Introduction to EigenLayer

EigenLayer is an Ethereum-enabled protocol that introduces restaking, a newly developed primitive in cryptoeconomic security. This model allows for the rehypothecation of ETH to the Ethereum blockchain’s consensus layer.

This is realized when users choose to leverage EigenLayer smart contracts to restake their ETH to provide cryptoeconomic security to additional applications on the network. On EigenLayer, these service-based middleware modules are called Actively Validated Services or AVSs.

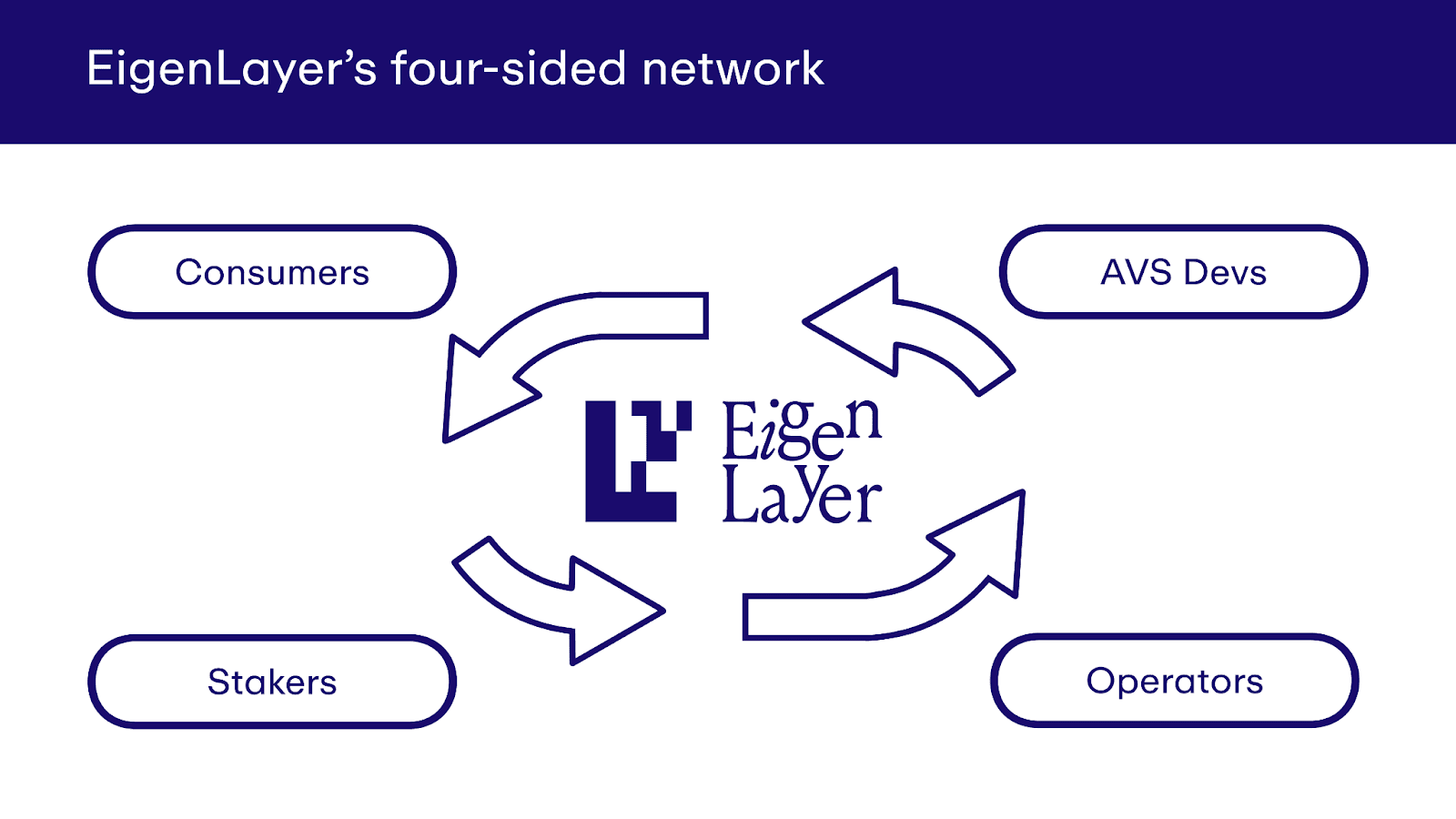

In essence, EigenLayer generates a free market for decentralized trust via Ethereum stakers to AVS modules that make use of validation and staking services provided by operators (more on these participants later). Therefore, much of EigenLayer’s potential lies in its ability to aggregate and extend cryptoeconomic security via is restaking primitive while providing validation services to new applications (AVSs) built atop the Ethereum blockchain.

In many respects, EigenLayer supports a large number of uses outside of decentralized finance (DeFi). This is because of the fact that any type of protocol, dApp, blockchain, service, etc. can be built on top of EigenLayer.

To better understand the basics of EigenLayer and how it works, feel free to check out our article “EigenLayer: A Restaking Protocol and On-Chain Collective” that dives into the platform in more depth.

Introduction to Blockchain Middleware

For those unfamiliar, blockchain middleware is any type of infrastructure that supports different blockchain systems — whether Layer 1 or Layer 2 platforms or related infrastructure — by providing services that interconnect the blockchain landscape.

Not only is middleware used to connect different elements within a Layer 1 or Layer 2 network, it is used to connect blockchains together and provide services to a plethora of network types, dApps, protocols, and the like.

Overall, these services can include oracle networks, data availability (DA) layers, bridges, wallets, sidechains, trusted execution environments (TEEs), consensus protocols, threshold cryptography schemes, keeper networks, secure multi-party computation (MPC) frameworks, newly developed virtual machines, and many others.

EigenLayer Purpose, Project Vision, and Significance

On EigenLayer, the above protocol types, networks, dApps, and others are represented as middleware that take the form of Actively Validated Services (AVSs) (more on AVSs and how they work below) that provide numerous services to the larger EigenLayer network.

In many respects, this service-specific architecture allows for previously unattainable innovation within blockchain systems. EigenLayer materially advances that realm of blockchain in ways that are not yet plausible, bringing with it the necessary infrastructure required to build platforms for nearly any use case imaginable.

Along with restaking (which we’ll touch on below), AVSs play a huge role in realizing this vision. While the central premise of AVSs is to offer services to the network, they also improve EigenLayer in numerous additional ways, including:

- Increased user trust: AVSs increase user trust by improving platform reliability, usability and serviceability for participants of all shapes and sizes.

- Continuous system monitoring: AVSs are generally involved in tracking real-time system operations which are important for pinpointing discrepancies in expected behavior.

- Automated validation: Automation tools such as scripts and others are used to continually test and verify that the larger EigenLayer platform (and other AVSs) is operating to its predefined standards.

- Proactive issue detection: Through the continuous monitoring and validation of the EigenLayer network, AVSs help identify possible issues before they escalate, allowing for timely intervention should it be required.

- Enhanced security: Regular security checks and validation help identify potential vulnerabilities, ensuring the network’s security is up-to-date and in good standing, dramatically reducing the possibility of a security breach.

- Improved reliability and performance: Continuous validation means the service remains reliable and proficient, allowing the larger network to meet required service level agreements (SLAs) and user expectations.

- More efficient compliance and auditing: AVSs help simplify compliance and auditing procedures via ongoing validation and documentation, making it simpler for network participants to abide by required rule-sets in various geographical regions.

In summary, EigenLayer is the first blockchain protocol that allows for the development of an endless number of utilities and real-world use cases in a cryptographically verifiable manner, ensuring protocol and participant integrity.

When you combine this serviceability along with the ability for users to dramatically increase their potential profits via staking rewards, it's clear that EigenLayer stands out in ways other blockchain-agnostic platforms simply cannot. This allows the network to support an ever-expanding range of uses and participants that will only grow moving forward.

Broadly speaking, there are three distinct layers that make up the EigenLayer collective: 1.) the core protocol, 2.) AVSs, and 3.) DeFi.

How EigenLayer Works

Understanding Restaking

As a reminder, Proof of Stake (PoS) blockchains make use of a protocol-level mechanism called staking whereby users bond (lock in) their tokens into validators to boost a network’s security and operational efficiency. In return, users (known as delegators) who bond their stake are rewarded in the network’s underlying asset.

However, this model presents some inefficiencies, notably the fact that delegator-locked assets must undergo an unbonding period of 7- to 28-days or longer. Although necessary to secure PoS chains, this design obfuscates asset liquidity for the end user because of the existence of the unbonding period prior to withdrawal.

To help eliminate some of these issues, EigenLayer pioneered the restaking concept to add unabated liquidity accessibility to PoS networks.

In essence, restaking is a protocol-based mechanism employing a shared security model that allows users to bond their tokens within a specific protocol in exchange for a liquid restaking token (LRT). On EigenLayer, users initially delegate their ETH (or a number of other tokens) to the network in exchange for a LRT.

This collateral is redeemable for the initially deposited tokens which users are then able to use within various DeFi primitives (such as lending, borrowing, yield farming etc.). Should the user wish to withdraw their initially deposited assets, they are then able to exchange them for their restaking tokens without an unbonding period.

This means the staker is able to accrue staking rewards for bonding their ETH within EigenLayer while simultaneously earning additional rewards on their LRTs by restaking their liquid restaking tokens within an independent protocol within EigenLayer.

This system effectively allows users to leverage their assets twice to earn two independent sets of rewards during the period their tokens are bonded within. In return, the protocol (called an EigenPod) offering restaking to restakers accrues additional tokens for hosting the service via EigenLayer and Ethereum.

EigenLayer Network Participants

To help us better understand how EigenLayer works, it's necessary to take a closer look at the network's main participants. These include:

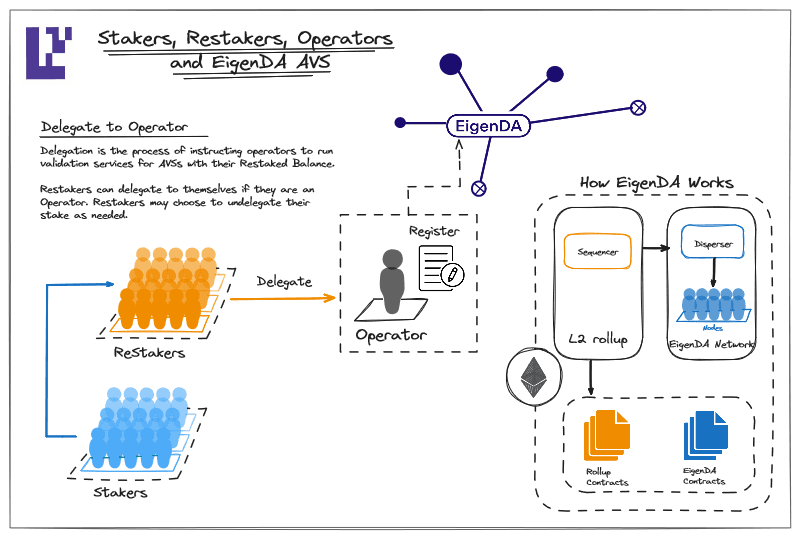

- Operators: Upon registration, operators allow stakers to delegate their staked assets as either native ETH or liquid staking tokens (LSTs). Operators then opt-in to provide a vast range of services (typically validation services) to AVSs to reinforce the overall functionality and security of their independent networks. Operators are somewhat akin to validators, but instead of validating blocks within an independent blockchain network, they validate and support Actively Validated Services (AVSs).

- Actively Validated Services: Through EigenLayer, developers are able to build various service-focused modules called Actively Validated Services. These can include data availability (DA) layers, bridges, sidechains, oracle networks, secure multi-party computation (MPC) frameworks, and more.

- Restakers: The EigenLayer protocol allows users to stake ETH across multiple protocols simultaneously via restaking, enabling staked ETH to be utilized as cryptoeconomic security within various protocols outside of Ethereum in exchange for rewards and protocol fees. Restaking can be leveraged by users for both natively staked ETH (by depositing 32 ETH into an EigenPod) or different liquid staking tokens.

- AVS Consumers: On EigenLayer, AVS consumers are essentially users that make use of the various types of AVS middleware modules.

- AVS Developers: EigenLayer provides developers with accessibility to Ethereum’s staked capital and decentralized validator set, making previously implausible consensus mechanism designs possible though the EigenLayer trust network. Developers play an important role in the long-term value proposition of the network because they build different types of AVSs.

Like any Proof of Stake (PoS) protocol, EigenLayer leverages delegation whereby stakers delegate their staked ETH or LSTs to operators or run delegation services themselves (as an operator). For this process to work as intended, both parties must mutually agree and opt-in to support one another.

Restakers and native ETH stakers play a vital role on EigenLayer. However, to make this explanation easier to understand, let’s focus on the mutually beneficial relationship between operators and Actively Validated Services.

Operators are allotted a predetermined amount of staking rewards from each AVS they support, in-turn taking on risk should any of the AVSs under their umbrella act maliciously or threaten the operator’s integrity on the larger EigenLayer network. This means operators must be extremely strict when choosing which AVSs to support.

In exchange, the AVS is able to piggyback operator security and validation services, providing them with the correct infrastructure they need to run their independent service platform, which in turn allows the AVS to collect rewards via their operator(s) while also eliminating complex validator bootstrapping and time/capital typically needed to initially launch their platform.

Security Models and Validation Processes

As it relates to the AVS-operator relationship, it's important to understand that a penalization structure is needed to ensure the integrity of the larger network and its participants.

As is common knowledge in blockchain circles, slashing is a penalization mechanism used by Proof of Stake blockchains to ensure that active validators processing and amending blocks is completed in an equitable manner.

Slashing is typically initiated towards validators that make use of a mechanism called maximal extractable value (MEV) that increases their profitability by deliberately including, omitting, or changing transaction ordering during block creation. This is done to extract additional rewards for themselves on top of the value they would normally obtain through transaction fees.

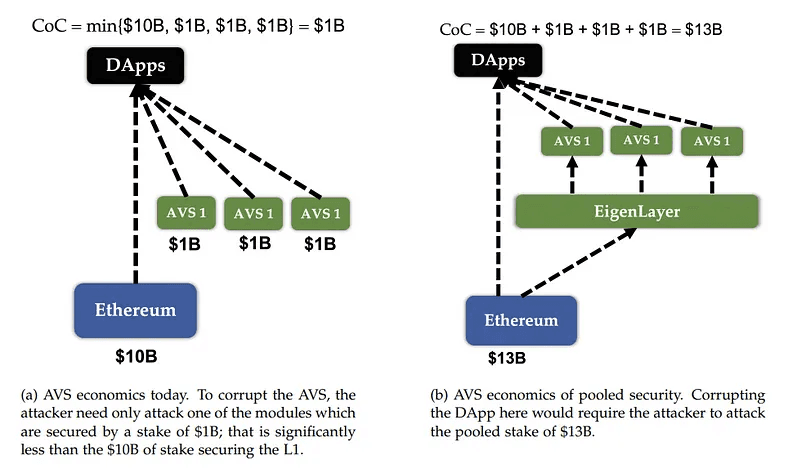

As such, on EigenLayer, the ability to carry out an attack is quantified via a theory called the Cost-of-Corruption (CoC). Case and point, when an attacker attacks an AVS (or dApp etc.) a predetermined cost (the CoC) exists based on numerous factors the attacker must take into consideration.

Essentially, to corrupt and/or control an AVS and potentially seize its assets, the attacker must possess a certain amount of capital (13 billion vs. 1 billion in the dual-pronged example above) and fulfill additional requirements in a best case attack scenario. In itself, one of the main foundational premises of EigenLayer is to provide cryptoeconomic security via a host of slashing mechanisms that impose a high CoC.

Therefore when the CoC is significantly higher than the Profit-from-Corruption (PfC), the system is thought to be extremely secure. To put it simply, if the potential challenges the attacker must undertake are much larger than the potential reward, it is not really worth conducting the attack in the first place.

As we noted in the diagram above, EigenLayer works using a pooled security mechanism that dramatically increases the CoC for potential attackers. In essence, there is a huge difference between the security robustness of AVSs leveraging pooled security and those that do not.

In addition to the above considerations, on EigenLayer two main types of risk exist that can compromise the integrity of the system. These include:

- Operator collusion: Several operators could work together to attack a group of AVSs concurrently.

- Unintended slashing vulnerabilities: AVSs may be susceptible to inadvertent slashing vulnerabilities (such as smart contract bugs) that can result in honest nodes being slashed.

To understand EigenLayers risk in much greater detail see our article “EigenLayer: Operators, Services and Slashing Equitability”

EigenLayer Staking Types

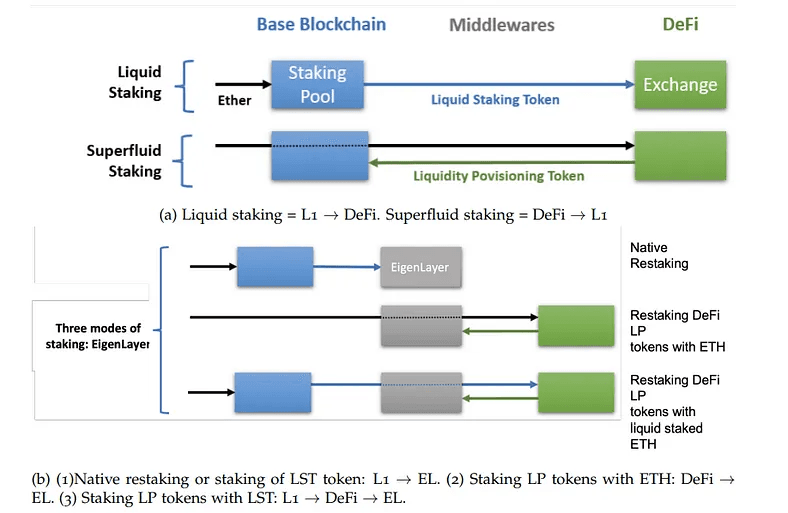

EigenLayer makes use of several related staking paradigms including: liquid staking, superfluid staking, and restaking.

- Liquid staking: Through liquid staking protocols on EigenLayer such as Lido, users are able to deposit their ETH within a staking pool to receive a liquid staking token (LST) that acts as a claim to their ETH and its staking yield. Inside the staking pool, the ETH is delegated to one of a large number of network validators participating in the network’s consensus. LSTs are fully redeemable for their underlying ETH value and are also fully tradable within the Ethereum DeFi ecosystem.

- Superfluid staking: Superfluid staking is realized by modifying the consensus protocol to enable the staking of liquidity provider (LP) tokens. LP tokens represent a share of the total liquidity contained within a decentralized exchange (DEX).

Liquid staking is a mechanism that allows users to stack additional yield via the core protocol and then the DeFi layer, while superfluid staking first goes through the DeFi layer prior to the core protocol layer (i.e., via a process that is the opposite of liquid staking).

In addition to liquid staking and superfluid staking, as we all know, EigenLayer leverages restaking. Specifically, EigenLayer makes use of several distinct variations of restaking, including:

- Native restaking: validators natively restake their staked ETH

- LST restaking: validators restake their LSTs, ETH already restaked and held within protocols such as Lido, Swell, and Rocketpool by transferring their LSTs into EigenLayer smart contracts.

- ETH LP restaking: validators stake their LP tokens paired with their ETH

- LST LP restaking: validators stake their LP tokens paired with a liquid staking ETH token

EigenLayer’s Key Features

The EigenLayer network provides numerous benefits to its participants including offering numerous flexible staking models, resulting in increased security for new services building on the network, furnishing more equitable incentive structures for validators and stakers, and increasing interoperability with other Ethereum protocols. Let’s look at some of these in more detail:

- Enabling a foundation for increased staking rewards: EigenLayer allows users to restake their ETH to secure multiple protocols in a simultaneous manner, therefore enabling them to earn additional rewards on their initially deposited assets to dramatically increase their total staking rewards.

- Providing equitable and decentralized governance: Like most open public blockchain protocols, EigenLayer leverages a decentralized governance structure, where token holders, validators, stakers, and other participants are able to propose and vote on changes to the protocol, ensuring community-driven governance long-term.

- Supporting the growth of decentralized services: Through the use of Ethereuem’s decentralized trust network, EiegenLayer helps allow decentralized services (AVSs) secure their underlying networks without having to bootstrap their own validator set, resulting in accelerated growth and reduced costs.

- Reducing the barrier to entry for new protocols: EigenLayer lowers the barrier to entry for newly developed protocols by piggybacking the serviceability of Ethereum’s L1 validator set, helping eliminate the need for distinct security and staking mechanisms needed to accelerate protocol launch.

- Strengthening the overall Ethereum ecosystem: EigenLayer strengthens the underlying Ethereum network by increasing staked ETH and validator participation, fortifying its security while also interconnecting the serviceability of additional decentralized services to complement Ethereum’s continued growth.

- Streamlining development for middleware solutions: EigenLayer streamlines protocol development by providing a standardized staking and security paradigm, giving developers accessibility to a platform that allows them to focus on the intricacies of dApp development instead of worrying about consensus mechanism design.

Today, if a developer wishes to build a smart contract protocol like a DEX, money market, or the like on Ethereum, they leverage the security from Ethereum's larger trust network by deploying their contracts on top of the Ethereum blockchain.

This has brought with it the massive proliferation of cutting-edge smart contract protocols focused on DeFi, NFTs, and more that harness the robust security guarantees of Ethereum.

Nonetheless, until recently, Ethereum’s security has only been realized on smart contract protocols, meaning it has been extremely difficult to provide security to distributed systems such as bridges, sidechains, oracle networks, sequencers, data availability (DA) layers, and others. Unfortunately, this has often led developers to undertake the complexities involved with bootstrapping their own trust network to acquire the security they need.

This cumbersome bootstrapping requirement is perhaps the most substantial obstacle limiting innovation in distributed systems from achieving comparable variety, scale, and speed typically seen in smart contract protocols. This has so far been one of the greatest limitations in the development of decentralized networks. Thankfully, EigenLayer solves this issue.

Imagine if developers the world over were able to tap into a massive network with billions of total value locked (TVL) and hundreds of thousands of validators instead of building their own network from scratch by utilizing the security and trust guarantees of Ethereum programmability based on the requirements of the platforms they’re developing.

This would help eliminate the need for significant capital, manpower, and time, allowing them to focus on building systems that pay fees to the programmable network to use its underlying security, bringing with it the ability to develop distributed systems to help realize a freer, more democratic internet.

Getting Started with EigenLayer

How to Stake and Restake ETH

Now that we know a bit about how EigenLayer works and that it introduced restaking as a newly developed DeFi model, let’s dive into the basics of how a user goes about restaking their assets via the DAIC operator/validator.

- First, a user will need to go to an exchange or related service and purchase some ETH.

- Next, the user will need to send their newly purchased ETH to one of the many Ethereum-based wallets supported by EigenLayer.

- Once the user has some ETH in their wallet, the next step is to follow the link to the main EigenLayer staking dashboard.

- Once inside the dashboard, the user is required to hit the “Connect” button in the top right corner of their screen to connect their wallet to the EigenLayer protocol.

- Next, the user selects the wallet they hold their ETH in. Let’s select MetaMask for this example.

- Prior to connecting, ensure you accept the terms of service and privacy policy; once connected, you are ready to restake

- Once in the restake dashboard, hit the “Restake” button at the top right of the screen. Next you’ll need to select one of many restaked assets, allowing you to then deposit your ETH within that specific asset’s corresponding protocol (e.g., for Lido, Lido Staked Ether (stETH).

- Next you’ll want to hit the “Submit” button, once doing so your assets will be deposited into the EigenLayer protocol. You are now restaking, congratulations!!

- The next step is where you’ll need to delegate your staked ETH to an operator as the next step. To do this look at the top of your screen and click on the Operator tab to go to the operator delegation menu.

- Finally, in the search bar search for “Coinage x DAIC” then click on the logo to select it, then hit the “Delegate” button and you're good to go. Congratulations you are now resting within the Coinage x DAIC operator.

Use Cases and Applications

Because of its design and intended utilities, EigenLayer is designed to allow for the creation of a host of utilities and services that complement Ethereum’s restaking narrative.

Specifically, EigenLayer is designed to help allow developers to build a wide range of distributed systems without worrying about the complexities involved in hosting their own underlying trust networks.

As we noted above, on EigenLayer, these distributed systems are known collectively as Actively Validated Services (AVSs). Essentially, AVSs are middleware protocols built to offer various services/uses to the larger EigenLayer network that benefit a wide range of network participants.

While there are additional AVS categories, for the purposes of this explanation, we’ll classify these AVSs into three main categories:

- Rollup Services - amplifying the Ethereum rollup ecosystem with numerous services that leverage various aspects of security from Ethereum’s trust network

- MEV Management - enabling block proposers to verify the integrity of how validators operate in their respective networks to ensure they act in a non-malicious manner (mainly as it relates to block inclusion and block ordering)

- AI Inference ensuring AI inference models are cost-effective, private, equitable, and accessible via EigenLayer

Rollup Services

EigenLayer is designed to enable the development of a wide range of all-important services that scale Ethereum, while simultaneously inheriting security from Etheruem’s decentralized trust network (i.e., the Ethereum blockchain). On EigenLayer, these solutions are collectively referred to as 'Rollup Services.’

It's important to note that rollup services on EigenLayer are separated into several distinct categories, with the most important of these being decentralized sequencing and data availability (which we go over below), with others including fast finality protocols, keeper networks, watcher networks, reorg-resistance protocols, and inbound and outbound bridges (additional info on these can be found in our more detailed EigenLayer use cases article).

Decentralized Sequencing

In general, sequencers (such as those operating major Layer 2s like Arbitrum, Optimism, and Polygon) are solely responsible for the order of transaction execution on rollup networks. Problematically, most present-day sequencers are susceptible to short-term censorship and manipulation issues.

This is because larger centralized entities typically operate sequencers using a single all-important node, meaning the end result is often overarching control.

Overall, long-term censorship is realized in rollups via a mechanism that writes transactions directly to Ethereum, meaning these sequencer-specific challenges can be alleviated by utilizing a decentralized transaction ordering service (i.e., a decentralized sequencer).

As a potential solution to the centralization challenges sequencers face, EigenLayer is able to furnish the infrastructure needed to help create decentralized sequencers which make use of a network of decentralized nodes to determine transaction ordering.

Data Availability (DA)

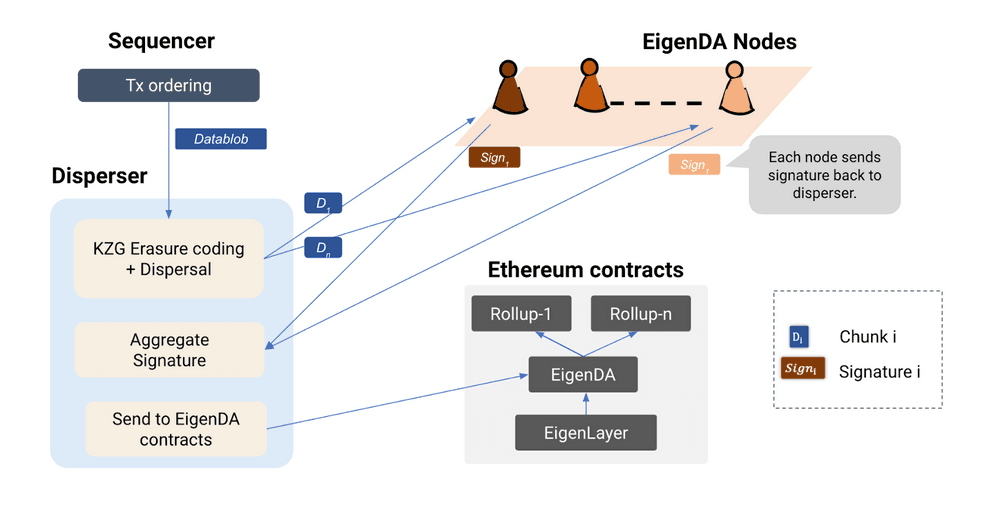

Data Availability (DA) is a core concept in blockchain and has become an increasingly important service that protocols, middleware systems, and other platforms utilize to operate more efficiently.

As it relates to rollups specifically, fundamentally, rollups must have accessibility to the data they need and a way to store it in an external environment to help increase protocol performance and efficiency.

More specifically, as a means to ensure the correctness of optimistic rollup (OR) state execution and ensure the liveness of zero-knowledge rollups and optimistic rollups, a vital prerequisite is the short term Data Availability of transaction blobs which are processed by the rollup.

If we consider situations where data-heavy consumer applications such as gaming and social networks typically possess low value per data bit but require a significant amount of bandwidth for state execution.

Consequently, these application types generally demand significant transaction throughput (high processing speeds). In order to meet this demand, high scalability data availability architectures that support the high security needs of rollups are needed. Thankfully, this is why the EigenDA data availability framework was built.

MEV Management

In blockchain systems, at times, validators implement a strategy called maximal extractable value (MEV) that increases their profitability by deliberately including, omitting, or changing transaction ordering during block creation. This is done to extract additional rewards for themselves on top of the value they would normally obtain via transaction fees.

EigenLayer is designed to expand upon services like Ethereum’s MEV-Boost that help reduce unethical MEV extraction (essentially manipulation to receive more rewards) on the Ethereum network by allowing validators to create a more flexible range of commitments to their counterparts, whether being builders or users specifically.

AI Inference

In recent years especially, artificial intelligence (AI) has become particularly crucial to the world’s evolving technological paradigm. Critically important to AI in general, is the interconnected relationship between AI training and AI inference.

AI training allows AI models to make factually correct inferences, while AI inferences allow AI models to produce predictions or conclusions based on the data they are given, while algorithmically providing a conclusion to their legitimacy.

Unfortunately, the AI inference landscape consists of a plethora of large-scale mega-conglomerates that operate most of the world’s AI inference engines (think Amazon, Google etc.). The global landscape needs other options to help mitigate this centralized approach. EigenLayer and its AVSs help fill this gap.

Closing Thoughts on EigenLayer Uses

The above utilities focused on Rollup Services, MEV Management, and AI Inference are representative of only a portion of the potential use cases within the continually expanding vision for EigenLayer.

As a multipurpose toolkit that allows developers across the world to craft their own protocols and services through programmable trust focused on decentralization, economics, and Ethereum inclusion trust, EigenLayer takes what is possible with blockchain to the next level.

DeFi Protocols Leveraging EigenLayer

Since Ethereum first allowed for the launch of DeFi protocols like MakerDAO, Uniswap, Compound, and others years ago, we've witnessed an on-chain renaissance supported by highly concentrated liquidity and increased capital efficiency.

However, in many ways we have hit a wall in this regard. Case and point, AMM liquidity providers have lost more than 700 million since The Merge took place in September 2022 and centralization continues to be the choice of many exchange platforms as a means to improve efficiency.

In addition, it's becoming harder to provide personalized (for retail users) DeFi loans because it's often less risky to lend capital to larger players with less default risk or easy access to fixed-rate loans for specific time periods.

Many of these challenges are the result of an Ethereum blockchain that increasingly struggles with slow transaction processing times and high gas fees and the lackluster ability to natively use off-chain data.

Modular architectures such as those provided via EigenLayer provide a way for Ethereum to offload heavy computation and integrate external data without sacrificing the chain’s core security guarantees. This is achieved via the implementation of coprocessors (tools that help manage complex tasks off-chain, while still preserving the core principles of the blockchain) that are capable of processing highly intensive tasks in a 100% verifiable manner.

Therefore, EigenLayer provides the infrastructure needed to create decentralized networks (AVSs) of node operators that are able to run arbitrary node software. AVSs dramatically decrease the cost of building and launching verifiable trustless services (i.e., anything imaginable that runs both on-chain and off-chain).

In the larger picture, AVSs are fully interconnected because they offer a wide range of services to dApps, DeFi protocols, other AVSs and Layer 1 and Layer 2 blockchains and the like. EigenLayer refers to this model as Intelligent DeFi because it brings real-time customizability and personalization to decentralized finance. In DeFi specifically, this infrastructure supports centralized and decentralized exchanges, derivatives platforms, lending and borrowing via decentralized money markets, compliant privacy mixers, and much more.

Some of the most prominent AVSs building on EigenLayer focused on supporting DeFi infrastructure include:

- AltLayer - a Rollup-as-a-Service (RaaS) architecture that allows for the deployment of various rollups types via a customizable no-code framework via EigenLayer and EigenDA

- Ethos Stake - a security coordination layer that utilizes restaked ETH through EigenLayer to dramatically improve the security of Cosmos appchains (more infos in our blog post: “Ethos Stake: Enhancing the Security of Cosmos via Restaking”)

- Lagrange - a zero-knowledge (ZK) hyper scalable processing protocol that harnesses State Committees to carry out restaking to create secure and extensible light clients for optimistic rollups

- Brevis Network - a smart ZK coprocessor that allows smart contracts to utilize the complete on-chain data history from any chain as a means to run customizable computation for DeFi, zkBridges, ZK identity, and other uses

- Automata a multi-prover Ethereum compute engine leveraging TEE coprocessors to realize machine-level trust, adaptability, and decentralization for AltLayer rollups

- Aethos Network - a decentralized policy layer built on EigenLayer that allows for the enforcement of customizable rules and conditions for on-chain transactions

If you’d like to explore these AVSs and others in more depth, consider reading our larger AVS article.

On the other hand, and perhaps even more importantly, additional protocols (called EigenPods) that hold large amounts of capital on EigenLayer include: Pepe (PEPE), Lido Finance (stETH), Wrapped Ethereum (wETH), Mantle Network (mETH), Stader Labs (ETHx), Swell Network (swETH), and many others.

EigenDA and Rollup Data Availability Explained

To better comprehend EigenDA and its potential applications, it's important to understand that the ability for a distinct network type to provide data to another independent party (i.e., for a protocol, middleware system, independent rollup network, application etc.) is called Data Availability, or DA.

While Actively Validated Services do make use of restaking and other constructs to guarantee their efficiency and security, ultimately, different AVS middleware platforms need access to specific data types to operate. This ability to provide data is required to increase AVS efficiency to complement and scale blockchains like Ethereum and others.

To help accomplish this goal, EigenDA offers high throughput and derives economic security through Ethereum operators and restakers. In the bigger picture nonetheless, EigenDA is able to provide data for any platform, protocol, or network operating on EigenLayer.

That said, the main use for EigenDA is as a data availability service for L2 rollup networks. Generally, rollups are able to obtain data availability from a Layer 1 like Ethereum or via an independent Data Availability (DA) layer. The current model however, poses many issues related to scalability, decentralization, customizability, data security, and economic serviceability.

In general, EigenDA supplies all-important transaction data to rollups, ensuring that this required data is fully available to be used by the node validation systems on various L1, L2, and L3 networks. This design allows rollups to be able to share data with dApps operating on their network in a lightweight, fast, secure, permissionless, and decentralized manner.

Overall, validators encompassing Proof of Stake (PoS) blockchains like Ethereum must be able to verify all transactions within a proposed block. The presence of DA guarantees that all transaction data is readily available for all necessary network participants, including validators that must verify the next block in the correct sequential order.

Ethereum validators are generally required to download and store all transaction data on-chain. This allows all participants to be able to verify the existing state of the block by reviewing historical transaction data. The problem with this approach is that it’s not scalable.

Case and point, as a larger number of transactions are amended and stored on the network over time, network performance is adversely affected, limiting overall efficiency.

Therefore, EigenDA helps solve Ethereum’s scalability issues associated with congestion and high costs as the increasing number of transaction data requirements atop a plethora of network types grows.

While EigenDA is primarily used for rollups, EigenDA is able to support a vast number of AVSs, networks, dApps, and protocols of all shapes and sizes. With this modular interoperable design, the larger EigenLayer network is built to support a vast range of uses of all types.

For a more comprehensive analysis of EigenDA and how it works, check out our EigenDA article.

EigenLayer Tokenomics and Economic Model

EIGEN Token Utility

The EIGEN fulfills several different functionalities within the larger EigenLayer network, including:

- Governance: EIGEN plays a vital role in community-focused ecosystem governance, allowing token holders to participate in numerous decisions-making processes associated with protocol upgradability and modification and the introduction of new services.

- Participation incentivization: EIGEN helps create a balanced incentivization framework by rewarding network participants (stakers, operators, AVSs etc.) for their efforts via staking, while simultaneously improving overall protocol security.

- Collateral and security: Operators/validators who participate in restaking are required to stake EIGEN as collateral to secure the network. This model makes use of a slashing penalization structure whereby operators who exhibit malicious misbehavior are susceptible to collateralized asset loss (loss of tokens).

- Restaking rewards: When a user restakes ETH (or other acceptable assets) their assets are used to secure AVSs and other service-specific platforms within the network. These staked assets then generate rewards for stakers, many of which are distributed as EIGEN.

EIGEN helps introduce a multi-layered economic system through the Ethereum base layer while improving capital efficiency through the multi-pronged utility of various staked assets, including EIGEN, ETH, and others.

EIGEN Token Supply and Distribution

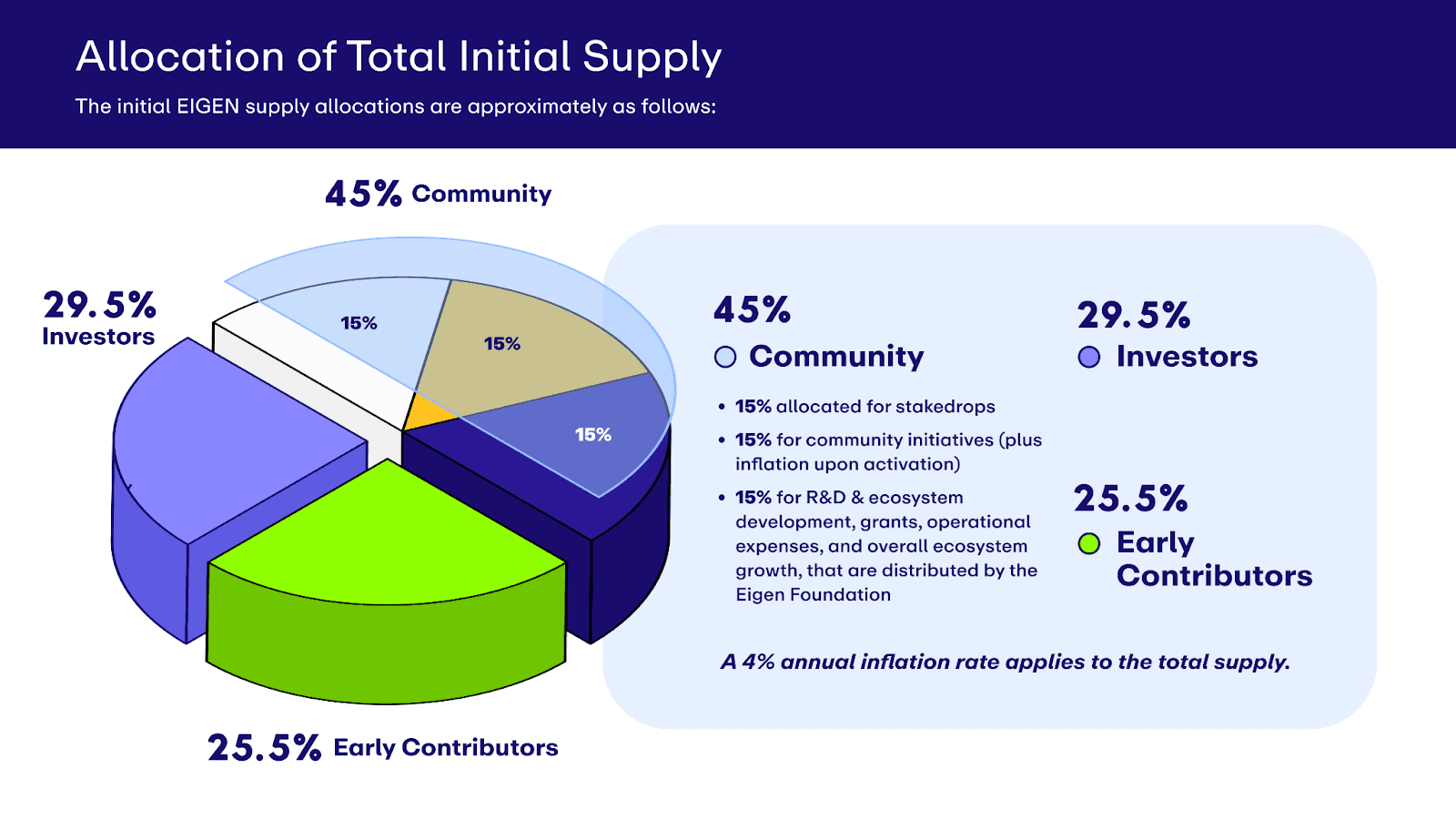

As of January 2025, EIGEN has a circulating supply of 210.8 million EIGEN and a total supply of approximately 1.673 billion, which were initially distributed as follows upon TGE:

- 45% - community

- 29.5% - investors

- 25.5% - early investors

The total initial supply exhibits a 4% inflation rate, meaning the total supply will grow by 4% each year, while the token generation event (TGE) and the initial availability of EIGEN on exchanges commenced on October 1st, 2024.

The EigenLayer ecosystem also leverages the use of bEIGEN as a wrapped version of the EIGEN token to ensure interoperability with external blockchain networks. This functionality allows for the use of EIGEN for numerous DeFi utilities such as staking, liquidity pools, governance, and more while maintaining a 1:1 ratio with EIGEN.

Furthermore, the minting (creation) and burning (destruction) of bEIGEN is directly linked to the unwrapping and wrapping of EIGEN to guarantee the overall supply remains constant.

Overall, the EIGEN token helps balance the EigenLayer ecosystem by incentivizing stakeholders (operators, stakers, AVSs, etc.), increasing network security, and ensuring the platform’s restaking mechanism continues to operate as needed.

The EIGEN token and EigenLayer’s overall economic system is designed to ensure the long term viability of the greater EigenLayer network (by contributing to governance, security, reward distribution, and collateral) as the platform matures and its growing uses continue to expand exponentially.

EigenLayer Governance and Community Involvement

Decentralized Governance Structure

For those unfamiliar with how EigenLayer’s governance structure works, let's explain like I’m 5 (ELI5). Specifically, EigenLayer’s governance structure employs the use of a Decentralized Autonomous Organization (DAO) whereby token holders, operators, validators, and other network participants are able to propose and vote on protocol changes to help shape the trajectory of the network over time.

This model supports the integrity of its community-driven decision-making processes, fostering transparency, inclusivity, and connectivity between stakeholders, resulting in a system that promotes long-term growth and aligns protocol development with the needs of the ecosystem.

In general, proposals are voted on by the community and decisions are made based on a token-weighted voting structure, thereby guaranteeing decentralized, community-driven governance and active participation in protocol evolution.

This transparency promotes trust and encourages more developers and other network participants to become involved, further fortifying the ecosystem. Overall, EigenLayer’s governance structure is designed to ensure that it evolves in an inclusive, decentralized and sustainable manner, fostering long-term growth for both the Ethereum network and other services (AVSs etc.) leveraging its infrastructure.

Additional Resources & Next Steps

Feel free to check out the below EigenLayer resources if you’d like to learn more about how the protocol works and why it's important:

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.