Key Takeaways

- Cross-Chain Interoperability: Injective connects major networks like Ethereum, Solana, and Cosmos, enabling seamless DeFi trading across chains.

- High Performance: With over 10,000 TPS and low gas fees, it supports fast, cost-effective transactions.

- Advanced DeFi Suite: Offers decentralized derivatives, spot trading, and sophisticated financial tools for professional traders.

- INJ Token Utility: Powers governance, staking, and liquidity mining within the ecosystem.

- Security and Decentralization: Strong emphasis on decentralized control through community-driven governance.

In a world gripped by a technological revolution, blockchain technology is a game-changer, transforming not only the financial landscape but other areas as well. However, as in any field, solving one challenge may lead to the emergence of new ones.

While the DeFi landscape is rapidly expanding, the spread of new protocols aimed at overcoming blockchain scalability challenges has led to liquidity fragmentation. Liquidity that used to flow like a river is now spread across different protocols, each of which contains its own decentralized exchanges (DEX) and DeFi applications. This fragmentation has led to usability issues, impermanent losses, and slippage of trades as liquidity is dispersed with users searching for more favorable terms.

Fortunately, Injective provides a solution to this challenge.

Utilizing the Cosmos SDK and Wormhole, Injective places a significant focus on interoperability for DeFi. This emphasis enables smooth communication not only with other Cosmos-based chains but also extends its interoperability beyond the ecosystem with support for EVM and non EVM chains such as Ethereum, Solana, Avalanche, and others.

Welcome to Injective, where the possibilities are limitless, and the future is decentralized!

Injective Overview

Going deeper, Injective is a cross-chain exchange-focused blockchain for building next-level powerful DeFi services, derivatives and Web3 applications across myriad networks.

Utilizing a multi-layer framework, Injective operates as a decentralized layer 2 exchange (DEX) on its own Cosmos SDK-enabled layer 1 blockchain.

While it might seem complex at first glance, in simpler terms, Injective runs on its own blockchain seamlessly integrated with the Cosmos ecosystem and its networks. Additionally, through second-layer solutions, it extends support to other major layer 1 networks such as Ethereum, Solana, Polygon, and more, providing cross-chain capabilities.

Employing a hybrid Proof of Stake (PoS) consensus model, Injective can operate at over 10,000 TPS, providing instant transaction finality and lightning-fast speeds, which is highly relevant for trading activities and DEXs. Moreover, its gas auction mechanism ensures fair and efficient transaction fees, while its decentralized design minimizes vulnerabilities inherent in centralized exchanges.

The Injective API nodes serve as the data layer, providing real-time data indexing, while integration of CosmWasm introduces a powerful smart contract layer based on the Cosmos SDK. This approach ensures the automatic execution, eliminating the need for external agents, thus fostering true decentralization in application development. Additionally, the adoption of Electro Chains facilitates the integration of Ethereum and Solana-based smart contracts into the ecosystem.

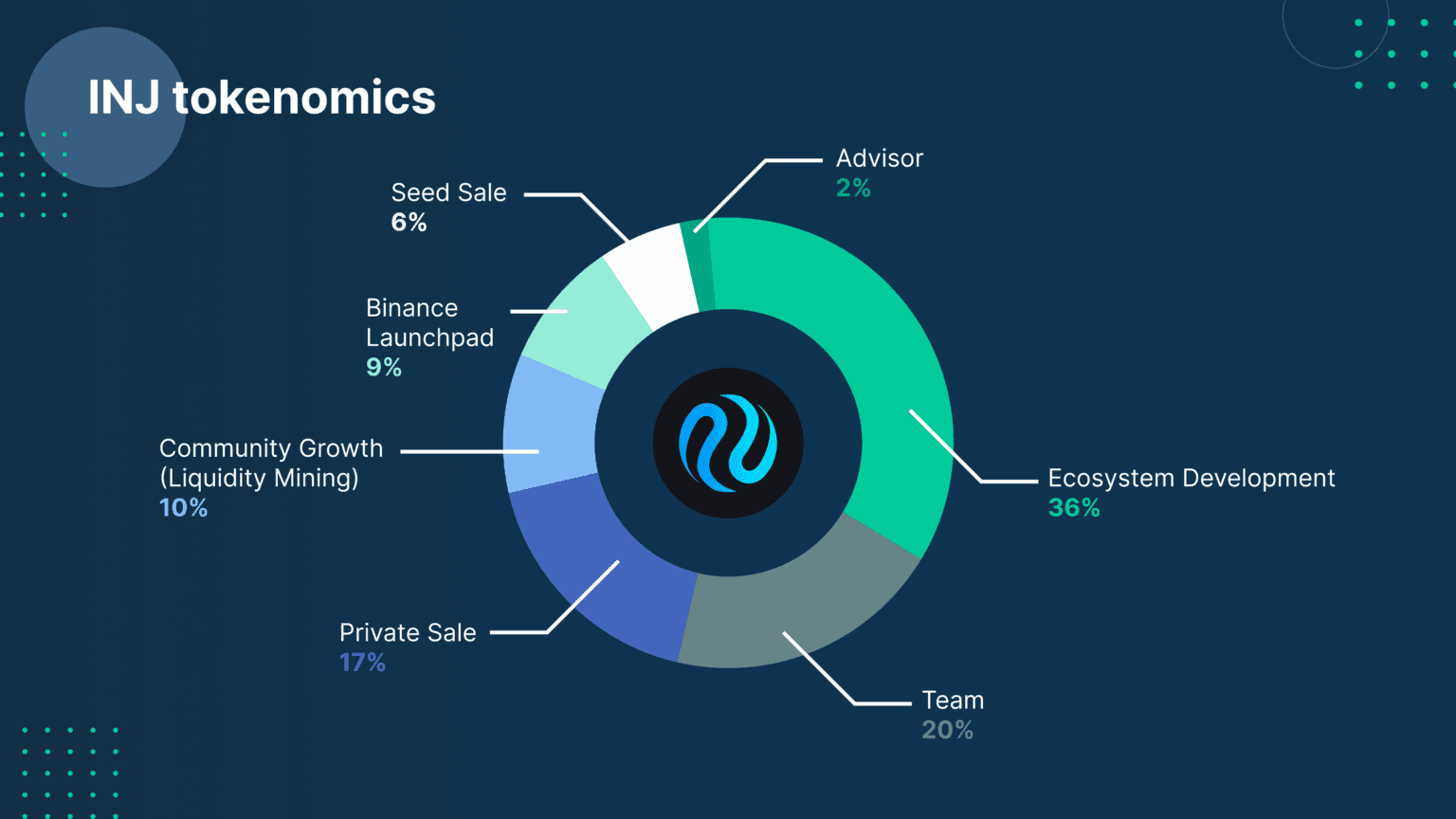

Injective's economy is built around its native utility token INJ, which serves various roles within the ecosystem, including, but not limited to, governance, token burn auctions, and staking on the PoS network.

The initial supply of INJ is 100,000,000 tokens and shall increase over time through rewards. The target INJ inflation is 7% at genesis and will decrease over time to 2%.

According to CoinMarketCap, the INJ token is traded on over 90 exchanges.

At the core of Injective is the ability to host a wide range of financial functions such as spot exchanges, perpetual futures, options, prediction markets and more. This creates a well-rounded ecosystem that provides a diverse range of financial products and services across protocols and networks.

Injective features for investors

Limitless Trading

The high trading speed and near-zero gas commissions of Injective are a compelling advantage compared to other Layer 1 blockchains, where users are facing network congestion and high fees.

Cross Markets Derivatives

Injective enables users to both trade diverse derivatives markets and craft their own markets using price feeds, providing access to various assets such as cryptocurrencies, commodities, stocks, and other.

Cross-Chain Trading and Income

The opportunity for cross-chain trading and revenue generation across different first-level networks allows building more flexible strategies bridging the gap between different decentralized ecosystems.

Advanced trading features

To facilitate professional market trading and enhance decision-making, Injective provides seamless integration with widely used trading tools like TradingView. It also offers an array of advanced trading features, including limit orders, stop-loss orders, and more.

AI Adoption

The infrastructure of Injective is set up to assist the ecosystem’s adoption of AI technology. For example, the recent integration with Google Cloud provides powerful analytics capabilities based on artificial intelligence.

Liquidity Mining

To foster a dynamic and liquid marketplace, Injective incentivizes users to engage actively in the ecosystem by rewarding them for contributing liquidity.

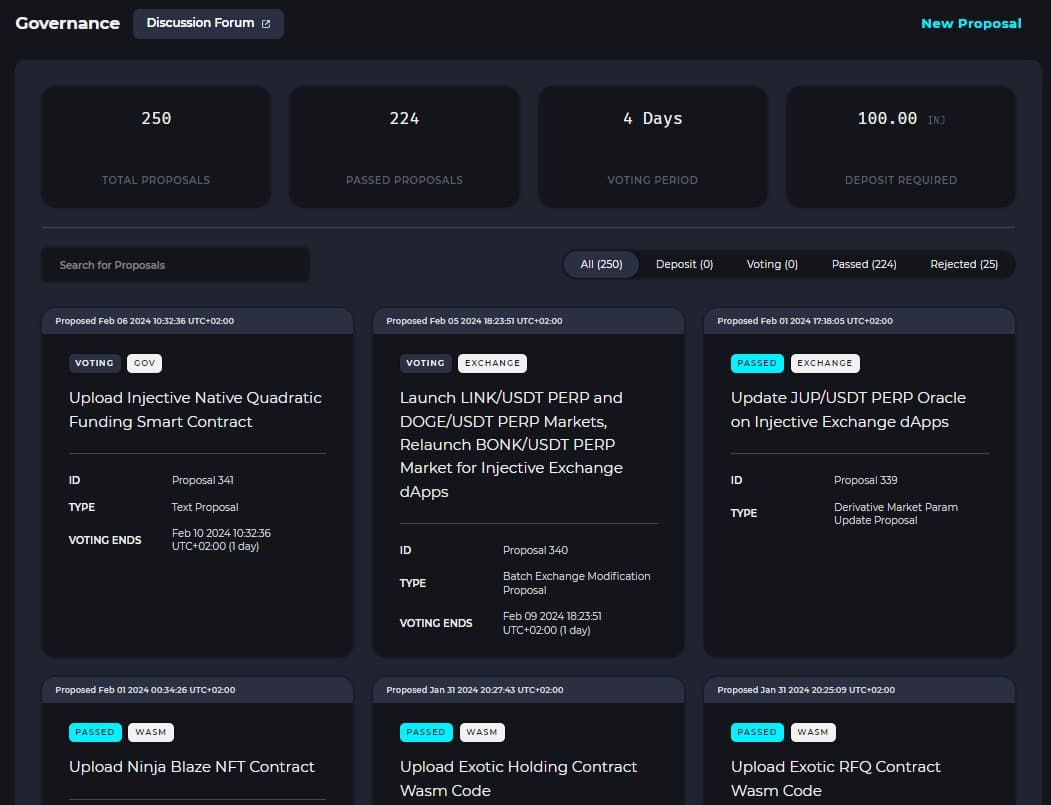

DAO

Injective ensures a democratic and inclusive approach to project management, where network members have the opportunity to influence its development through voting.

History

The concept behind Injective emerged in 2017, when Eric Chen and Albert Chon were engaged in developing a decentralized exchange tailored for trading perpetual swaps. Dissatisfied with the limitations of existing platforms, they envisioned a DEX that could deliver rapid, secure, and cross-chain trading capabilities.

They aimed to enhance liquidity, transaction speed, reduce fees, and provide access to derivative market instruments, amplifying the prominence of DeFi.

By 2018, Injective Labs was born, laying the groundwork for what would become Injective. Securing its initial funding in 2019, Injective Labs propelled the project forward, culminating in the launch of its flagship product - a decentralized exchange (DEX) - in 2020.

Driven by a shared vision to elevate DeFi, Injective team garnered support from industry heavyweights like Binance, Pantera Capital, QCP Soteria, Axia8 Ventures, BH Digital, Jump Crypto and has raised a total funding of $190M.

Unified by a common goal, Injective's team is on a mission to democratize financial access through the Injective platform. Their collaborative efforts have propelled Injective into the forefront of blockchain innovation, empowering developers and users alike to venture into new horizons within the realm of DeFi.

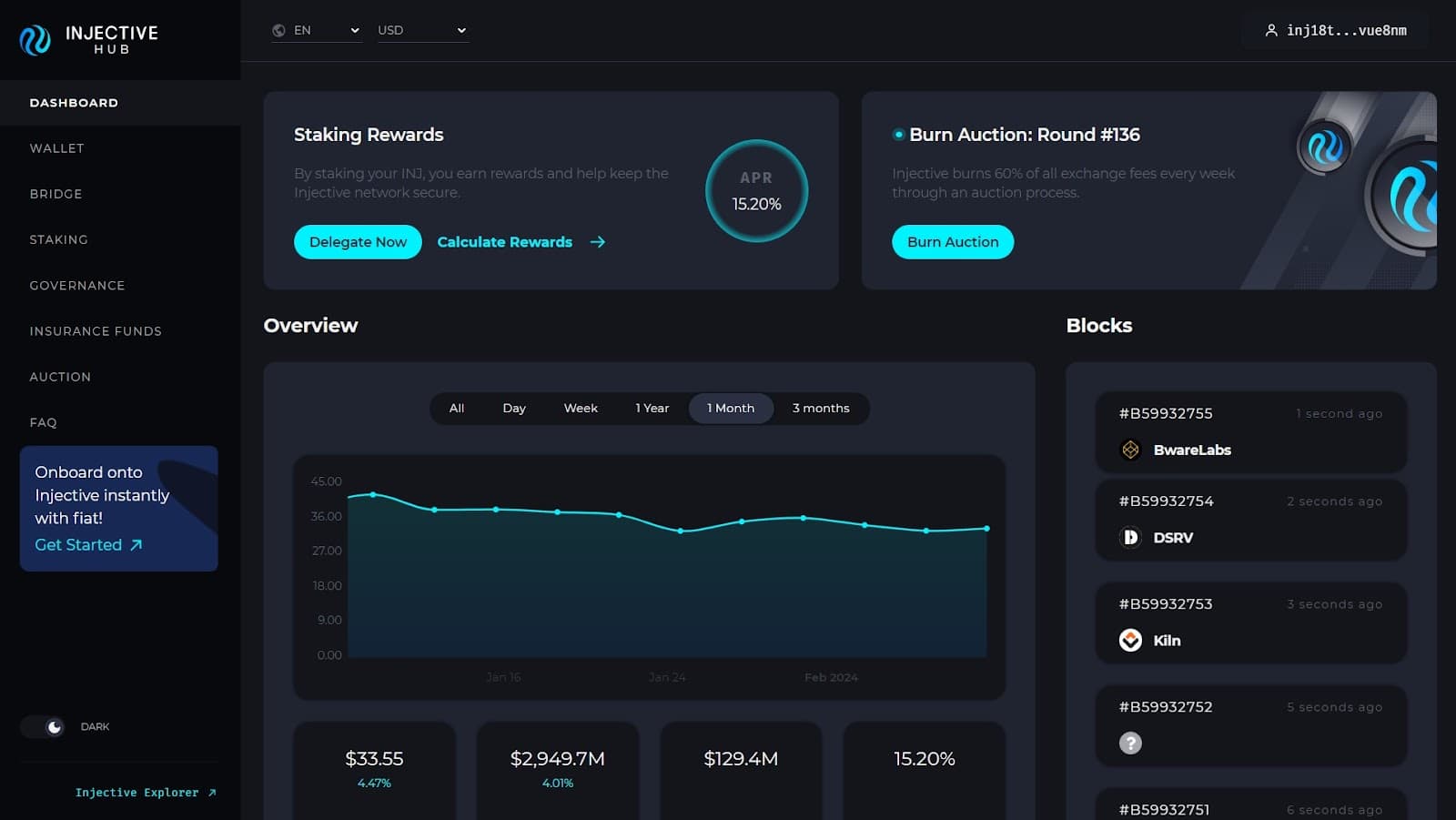

Injective HUB

As someone said, it's better to see once than to hear or read a hundred times.

Injective Hub is a platform and single point of entry for those who choose to discover the Injective ecosystem. Injective Hub provides users with a set of tools to access various features across DeFi.

All Injective's main features are available to the user in one place.

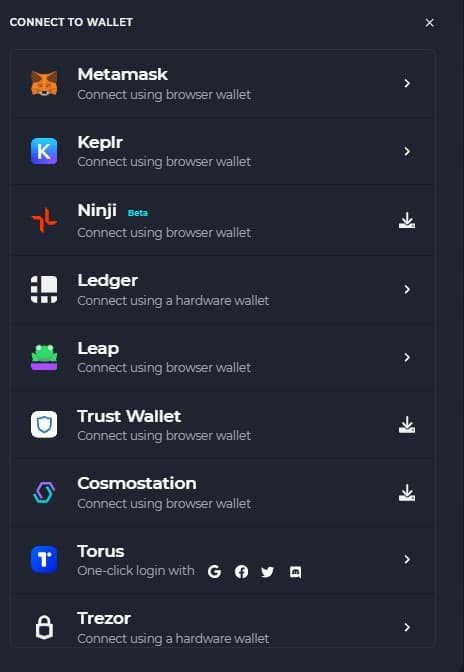

Wallets

The platform supports a wide range of wallets, allowing users to manage their funds, send and receive tokens, and interact with decentralized financial applications (DeFi) directly in the Injective ecosystem.

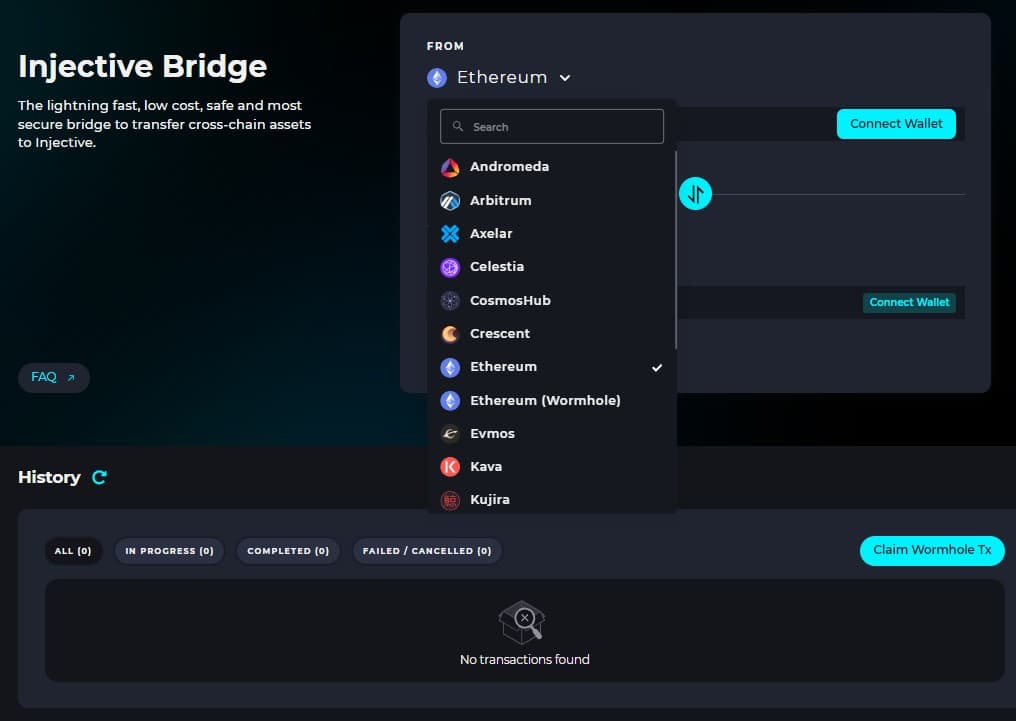

Injective Bridge

The Injective Bridge is a critical infrastructure component that enables the seamless exchange of assets from other networks into Injective. At this time, about 20 networks are supported.

Injective Governance

The DAO mechanism allows users to participate in the ecosystem, contributing to the long-term growth of Injective. By owning INJ tokens, users can participate in voting on proposals related to blockchain updates and other decisions.

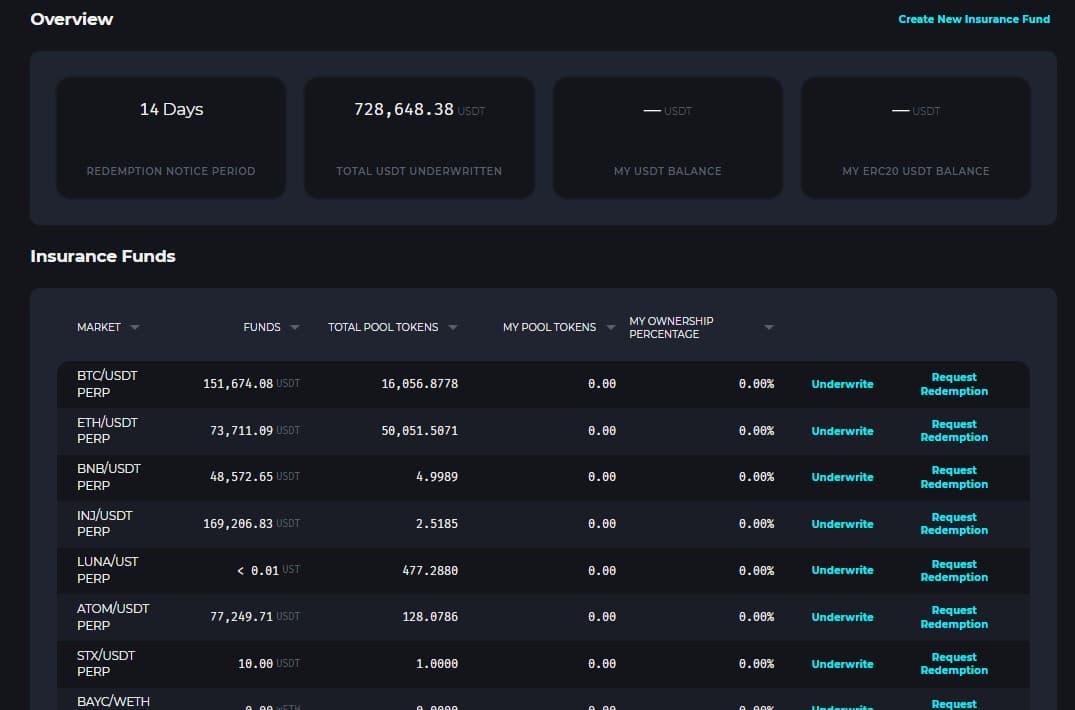

Injective Insurance Funds

The Insurance Funds mechanism helps protect users from potential losses in DeFi applications built on Injective. Users are able to create insurance funds for derivatives markets and become insurers by adding assets to these funds.

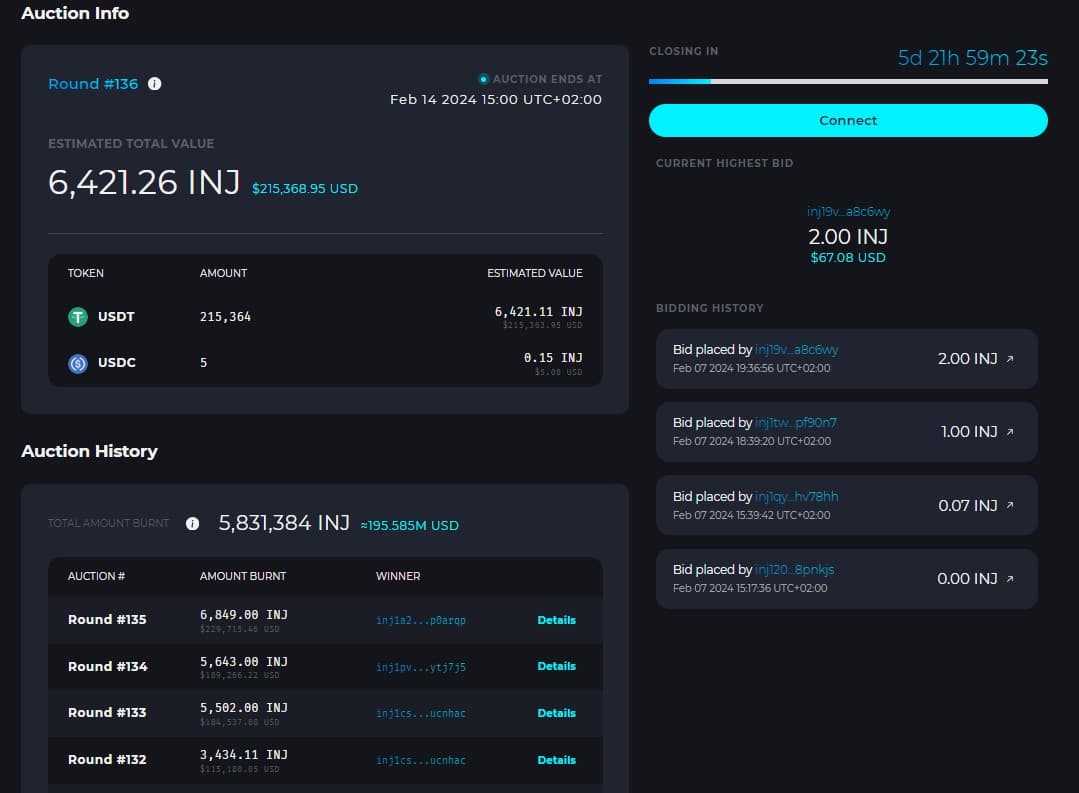

Injective Auction

Injective has implemented an innovative auction format to reduce token circulation.

The platform collects 60% of the trading fees paid by users on a weekly basis, which are then placed in an auction and the community can bid for them with INJ tokens. The winner of the auction receives these fees while their bid is burned, reducing the total number of INJ tokens in circulation.

Fiat Gateway

By the way, users have a convenient and fast option to purchase INJ tokens for fiat directly on the platform through several payment providers.

Injective Labs dApps

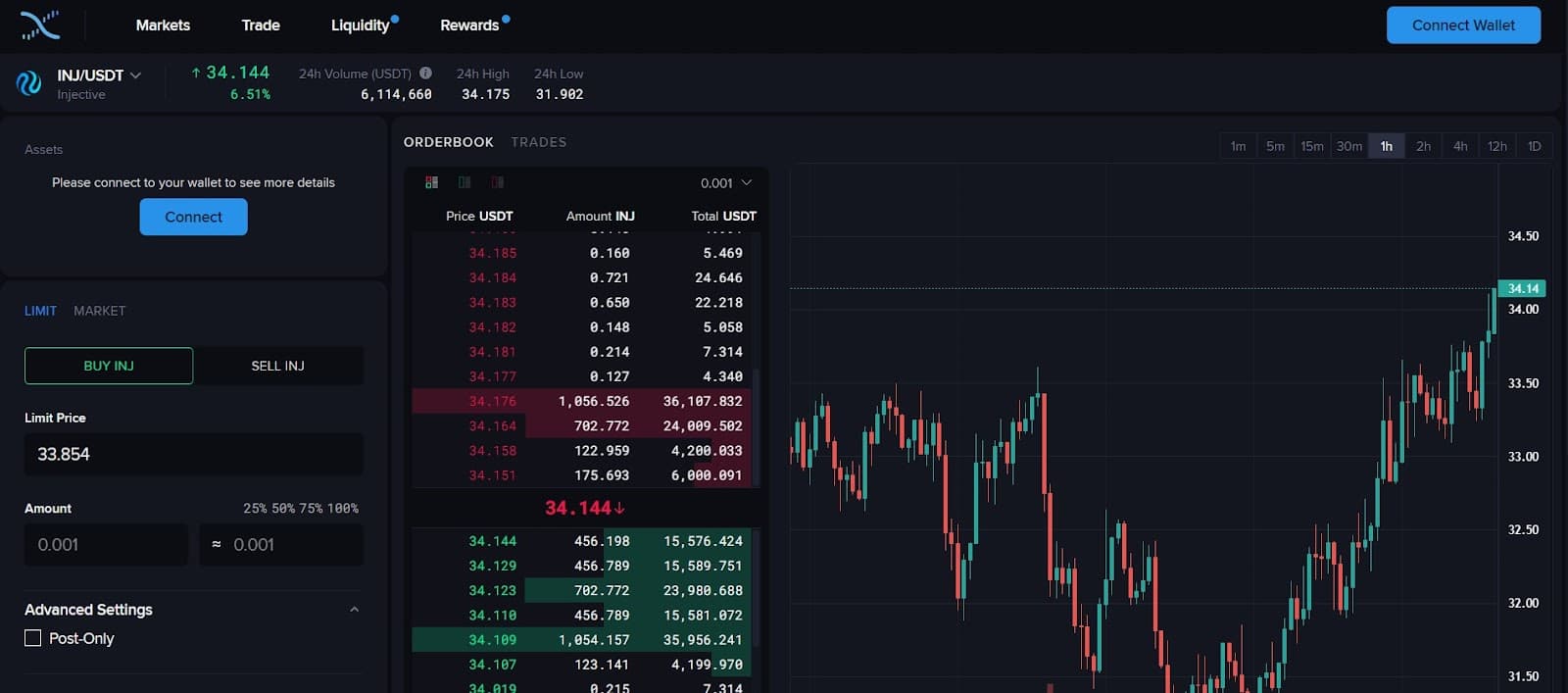

Helix

Trading opportunities are available on the decentralized Helix exchange, which is fully supported by Injective Labs.

Helix distinguishes itself as a decentralized exchange rooted in the fundamental principles of blockchain technology. By eliminating the necessity for a central authority, Helix establishes a trusted and censorship-resistant platform for users.

Providing an advanced trading environment, Helix introduces sophisticated order types for precise trade executions. Traders can engage in spot and perpetual markets, utilizing features like stop loss and take profit.

With the absence of gas fees and attractive commission discounts, Helix ensures a cost-effective trading experience. The platform's cross-chain functionality broadens possibilities, granting access to both popular and unique markets. This capability to trade diverse assets across different blockchains offers users unparalleled flexibility and choice.

From the last news, Helix recently achieved another milestone with over $14 billion in cumulative derivatives volume.

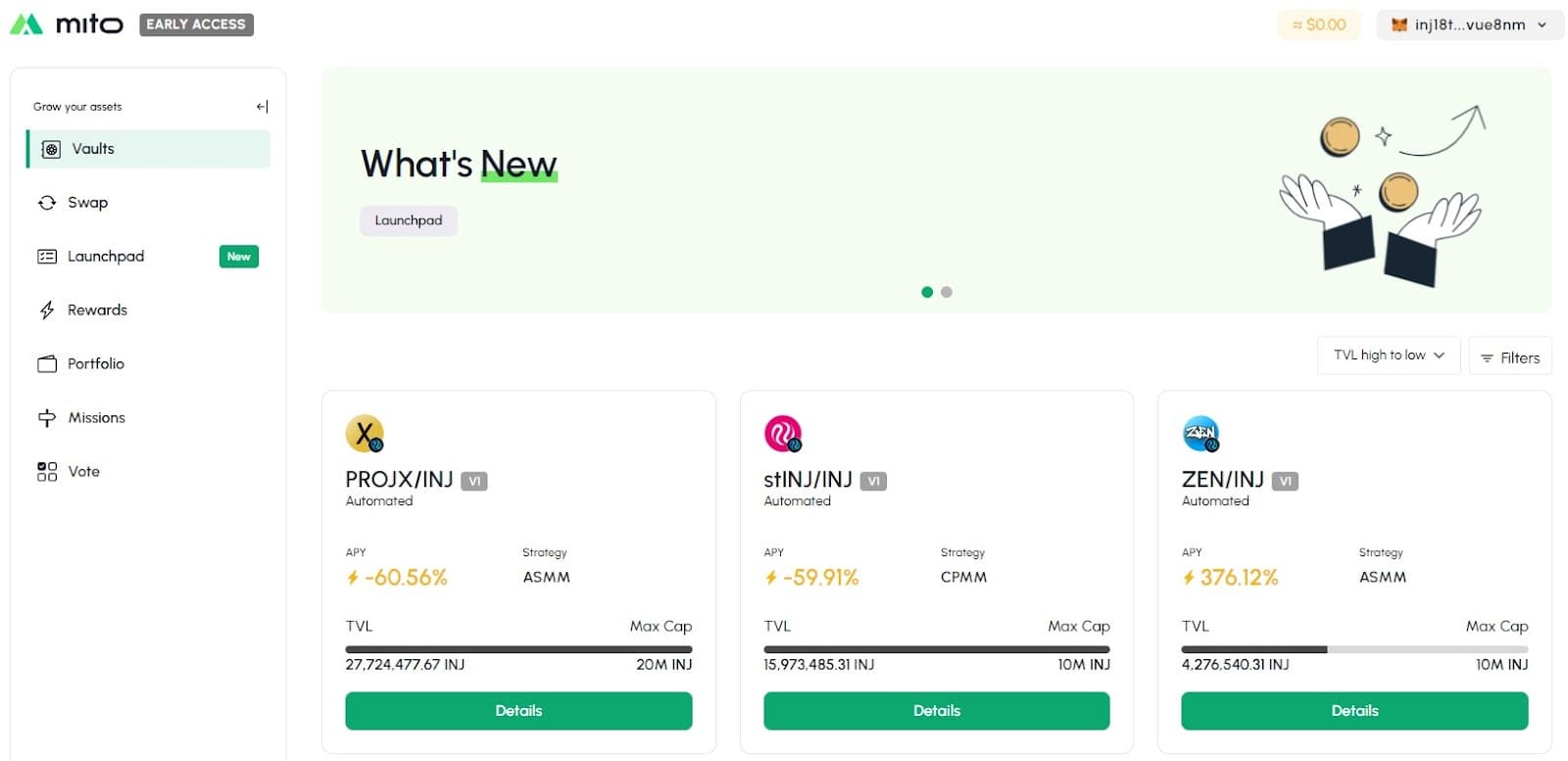

Mito

Mito (formerly Project X) is Web3 protocol that represents a combination of strategic vaults for passive yield generation, impermanent loss (IL) protected AMMs, and a streamlined one-click launchpad.

Mito positions itself as the central hub for all DeFi, democratizing interactions for both users and projects. Users will now have access to previously exclusive strategies, while developers can utilize Mito as the premier platform for token launches. The project's impact extends beyond individual transactions, fostering growth within the larger Injective ecosystem by interconnecting diverse dApps and empowering innovation in decentralized finance.

Recently, the first Mito Launchpad vote went live with the community able to choose from a total of four highly anticipated projects: Black panther which is an asset management protocol, Hydro protocol which is an Injective-native liquid staking derivatives protocol, and two NFT projects, Berb token and Quants.

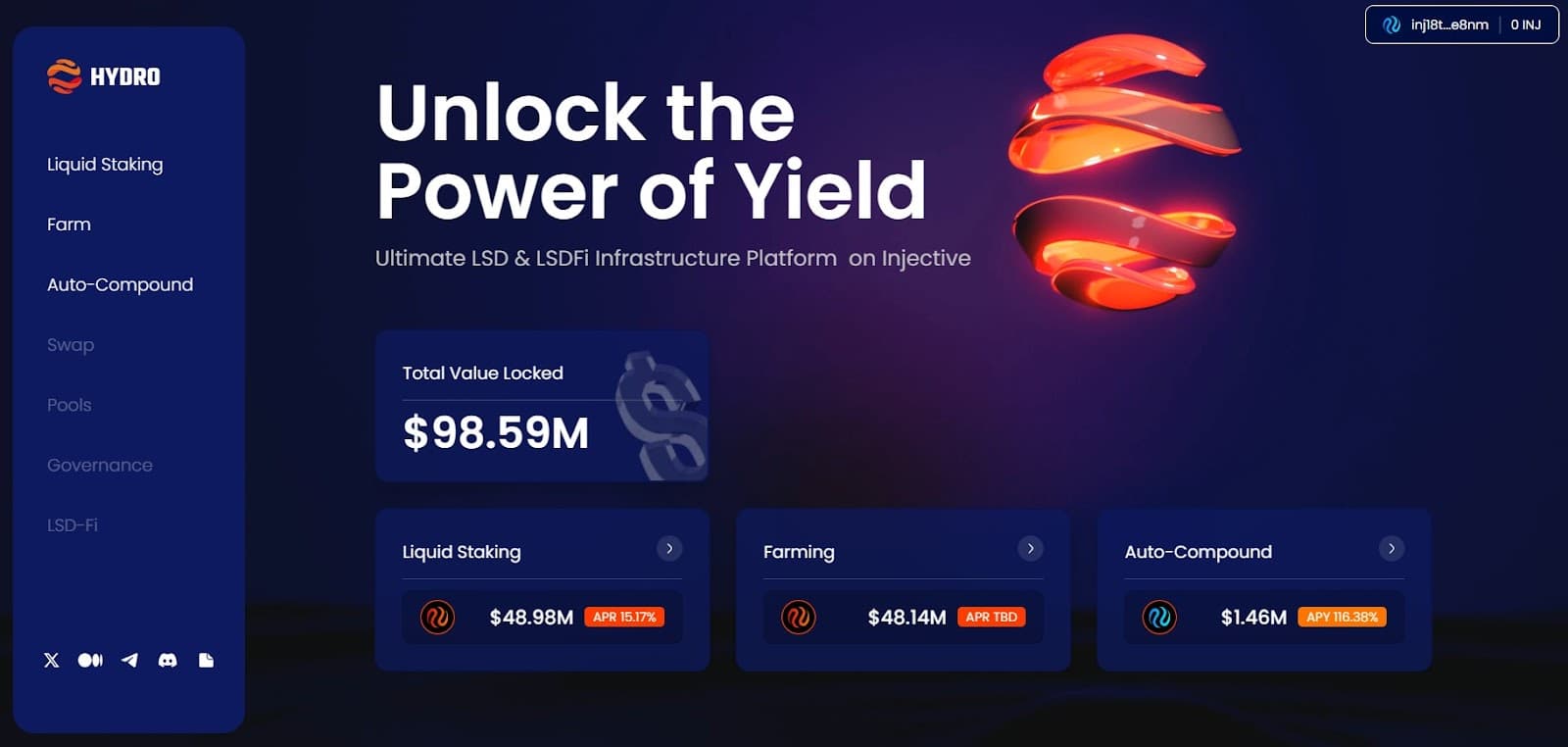

Hydro

The Hydro Protocol is an innovative infrastructure platform for maximizing returns and liquidity across the Injective network. The protocol combines Liquid Staking Derivatives (LSD) and Real World Assets (RWA) products to offer a specialized set of LSDFi products.

The Hydro Protocol empowers users to enhance their decentralized finance journey through the LSDFi infrastructure, operated by Hydro and deployed across the Injective network. Leveraging Hydro's LSD, users maintain their stakes while simultaneously utilizing their liquidity to optimize activities across various dApps, including trading and lending. This innovative system ensures that users can maximize the efficiency and utility of their assets within the decentralized finance ecosystem.

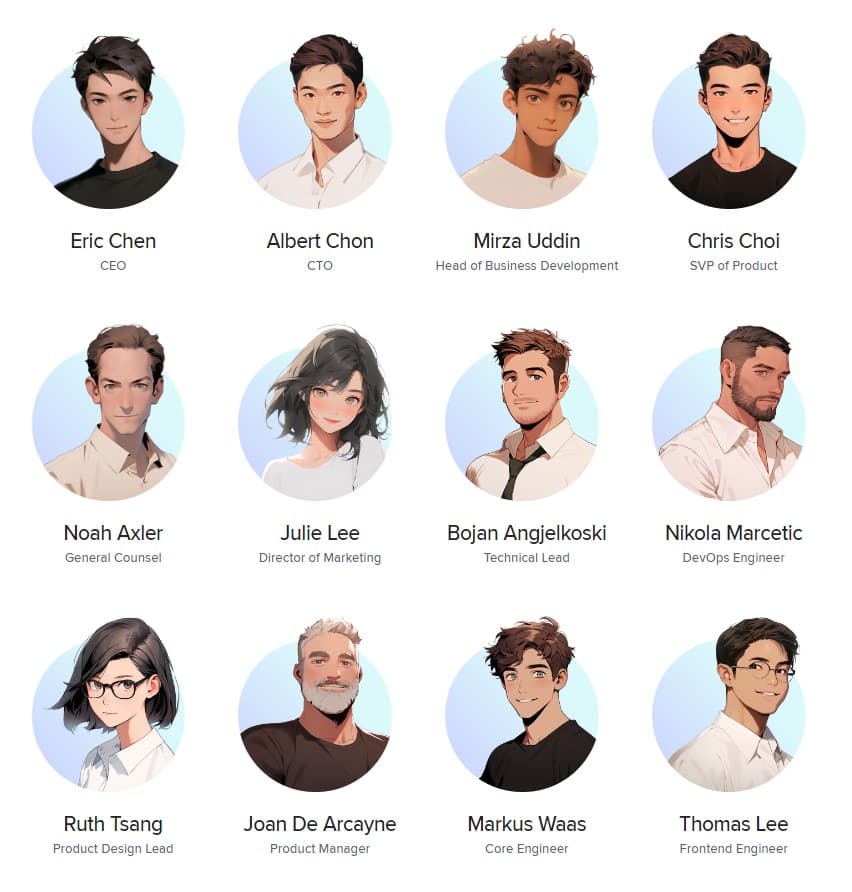

Team

The Injective team is led by co-founders Eric Chen and Albert Chon.

Albert Chon is a former software engineer at Amazon Web Services and consultant at Open Zeppelin. Eric Chen was a researcher at Innovating Capital working on trading strategies and protocol research. Before that, he took a part in the NYU Blockchain Labs.

Together, Eric and Albert put together a team of developers with experience in blockchain technology, software development, and finance.

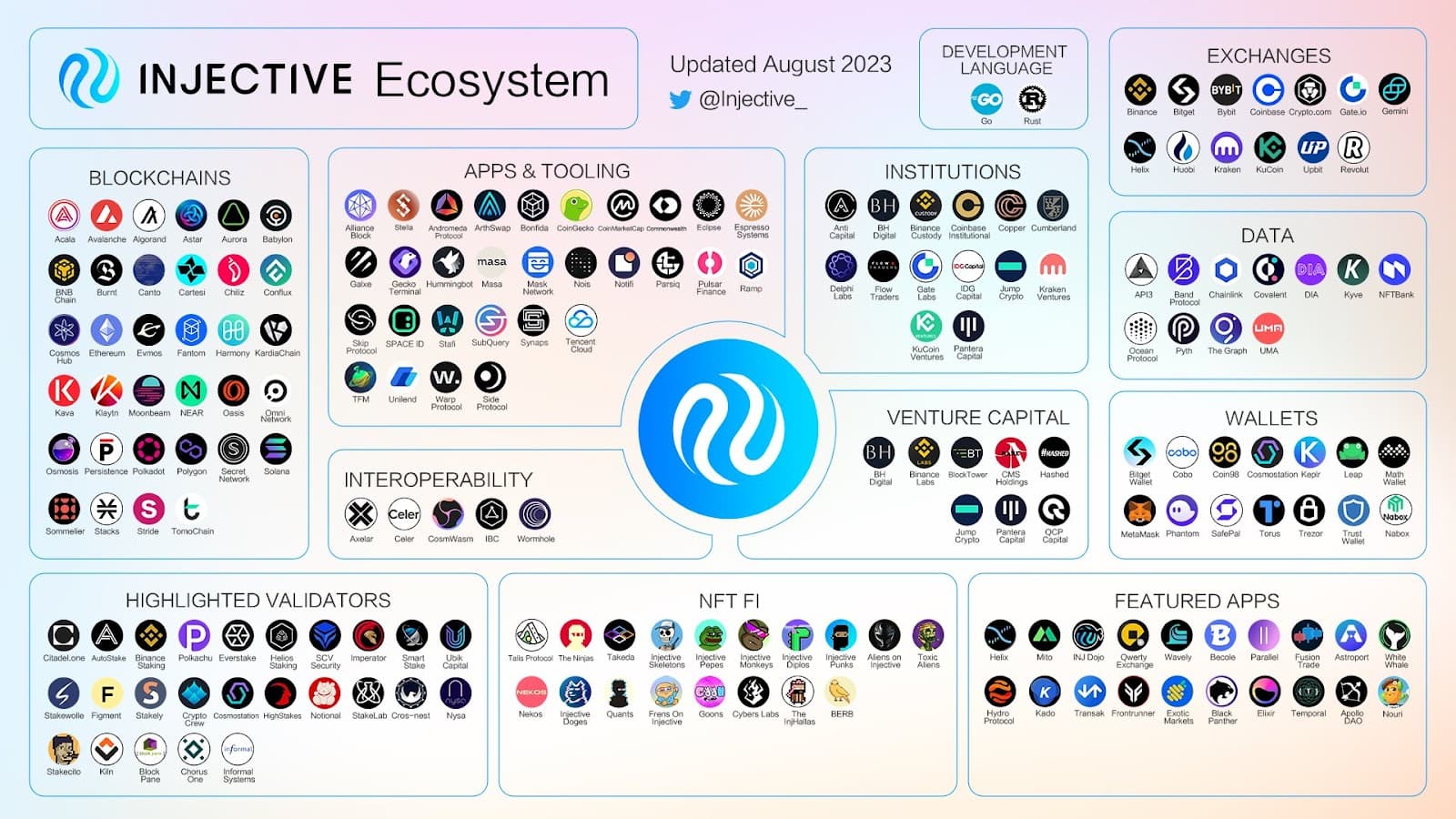

Injective Ecosystem

The rapidly expanding Injective ecosystem boasts over 200 DApps across diverse Web3 categories, showcasing its commitment to a free and inclusive financial world.

With applications ranging from Bridges and DEXs to Stablecoins and Venture Capital, Injective serves as a hub for innovation and collaboration. The ecosystem's emphasis on Data and Interoperability ensures seamless interaction between different blockchains, offering users a comprehensive suite of financial tools and services, making it a versatile solution for various Web3 financial needs.

Roadmap and Future Plans

As for the Injective itself, there is no roadmap beyond 2024 yet. From the team's recent reports, it is clear that the project is staying on its course, focusing on interoperability and the expansion of financial dApps.

Equally, the project team is interested in its expansion into the institutional sector, taking Injective to the next level. A separate focus is directed at attracting developers and maintaining the infrastructure growing DeFi field.

2022 Q4

- Injective Explorer V2

- Wormhole Bridge Integration to bring EVM and Solana assets into Injective

- Fiat on and off-ramp for dApps

2023 Q1

- Injective Hub V2

- Institutional Zone

2023 Q2

- Injective Exchange Module V2

- Casablanca Upgrade

2023 Q3

- Injective Orbital Chains

2023 Q4

- Mesh chain network

- Carcosa Upgrade

2024 Q1

- Multi VM Chains

- Volan Upgrade

Conclusion

In conclusion, Injective stands out as a versatile platform in the DeFi ecosystem, combining decentralized services, cross-chain interoperability, user-centric design, and scalable, secure infrastructure.

Its specialization in trading applications, including spot and derivative markets, positions it as a go-to platform for decentralized trading, attracting a diverse range of trading-focused services and investors.

With strong community backing and support from investors, Injective is poised for mass adoption, shaping the future of cross-chain decentralized finance.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.