Overview

Beradrome is Berachain’s premier restaking and liquidity marketplace, designed to address key challenges in DeFi liquidity management and capital efficiency. It provides protocols and users with innovative solutions to build deeper, more sustainable liquidity with fewer resources. By combining advanced features like vault-based yield integration, a bonding curve mechanism, and token-owned liquidity (ToL), Beradrome creates a dynamic ecosystem where liquidity is not just a necessity but a strategic advantage.

At its core, Beradrome leverages Berachain’s unique Proof-of-Liquidity (PoL) mechanism to align liquidity provision with network security and protocol sustainability. This alignment ensures that protocols using Beradrome can deepen their liquidity while minimizing costs, offering users enhanced flexibility, lower slippage, and more robust trading conditions.

Beradrome introduces $BERO, its native token, as the cornerstone of its ecosystem. Through $BERO and its associated tokens ($hiBERO and $oBERO), the platform incentivizes participation, governance, and liquidity creation, creating a self-reinforcing flywheel of growth. The bonding curve further enhances the ecosystem by maintaining price stability and providing protocols with predictable liquidity access.

By supporting a wide range of yield-generating assets within its vaults and enabling decentralized governance, Beradrome empowers both protocols and individual users to actively shape the ecosystem. Whether through staking, governance participation, or liquidity provisioning, Beradrome ensures that every participant has a meaningful role in the ecosystem's success.

As a central player in the Berachain ecosystem, Beradrome exemplifies how DeFi can be reimagined to offer deeper collaboration, sustainable growth, and unprecedented efficiency.

Key Features

- Vaults: Beradrome's unique vault model enables any yield-generating asset within the Berachain ecosystem to integrate seamlessly, each with its dedicated gauges. Users can deposit LP tokens from decentralized exchanges, tokens from lending platforms, and other yield-generating tokens. These gauges generate $oBERO as incentives, representing a call option for $BERO at a predefined floor price of 1 HONEY.

- Bonding Curve: The Beradrome Bonding Curve algorithmically controls the supply of $BERO tokens, ensuring a stable foundation and providing liquidity at market-driven rates. This mechanism maintains the price of $BERO at or above 1 HONEY per $BERO.

- Token-Owned Liquidity (ToL): Beradrome introduces Token-Owned Liquidity, allowing protocols to own their liquidity through the bonding curve. This approach reduces reliance on external liquidity providers and enhances stability within the ecosystem.

Tokenomics

Beradrome's tokenomics are designed to attract and partner with protocols and users contributing to its growth:

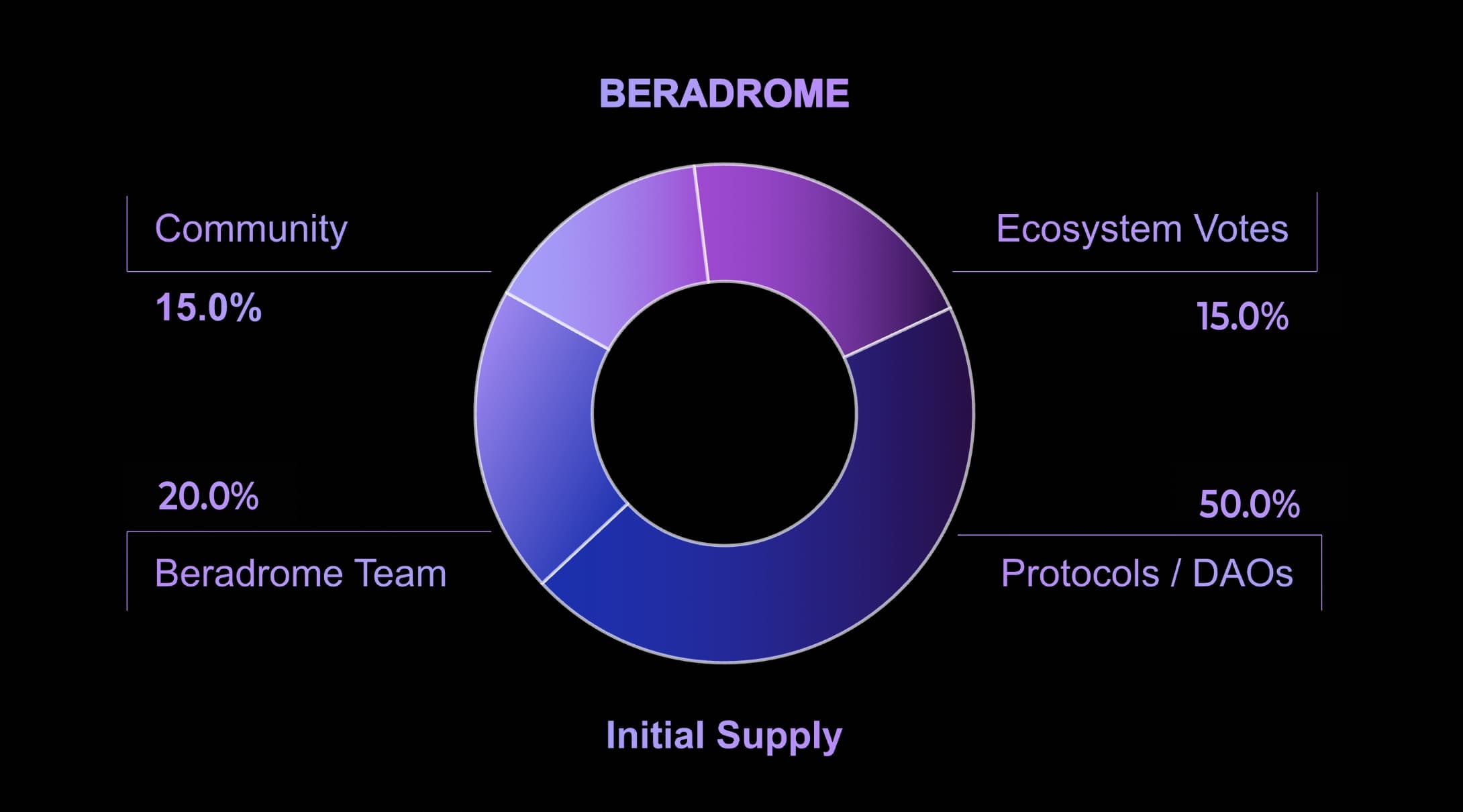

- Initial Supply (100k)

-

Emissions:

Weekly $oBERO emissions start at 4,000 (4% of the initial supply) and decay at 1% per week. $hiBERO stakers receive 20% of emissions. Emissions continue indefinitely with no fixed supply. 5% of emissions go to a team-controlled multisig weekly.

Why Beradrome?

- Adaptability: Through the integration of plugins, Beradrome supports gauges involving any yield-generating asset, enhancing adaptability within the ecosystem.

- Innovative Token Structure: Beradrome introduces $BERO, $hiBERO, and $oBERO tokens, each offering users diverse advantages and motivations. The bonding curve mechanism ensures a stable foundation for $BERO tokens while providing liquidity at market-driven rates.

- Enhanced Liquidity: By allowing protocols to own their liquidity through the bonding curve, Beradrome reduces reliance on external liquidity providers, fostering a more stable and self-sufficient ecosystem.

NFTs

Beradrome offers NFTs that provide holders with various benefits, including governance participation, exclusive access to new features, and eligibility for token airdrops. These NFTs enhance user engagement and offer additional utility within the Beradrome ecosystem.

FAQs

What is Beradrome?

Beradrome is Berachain’s native restaking and liquidity marketplace, designed to address key challenges in DeFi liquidity management and capital efficiency. It provides protocols and users with innovative solutions to build deeper, more sustainable liquidity with fewer resources.

How does Beradrome's bonding curve work?

The Beradrome Bonding Curve algorithmically controls the supply of $BERO tokens, ensuring a stable foundation and providing liquidity at market-driven rates. This mechanism maintains the price of $BERO at or above 1 HONEY per $BERO.

What are vaults in Beradrome?

Beradrome's unique vault model enables any yield-generating asset within the Berachain ecosystem to integrate seamlessly, each with its dedicated gauges. Users can deposit LP tokens from decentralized exchanges, tokens from lending platforms, and other yield-generating tokens. These gauges generate $oBERO as incentives.

What is Token-Owned Liquidity (ToL)?

Token-Owned Liquidity allows protocols to own their liquidity through the bonding curve. This approach reduces reliance on external liquidity providers and enhances stability within the ecosystem.

How are emissions structured in Beradrome?

Weekly $oBERO emissions start at 4,000 (4% of the initial supply) and decay at 1% per week. $hiBERO stakers receive 20% of emissions. Emissions continue indefinitely with no fixed supply.

What tokens are involved in Beradrome's ecosystem?

Beradrome introduces $BERO, its native token, as the cornerstone of its ecosystem. Through $BERO and its associated tokens ($hiBERO and $oBERO), the platform incentivizes participation, governance, and liquidity creation.

Does Beradrome offer NFTs?

Yes, Beradrome offers NFTs that provide holders with various benefits, including governance participation, exclusive access to new features, and eligibility for token airdrops.