Berachain Incentives are more than just a feature, it’s the engine of Proof-of-Liquidity (PoL) system, a novel twist on blockchain rewards. This is a driver that channels BGT emissions to fuel liquidity across the ecosystem, from DEX pools to emerging dApps. Unlike traditional staking setups that are well known, it's a dynamic ecosystem where protocols, validators, and liquidity providers come together to drive network growth. Here’s a deep dive into how the incentive system operates, its core mechanics, and why it’s a cornerstone of Berachain’s vision.

Key Takeaways

- Rewards for Liquidity: Incentive tokens are used by protocols to draw BGT emissions, incentivizing activity through user rewards.

- Validator-Driven: Validators direct BGT tokens to vaults, earning a percentage of the incentives they unlock.

- Community Control: BGT holders whitelist tokens by voting, shaping the reward stream.

- Flexible Setup: Reward Vaults and adjustable rates keep the ecosystem dynamic yet secure.

How Berachain Incentives Work: Rewards for Everyone

Berachain’s PoL system encourages activity in the ecosystem while keeping the network running smoothly. At the center of the system is BGT, the Bera Governance Token, which you can only earn by contributing to the network. BGT is unique in the sense that it's non-transferable, you can't sell or buy it, but you can use it to get rewarded and engage in determining how the network operates.

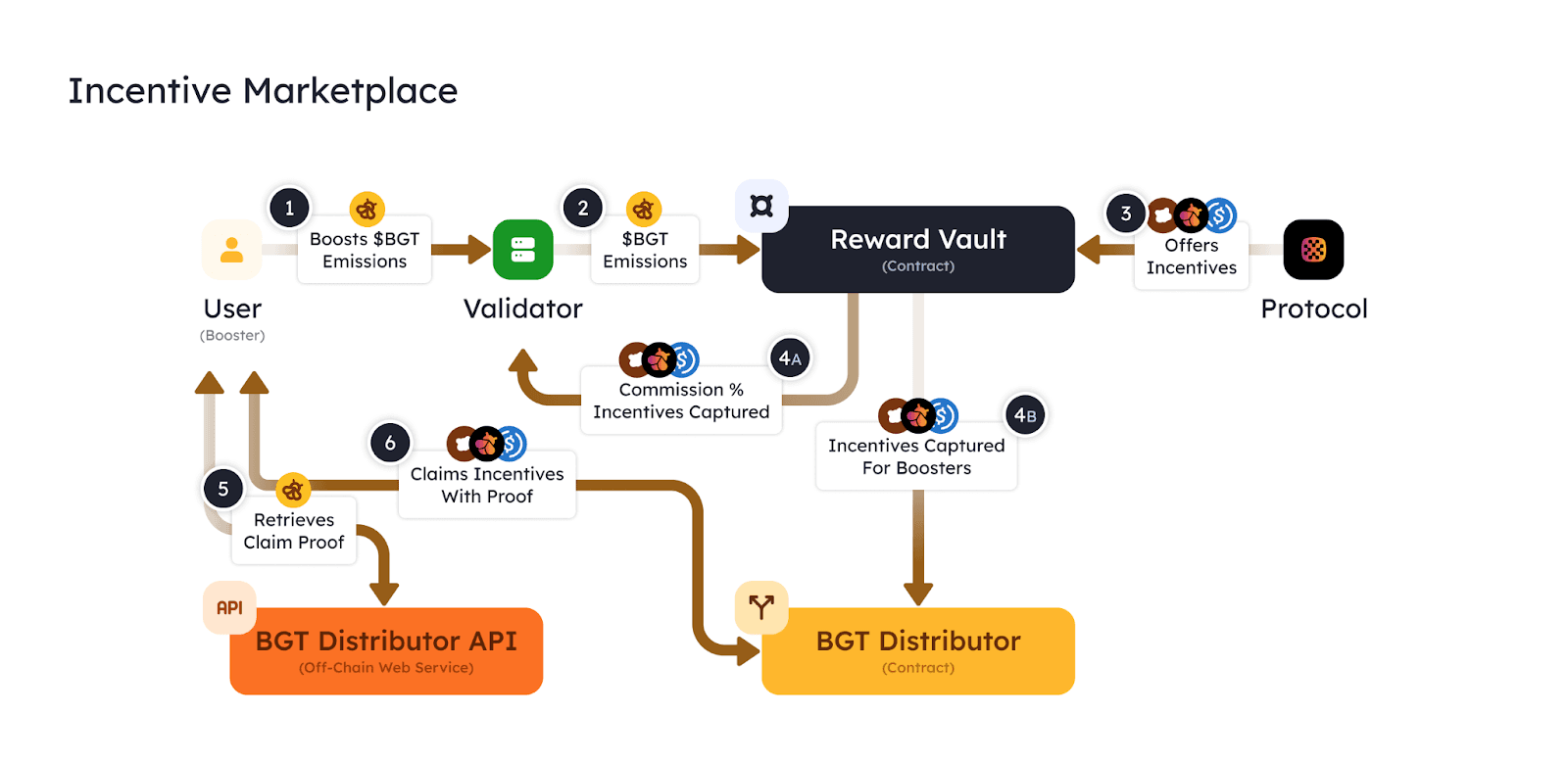

Incentive Marketplace and Reward Vaults are at the core of this system, uniting three main groups: users (also called Boosters), validators, and protocols (apps). Let's explore how each group gets rewarded, their roles, and what's changed and new with the recent updates.

How It Works: The Basics

The Incentive Marketplace is like a hub for all participants, it ensures rewards flow to those who contribute to the ecosystem. Three players make this system run smoothly:

Protocols and dApps: They set up Reward Vaults and offer incentive tokens to attract BGT emissions and draw in users.

Validators: These network nodes receive block rewards in the form of BGT emissions and decide which Whitelisted Reward Vaults get their BGT, based on a reward allocation list, and earn incentives in return.

Boosters: Users who participate in apps, earn BGT by staking Receipt Tokens in Whitelisted Reward Vaults, and then boost a validator to share in the incentive distribution.

This interconnected process keeps rewards flowing fairly, with transparency ensured through hub.berachain.com.

How It Works: In-Depth Mechanics

Several critical mechanisms facilitate the operation of the Incentive Marketplace, ensuring accuracy and equity in reward allocation:

Token Whitelisting: Only governance-approved vaults can offer incentives. A proposal must specify an incentive token and the corresponding token manager. Each Reward Vault can support a maximum of two tokens, and adding or replacing any one of these needs a new vote in governance.

Token Managers: A single wallet address controls all incentive tokens in a vault. The address, established by governance, can control more than one token across several vaults. Token or manager updates need further governance approval.

Incentive Offering: Vaults may provide two incentive tokens at the same time. Tokens that have been offered cannot be withdrawn. A token manager sets an initial incentive rate, e.g., 0.2 USDC per BGT, and it can be increased, but not decreased until validator-directed emissions exhaust the token supply. At exhaustion, a new rate can be set.

Distribution Process: Validators spread BGT emissions into vaults and are paid a commission, typically a percentage like 5%, of the rewards received. The remainder is divided to proportionately reward boosters based on their BGT contribution, available in a contract that has a daily-updated proof.

Practical Illustration

Consider an example of a Reward Vault offering 1000 USDC at an incentive rate of 0.2 per BGT. A validator directs 1 BGT to the vault, receiving 0.2 USDC. With a commission rate of 5%, the validator retains 0.01 USDC, while 0.19 USDC is allocated to boosters based on their BGT proportion.

The token manager can then increase the rate to 0.3, adding another 500 USDC to sustain the incentive pool. This model prevents rate drops or symbolic withdrawals before supply runs out, ensuring constancy. The boosters redeem their portion by way of the BeraHub, and there is no time constraint on eligibility.

Adaptability and Growth

The market is built for flexibility. Protocols can propose vaults for a wide variety of activities, e.g., perpetuals trading, gaming dApps, or real-world assets, each accommodating up to two incentive tokens. Token managers adjust rates to maintain competitiveness, and validators rebalance allocations to optimize returns. Governed by BGT holders, this system enables continuous innovation, allowing Berachain's developer community to integrate novel, stakeable concepts into the reward system.

How to Get Started with Berachain Incentives

Ready to jump into Berachain’s rewarding ecosystem? Whether you’re a user, validator, or dApp developer, here’s how to get started with earning incentives through Proof of Liquidity.

For Boosters: Earn Rewards Today

As a Booster, you are able to gain BGT and beyond through interactions with applications and supporting validators. Here is how:

- Explore newly approved Reward Vaults on DEXes like BEX, Kodiak, and Beradrome.

- Use an app like BEX to provide liquidity to a pool, earning pool commissions and LP tokens.

- Stake your LP tokens in the app’s whitelisted Reward Vault to start earning BGT.

- Boost a validator with your BGT, looking at their vault choices, commission rates, and uptime to maximize your Incentive Tokens and fees.

- Stay updated by following Berachain on X (@berachain) and checking their blog for new vaults and governance changes.

For Validators: Secure the Network and Get Rewards

Validators are the guardians that keep Berachain running while earning rewards for themselves and their Boosters. Get started with these steps:

- Stake BERA to run the node and join the active set for participating in the network.

- Direct BGT to whitelisted Reward Vaults, selecting them based on the Incentive Tokens offered to capture the best rewards, and share those incentives with your Boosters.

- Set a reasonable commission rate to reward Boosters and build a strong support foundation.

For dApps: Grow Your Project with Incentives

If you’re building a dApp or protocol, Berachain’s Incentive can help you attract users and liquidity. Here’s how to get going:

- Establish whitelisted Reward Vaults and incentivize users with receipt tokens.

- Offer up to two Incentive Tokens with an Incentive Rate fixed at a predetermined value to entice BGT from validators.

- Encourage user activity to grow your app and contribute to the Berachain ecosystem.

For more details, the official documentation is a great resource to dive deeper into the mechanics of PoL and incentives.

Latest Updates: Governance Phase 1 and Beyond

The Berachain ecosystem is in a buzz with recent news, and the launch of Governance Phase 1 is a major milestone. Here's what's new:

PoL Goes Live with Governance Phase 1

The Berachain Foundation (@berachain) made the announcement that PoL went live on March 24, 2025, thus starting Governance Phase 1. This phase opens BGT emissions to a broader array of dApps beyond the realm of BEX pools with new possibilities for all participants:

New Whitelisted Reward Vaults: The first batch of vaults has been approved, focusing on DEX pools from protocols like Kodiak and Beradrome, as well as BEX itself. These vaults feature assets like BERA, HONEY, and major stablecoins, giving users more options to earn BGT. According to the Berachain Governance Phase 1 blog post, these vaults were selected for their liquidity, security, and strategic importance.

Incentives Start Flowing: As of March 24, these vaults are live, and incentives are now flowing to users, validators, and protocols. This is the beginning of "real Proof of Liquidity," where dApps compete for emissions in order to grow.

More Governance Power: BGT holders now have greater control over emissions by boosting validators. Soon, you’ll be able to view each validator’s reward vault allocations and incentive earnings on BeraHub, making it easier to optimize your rewards.

What’s Next?

The ecosystem will further grow. From the week after March 24, Berachain will review additional Requests for Reward Vaults (RFRVs), going beyond DEX pools to include uses like RWAs, DeFI, and games. The cutoff for the second batch of RFRVs was March 27, 2025, so expect more announcements soon. With $3 billion in total value locked (TVL) and $1 billion in circulating stablecoins since the mainnet launch on February 6, 2025, Berachain is quickly becoming a DeFi powerhouse.

As new dApps join the ecosystem and fresh applications are built, opportunities to earn BGT will grow. If you're a degen farmer, a governance enthusiast, or just a curious Bera, now’s the perfect time to get involved. So, what are you waiting for? Let’s get staking, boosting, and building the future of DeFi together! 🐻⛓️

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.