The story of blockchain is one of non-stop innovation - from its early days to the evolution it is experiencing right now, every other day sees new technologies emerge either to overcome different challenges or unlock new possibilities. Arguably one of the most meaningful developments to rise in the last years is Proof of Stake. But what is PoS, and how does it represent a core shift in how blockchains work? Let's dive deep into the details of this ground-breaking consensus mechanism.

Key Takeaways

- Proof of Stake is a consensus mechanism that secures blockchain networks with economic incentives.

- PoS is more energy-efficient, highly scalable, and secure compared to the traditional Proof of Work systems.

- The Web3 revolution relies heavily on PoS to promote decentralization, financial inclusion, and user empowerment.

- By understanding PoS better, you will understand the full potential of blockchain technology and how you can influence the future of the internet.

Understanding Consensus in Blockchain

Before we explore PoS, let's briefly revisit why the consensus mechanisms are crucial to blockchain technology.

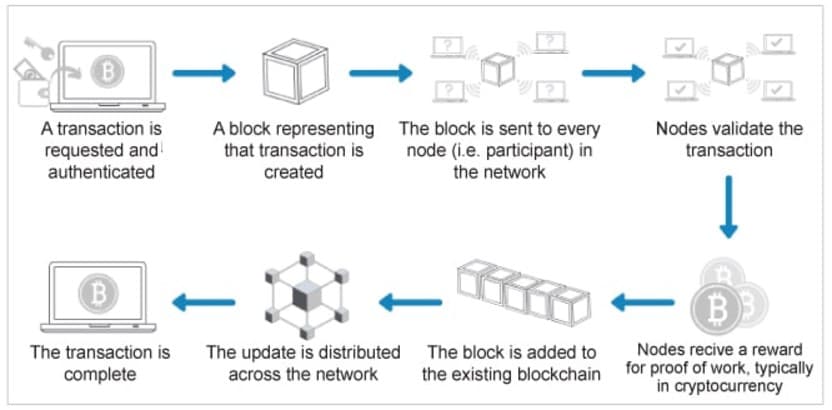

Generally speaking, a blockchain is a distributed ledger - a collective record of transactions maintained by a network of computers (nodes). That is popularly known as DLT, or Distributed Ledger Technology. Since the integrity of the distributed ledger is at stake here, all participants need to agree upon the version of truth. Consensus mechanisms come into play here.

The network provides an incentive for nodes to update the blockchains by using various forms of digital tokens or currency.

What is a Consensus Algorithm?

The consensus algorithm is the process or the protocol wherein all nodes in a distributed network agree on the state or the order of events of that network. It is how decentralized networks keep the shared states coherent when there is no central guiding authority.

Cryptocurrencies are decentralized systems and, as such, have no physical exchange of notes and coins. It also means there is no bank involved, or other central authority, to keep track of how much money is in each account and whether transactions are valid or fraudulent. Everybody participating in the network, each node, somehow needs another way to keep on top of ledger and transactions.

Consensus algorithms ensure that all participants validate and accept added transactions and blocks to the chain in the same order.

The more information is added to the network, the more most nodes have to give an update on the legitimacy of the new data by permission or economic incentives, so to speak - consensus mechanisms. That means it requires every node to simultaneously access the same database, otherwise, the blockchain won't work. On that very basis, consensus at every node is needed with regard to any alteration on the record.

When that consensus is reached, then, a new block is made and attached to the chain, afterward, all nodes are updated based on the blockchain ledger.

Types of consensus algorithms

Each of the algorithms has its own mechanisms, advantages, and limitations. Some of them depend on factors like the required scale, decentralization level, and security assumptions.

- Proof-of-Work (PoW)

- Proof-of-Stake (PoS)

- Delegated Proof-of-Stake (DPoS)

- Byzantine Fault Tolerance (BFT) and others.

PoW is most well-known and used in Bitcoin, while the variants of PoS, like those used in Ethereum 2.0 and Cardano, gain more traction for their eco-friendliness.

Learn more about the differences of Proof-of-Work (PoW) and Proof-of-Stake (PoS) in our article: From Proof of Work to Proof of Stake

Enter Proof of Stake

One of the very fundamental principles of blockchain-anything is decentralization, meaning the distribution of power and control across a network of participants. Well, Proof of Stake (PoS) does take that to the next level by empowering users to be direct contributors in securing the network and validating transactions.

But how does "staking" work, and what does it really mean for individuals and the greater ecosystem as a whole? Let's explore the democratizing potential of PoS.

The Proof of Stake algorithm was first proposed back in 2011 on the Bitcointalk forum. It actually was suggested to solve problems that exist in Proof of Work. Both of these have exactly the same purpose, which is to achieve the consensus on blockchain, however, it does it in very different ways. Instead of needing to provide a computational-intensive proof, participants actually prove that they have some staked coins.

In PoW, the consensus algorithm used in Bitcoin, miners must solve complex mathematical puzzles to add new blocks to the chain. Instead of computational force, PoS uses economic incentives to secure the network. Validators are participants who "stake" their cryptocurrency holdings as collateral, essentially vouching for the validity of transactions. The more tokens they stake, the higher the chances that they get to be the one validating a transaction and adding a new block to the chain.

The staking mechanism below this lines up the interests of the validators with the general well-being of the network. Validators get usually rewarded with either some transaction fees and newly minted tokens. Those who try to cheat or disrupt the network will face slashing, which means losing staked tokens.

Apart from the security benefits, PoS boasts of great efficiency and scalability benefits. It reduces the ecological footprint of blockchain technology because mining, which consumes a great deal of power, is not required in it. Furthermore, PoS is capable of handling higher throughput of transactions, making the consensus more suitable for applications requiring fast and efficient processing.

Technical Advantages of PoS

Energy Efficiency: PoS consensus does not need to burn the power consumed by mining, hence, it is much more eco-friendly. For example, Ethereum's transition from PoW to PoS (known as "The Merge") resulted in a 99.95% reduction in energy consumption

Scalability: PoS-based networks can support higher throughput in transactions, thus making them more suitable for applications that require fast and efficient processing. For example, Ethereum running on PoW was able to process 15 transactions per second (tps), and after switching to PoS Ethereum aims to process up to 100,000 tps.

Security: Economic incentives within PoS make it unfavorable to behave maliciously, which ultimately forces validators to act in the best interest of the network. Performing a 51% attack in Proof of Stake networks is still very much possible, but this time around, the attackers would have to be in possession of more than half of the staked assets. Aside from that, any validator that acts in bad faith or validates fraudulent transactions risks losing their staked assets.

Less Centralization: The main advantage of the Proof of Stake is the probable increase in decentralization of the blockchain ecosystem and democratic in nature. This may be because, by very design, it has much lower barriers to entry to those who want to be validators - the participants who actually validate transactions and maintain the integrity of the network.

Faster Finality: The "finality" here is the time after which a transaction can be assumed irreversibly confirmed and immutably set into the blockchain. For any blockchain application, speed of finality is important in terms of usability and practicality. Proof of Stake systems generally offer much faster finality compared with Proof of Work (PoW) systems, and this difference in performance has a great impact on user experience.

Inclusivity: The other strong advantage of Proof of Stake over Proof of Work is inclusiveness. On the networks of PoS, anyone owning a certain amount of cryptocurrency can become a validator, reducing the need for expensive mining hardware as in PoW blockchains. DPoS mechanisms enable small holders to delegate their tokens and still participate in protocol staking. In this way, more users can take part in securing the network and its decentralization while earning a reward in return.

How Proof of Stake Works

The concept of "staking" is the bedrock of PoS. For participation in the consensus to occur, each user is required to lock up some amount of the native cryptocurrency of the blockchain, which shall act as the stake. It's one form of financial commitment for validators that they should behave with integrity and support the ecosystem. The greater is stake, the greater potential rewards accrue.

Validator Selection: A Fair Lottery

Validators are pseudo-randomly selected to create new blocks and validate transactions. In order to favor a balance of both wealth and commitment, the consensus algorithm utilizes staking age and node's net worth.

This does by methods such as:

Randomized Block Selection: The validators are chosen in a random way according to a random selection of the lowest hash value - a cryptographic fingerprint and the highest stake. This approach ensures that the randomness in the distribution is related to both wealth and chance.

Coin Age Selection: Another thing taken into consideration by this algorithm is the time the coins of a validator were staked. The "coin age" is calculated as days by the number of coins staked. As a node creates a block, the coin age for a node goes to zero, so that large stake holders may not monopolize this process. A node can't make another block before a specific amount of time as well.

Validator age: It tells how long ago the node became a validator. A node that is older stands a higher chance of getting selected.

The Forging Process

Once a validator is selected, it is supposed to take the responsibility of verifying the set of transactions included in the next proposed block. He will verify each transaction for validity to ensure that the sender has sufficient funds and that the transaction abides by the rules of the network. If the transactions are valid, the validator adds the block to the blockchain, extending the chain and thereby confirming the transactions within.

Reward System

Validators are incentivized to do this work and are rewarded for their service in securing the network. These rewards may come in the form of transaction fees related to the transactions in the block they created and, depending on the particular blockchain's tokenomics.

Real-World Implementations: Leading PoS Blockchains

A number of prominent blockchain projects have implemented PoS and its variants:

- Ethereum 2.0: This is the highly awaited upgrade to Ethereum, which finally transitioned the platform from PoW to PoS.

- Osmosis is a premier cross-chain DeFi hub and DeX in Cosmos ecosystem, that leverages Proof-of-Stake with the innovative concept of Superfluid Staking, which allows simultaneously usage of staked OSMO tokens as liquidity in pools.

- Sui is a Layer 1 blockchain that is very different from other blockchains. It follows the DAG-based consensus protocol Mysticeti, optimized for low latency and high throughput, together with a Delegated Proof of Stake system.

- Akash Network: Akash uses PoS in an interesting way, nesting the consensus model within the Reverse Auction model applied to its decentralized cloud computing marketplace.

- Sei is a Layer 1 blockchain optimized for trading. It uses a Twin-Turbo consensus mechanism that combines elements of PoS with an innovative order-matching engine.

In the end, Proof of Stake represents an important milestone in the road of blockchain evolution. This is not only a technical change, but also one that will lead to a more democratic and inclusive blockchain ecosystem. PoS has, for a long time, allowed token holders to actively participate in the governance of a network, thus giving power to the users and driving innovation, especially within the rapidly growing field of DeFi.

Major projects like Ethereum have already pulled off a successful transition to PoS setting a powerful example of its viability and potential. This is a signal that even large, established networks can make use of PoS and probably will contribute to its wider diffusion. As PoS continues to improve, it is very probable that it will form a cornerstone in Web3-the decentralized internet - and thus allows further creativity in the creation of new applications and services.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.