From passive holding to active participation, staking is a realm where your digital assets drive innovation and decentralization, while you earn rewards in the process. But staking isn't a monolithic concept - it's a diverse landscape with a strategy for everyone, from the tech-savvy to the hands-off investor. Join us as we navigate this exciting frontier and uncover the possibilities of staking for everyone.

Key Takeaways

- Staking as Active Participation: Earn profit by securing PoS networks, with rewards proportional to stake.

- Benefits Beyond Yield: Passive income, right to governance, ease of access compared to the traditional mining.

- Diverse Staking Options: Choose from running your own validator node, delegating, joining pools, liquid staking, or using exchanges.

- Risk Management is Key: Mitigate risks by diversification of assets and storing them securely.

- Opportunities for All: Individuals and institutions can earn yield and benefit from active participation in Web3 ecosystem.

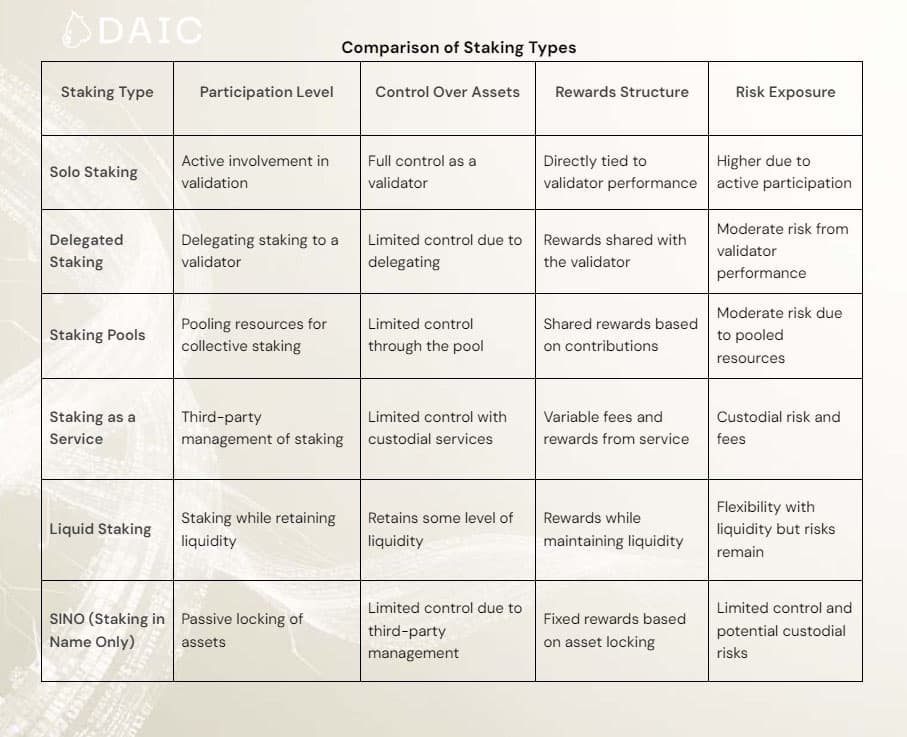

Exploring Staking Variations

At the heart of staking lie two of the main consensus mechanisms: Proof of Stake and Delegated Proof of Stake. PoS allows any owner of a native network’s cryptocurrency to take part in validating transactions and creating new blocks, the probability of participation increasing with the staked amount. DPoS utilizes a voting system wherein stakeholders vote for delegates to carry out these functions, potentially speeding up the process of transaction validation at the cost of some degree of centralization.

Becoming a Validator

Let's begin with the most direct form of staking: becoming a validator. The "gold standard" of this type of staking involves running your own validator node. This path demands technical proficiency, dedicated hardware, and a substantial initial investment. While it offers the allure of full rewards and direct influence on network decentralization, it comes with the weight of responsibility and the risk of penalties for any lapses in node performance or protocol compliance.

For instance, in order to operate a node on Ethereum, it is necessary to invest substantial amounts of native tokens, such as 32 ETH, which is valued at approximately $84,128 at the time of writing.

Beyond initial hardware costs, consider ongoing expenses such as electricity consumption and internet bandwidth. Using cloud services like Google Cloud can simplify the process and reduce the need for physical hardware but will incur hourly charges based on usage.

Delegated Staking

For those seeking a less hands-on approach, delegated staking provides an attractive alternative. By delegating your assets, you can partner with an experienced validator, who manages the staking process, and earn a portion of the validator's rewards. This approach fosters wider participation while mitigating the complexities and risks associated with solo staking. However, investors, for this purpose, must be very careful in selecting a reputable and trustworthy validator that will ensure safety and maximum performance of the staked asset.

If you're eager to dive deeper, we've prepared for you "Beginner's Guide to Staking Cryptocurrency: Everything You Need to Know".

Staking Pools

Staking pools offer a collaborative solution for those who might not have the resources or technical know-how to stake solo. It acts as a community effort where multiple users combine their crypto assets into a shared pool. This is where the increase of the total pooled staking power from a collective increases the chances of earning rewards. These pools are usually managed by operators who handle all the technical aspects and ensure a fair distribution among the participants. It's a pretty good way to get into staking with little upfront investment, but let me remind you once more: choose a trustworthy operator and understand the fees associated with it.

Staking-as-a-service (SaaS)

The use of SaaS has become an important solution to make things easier and more available to a wide audience. These platforms act as an intermediary between individuals who have set up and operate a validator node, with either an individual or institutional involvement in staking.

SaaS come in two main types: custodial and non-custodial.

Custodial SaaS staking, made available by most centralized exchanges, allows seamless user experience of depositing their assets into a service provider and having it handle the end-to-end staking. This approach appeals to those seeking convenience, as it eliminates the need for technical expertise and infrastructure management. However, it's important to acknowledge the inherent counterparty risk associated with relinquishing control of your assets to a third party.

On the other hand, non-custodial SaaS prioritizes security and self-sovereignty as core values. Customers maintain full control over their private keys and, therefore, their assets. Such services provide the necessary infrastructure and toolset that allow users to stake directly from their own wallets. While this approach requires a degree of technical proficiency, it minimizes counterparty risk and aligns with the core tenets of decentralization.

The choice between custodial and non-custodial SaaS depends on individual preferences and risk tolerance. Novice users or those oriented towards convenience may use custodial solutions, while professional crypto players, who put a higher emphasis on security and control, may get interested in non-custodial platforms.

Liquid staking

Liquid staking has emerged as a compelling innovation within the Proof-of-Stake (PoS) and Delegated Proof-of-Stake (dPoS) ecosystem, offering enhanced flexibility and capital efficiency for cryptocurrency holders. By staking assets through a liquid staking platform, users receive tokenized representations, often called liquid staking derivatives (LSDs), that can be traded on secondary markets or utilized across various decentralized finance (DeFi) protocols.

The tokenized representation of staked assets provides users with the liquidity to engage in lending, borrowing, yield farming, and other lucrative DeFi opportunities, all while their original assets remain committed to the PoS network, earning staking rewards.

Although liquid staking offers an enticing blend of returns and accessibility, prudent risk assessment and due diligence are crucial for any investor considering this strategy.

SINO

SINO stands for "Staking in Name Only," a neologism describing practices within the cryptocurrency ecosystem that technically are lending but are represented as staking. This often includes the many and varied yield-generating activities and earn programs by a wide array of crypto service providers, both CEXes and DEXes, and custodial wallets.

In the context of SINO programs, users deposit or "lock up" specific cryptocurrencies for a predetermined period, with the expectation of accruing interest over time. The service providers, in turn, use these funds for a variety of purposes, such as lending to margin traders. The profits generated from these activities are then distributed to the participants in the form of interest payments. Yield farming, a prevalent practice within DeFi services, is frequently employed by service providers in the execution of SINO programs.

As you can see, SINO programs let you make money by doing different things. However, you must consider that SINO programs depart from their core intention of staking, which means active users are contributing to network security and validation.

Navigating the Choices

Selecting the right staking method hinges on individual priorities, whether prioritizing decentralization, efficiency, flexibility, or ease of use. Thorough research into available platforms, particularly third-party providers, is paramount to ensure the responsible handling of assets. The staking landscape continues to evolve and staking will undoubtedly play an increasingly pivotal role, offering individuals and institutions diverse ways to participate and reap the rewards of network contribution.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.