Key Takeaways

- Proof of Liquidity (PoL): Berachain’s unique consensus mechanism boosts liquidity and capital efficiency through validator and governance incentives.

- Ecosystem Growth: Offers decentralized trading, lending, and liquidity services via its DEX and other financial tools.

- Long-Term Potential: Positioned for sustainable growth in DeFi by eliminating traditional liquidity mining issues.

If you're interested in Berachain, explore our dedicated section filled with blog posts and comprehensive guides: https://daic.capital/blog/category/Berachain

Berachain Ecosystem Overview

The Berachain project is quite new and its ecosystem is not yet of significant size. Make no mistake however, Berachain is focused on the development of a blockchain that has the potential to accrue a significant amount of value within the greater industry moving forward.

At this time, the founders of Berachain consider the platform to be the first chain that allows newly developed protocols to sustainably build their liquidity base and drive capital efficiency over time (via the Proof of Liquidity (PoL) framework).

Case and point, as far as the liquidy bootstrapping process is concerned, protocols generally launch a liquidity mining process whereby their own native token is paired against another token, requiring users to stake this LP token in exchange for emissions in the form of their native token, typically inflating and devaluing their native token’s price.

Conversely, Berachain makes use of bribes (a process that incentives different user types via PoL and governance) to bootstrap liquidity via the Berachain Exchange (BEX) and the greater Berachain ecosystem through the following mechanisms:

- Newly developed protocols offer an amount of their native token to validators via a bribe.

- Validators direct a portion of their BGT rewards to that protocol’s pool within the native DEX, so that liquidity providers earn BGT emissions for providing liquidity.

- Berachain validator delegates received a percentage of independent-protocol bribes

- This model in turn significantly reduces the capital acquisition costs for protocols. building on the platform, while incentivizing protocols to run their own independent validators in order to direct emissions to their own liquidity pools.

As explained in the above example, Proof of Liquidity is an extremely advanced paradigm that allows the Berachain platform and its underlying ecosystem to continue to accrue value at a cost-reduced manner. This allows projects building on the platform to be economically viable for the long-term, creating an vast interconnected ecosystem of value sharing that incentivizes independent protocols, validators, and users to continue supporting the Berachain network as it ultimately matures over time.

Berachain Roadmap and Future Initiatives

Berachain’s journey to this point has been long and well-travelled, with the team behind the initiative bent on creating a truly innovative platform that has taken a significant amount of effort.

To watch the project evolve from an early stage NFT collection to a fully-fledged blockchain and DeFi ecosystem has been extraordinary. Since inception, Berachain has carried out the following milestones:

- April 2021 - Bong Bears is initially founded as an NFT collection

- Throughout 2021 and early 2022 - Bong Bears releases several additional NFT collections (including Baby Bears, Bit Bears, Bond Bears, Boo Bears, and Band Bears)

- April 2022 - Berachain announces their intention to create a Layer 1 blockchain protocol (composed of innovations such as Polaris EVM and Proof of Liquidity)

- January 2024 - Berachain announces the launch of their Artio testnet

- January 2024 - with the testnet launch, 5 in-house DeFi testnet dApps become available (including Berachain Exchange (BEX), Berachain Lend (BEND), BERPS, Honey, and BGT Station) for user interaction

- April 2024 - Berachain announces a 100 million Series B funding round with a reported valuation of 1.5 billion

- June 2024 - Berachain announces the launch of their second testnet (v2 Bartio) June and July 2024 - Berachain’s Barito testnet processes more than 137 million transactions in its first two months, averaging 2.5 million transactions per day in June and July

- December 2024 - the StakeStone Berachain Vault surpasses 30,000 token holders with a 100 million in total value locked (TVL)

- The number of distinct addresses on the Berachain testnet reaches 240 million by the end of 2024, with daily active addresses peaking at 7 million on December 3rd

- Q1 2025 - Berachain mainnet launch expected

Comparative Project Analysis

Berachain is a Layer 1 blockchain focused on the development of a protocol that is decentralized and equitable for all ecosystem participants. The Berachain network leverages Ethereum compatibility via the modular BeaconKit consensus layer, while harnessing the CometBFT protocol as a complement to Proof of Liquidity.

Berachain’s Proof of Liquidity (PoL) sybil resistance mechanism is designed primarily to support the equitable sharing of liquidity through various in-protocol incentives to ensure the platform’s DeFi-focused model and the greater Berachain ecosystem works as intended.

This model is arguably unlike no other, representing an ingenious form of economic and governance engineering. Many blockchains have tried to create similar economic models but very few have incorporated equitable liquidity distribution into their protocol in the same manner Berachain has.

One of the biggest hurdles in terms of adoption for Berachain compared to many projects is the fact that the project is just now launching its mainnet. Below we’ll provide an analysis comparing Berachain to Kava Network, Composable Finance, and Injective Protocol, of which offer similar products and services to the Berachain platform.

Kava Network

Like Berachain, Kava Network is a Cosmos-focused DeFi project that makes use of its own suite of various DeFi products and services. These include Kava Lend, Kava Mint, Kava Swap, Kava Staking, Kava Earn, Kava Liquid Staking, and Kinetix (which consists of several additional services like perpetual futures trading).

Similar to Berachain, Kava Network is also an Ethereum Virtual Machine (EVM)-compatible blockchain. This functionality is realized by connecting Ethereum and Cosmos together via its Cosmos co-chain and its Ethereum co-chain which incorporate both Ethereum and Cosmos bridges to offer full interoperability and connectivity to the larger Ethereum ecosystem.

Though Kava’s tech is highly advanced in its own right, Berachain’s Polaris Virtual Machine represents an alternative to EVM compatibility that is more refined and state-of-the-art by many accounts.

The Kava project also boasts a 120+ project-strong ecosystem with numerous integrations including those with market makers, infrastructure providers, middleware tooling systems, both decentralized exchanges (DEXs) and centralized exchanges (CEXs), numerous wallet providers, and various additional dApps and protocols.

Like Berachain, Kava makes use of its own utility and governance token (KAVA) and its own stablecoin (USDX) as well as several distinct in-house assets including SWP (used within its swapping protocol) and HARD (a separate governance token).

With all of these proprietary assets considered, perhaps of highest importance to Kava is its USDX stablecoin; which similarly to HONEY on Berachain, acts as an ERC-20 base currency used to trade against other crypto assets on Kava’s numerous DeFi protocols. USDX is actually issued by Tether Limited and went live in Kava in June of 2023. Differently from Berachain’s HONEY stablecoin, USDX works via a CDP-focused system to maintain its equilibrium through a balanced burning and minting mechanism.

USDX also maintains price stability via multiple borrowing APY standards, a specialized USDX savings rate, and various additional Kava incentives that are too complex to explain at this time. Regardless, without USDX, the Kava platform would be unable to operate as intended.

Similarly to Berachain, the Kava platform also leverages its own foundation and governance structure that should help boost its decentralization and continued development as the project grows. Kava surely exhibits a first mover advantage over Berachain because it was released in 2019. That said, Berachain is a unique offering in its own right with immense potential.

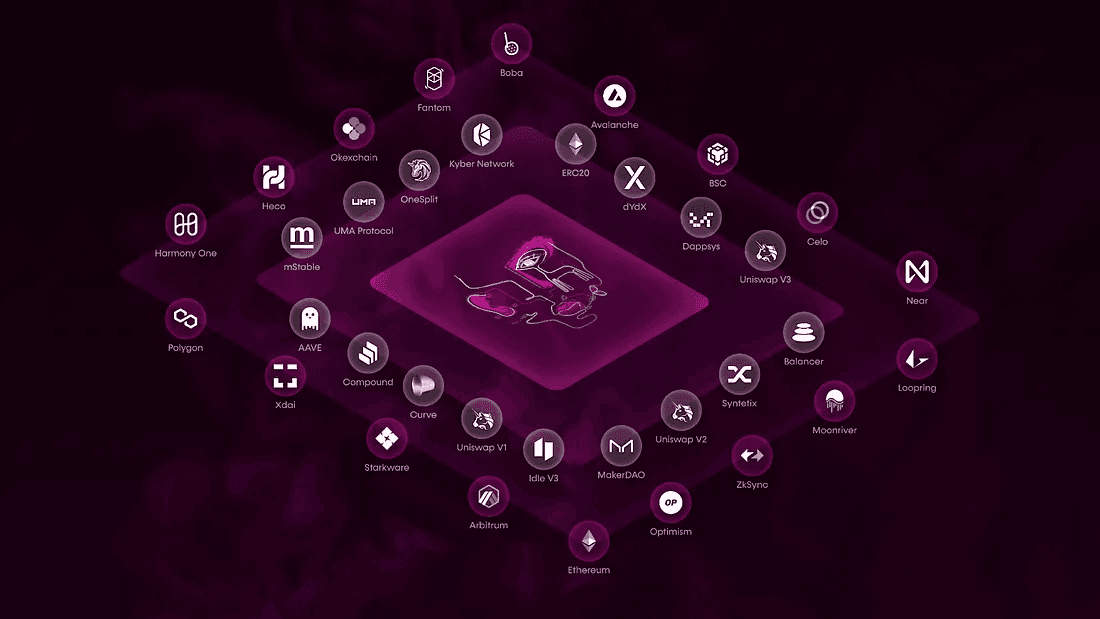

Composable Finance

Although Composable Finance is somewhat focused on the interoperability niche, presently connecting to more than 20 independent networks and various ecosystems (including NEAR, Solana, Neutron, Osmosis, Sei, Astar, Polkadot, Kusama, Ethereum, and Cosmos), the main reason for this connectivity is to position itself as an interoperable DeFi hub that is compatible with a large number of blockchains.

Because Composable originally launched in 2021 as a parachain on the Polkadot network, its first blockchain operates as a separate platform on Polkadot, while it also recently launched an Ethereum IBC-Cosmos Chain. The network is also responsible for the development of Picasso, the first IBC-enabled Cosmos blockchain that will soon connect to Solana.

While many blockchains make use of bridges to realize interoperability for cross-platform data and asset transfer, cross-chain DeFi on Composable is realized via the Inter-Blockchain Communication (IBC) Protocol, privacy-preserving zero-knowledge cryptography, and other means. This model is arguably much more sustainable long-term, especially in terms of security, as is evidenced by the susceptibility of bridges to attacks over the last number of years that have resulted in losses in the billions.

Berachain’s DeFi suite (consisting of a DEX, perpetuals trading platform, lending and borrowing protocol, stablecoin exchange protocol, and a BGT governance staking and voting dashboard) presents a unique offering compared to Composable’s. The Composable Virtual Machine (CVM) is unique compared to Berachain’s Polaris Virtual Machine, but is arguably not as advanced.

Composable’s DeFi services include multi-network liquid staking, token swapping between protocols, and regular staking across a vast number of chains through its Trustless and Picasso-based platforms.

The conclusion when comparing Berachain and Composable, is that Berachain’s Proof of Liquidity (PoL) consensus mechanism and Berachain’s Polaris EVM is more advanced in terms of driving capital efficiency and EVM smart contract development on the platform. On the other hand, Berachain and Composable should be considered equal (though quite different) as it relates to cross-chain interoperability.

The DeFi service offerings of both platforms are also comparatively different, with both presenting promising DeFi primitives in their own right.

Injective Protocol

Though there are many differences between Injective and Berachain, Injective represents a similar ecosystem model to the Berachain project, albeit in a less decentralized manner. For those unfamiliar, Injective is mainly a DeFi trading and investment platform that allows users to make use of its proprietary orderbook-focused DEX, Helix.

Injective also offers perpetual futures trading services and the Injective Bridge as a means to conduct cross-chain asset transfers between various networks including Ethereum and Cosmos. The protocol has also recently popularized its own distinct DeFi ecosystem consisting of various dApps including Mito (automated trading, launchpads and yield generation), Black Panther (asset management), and Talis (an NFT marketplace). Injective’s platform also allows users to deploy a host of additional protocols and dApp types, including those focused on options, insurance, and savings, among others.

Although the Injective blockchain makes use of Ethereum compatibility, Berachain’s Polaris EVM platform is arguably more advanced than Injective’s EVM implementation because it allows for connectivity and interoperability with a larger number of dApps and protocols on Celestia, Cosmos, and Ethereum. That said, Injective offers connectivity to Solana and Avalanche via Wormhole, which Berachain does not.

As a counter argument, Injective recently completed the development of its new Injective Solana Virtual Machine (inSVM) in partnership with Eclipse and its Injective Ethereum Virtual Machine (inEVM) in partnership with Caldera, both of which are Celestia projects.

On a different note, Berachain’s PoL consensus is arguably ahead of Injective as far as decentralization and economics are concerned because of its innovative capital flywheel effect tailored specifically for validator, governance, and community member incentivization.

While Injective’s Cosmos-SDK PoS consensus is very fast with transactions being finalized nearly instantly between wallets, exchanges, and the like; because of its insane demand of late, their main DEX, Helix, has arguably become quite slow at times and has even become unusable for trade execution during times of increased network bloating.

It will be interesting to see how Injective addresses this continued demand moving forward; and alternatively, to see how Berachain deals with similar challenges moving forward.

If you want to learn more about Injective, check out our blog posts:

Berachain Compliance and Regulatory Considerations

Berachain is an extremely innovative protocol but could potentially pose some regulatory concerns in various jurisdictions, mainly because the chain is largely focused on DeFi and offers a DEX, liquidity pools, perpetual swaps futures trading, and a money market for borrowing and lending (BEND).

As must always be considered, projects building in the DeFi niche could potentially be susceptible to issues related to Know Your Customer (KYC), user tax avoidance, and other issues.

The fact that Berachain’s governance structure and economic mechanisms operate in a decentralized manner could be a challenge for the founders of the project as it relates to regulation.

This design could represent a slippery slope because international governments may not like the fact that it is difficult to keep track of peer-to-peer (P2P) trading and value transfer between users. With almost 200 nations globally and a never-ending set of laws to adhere to at an international, national, regional, and municipal level, juggling online DeFi legality becomes extremely complex.

The balancing act to find equitability between complete anonymity and absolute transparency on blockchains is surely challenging. However, if Berachain works with regulators to define a systematic approach to these issues, the project has the potential to improve accessibility to tokenized assets for many.

Analyzing Berachain’s Long-Term Potential

Though the project’s founders created a meme out of the Bong Bears brand initially and it may not be taken seriously by many, Berachain represents a highly advanced, exceptionally performant, and cutting-edge blockchain solution in many respects.

This is accomplished through its major advancements in Proof of Liquidity consensus, BeaconKit EVM-equivalent connectivity layer, strong governance and tokenomics provisioned via is tri-token flywheel liquidity distribution model and validator and user incentive structure that helps ensure overall functionality and liquidy accrual within the greater Berachain ecosystem.

Although the project is new and relatively unknown in industry terms, Berachain represents an innovative take on the creation of decentralized networks, especially in terms of a DeFi-focused initiative that is focused on creating a host of services that offers democratized access to an alternative financial platform without the manipulative effects of overarching centralized intermediaries.

💬

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.