In this comprehensive guide, we’ll cover everything you need to know about staking — how it works, the benefits and risks involved, and how to get started. This allows both experienced crypto investors and those new to the industry to make informed, intelligent decisions regarding staking digital assets. Let's explore the potential of crypto staking.

Key Takeaways

- Learn the basics of staking: how it works and how you earn rewards for holding your crypto.

- Discover the benefits of staking, including passive income generation with an overall contribution to the security of the network.

- Investigate the various ways in which you can stake your digital assets.

- Identify the key factors to consider in choosing a cryptocurrency for staking.

- Understand possible risks that impact your staking returns.

- Evaluate exciting trends such Cross-chain Staking and Liquid Staking to get more revenue.

We welcome you in the world of cryptocurrency staking, which allows you to use your digital assets for more than just idly lying in your wallet.

Beyond the usual long-only holding with hope for the future, staking is one of the easiest ways to generate passive income in Web3 space, making your investments work for you now. It’s a true win-win approach where you contribute to the stability of the ecosystem, and in return, you're rewarded for your participation.

What is Staking?

Since the launch of the well-known Bitcoin public blockchain in 2009, hundreds of blockchains have been developed, catering to a variety of industries and applications.

All of these networks run on consensus algorithms that are designed to regulate the operation of the distributed ledger and its nodes, maintaining the state of the blockchain. Among the wide range of consensus algorithms, Proof of Stake (PoS) has emerged as a compelling alternative to the energy-intensive Proof of Work (PoW) algorithm, ushering in a new era of sustainability and inclusivity.

Central to the PoS mechanism is the concept of Staking, a process that allows cryptocurrency holders to actively contribute to the network's operations while earning passive income from their holdings. In essence, staking includes locking up a predetermined quantity of cryptocurrency to support the creation blocks and validation of blockchain transactions. This commitment serves as a form of collateral, aligning the interests of validators, those who stake their coins, with the overall health and safety of the network.

How Staking Works

By staking their tokens, participants become eligible to be selected as validators, entrusted with the responsibility of fully participating in the network's performance. In return for providing their contribution, validators are rewarded with newly minted coins or a portion of fees, thereby incentivizing active engagement and maintaining the network's smooth operation.

For those who are not ready to immerse themselves in the technical details, there is an appealing opportunity to generate revenue from their holdings, similar to earning interest on a traditional savings account. This involves selecting a reliable validator and staking on him, which increases the validator's chance of participating in the network and his reward. The validator then shares received rewards with all his stakers.

The yield on staked assets, often expressed as an Annual Percentage Rate (APR), can be substantial, making it an attractive proposition for long-term holders seeking to maximize their investment.

Benefits of Staking

- Passive Income: Rewards for staking come in regularly, just like the interest that an investor gets, without necessarily having to trade actively.

- Network Security: Users participating in the staking network are protecting and stabilizing the blockchain, making it resistant to attacks.

- Higher Returns: Staking often guarantees higher returns compared to traditional types of investments such as savings accounts or bonds.

- Compounding Rewards: The rewards accumulate and, in time, will further increase the amount that you have staked.

- Eco-Friendly: It consumes less energy compared to mining. This is more sustainable.

- Control Liquidity: Most stakers retain control over their assets and can withdraw after a predetermined time.

- Governance Participation: Stakers acquire the right to vote and, thus, the right to decide on the future of the network.

Choosing Your Staking Path: Factors to Consider

The best staking method will depend on your needs, investment goals, and risk preference. The diverse staking strategies available cater to a spectrum of experience levels, investment sizes, and risk tolerance. Let's explore these avenues in greater depth.

Solo Staking: Independence and the Highest Rewards

For technologically adept individuals with substantial resources, solo staking - in the form of managing a personal validator node - offers unparalleled power and control over the staking process. Full control means having all powers regarding transaction validation and reward collection, it is here that the highest return can be expected. However, solo staking demands a substantial upfront investment in specialized hardware and technical expertise, besides continuous maintenance to keep the node up and secure nonstop.

Pros:

- Full control over your stakes

- Maximum rewards

Cons:

- Requires technical expertise

- High initial investment and continuing maintenance

Delegated Staking: Shared Responsibility, Shared Rewards

Delegated staking presents an attractive alternative for those who wish to participate in staking without the technical complexities of running a node. In this case, by delegating your stake to a trusted validator, you can earn passive income while avoiding all the complicated technicalities and specialized hardware. Because of this convenience, some rewards go to the validator as compensation for the services provided.

Pros:

- Easy to set up and manage

- Does not require technical know-how

Cons:

- Rewards are shared with the validator

- A trustworthy validator should be chosen.

Find out the best strategy how to choose your validator in our blog post: “How to Choose the Right Validator for Staking”.

Staking Pools: Collective Strength, Reduced Barriers

Staking pools enable individuals with smaller holdings to combine their resources and increase their collective staking power. This is a very mutually cooperative process, increasing the chance of reaping consistent rewards and thus an attractive opportunity for people who do not hold enough to be staking independently. Pool operators manage the technical complexities, making this an accessible option for beginners. However, participants must share rewards with the pool and rely on the operator's transparency and reliability.

Pros:

- Lower minimum stake requirement

- The pool operator takes care of the technical management.

Cons:

- Shared rewards with the pool

- Depends on the reliability and integrity of the operator

Staking on Exchanges: User-Friendly and Accessible

Many cryptocurrency exchanges provide staking services in-house on their platform, which is convenient for the user in general and those who are already active in trading operation. Within a few clicks, users can stake and start getting rewards. It is worth mentioning that you should choose an exchange that is secured and reliable, since this avoids the risks of custodial centralization of assets.

Pros:

- Very easy to set up

- No technical knowledge needed.

Cons:

- Need to entrust an exchange with your assets

- Some platforms may have lower reward rates

Staking as a Service: Streamlined and Trust-Based

Staking as a service, typically offered by platforms, that take care of completely hands-off investing in those who require less involvement with the process of staking. The service assumes responsibility for all aspects, from determining the strategy to asset management. While this option is really convenient, it does require a high level of trust in the security and best operational practices of a platform.

Pros:

- Very user-friendly

- Ideal for those who do not want to deal with staking at all.

Cons:

- Rely on the platform’s trustworthiness and security

- Reduced controllability of your assets and strategy

Liquid Staking: Flexibility and Liquidity Preservation

Liquid staking is a brand-new concept that brings together the vast benefits of earning staking rewards with the flexibility in maintaining liquidity. The representative tokens and tracking of staked assets incentivize users to trade or use them in other DeFi applications, generating additional revenue. In this sense, a door is finally open, this enables a user to maintain liquidity and simultaneously benefit from rewards through staking with these original assets.

Pros:

- Liquidity provision and yield farming.

- Allows trading or DeFi participation with representative tokens.

Cons:

- Potential complexity for newcomers

- Value and acceptance depend on representative tokens

Hot vs. Cold Staking: Balancing Security and Accessibility

It is a relative concept based on an individual's notion of security and accessibility.

- Hot staking can be done by the assets being left online in a wallet or exchange. It may be very accessible and liquid, but with high exposure to cyber risks.

- Cold staking means storing assets in an offline environment, say on a hardware wallet, provides a safer option but with some limitations to liquidity.

The best route for staking, after all is said and done, is what suits your very specific situation, investment goals, and risk tolerance. Time spent researching all options and weighing the same against needs and visions does indeed empower you toward maximal potential success in this dynamic world of cryptocurrency staking.

What You Need to Consider Before Staking Crypto

Before you dive into the world of staking, you need to consider a few crucial factors carefully.

Minimum staking amount

Minimum staking requirements exist for various blockchain networks and/or associated platforms. Make sure you have the minimum required capital, or sign up for pool staking, where you bring all your assets together with that of others to reach the threshold amount.

Lock-Up Periods

Staking most of the time consists of a kind of lock-up of the assets for a certain period, rendering them unavailable for selling or other uses. Make sure your liquidity needs align with the lock-up period, fitting within your investment strategy. Consider alternatives like liquid staking to maintain flexibility.

Reward Mechanism

Staking rewards can vary widely and usually are expressed in annual percentage rate (APR), depending on the type of cryptocurrency selected, network conditions, and the system of staking. That's why it's very important to do some research and find out what the estimated rewards can be and how they might change over time.

Compounding and Auto-Stake

Compounding is one of the major means whereby staking rewards increase, making much more profit in the long run by reinvesting your earnings back for even greater returns. Auto-staking feature lets your rewards snowball — you earn returns not only on your initial stake but also on previously collected rewards. However, compounding also lies in factors other than just a staking reward, it also depends on cryptocurrency price and network payout structure.

Requirements and Skills

Hosting your own validator node will require high-level technical experience and resources, such as good hardware, a solid internet connection, and the ability to keep that node online 24/7. If that is too geeky, there is "delegated staking," whereby you delegate your assets to a trustworthy validator that keeps all the technical details for you.

Selecting a crypto for staking

Selecting the right cryptocurrency for staking requires a multifaceted approach that encompasses both fundamental analysis and practical considerations. While the allure of passive income is undeniable, a prudent investor must delve deeper to ensure a successful and sustainable staking experience.

Fundamental Analysis

The token’s underlying project, its team, and its use case play a significant role in determining its long-term potential. Consider the project vision, development team's strength and capability, vibrancy of the community, and clarity of use case. In other words, a strong project with a committed team and a clear value proposition will have far more assured long-term growth and rewards from staking.

Staking Requirements

After identifying some promising projects, the next step will include reviewing each of their staking requirements and reward structures. Minimum requirements for staking differ across different networks. For example, Ethereum requires validators to hold at least 32 ETH, while Avalanche requires a minimum 2,000 AVAX for validators and 25 AVAX for those who want to be a delegator.

Additionally, find out the APR you can potentially achieve, how long any lock-up period is (can range from a few days to a month), and how often the payouts of rewards occur - all of this is part of your investment and risk strategies. This should always be publicly available in the documentation of the project or by using a reputable staking platform.

Staking Platform or Wallet

You can stake your cryptocurrencies in a few ways: for instance, some centralized exchanges like Coinbase and Binance offer seamless staking within their system. However, these are usually more costly and involve some form of counterparty risk. On the other hand, self-custody wallets do offer more security but require a little more technical knowledge in staking. If you choose to use wallets, make sure they are compatible with your devices and offers features like backup and recovery in case of lost access. Once set up, follow the token’s documentation for guidance on how to begin staking.

Acquiring Crypto for Staking

There are several ways to acquire the cryptocurrency you plan to stake:

- Purchase from a centralized exchange (CEX): This is the simplest option for beginners, as exchanges often provide wallets and a streamlined buying process.

- Purchase from a crypto ATM: ATMs primarily support Bitcoin, but may offer other tokens like ETH. You'll need a wallet ready before making the purchase.

- Purchase through a decentralized exchange (DEX): This method requires a crypto wallet and is typically more suited for users with some experience.

- Peer-to-peer (P2P) services: Another way to acquire crypto directly from other users.

Comparing Staking Rewards

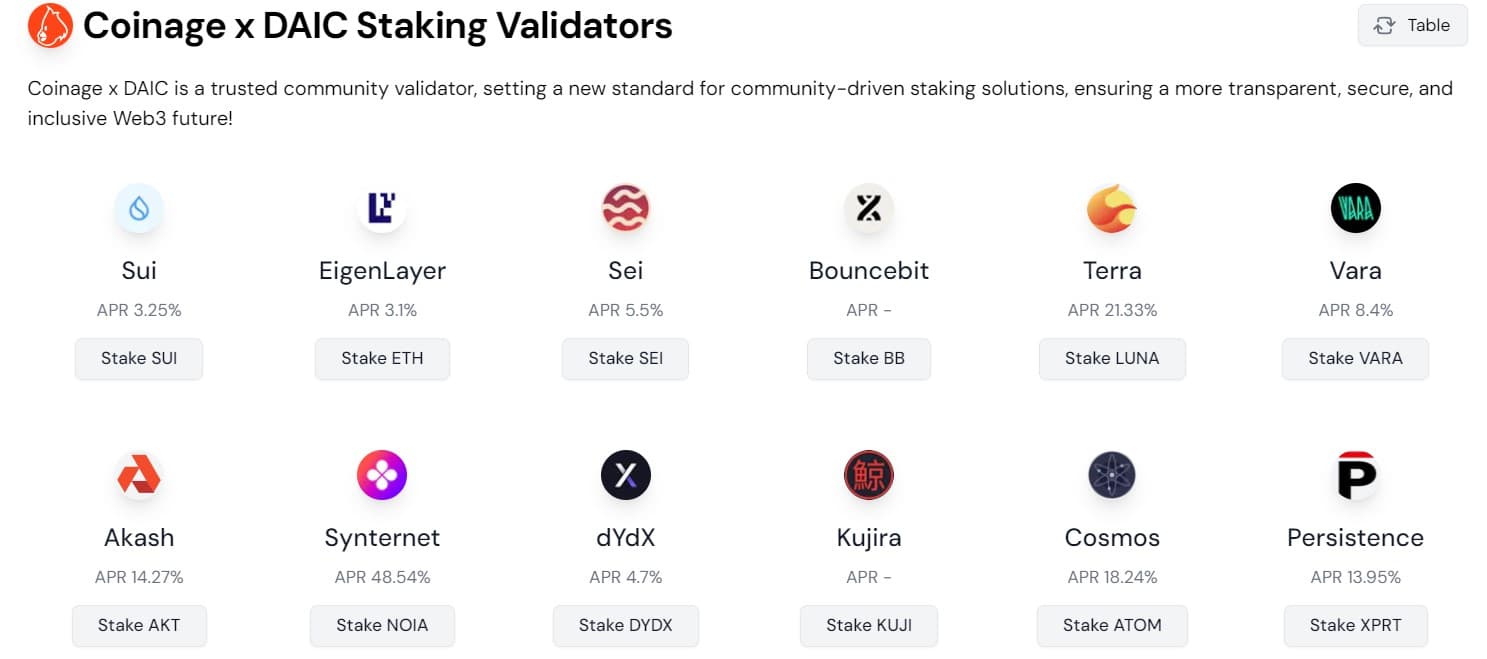

Rewards from staking vary across networks and with different roles in the process of staking. Validators usually get more reward for investing the most resources in securing the network than delegates who simply put their coins on validators or pools. Perform thorough research and compare the rewards potentially available through different cryptocurrencies and staking platforms. For instance, on our daic.capital platform, you can find out the annual percentage rate (APR) of various Cosmos-based projects and stake your assets in a few clicks.

How to Start Staking: A Step-by-Step Guide

Ready to make your crypto work for you and generate rewards? Let's take a look at how to get started with staking in a few easy steps:

- Select Your Favorite Crypto: Not all cryptocurrencies support staking, so choose one that is PoS-based. You may consider popular ones like Ethereum (ETH), Cardano (ADA), Polkadot (DOT), or Solana (SOL). Each of these offers different rewards and sets different rules, so it would be very useful to research which is best suited for your investment purpose.

- Choose Your Staking Platform: Now it's time to decide on staking. You can stake in a major exchange such as Coinbase or Binance - easy for a complete beginner and less financially rewarding. If you want to go the other way, a crypto wallet such as Exodus or Trust Wallet gives complete control, but you're on your own with the technical details.

- Stake Your Crypto: Time to get to work with your crypto! Follow the instructions on the platform, which generally means connecting your wallet, selecting how much to stake, and confirming the transaction. If you are a little short to stake on your own, consider joining a staking pool to team up with others.

- Sit Back and Earn: Once you have staked, your crypto is locked up for a certain period of time, and you will start earning rewards. How much you earn depends on the platform's APR - and how long you stake. Most will show you your estimated earnings and track your rewards.

Navigating the Risks: Proceed with Caution

Staking, as exciting it might be with offering very attractive returns, does also have to be approached with extra care and deep understanding of its risks.

Market Volatility

One of the major risks a staker may assume is market volatility. While a staking reward could give an investor passive income, if the value of the underlying staked assets declines rapidly and significantly, such gains will be nullified to the net loss. Therefore, careful analysis of market trends, combined with a reasonable assessment of the inherent volatility of cryptocurrencies, is very necessary before you commit your assets to staking.

Constraints on Liquidity

Another significant issue is liquidity constraints. Staking mostly involves the sort of locking-up of the assets for a fixed time, during which they may become useless for trading or other activities. Lack of liquidity may prevent the investor from reacting to market fluctuations or embracing other investment opportunities. The liquid staking solutions reduce this risk but introduce additional complexity and potential vulnerabilities, which are worth considering because of the use of representative tokens.

Validator Risk

The most important thing is to choose a reliable validator to whom you will delegate your stake. Validator misbehavior - a validator is down or behaving maliciously, may provoke a slashing event that leads to the confiscation of part of the staked assets. Thorough due diligence is essential to identify validators with a proven track record of reliability, security, and adherence to network protocols.

Security Concerns

Security in the field of cryptocurrencies is very critical, and so it is with staking. Finding well-known platforms that implement strong security measures, will help you protect your assets from hackers. Examples of security measures include cold storage, multifactor authentication, and regular audits.

Educational Barriers

The technical complexities of staking are overwhelming for any newcomer. In that respect, good understanding is needed about blockchain technology, the process of staking, and specific requirements of various platforms in order not to make costly mistakes. You will greatly improve in staking by investing in self-education and leveraging the resources available to you.

Regulatory and Tax Implications

The laws on cryptocurrency vary significantly at each different level. Keep an eye out for the alterations in the rules and possible tax consequences of the accumulated profits from digital currency activities. When in doubt, consult with your financial or tax advisor.

As such, while staking is a very lucrative activity in terms of rewards and an opportunity for active participation within the blockchain ecosystem, prudence and information play a key role. With proper research into the selection of a reputed platforms and validators, coupled with knowledge of the regulatory landscape, an investor will be confident to tread through the staking ecosystem to full potential. Remember, staking is for the long term, a measured approach combined with continuous learning and adaptation shall go a long way in helping you in this journey.

Future of Crypto Staking

The future of staking in the blockchain space promises to become even brighter, with some amazing innovations and opportunities for crypto enthusiasts.

Emerging Trends

- Cross-chain Staking: creates an allowance for users to stake their assets on one blockchain but use them on another, which makes this a little more flexible and opens new pathways toward cross-chain collaborations and DeFi applications.

- Liquid Staking and Restaking: these innovative solutions aim to achieve a balance in earning staking rewards while still maintaining liquidity, allowing stakers to participate in other DeFi activities while their assets are staked. Restaking is used to further amplify earning potential by enabling users to stake derivative tokens for additional rewards.

- Integration of staking with DeFi: is going to be deeper, reinforcing these two powerful concepts. In the meantime, staking as a service may get widespread, participants will be able to earn staking rewards while participating in different DeFi protocols, such as yield farming or liquidity provision.

- Layer-2 staking solutions: emerge to improve transaction speed and efficiency. These solutions are designed to cut costs, speed up reward payouts, and provide more opportunities for staking even to small investors.

In Web 3.0, the blockchain-enabled decentralized Internet, staking could take center stage to empower governance models, incentivize data storage and sharing, or access multiple decentralized services.

Conclusion

Staking offers a great opportunity to earn passive income while actively supporting the blockchain networks you believe in. It is an easy way to increase your crypto holdings without trading, thus participating in the bright decentralized future of finance. However, keep in mind that due diligence with a prudent approach is key to ensuring maximum reward with minimal risk.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.