Key Takeaways

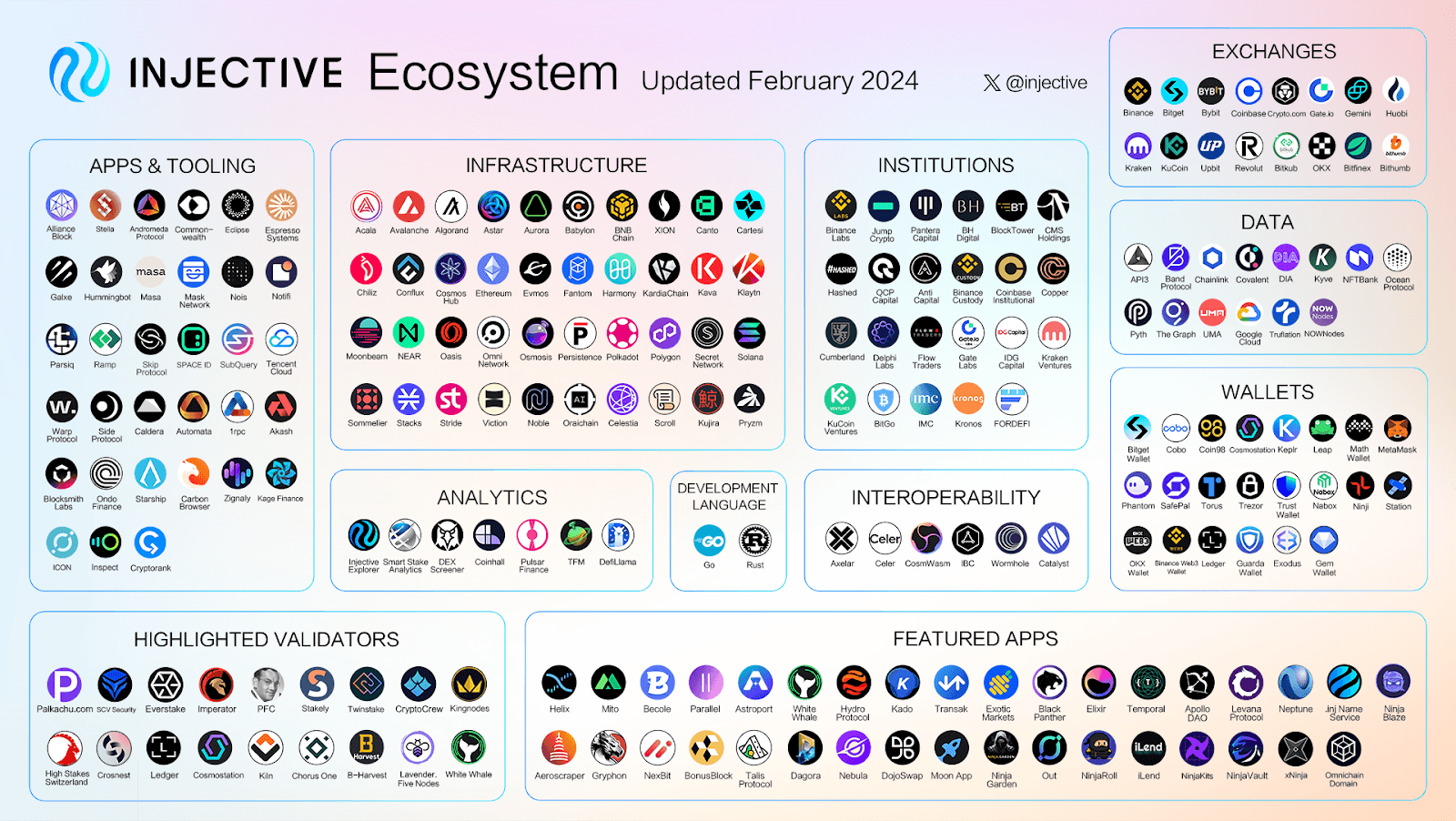

- Cross-Chain DeFi: Injective supports decentralized trading, derivatives, and asset swaps across multiple chains, including Ethereum and Cosmos.

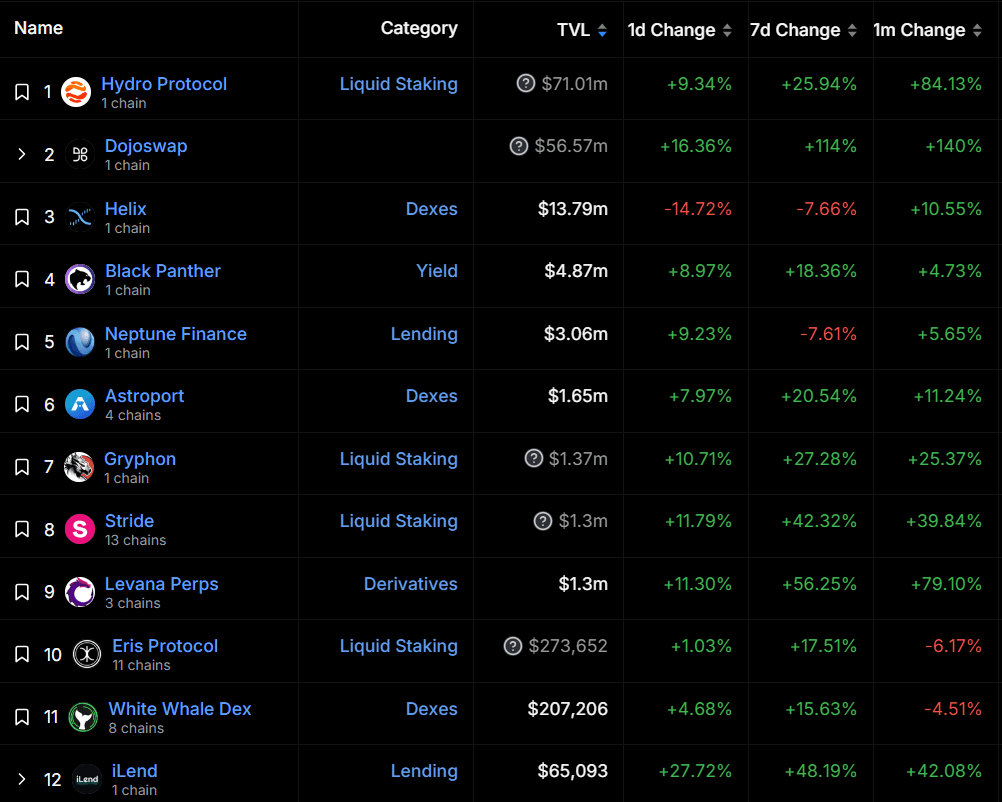

- Surging TVL: Total Value Locked (TVL) in Injective's ecosystem has grown exponentially, reflecting increased DeFi activity.

- Major dApps: Projects like Helix (DEX), Dojoswap (AMM), and Hydro Protocol (liquid staking) drive ecosystem growth.

- Low-Cost Transactions: Injective offers near-zero gas fees, boosting accessibility for users.

- Developer-Friendly: Supports both EVM and non-EVM chains, offering flexibility for dApp development.

Introduction

Imagine a financial playground that's open to everyone, with a diverse range of equipment, and no gatekeepers in sight. This playground is the Injective ecosystem, a game-changing force in decentralized finance (DeFi) designed specifically for a variety of derivatives use cases. Unlike traditional markets with their limited options and strict rules, Injective optimized for building major Web3 financial applications.

In our previous articles, we have explored Injective and its technical part. Today, we are going to take a closer look at the ecosystem surrounding Injective and the projects that run on it.

Brief overview of Injective

Injective prioritizes a permissionless, trustless, and censorship-resistant environment. This fosters a paradigm shift compared to traditional financial systems, allowing users to explore advanced trading strategies without relying on centralized entities or facing potential biases and limitations.

Injective Chain, the native high-throughput blockchain powering the ecosystem, boasts superior scalability and significantly lower transaction fees compared to traditional DeFi protocols. This translates into a more cost-effective and user-friendly platform, facilitating faster and smoother transactions, ultimately increasing accessibility for a broader audience.

The INJ token serves as the cornerstone of the Injective ecosystem, empowering its holders to actively participate in shaping its future through a decentralized governance structure. This fosters a sense of community ownership and shared responsibility for the ecosystem's growth and development, ensuring it remains community-driven and adaptable to the ever-evolving needs of the DeFi landscape.

But the true game-changer lies in Injective's unwavering commitment to interoperability and powerful plug-and-play modules for developers to create unrivaled dApps.

Major DeFi services often operate in isolated silos, hindering the free flow of liquidity and limiting investment opportunities. Operating as a Layer1 DeFi chain and ecosystem developed on the Cosmos SDK with support for EVM and non EVM networks, Injective shatters these limitations, fostering greater liquidity and accessibility.

Imagine exploring a vast universe of financial instruments without being restricted by individual blockchain boundaries – this is the power of Injective's interoperable ecosystem.

Injective Ecosystem

As the crypto market embarks on a bullish run, Injective is experiencing a surge in activity, reflected in its record-breaking Total Value Locked (TVL) exceeding $73 million as of early March due to DefiLlama. This meteoric rise stands in stark contrast to November's figures, where Injective's TVL sat at a modest $15 million.

This phenomenal growth signifies a thriving ecosystem blossoming within Injective. Hydro Protocol, Dojoswap, and Helix are leading the charge, wielding impressive TVLs of $63 million, $50 million, and $14.93 million respectively.

Hydro Protocol, a liquid staking platform mirroring the DeFi titan Lido DAO, emerges as a prominent player. Their website boasts a colossal TVL of $126.11 million, with $62.96 million strategically allocated to liquid staking and an additional $60.46 million deployed in farming activities. Furthermore, their auto-compound platform efficiently manages $2.18 million in assets.

Dojoswap, revs up with a TVL exceeding $56 million ($66.6m on its site). Inspired by Uniswap's AMM model, it fosters seamless token swaps and vibrant liquidity pools. Dojoswap doubles as a launchpad for DeFi projects, empowering users (via INJ tokens) to participate in IDOs. As Injective evolves, Dojoswap remains a core component, solidifying Injective's position as a DeFi leader.

Meanwhile, Helix, a decentralized exchange (DEX) residing within the Injective ecosystem, has carved its own path to success. Data from CoinMarketCap (CMC) reveals that Helix has captured a significant portion of the DEX market volume, surpassing a staggering $89 million in the past 24 hours. This impressive achievement put Helix practically in the top 20 largest DEX platforms.

This surge underscores Injective's potential as a major player in DeFi landscape. As the crypto market ascends further, Injective appears well-equipped to capitalize on this momentum and solidify its position as a DeFi leader.

Let's delve further and explore projects spanning various categories.

DEXs

The Injective ecosystem serves as a fertile environment for innovative Decentralized Exchange (DEX) protocols. These advanced platforms move beyond the constraints of conventional exchanges, providing users with enhanced control, security, and access to a broader spectrum of financial instruments.

Helix

Undoubtedly the most well-known decentralized application (dApp) on Injective, Helix reigns supreme as a decentralized exchange (DEX) facilitating cross-chain asset spot and derivatives trading. Since its launch in November 2021, Helix has achieved $22.6 billion in cumulative derivatives volume.

The project is constantly innovating, recently announcing a Pre-Launch Futures Trading Competition featuring JUP and ZRO tokens. This competition boasts a generous total prize pool of up to $30,000 in INJ tokens, incentivizing users to participate and explore Helix's advanced derivatives trading capabilities.

Levana

This innovative platform caters to experienced traders seeking high leverage. Levana facilitates fully collateralized perpetual swaps trading with up to 30x leverage and low fees. This targets a specific niche of users who require amplified returns but are comfortable with the associated risks.

Becole

Focused on accessibility and user empowerment, Becole offers a decentralized exchange where users can trade any token on the blockchain without the need for sign-ups or custodians. This fosters complete control and ownership of assets, appealing to users who prioritize self-custody and a permissionless trading experience.

Parallel

Parallel (DEX) shatters blockchain barriers, empowering users to trade seamlessly across Ethereum and Cosmos networks. It eliminates gas fees, a major pain point in traditional DeFi, and boasts exceptionally low taker fees. Additionally, its highly competitive maker fee rebates incentivize market liquidity, further enhancing the trading experience for all participants.

Parallel Exchange unlocks a universe of unique markets previously inaccessible, fostering a truly interoperable DeFi experience.

Swaps

The heart of any thriving Decentralized Finance (DeFi) ecosystem lies in its ability to facilitate efficient and secure token swaps. Injective stands tall in this regard, boasting a robust suite of Swap protocols designed to cater to the diverse needs of its users.

DojoSwap

DojoSwap takes center stage as the pioneering AMM protocol built directly on Injective. Drawing inspiration from the widely adopted Uniswap model, DojoSwap offers seamless on-chain asset exchange within the Injective ecosystem, empowering users to trade various cryptocurrencies in a familiar and user-friendly environment.

DojoSwap doesn't stop at facilitating asset swaps. In collaboration with Injective, they spearheaded the introduction of the CW404 standard. This innovative standard bridges the gap between Injective and Ethereum by bringing the ERC-404 functionality to Injective.

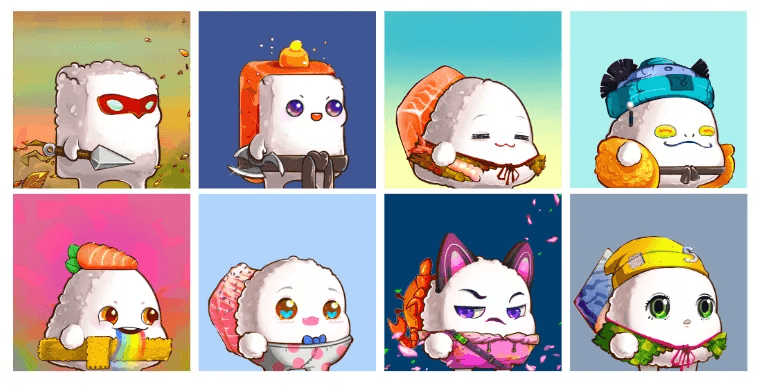

Sushi Fighters NFT (also $SUSHI) is a first-of-its-kind NFT collection (CW404 standard) launched by the Dojoswap team on the Injective chain.

The CW-404 standard, similar to Ethereum's ERC-404, combines the features of CW-20 and CW-721 standards, serving the purposes of both token issuance and Non-Fungible Tokens (NFTs).

The reason for the launch is simple: when you make a transaction on Ethereum with the ERC404 token, the gas cost can be as high as $60 USD. However, with the latest update of the Injective gas compression system, the cost of a transaction on the Injective Chain is only $0.06 USD, which is 1000 times cheaper.

Astroport

Astroport is geared towards experienced DeFi users by offering a comprehensive suite of AMM functionalities beyond basic asset swaps. Users can leverage advanced features to tailor their strategies, optimizing liquidity provision and earning potential. This empowers them to explore a wider range of DeFi opportunities within Injective.

Astroport isn't a newcomer to the DeFi stage. Its integration into Injective's mainnet in March 2023 was a pivotal moment. This move broadened Injective's DeFi offerings, drawing in a more diverse user base looking for enhanced AMM functionalities and a recognizable interface.

White Whale

White Whale is an interchain liquidity protocol enabling users to smoothly transfer and utilize liquidity across the Cosmos ecosystem, including Injective.

Users are able to swap tokens in and out of pools to generate yield by leveraging price disparities through arbitrage. Experienced users can engage with vaults and flash loans by using open-sourced arbitrage trading bots with no minimum capital requirements.

This enhances the interconnectedness of the DeFi landscape, boosting overall capital efficiency and market depth within Injective.

With the emergence of new arbitrage opportunities, dApps operating on Injective can create a more capital-efficient environment, which is enhanced by Injective's unmatched institutional support.

Yield

While some projects focus on facilitating seamless asset swaps and market making, other captivating DeFi services take center stage by empowering users to unlock the true earning potential of their digital assets.

Mito

Mito empowers users with automated trading strategies, a community-driven launchpad for vetted projects, and real yield generation. This suite of tools simplifies DeFi, allowing users to earn passive income and access promising investment opportunities.

Over 150,000 users fueled the Mito testnet, paving the way for a successful mainnet launch featuring a community-backed project and diverse earning opportunities.

Elixir Finance

Elixir Finance revolutionizes market making by introducing innovative financial primitives. Elixir adopts a trustless, decentralized model for market making, enabling broad participation in providing liquidity for exchange pairs across both centralized and decentralized platforms. Users can effortlessly supply liquidity to pairs on Injective and earn rewards through Injective's new Open Liquidity Program (OLP).

Traditionally, initiatives like this are tailored exclusively for elites and high-net-worth institutions. OLP breaks the mold as the first program of its kind, opening up global access for genuine on-chain DeFi and trading. Any participant within DEXs built on Injective can now earn rewards for providing orderbook liquidity with minimal barriers to entry.

Black Panther

Black Panther is the first native asset management protocol built on Injective. Its primary objective is to equip users with the tools necessary to achieve superior returns.

Participants can explore a diverse array of advanced trading strategies on the platform, encompassing grid trading, trend following, and auto-compounding vaults. This consolidation of sophisticated tools in a single platform democratizes access, enabling the Injective community to harness DeFi strategies that were once reserved for institutional use.

Temporal

Temporal revolutionizes the liquidity protocol landscape, presenting a pioneering system that establishes market-determined, continuous yield, and forward curves for digital assets.

Their fixed-rate lending/borrowing protocol specifically targets shorter timeframes, significantly improving capital efficiency within the Injective ecosystem. This innovative approach fosters a more secure and efficient "credit creation cycle" while also opening the door for the incorporation of market-determined yield curves into the broader DeFi landscape.

Pryzm

Pryzm transcends the limitations of traditional yield aggregators, establishing itself as a Layer 1 Yield Hub. They spearhead the development of innovative yield strategies and unlock a revolutionary paradigm - the separation of future yield from the underlying assets themselves.

This groundbreaking approach grants users unparalleled flexibility in tailoring their investment strategies. Imagine being able to access and leverage future yield streams independently of the underlying assets, opening doors to entirely new financial possibilities within the DeFi space.

Sommelier Finance

Sommelier Finance lives up to its sophisticated name, acting as a discerning expert in the realm of DeFi yields. Their meticulously designed automated vaults scour the market landscape, identifying the best-in-class yield opportunities while simultaneously mitigating risk.

This user-centric approach empowers investors to confidently participate in DeFi by offering curated investment opportunities that deliver attractive returns without the burden of constant monitoring and portfolio management.

In addition, Sommelier is a noncustodial protocol and entirely governed in a decentralized manner by its users.

Exotic Markets

Exotic Markets carves a niche within the Injective ecosystem by introducing one of the first options protocols on the platform. This groundbreaking development unlocks a dynamic marketplace for exotic financial products. These instruments empower users with the ability to customize risk-reward profiles through the parametrization of risk-to-maturity features.

Imagine being able to meticulously tailor complex financial instruments by adjusting risk tolerance and investment horizons. Exotic Markets equips users with this level of precision, fostering a vibrant environment for sophisticated options trading within the Injective ecosystem.

Lending

The Injective ecosystem pulsates with a diverse range of lending protocols, each offering unique approaches to unlocking liquidity and facilitating efficient capital utilization.

Neptune

Neptune breaks the mold of traditional lending platforms by adopting a self-serve, digital credit facility model. This user-centric approach empowers borrowers and lenders to interact directly, fostering a more streamlined financial experience.

Through a sophisticated interest rate model that reacts to market conditions in real-time, the system encourages high-interest lending opportunities, ensuring lenders receive competitive returns. Through smart contract automation, borrowers are matched with lenders at the most advantageous rates, optimizing capital allocation within the ecosystem.

Additionally, Neptune has implemented a Leaderboard Scoring System. This gamified approach encourages user participation by rewarding individuals based on their lending and borrowing activity on the platform.

Aeroscraper

Aeroscraper disrupts the lending landscape by pioneering a revolutionary concept - 0% interest-free loans. Users can leverage their existing holdings on the platform as collateral to secure these loans, essentially borrowing against their assets without incurring any interest charges. This innovative approach unlocks new financial possibilities, empowering users to access additional liquidity without straining their budgets.

iLend

iLend serves as the cornerstone of the Injective ecosystem's lending infrastructure. Built on the Injective Protocol, it leverages native smart contracts to facilitate seamless lending and borrowing activities. This decentralized approach fosters transparency and efficiency, ensuring users maintain complete control over their assets throughout the lending process.

Targeted to user security, iLend focuses on user safety through a comprehensive collateral management system that safeguards all deposited assets, offering users peace of mind in their activities on the platform.

By leveraging the capabilities of the Injective Protocol, iLend enhances its offerings providing fast, secure, and EVM-compatible DeFi transactions across multiple blockchain ecosystems.

Liquid Staked Derivatives

LSDfi (Liquid Staked Derivatives Finance) represents a revolutionary new frontier, empowering users to explore the vast potential of liquid staked derivatives and unlock a new era of financial flexibility within the DeFi space.

Hydro Protocol

As the pioneering native Liquid Staking Derivatives (LSD) protocol built directly on Injective, Hydro Protocol fosters a tightly integrated LSD experience, eliminating the friction often associated with cross-chain interactions.

But Hydro's true innovation lies in its ability to transcend the limitations of traditional LSDs. By incorporating Real World Assets (RWAs) into its product suite, Hydro unlocks a new frontier in DeFi. Users can now strategically combine the flexibility and high yields of staked crypto assets with the stability and diversification benefits of RWAs like commodities or equities.

Imagine seamlessly integrating your staked crypto assets with exposure to real-world commodities or equities. Additionally, Hydro fosters a dynamic yield farming environment and offers an auto-compounding feature for passive income generation.

Gryphon

Gryphon swoops into the Injective ecosystem with a mission: supercharge the power of Liquid Staked Derivatives (LSDs). It achieves this by introducing a groundbreaking concept – the seamless integration of LSDs with a stablecoin (CDP) component. Imagine a leading DeFi lending protocol and a popular stablecoin working in perfect harmony – that's the essence of Gryphon.

This innovative approach empowers users to unlock liquidity that would otherwise be trapped within their staked assets. Traditionally, staking involves locking up your crypto for a period to earn rewards. However, Gryphon allows users to earn a fixed 5% yield by staking nUSD, with the added advantage of pairing USDT/USDC with nUSD to earn trading fees and additional Gryphon rewards. Essentially, users can access additional liquidity without sacrificing their staking rewards.

The implications are far-reaching. Imagine earning staking rewards while simultaneously using assets to invest in other opportunities within the DeFi landscape. This opens doors for sophisticated investment strategies and the potential to amplify returns.

Ninja Garden

Ninja Garden, a project that expands the utility of Liquid Staked Derivatives (LSDs) by introducing a social and educational dimension. Beyond offering a platform for staking assets, Ninja Garden cultivates a dynamic SocialFi environment where users can connect, share knowledge, and collaborate.

This is a platform where you can discuss optimal staking strategies with fellow DeFi enthusiasts, discover new investment opportunities through community insights, or participate in friendly competitions to gamify the staking experience. Ninja Garden fosters this kind of social interaction, creating a more engaging and approachable environment for both seasoned DeFi veterans and newcomers alike.

The project is currently on testnet.

Persistence

Leveraging its established expertise in staking solutions across the Cosmos network, Persistence One transcends the role of a mere service provider. By spearheading LSD adoption, crafting innovative LSTfi (Liquid Staking Tokenized Finance) yield opportunities, and introducing the concept of Restaking, Persistence One empowers users to unlock the full potential of their staked assets.

By automatically compounding staking rewards, users benefit from the power of compound interest in a seamless and automated manner. This simplifies the staking process and broadens the potential user base within the Injective LSDfi landscape.

Apollo

Apollo shines as a beacon for users seeking to maximize returns on their Liquid Staked Derivatives (LSDs) across the DeFi landscape. This user-friendly platform transcends networks boundaries, offering attractive yields on LSDs from various ecosystems.

Apollo Vaults tokenize yield opportunities, enabling supercharged yield on LSDs. In collaboration with Neutron, Apollo has launched the own locked wstETH/ETH Vault, offering one of the highest APRs for any liquid staking ETH opportunity.

By aggregating LSD options from various corners of the DeFi universe, Apollo empowers users to make informed investment decisions and optimize their DeFi portfolios for maximum yield generation.

Trading

Trading projects represent a revolutionary force in the financial landscape. By leveraging blockchain technology, they are redefining traditional financial structures and democratizing access to markets.

Moon App

Moon App is a comprehensive ecosystem designed to empower users with a variety of tools. Automated trading features streamline your strategy execution, while liquidity pool sniping capabilities allow you to capitalize on fleeting market opportunities. Precise control over your investments is ensured through limit order functionality.

Beyond trading, Moon App serves as a launchpad for new and innovative projects on the Injective blockchain. Investors and crypto enthusiasts can discover promising new projects within the Injective ecosystem. The platform allows for efficient project discovery, while seamless integration with Injective's trading infrastructure facilitates easy participation in token offerings and secondary market trading.

Hummingbot

Hummingbot isn't just another crypto trading platform, it empowers you to become your own algorithmic trader. This open-source software acts as your personal trading bot factory, equipping you with the tools to design, test, and deploy automated trading strategies.

Imagine crafting sophisticated bots that execute trades based on your predefined parameters. Hummingbot's library of templates and script examples serves as a springboard for your creativity, allowing you to build bots that align with your specific trading goals and risk tolerance.

Before unleashing your bots into the real world, Hummingbot offers a robust backtesting feature. This allows you to simulate your strategies against historical data, providing valuable insights into their potential performance and helping you refine your approach before risking real capital.

Kage Finance

Leveraging Injective's robust infrastructure, Kage Finance offers a seamless platform for buying, selling, and managing your Injective-based crypto assets. Whether you're a seasoned trader or just starting out, Kage's intuitive interface and diverse features cater to various user levels.

For those seeking an extra layer of convenience, Kage boasts a Telegram Trading Bot, one-stop shop for trading on Injective. This bot ensures you never miss out on exciting new token launches, keeping you at the forefront of the ever-evolving DeFi landscape.

Traders who crave a powerful and accessible trading experience, Kage Terminal is on the horizon. This platform promises a seamless fusion of professional features like built-in security scanners, an alert system, and secure vaults – all presented in a user-friendly interface. For experienced users with a high-risk tolerance, Kage Finance might offer leveraged trading, allowing for potentially amplified returns.

Zigdao

Zigdao (formerly Zignaly) is a social trading foundation, connecting users with experienced traders and facilitating copy-trading strategies. Investors gain access to valuable social features, a diverse range of Decentralized Finance (DeFi) services, and the potential to discover promising new projects launching on the Injective blockchain.

Additionally, Zigdao integrates cutting-edge Artificial Intelligence (AI) technology to analyze market trends and potentially optimize investment returns. This empowers users to make more informed decisions by leveraging AI-driven insights.

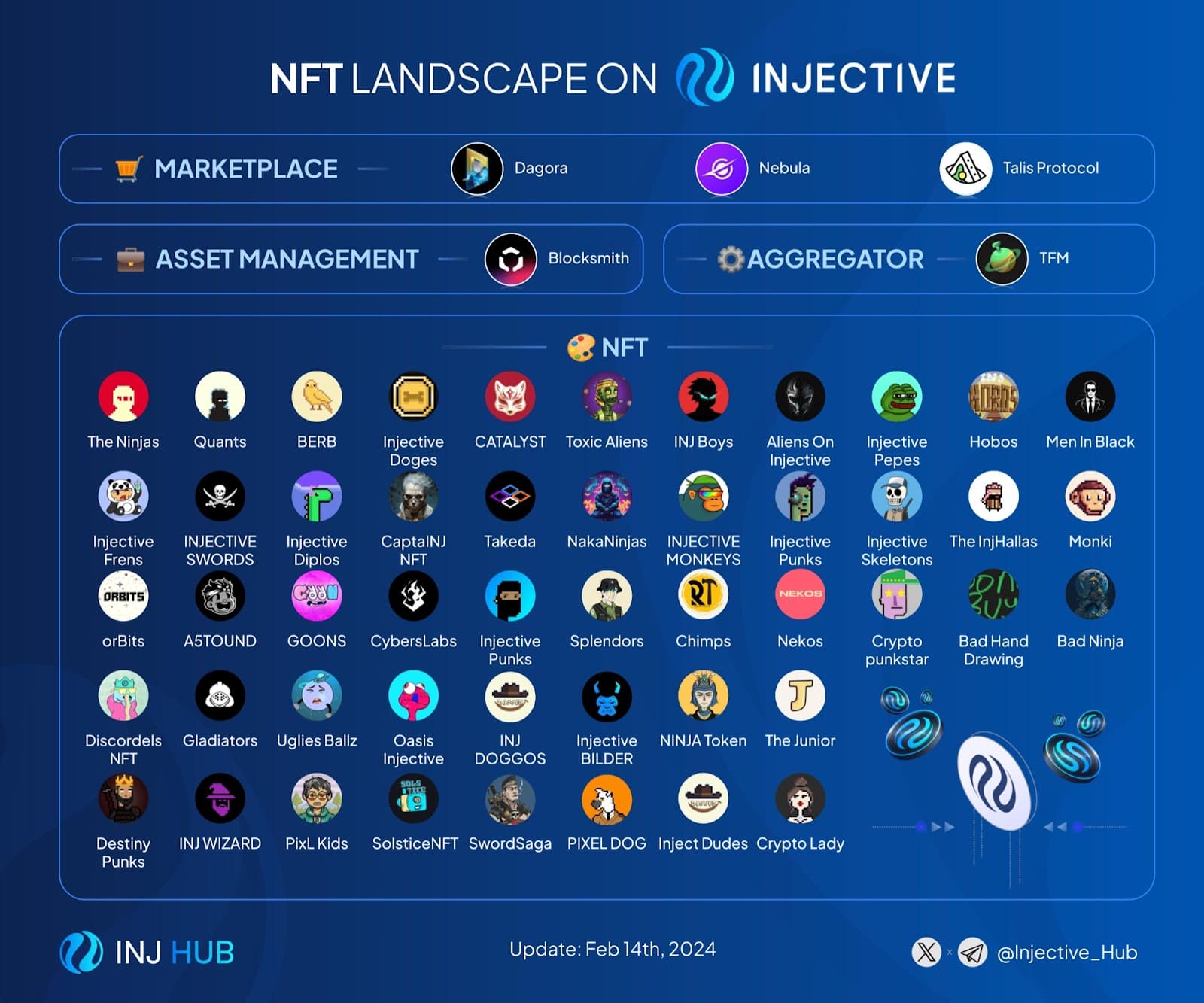

NFT Finance

By nurturing a diverse range of NFTFi (NFT Finance) projects, Injective is rapidly transforming into a comprehensive hub for NFT enthusiasts, creators, and investors.

Talis Protocol

Talis Protocol holds the distinction of being the first native NFT marketplace built directly on Injective. This groundbreaking project serves as a gateway, ushering in a new era of NFT exploration and utility within the Injective ecosystem.

Users can seamlessly buy, sell, and trade unique digital assets – collectible trading cards, avatars for the metaverse, or even fractionalized ownership of digital artwork. Its presence signifies Injective's commitment to fostering a vibrant NFT community and empowering users to interact with this burgeoning asset class in new and exciting ways.

Dagora

Dagora transcends the boundaries of a traditional marketplace by incorporating a launchpad functionality. This empowers innovative NFT projects to secure funding and gain exposure within the Injective community.

Now aspiring creators can showcase their groundbreaking NFT projects, be it music albums tied to NFTs, digital real estate ownership, or memberships to exclusive online communities – and connect with a pool of potential investors and enthusiasts eager to support the next generation of digital collectibles.

With its dual functionality, Dagora fosters a dynamic and self-sustaining NFT ecosystem within Injective, providing a launchpad for NFT creators and a vibrant marketplace for NFT collectors.

InjLending

InjLending introduces a revolutionary concept – NFT lending. The recently launched platform allows users to leverage their existing NFT holdings as collateral to secure loans. This functionality unlocks new financial possibilities for NFT holders, allowing them to free up capital for other investments while still retaining ownership of their prized digital assets.

The project team is also preparing to launch Injstaking, multi-collection NFT staking platform, which allows projects to reward their holders.

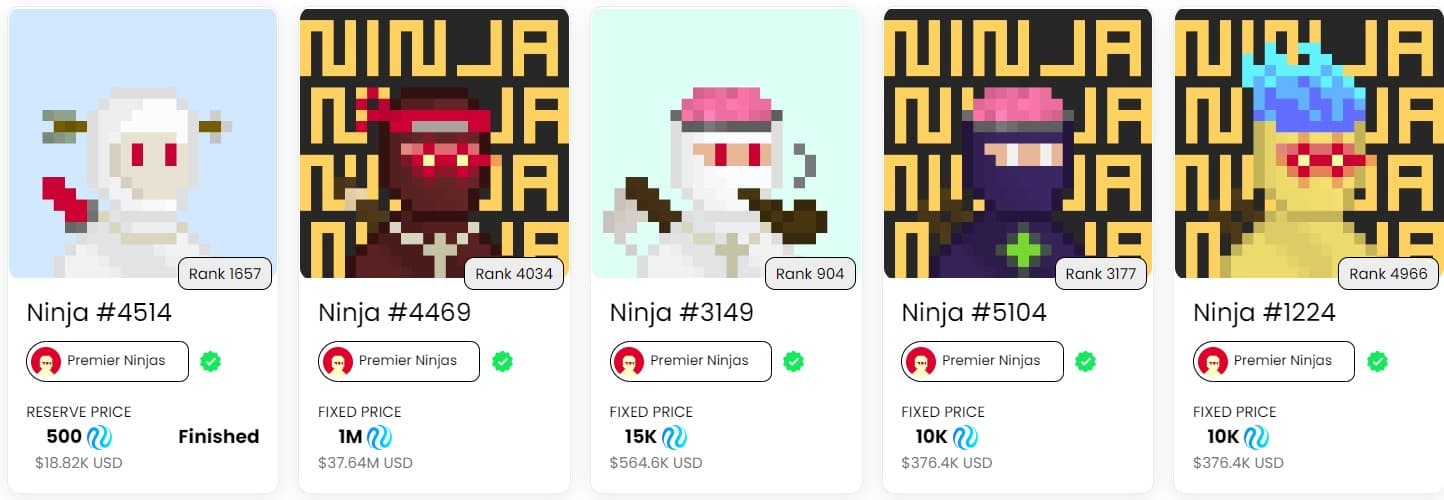

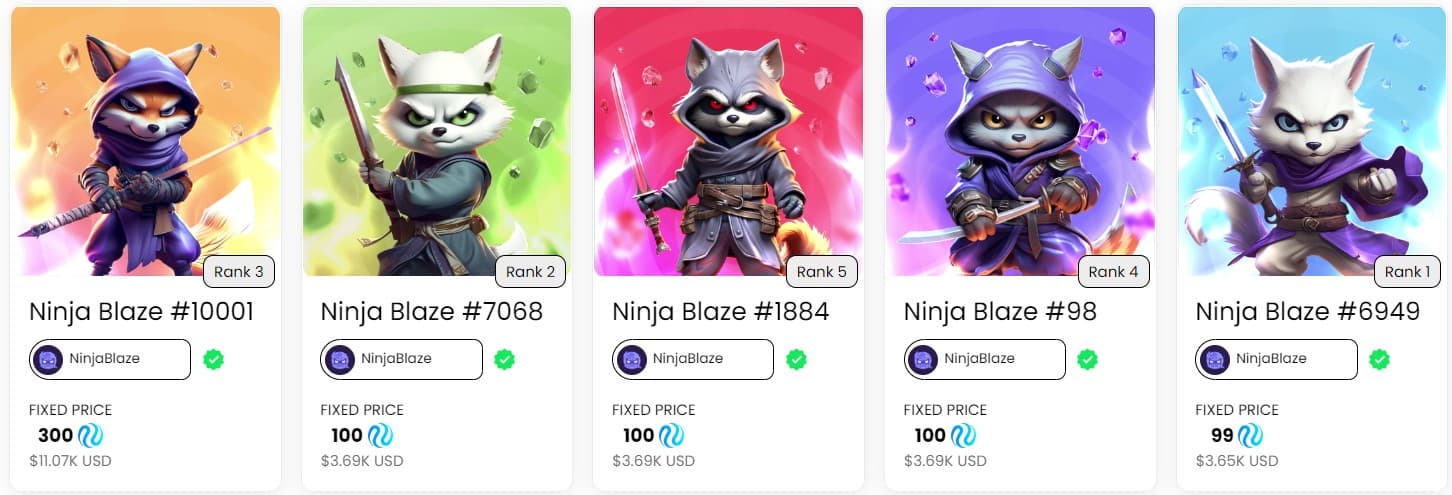

Trending NFT Collections

Offering cross-chain compatibility and decentralized ownership, Injective stands as a vibrant hub for both artists and collectors.

As the Injective NFT ecosystem continues to evolve, there's something for every investor. Let's explore a few intriguing projects.

The Ninjas: This collection of 5,553 colorful pixelated ninjas has become a mainstay within the Injective ecosystem. Each ninja boasts unique traits and characteristics, adding a layer of excitement to the collecting experience.

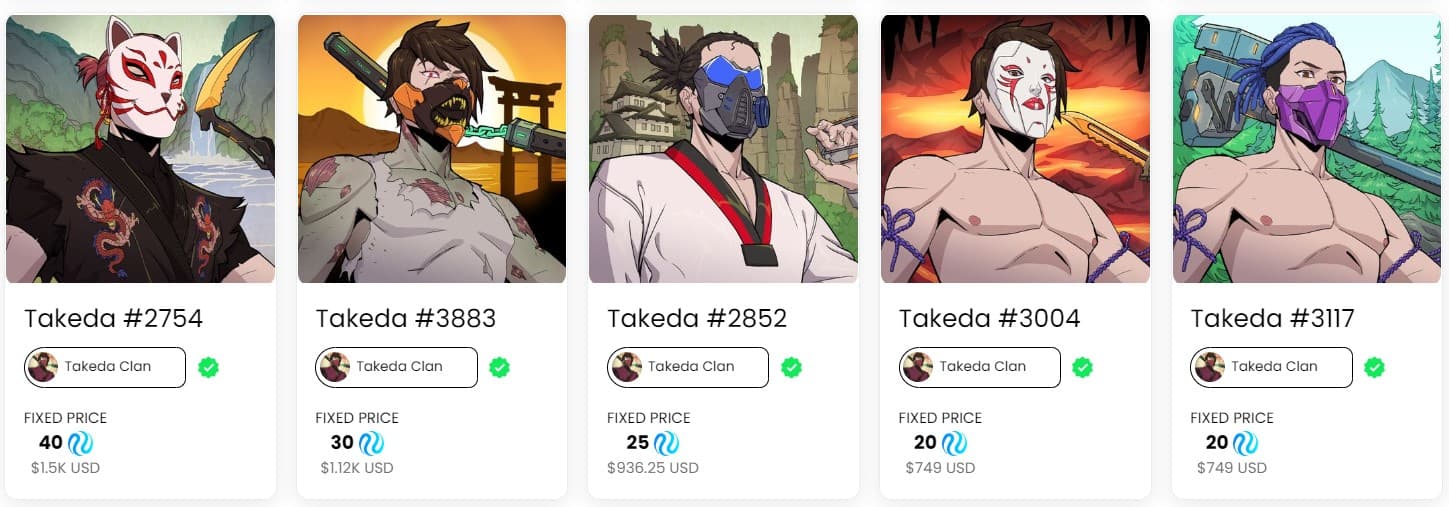

The Takeda NFT collection presents a unique opportunity to own a piece of Japanese history, connect with a passionate community, and potentially unlock exciting future benefits. Whether you're a history buff, an NFT aficionado, or simply captivated by the legacy of the Takeda clan, this collection offers a compelling entry point into a world of honor, valor, and digital innovation.

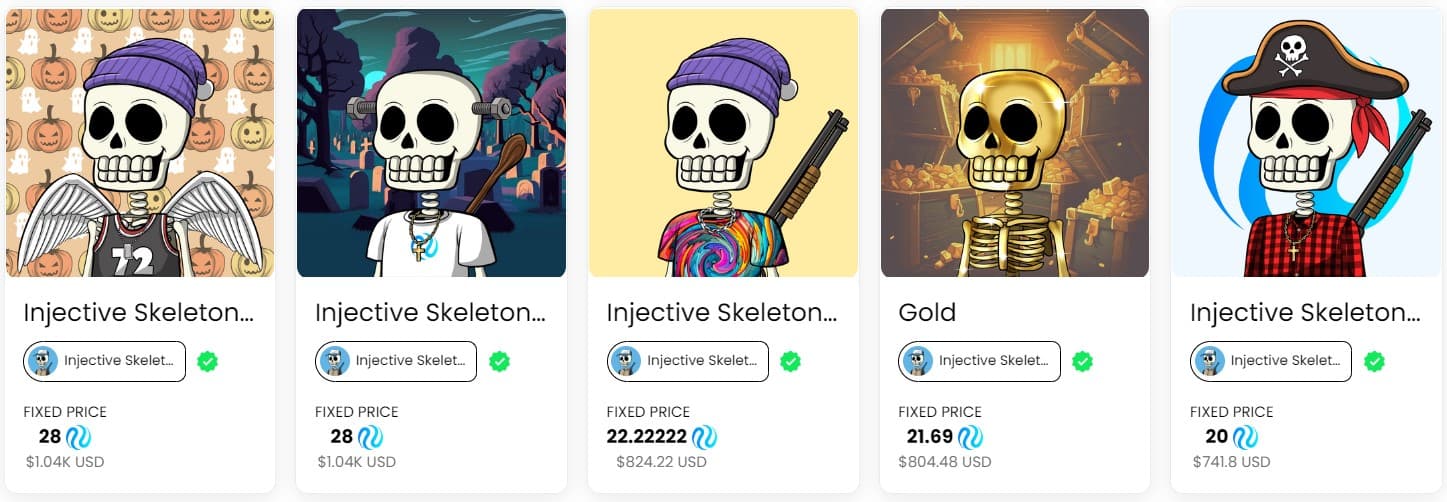

Injective Skeleton is PFP & Utility collection of 2555 spooky skellies. It’s not just about the NFTs themselves, it's about fostering a vibrant community. The team behind the project actively cultivates a space where NFT enthusiasts have fun, share opinions and earn money.

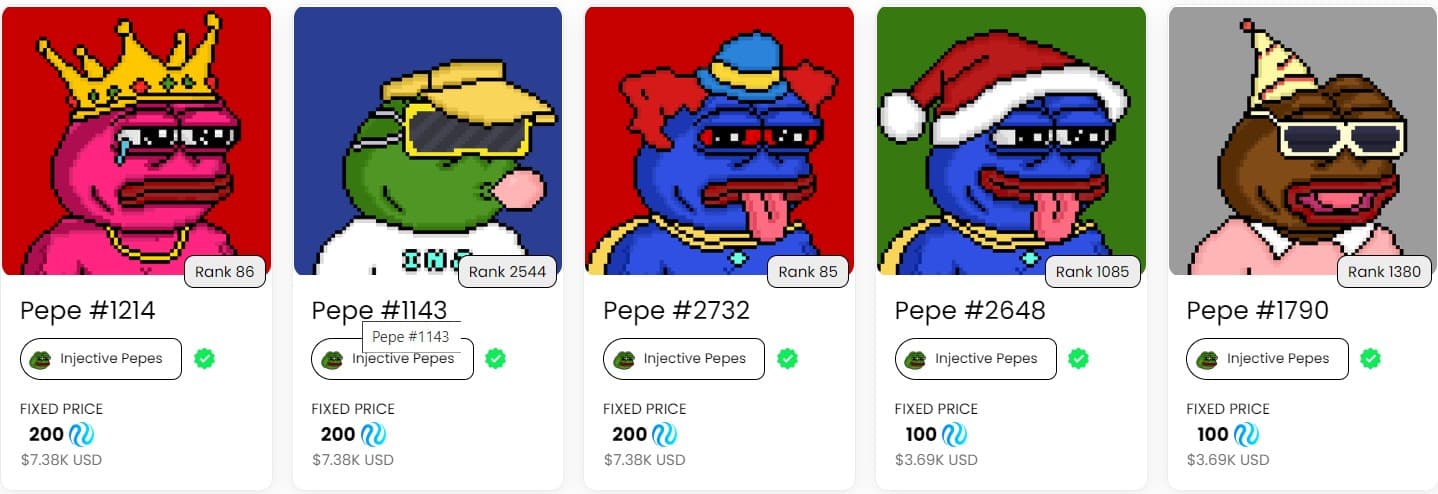

The Injective Pepes collection brings humor and community to DeFi with 3,333 unique meme-inspired NFTs. Owning a Pepe grants access to exclusive games, educational content, and potential future utility within the Injective ecosystem. It's a fun and informative way to join the Injective community.

Gaming

Injective is still young in the gaming space, but as the ecosystem grows we can expect to see a wider range of innovative gaming projects.

Ninja Blaze

Ninja Blaze bursts onto the scene as a play-to-earn gaming platform built on the Injective blockchain. This project merges the thrill of competitive gaming with the power of decentralized finance, offering players a unique and potentially rewarding experience. Whether depositing funds, participating in games, or determining winners, everything is recorded on the blockchain, fostering trust and confidence among players.

Over 25,000 players are already experiencing the thrill of Ninja Blaze. The platform boasts its own NFT collection, with 10,000 unique NFTs minted. Owning a Ninja Blaze NFT grants you exclusive benefits and positions you as an early adopter within the community.

Ninja Blaze - Blockchain gaming platform | Trailer

NinjaRoll

Built on the Injective blockchain, NinjaRoll prioritizes ease of access and fair, transparent gameplay, all without the hassle of user registration or deposits.

NinjaRoll boasts the decentralized Proof-of-Stake (PoS) random settlement network. This system utilizes a Verifiable Random Function (VRF) network to ensure provably fair outcomes in their games. While NinjaRoll currently thrives on Injective, the team has ambitious plans for the future. They envision deploying their VRF network on other Cosmos-based blockchains.

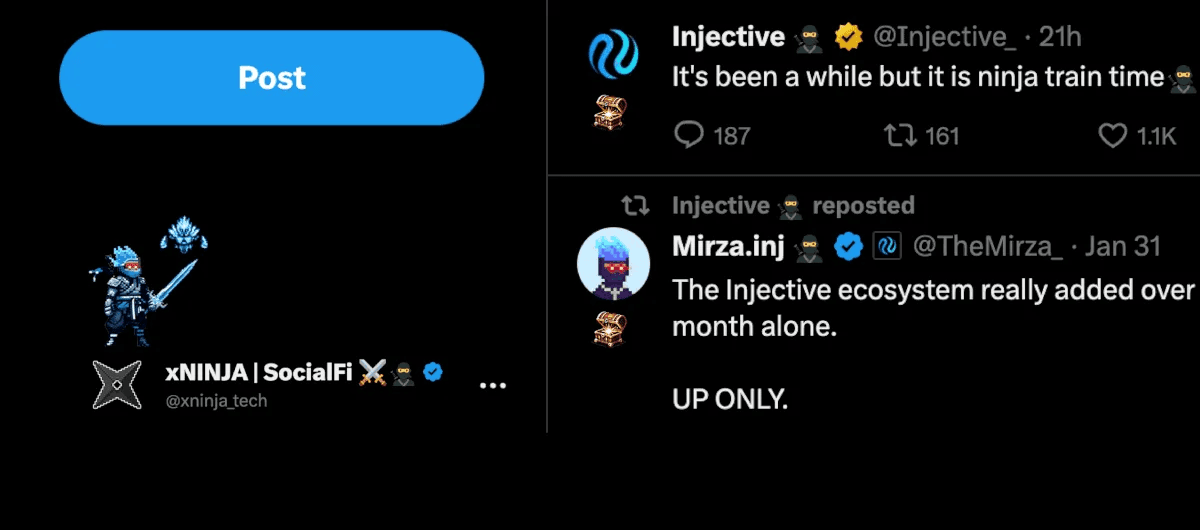

xNinja

xNinja is the first SocialFi 2.0 platform built on the Injective network, bringing an exciting level of gamification to the Twitter (𝕏) experience. xNinja transcends the limitations of conventional social media by offering a dynamic and interactive environment.

The platform introduces the concept of a trainable "Ninja" character, essentially a user avatar that can engage in strategic battles with other members of the ecosystem. Robust reward system, ensuring that user activity is valued and incentivized. Whether it's diligent character training, engaging discussions within the community, or participating in thrilling battles on the 𝕏 interface, user efforts contribute to overall platform growth and are duly recognized.

Launchpad

Starship Network rockets into the Injective ecosystem, not as a traditional launchpad, but as a community-driven fundraising platform for builders.

Projects can receive funding directly from the Injective community through token offerings and potentially Initial DEX Offerings (IDOs). This fosters greater ownership and control for both creators and investors. The platform caters to a variety of project types and funding needs, offering flexibility for creators to design campaigns that align with their specific goals.

But the story doesn't end there. Several projects within the Injective ecosystem, such as Mito, DojoSwap, and Moon App, have taken the initiative to launch their own Launchpad platforms, creating a dynamic network of fundraising opportunities.

Moon App Launchpad acts as a launchpad that, in collaboration with incubators, identifies high-potential projects for initial DEX offerings (IDOs) on Injective. Projects gain exposure to the dedicated Injective community, potentially attracting a loyal user base and boosting early adoption. Users are given the opportunity to participate in IDOs before projects get listed, potentially reaping significant rewards if the project thrives.

Mito Launchpad offers a broader perspective. It serves as a hub where projects can showcase themselves and users can participate in exciting new dApps. This platform fosters a user-friendly experience for both projects seeking funding and users eager to contribute. One of the unique features of Mito Launchpad is the subscription model. This model offers three distinct scenarios – successful subscription, unsuccessful subscription with full refunds, and oversubscription with proportional allocation. This incentivizes participation from users while also helping projects establish initial liquidity for their tokens.

DojoSwap Launchpad stands out for its innovative "Dynamic Overflow" model. This approach prioritizes user participation by allowing them to subscribe freely for their desired allocation. However, final allocations are determined by the user's contribution relative to the total pool size at the sale's close. This ensures that even if a project receives more interest than anticipated, users will still receive a portion of their desired allocation. Any leftover funds are claimable alongside their tokens, minimizing the risk of user disappointment. Furthermore, the "Dynamic Overflow" model incorporates an overflow cap. If committed funds exceed this cap, a new fundraising round automatically unlocks. This not only benefits projects by potentially increasing the total raise but also boosts overall liquidity for the new token.

Domain Name

Domain name services are a significant step towards a more user-friendly and accessible Web3 experience. By simplifying wallet address management, enhancing security, and laying the foundation for a unified Web3 identity, domains are empowering users to navigate the decentralized world with greater confidence and ease.

.inj Name Service

Built on the robust infrastructure of SPACE ID 3.0, .inj Name Service offers a decentralized solution for users within the Injective ecosystem. Imagine a system where you can ditch those long and complex wallet addresses in favor of a user-friendly and memorable .inj domain name.

This goes beyond mere convenience, it empowers you to build your own Web3 brand identity. Your custom .inj domain becomes your calling card within the Injective ecosystem, simplifying transactions and interactions. No more fumbling with lengthy wallet addresses, send and receive crypto, NFTs, and other digital assets with ease using your personalized .inj domain.

Omnichain Domain

Injective bridges the gap between blockchains with the launch of their Omnichain Domain name service, a collaborative effort with Bonfida. This innovative service allows users to seamlessly navigate and build applications (dApps) across both the Solana and Injective ecosystems using a single, memorable domain name.

Furthermore, Injective now empowers users to acquire .sol domains using INJ tokens, the native token of the Injective blockchain. This not only fosters interoperability between the two ecosystems but also expands the utility of INJ, potentially increasing its value and appeal to token holders.

Portfolio Management Tools

Injective's ecosystem isn't solely focused on trading individual assets, providing solutions to streamline the management of diverse DeFi portfolios.

NinjaKits

NinjaKits transcends basic portfolio tracking by providing insightful performance analytics, enabling you to strategically optimize your investment strategies. This data-driven approach equips you with the knowledge required to navigate the ever-evolving DeFi landscape with confidence.

Recognizing the burgeoning utility associated with NFTs, the platform allows you to explore and leverage the unique capabilities tied to your Injective NFTs. This could encompass exclusive access to gated content, participation in governance decisions of NFT-based projects, or even special discounts on other services within the ecosystem.

NFTBank

NFTBank prioritizes informed investment decisions by offering highly accurate NFT valuation tools. The platform goes beyond simple price charts by delving into the factors that truly influence NFT value. This could encompass an NFT's rarity, historical trading data, the reputation of the artist or project behind it, and even the overall sentiment within the NFT community.

Whether you're a seasoned NFT collector or just starting to explore this exciting space, NFTBank serves as a valuable portfolio assistant. By leveraging its cutting-edge valuation tools and user-friendly interface, you can navigate the NFT market with greater confidence, identify potentially undervalued gems, and build a robust and profitable NFT portfolio.

Pulsar Finance

Pulsar Finance steps onto the scene as an all-in-one portfolio management solution designed to streamline your web3 experience. The platform boasts cross-chain functionality, allowing you to seamlessly monitor your investments across a staggering 100+ different blockchains. This eliminates the need to juggle multiple platforms and provides a holistic view of your entire web3 portfolio, irrespective of the underlying blockchain technology.

Additionally, Pulsar provides access to developing network/blockchain protocols, emerging markets such as NFTS, lending & borrowing collation, and liquidity in various on-chain financial projects. Even identifying all the staking rewards that are available to be claimed as it goes through each validator and checks each delegation’s rewards.

Ninja Vault

Ninja Vault functions as a comprehensive hub, providing users with a view of their Injective DeFi holdings. Beyond portfolio tracking, the platform introduces the innovative concept of "smart vaults." These pre-configured investment strategies simplify DeFi participation and enable users to generate passive income with ease.

In addition, Ninja Vault streamlines the token swap process within the Injective ecosystem by integrating a powerful decentralized exchange aggregator.

Apps&Tools

This diversity of dapps allows users to interact with DeFi in a wide range of ways.

Nouri

Nouri takes the lead as the inaugural decentralized application (dApp) that seamlessly combines productivity and learning features. Providing essential tools to streamline your daily tasks and projects, it also presents captivating educational resources, enabling you to stay well-informed and ahead of the curve.

Participate in skill-building endeavors while in Focus mode to gain fresh knowledge, enhance your skills, and promote personal development. The application provides a distinctive virtual garden encounter, enabling users to cultivate and care for their digital plants.

1RPC

Traditional Web3 interactions often reveal sensitive details like your IP address, user agent, and request timestamps. This metadata exposure can compromise your privacy.

1RPC acts as a secure intermediary, masking this data from third-party observers. The platform stands out remarkably in security and privacy protection, utilizing a myriad of techniques including metadata masking, random dispatching, request caching and multicall disassociation.

Your Web3 activities remain shielded, enhancing your overall privacy within the ecosystem.

Akash

Akash functions as an open-source network, fostering a transparent and decentralized marketplace for buying and selling computing power.

Finding the best cloud computing resources at competitive prices can be a challenge. Akash levels the playing field by offering access to a vast pool of resources from a variety of providers.

Providers rent out computing resources to a global audience, generating additional revenue and contributing to a more efficient utilization of computing power across the network. This fosters competition, potentially leading to lower costs and improved service for consumers.

Carbon Browser

At its core, Carbon Browser prioritizes user control and data ownership. Built on a decentralized foundation, it breaks free from the constraints of traditional browsers controlled by large corporations. This means your browsing history and personal information remain under your control, not locked away in servers you don't own.

Carbon Browser combines powerful features such as AdBlock, built-in dVPN, crypto wallet, anti-tampering protection that allows you to browse anonymously, protecting your online activities and simplifying your cryptocurrency management.

On Ramps

Injective's DeFi ecosystem offers a plethora of opportunities, but getting started often requires exchanging fiat into cryptocurrency. Thankfully, Injective provides user-friendly payment solutions to bridge the gap and get you started on your DeFi journey.

- Transak: User-friendly gateway to the Injective world. Transak allows buying 160+ cryptocurrencies (including INJ) from over 150 countries.

- Kado: Seamless fiat-to-crypto experience within Injective. Kado integrates directly with Injective Bridge, enabling users to convert fiat currency into INJ with ease.

- Payfura: Global payment gateway for your Injective needs. Payfura allows users in over 130 countries to purchase INJ directly using credit cards or bank transfers.

Community

Unlike traditional user engagement methods that prioritize superficial metrics such as number of subscribers or clicks, these projects aim to encourage meaningful activity in the web3 environment.

Galxe

Galxe has emerged as a powerhouse in the realm of community building specifically designed to cultivate vibrant and engaged communities around Web3 projects and protocols. Boasting over 14 million unique users, Galxe has played a critical role in the growth of industry leaders like Solana, Polygon, Binance and others.

The success of Galxe speaks for itself. The trust of over 4,700 prominent Web3 projects and protocols, massive user base of over 16 million users and the sheer number of campaigns launched (over 60,000) highlight their versatility and ability to cater to a wide range of Web3 projects.

Masa Finance

The digital landscape is undergoing a seismic shift, with the ever-growing influence of artificial intelligence (AI) placing a new premium on personal data. Masa Finance emerges at the forefront of this transformation, not as another data-hungry corporation, but as the world's largest decentralized personal data network.

Imagine a world where you, the user, are no longer a passive source of information for big tech companies. Masa empowers you to take control of your digital footprint, fostering a future where you not only own your data, but can also profit from it.

In just over a year, the platform has garnered a significant user base, with over 1.2 million user wallets actively contributing data to the network. This collective contribution has yielded a staggering 23 million data points, highlighting a growing user base embracing the concept of data ownership and the potential of the Masa ecosystem. Additionally, Masa has fostered partnerships with over 70 leading businesses and developers, showcasing increasing adoption within the tech industry.

BonusBlock

BonusBlock recognizes the value of user engagement within the Web3 space with the focus on rewarding meaningful on-chain activity.

The platform utilizes blockchain technology to ensure a verifiable and tamper-proof record of user activity. This eliminates the potential for manipulation and ensures that rewards are distributed fairly based on a user's demonstrably on-chain contributions. Projects can gain confidence that they are attracting users who are genuinely interested in their offerings, while users can be assured that their efforts are recognized and rewarded.

Developer Tools

The rapid innovation within the Web3 space necessitates a robust set of developer tools to translate ideas into reality. Here, we explore various categories of developer tools that empower creators to build secure, scalable, and user-friendly Web3 applications on Injective.

Blockchain Interoperability

Andromeda Protocol: This comprehensive suite offers a one-stop shop for building multichain dApps. Developers have access to tools and resources that streamline the process of creating applications that can interact with multiple blockchains seamlessly.

Celer, ICON, Axelar, Skip, Evmos: These platforms all address the challenge of interoperability, allowing developers to break free from the silos of individual blockchains.

Celer focuses on enabling inter-chain dApps with features like efficient liquidity utilization across chains. ICON provides an interoperability layer specifically designed for building successful cross-chain applications. Axelar takes a programmable approach to interoperability, aiming to scale the next generation of Web3 applications. Skip offers a comprehensive solution for sovereign blockchain protocols, enhancing user experience, interoperability, and value capture. Evmos, the Ethereum Canary Chain, allows developers to deploy future-proof applications that leverage the power of IBC (Inter-Blockchain Communication) and interchain composability.

Infrastructure Providers

Tencent Cloud, Warp Protocol, Bware Labs: These providers offer the essential building blocks for Web3 development. Tencent Cloud provides robust cloud infrastructure solutions specifically tailored for Web3 applications. Warp Protocol empowers developers to integrate new features into existing platforms with cost-efficient, decentralized automation. Bware Labs focuses on high-performance and reliable infrastructure services and development tools, ensuring a solid foundation for Web3 applications.

Notification Platform

Notifi: In the fast-paced world of Web3, user engagement is crucial. Notifi stands out as a leading platform for driving customer engagement innovation through multi-chain web3 communications infrastructure. By enabling developers to send timely and relevant notifications, Notifi helps bridge the gap between dApps and their users.

Oracles

Pyth, API3, Band Protocol, Chainlink, DIA, UMA: These platforms bridge the gap between the real world and blockchain networks by providing access to reliable and secure data feeds.

Pyth delivers real-time market data for crypto, equities, FX, and commodities to 50+ blockchains. 95+ major market participants including Jane Street, CBOE, Binance, OKX, and Bybit contribute data to the network. API3 aggregates data feeds directly from first-party oracles on the native chain, eliminating the need for centralized middlemen. Band Protocol and Chainlink are established players in the decentralized oracle space, offering secure and scalable solutions for connecting real-world data and APIs to smart contracts. DIA is another player in this growing field, providing a decentralized oracle network for various data needs. UMA's Optimistic Oracle (OO) simplifies data integration and empowers developers to build robust and reliable dApps with streamlined data verification.

Data Providers

Google Cloud, NOWNodes, Truflation: Due to collaboration between Injective Labs and Google Cloud, developers now have the opportunity to access real-time data across the Injective network through Google Cloud’s Analytics Hub. NOWNodes provides access to blockchain data and nodes through a robust blockchain infrastructure. Truflation specializes in on-chain and off-chain data feeds, catering to the diverse data requirements of Web3 developers.

Rollup Solutions

Espresso Systems, Caldera, Cartesi, Omni: As the popularity of Ethereum grows, scalability becomes a pressing concern. Rollup solutions offer a promising approach by processing transactions off-chain and then batching them onto the Ethereum mainnet.

Espresso Systems offers a rollup sequencer designed for credible neutrality, enhanced interoperability, and long-term alignment with Ethereum. Caldera acts as a rollup deployment platform, allowing developers to launch high-performance, customizable rollups. Cartesi provides application-specific rollups with a Linux runtime environment, enabling developers to build more complex dApps. Omni takes a unique approach, offering a low-latency interoperability network that connects Ethereum rollups securely.

Additional Resources

SubQuery, Cosmology, Oasis, Oraichain, Nois: This category encompasses a range of additional tools and resources that empower Web3 developers.

SubQuery provides fast, flexible, and reliable open-source data indexer that provides developers with custom APIs for web3 projects across all the supported chains.

Cosmology develops tools for seamless interactions across the interchain ecosystem. Oasis builds cutting-edge technologies in decentralization, privacy, and AI, offering solutions that can be integrated into next-generation dApps. Oraichain is an IBC-enabled Layer 1 solution specifically designed for verifying the trustworthiness of AI and building Web3 applications with unique AI oracles. Nois allows developers to use secure, unbiased and cost-efficient randomness via IBC.

Institutional

The Injective ecosystem caters to a variety of participants, including institutional investors. Here's a breakdown of some prominent projects within the Injective landscape that offer solutions and services geared towards institutional needs.

Custody and Security

- BitGo: A leading provider of institutional custody and digital asset finance solutions, BitGo offers secure storage and management of crypto assets for institutions.

- Fordefi: This platform empowers institutions with secure self-custody of private keys, seamless dApp interaction across various blockchains, and granular control through customizable policies.

- Cobo: Trusted by institutions, Cobo provides secure digital asset custody solutions.

- Copper: Offering a comprehensive suite of services, Copper caters to institutional needs with custody, prime services, and collateral management.

Trading and Investment

- Cumberland: This arm of Digital Currency Group (DCG) helps institutional investors take advantage of new opportunities within the crypto space.

- Finoa: A regulated platform designed for sophisticated investors, Finoa provides secure asset management and growth solutions built with institutional needs in mind.

- Galaxy Digital: This leading firm offers institutions access to a wide range of services within the digital asset ecosystem, including trading, investing, and custody solutions.

- Flow Traders: A global leader in financial technology, Flow Traders brings its expertise to the crypto market, providing liquidity solutions for institutions.

- BlockTower Capital: This investment firm bridges traditional and digital assets, offering institutional clients professional trading, venture capital, credit underwriting, and portfolio management services.

- Anti Capital: This firm combines traditional finance and crypto expertise, offering institutional clients a blend of proprietary trading capabilities, liquidity optimization strategies, and advisory services.

Additional Resources

- Delphi Digital: While Delphi Labs focuses on protocol development, its parent company, Delphi Digital, offers institutional clients research and investment insights within the crypto space.

- IDG Capital: A leading investment firm with a focus on fostering innovation, IDG Capital's involvement in the Injective ecosystem suggests potential opportunities for institutional investment.

- Ondo Finance: This project aims to build next-generation financial infrastructure, potentially improving market efficiency and transparency for institutional participants.

Supported Wallets

Injective strives to break down barriers for users by providing a variety of wallet options. Whether you're an Ethereum veteran or a Cosmos native, you can likely use your existing crypto wallet to access Injective's features and functionalities. This flexibility empowers users to participate in the Injective ecosystem without the need to create entirely new wallets.

For a complete list of wallets supported by Injective, visit the Injective ecosystem page. This resource empowers you to explore the available options and select the wallet that best suits your needs and preferences.

Dashboards

By leveraging the available dashboards and staying informed about upcoming developments, Injective users can effectively navigate the DeFi landscape and make informed decisions within the ecosystem.

- DAIC’s Peggo Dashboard: A Dashbaord especially made for validators to check their Peggy performance.

- CryptoRank, CoinGecko, CoinMarketCap: These powerhouses are your one-stop shops for cryptocurrency market intelligence. Imagine them as comprehensive dashboards displaying everything you need to track the ever-fluctuating world of crypto. Coin prices, market capitalization, trading volume, and a plethora of other metrics are all at your fingertips.

- DEX Screener: This dashboard caters specifically to the world of decentralized exchanges (DEXs). DEX Screener empowers you to become a DEX master by providing a platform to compare the liquidity offered by different DEXs. You can also compare trading pairs, fees associated with trades, and other crucial factors to identify the DEX that best suits your trading needs.

- GeckoTerminal (by CoinGecko): While CoinGecko offers a general market overview, GeckoTerminal is likely targeted towards experienced crypto users seeking advanced analytics and data. On-chain analysis (examining data directly on the blockchain), powerful charting tools for visualizing market trends, allow you to conduct thorough research and make strategic investment decisions within the complex world of DeFi.

- Coinhall: It's a real-time price charting and DEX aggregator platform, specializing in aggregating swaps across all Automated Market Maker (AMM) DEXes. Imagine a platform that allows you to compare swap rates and identify the most efficient DEX to execute your cryptocurrency trades. This functionality caters to both experienced DeFi users and those new to the space by simplifying the process of finding the best deal on cryptocurrency swaps.

- TFM: This one-stop NFT aggregator empowers you to delve into the world of Injective NFTs with confidence, offering a comprehensive platform for discovery and analysis. See how NFTs are distributed among various wallets, stay updated on the latest additions, and gain insights into current market activity – all within a single platform.

- Smart Stake: This dashboard gives you all information about staking and validators. It also shows the top holders of injective and gives you insights about how many tokens are staked and unstaked currently.

Conclusion

Our long and fascinating journey into the depths of Injective has come to its end. Injective's strategic approach to ecosystem growth is undeniable. By tackling user experience, developer enablement, and interoperability, Injective positions itself for a strong future.

However, to compete effectively with established DeFi leaders, Injective must cultivate deeper liquidity within its markets and attract a wider user base to fully capitalize on its potential. The unique value proposition of its on-chain experience and robust tokenomics offer a strong foundation for achieving this goal.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.