Decentralized finance is in a constant state of change, and Berachain is a new direction in its development due to the revolutionary Proof-of-Liquidity (PoL) consensus mechanism. Berachain's PoL is a re-imagined way blockchains can function, putting everybody - validators, projects, and users-working together and sharing in the rewards. In this article, we are going to explain this model.

Key Takeaways

- Berachain has the potential to significantly impact the DeFi landscape, offering a unique and potentially more equitable Proof-of-Liquidity (PoL) model.

- Participants are key to the ecosystem: Your actions as a liquidity provider directly impact the flow of rewards and the success of projects on Berachain.

- Berachain's PoL aligns incentives: Validators, dApps, and users all work together, creating a more collaborative and rewarding DeFi ecosystem.

- All dApps are interconnected: You can use earned tokens and rewards from one dApp in another.

If you're interested in Berachain, explore our dedicated section filled with blog posts and comprehensive guides: https://daic.capital/blog/category/Berachain

What if you were able to earn rewards in DeFi not just for staking but for actively making the ecosystem more liquid and useful? That's the revolutionary concept behind Berachain, a new blockchain turning the idea of Proof-of-Stake on its head with its innovative Proof-of-Liquidity model. While in most of the traditional Proof-of-Stake models, rewards are given mainly to the ones who stake the maximum amount of tokens, Berachain's PoL incentivizes directly those users who make the network usable. By incentivizing liquidity provision, Berachain tries to create a more vibrant and efficient DeFi ecosystem where everyone is involved and reaping benefits.

What Makes Proof-of-Liquidity Different?

Most blockchains are based on Proof of Stake, where the users "stake" their tokens in order to secure the network and get their rewards. Berachain takes that to a whole new level. Instead of mere staking, PoL directly incentivizes liquidity provision, and at the heart of this action, there is you - the user.

The Core Components: $BERA, $BGT, and You

Berachain's PoL revolves around two leading tokens and, importantly, your active participation:

$BERA: Think of $BERA as the fuel that keeps Berachain running. It's used to pay for transaction fees (gas) and is also staked by validators – the entities that secure the network – to participate in consensus. Validators need at least 250,000 $BERA to get started, and the more they stake, the better their chances of earning rewards. The total $BERA staked also makes the network more secure.

$BGT (Governance Token): This is where things get interesting. $BGT is the governance token you receive for participating in PoL. It can't be bought-it can only be earned by providing liquidity. $BGT gives you a voice in the future of Berachain through voting on proposals. It's also used to "boost" validators, netting you a portion of their rewards.

Your Role: In Berachain, you are not a passive user. You provide liquidity and get $BGT in return. Then you delegate your $BGT to validators, and by doing so, you having your say in which projects get supported and getting even more rewards. Your actions directly affect the flow of rewards and the growth of the Berachain ecosystem.

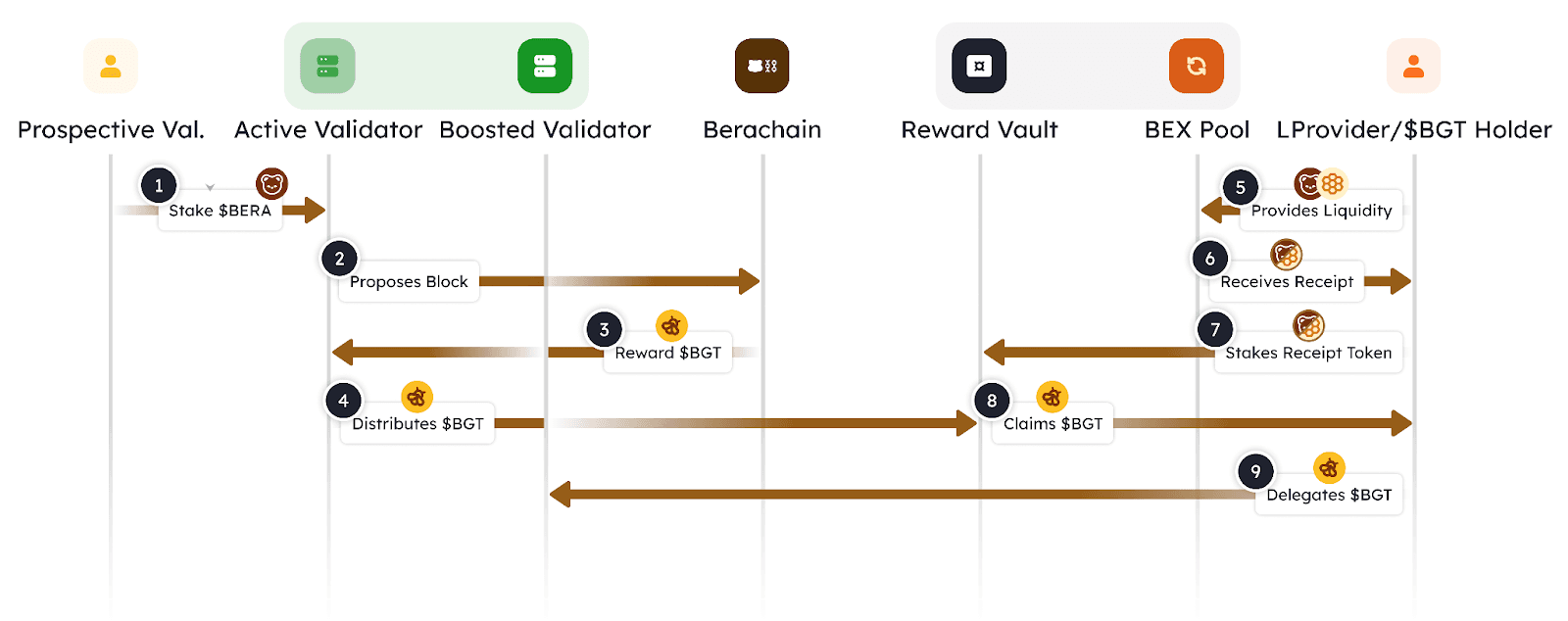

The Proof-of-Liquidity Lifecycle: How It All Works

Let's explore how PoL functions in practice:

- Validators stake $BERA and earn $BGT: Validators stake their $BERA to become eligible to participate in consensus of the blockchain. The amount of their stake determines their chances to propose a block and receive $BGT rewards in return. This reward has two parts: a base emission and a variable emission. The size of the variable emission is determined by the validator's "boost." This boost is calculated based on how much $BGT has been delegated to that validator by users.

- Validators Distribute $BGT to Reward Vaults: Validators keep the base $BGT reward for themselves. Then they distribute the variable portion of their earned $BGT to special smart contracts called “Reward Vaults”. These vaults are linked to specific dApps and actions, primarily providing liquidity. But here's where it gets interesting: validators don't just distribute these rewards randomly.

- dApps and Reward Vaults: This is where decentralized applications (dApps) play a crucial role. Each dApp can create one or more Reward Vaults, each associated with a specific action, most commonly providing liquidity. For instance, BeraSwap have a Reward Vault for a $HONEY/$BERA liquidity pool, while BEND might have one for users who borrow $HONEY. To attract validators and their $BGT emissions, dApps can offer "incentives" – extra rewards paid in the dApp's own token or other valuable assets.

- Users Provide Liquidity and Earn $BGT: Users provide liquidity to various dApps and receive receipt tokens (LP tokens) that represent their share of the pool. Then these LP tokens can be staked in the corresponding Reward Vault. Based on the share of the vault and the amount of $BGT directed to it, they earn $BGT rewards.

- Users Delegate $BGT to Validators: Users can delegate $BGT tokens to validators for support, resulting in the 'Boosting' effect, whereby they can receive additional rewards. Validators can also share part of the incentives they get from protocols with their delegators.

This creates a "virtuous cycle": Users are incentivized to provide liquidity to earn $BGT. dApps offer incentives to attract validators and liquidity. Validators are incentivized to direct $BGT to the most rewarding (and therefore the most liquid and useful) vaults. Users delegate $BGT to the validators that support the dApps they use, further boosting those validators' rewards. More liquidity and more users create more rewards for everyone in the ecosystem.

Putting Proof-of-Liquidity into Action: Earning $BGT

What does that mean for you in practical terms? Berachain's PoL model creates a dynamic and rewarding DeFi, where every action counts. You can get valuable governance power, $BGT, for providing liquidity - a thing that many users of DeFi are doing anyway.

Let's take a look at a real-world example:

Imagine that you want to use BeraSwap, the main decentralized exchange from Berachain, and you decided to add some of your tokens in a particular liquidity pool, for example, the $HONEY and $BERA one. For that, you get special receipt tokens showing your share in the pool - LP tokens serving as your gateway to getting the $BGT. With these LP tokens, you are able to stake them in a Reward Vault. This is where the magic happens, and you start earning some sweet $BGT rewards.

If you want to get a detailed guide on providing liquidity via BeraSwap and staking your receipt tokens, refer to "How to Earn $BGT on Berachain: Your BeraSwap Liquidity Guide".

But that is not all: once you have acquired some $BGT, you can extend the rewards even further by delegating it to a validator. That would be called "boosting," which also helps in securing the network and results in a share of rewards from the validator.

For how exactly to delegate your $BGT, we've prepared a guide: "How to Stake $BGT: A Step-by-Step Guide".

And that is not all! You also can earn $BGT by borrowing $HONEY on BEND, a platform for lending and borrowing.

A New Era for DeFi

The Proof of Liquidity developed by Berachain goes beyond a consensus mechanism into the structural change of how DeFi ecosystems can be designed. Berachain creates an environment where everyone benefits from contributing value to a thriving network by directly rewarding liquidity and aligning incentives. This provides one of the clearest visions yet for what might be in the future of DeFi, as it will truly reward active participation and give the user a meaningful say in platform development.

Ready to be part of the new generation of DeFi? Check out the Berachain website now, explore dApps, and earn $BGT today!

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.