Key Takeaways

- Actively Validated Services (AVS): EigenLayer introduces AVSs to expand Ethereum’s security to external services like oracles and sidechains.

- Restaking Mechanism: Validators can restake ETH to secure multiple AVSs, optimizing Ethereum's decentralized security.

- Programmable Trust: AVSs offer customizable, programmable trust for distributed applications.

- Ecosystem Growth: EigenLayer AVS supports diverse blockchain ecosystems, enhancing security and flexibility.

- Incentivized Validation: Validators are rewarded for securing AVS with Ethereum’s pooled security.

To get an overview about EigenLayer check out our massive blog post: Ultimate Guide to EigenLayer: Revolutionizing Ethereum Staking and Security

Introduction to the EigenLayer AVS Ecosystem

In recent months, EigenLayer has become an extremely well-known platform in the blockchain sphere as the pioneer of the restaking DeFi primitive as evidenced by its massive explosion in total value locked (TVL). However, EigenLayer boasts a plethora of additional uses that complement restaking.

To provision this wide range of utilities, EigenLayer boasts an interconnected relationship with two main network participants:

- Operators: Upon registration on EigenLayer, operators enable ETH stakers to delegate their staked assets as either native ETH or liquid staking tokens (LSTs). Operators then opt-in to provide a vast range of services (typically validation services) to AVSs to reinforce the overall functionality and security of their independent networks. Operators are somewhat akin to validators, but instead of validating blocks within an independent blockchain network, they validate and support Actively Validated Services (AVSs) which represent different types of services. Operators are designed to optimize AVSs and increase capital efficiency by reducing their costs.

- Actively Validated Services: Through EigenLayer, developers are able to build middleware modules called Actively Validated Services. These can include data availability (DA) layers, bridges, sidechains, oracle networks, trusted execution environments (TEEs), consensus protocols, threshold cryptography schemes, keeper networks, secure multi-party computation (MPC) frameworks, virtual machines, and more.

Within the EigenLayer ecosystem, restakers enable the sharing of security via Ethereum, acting as the foundation of the EigenLayer protocol. In turn, AVSs leverage restaked ETH to dramatically increase their functionality, while rollups and other protocol types benefit from newly initiated modular services provisioned via AVSs.

AVS middleware service protocols that furnish different service types on the larger EigenLayer are supported by operators. In addition to helping AVSs run their software, operators leverage their validator networks to help AVSs maintain balanced network consensus.

Collectively, EigenLayer is built to increase the rate and scope of open innovation by serving as an amphithere for programmable trust through the Ethereum trust network, allowing developers to realize a vast array of interconnected platforms such as interoperability layers, modular execution layers, data availability services, and more.

By making use of EigenLayer’s security, speed, modular customizability, and economically-serviceable design, developers are able to adopt trust via the Ethereum trust network in a programmable manner that is completely tailored to a wide range of specific use cases. Essentially, EigenLayer provides the foundation required to build any type of AVS or independent protocol.

Ingeniously, EigenLayer allows developers to remove the burden of building their own distinct trust network, dramatically reducing both upfront and continued costs required to run their own independent protocol. This allows developers to leverage Ethereum’s all-encompassing network of decentralized validators, while simultaneously harnessing Ethereum’s significant staked capital base.

The above-mentioned framework allows developers building on EigenLayer to reap a wide range of benefits. These include:

- the ability to create blockchain systems without incurring the costs of maintaining a network-specific validator set

- eliminating the need for high token inflation rates required to incentivize system-specific security

- removing the need to launch a native protocol-specific token should it be deemed unnecessary

- allowing builders of different Actively Validated Services to custom-tailor their designs to focus on the types of service offering they feel will solve challenges that sorely need to be addressed without the headaches of building their entire tech stack from the ground up

This capital-efficient model is designed to eliminate the barriers to entry for new blockchain projects, while dramatically enhancing security for more established protocols, resulting in a more streamlined paradigm capable of realizing permissionless, flexible, decentralized innovation on Ethereum.

In the next few paragraphs we'll introduce some of the most well-known AVSs on EigenLayer, but first let’s touch on the data availability-focused EigenDA AVS.

EigenDA: EigenLayer’s In-House Data Availability AVS

Developed by Eigen Labs, EigenDA is the first AVS to deploy on EigenLayer. Its main premise is to support rollups with cost-efficient hyperscale Data Availability (DA), while systematically providing cryptoeconomic security via EigenLayer restakers.

That said, EigenDA is capable of supporting a wide range of lightweight and hyperscale middleware modules (AVSs that provide specific services) on EigenLayer, which in turn can be iterated to provide far-reaching participation from solo stakers.

In addition, these Actively Validated Service modules are able to take advantage of significant discrepancies between stakers which may differ in computational capacity, identity, and risk-to-reward preferences.

While AVSs on EigenLayer leverage restaking and other constructs to guarantee their efficiency and security; ultimately, different AVS platforms must be able to access a plethora of data types to operate. In essence, EigenDA is built to provide DA for any type of AVS built on the network.

In addition, EigenDA offers high throughput and derives economic security through Ethereum operators and restakers. In the bigger picture nonetheless, EigenDA is able to provide data for any platform, protocol, or network operating on EigenLayer, extenuating the collective ability of the complemented platform as needed.

If you’d like to learn more about EigenDA, consider reading our blog post on the topic in the 5th installment of this series.

A Refresher on Pooled Security and Programmable Trust

As we touched on previously in subsequent EigenLayer blog posts (see EigenLayer post 1 and post 2), EigenLayer makes use of a pooled security mechanism to provision programmable trust (see EigenLayer blog post 3) for a large number of restakers, operators, consumers, and developers that make use of the platform.

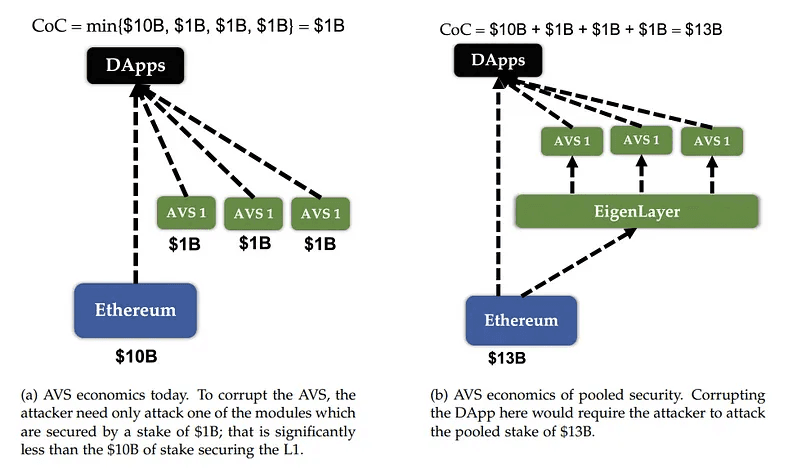

This pooled security framework employs restaking and various staking types that aggregate and extend cryptoeconomic security and decentralization from Ethereum to AVSs within the larger EigenLayer network.

EigenLayer’s pooled security model is significantly more robust than traditional security iterations because it incurs a significantly greater attacker Cost of Corruption (CoC) compared to non-pooled security models.

Therefore, outside of high throughput, equitable economic serviceability, and full customizability, EigenLayer’s pooled security model is one of the main reasons why newly developed protocols and blockchain-agnostic service protocols choose to build on the network. For new developers building their use-specific platforms, asset and data security is absolutely critical because of the fact that exploit susceptibility has the potential to become disastrous should a worst case scenario play out.

Remember, Actively Validated Services are not simply distinct blockchain networks, but custom built networks and protocols designed to offer various services to different blockchains or blockchain ecosystems.

For example, a team of developers could build a watcher network designed for security monitoring or a trusted execution environment (TEE) committee that aggregates security and various services amongst a network of independent TEEs.

Notable AVSs Building on the EigenLayer Platform

Now that we’ve been given a refresher on network operators, middleware AVS service systems, EigenDA, the EigenLayer collective, and the importance of the platform’s adaptable, interoperable, and security-focused design, let’s introduce you to some of the most important AVSs operating on the EigenLayer network:

- AltLayer - a Rollup-as-a-Service (RaaS) architecture that allows for the deployment of various rollups types via a customizable no-code framework via EigenLayer and EigenDA.

- Ethos Stake - a security coordination layer that utilizes restaked ETH through EigenLayer to dramatically improve the security of Cosmos appchains.

- Omni Network an interoperable rollup connectivity hub that acts as a layer to connect all Ethereum rollups via the EigenLayer restaking paradigm.

- Lagrange - a zero-knowledge hyper scalable processing protocol that harnesses State Committees to carry out restaking to create secure and extensible light clients for optimistic rollups.

- Brevis Network - a smart ZK coprocessor that allows smart contracts to utilize the complete on-chain data history from any chain as a means to run customizable computation for DeFi, zkBridges, ZK identity, and other uses.

- Witness Chain a DePIN infrastructure layer and watchtower network used to increase the security of rollups via restaking for Proof of Diligence, Proof of Location, and other verifiable proof-based systems.

AltLayer: The Fast Finality Layer for Ethereum Rollups

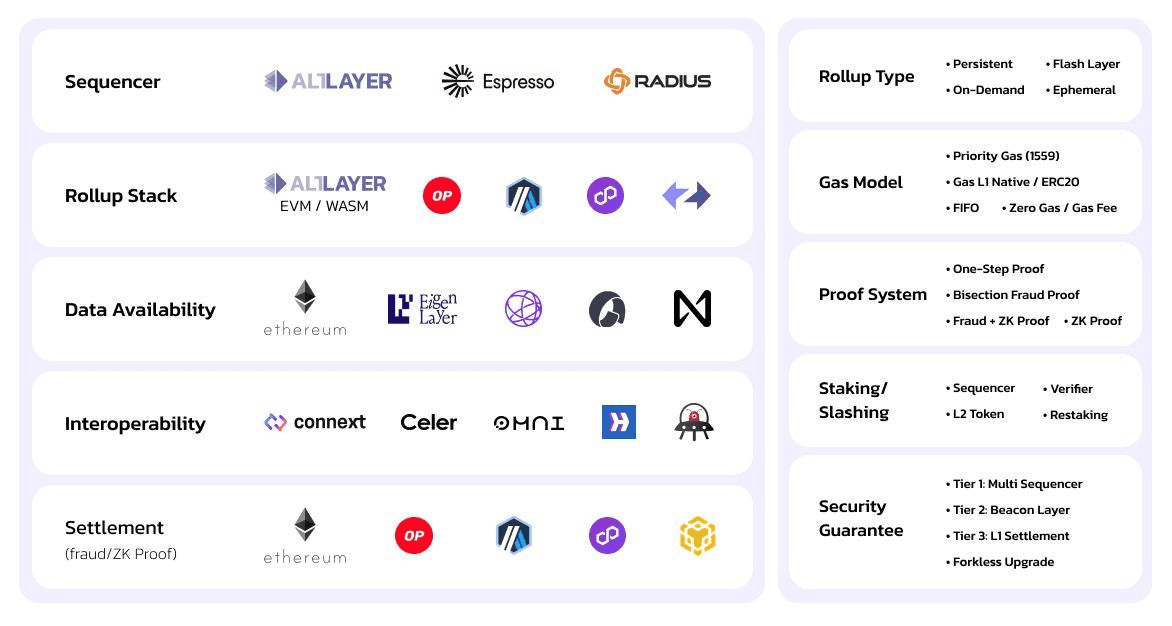

Founded in 2021, AltLayer is a decentralized protocol that enables the launch of native and restaked rollups from both ZK-rollup and optimistic rollup architectures.

Designed to optimize on-chain functionality at all levels including: sequencing, execution, and verification; AltLayer is built to improve rollup security, customizability, security, and interoperability for all rollup types.

AltLayer furnishes a no-code Rollups-as-a-Service (RaaS) launchpad that allows any developer to create their own customizable rollup with a few simple clicks in a matter of minutes. AltLayer’s RaaS launchpad is blockchain-agnostic, meaning it is built to support a multitude of blockchains and virtual machine environments, while simultaneously built to scale execution at a fraction of the cost.

These characteristics allow developers to deploy their iterations using various protocol stacks including OP Stack, Arbitrum Orbit, Polygon CDK, Linea, and ZKSync. In addition, the protocol also allows software engineers to integrate their newly developed networks with a vast range of oracles, bridges, indexers, on-ramps, blockchain explorers, and much more.

In particular, AltLayer offers native rollups as a service and restaked rollups as a service. In contrast to native rollups that are developed on an independent rollup operating outside of EigenLayer, restaked rollups leverage EigenLayer’s restaking mechanism to create a rollup framework that is more decentralized, secure, high-speed, and interoperable than the majority of its counterparts.

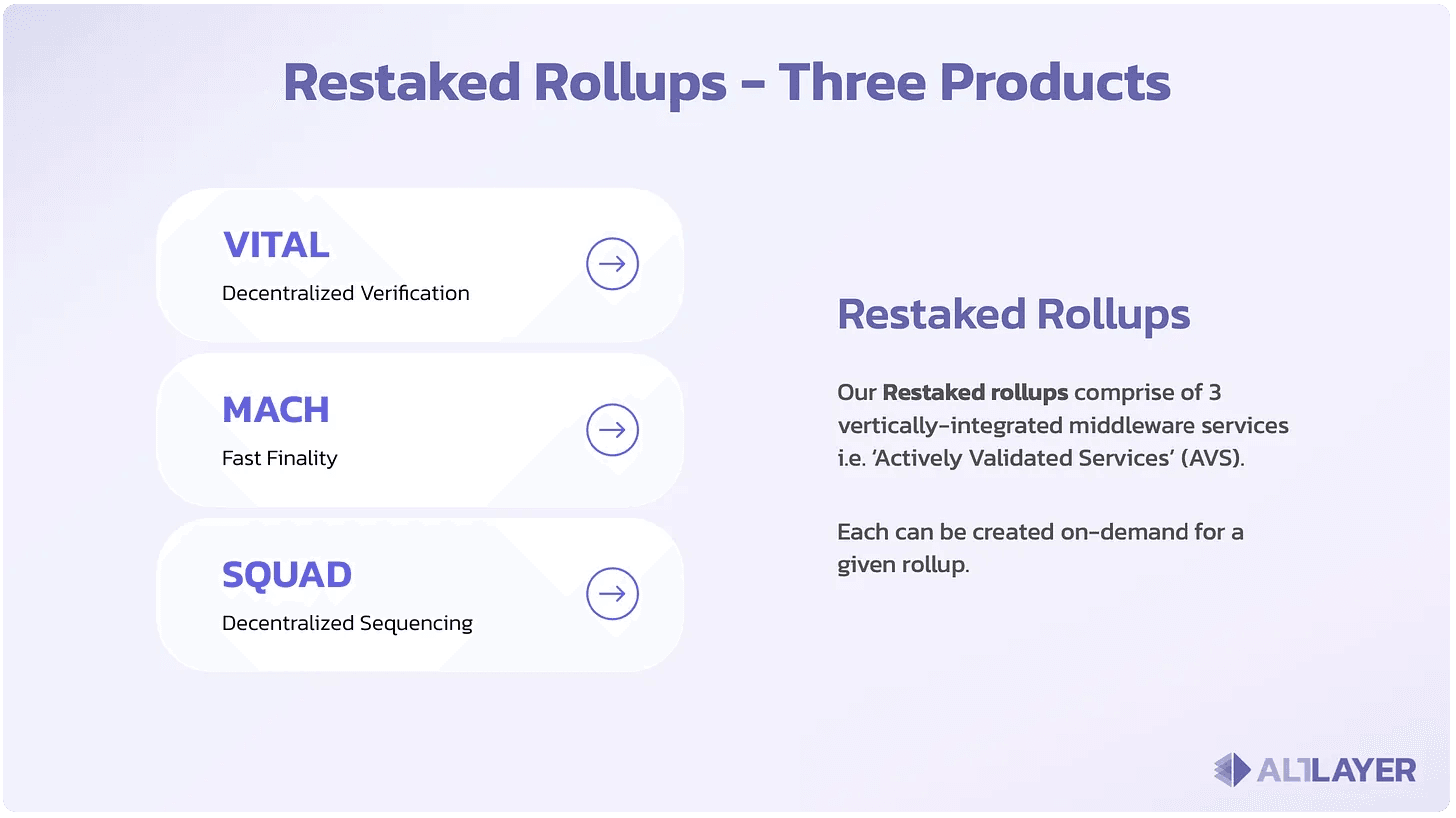

In particular, AltLayer provides EigenLayer with three distinct vertically-integrated middleware rollup services (i.e., Actively Validated Services), including:

- MACH - designed for fast finality

- VITAL - built for decentralized verification

- SQUAD - developed for decentralized sequencing

As one of the most important AVSs on EigenLayer, the recently launched AltLayer MACH framework is designed specially for rollups focused on achieving extreme transaction speeds and fast on-chain finality. More specifically, it harnesses EigenLayer’s restaking mechanism to construct a decentralized network focused on OP Mainnet rollup validation.

As a general rule, block validation is completed by verifying that the new rollup state is clearly the result of administering the state transition function upon an ordered set of transactions proposed via the sequencer and previously valid rollup state.

In the event an invalid block is detected, MACH operators raise an alert that if agreed upon by enough operators, is pushed upstream to potentially affected clients such as dApps. Once this alert type is received, a client leveraging MACH’s services has the ability to ensure that the invalid state update is rejected as soon as possible.

MACH is built to address Ethereum’s slow 12-minute finalization processing times and the OP Stack sequencer-enabled soft-confirmation model that lacks economic backing. More precisely, MACH is an Ethereum overlay network that is able to provide soft-confirmations with economic backing via the restaking process.

Built as a fast finality AVS, MACH provides the below core services to users of OP rollups:

- Accelerated confirmation times for rollup transactions

- Robust crypto-economic security focused on early detection of malicious network participants

- Decentralized and permissionless rollup state validation

MACH allows dApps, users, and a plethora of service types to leverage MACH’s service-focused platform via an RPC endpoint that verifies if a specific rollup block is considered final. The RPC endpoint is easily integrated into dApps operating atop OP Stack rollups to extend faster and more reliable transaction confirmations.

By leveraging the economic guarantees of MACH, dApps are able to safely update UI and front-end contract state to ensure a more reliable and user-friendly UX.

The serviceability of MACH also offers value to exchanges, bridges, lightweight explorers and additional ancillary services that harness access to rollup states and blocks by offering faster and more secure accessibility to their distinct products and services (e.g., by lowering the barrier entry to asset accessibility by eliminating 7-day withdrawal waiting periods etc.).

Ethos Stake: A Cosmos Security Coordination Layer for Restaking

Ethos Stake is an interoperable middleware AVS service provider that allows Proof-of-Stake (PoS) Cosmos appchains to simultaneously piggyback security from Ethereum and EigenLayer. While a distinct AVS in its own right, Ethos Stake is a Cosmos-SDK-enabled Layer 1 blockchain that shares security through the restaking of ETH to complement EigenLayer’s shared security model.

Moreover, Ethos is built to streamline the development of Cosmos appchains by supplying its independent 100-strong validator set of guardian nodes to independent Cosmos chains. This functionality eliminates the challenging task of developing an entirely new validator set from scratch, significantly reducing the barrier to entry for new projects building use-specific chains.

Ethos Stake, also dramatically increases the potentiality for innovation on new chains, eliminating the propensity for extensive stakeholder management by allowing engineers to concentrate on their core competencies and tailored development practices, therefore markedly reducing overall time to market.

Generally, new projects bootstrapping their upcoming protocols must spend a significant amount of time to develop their protocol stacks instead of concentrating on their intended value proposition and distinct design parameters.

Because of this fact, appchains employ the utility of Ethos’ predefined validator set, while simultaneously eliminating capital efficiency challenges for newly developed chains by allowing them to forgo the arduous task of convincing a host of stakeholders to hold and stake their token prior to launch. This streamlines token liquidity bootstrapping and eliminates the possibility of the asset losing most of its value shortly after launch.

Dive deeper into Ethos Stake by checking out our previously released blog post on the project.

Omni Network: Ethereum Rollup Connectivity Realized

Omni Network is a Cosmos-enabled rollup unification and connectivity layer designed to facilitate communication between various Ethereum rollup types.

In recent years, Ethereum’s rollup-centric architecture has diminished the network’s ability to scale, meaning it typically makes use of several different execution environments. This has resulted in developer, user, and liquidity fragmentation across a large number of platforms, degrading Ethereum’s overall network effects.

Case and point, the lack of interoperability between blockchains and system types (at the network, user, and developer level) must be solved so the blockchain and crypto industry is able to fully realize its potential.

To help solve these problems, on Omni, developers are able to build applications across multiple Ethereum rollup frameworks through a single state-machine via the Omni EVM, unlocking accessibility to Ethereum’s far-reaching user base and global liquidity store, exponentially expanding reach and utility for all involved.

This system allows applications built atop Omni to exist across all Ethereum rollups by default, resulting in a simplified cross-rollup application that allows for the propagation of interfaces and contracts across any rollup architecture, dramatically minimizing the possibility of smart contract vulnerabilities.

Onmni chose to build an independent AVS on EigenLayer as a protocol built to address numerous potential real-world applications, while piggybacking the security from the larger EigenLayer network. Some of these applications include cross-rollup stablecoins and liquidity aggregation between rollup types.

The Omni Network utilizes CometBFT consensus and the Cosmos ABCI++ adapter to simultaneously validate cross-rollup messages and transactions atop the Omni EVM while offering robust restaking-enabled security and accessibility to a novel node architecture built around Ethereuem’s engine API. This design creates separation between different node consensus and execution environments, while allowing nodes to harness the utility of existing Ethereum execution clients.

Lagrange: ZK Optimistic Rollups for State Committees

Lagrange is a ZK-prover network focused on the development of specialized architecture for ZK-based cross-chain state and storage proofs.

The Lagrange platform is built to provide restaking-enabled super-linear security as a state-of-the-art primitive to dynamically scale the underlying security of state proof generation to eliminate the inherent security limitations that bridges face at scale.

To help realize these goals, Lagrange makes use of what are known as Lagrange State Committees. State Committees leverage restaked EigenLayer validators and are built to attest the finality of proposed block state transitions that are submitted by optimistic rollup sequencers to the Ethereum blockchain.

Furthermore, these attested blocks are subsequently used to generate zero-knowledge state proofs via Lagrange’s ZK MapReduce proof system. This technology is important because it allows bridging and messaging protocols to create a permissionless shared security framework for cross-chain state that any interoperability protocol or dApp can utilize without incurring high operational overhead.

When compared to the majority of cross-chain interoperability solutions such as those that leverage permissioned validation or bonded staking/slashing mechanisms, which are often susceptible to risk stacking, price volatility, and low latency, State Committees and EigenLayer restaking offer an optimal balance of cost efficiency, trust minimization and decentralization, and robust shared security.

How Do Lagrange State Committees Work?

All individual State Committees are made up of a group of client nodes that hold restaked ETH via EigenLayer. Each individual Lagrange State Committee node individually attests to the finality of an optimistic rollup’s state once transactions are finalized on a Data Availability (DA) layer (such as EigenDA). Next, Lagrange’s ZK Coprocessor can be used to generate a ZK state proof that applications harness as a source of truth for the state of a particular optimistic rollup.

Although inspired by Ethereum’s Sync Committee model, Lagrange State Committees are not limited by the number of nodes. Therefore, they offer super-linear security by dynamically scaling the number of nodes verifying an optimistic rollup’s state as capital increases. State Committees are also designed to be chain-agnostic, meaning they possess the capability to integrate fully with existing interoperability protocols as an additional security layer.

The connectivity realized through the EigenLayer-Lagrange integration is especially significant because it helps eliminate operator susceptibility to reduced opportunity costs related to restaked capital, while also providing cross-chain interoperability protocols with increased economic security and dApp users with reduced fees and improved security guarantees.

State Committees and Additional ZK Building Blocks

Lagrange State Committees harness a wide range of complementary components that improve the utility of Lagrange’s tech stack. As an example, Lagrange’s Reckle Trees and ZK Coprocessor combine to provide efficient aggregation of public (APK) proofs to foster AVS participation by ensuring the computational costs needed to verify committee node attestations remains low.

This system also allows Lagrange to support linear-economic security by eliminating the potential susceptibility to an attack vector because of the fact that a successful attack would require collusion of the entire larger node set, as opposed to a smaller subset.

Moreover, State Committees possess the capability to be combined with Lagrange’s ZK Coprocessor and Verifiable Database to realize scalable, efficient, inexpensive on-chain data computations through an off-chain database.

For example, a multi-chain lending application developer could utilize Lagrange’s ZK Coprocessor in combination with a State Committee light client to improve the calculability of the total amount of user-deposited collateral across a plethora of independent chains.

Brevis Network: Zero-Knowledge Co-Processing Unboxed

Brevis Network is a smart ZK coprocessor that strengthens the functionality of smart contracts by allowing them to utilize the complete historical on-chain data from any sovereign blockchain, while concurrently running fully customizable computations in a trustless manner.

At outset, Brevis operated specifically using a “pure-ZK '' model that allowed ZK proofs to be exclusively generated upfront and verified on-chain prior to coprocessing results being utilized.

Although the pure-ZK model affords simplicity and trustlessness, many dApps require a more flexible solution that is prohibitively cost-effective across a plethora of scenarios correlated to the value and time sensitivity of a request, while simultaneously ensuring security via robust ZK guarantees.

To meet this demand, Brevis launched its coChain AVS fuelled by EigenLayer’s restaking quorums, introducing its ZK coprocessor architecture to synergistically combine both Zero Knowledge Proofs and crypto-economic security into one framework.

The newly developed architecture offers a framework that offers a significant reduction in ZK coprocessing requests, allowing developers to build dApps that are considerably more feature-rich compared to traditional ZK iterations.

When receiving a request, the Brevis coChain produces crypto-economically secured coprocessing “proposals,” subject to "challenges" via ZK fraud proofs. In most cases, when challenges are not introduced, the results are used specifically within smart contracts without incurring high ZK proof generation and verification costs.

In addition to substantial cost savings, the introduction of the coChain AVS also supports critical features such as proof of non-existence and proof of completeness, which have typically been challenging to obtain in pure-ZK models.

Brevis is capable of supporting a wide range of use cases including data-driven DeFi, trustless Active Liquidity Management, ZK Reputation, ZK Bridges, autonomous intent frameworks, dApp UX personalization, and more.

As of this writing, Brevis is supported by an assorted set of 29 AVS operators (including DAIC Capital and others) and has so far received a total of 1.6 billion in restaking commitments from Renzo, Ether.Fi, Bedrock, and Swell.

Witness Chain: A DePIN Utility Coordination Network

Witness Chain is a blockchain protocol designed as an infrastructure for network coordination amongst De-centralized Physical Infrastructure Networks (DePINs).

Operating atop EigenLayer to provide services for a host of operators, rollups, protocols, and AVSs, Witness Chain is the first physical state consensus protocol focused on unifying a siloed DePIN economy through the streamlined exchange of a shared economy of physical assets such as computing power, storage, energy, and more.

As one of the first AVSs to launch on EigenLayer, Witness Chain’s DePIN Coordination Layer (DCL) is capable of translating unverified DePIN network attributes into verifiable digital proofs that can be consumed and attested by a wide range of dApps and DePIN chains to help streamline the development of a plethora of new products and services.

By providing numerous foundational proof systems, Witness Chain provides various types of decentralized verification attributes to physical infrastructure networks, including:

- Proof of Location: Proof of Location (PoLoc) is a decentralized protocol designed to verify the geographical locations of IP addresses via internet delay measurements to dramatically improve accuracy and Byzantine tolerance.

- Proof of Diligence: Also known as the Rollup Watchtower Network, Proof of Diligence (PoD) is a protocol that provides cryptoeconomic security for rollups by utilizing Watchtowers to continuously provide proofs on L2s in exchange for incentivized rewards.

- Proof of Service: Proof of Service is a protocol that guarantees proof of service and payments for decentralized cellular networks by applying two-sided measurements to provide a decentralized slicing marketplace and contract-free cellular roaming.

- Proof of Backhaul: Proof of Backhaul (PoB) (sometimes also known as Proof of Bandwidth) is a protocol used to measure the bandwidth of the backhaul (broadband) link of a wireless access point (a prover) in a decentralized and trustless manner.

In many respects, this use-specific proof system is designed to enhance the functionality of optimistic rollups. In general, Witness Chain’s DePIN Coordination Layer enables:

- Increased security with accessibility to dual-staking

- Allows applications to build DeFi for physical assets

- Interoperability and discoverability with other DePINs

In addition to the aforementioned protocol types and other characteristics, Witness Chain offers several attributes that make it extremely valuable. These include:

- Creation of New Services/Packaged offerings: By sharing state information, the development of new products and services is enabled atop DePIN assets. This helps DePIN projects be more easily discoverable, access a wide range of financial instruments, and bootstrap their economic viability as they evolve.

- Enhanced Resource Utilization: By sharing state information across the network, apps are given real-time resource data that helps them better determine how to use resources and improve task allocation throughout the interconnected network, resulting in less wastage and the improvement of resource utilization for DePIN assets.

- Increased Innovation and Service Refinement: Accessibility to far-reaching state information allows providers to identify critical patterns and trends to help drive innovation, allowing application developers to create new services and improve existing ones by taking critical information into consideration.

As of May 2024, Witness Chain has attracted a TVL of more than 5 billion in restaked ETH atop EigenLayer. At the same juncture, the platform has also built an ecosystem of more than 20 DePINs and rollups with integrations of all types totalling more than 50 distinct projects.

The Continued Evolution of Actively Validated Services

As the EigenLayer platform evolves, an ever-growing number of Actively Validated Services will continue to launch on the network. EigenLayer is especially innovative in that it leverages different staking modalities to create a pooled security model built on the equitably distributed value of capital and various network participants.

The synergistic relationship between EigenLayer operators, AVSs, restakers, AVS consumers, and AVS developers creates a value-accrual feedback mechanism that is difficult to match across the blockchain and crypto industry.

The reasons for EigenLayer’s popularity are many, but one of the biggest factors is its continued record-breaking adoption metrics. That said, the platform’s overall network effect as a foundational paradigm focused on realizing the collective utility of so many distinct use cases is arguably the primary reason the network is so valuable. To learn more about these uses and why they are critical to the continued evolution of blockchain, see our AVS-powered EigenLayer use cases blog post.

As of this writing, EigenLayer has a total value locked of over 20 billion, a remarkable figure considering the protocol only recently launched on mainnet. If EigenLayer’s astonishing adoption over the last several months is any indication, it seems likely that the platform will continue its trajectory towards becoming one of the most innovative protocols in the space for the foreseeable future and beyond.

Resources

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.