Key Takeaways

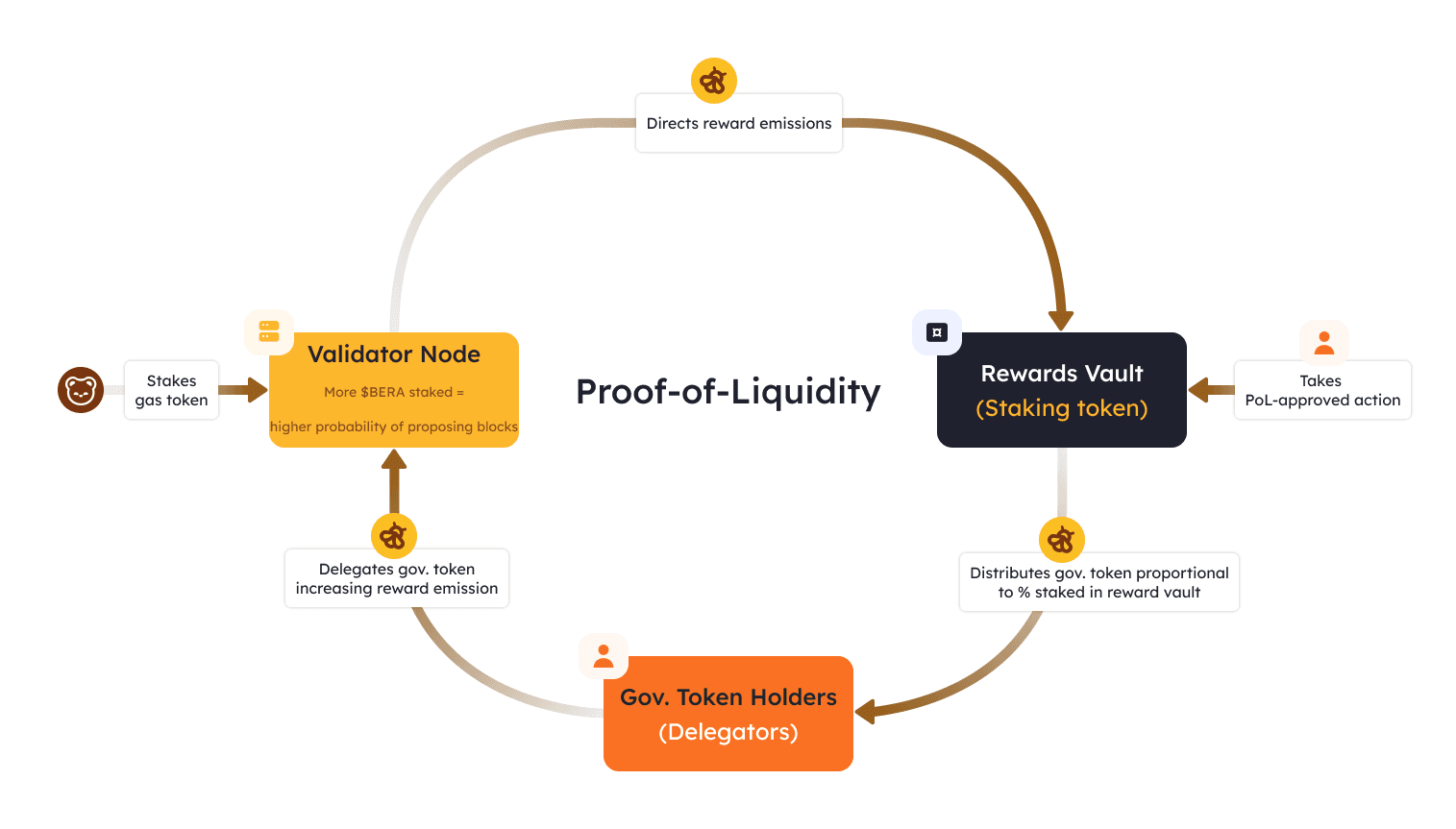

- Proof of Liquidity (PoL) Consensus: Berachain introduces PoL, a unique consensus mechanism that enhances network security and liquidity by rewarding participants across its ecosystem.

- EVM Compatibility: Berachain leverages the BeaconKit framework to achieve Ethereum Virtual Machine (EVM) compatibility, enabling seamless smart contract functionality across multiple blockchains.

- Tri-Token Model: The ecosystem utilizes three tokens - BERA, BGT, and HONEY - for governance, liquidity incentives, and stability within the network.

- DeFi Platform Offerings: Berachain provides platforms for lending, borrowing, decentralized exchange (BEX), and a stablecoin infrastructure, enhancing its DeFi capabilities.

If you're interested in Berachain, explore our dedicated section filled with blog posts and comprehensive guides: https://daic.capital/blog/category/Berachain

Introduction to Berachain

Berachain is an Ethereum-equivalent Layer-1 blockchain designed as a new model for liquidity accrual in decentralized finance (DeFi) and blockchain overall.

To help realize equitability in protocol design, Berachain makes use of an innovative architecture called Proof of Liquidity (PoL). PoL is built to improve liquidity connectivity on Berachain by furnishing accessibility to liquidy, users, and the like in a manner that benefits all ecosystem participants equality, whether dApps, DeFi protocols, or users utilizing the larger Berachain network.

While PoL helps eliminate issues related to liquidity synchronicity on Berachain, many existing Ethereum compatible chains present other challenges. In particular, many Layer 1 designs synergistically integrate consensus with execution. Unfortunately, when consensus and execution are combined, network performance typically suffers.

To combat these inefficiencies, Berachain leverages BeaconKit, an innovative framework that allows for CometBFT consensus algorithm malleability in EVM execution environments. In simple terms, BeaconKit is essentially a modular consensus layer that is built to streamline the development of Ethereum-compatible blockchains atop Berachain.

Essentially, BeaconKit helps separate consensus from execution for the development of EVM chains on the network, freeing up the chain’s mempool to support the growing demand for blockspace as more users ultimately make use of the network and adoption grows. Through the combination of Berachain and BeaconKit, the platform becomes EVM identical.

By harnessing the capabilities of BeaconKit to build on principles standardized by Ethereum’s modular separation of consensus and execution, developers are able to leverage any execution client on Berachain utilizing the EngineAPI.

This design is built with modularity top-of-mind because it is able to exhibit seamless connectivity with a host of layer types including a custom block builder, a rollup layer, and a data availability layer, among others, ultimately allowing for the development of many types of chains for uses of all shapes and sizes.

BeaconKit allows developers to spin-up their own multi-execution client EVM L1 or L2 and supports EIP-4844 (Proto-danksharding) to enable a dramatic reduction in cost of posting L2 rollup data to Ethereuem via data “blobs.” In addition, developers can leverage BeaconKit with any ABCI 2.0 compatible consensus engine, which therefore allows for the integration with Rollkit to create powerful Layer-2 solutions.

Through the development of an Ethereum-like system that is identical to the EVM developer experience (via BeaconKit) that is so readily familiar and combining it with next-level UX through Proof of Liquidity, Berachain represents a cutting-edge blockchain in technological terms, especially for smart contract development.

Proof-of-Liquidity Explained

At this time, most blockchains make use of Proof of Stake (PoS) architectures. Unfortunately, most PoS chains and their underlying ecosystem’s exhibit challenges related to poor security and fractionalized liquidity. Fractionalized liquidity typically occurs when liquidity is fragmented between several assets, meaning the liquidity within the system (often existing within liquidity pools on the network) dries up and becomes liquidity debt.

To combat these issues, Berachain introduces its novel Proof of Liquidity (PoL) consensus mechanism, designed to align multiple network incentives by producing a synergistic relationship between Berachain validators, users, and projects building on top of the greater Berachain network. In addition, Proof of Liquidity is built to enhance network security by providing liquidity to a suite of DeFi primitives that exist on top of the protocol itself; in particular a lending and borrowing platform, an AMM DEX, and a perpetual futures exchange.

Through the operation of PoL and Berachain’s tri-token system (consisting of BERA, BGT, and HONEY), liquidity continuously flows between all Berachain validators, users, and ecosystem participants via a specialized feedback mechanism that helps guide protocol governance and overall functionality. This flywheel effect is realized through the redemption of incentivized BGT for validator staking and the use of the protocl’s DeFi suite. There are also additional mechanisms in place that allow network contributors to earn HONEY and BERA.

To read more about Proof of Liquidity (PoL) and Berachain’s other technical elements, consider having a look at our second article in our larger Berachain article series.

Berachain History and Background

The team behind Berachain found inspiration in the form of rebasing protocol OlympusDAO because of the traction it had gained at the time, culminating in their OHM token being valued at a price of $1,300 during the fall of 2021.

In 2021 Berachain began its blockchain journey following in the footsteps of Olympus DAO by developing the first-ever rebasing NFT collection. Introduced as Bong Bears, the offering constituted several types of bong-wielding meme-focused bear NFTs available for purchase on the OpenSea NFT marketplace. On OpenSea, the Bong Bears collection is described as “100 absolutely zooted NFT bears getting baked,” a moniker that surely resonated with its community as being humorous.

Soon after the Bong Bears release in August 2021, the team introduced numerous additional NFT collections (constituting 6 in total) including Bond Bears, Baby Bears, Bit Bears, Boo Bears, and Band Bears, all of which grew to become extremely expensive (e.g., 10 to 20 ether (ETH) per NFT), selling out entirely in time.

In April 2022, the team behind Bong Bears announced they had chosen to expand their vision for the brand by launching their own independent Layer 1 blockchain protocol (Berachain). Only then, could the vision for their offering become more than simply a joke-inspired meme focused on cartoonized bears.

In their eyes, it would be representative of an entire blockchain ecosystem focused on rewarding its participants in an equitable manner for their contributions, while simultaneously offering a multitude of extremely advanced tech innovations.

The Berachain project is made up of a team of pseudonymous co-founders known as Smokey the Bera, Dev Bear, Homme Bera, Papa Bear, and others. Most of the Berachain team hail from Toronto, Ontario, Canada; with other team members hailing from various geographical regions across the globe. For the most part however, the founding team’s real identities are unknown to the general public.

This may change in time, but for now, the founders of the project are synonymous with appearing at various blockchain- and crypto-focused events to discuss the Berachain project and all things blockchain in larger-than-life teddy bear head masks and the like.

At times, the project's founders have referred to Berachain as “Bera”, an intentionally misspelled moniker representing bear, supposedly conceptualized from the ethos of crypto’s “hodl” mantra (meaning hold, referring to the act of holding crypto long-term).

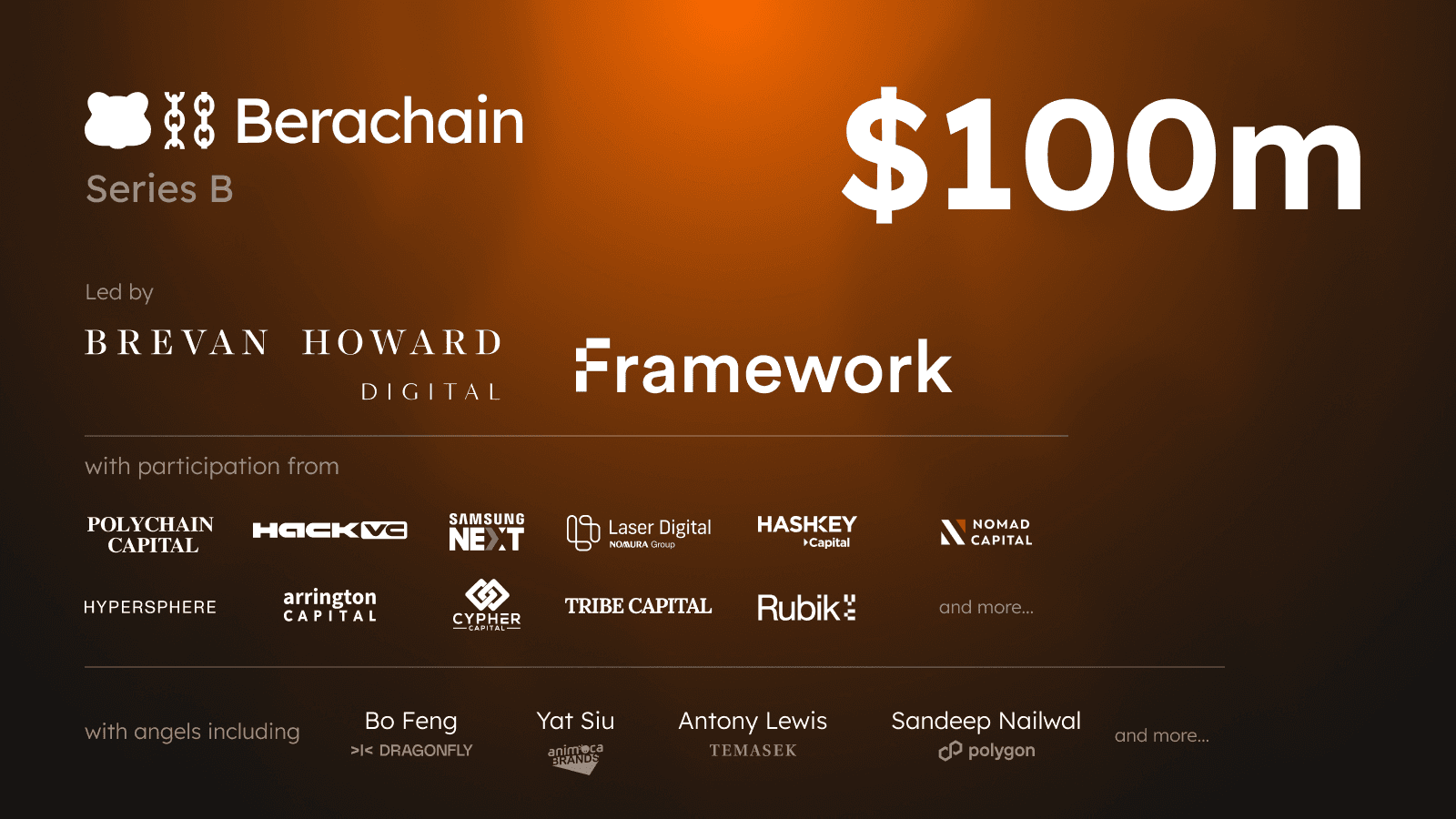

After raising 42 million in April 2023 via a series A funding round supported by Polychain Capital and venture capital firms da05, Hack VC, Tribe Capital, CitizenX, Shimla Capital, and Robot Ventures, the project raised an additional 100 million in a series B round a year later in April 2024.

The series B round was lead by Framework Ventures and the Abu Dhabi branch of Brevan Howard Digital (BH Digital) with additional participation from venture capital firms Polychain Capital, Hack VC, Samsung Next, Hashkey Capital, Nomad Capital, Hypersphere, Arrington Capital, Cypher Capital, Tribe Capital, Rubik, and numerous angel investors including Polygon’s Sandeep Nailwal, among others.

Use Cases of the Berachain Platform

Berachain has many utilities in the real world, many of which are related to the usability of the platform for DeFi. Berachain’s DeFi sphere is focused on the development of decentralized applications (dApps), protocols, smart contracts, and more, on a host of additional chains as the project matures.

At this time however, Berachain presents primarily as a DeFi-focused protocol. To this point, Berachain’s main DeFi offerings include:

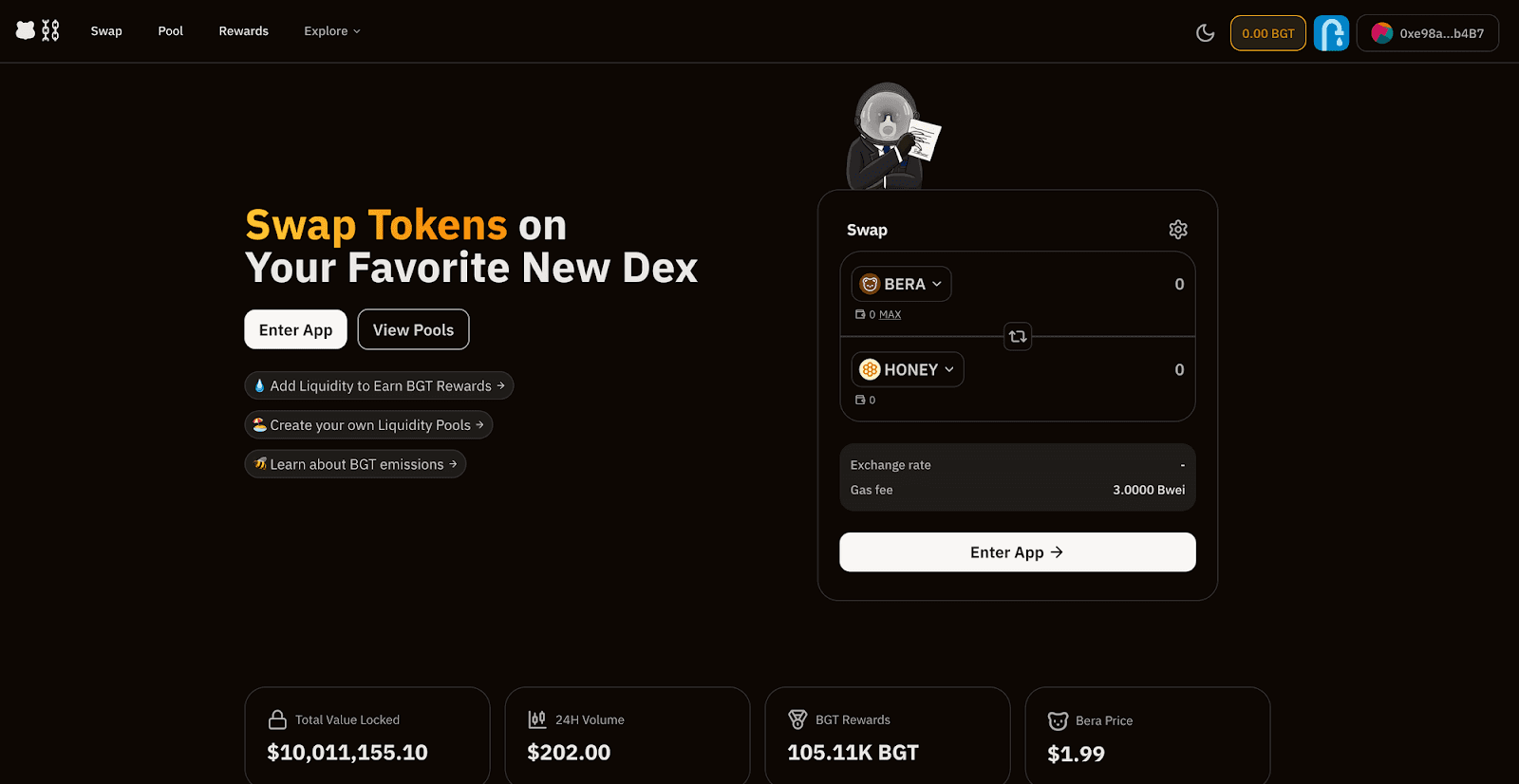

- Berachain Exchange (BEX) - a decentralized exchange

- Berachain Lend (BEND) - a lending and borrowing platform

- BERPS - a perpetual swap futures marketplace

- Honey - a stablecoin exchange platform

- BGT Station - a BGT staking and governance dashboard

The Berachain Exchange, or BEX, allows users to trade, swap, and make use of various liquidity pools (including House Pools and MetaPools) to earn incentivized token rewards. The importance of BEX cannot be understated and its presence will go a long way to ensure continued liquidity accrual and adoption of the ecosystem moving forward.

BEX is complemented by the Berachain Lend (BEND) platform, a lending and borrowing protocol that allows users to accrue BGT assets in exchange supplying liquidity to the platform.

Like all of Bera’s offerings, BEND operates directly on the Berachain blockchain.

To complement the BEX and BEND platforms, Berachain offers the BERPS derivatives trading protocol as a means to allow users to speculate and hedge leveraged trading positions with up to 100x leverage.

What’s more, Berachain also furnishes the HONEY stablecoin exchange framework, allowing users to exchange different types of stablecoins to and from Bera’s HONEY stablecoin. This is significant, primarily because a stablecoin is extremely important to ensure the long-term viability and success of any blockchain ecosystem.

Finally, the Berachain platform also offers its BGT Station governance dashboard that allows users to engage in bribes that incentivize BGT validator bonding and staking participation to refine governance systemization, improve security robustness, and increase liquidity accrual on the Berachain platform.

Like most DeFi applications, all protocols mentioned above that operate on Bera allow users to connect a non-custodial wallet, facilitating user interaction with the underlying blockchain and its many DeFi services.

In addition to its in-house DeFi primitives, Berachain can be used as a means for Berachain ecosystem projects to build their own decentralized exchanges (DEXs), borrowing and lending platforms (decentralized money markets), derivatives solutions, stablecoin infrastructures, token issuance platforms, and even for various peer-to-peer payment and settlement infrastructures.

Because of the fact that Berachain is built in a highly decentralized manner, it seems unlikely that Berachain will be viewed as an enterprise, government, or institutional platform in the near-term. However, this could change as the project evolves, especially because of its strong standing within the modular blockchain narrative.

Potential future uses in these niches could include remittances and payments, supply chain management, decentralized identity (DID), FinTech, intellectual property, big data, cybersecurity, and asset issuance, among others.

Depending on its evolution long-term, Berachain could be used as a platform for these and other uses, but for now it's likely to continue its development of its DeFi suite with a strong focus on serving the needs of various blockchain ecosystems.

Berachain Tokenomics

Berachain makes use of three main token types that work together to maintain the overall integrity and balance of the liquidity-focused Berachain ecosystem. These include:

- Berachain token (BERA): The BERA utility token is primarily used to pay transaction fees needed to send transactions on the network, while also supporting several additional uses related to its symbiotic relationship with HONEY and BGT. For example, users are able to redeem or burn 1 BGT in exchange for 1 BERA in a non-reversible process.

- Berachain Governance Token (BGT): The BGT governance token is designed to ensure the robustness of the Berachain platform by provisioning in-protocol liquidity via the Proof of Liquidity consensus mechanism in a similar manner to traditional PoS models. BGT plays a pivotal role in protocol governance and can be staked within network validators and earned in exchange for using Bera’s DeFi products and services. The token is non-purchasable at this time as a means to align protocol-user incentives long-term (i.e., it can only be obtained in exchange for on-chain network contributions).

- Honey stablecoin (HONEY): The HONEY stablecoin is the proprietary Berachain asset pegged 1:1 to the US dollar. HONEY is used primarily through the Berachain Exchange (BEX) and Berachain Lend (BEND) protocols and within the Honey dApp for the swapping and exchanging of assets, which is then used within various liquidity pools and for other means.

Berachain’s tri-token model helps create a synergistic effect built to facilitate the equitable exchange and distribution of value within the greater Berachain ecosystem. This model is especially related to Proof of Liquidity and helps allow the system to work in a balanced and liquidity-enriching manner.

As is evidenced above, all three tokens work together to create a reciprocal relationship between validators, users, liquidity providers, and the greater Berachain network by rewarding all ecosystem participants (in BGT, HONEY, and BERA) for their loyalty to the platform and its continued development.

Exploring the Berachain Governance System

Although the Berachain governance system is somewhat complex, governance proposals are meant to propose a host of functionalities to various network participants including validators, whitelisted liquidity pools, whitelisted tokens, and more.

In general, the Berachain governance system leverages the Berachain Governance Token (BGT) as a mechanism to allow token holders to contribute to the decisions-making processes related to the core functionality of the Proof of Liquidity (PoL) and the platform’s core dApps.

Overall, Berachain governance can be used to conduct/contribute to Proof of Liquidity assets whitelisting (e.g., new staking assets, whitelisting incentive assets), and native dApp governance (e.g., change to BeraSwap protocol fees). Let’s discuss this process in more detail below:

Reward Vault Whitelisting

Berachain makes use of a system that harnesses specialized smart contracts called Reward Vaults that allow stakers to stake their Proof of Liquidity (PoL) eligible assets as a means to receive BGT tokenized rewards in exchange.

Whereas creating a Reward Vault is permissionless, in order for it to receive BGT emissions from validators, it must be whitelisted (pre-approved) via a governance proposal. This whitelisting process ensures community oversight (a process that allows community members to ensure governance proceeds in an equitable manner) and alignment prior to a project joining the Proof of Liquidy (PoL) ecosystem.

More specifically, two components are required prior to whitelisting a new vault and are both composed concurrently via a single governance proposal. These include:

- Whitelisting the Reward Vault

- Whitelisting the incentive token(s)

Main Governance Process

As of this writing, Berachain;s governance processes are conducted in several distinct stages, including:

- Proposal creation: All users that exhibit sufficient voting power are able to create a governance proposal.

- Pending state: Upon creation, the proposal in question enters a waiting period prior to becoming active for voting.

- Active voting: At the commencement of the voting period, BGT holders are able to cast their votes

- Proposal outcome: After the voting period has concluded, the proposal is either marked as Succeeded (accepted) or Defeated (denied), while a quorum (the majority must vote in favour) of BGT is required for the proposal to be accepted.

- Timelock: In the event the proposal is passed successfully , it enters a queue with a timelock delay

- Execution: Once the timelock period concludes, the proposal is executed and the proposed changes are implemented.

Resources

💬

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.