actors at bay.

- Participating in governance by voting on proposals that will shape the future of the network.

Interested in staking, but feeling a bit lost? Read our "Beginner's Guide to Staking Cryptocurrency: Everything You Need to Know." It's akin to a map guiding you through the exciting landscape of staking, with many insights and tips there to help navigate this rewarding adventure.

Right Validator for Staking: Key Points

Choosing Staking Validators is one of the most important decisions you'll make along your investment journey. It will significantly affect your rewards, the security of your assets, and by extension, your experience in the staking ecosystem.

Below is a checklist of key metrics that separate the best validators from the rest, all in one, to empower you toward informed decision-making and optimized staking strategy.

On-chain identity

Stake with validators that have a verifiable on-chain identity. This digital fingerprint gives you the ability to look back at a validator's history, evaluate their past performance, and build faith in their legitimacy. Validators who operate anonymously, therefore without a traceable identity, raise concerns about the trustworthiness.

Website and contacts

A very important one would be the validator's website and communication channels. A nice, functional website is like a business storefront. It says much about how serious someone is in business, infrastructural preparedness, and security setup. Clear contact information contributes to readiness to serve its delegators and handle concerns of all kinds in time.

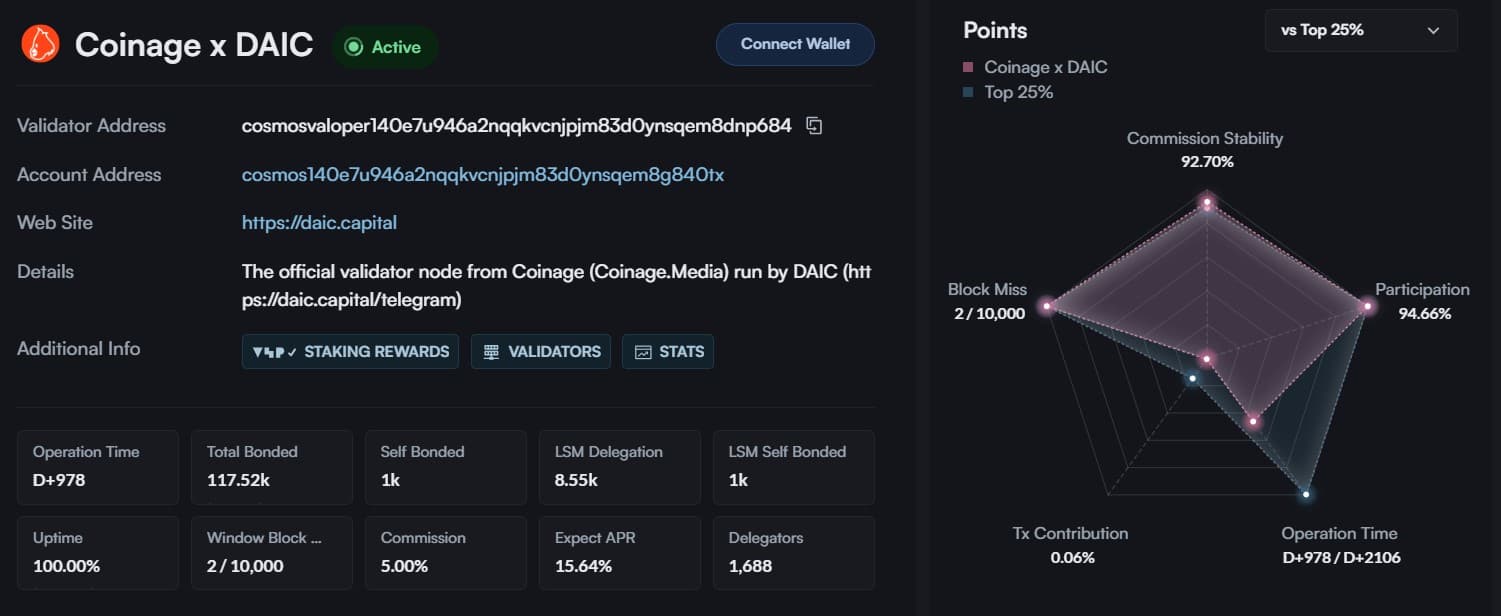

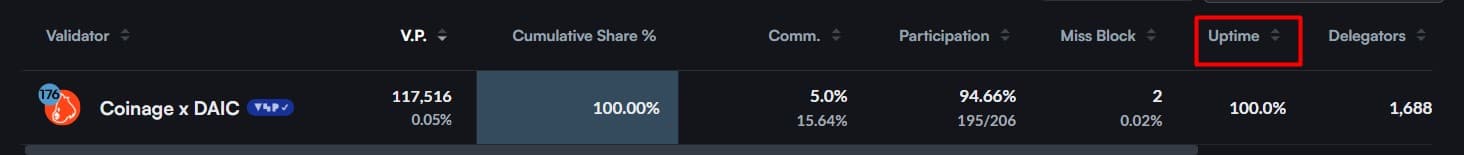

Uptime and Reliability

Look for validators maintaining uptimes close to 100%. High uptime is a sign of reliability and ensures your rewards are maximized with no penalties from missed blocks.

Beware that 100.00% uptime doesn't necessarily mean the validator is exceptional. As a matter of fact, more rigorous security measures introduce more latency, which means that more secure validators might miss a block more from time to time.

Commission Rates

The commission rate is the proportion of accrued staking reward that is paid to a validator for the services. A smaller commission means more rewards to you, but make sure the fee structure is reasonable with the quality of service being provided.

Analyze the validator's commission history, noting their maximum cap and the rate of change at which they modify their fees. A reasonable cap, such as ~10-20%, and a low and consistent commission change rate would represent good financial management and predictability. Also avoid very low-fee or no-fee validators, because such are not likely to be able to support operation in the long run, or after attracting a few delegators, they might maximize commission.

Choose validators whose rates align with your preferences, ensure they provide fair value for their services. Usually, the commission rate should be somewhere between 5% and 10% - more or less.

Self-Bonded Stake

The validator should have a high degree of self-bonded stake. This is basically alignment of interests that incentivize the validator to act for the benefit of the network and its stakers.

Validators should stake to themselves, called "self delegation". Validators with more at stake are incentivized to act in the best interest of the network. Often times a validator's reputation is worth far more than their self delegation at risk.

Security Measures

Ensure the validator has robust security measures in place to prevent attacks and downtime. Research your validator's security measures. A good validator should be public about their security best practices, infrastructure, and organizational / team structure.

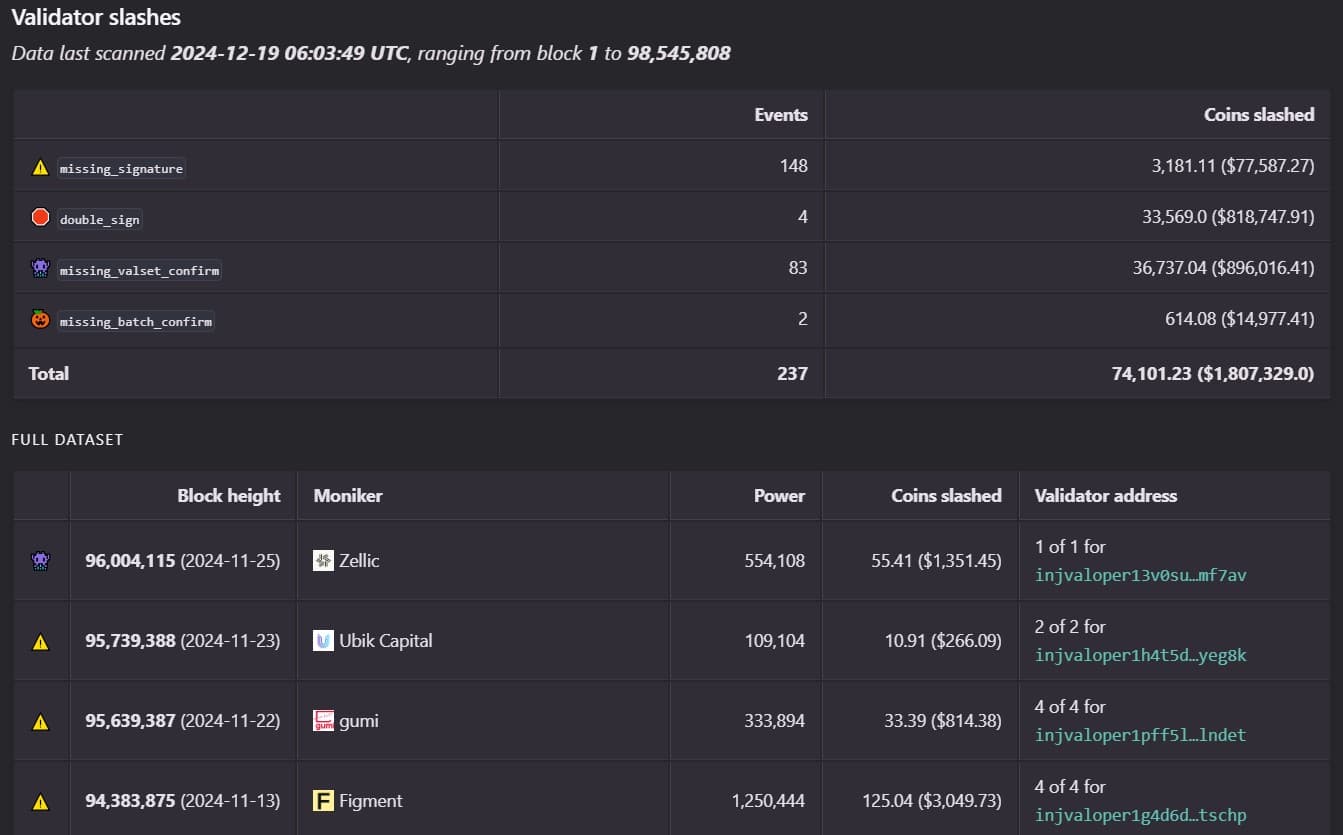

Slashing History

Slashing is a penalty imposed on validators for offenses like double-signing (signing two blocks at the same block heights) or going offline. It can result in a loss of staked tokens, impacting both the validator and their delegators.

First, try researching whether your validator was previously slashed for soft or hard faults, even. Some blockchain explorers display how often this had been the case.

Finally: Does your validator use to publicly acknowledge incidents in these cases and investigate why something had gone wrong? This ensures they'll prioritize transparency and strive for continuous improvement to prevent similar mishaps.

Community Engagement

Engaging with your selected validators through social media or community forums can provide insight into their operational and responsiveness. Validators that contribute to the different communities increase overall ecosystem reach and information available, improve morale and vibe in general.

Look out for validators with a positive presence in community forums and on social media.

Validator Reputation

Check the review and feedback from users who have experience with different validators. Websites like Staking Rewards can give valuable insights into validator performance and user satisfaction.

Transparency in Operations

Choose validators that give detailed information on their operations, the policy on reward distribution, and what commission is taken. It gives trust and a full understanding of how your rewards will be calculated.

For instance, we at DAIC Capital provide a wealth of information on our operations, reward distribution, and commission structure. We even go a step further by developing a Slashing & Insurance Fund Policy, offering an additional layer of protection for our delegators in the event of unforeseen slashing incidents. It's like having an insurance policy for your staked assets, providing peace of mind and demonstrating our commitment to delegator security.

Voting Power

Sometimes, Centralized Exchanges (CEX) allow customers to stake tokens on their platform. Of course, they will choose their own validators to do that. Because most crypto users are still holding most of their coins on CEXs this system leads to drastic centralization of stake and governance voting power. On the other hand, there are always other risks with staking on CEXs, as users do not own private keys and can be blocked for various reasons, losing access to their funds.

Diversifying your stake-especially through delegations to validators outside the top ten - can prevent the centralization of voting power and help enable new contributors. This is extremely important for a balanced and decentralized network.

Validators holding too much voting power have a negative impact on the security and governance outcomes of the network. This makes supporting smaller or newer validators not only good for the health and resilience of the network but also gives you the power to incentivize various ecosystem contributions from these often smaller teams.

Being a delegator means that you're an active citizen within a blockchain network: you help to support the security of the network, and in many blockchains, your vote is taken into consideration in terms of the project's roadmap. By understanding validator roles and making informed choices, you can become a pro in contributing to a robust, decentralized blockchain ecosystem.

Together, we can unlock the full potential of staking and shape the future of decentralized finance. Start your staking adventure today and watch your crypto grow!

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.