Key Takeaways

- High-Performance Blockchain: Built on Cosmos SDK, Injective features fast transaction finality and a hybrid consensus (CometBFT and PoS) ensuring scalability and security.

- Advanced DeFi: Supports decentralized trading of derivatives, spot markets, and perpetual swaps with MEV-resistant orderbook infrastructure.

- Interoperability: Injective integrates seamlessly with IBC-enabled blockchains, Ethereum, and non-EVM chains, expanding cross-chain functionality.

- No Gas Fees: Offers near-zero gas fees for trading and transactions.

- Developer Tools: Provides a robust toolkit for building DeFi dApps, with support for CosmWasm, EVM, and SVM environments.

Introduction

Remember those early days of DeFi, where swapping tokens felt like scaling Mount Everest in flip-flops? Transactions were slow, network fees spiked, and dreaming of accessible, advanced crypto derivatives meant juggling endless wallets. Well, dream no more! Projects like Injective are making it a reality.

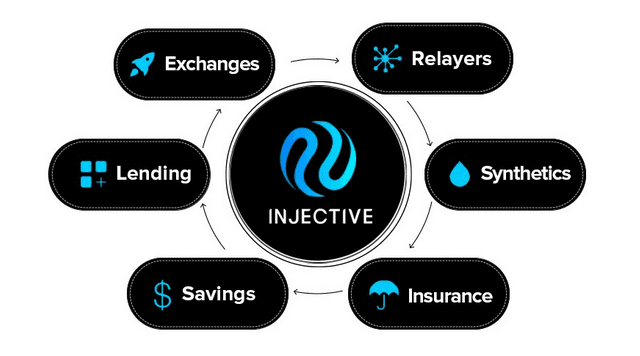

Injective offers the DeFi community a unique solution: an innovative, highly interoperable blockchain model with native DEX functionality. This versatility allows for the creation of virtually any financial product imaginable, from traditional cryptocurrency spot trading to exotic gold options. Key features like a decentralized orderbook infrastructure, seamless interoperability, Multi-VM smart contract environment, instant transaction finality, and near-instantaneous trade execution position Injective as a robust platform for building diverse chain-agnostic DeFi services and attracting new users.

In our previous article, we introduced the project in general terms. In this one, we will look under the hood and take a closer look at how Injective works, what its unique features and benefits are, and why it could become the leading platform for DeFi innovation.

Injective

Introducing an interoperable blockchain with native DEX, Injective is emerging as a DeFi powerhouse, offering a high-performance platform that is poised to shape new financial paradigms in the Web3 world.

Unlike fragmented, fee-ridden ecosystems, Injective champions borderless, trustless, and censorship-resistant trading for diverse assets across multiple blockchains.

Born from the vision of Injective Labs, led by Eric Chen and Albert Chon, Injective's multilayer and cross-chain architecture empowers users with:

-

Cross-chain perpetual swaps, margin trading, and spot trading: Seamlessly access a plethora of digital assets – derivatives, forex, synthetics

- Customizable market creation: Unleash entrepreneurial freedom by creating personalized markets readily accessible to a global audience.

- Blockchain-agnostic DEX infrastructure: Injective serves as a foundation for building cross-chain EVM and non EVM dApps, fostering a vibrant DeFi ecosystem.

- Instant transactions, lightning-fast speed, and MEV resistance: Experience trading reimagined with instant settlements, eliminating frustrating delays and market manipulation.

- Zero gas fees, EVM and SVM interoperability: Cost-effective trading coupled with the ability to leverage existing Ethereum or Solana expertise for effortless dApp migration to Injective.

But Injective's true differentiator lies in its unwavering focus on interoperability. Breaking down siloed DeFi experiences, Injective connects various blockchains, enabling users to tap into a global pool of liquidity, assets, and markets, all while upholding speed, security, and decentralization.

Injective's multifaceted design, encompassing a well-structured multi-layered architecture and a user-centric approach, empowers both developers and users.

Tech Innovations

Injective's success hinges upon its meticulously designed, multi-layered architecture. Each layer serves a distinct function, allowing the platform to meet a broad spectrum of user needs and facilitate diverse financial applications. This structured approach echoes the principles of modular design, ensuring agility and responsiveness within the rapidly evolving DeFi landscape.

Injective Chain

The Injective ecosystem revolves around Injective Chain, a layer 1 blockchain built on top of the Cosmos SDK framework. To ensure security, Injective Chain utilizes a hybrid Byzantine Fault Tolerant (BFT) consensus mechanism powered by CometBFT (a modern fork of the original Tendermint Core) and Proof-of-Stake (PoS) by Cosmos SDK. This system ensures near-instant finality and fulfillment of transactions, exceptional fault tolerance and horizontal scalability, providing a solid and reliable foundation for financial activity. Secure staking incentives attract network participation, further solidifying trust, while advanced cryptography safeguards user privacy.

Although this may seem like a standard set-up for any blockchain on the Cosmos network, there is more to come.

Injective's blockchain powers the most advanced existing, fully decentralized orderbook-based exchange infrastructure, which includes features such as advanced order types, liquidity incentives, and MEV protection mechanisms.

In addition, the platform's interoperability extends beyond its native ecosystem, providing seamless integration with other IBC-enabled blockchains, Ethereum-based networks and others non-EVM major chains.

Every aspect of the exchange infrastructure, from the orderbook and matching mechanism to oracles and insurance funds, operates in a decentralized manner, empowering users and ensuring community ownership.

By offering a seamless trading experience, developers can build decentralized exchanges (DEX) on Injective without sacrificing functionality or governance.

Moreover, Injective stands out by enabling automated smart contract execution with self-executing smart contracts. This innovative feature introduces a powerful new primitive, opening up a unique design space for diverse applications.

Injective Chain modules

The Injective Chain not only inherits all the modules that are available in the Cosmos SDK, but also implements unique modules like Auction, Exchange, Insurance, Oracle, and others, which are crucial for a wide range of DeFi applications.

Auction

Injective's Token Burn Auction transforms transaction fees into ecosystem value. Previously, 60% of exchange dApp fees were pooled weekly, with bidders contributing to a smaller INJ supply. This has led to over 5.7 million INJ tokens being burned.

With the INJ 2.0 upgrade, the burn mechanism now extends beyond exchange dApps to lending platforms, NFT marketplaces, and other dApps on Injective, allowing them to contribute fees to the auction, even up to 100%.

The Volan Upgrade adds the ability for projects to burn their own bank tokens, offering more flexibility in tokenomics and further reducing the circulating supply. Overall, the Token Burn Auction fuels a more valuable, sustainable Injective ecosystem.

Exchange

Injective Exchange is the cornerstone of the ecosystem, enabling decentralized derivatives and spot trading with advanced capabilities. Integrated with modules like Auction, Insurance, Oracle, and Peggy, it ensures a secure, comprehensive trading environment.

With an on-chain orderbook and matching engine, Injective offers top-tier execution for spot, perpetual, and options markets. Its Frequent Batch Auction (FBA) mechanism ensures fair, front-running resistant execution by clearing prices every block.

Injective supports advanced order types, market-maker rebates, and liquidity incentives, enhancing trading flexibility and participation. Its CosmWasm platform and cross-chain bridging expand DeFi opportunities across networks, driving liquidity and market reach.

Attracting developers with its powerful primitives, Injective fosters innovation, enabling the creation of next-gen dApps and a thriving DeFi ecosystem.

Insurance

Imagine diving into the world of high-leverage trading on derivatives in DeFi, but without the constant fear of losing everything in a blink. Sounds impossible, right?

The Insurance module serves as a critical component within the Injective, fostering trust and facilitating derivative trading through a community-driven risk mitigation mechanism.

Unlike traditional centralized exchanges, Injective employs a decentralized approach to risk management. Each derivative market maintains its own unique insurance fund, funded by a permissionless pool of underwriters. These underwriters stake the collateral token associated with the specific market, receiving proportionally representative insurance fund share tokens. This isolates market-specific risks, ensuring transparency and mitigating systemic exposure.

The insurance fund exhibits dynamic behavior, growing when positions in its corresponding market are liquidated with positive equity (contributing half the surplus). Conversely, negative equity liquidations draw from the fund to cover the shortfall, safeguarding market participants from potential losses. This mechanism incentivizes responsible trading practices and maintains equilibrium within the ecosystem.

Underwriters play a pivotal role in the Injective Insurance system. By staking their collateral and underwriting market risk, they contribute to the overall stability and liquidity of the ecosystem. In return, they receive proportional rewards based on the growth of the insurance fund, offering attractive returns commensurate with the assumed risk.

The presence of an insurance fund empowers traders to engage in derivative strategies with greater confidence. The knowledge that potential losses are mitigated by the communal fund attracting a wider range of participants.

OCR module

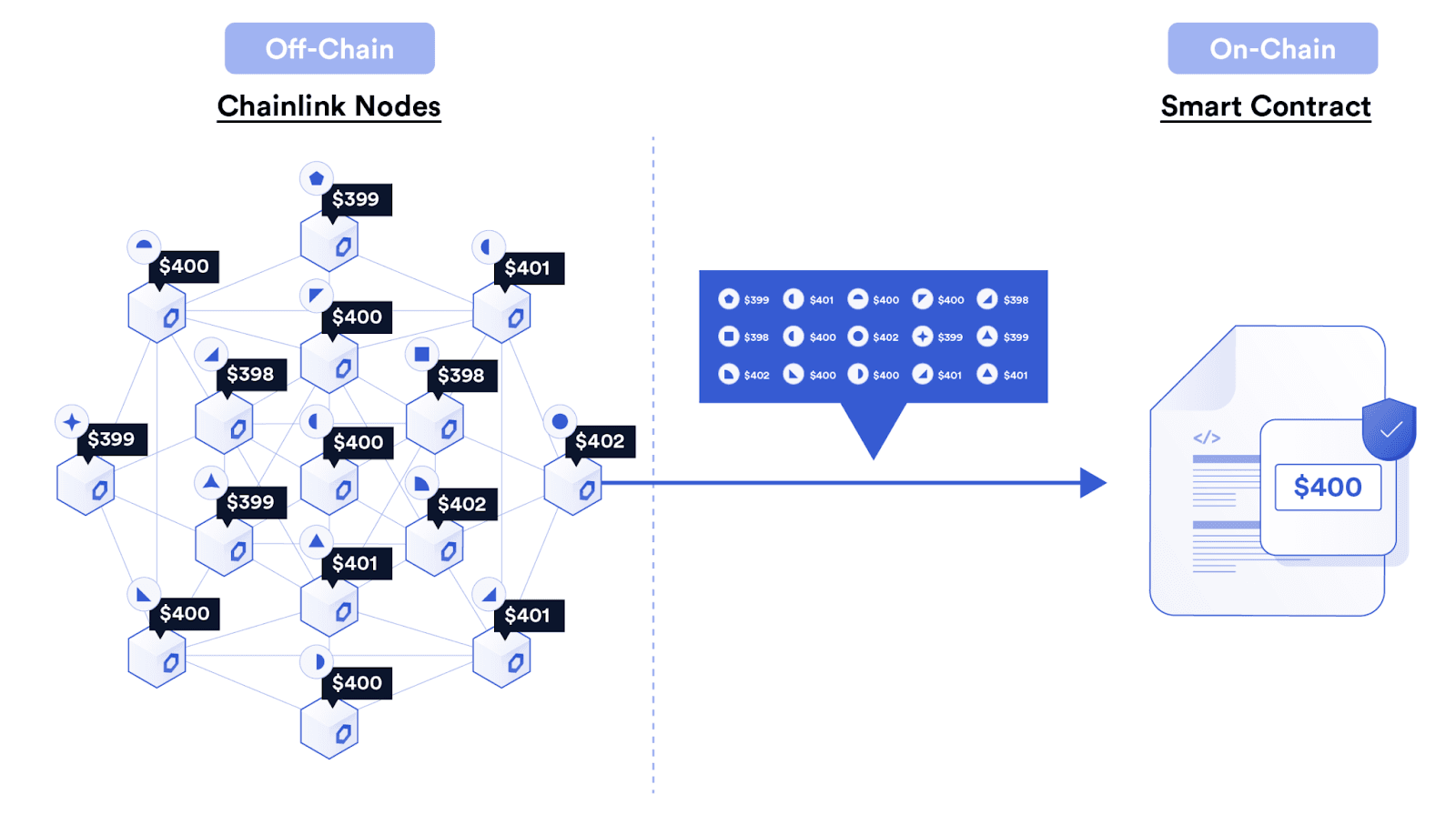

Decentralized applications, particularly derivative markets, require accurate and reliable price feeds for fair and efficient execution. However, blockchains inherently lack the capacity to generate such data independently, necessitating oracles to bridge the gap with off-chain sources.

Injective leverages Chainlink, a leading decentralized oracle network, to integrate real-world data feeds via its cutting-edge OCR technology. This innovative solution boasts a 10x increase in data availability with a 90% reduction in operational costs, unlocking unparalleled scalability and affordability.

Chainlink feeds rely on a network of independent, Sybil-resistant nodes operated by renowned security and blockchain DevOps teams. These nodes meticulously gather data from premium off-chain aggregators, ensuring broad market coverage and high-fidelity representation.

Injective's OCR module stands as a groundbreaking innovation. By crafting a custom integration from the ground up, Injective has not only unlocked Chainlink's diverse price feeds for its own users but also paved the way for seamless integration across all Cosmos SDK-based chains. This opens doors for broader adoption of reliable and secure data oracles within the Cosmos ecosystem.

Oracle

Injective's Oracle module stands as a cornerstone of its robust derivatives trading infrastructure. By ensuring secure and reliable data access, it fuels the creation of innovative financial products and fosters a thriving DeFi ecosystem.

The Oracle module operates through a well-defined workflow. Relayers with proper authorization submit price data, which is subsequently validated and stored within the system. Additionally, the module automatically filters out extreme values (less than 1% or greater than 100x from last prices) to safeguard against potential manipulation attempts.

Injective harnesses the power of Band (IBC) protocol to facilitate seamless integration with its decentralized oracle network. This enables native access to customized data feeds provided by BandChain, expanding the spectrum of available data sources for Injective users and enriching their analytical capabilities.

The recent Volan upgrade introduces a groundbreaking feature: direct on-chain integration of off-chain price feeds. This empowers dApps built on Injective to incorporate a wider array of exotic assets, encompassing real-world assets (RWAs), foreign exchange (FX), and tokenized bonds, significantly expanding the scope of financial instruments available within the ecosystem.

Peggy

As Injective Chain strives to become a leading hub for innovative DeFi applications, fostering seamless interaction with other blockchains becomes crucial. The Peggy module is a crucial component of this mission, enabling a decentralized and trustless bridge between Injective Chain and Ethereum blockchain.

Traditionally, transferring assets between different blockchains often involved centralized third-party custodians, raising concerns about trust and security.

Injective breaks this mold by establishing a decentralized, non-custodial bridge, empowering users with direct control over their assets. Unlike custodial bridges, it leverages the Injective Chain's Proof-of-Stake consensus, eliminating the need for centralized entities and fostering enhanced security.

Its architecture revolves around three key components:

- Peggy Contract (Ethereum): This cross-chain smart contract handles ERC-20 token transfers from Ethereum to the Injective Chain, ensuring verifiable and secure transactions.

- Peggo Orchestrator: Operated by each Injective validator, this off-chain relayer transmits ERC-20 transfer data to Injective Chain, facilitating efficient communication.

- Peggy Module (Injective Chain): Responsible for minting new tokens on the Injective Chain upon an ERC-20 deposit from Ethereum, and burning tokens upon withdrawing a token from the Injective Chain back to Ethereum. It also manages validator incentives to maintain system integrity.

Peggy facilitates bidirectional cross-chain token transfers, enabling users to seamlessly move ERC-20 tokens between Ethereum and Injective Chain. This unlocks diverse opportunities for asset utilization, allowing users to participate in Injective's unique trading features and explore other DeFi applications across different blockchains.

Tokenfactory

The Token Factory module empowers decentralized applications (dApps) and users to effortlessly create and manage customized native tokens on the Injective Chain.

The module removes the requirement for permissioned authorities, enabling any account to mint new tokens. This permissionless approach leverages a unique naming convention - factory/{creator address}/{subdenom} - effectively mitigating potential name collisions by namespacing tokens based on the creator's address. This empowers individual users and dApps to readily launch their own tokenized assets within the Injective ecosystem.

A single account can establish distinct token types by simply providing unique subdenoms for each creation. Upon successful token creation, the initial creator acquires "admin" privileges over the token, granting them the ability to:

- Mint tokens to any account within the ecosystem, facilitating distribution and expanding token circulation.

- Burn tokens from any account, ensuring flexibility in managing token supply and addressing potential overruns.

- Initiate token transfers between any two accounts, fostering seamless movement of tokens within the Injective network.

- Modify the admin associated with the token, offering granular control over token management responsibilities.

In the future, the Injective Team aims to expand the administrative capabilities provided by the Token Factory module.

Wasmx

The Wasmx module serves as the foundation for integrating and executing CosmWasm smart contracts within the Injective Chain. Unlike traditional CosmWasm implementations, Injective's Wasmx introduces a groundbreaking innovation: automatic execution of smart contracts within every block. This eliminates the need for explicit user interaction to trigger contract execution, enabling continuous and autonomous operation of dApps built on Injective.

The Injective Wasmx module stands as a transformative addition to the CosmWasm landscape. Its automated execution framework and developer-centric tools empower the creation of groundbreaking, decentralized, and permissionless dApps within the ecosystem.

Real World Asset (RWA)

In the latest update, Injective introduced the Real World Asset (RWA) module, revolutionizing the bridge between traditional and decentralized finance. The RWA module enables institutions to tokenize diverse assets like fiat pairs, treasury bills, credit products, real estate, and artwork. These tokenized assets benefit from blockchain's advantages, such as fractional ownership, improved liquidity, and seamless trading through compliant gateways.

The module includes a permissioning system, allowing institutions to control access to their tokenized assets, ensuring compliance and selective participation. This unlocks new asset classes for DeFi, promoting portfolio diversification and offering individual investors access to investments previously reserved for institutions.

Injective APIs

Injective coupled with its extensive API offerings, invites everyone to be part of a vast global trading community. The Injective APIs empower individuals, institutions, liquidity providers, and algorithmic traders to run all components of the Injective's backend infrastructure.

Injective API nodes serve as the backbone of the Blockchain, providing crucial infrastructure for developers and users alike.

These nodes fulfill two critical functions:

1. Data Layer

API nodes act as tireless data providers, indexing block events from the Injective Chain. This readily available data empowers external clients, including developers and dApps, to interact with the Injective efficiently. This fosters transparency, trust, and broad accessibility within the DeFi landscape.

2. Fee Delegation Service

Beyond data provision, Injective API nodes can offer an optional fee delegation service, providing users with the ability to trade at zero commission, which is a significant benefit in the DeFi space. This service is particularly beneficial for newcomers or those seeking to test the platform without upfront costs.

By embracing Injective APIs, developers can significantly reduce the development time for DeFi applications, leveraging a high-quality, decentralized, and permissionless infrastructure.

As projects integrate Injective into their products, they become vital contributors, acting as relayers and liquidity sources to the protocol and receiving incentives for their valuable contributions to the network. Injective API emerges not just as a technical solution, but as a gateway to democratizing and globalizing decentralized finance.

Whether utilizing the Exchange API, Coordinator API, Derivatives API, or the Graph API, developers can seamlessly integrate their applications with the Injective Chain. With complete SDKs for Python, Go, and TypeScript, Injective ensures accessibility for developers across different programming languages.

Injective's commitment to providing cutting-edge solutions is evident in its latest enterprise APIs. A substantial update has significantly reduced latency, offering institutional users up to a 90% improvement in processing speed. This enhancement results from an innovative mechanism enabling users to post transactions directly onto the blockchain, bypassing indexers.

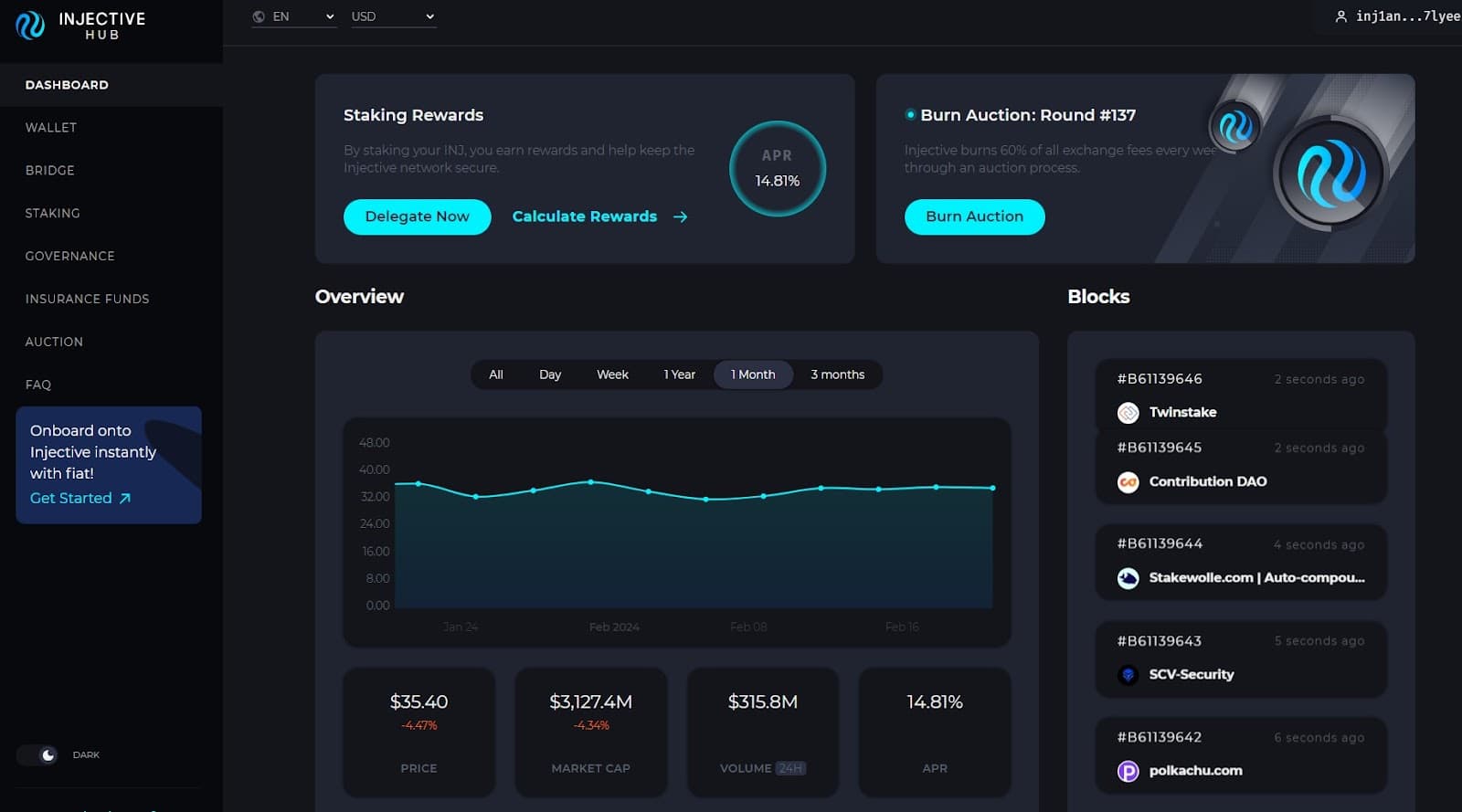

Injective Hub

The Injective Hub is a critical gateway in the ecosystem, seamlessly integrating core functionalities to empower individuals, developers, institutions, and liquidity providers. More than just an interface, it unlocks diverse opportunities for participation and contribution within the Injective.

- Staking: Users can stake INJ tokens, the native fuel of the blockchain, to contribute to network security and earn rewards. This fosters ecosystem stability while offering individuals a path to financial gain.

- Governance: INJ token holders gain voting rights within the Injective, determining its future course through proposals related to blockchain upgrades, tokenomics, and other critical decisions.

- Insurance Funds: These mitigate risks associated with high-risk assets, attracting both individual and institutional participants seeking a secure DeFi experience.

- Auction: Users and projects can participate in a weekly auction that aims to reduce token issuance by burning INJ and rewarding the winning bidder with a basket of tokens. This encourages community engagement and further increases the utility of INJ tokens.

- Bridge: This powerful tool facilitates seamless asset transfers between the Injective Chain and various 20+ other blockchains, including Ethereum and Solana. This fosters interoperability and broadens the accessibility of DeFi opportunities.

- Fiat Gateway: Users have a convenient and fast option to purchase INJ tokens for fiat directly on the platform through multiple payment providers.

- Wallet Integration: Seamless connections to popular wallets like Keplr and MetaMask empower users to manage assets conveniently and interact with various DeFi applications within the ecosystem, ensuring a user-friendly and cross-chain experience.

Our previous article provided a detailed examination of each aspect of the Injective Hub.

By offering a comprehensive suite of functionalities, fostering collaboration, and prioritizing user experience, Injective Hub empowers diverse stakeholders.

Oracles

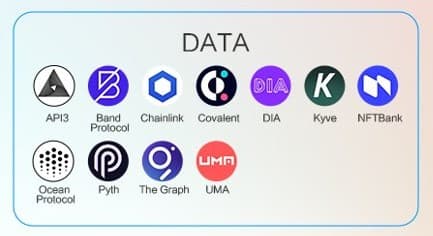

While Injective's bridge infrastructure facilitates seamless communication across chains, another critical layer ensures the trustworthiness of external data feeding into its smart contracts: oracles. Injective doesn't rely on a single source of truth but embraces a multi-oracle approach, weaving a symphony of reliable data feeds for robust decentralized derivatives.

Imagine a trader on Injective executing a futures contract based on the price of gold. Blockchain doesn't store this price itself, it relies on oracles to fetch it from reputable sources. To guarantee accuracy and prevent manipulation, Injective doesn't simply pick one oracle. Instead, it leverages a diverse group, including Band Protocol and Chainlink. Each oracle transmits the same data point, and Injective's consensus mechanism aggregates these feeds, filtering out outliers and ensuring the integrity of the final price used in the contract.

Multi-VM development environments

Injective is now the only chain to support WASM, EVM and SVM development environments.

WASM

Since Injective is Cosmos-based blockchain, its development environment relies on CosmWasm, a smart-contract platform built on WebAssembly (WASM). This opens doors for developers accustomed to languages like Rust and Go, allowing them to seamlessly transition to dApp development within the Injective ecosystem.

One notable aspect of Injective's CosmWasm implementation is its capability to automate smart contract execution, facilitating streamlined operations and enhancing user experience. Beyond the standard CosmWasm experience, Injective offers pre-built modules and unique functionalities tailored to its ecosystem. Access to the on-chain order book and margin trading engine empowers developers to craft dApps deeply integrated with Injective's core strengths, unlocking previously unimaginable possibilities.

CosmWasm contracts are not confined to Injective's chains. They can interact seamlessly with assets and functionalities across various chains connected through Injective's network. In addition to the Cosmos ecosystem networks, for example, Astar Network a leading Polkadot parachain, is integrated with Injective providing access to Astar's diverse assets, fostering synergies within the broader Polkadot and IBC networks. Astar's unique approach lies in its dual support for Ethereum Virtual Machine (EVM) and WebAssembly (WASM) environments.

This unlocks a universe of possibilities, enabling dApps to access diverse DeFi protocols, liquidity pools, and other applications across interconnected ecosystems.

inSVM

Imagine seamlessly deploying your Solana dApps to the interconnected Cosmos universe, without rewriting code or sacrificing developer experience.

This vision becomes reality with Cascade sidechain that brings the first Solana Sealevel Virtual Machine (SVM) rollup within the Cosmos ecosystem, empowering Solana developers to seamlessly deploy their dApps without codebase modifications or intricate tooling changes.

The ambitious initiative, born from the combined efforts of Injective's team and Eclipse (customizable rollup provider), acts as a bridge, unlocking a wealth of benefits for both developers and users alike. This collaborative approach, empowers developers to "pick and choose" the best aspects of different blockchain technologies, streamlining their path to deploying dApps within the vast Cosmos ecosystem.

Developers gain access to the expansive Cosmos user base, exponentially amplifying their potential reach and impact. Additionally, Injective's infrastructure, mirroring Solana's SVM in its parallel processing capabilities, guarantees high-performance and cost-effective transactions. This paves the way for scalable dApps catering to a broader audience and fostering a flourishing developer community within the Cosmos network.

Injective users stand to gain immense value from the influx of established and proven Solana dApps brought in by Cascade. This enriches their experience, offering a wider array of applications and functionalities within their familiar environment. The diversity not only expands user choice and caters to a broader range of needs but also fosters a dynamic and multifaceted dApp ecosystem within Cosmos.

inEVM

inEVM, the brainchild of Injective and Caldera, stands as a revolutionary portal for Ethereum developers seeking to expand their reach beyond the familiar confines of their native ecosystem.

This innovative EVM-sidechain allows developers to effortlessly deploy their existing Solidity codebase and leverage their established tooling within the dynamic Injective universe. By leveraging the power of rollup technology, inEVM offers significant scalability improvements, expediting transaction processing speed while significantly reducing costs.

However, the true power of inEVM lies in its ability to unlock an interconnected future within the Web3 landscape. Shared liquidity across the Cosmos IBC universe and Solana opens doors to previously untapped markets and user segments, further enriching the Injective ecosystem.

This fosters a vibrant environment where dApps can seamlessly interact and exchange value, leading to groundbreaking possibilities and enhanced composability, ultimately benefiting the entire Injective community.

By dismantling the barriers between ecosystems and empowering developers with a familiar yet powerful toolkit, inEVM paves the way for a future where collaboration and shared knowledge drive innovation within the Injective ecosystem.

Interoperability and bridges

With a major focus of the Injective team on interoperability, the project continues to actively expand its integration with other networks and bridges.

IBC Integration: Injective leverages the Inter-Blockchain Communication (IBC) protocol, a native feature of the Cosmos ecosystem.

The recent Volan upgrade significantly enhances IBC protocol, enabling direct interaction between external dApps and its on-chain orderbook. This unlocks advanced functionalities like cross-chain swaps and order routing for users on other Cosmos chains, executed seamlessly through Injective's robust engine.

Injective's Native Peggy Bridge: This decentralized bridge, secured by Injective's validators, facilitates a trustless, on-chain bidirectional token bridge, allowing seamless conversion between ERC-20 tokens on Ethereum and Cosmos-native coins on the Injective Chain.

Wormhole: This recent addition connects Injective to an array of prominent L1 and L2 networks like Solana, BNB Chain, Avalanche and others. This significantly expands the reach of Injective's ecosystem, allowing users to bridge assets from these diverse chains through a single gateway.

Gravity Bridge: The Injective Chain uses a two-way peg for ETH & ERC-20 tokens using the peg-zone architecture that is based on the Cosmos blockchains' Gravity Bridge. The Gravity Bridge enables cross-chain transfers of assets between Cosmos and Ethereum.

Axelar: provides connections to a wider range of blockchains, including EVM networks. This expands the reach of Injective's assets and functionalities, attracting users and developers from diverse ecosystems.

Celer: noncustodial asset bridge designed to facilitate token transfers across over 40 blockchains and layer-2 rollups. Utilizing the robust foundation of the Celer Inter-chain Messaging Framework, cBridge has successfully handled over $14 billion in cross-chain asset transfer volume.

Privacy and Security

Injective understands the paramount importance of security and privacy within the decentralized finance (DeFi) landscape. It goes beyond offering traditional security measures but also integrates innovative solutions to empower users and foster trust in its ecosystem.

Injective integrates 1RPC, a privacy-preserving Web3 endpoint relay developed by Automata Network. This innovative solution acts as a shield, preventing the leakage of sensitive user information during interactions with the blockchain. With over 20 billion relays protected since launch and support for 53+ networks, 1RPC fosters a transparent yet private experience for users.

To empower project builders and individual users, Injective introduces Apollo Safe, the first-ever multi-signature protocol on its platform. Through a user-friendly interface, Apollo Safe allows for the creation of multisig wallets, requiring multiple approvals for transactions. This collaborative approach adds an extra layer of security, safeguarding assets and mitigating individual vulnerabilities.

Building trust requires validation. Injective has undergone rigorous audit by Informal Systems, a security company. These evaluations scrutinize the blockchains's codebase and underlying infrastructure, identifying and addressing potential vulnerabilities. By embracing comprehensive audits, Injective demonstrates its commitment to providing a secure and reliable platform for its users.

Optimizing DeFi Through Tailored Solutions

Injective transcends the limitations of traditional DEXs by offering a suite of solutions specifically designed to address the core challenges impeding DeFi's widespread adoption. Through its focus on speed, scalability, interoperability, and an open, community-driven approach, Injective positions itself as a leading force in shaping a more efficient, accessible, and innovative DeFi future.

Addressing Challenges with Innovation:

- Decentralized Orderbook: Traditional DEXs often grapple with network congestion and high gas fees, leading to sluggish transactions and exorbitant costs for users. Injective tackles this head-on by employing a decentralized order book matched directly on-chain. This innovative approach ensures fast and efficient trade execution, eliminating the need for centralized order matching engines and their associated trust concerns. Furthermore, Injective's MEV-resistant infrastructure prevents front-running, guaranteeing fair and transparent trades for all participants.

- Permissionless Market Creation: Many DEXs restrict users to pre-defined markets, stifling innovation and limiting investment opportunities. Injective breaks free from this paradigm by enabling unrestricted market creation and usage. This permissionless and community-driven approach empowers anyone to create custom markets for diverse assets, including derivatives. This fosters a dynamic and inclusive financial ecosystem where innovation flourishes and users gain access to a wider range of financial instruments previously out of reach.

- Cross-Chain Interoperability: Fragmented blockchain ecosystems pose a significant barrier to DeFi's full potential. Injective recognizes this problem and addresses it with an entire infrastructure of bridges, protocols, and integration with other networks. By fostering collaboration and liquidity flow across disparate ecosystems, Injective contributes significantly to the growth and interconnectedness of the DeFi landscape.

- Multi-VM Execution Framework: Streamlining dApp development, Injective attracts a wider range of developers, enriching the DeFi application landscape within its ecosystem.

- Cost-Effective Participation: Prioritizing lower gas fees, Injective makes DeFi participation more accessible, attracting users from various economic backgrounds and fostering broader financial inclusion.

Injective's commitment to optimizing the DeFi experience goes beyond its core features. By prioritizing user experience and fostering collaboration across blockchain ecosystems, Injective lays the foundation for a truly inclusive and interconnected financial landscape.

Why Build with Injective

Conclusion

Injective goes beyond the traditional boundaries of DeFi, establishing itself as a purpose-built blockchain designed to enable frictionless, interoperable financial interactions. With its carefully engineered architecture, it overcomes the limitations of typical DEXs, providing an optimized environment for fast trading and seamless cross-chain connectivity.

Moreover, Injective bridges the gap between decentralized finance and traditional financial markets by integrating real-world assets (RWAs). This opens the door to institutional participation, driving DeFi towards broader adoption and closer alignment with mainstream finance.

Injective’s commitment to innovation is not just about delivering individual solutions but fostering a collaborative ecosystem. By continuously partnering with developers and other DeFi projects, Injective cultivates a collective vision for a future where finance is borderless, decentralized, and driven by user empowerment.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.