Overview

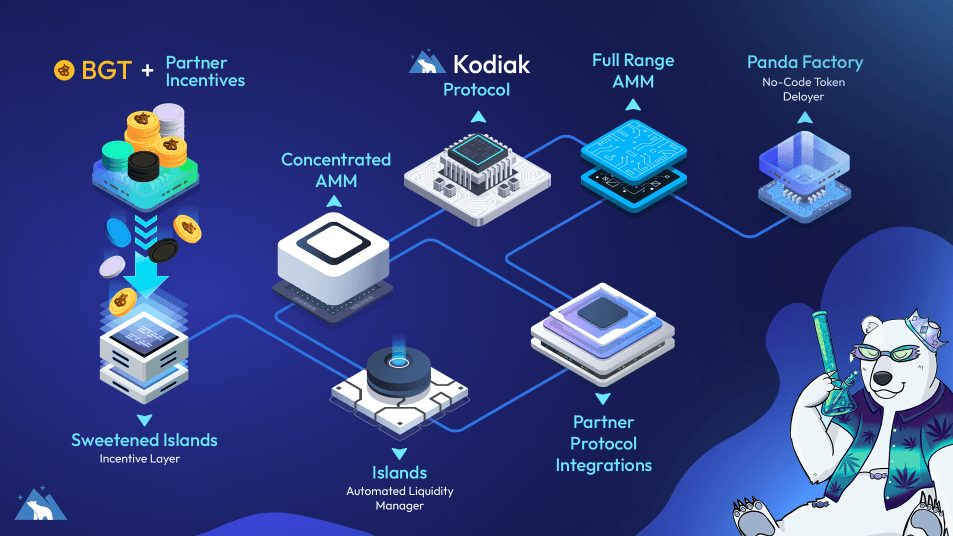

Kodiak is a vertically-integrated liquidity hub built on Berachain, designed to revolutionize liquidity management and trading in decentralized finance (DeFi). With a suite of innovative tools and features, Kodiak simplifies DeFi for both experienced traders and newcomers, offering seamless access to automated liquidity management, efficient trading, and incentivized farming.

Kodiak’s deep integration with Berachain leverages the chain’s Proof-of-Liquidity (PoL) consensus mechanism, ensuring liquidity provision directly enhances network security while driving ecosystem growth.

Key Features

- Kodiak DEX: The Kodiak decentralized exchange (DEX) offers a dual AMM model:

- Islands: Automated liquidity management vaults, known as Islands, streamline the management of concentrated liquidity positions. Each Island is tokenized, providing users with an easy way to maintain liquidity in-range and maximize profitability.

- Sweetened Islands: Liquidity providers can participate in Sweetened Islands, a feature that incentivizes liquidity through additional token rewards. By locking their positions for longer durations, users can increase their reward multipliers, boosting their earning potential.

- Panda Factory: A no-code token deployer designed for the permissionless launch of tokens and their initial liquidity on the Kodiak full-range AMM. The Panda Factory is especially suited for volatile assets, providing an easy entry point for token creators.

Tokenomics

- KDK Token: Kodiak's native token, KDK, serves multiple purposes within the ecosystem. Users can acquire KDK by providing liquidity to Kodiak's Islands or swapping for it through the Kodiak DEX. KDK incentivizes deep liquidity and low-slippage trading on the Kodiak DEX. Additionally, holders can convert KDK into xKDK to participate in governance, protocol rewards distribution, and the development of Kodiak ecosystem products.

- xKDK Token: xKDK is a non-transferable escrowed governance token earned by providing liquidity to Kodiak's Islands or through direct KDK conversion. The primary use of xKDK is allocation to Utility Modules, allowing users to stake xKDK into the token contract and assign the deposited amount to a specific Utility Module in exchange for various benefits.

Why Kodiak Finance?

- Integrated with Berachain: As a native dApp of Berachain, Kodiak benefits from its high-speed, low-cost transactions and innovative Proof-of-Liquidity consensus mechanism.

- Capital Efficiency: The dual AMM model ensures that liquidity providers can maximize their returns while minimizing idle assets.

- User-Friendly Design: From automated liquidity management with Islands to no-code token launches via the Panda Factory, Kodiak is built for accessibility.

FAQs

What is Kodiak Finance?

Kodiak Finance is a vertically integrated liquidity hub on Berachain, offering a decentralized exchange (DEX), automated liquidity management through "Islands", incentivized farming via "Sweetened Islands", and a no-code token launch platform called "Panda Factory”.

How does Kodiak's DEX operate?

Kodiak's DEX utilizes both full-range (V2) and concentrated (V3) Automated Market Makers (AMMs), inspired by Uniswap's designs. This dual approach allows for efficient trading and flexible liquidity provision strategies.

What are Kodiak Islands?

Kodiak Islands are automated liquidity management vaults that maintain users' concentrated liquidity positions within optimal price ranges. These vaults simplify the process of providing liquidity and are designed to maximize profitability.

What is the purpose of Sweetened Islands?

Sweetened Islands incentivize liquidity providers by offering additional token rewards. Users can lock their liquidity positions for extended periods to receive higher reward multipliers, enhancing their earning potential.

How does the Panda Factory function?

The Panda Factory is a no-code platform that enables the permissionless deployment of new tokens, including memecoins, on Kodiak's full-range AMM. It simplifies the token launch process, making it accessible to users without technical expertise.

What is the KDK token?

KDK is Kodiak's native token, used for incentivizing liquidity provision, participating in governance, and accessing protocol rewards. Users can acquire KDK by providing liquidity or swapping on the Kodiak DEX.

What is xKDK?

xKDK is a non-transferable escrowed governance token obtained by converting KDK. It allows holders to participate in governance decisions and allocate tokens to Utility Modules for various benefits within the Kodiak ecosystem.

How is Kodiak integrated with Berachain?

Kodiak is deeply integrated with Berachain's Proof-of-Liquidity (PoL) consensus mechanism. This integration ensures that liquidity provision on Kodiak directly contributes to the security and growth of the Berachain network.

What sets Kodiak apart from other DEXs?

Kodiak's unique combination of dual AMMs, automated liquidity management, incentivized farming, and a no-code token launch platform distinguishes it from other DEXs. Its integration with Berachain's PoL mechanism further enhances its value proposition.