Staking-as-a-Service (SaaS) democratizes access to staking rewards, making participation in the exciting world of Proof-of-Stake blockchains easier than ever for individuals and institutions alike. In turn, having a thorough understanding of benefits, risks, and considerations will grant you confidence to choose a provider and embark on your staking journey with a peace of mind.Enter the world of SaaS and unlock all potentials that your crypto hold!

Key Takeaways

- SaaS enables the delegation of staking activities to third-party providers, making it easier to stake.

- SaaS reduces the entry barriers to staking, allowing those users who have no technical background to enjoy rewards on their cryptocurrency holdings.

- Some providers include slashing protection and insurance against the loss of rewards or penalties arising from validator misbehavior.

- SaaS providers often supply tools for portfolio tracking, analytics and tax documentation on their platforms.

- Transparency of the service provider, its reputation, supported networks, security measures used, and flexibility are important factors for consideration.

The Concept of Staking as a Service

Staking is a core mechanism of Proof-of-Stake blockchains, which enables active and meaningful involvement of crypto holders in the network operation. A staker secures the network, participates in governance, and is incentivized financially by "locking up" digital assets.

Staking-as-a-Service, therefore, represents something quite simplified and streamlined, whereby service providers go through all the technical stuff involved in staking, like node setup, maintenance, and security on behalf of their clients. This way, this could significantly enable those individuals and institutions that might not have the necessary technical know-how or invest in infrastructure to participate in staking.

The fact remains that most SaaS companies take a kind of commission from their own service. However, there is convenience and accessibility added via the use of such a model, which offers staking to a big pool of investors, especially new participants and institutional players for whom efficiency and reliability are foremost.

The Evolution of Staking Services

SaaS providers have moved a long way from simple staking services, offering a wide range of features aimed at enhancing the user experience and maximizing their rewards. These advances meet a rising demand for increasingly user-friendly staking options.

Increased Variety in Staking

Many SaaS providers now allow a wide range of diversified cryptocurrencies and blockchain networks to be offered, enabling users to diversify their staking portfolio with optimized investment strategies. They can now explore different staking opportunities by leveraging this flexibility and achieve potentially better returns.

Automated Reward Reinvestment

Some SaaS providers also offer features for automatic reinvestment of rewards, which further streamlines the entire staking process by allowing for the automatic compounding of rewards from staking without the user's manual involvement.

Improving Liquidity

With SaaS, the owners can stake their assets but maintain the assets' liquidity. In common staking, the tokens are locked up for a predetermined time, making them less liquid. In SaaS, users can usually unstake their tokens at any given moment, making the resources highly available and accessible.

Dedicated Support Teams

Recognizing the value of customer support, many SaaS providers maintain a team that can answer all inquiries and technical issues of users.

While staking continues to change, SaaS providers have always been on the frontline in making the technology better with each passing day. Such is the dedication to getting better that individuals face no problems in taking part in staking and enjoying the associated benefits without dealing with complexities related to managing their infrastructure.

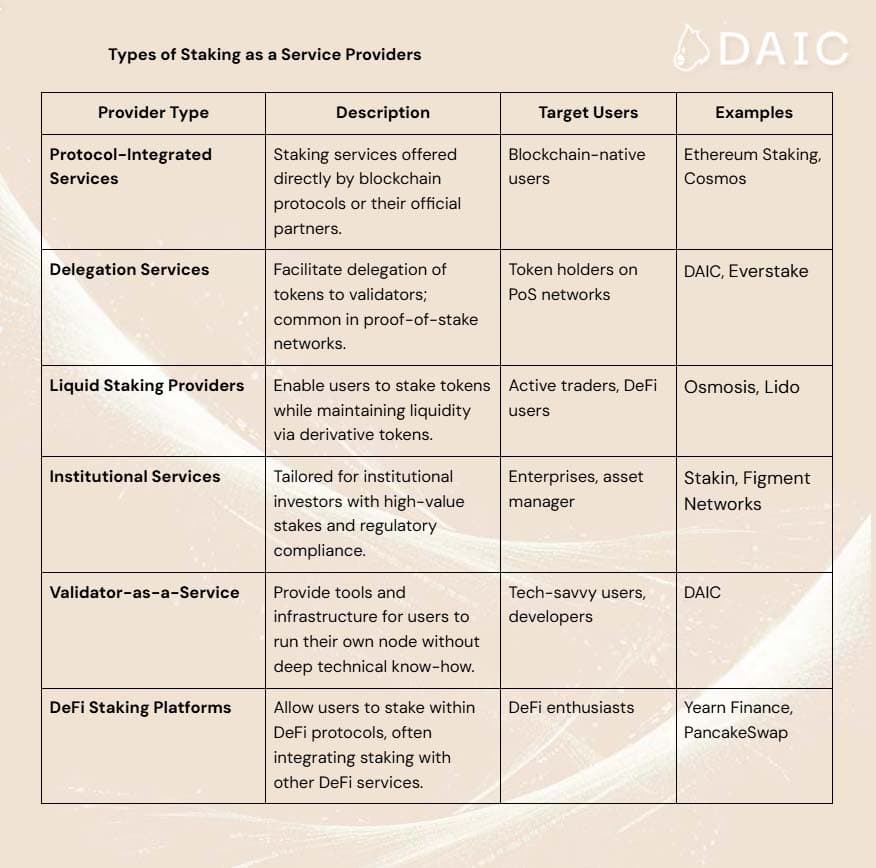

Types of Staking as a Service Providers

SaaS operators offer a variety of solutions that meet the different needs and risk tolerances of investors. Basically, there are three types of SaaS services: custodial, non-custodial, and hybrid. Each type has advantages and disadvantages.

Custodial SaaS

In a custodial model, common with centralized exchanges such as Coinbase and Kraken, providers of the service take custody of the user's assets across the staking process. It has advantages regarding ease and simplicity, hence may be more appealing to customers seeking passive approaches to staking.

On one hand, while custodial SaaS removes the technological complexities involved in staking, this form of service introduces a certain element of counterparty risk in which users don’t have access to their private keys.

Non-Custodial SaaS

If you are one of those who like to keep their keys close, non-custodial SaaS will be your preferred choice. You still have control over your crypto, but you outsource your staking power to a validator.

The benefits include having more control and minimizing the possibility of losing your assets in the event that the SaaS provider decides to go rogue. It does, however, involve a bit more technical expertise and responsibility on your part.

Hybrid SaaS

Some SaaS providers do use a hybrid method: offer a hybrid approach whereby the convenience of custodial services is combined with the security of non-custodial options. Hence, you choose any type of staking, respectively, to the purpose in mind and accepted risk exposure.

Which SaaS is Right for You?

Custodial, non-custodial, and hybrid are the options you can consider for SaaS, depending on your personal needs and preferences. If you are into convenience and ease of use, then custodial SaaS might be your thing. If security and control matter to you, then perhaps non-custodial SaaS would be a better fit. And if you want to have your cake and eat it too, a hybrid approach may be just the perfect solution.

Going a little deeper into the details of SaaS in this article, it should be more engaging to know that our team, DAIC Capital, is a non-custodial staking provider and Web3 infrastructure company committed to empowering individuals and businesses involved in the blockchain ecosystem.

With a high focus on community involvement and security, we provide an all-in-one suite of services that simplify staking, increase access, and foster further innovation. As a trusted validator on 41 blockchain networks, DAIC has more than $380 million in staked assets on behalf of over 30,000 unique stakers. Our robust infrastructure and commitment to security ensure the best results in staking while minimizing risks.

To further increase users' confidence, we have created a Slashing & Insurance Fund that covers up to 80% of the possible losses resulting from validator downtime or slashing events. This security allows our delegators an extra layer of protection for staking with confidence.

Moving beyond just staking, we offer all the necessary infrastructure and developer tools. Our Indexing API, EigenLayer Restaking, and Node-as-a-Service let developers streamline blockchain processes so they can focus on what matters most-building innovative applications-while we handle the complexity in managing the infrastructure. Feel free to contact us if you have any questions or suggestions!

Choosing the Right SaaS Provider

While SaaS offers a number of benefits for crypto staking, there are some potential challenges to consider, including the following: custodial risk, where the assets and private keys are entrusted to third-party providers; fees, which may impact overall returns; market volatility, where price fluctuations affect the value of staked assets; and regulatory uncertainty, with evolving regulatory landscapes that may bring additional complexities.

Transparency and Trust: Prioritize reputable providers with clear fee and payment policies.

Network Compatibility: Make sure your required blockchains and cryptocurrencies are supported.

Robust Security: Go for a provider that offers advanced protection for your assets.

Flexibility and Control: Look for providers offering flexible unbonding periods, meaning you can get quick access to your funds if an emergency arises.

Cost-Effective Solutions: Evaluate the fees charged by different SaaS providers and understand their fee structure.

Exceptional Customer Support: Ensure the provider has a responsive and helpful customer support team.

Reputation is Everything: Do your homework! Research the provider's track record, read reviews from other users, and check their standing in the crypto community.

Start Small and Test: Before committing a large amount of crypto, start with a smaller investment to test the provider's service and ensure it meets your needs.

By carefully considering these factors, you can select a reliable SaaS provider to maximize your staking rewards while mitigating risks.

The SaaS Revolution

We will be seeing more rewarding and professional services with increased competition among SaaS providers as the demand for staking services goes up. In addition, advanced technologies like AI and machine learning are going to optimize staking strategies even more.

SaaS will have a strong impact on the cryptocurrency market by increasing the accessibility of staking. This, in turn, will increase the robustness of blockchain networks and contribute to the wider adoption of cryptocurrencies. In such a way, SaaS makes staking as easy and riskless as possible for both the individual user and the entire crypto community.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.