Key Takeaways

- Memecoins blend finance and internet culture, turning viral jokes into billion-dollar digital assets.

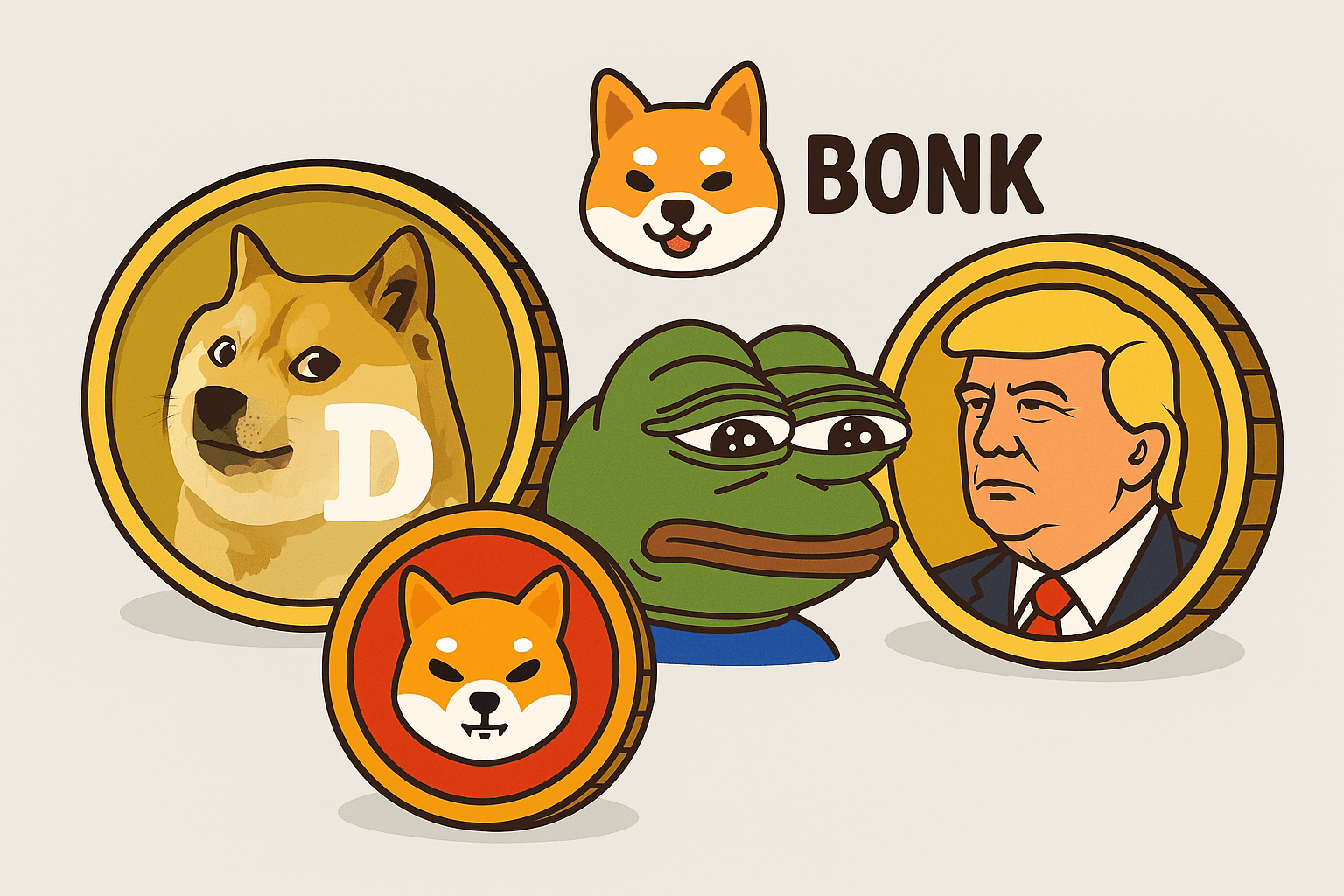

- From Rare Pepes and Dogecoin to TRUMP and BONK, memecoins evolve through hype, community, and meme energy.

- Virality, low entry barriers, and speculative fun drive explosive growth, but also massive risk.

- Scams, copycats, and influencer-driven pump-and-dumps are common - always DYOR before jumping in.

- The future of memecoins may include utility, AI integration, DAOs, and mainstream brand collaborations - but regulation is catching up.

Introduction

In the ever-evolving landscape of cryptocurrency, a peculiar and powerful category of digital assets has carved out a unique niche: memecoins. Whether it's the dog-faced Dogecoin or the absurdity-laced Pepe tokens, memecoins embody the internet's chaotic humor and a generation's new approach to money. What started as jokes have become financial instruments with billions in market cap and millions of followers. This post dives deep into the roots, rise, culture, and caution surrounding memecoins.

What Is a Meme? And Why Do Memes Matter?

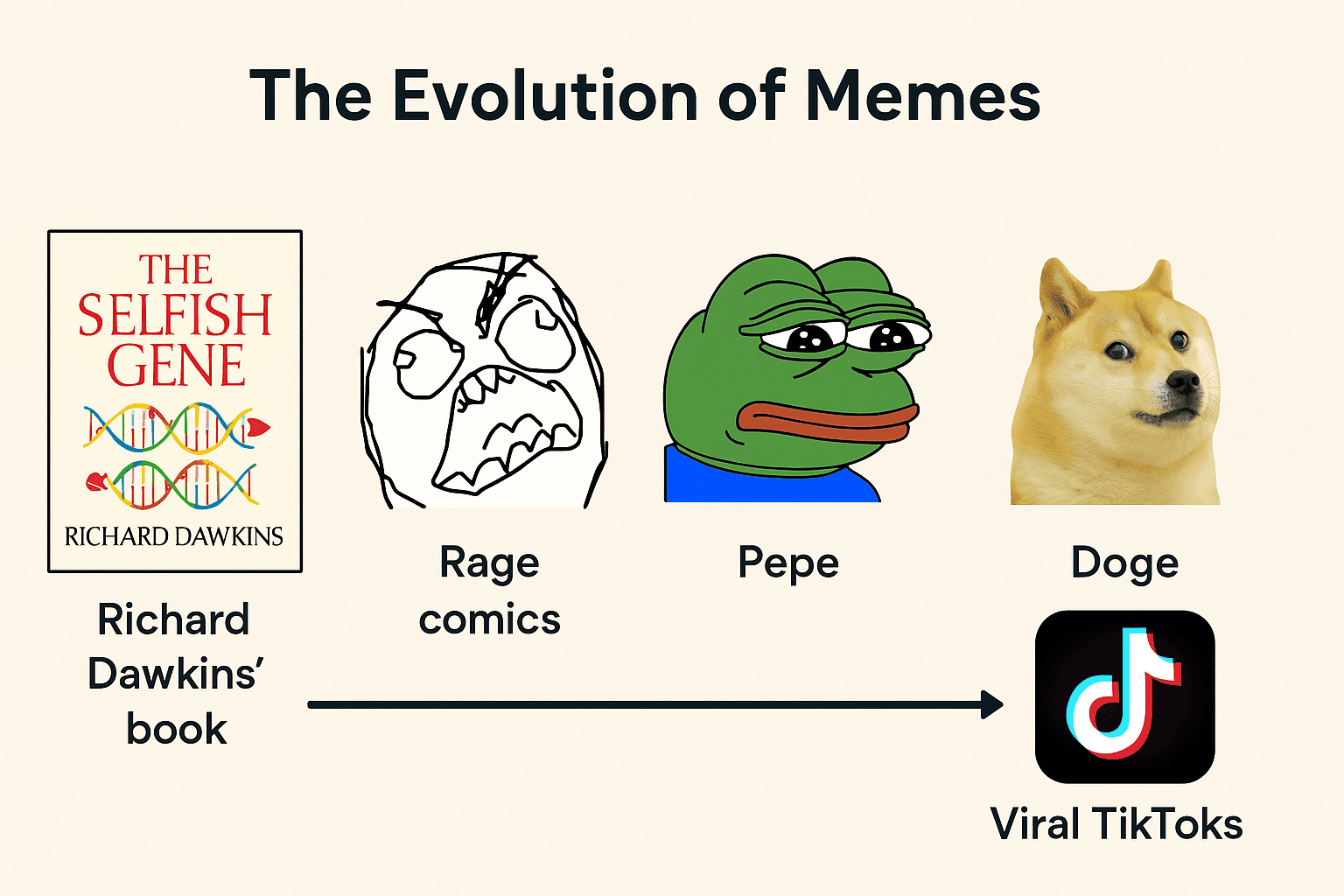

Before understanding memecoins, it’s essential to understand what a meme actually is.

The word "meme" was first coined by biologist Richard Dawkins in his 1976 book The Selfish Gene. He described it as an idea, behavior, or style that spreads from person to person within a culture; much like a gene spreads biologically. In the internet age, this definition evolved into something far more visual and viral.

An internet meme is typically a humorous image, video, or piece of text that spreads rapidly online, often with slight variations. Memes act like digital folklore - shaping culture, spreading ideas, and building shared narratives in online communities.

How Memes Drive the Internet

Memes are not just jokes; they are a language of the internet. They:

- Communicate complex ideas quickly and humorously

- Cross borders and languages faster than news

- Create inside jokes and group identity within online tribes

- Fuel trends, movements, and even political campaigns

Memes influence elections, brand marketing, and yes, even financial markets.

The Streisand Effect: You Can’t Stop a Meme

One of the most fascinating aspects of memes is their uncontrollability. Attempts to suppress a meme usually backfire - a phenomenon known as the Streisand Effect. Named after Barbra Streisand, who tried to suppress photos of her house (which made them go viral), it perfectly illustrates how trying to silence a meme only amplifies it.

Memes have toppled PR campaigns, started cultural revolutions, and redefined digital identity. Their power lies in their relatability, reproducibility, and irreverence.

Now imagine combining that power with money. That’s what memecoins are.

What Are Memecoins?

Memecoins are cryptocurrencies that originate from internet memes, viral content, or community-driven online movements. Unlike Bitcoin, which was created with the serious intent of becoming a decentralized alternative to traditional currencies, memecoins often begin as parody projects. However, they frequently evolve into large-scale ecosystems with real-world impact.

Dogecoin (DOGE) is perhaps the most recognizable example. Created as a joke based on the Doge meme, it unexpectedly gained traction and spurred an entire subculture. Other notable memecoins include Shiba Inu (SHIB), Pepe, Wojak, and even politically-inspired tokens like TRUMP.

The appeal of memecoins lies in their accessibility, humor, and community-driven nature. They often cost a fraction of a cent, making them an entry point for new investors. But beyond the memes lies a complex story of internet culture colliding with decentralized finance.

The Evolution of Memecoins

The Pre-Dogecoin Era: Rare Pepes and Counterparty

Before Dogecoin became the face of memecoins, early crypto-artists were already experimenting with memes on the blockchain. One of the first significant examples came in the form of Rare Pepes on the Counterparty protocol - a platform built on Bitcoin that allowed users to issue their own tokens.

In 2016, the Rare Pepe community began creating and trading digital cards of Pepe the Frog, each uniquely designed and stored on-chain. These were not mere images, they were early NFTs (Non-Fungible Tokens) that represented ownership and scarcity. Some Rare Pepes sold for thousands of dollars and gained cult status.

This era proved two things: memes had value, and the blockchain could capture that value in a decentralized, permanent way. It was a major precursor to both the NFT boom and the memecoin craze that would follow.

The Birth of Dogecoin

In December 2013, software engineers Billy Markus and Jackson Palmer released Dogecoin — a coin based on the popular Shiba Inu "Doge" meme. Intended as a parody of Bitcoin and the wave of altcoins emerging at the time, Dogecoin was meant to be fun and lighthearted.

But it caught on. Dogecoin's friendly branding, unlimited supply, and low transaction fees made it popular for tipping and microtransactions. The Dogecoin community became known for its positivity and grassroots initiatives, such as sponsoring a NASCAR driver and funding the Jamaican bobsled team's trip to the 2014 Winter Olympics.

Dogecoin was no longer a joke, it had become a symbol of community-powered finance.

The Memecoin Boom: 2021 and Beyond

The memecoin market experienced unprecedented growth during the cryptocurrency bull run of 2021. In May of that year, the total market capitalization of memecoins soared to a historical high of $89.95 billion, before declining below $20 billion in 2022 - a drop of nearly 80%.

Platforms like Pump.fun emerged during this hype cycle, allowing users to create and trade memecoins with minimal effort. At its peak in January 2025, over 70,000 tokens were being created daily. However, analysis showed that 98% of these coins failed to survive beyond three months, with an average lifespan of just 12 days.

The daily launch rate of memecoins fluctuated between 40,000 and 100,000 tokens, reflecting the immense saturation and speculative nature of the market.

Why Do Memecoins Gain Traction?

Memecoins succeed not despite their absurdity, but because of it. They are fun, viral, culturally relevant - And that makes them incredibly powerful in the attention economy of the internet.

What makes people throw money at a dog coin, a cartoon frog, or a political parody token? A mix of psychology, community dynamics, speculation, and meme culture explains the phenomenon.

Key Drivers of Memecoin Popularity:

- Social Media Virality: Memecoins live and die by their ability to spread. Twitter/X, Reddit, Telegram, and TikTok are their battlegrounds. A good meme paired with the right influencer or community push can go viral overnight - turning a $5,000 market cap into $50 million in days.

- Community Engagement: Unlike traditional crypto projects with rigid branding and roadmaps, memecoins embrace chaos. Communities rally around inside jokes, memes, and shared internet subculture. The result? A sense of identity that makes people emotionally and socially invested.

- Low Barrier to Entry: Most memecoins cost fractions of a cent. For $100, you might get a million tokens. That psychological thrill of owning “a lot of something” taps into retail investor behavior. It's affordable, gamified finance.

- Speculative Fun: Investing in memecoins often feels like betting on a viral moment. It’s not about whitepapers - it’s about timing, hype, and fun. It scratches the same itch as lottery tickets and gambling.

Current Theories About Their Rise:

- Financial Nihilism: Many younger investors are disillusioned with traditional finance - stagnant wages, student debt, inflated markets. Memecoins represent a rebellion: “If the system’s a joke, why not bet on the funniest one?”

- Influencer and KOL Manipulation: Key Opinion Leaders (KOLs) often promote memecoins on social media, especially when they already hold large bags. This creates artificial hype, drives price up, and allows them to dump on their followers. It’s an open secret and a serious risk.

- Cultural Resonance: Memecoins often tap into existing meme formats, political narratives, or pop culture icons. If a token “feels” familiar, like Pepe, Doge, or Trump, it gains instant recognizability and shareability. It becomes a financial meme.

- Ease of Creation: With platforms like Pump.fun, anyone can create a memecoin in minutes. This has led to daily creation spikes in the tens of thousands. The ease of entry fuels experimentation, joke tokens, and fast-moving viral coins.

- Copycat Hype Cycles: Once a coin explodes, dozens of near-identical tokens follow. These often exploit similar names or images to trick users who don’t check contract addresses carefully. It’s an opportunistic trend, but part of the memecoin lifecycle.

Real Examples of Explosive Growth:

- Dogecoin (DOGE): Originally created in 2013 as a joke, Dogecoin exploded in popularity during the 2021 bull run. After Elon Musk began tweeting about it, DOGE surged 135% in just four days. At its peak, Dogecoin hit a market cap of nearly $90 billion, briefly making it one of the top five cryptocurrencies in the world. It became a symbol of internet-driven finance and proved the power of meme-fueled speculation.

- Shiba Inu (SHIB): Launched in August 2020 as a “Dogecoin killer,” SHIB leveraged its meme status and massive supply to attract retail investors. It gained traction via social media and listings on major exchanges. One of the most famous cases is a retail investor who turned $8,000 into over $5 billion during SHIB’s run. By October 2021, it had reached a market cap of over $40 billion, cementing its place among the most valuable memecoins.

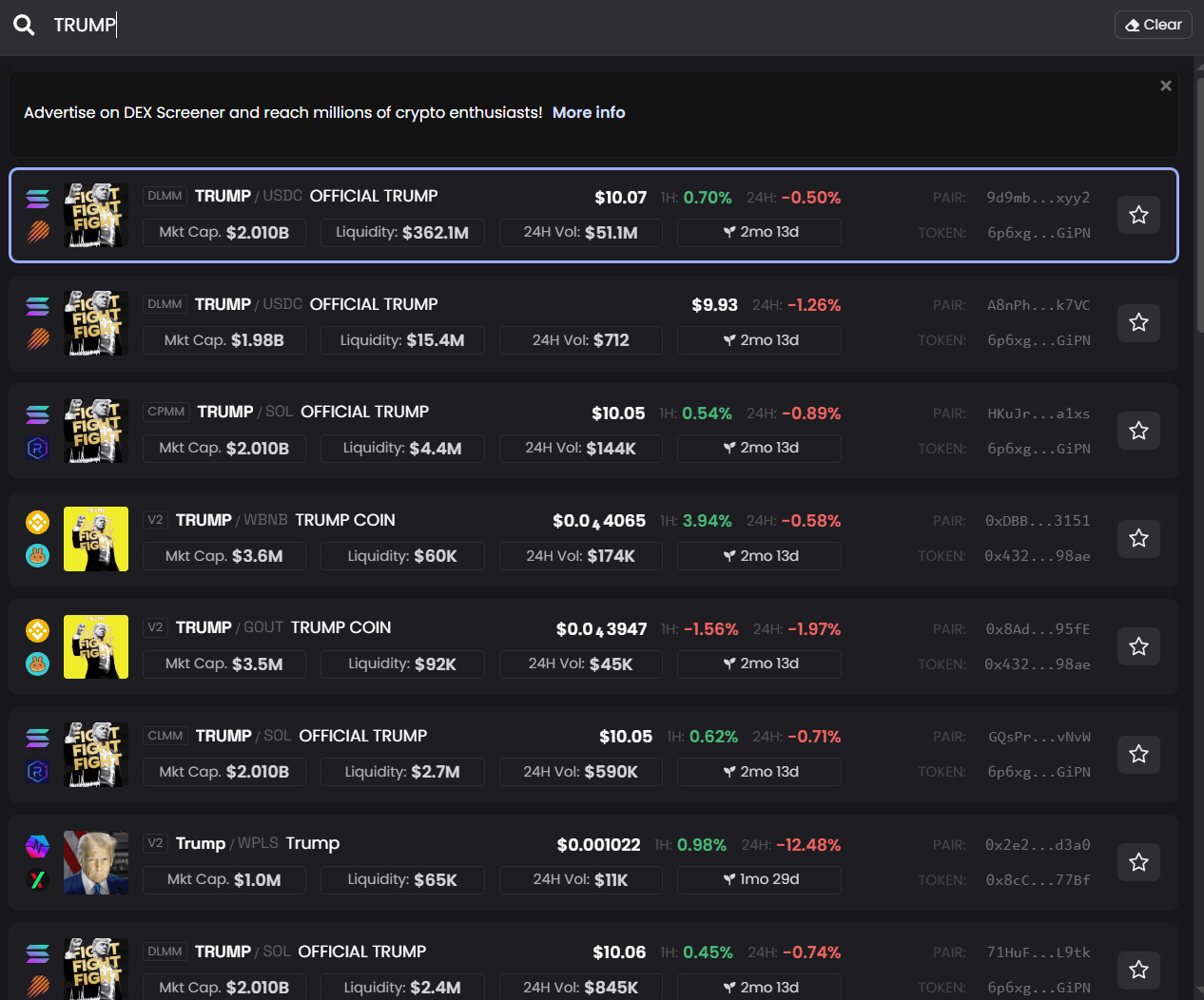

- TRUMP: Launched just days before Donald Trump's 2025 inauguration, $TRUMP gained more than 300% in 48 hours and reached a market capitalization of around $6 billion, trading at a peak of $31 per coin. It was the 19th largest cryptocurrency by market cap at its peak. The memecoin capitalized on political identity, Trump fandom, and cultural tribalism to fuel its viral rise.

- MELANIA: Melania Trump launched her own token shortly after the success of $TRUMP. Within days, it reached a $2 billion market cap, although it quickly dropped more than 20% to around $5.40 per coin. The coin's creation and volatility underscored how memecoins can pivot off real-time news and public figures.

- Reverend Sewell's Coin: In a bizarre twist, the reverend who delivered the benediction at Trump’s inauguration, Lorenzo Sewell, launched his own coin shortly after the ceremony. It skyrocketed ~18,800% in two hours, reaching a market cap of $314,000 and over $38 million in 24-hour trading volume. This moment illustrated how literally anyone involved in a meme-able event could launch a token and benefit from viral exposure.

- BONK: BONK was issued during Solana's market bottom in December 2022, when the network was reeling from FTX fallout and low public sentiment. It was distributed to NFT holders and developers across Solana as a community airdrop. BONK became Solana’s first major memecoin and rallied over 4,000% in early 2023. On March 24, 2025, BONK surged again with a 14.8% price spike in 24 hours and a daily volume of $210 million, marking its return as Solana’s flagship meme token.

Risks and Challenges

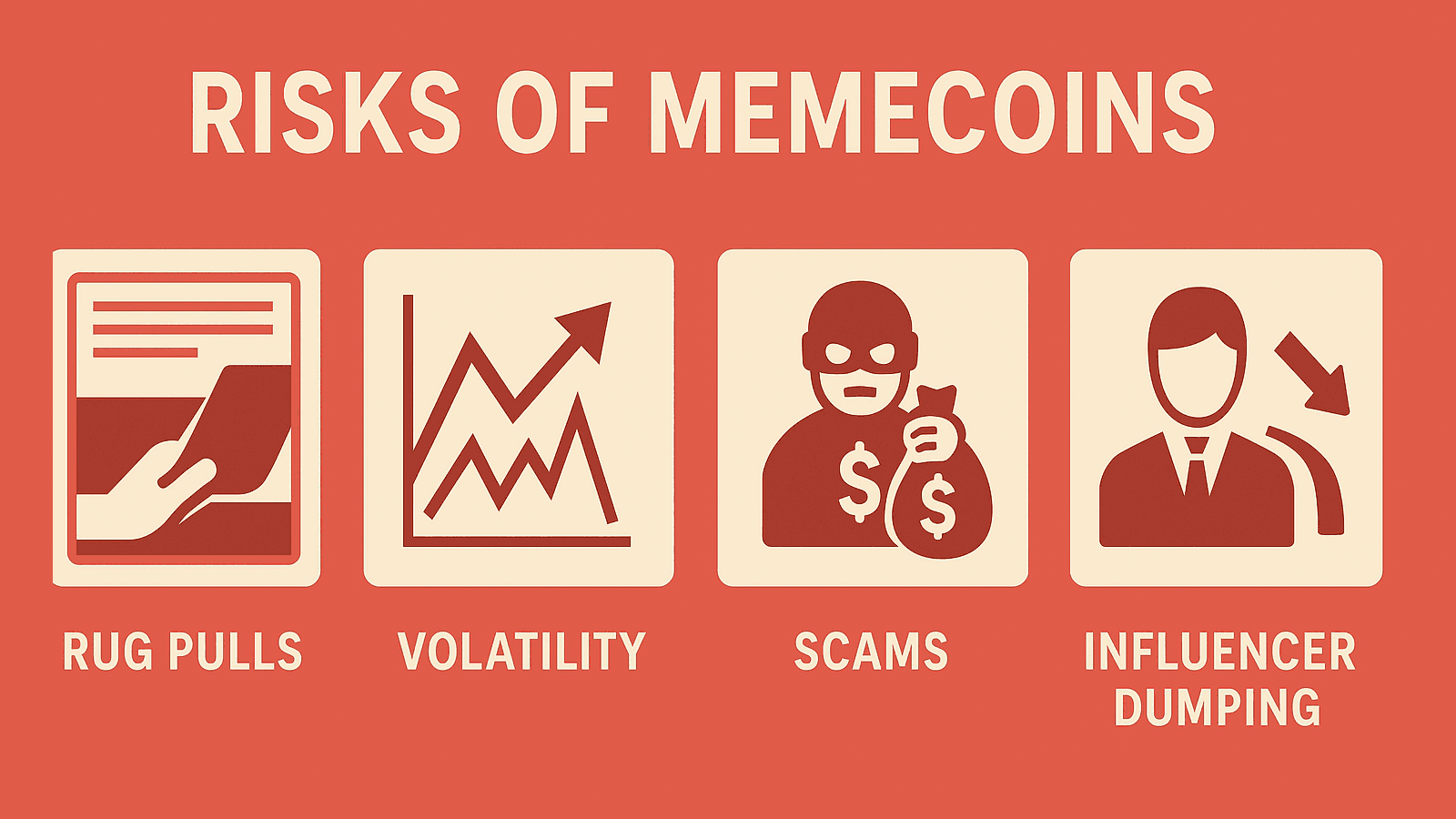

While memecoins offer excitement, entertainment, and even the possibility of life-changing returns, they also come with substantial risks. Most investors in this space aren’t evaluating fundamentals - they’re chasing hype. And that can end badly.

Key Risks to Be Aware Of:

- Extreme Volatility: Memecoins are highly volatile. Prices can surge by 1,000% in a day, and crash just as fast. Their value is often driven by emotion, memes, and social momentum rather than utility or adoption.

- Rug Pulls & Scams: Many memecoins are launched anonymously. Developers can withdraw liquidity, abandon the project, or even execute a rug pull - leaving investors with worthless tokens. These scams are especially common on low-barrier launch platforms.

- No Real Utility: While some memecoins evolve into communities or integrate DeFi functions, many have no actual use case. They’re purely speculative, with no intention of becoming a product, service, or protocol.

- Regulatory Uncertainty: Memecoins often fall into legal gray areas. Regulators around the world are beginning to scrutinize crypto influencers, memecoin promotions, and the classification of these tokens as securities. Legal risk is growing, especially as memecoins become more mainstream.

- Copycat Coins and Name Confusion: After a memecoin becomes successful, it’s common for hundreds of clones and knockoffs to appear. These often use similar names, logos, or branding to confuse investors and divert funds from the original. Users who don’t verify contract addresses can easily get scammed.

- KOL Manipulation and Pump & Dumps: Influencers (aka Key Opinion Leaders or KOLs) often shill coins they already own, promoting them as the next big thing. Once enough hype builds and followers buy in, these influencers dump their holdings, leaving their audience with massive losses. It's common, poorly regulated, and extremely risky.

- Short Lifespans: The vast majority of memecoins don’t last more than a few days, weeks or months. Even some with large market caps experience sharp declines in both interest and price once the meme fades or the community moves on.

Cultural Impact: Finance Meets the Meme Generation

Memecoins aren’t just a financial phenomenon, they’re a cultural one. They exist at the crossroads of humor, rebellion, internet tribalism, and digital identity. To understand memecoins, you have to understand the generation that fuels them.

Memecoins as Cultural Expression

For many Millennials and Gen Z, finance isn’t about Wall Street suits or legacy institutions. It’s about online communities, TikTok trends, and group chats. Memecoins offer a form of financial self-expression:

- You don’t just own a memecoin - you identify with it.

- Buying into a memecoin means participating in an ongoing joke, movement, or internet moment.

- Memecoins are a way to bet on memes you believe in; or just enjoy.

Where older generations might see investing as serious business, the meme generation often sees it as a game, a community sport, or a means of expression.

Anti-Establishment Energy

Many memecoins carry a rebellious spirit. They laugh at traditional finance, poke fun at billionaires, and often flip the bird to authority. Their success reflects a deeper truth: the internet generation doesn’t trust traditional systems - and they’re building their own, even if they start as jokes.

- Dogecoin mocked crypto tribalism and became a blue-chip asset.

- TRUMP, MELANIA, and other political tokens show how memes and ideology blend.

- Pepe, Wojak, and similar coins lean into meme archetypes - making finance personal, funny, and chaotic.

From Internet Joke to Tribal Identity

Memecoins evolve from trends into tribes. The longer a memecoin lives, the more its community builds inside jokes, rituals, and content. It becomes a digital nation of sorts - not bound by geography but by humor, belief, and shared risk.

Some communities create:

- Daily meme contests

- Influencer campaigns

- Charity drives

- NFTs, merch, and real-world events

These aren't just coins - they're microcultures built around tokens.

The Future of Memecoins

Memecoins began as jokes, internet culture made liquid. But over time, some have evolved beyond parody. The future of memecoins could be more dynamic, surprising, and influential than most expect.

Utility Will Separate the Memes That Last

As competition grows and attention spans shrink, memecoins with real utility or ecosystem integration may outlast the hype.

- Some memecoins are starting to incorporate DeFi features (staking, liquidity pools, reward mechanics).

- Others are embracing NFT integrations, allowing holders to mint avatars, join games, or unlock access to private communities.

- Projects like Shiba Inu have launched decentralized exchanges (ShibaSwap) and are experimenting with metaverse tie-ins.

A memecoin with both meme value and actual features will have more staying power than one that only rides a viral moment.

AI-Generated Memecoins and Bots

Memecoins are increasingly intersecting with AI.

- Some new tokens are launching alongside AI chatbots that interact with users.

- Meme communities are using AI-generated memes and content to automate virality.

- There’s speculation about future memecoins that evolve on their own, governed by AI logic and community memes.

Expect more intelligent, responsive, and even conversational memecoins in the near future.

DAO-Driven Meme Economies

Many meme communities are exploring decentralized autonomous organizations (DAOs) to govern their tokens. Instead of a central dev or founder, holders can vote on:

- Supply changes

- Marketing strategies

- Treasury spending

- Exchange listings

This gives memecoins a grassroots structure - the joke might start with one person, but it becomes community-owned.

Cultural Legitimacy and Brand Collabs

As meme culture becomes more mainstream, memecoins may see collaborations with:

- Influencers

- NFT projects

- Fashion brands

- Games and streaming platforms

Imagine a popular memecoin being integrated into a major video game or worn as streetwear. This fusion of crypto and mainstream culture could expand memecoin appeal beyond the crypto-native crowd.

Regulation is Coming

As memecoins become more prominent, and more people get scammed or rekt, regulatory scrutiny is inevitable.

- Influencers promoting memecoins may face legal consequences if they don't disclose financial interests.

- Some tokens may be labeled as unregistered securities.

- Future rules may limit memecoin listings on major exchanges or require project teams to verify their identities.

This doesn’t mean the end - but it could mean more accountability and a thinning out of low-effort or malicious projects.

Final Thoughts

Memecoins started as jokes - absurd, ironic, and often created in minutes with no expectations. But they’ve grown into something far more powerful: a cultural and financial movement that reflects how the internet thinks, feels, and invests.

They’ve disrupted the seriousness of finance. They’ve turned memes into money. And they’ve proven that community and narrative can sometimes outweigh technology and fundamentals.

Yes, memecoins are risky. Yes, they are speculative. Yes, many will disappear as quickly as they appeared. But in the process, they’ve changed how people relate to digital value. They’ve given power to communities. They’ve made finance fun - and a little weird.

Whether you believe memecoins are the future of decentralized culture or a passing phase of financial chaos, one thing is undeniable:

Memecoins are no longer a joke — they’re part of the story.

They reflect where we are now: meme-literate, digitally native, rebellious, and always online.

As with any trend in crypto, the most important tools are awareness, research, and a healthy dose of skepticism - but also curiosity, because you never know when a meme might just go to the moon.

FAQs

What are memecoins?

Memecoins are cryptocurrencies inspired by internet memes, jokes, or viral trends. They often begin as humorous or satirical projects, but can gain massive followings and significant market value due to their cultural resonance and speculative appeal.

Is Dogecoin a memecoin?

Yes. Dogecoin is considered the original memecoin. It was created in 2013 as a parody of Bitcoin, featuring the Shiba Inu “Doge” meme. Despite its humorous origins, it became one of the most widely recognized and traded cryptocurrencies in the world.

Are memecoins a good investment?

Memecoins can deliver massive gains - but also crushing losses. Most are highly volatile, lack intrinsic value, and are driven by hype and speculation. They should be treated as high-risk assets. Never invest more than you can afford to lose.

How do I buy memecoins?

You can typically buy memecoins on decentralized exchanges (like Uniswap or Jupiter) or, if they’re more established, on centralized exchanges like Binance or Coinbase. Always double-check the token’s contract address to avoid scams or copycats.

What is the first memecoin ever?

While Dogecoin is the first major memecoin, some earlier meme-driven blockchain assets existed - such as the Rare Pepes on the Counterparty protocol. These were tradable meme cards on Bitcoin and are considered precursors to today’s memecoins and NFTs.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.