Key Takeaways

- Innovative Consensus: Combines DAG and Blockchain technologies for faster, more efficient transaction verification.

- Scalability: Object-oriented architecture and parallel transaction processing allow for unlimited horizontal scalability.

- Sui Move Language: A new smart contract language prioritizing security and flexibility.

- Unique Ownership Model: Uses objects with different ownership types for enhanced control over on-chain assets.

- Security Focus: Strong protections against vulnerabilities like reentrancy and double spending.

If you haven't read our first article, we recommend you start with it to get into the technicalities of the project more easily. SUI - Explainer

How Sui Works

Imagine a blockchain that can sidestep consensus for everyday transactions, eliminating the bottlenecks that plague many contemporary blockchains. In addition, its object-oriented data representation enables parallel execution of transactions, allowing horizontal scaling.

Intrigued? Now, first things first.

Spearheaded by the forward-thinking innovators at Mysten Labs, Sui project stands out as a cutting-edge blockchain platform with a fresh approach to adaptability, scalability, and security.

Consensus Mechanism

To organize the operation of the network, Sui utilizes the widely-adopted Delegated-Proof-of-Stake (DPoS) consensus algorithm, with transaction processing conducted by validator groups that change every 24 hours and represent active full nodes.

As the consensus suggests, a validator's voting power in the network is determined by the amount of stake delegated to them by SUI token holders. The higher delegated stake is, the more voting power a validator has. In exchange for processing transactions and conducting consensus, validators receive rewards.

You may say, "Nothing new! Most DPoS blockchains inherit the same principles", but let's not be hasty, the fun part is next.

Here we have a something special from Mysten Labs team – a mix of two powerful ideas, DAG and Blockchain!

At the high level, DAG-based consensus is a mechanism in which verification occurs at the transaction level rather than at the block level as in other traditional blockchain systems.

In the realm of blockchains and distributed ledger technologies, DAGs (Directed Acyclic Graphs) serve as an alternative to the conventional blockchain structure. Rather than forming a linear chain of blocks, these systems establish a graph of transactions. In this structure, each transaction validates one or more preceding transactions, offering the potential for increased scalability and parallel processing.

DAG, or Directed Acyclic Graph, is a computer science and mathematical concept depicting a graph with no directed cycles. In a DAG, edges have a defined direction, moving from one vertex to another, creating a non-cyclic structure. This ensures that traversing the graph along the edges' directions won't lead back to the starting vertex.

Notable systems employing DAGs include IOTA, Hedera Hashgraph, and Nano. Other networks, like Fantom and Casper, showcasing their incorporation of DAG elements within a traditional blockchain framework.

The primary advantage of the DAG-based consensus system lies in its ability to achieve high-throughput parallelization. This means that numerous transaction processes, not reliant on strict ordering among themselves, can occur simultaneously in parallel.

Recently Sui has introduced Mysticeti, a new redesigned consensus protocol, which improves on Narwhal-Bullshark by addressing specific latency issues inherent in the system. Designed specifically for Sui, Mysticeti supports both single-owner object transactions, the fast path, and shared object transactions, at a fraction of the CPU costs and complexity of today’s Sui network.

Key innovations of Mysticeti include:

- Round Trip Efficiency: Mysticeti validators sign and share their blocks, achieving latency of a half round trip per block during a round, reducing round trips by 50% compared to Narwhal-Tusk.

- Simplified Architecture: Mysticeti streamlines transaction processing by eliminating the worker-to-primary communication step, enabling Sui to achieve a throughput of over 100,000 transactions per second.

- Novel Commit Rule: Mysticeti’s commit rule appoints multiple leaders every round, committing more transactions earlier and reducing latency significantly.

These innovations result in Mysticeti achieving fast transaction confirmation in about half a second, while still maintaining high throughput and the key benefits of DAG consensus, such as robustness and censorship resistance.

Next, we'll cover solutions that allow Sui to scale without an upper limit.

Scalability of Sui

Object-oriented architecture

Sui stands out from other distributed ledgers due to its hybrid model where its history is stored in objects with globally unique IDs.

Most smart contract platforms like Ethereum utilize accounts to manage the blockchain's state, holding user balances, while other like Bitcoin and Cardano employ unspent transaction outputs (UTXO) to represent the remaining asset amount post-transaction.

Unlike traditional blockchains relying on accounts as the fundamental data entities, Sui revolutionizes the approach with an object-centric paradigm. Within this framework, on-chain entities take the form of objects, meticulously shaped and regulated by smart contracts.

Sui Smart Contracts are also objects called Move Package. During transactions, the objects involved in the transaction are dynamically grouped and treated as this group.

These objects embody diverse asset types, featuring specific attributes such as unique identifiers and ownership information.

One of the key components of Sui's object-centric model is a feature called "Transfer to Object," which went on mainnet in 2024. It gives the objects the ability to receive other objects directly, thereby allowing smart contracts to provide even more complex and dynamic sets of interactions.

Previously, only an address could be the recipient of a transferred object. This enhancement can now enable transferring objects to other objects, thus opening the floodgates to a whole new range of possibilities that can be leveraged by the developers.

Key benefits and use cases of Transfer to Object

Improved Object Ownership: It enriches Sui's object ownership model by allowing objects to own other objects (child objects). These child objects can be transferred out to other objects according to predefined rules. This allows to reach finer control against object interactions.

Kiosk Functionality: A feature that allows many-to-one concurrent interactions with an object. Example: Many ticket receipts are allowed to be sent in parallel to one ticket register object. It supports mass airdrops to Kiosks and transferring assets between Kiosks.

Smart Contract Wallets: Transfer to Object enables developing smart contracts wallets with access to objects based on dynamic policies. As a result, multi-sig support, spending limits, and upgradable security policies become possible, similar to functionalities of Account Abstraction ERC-4337 on Ethereum.

RWA Tokenization: This feature enables the direct tokenization of real-world assets that are often subject to complex compliance and separation-of-concern requirements. Transfer to Object makes fine-grained and flexible transfer policies possible, reducing friction in onboarding for institutions considering the RWA tokenization.

Furthermore, Sui's objects showcase adaptability, allowing them to be either mutable or immutable, providing a nuanced strategy for asset management and interactions in the blockchain realm.

As a result, Sui has five types of ownership for objects:

- Owned by an address: Objects owned by a specific address are accessible only through transactions signed by that particular address. (This is common for items like NFTs or fungible tokens)

- Owned by another object: Referred to as child objects, these objects require transactions to be signed by the owner of the parent object for access. (For example, in gaming NFTs, a sword NFT might be owned by an avatar NFT)

- Immutable: Immutable objects cannot be modified or owned by anyone after creation, but they can be read. (Move Packages, such as auctions frozen after completion, fall into this category)

- Shared: Objects falling into this category can be interacted with and accessed by anyone based on the access-control mechanism defined by the smart contract governing the object. (These objects need consensus for sequencing reads/writes and can enforce their access control during execution, making them suitable for use cases like decentralized exchanges (DEXs) or auctions)

- Wrapped: Once an object is wrapped, it no longer exists independently on-chain. It becomes part of the data of the object that wraps it. Wrapping can be used to restrict access to an object, making it inaccessible outside specific contract calls.

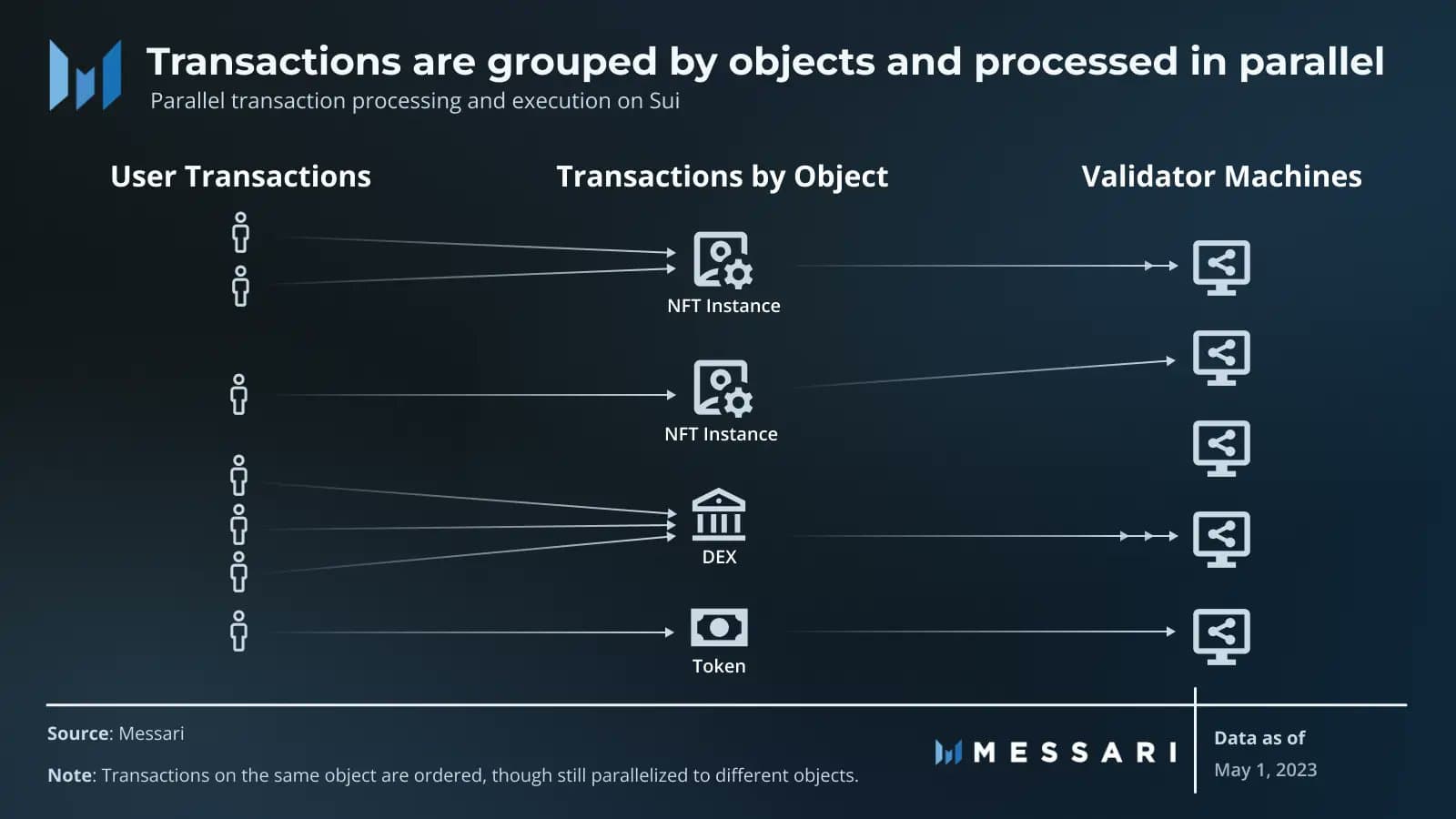

Sui's object-centric model unleashes scalable parallelization for object interactions. Transactions are organized by the involved object, enabling validators to handle them simultaneously on separate machines if they're independent. This scalability boosts as validators expand their node with more machines, offering a distinctive pathway for network growth.

Magic of Parallel Processing

And now a short note on how some transactions are executed, bypassing consensus.

Traditional blockchains often face a bottleneck, requiring strict structuring of each transaction, which ultimately affects network throughput.

Sui's approach addresses this problem by eliminating consensus on objects, that are categorized as simple transactions. An example of a simple transaction would be the transfer of an asset to someone. Meanwhile, shared objects, which are classified as transactions or sets of transactions with strong interdependencies, go through consensus.

With this solution, simple transactions, being independent, can be processed in parallel without the need to maintain a strict sequence and the agreement of the entire validator pool.

For a high-throughput blockchain like Sui, the capability of processing many transactions both quickly and safely is very important. However, shared objects add some complexity: many transactions editing the same shared object have to be executed one by one in order to keep data consistent, further leading to larger checkpoint times, which may impede the efficiency of state synchronizations.

Sui's previous congestion control mechanism was limited, completely managed by the transaction manager. It frequently resulted in partial rejections of transactions and object lockups due to inconsistencies across validators. It also lacked any ability to accurately estimate execution times for dependent transactions and the capability to prioritize them according to gas fees.

The new design of the Consensus Handler introduces something more subtle. It introduces a dependency graph which summarizes the execution sequence with respect to their gas price, based on the contention level of the shared objects involved. This brings an accurate estimation of execution latency while enabling efficient transaction processing at the same time.

Key components of the mechanism

- Prioritization: Transactions are ordered into a priority based on their gas fees, with the higher-paying transaction getting executed faster.

This does incentivize users to manage their fees for the timely execution of their offers, especially when the network is in high use.

- Deferral: The consensus handler is now capable of deferring transactions to future consensus commits and better manage dependencies related to execution in checkpoints.

- Cancellation: Transactions that have been deferred several times are explicitly cancelled, in order to avoid resource lockup and maintain system responsiveness. This ensures that transactions unlikely to enter a checkpoint due to insufficient gas or sustained contention do not consume resources indefinitely.

Sui ensures that the complexity of concurrent transactions sharing objects is well-managed to provide a robust and responsive network for demanding, rapidly growing ecosystems of decentralized apps.

Having understood how parallelization occurs in a network, let's take a closer look at horizontal scalability.

Horizontal Scalability

Sui's horizontal scalability is a crucial aspect that enables the platform to effectively handle heightened demand across the network. Validators have the flexibility to dynamically adjust their computing power, ensuring that gas fees remain consistently low and stable, even during periods of intensified traffic.

This scalability isn't limited to transaction processing, it seamlessly extends to storage solutions, presenting a cost-effective and scalable approach.

It means that developers can create intricate, feature-rich assets directly on the blockchain. This, in turn, reduces the reliance on external storage solutions, contributing to a more efficient and cost-effective gas utilization.

The Mysten Labs continue working on scalability and published tests on Pilotfish, a prototype Sui extension, represents a quantum leap in blockchain scalability. This innovative multi-machine execution engine lets Validators split transaction processing across many machines for the next step in Sui's throughput at high-volume, complex applications.

While running tests in a Sui blockchain environment, Pilotfish was able to show the following:

- Higher Throughput: Pilotfish increased throughput supported by 8 machines and was able to showcase the potential for linear scaling.

- Lower Latency: The latency per transaction decreased with the additional machines during the test. At a low latency of 6 to 7 milliseconds, the eight-machine configuration processed five to six times as many individual transfers compared to a single machine.

- Linear Scalability for Compute-Bound Loads: While it is not perfectly linear for simple transfers, Pilotfish has shown close-to-linear scalability for compute-bound loads, thereby showing its ability to efficiently take advantage of extra computational resources.

This development is going to have a great impact on the future of blockchain technologies. The development of Pilotfish is not yet complete; once integrated into the Sui mainnet, much is going to be expected from it. Considering its great originality in horizontal scaling, Pilotfish is going to ensure that Sui realizes its full potential and helps build a new face for blockchains.

Interoperability

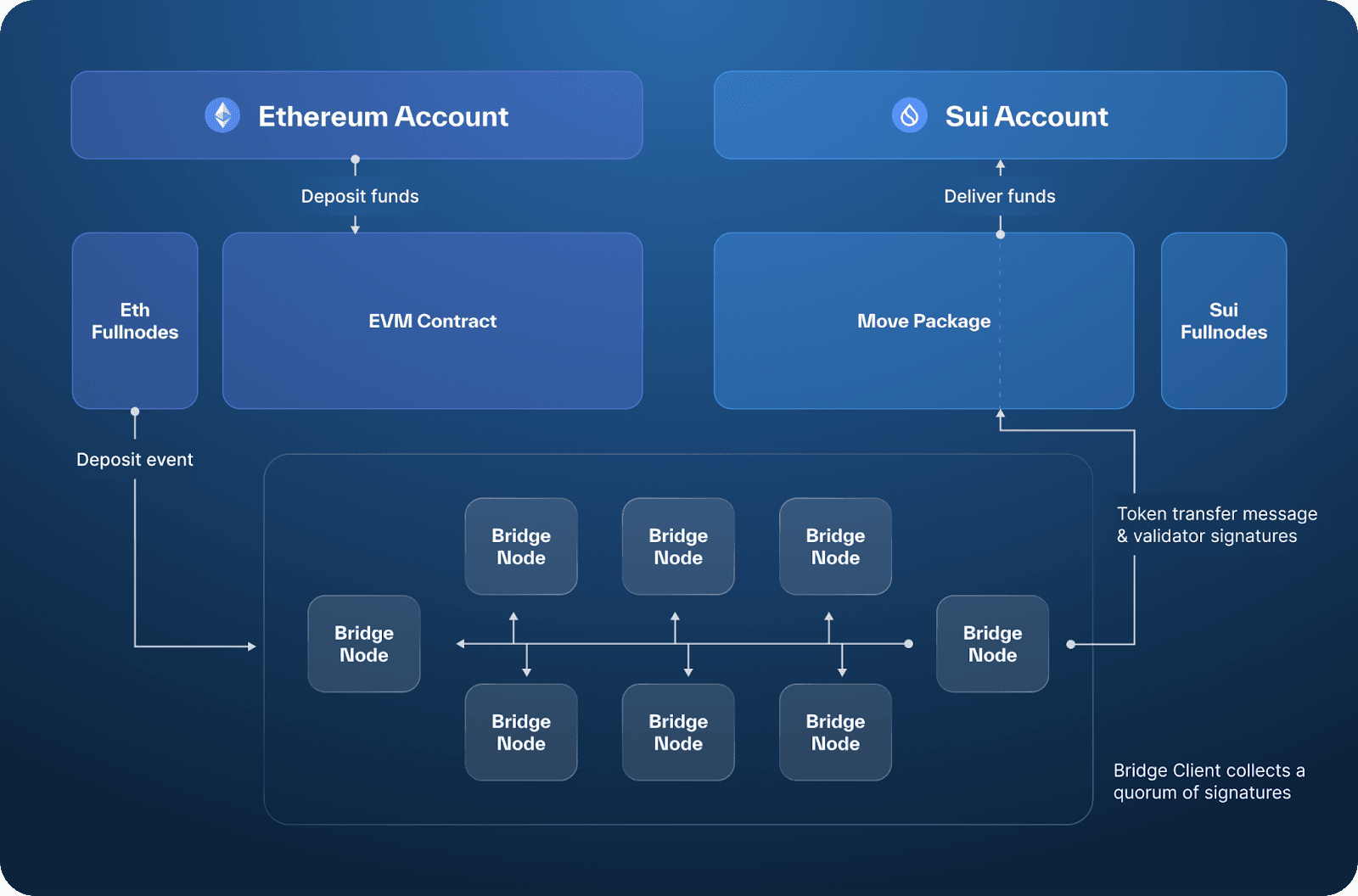

Sui believes that no blockchain ecosystem will achieve complete success without proper, seamless interoperability between different networks. One great step toward this goal is the Sui Bridge, which launched on Mainnet in September 2024 and natively allows for secure and efficient asset transfers between Sui and external blockchains, starting with Ethereum.

Key Features and Benefits of Sui Bridge

Sui Bridge goes far beyond a simple linker and reflects a well-thought-out system with its main goals in optimizing security, efficiency, and user experience.

- Native Integration: Sui Bridge is developed natively for Sui, drawing full advantage of its object-oriented architecture and programmable transaction blocks to ensure secure and efficient cross-chain transfers.

- Trust-minimized security: While most bridges are secure because of the security of the external set of validators or intermediaries, the Sui Bridge is secured by the same set of validators responsible for the security of the Sui network itself. This inherently means robustness and decentralization of Sui's infrastructure ensure that the security for bridged assets enjoys the same level as that of the native Sui assets.

- Prioritization of User Experience: The first release of Sui Bridge started by implementing the transfers of ETH and WETH, demonstrating a focused approach that prioritizes a stable and secure user experience. More functionalities, supported assets will arrive with time, enlarging the bridge's versatility without sacrificing its reliability.

- Efficient and Transparent Architecture: By design, the core architecture of Sui Bridge is streamlined, with four key components:

This see-through design gives users full control over asset flow and enables verification of security around the bridging process.

- On-chain transparency: Bridging records and approvals are kept on-chain in the Sui Bridge object, ensuring they are transparent and auditable. This on-chain record-keeping allows for public verification of bridge operations, fostering trust and accountability. Moreover, the Sui Bridge contract handles governance actions, meaning that its operation can be adapted and upgraded to meet the evolving needs of the Sui ecosystem.

- Robust Security: Sui Bridge uses the Elliptic Curve Digital Signature Algorithm, or ECDSA, for the secure verification of the set of transactions and for compatibility with other blockchain networks. The recoverable ECDSA signatures further smoothen the verification process, hence making it efficient and secure.

- Optimized Bridge Messages: Sui employs lightweight and standardized message formats with the goal of minimizing gas costs involved in cross-chain communication. Examples include only the essential information in the bridge message, such as message type, version, sequence number, source chain identifier, and payload. This should reduce unnecessary complexity and computational overhead, and thus enable fast and cost-efficient cross-chain interactions.

- Future-Proof Design: Sui Bridge architecture is designed to scale and extend in line with growing demand, further integrations with other blockchain networks, and future development. This foresighted design gives assurance that the Sui Bridge would be able to evolve in a maturing landscape of blockchain interoperability-supporting new assets, functionalities, and cross-chain interactions.

Beyond Sui Bridge

Besides Sui Bridge, the introduction of the Cross-Chain Transfer Protocol will add to Sui's interoperability in USDC. CCTP enables a safe and efficient transfer of USDC among those chains that supported the protocol, like Sui. The integration will give more powerful composability to developers and increased safety when building applications involving cross-chain USDC transfers.

Sui's commitment to interoperability through Sui Bridge and the upcoming CCTP integration is part of its larger vision for a much better-connected blockchain universe. Enabling seamless asset and data transportation across a wide variety of networks, Sui unleashes builders to achieve new levels of innovation in cross-chain apps and to unlock all-new possibilities for DeFi, gaming, and a host of up-and-coming use cases.

Sui Move & Smart Contracts

In the blockchain field, smart contracts refer to a unique environment focused on automated, rule-enforced transaction execution. The Sui blockchain operates similarly, executing smart contracts written in the Sui Move language.

It's not hard to guess that Sui Move is based on the core of the Move language that was developed by Meta (Facebook) for its Diem (Libra) blockchain project.

In the beginning, Diem explored the option of utilizing existing blockchain programming languages like Solidity for their project. However, they encountered several limitations that were detrimental to the blockchain, which inspired the development of a new programming language called Move.

Since the Diem project focused on creating an advanced payment platform for digital currency supported by blockchain technology, Move was perfectly suited to this goal. Its account-based data model allowed digital assets to be owned by specific accounts. However, the Mysten Labs team's vision went beyond the Diem blockchain. They aimed to create Sui, as a more versatile network infrastructure with exceptional capabilities.

In this case, Sui Move takes a new approach by placing objects at the forefront. This choice gives Sui Move unlimited parallel transaction processing capabilities that traditional sequential blockchains cannot achieve.

With this novel design, Sui's execution environment can effectively differentiate between single-owner objects and shared objects.

Whereas the original Move relied on global storage tied to specific pairs of addresses and types, Sui Move replaces it with a global storage system based on object IDs. This shift opened the door to infinite possibilities where objects can own other objects, a concept known as componentization.

Move and other smart contract programming languages were influenced by cryptocurrencies, where the primary focus was on asset ownership, leading to an account-centric approach. The updated Sui Move paradigm, however, offers incredible flexibility in creating and managing complex and robust smart contracts, opening up opportunities to develop solid programs and engaging games that meet the expectations of the public.

Security Features

You've already aware that the Sui blockchain is based on the principle of treating everything as an object, each with its own unique metadata, ownership attributes, and characteristic reference system.

The Sui Move programming language serves as a foundational element of the Sui architecture and designed for creating efficient, secure and versatile smart contracts with a flexible approach to asset management.

While a completely secure coding language doesn’t yet exist for smart contracts, Sui Move is inherently more secure and intentionally designed to address vulnerabilities found in Solidity, including reentrancy attacks, double spending, DoS attacks, and compiler issues.

A distinctive security feature of Move is the bytecode verifier, which guarantees the validity and safety of a smart contract's bytecode before execution.

Unlike the EVM, which only performs source code verification, confirming equivalence with the bytecode but not the contract's correctness, Move's bytecode verifier is engineered to prevent the execution of malicious code that might create counterfeit coins, artificially inflate coin values, or manipulate existing coins on-chain.

Tokenization & NFTs

Sui is not just a blockchain, but actually a platform that really pushes the boundaries of what you can do with tokenized assets. This includes the combination of its unique object-oriented architecture, state-of-the-art token standards, and a focus on bringing real-world assets into one dynamic, adaptive ecosystem for both NFTs and tokenized assets. It is an approach focused on unlocking blockchain technology for secure, transparent, and efficient digital and physical representation and management of anything.

Soulbound Tokens (SBTs)

Sui enables the creation SBTs, non-transferable NFT tokens that can represent a person identity, credentials, or achievements in the digital world. Most interesting of all regarding Sui's implementation of SBTs is that they can change and evolve through dynamic fields according to changing circumstances and user interactions. This newfound dynamic capability opens the floodgate of exciting possibilities for SBTs in areas such as verifiable credentials, reputation systems, event ticketing, gaming achievements, and intellectual property protection. Imagine a future in which your educational degrees, professional certifications, and even your online reputation take physical form in the shape of SBTs, forming a sort of verifiable and portable digital identity owned by you.

Use Cases and Examples:

- DeepBook and SuiNS: These projects have used SBTs for token allocations and community engagement before token launches, demonstrating the versatility of SBTs for managing early access and governance rights.

- SuiLink: This uses SBTs for cross-chain identity verification, showing the potential of SBTs to bring security and interoperability into decentralized identity solutions.

- SuiPlay0X1: Uses SBTs to pre-order the physical device - a use case of how SBTs can bridge the physical and digital world.

Closed-Loop Tokens (CLTs)

Compared to Sui's Coin standard, CLTs are much more containable and customizable. They allow developers to create closed token systems that come with predetermined rules and constraints, making them ideal for loyalty programs, in-game currencies, and restricted marketplaces. Then, picture a loyalty program with reward tokens spendable only on a subset of products or services, or maybe an in-game currency spent within a particular game or virtual world. CLTs empower builders to build such tailored token economies, enhancing security, compliance, and user engagement.

The Sui framework gives developers the following options using the CLT standard:

- Restrict token usage to authorized apps.

- Specifying user-defined policies regarding transfers, spends, and conversions.

- Imposing arbitrary restrictions on token transfers between user addresses, spending of tokens, and the usage of tokens through smart contracts.

CLTs give builders a greater degree of permissions and customization of how tokens are used and transferred within their applications.

P2P NFT Trading and Royalties

Sui supports peer-to-peer trading of NFTs directly through its Kiosk primitive. This is a native part of the platform, which enables the creation of zero-fee trading platforms with a high degree of customization over transfer policies. Here, builders can implement policies for enforcing royalties or depend on Sui's own pre-built royalty primitive.

It allows creators to keep earning from their work in perpetuity, even as their NFTs change hands. This makes the ecosystem more sustainable and fair for digital artists and creators. The versatility of the Kiosk primitive extends beyond buying and selling; the functionality also includes the borrowing and lending of NFTs, thus expanding the prospect of utility and interaction with NFTs.

Real-World Asset (RWA)

Sui's architecture and primitives support tokenization and make use of RWAs in ways no other blockchain is uniquely supporting. This bridges a gap from TradFi into DeFi for the potential use of RWAs onto blockchain for real estate, commodities, and artwork.

- Sui's dynamic NFTs can make RWAs represented in such a way that they can evolve and update over time, capturing changes in asset attributes or valuations. This ensures that the digital representation of the asset is accurate and transparent.

- Sui Kiosk makes the transaction of RWAs easier, hence making it more accessible for users to buy or sell a tokenized asset or lease it out. This lowers the barrier to entry for investors and traders who want to be involved, thus democratizing traditionally illiquid assets.

- Closed-Loop Tokens allow a higher degree of control and customization, hence enabling such assets to comply with the standards set by regulators and, where needed, specific restrictions on use.

This is key towards enabling tokenized RWAs to operate within the legal and regulatory bounds for their propositions, thereby further increasing their level of trust and eventual adoption by institutional investors.

Sui stands in a perfect position to become one of the leading platforms for the next generation of tokenized assets and NFTs. Its unique blend of scalability, security, flexibility, and interoperability forms a fertile ground for innovation in space. The more the Sui ecosystem keeps growing and changing, the more creative and impactful uses of tokenization and NFTs we will further see in changing how we will interact with digital and physical assets in the decentralized world.

DeepBook: Liquidity Layer

DeepBook represents the core building block of the Sui DeFi ecosystem, acting as a secure, efficient, and accessible liquidity layer for a wide variety of decentralized financial applications. It empowers developers and users with the tools and infrastructure to create and participate in a rich DeFi ecosystem on Sui.

With these tools, the creativeness of DeFi builders can be focused on creating unique features and value propositions, rather than troubleshooting problems with simple trading logic and bootstrapping of independent liquidity pools. Applications powered through the DeepBook API can embed advanced trading functionality, enabling users to execute trades by utilizing its smart routing functionality to ensure competitive prices for swaps.

Serving as a sophisticated CLOB system, DeepBook’s architecture is carefully optimized for high-throughput trading, whereby traders can execute orders in an expeditious way at fair prices, having been given an edge in their trading capability. At its core lies a distinctive design wherein each trading pair is assigned a shared object representing the pool. This facilitates the reduction of conflicts between pairs and greatly enhances the parallelization of transactions. Combined with Sui's high-throughput consensus engine, this ensures that DeepBook is able to provide a trading experience that's comparable to centralized trading platforms.

DeepBook grants access to an extensive range of order types, including market and limit orders, ensuring flexibility and control for effectively carrying out trading strategies. In addition, smart routing functionality employs Depth-First-Search algorithms in finding the most efficient token swap routes, which makes these trades cost-effective and efficient for all participants.

With the recent DeepBook Version 3 upgrade and DEEP token launch in October 2024, protocols will find substantial improvements that let them explore new mechanisms and give their users more efficient and flexible DeFi options.

- Lower transaction cost: DeepBook's efficiency improvements make transaction costs 60% less than it was with its previous version.

- New Orders Interface: DeepBook's new swap-like interface makes integration with this tool far easier for the DeFi protocols.

- Flash loans: The ability to instantaneously borrow against zero collateral unlocks arbitrage, liquidity provision, and risk management opportunities in the high-performance environment of DeepBook.

- Dynamic Fees: DeepBook provides a new governance model along with DEEP token, where stakers have an opportunity to propose changing taker and maker fees with votes held at every epoch.

- Shared liquidity across pools: A reduced risk for maintaining deep liquidity, market makers can share capital across pools.

To ensure a fair and open trading environment, the team has implemented a strong mechanism to discourage Wash trading and other manipulative practices. Careful tuning of the Maker incentive ensures that the volume is not artificially inflated. A burning mechanism will make sure that tokens used within wash trading are removed from circulation. These will ensure rewards are fairly earned through actual trading activity and safeguard the integrity of the marketplace in DeepBook.

Liquid Staking

Liquid staking is one of the most essential DeFi use case that enables users to earn staking rewards and utilizing liquidity. Among all the ecosystems, Sui is unique in its liquid staking solution by addressing challenges presented in other ecosystems and making this experience much more user-friendly and integrated.

That being said, the distinguishing factor is Sui's unified coin standard. All tokens at the network layer are treated as equals - including liquid staking tokens. This greatly simplifies integrations for applications and ensures that LSTs will work out-of-the-box across the Sui ecosystem.

Among the advantages this could have are the following:

- No unbonding periods: Seamless transition into liquid staking, with no unbonding periods in between.

- Reduced Gas Costs: The gas costs of interacting with LSTs are the same as native SUI, ensuring accessibility.

Liquid staking on Sui boosts the composability of the chain by making it possible to stake and unstake on-chain and in an atomic manner. Thanks to Programmable Transaction Blocks (PTBs), users can unstake LSTs and use the returned SUI in other transactions immediately. For developers building innovative DeFi applications, this opens a whole new world of possibilities.

Higher Degree of Decentralization and Transparency

Sui's model for liquid staking allows greater decentralization and transparency due to the following reasons:

- Participation Incentives: Provide incentives for users to participate in both network staking and DeFi protocols.

- Permissionless Delegation: The ability to delegate any amount of SUI to any validator.

- On-Chain Transparency: Provide transparency into the underlying delegation strategies of liquid staking protocols.

By solving challenges and offering a unified coin standard, Sui ensures that liquid staking is seamless, efficient, and available to all. Further, its focused approach toward composability, decentralization, and transparency ensures the position of Sui as the leading platform for innovation in the area of DeFi.

Sui Web3 Identity

zkLogin

zkLogin represents an innovative and at the same time very unique authentication mechanism that was developed with the aim to make the onboarding of users easier and, at the same time, more secure within the Sui ecosystem. This would enable users to use their already existing credentials from Web2 - for example, Google, Facebook, or Apple-in order to get comfortable with creating and managing their respective Sui addresses without the fuss associated with traditional wallet management.

This basically remove some frictions in managing the private key and seed phrase, thus opening Sui to everyone.

Key Features and Benefits:

- Seamless Onboarding: zkLogin removes friction from user onboarding since neither the creation of new wallets nor the memorization of complicated seed phrases is required. This simplifies the user experience and further encourages the wider adoption of Sui applications.

- Security Enhanced: zkLogin lets users keep their Web2 credentials safe from ever being leaked or written on-chain, thanks to zero-knowledge proofs. This cryptographic method of key verification enables users to authenticate themselves without revealing their private keys, hence offering higher security and privacy.

- Multi-sig recovery: ZkLogin allows multi-signature recoveries, which are secure and flexible so that users can recover their account even when the original application or credential issuer is no longer active.

- Flexibility and Customization: zkLogin can be integrated with a different Web2 credential providers for flexibility and user choice. Multi-sig capabilities enable such complex use cases as multi-factor authentication and delegated account access.

zkLogin relies on a Salt server to generate and manage a set of unique salt values that are important for the protection of the privacy of its users. These salt values prevent tracing on-chain addresses back to the users' Web2 credentials, thus preserving anonymity and preventing possible attacks.

SuiNS Subnames

SuiNS (Sui Name Service) is the core infrastructural component of the Sui ecosystem designed to enhance user experience and promote decentralized identity management. By allowing human-readable identifiers to be associated with Sui addresses, SuiNS facilitates easier blockchain interaction and provide users with greater control over their digital presence.

Features and Benefits:

- Simplified Addressing: Complex addresses are replaced with user-friendly identifiers, making transactions more intuitive and reducing error possibilities. This gives way to a much more usable and accessible platform for all users and organizations in the Sui ecosystem.

- Ownership of Identity: SuiNS identifiers are presented as NFTs, thus providing actual ownership to users, along with the ability to manage their digital identities. It leads toward the object-centric model followed by Sui, through which users can maintain an equal amount of authority on their SuiNS identifiers as any other asset on the network.

- Improved User Experience: SuiNS support avatars and IPFS websites that can be used to personalize online identity in a more innovative manner.

- Dynamic Namespace Management: SuiNS identifiers have expiration dates. These and other renewal mechanisms ensure the namespace is dynamic, adaptive. Preventing identifier squatting, recovering lost or abandoned identifiers, which in turn ensure there is optimal resource allocation and negate namespace congestion.

- Hierarchical Identity Structures: The subnames support hierarchical identities of users. It allows an organization or entity to handle complex structures and relationships on-chain. This greatly facilitates business, DAOs, and similar entities that aim at an organized on-chain presence effectively.

- Intuitive Naming Convention: SuiNS has migrated to the more intuitive naming convention, using the "@" prefix, such as @alice, versus the ".sui" extension. This will be highly recognizable from Web2 and should make the transition to Web3 much easier for users to adopt. Under the hood, the infrastructure is very robust and flexible, with both naming conventions resolving to the same address.

SuiNS Subnames represents a significant step toward a much more user-centric, decentralized digital identity, empowering people and organizations to shape their own presence in the Web3 world by affording users actual ownership and control over their online identities.

Security Guarantees

- Sui prioritizes security, ensuring robust control over assets through auditable smart contracts, allowing owners to confidently use their assets.

- Transactions in Sui require the digital signature of the asset owner, which keeps the asset handling process secure.

- Smart contracts define assets and dictate transaction logic, ensuring safe and trustworthy interactions.

- The network maintains reliability even if some validators deviate, because security architecture relies on hybrid consensus protocol (BFT and DPoS) provides trusted and censorship-resistant network.

- Users can enhance privacy and security through zkLogin functionality, which eliminates the need to manage wallets and seed phrases.

Growth Milestones in 2023

The Sui team recently published a short report on their milestones for 2023.

January 25th

Testnet Wave 2 launches, using two gamified apps to test the tokenomics model in relation to Validators. The results, with statistics including 36.5 million transactions, set the stage for Mainnet launch. Wave 2 followed Testnet Wave 1, launched in 2022, which focused on Validator coordination.

March 29th

Testnet launches as a permanent resource, letting builders test their apps and ready them for public launch. This Testnet brought new Sui features to builders, such as sponsored transactions, the Kiosk primitive, and programmable transaction blocks.

May 3rd

Sui Mainnet launches, opening up the network to unfettered public use. Supported by over 100 Validators and over 400 nodes, builders can launch their apps and bring Sui's innovative features to the public.

July 12th

DeepBook, Sui's first native liquidity layer, launches. This central limit order book gives DeFi protocols and other app builders a mechanism to support both market and limit token swaps.

July 15th

Sui celebrates hosting 1 000 000 active accounts, an early indicator of interest in the seven million active accounts network.

July 26th

Sui experiences over 65 million transactions in one day, the most recorded on a blockchain ever and proof of its scalability. Other metrics for Sui Mainnet's first three months include hitting 5,414 transactions per second without causing a gas fee spike.

August 15th

Momentum continues to grow as Sui reaches 3 million active accounts.

September 13th

zkLogin, an innovative new primitive, launches on Sui, letting builders incorporate authorization through existing credentials from providers such as Google, Facebook, and Twitch. zkLogin greatly eases the onboarding path for new Web3 users.

October 19th

DeFi shows substantial growth, with combined activity from protocols showing Total Value Locked rising 341 % and volume rising 229 % over three months.

November 2nd

Using the technology behind zkLogin, zkSend launches in beta, giving users a seamless means of sending tokens to anyone, even those not yet using Sui.

November 8th

Combined Total Value Locked for DeFi protocols on Sui crosses the $100 million mark, showing continued DeFi growth.

November 27th

9 000 000 accounts became active on Sui, as new users onboarded through the many engaging projects on the network.

December 1st

Sui surpassed $150,000,000 in Total Value Locked (TVL).

December 25th

Sui surpassed $200,000,000 in Total Value Locked (TVL) - that’s 500% plus vs. September

Growth Milestones in 2024

January 6th

Sui surpassed $225,000,000 in Total Value Locked (TVL)

January 27th

Sui surpassed $402,000,000 in Total Value Locked (TVL)

February 4th

Sui surpassed $500,000,000 in Total Value Locked (TVL). A 15x growth in the last 5 month.

February 14th

Sui surpassed $600,000,000 in Total Value Locked (TVL).

March 20th

Sui announces global hackathon with a $1,000,000 price pool.

April 10th

Sui hosts it’s own conference - the Sui Basecamp in Paris with more than 1,000 attendees. Announcements of Sui Play, Mysticeti and much more projects.

May 20th

Sui hit 1,000,000 Daily Active Wallets.

May 21th

Sui surpassed $750,000,000 in Total Value Locked (TVL).

June 11th

Sui announces the Sui Bridge, a native bridge purpose-built for seamless asset and data transfers between Ethereum and Sui, and its testnet incentive program.

July 9th

Sui has the largest and fastest-growing Move developer community according to the latest Electric Capital developer data.

Since the last update in January, Sui has seen developer growth according to Electric Capital data:

+219% monthly active devs

+145% full-time devs

+125% total commits

+84% total repos

July 25th

Sui rolls our it’s new consensus mechanism Mysticeti on mainnet.

September 3rd

Pre-order for SuiPlay0X1 are available. Expected delivery time is H1 2025.

September 25th

DeepBook hits $500 billion volume

September 30th

Sui Bridge Goes Live on Mainnet

Sui: the Universal Coordination Layer for Web3 Future

During Sui Basecamp 2024, Co-founder and CEO of Mysten Labs Evan Cheng gave a keynote on the shifting power of decentralized solutions and Sui's mission.

Sui is not another blockchain, it's about creating a trusted, user-centric digital world that will change how people and software interact. He also identified that huge lack of trust in the central institutions is growing along with huge desire for self-expression and control by consumer and developer.

Key Takeaways:

- Trust and Decentralization: Web3 and Sui are driven by an evolving demand for greater trust and decentralization in a world that has put too much power into the hands of centralized entities.

- User Control and Self-Expression: Consumers and developers all over the world yearn for more control over their digital experiences and assets. Sui empowers them to define their rules and shape their identities.

- Breaking Down Barriers: Sui breaks down the boundaries between different platforms and services, letting users maintain a consistent identity and take their assets and history with them across various digital spaces.

- The Metaverse is About You: VR and AR is about giving users self-sovereign ownership and control of their digital identities, assets, and experiences.

- Intelligent Objects: Sui has an object-centric model wherein objects are equipped with inherent rules and logic, cooperating to achieve trust and safety.

- Universal Coordination: Sui provides a universal coordination layer to enable trusted, decentralized interactions of both human-software and software-software varieties.

- Reimagining Human-Software Interaction: The idea of Sui goes beyond building a blockchain, it rethinks how humans interact with software. This opens new frontiers to a future that is going to be much more user-centric and empowering.

- A Bigger Mission: Other than the basic utilities of crypto, the greater mission behind Sui is to really change how we interact with digital assets and services in general-to create a much more fair and trusted digital world.

Evan Cheng concluded his talk by inviting the audience to join them at Sui and define with them what the future of Web3 would look like. He reiterated that this is just the beginning of their journey, which now was one of those unique moments where the Sui community had a chance to shape a more decentralized, user-centric, and trustworthy digital world.

Conclusion

In conclusion, Sui Blockchain presents a unique landscape in the competitive blockchain arena, particularly in its differentiation from traditional L1 solutions. Its innovative object-centric data model sets it apart, challenging the account-based systems used by its competitors. Sui's potential to rival on-chain storage protocols and compete in the scalability narrative introduces intriguing dynamics.

A significant aspect of competition comes from Layer-2 solutions focused on scalability and user onboarding. Despite the innovative design of Sui, success hinges on providing a user-friendly experience, a challenge where Layer-2 solutions may pose strong competition.

The success of Sui could hinge on the development of high-quality DApps accessible to non-crypto users. The broader consideration revolves around whether Non-EVMs can outperform EVMs in a Web3 environment that prioritizes user experience.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.