Trillions of dollars in stablecoins are moving across blockchains that can't keep up, creating high fees and friction that limit their potential. Plasma was engineered not just to be a faster network, but as a more intelligent economic system for this new era of digital money. This is achieved by putting in place a unique dual-layer economy, separating everyday payments from the underlying asset that supports the network. In this article, we discuss how the model works, from user-facing commercial assets such as USDT and pBTC, to the tokenomics of native XPL that powers it all.

Key Takeaways

- Plasma economy is structured in a form that utilization of stablecoins increases the value of native token XPL.

- Users can pay transaction fees with whitelisted tokens like USDT and pBTC, removing the need for a separate gas token.

- The economic setup of XPL offsets validator reward inflation with deflationary fee burning.

- The staking model uses reward slashing instead of stake slashing to reduce capital risk for investors.

The Commercial Economy: Payments with USDT and pBTC

Plasma’s commercial economy is designed to directly address the friction that limits the use of digital assets for everyday payments. This is achieved by building the user experience around the market's most dominant stablecoin, USDT, and by creating a secure gateway for Bitcoin's economic weight through pBTC.

The network fundamentally improves the usability of these assets in two ways.

First, the Custom Gas Tokens feature allows users to pay for any transaction using a given set of whitelisted tokens, with USDT and pBTC being the initial assets supported. This is handled by a protocol-maintained paymaster that can sponsor transactions, a stark contrast to external solutions that often are expensive and unreliable. Using trusted oracles, this system automatically calculates the fee on the backend without any markup, allowing users to interact with the blockchain using only the assets they already hold.

Second, Plasma incorporates pBTC, a version of Bitcoin designed to serve as high-quality, programmable collateral. Its bridge will be secured by a network of independent, high-trust institutions, such as stablecoin issuers, that each run their own full Bitcoin node. Critically, pBTC is minted as a LayerZero Omnichain Fungible Token (OFT), a standard that makes it a single asset on many chains. This new architecture keeps the liquidity from getting fragmented across ecosystems, a large issue with legacy wrapped tokens like WBTC.

XPL: Securing the Plasma Economy

Though users mainly may engage with assets like pBTC and USDT, the underlying security of the network is achieved via the token XPL.

As the native asset of the Plasma ecosystem, XPL plays several crucial roles. It forms the primary mechanism whereby the network obtains security, since validators are required to stake their XPL in order to participate in network consensus, thus providing a clear economic incentive for positive behavior. It also functions as the main currency for transaction fees for operations like smart contract deployment, and a portion of these fees is permanently burned to reduce the total token supply over time. Beyond such operating roles, XPL has even been developed towards future uses such as within governance, where holders can be allowed to vote on improvements and protocol tuning.

Token Distribution and Public Sale

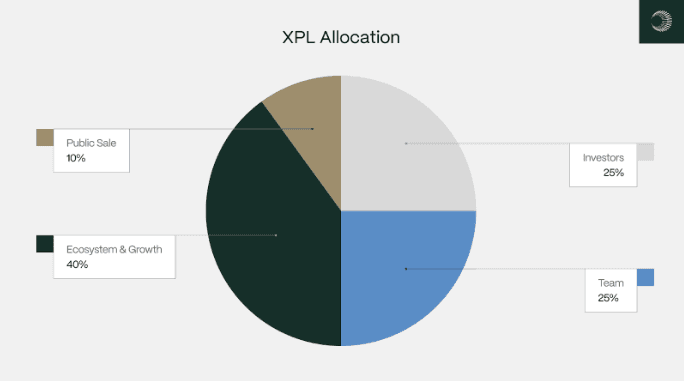

The economical basis of Plasma is built on a core distribution of 10 billion XPL tokens. The token distribution has been carefully crafted to encourage sustainable development, induce early contributors, and keep team members and investors committed.

The public sale set the stage for a broad, community-driven network, with 10% of the total supply (1 billion XPL) allocated to participants. The public sale was highly successful, with over $373 million committed in bids. Furthermore, the Plasma Mainnet Beta is expected to launch with over $1 billion in stablecoin liquidity available from day one.

Tokens reserved for non-US buyers will be available upon the launch of the mainnet beta, while US buyers will be required to adhere to a twelve-month lockup period ending on July 28, 2026.

A significant 40% of the supply, valuing 4 billion XPL, is reserved for Ecosystem and Growth projects. To support a strong launch, 8% of the total XPL supply, or 800 million XPL, will be released at once to cover DeFi incentives, improve exchange liquidity, and trigger early growth promotions. The remaining balance from this fund will be unlocked every month over a span of three years to ensure continued adoption.

For long-term alignment, 50% of the distribution goes to early investors and the team, totaling 5 billion XPL. All shares follow the same vesting schedule, which includes a one-year cliff from the release of the mainnet, followed by two years of monthly unlocks. This setup aims to keep the major contributors to the project focused on its success for the next few years.

How to Buy and Hold XPL Token

Following the initial public sale and the mainnet launch, XPL will be available for purchase on secondary markets. The token is expected to be available for trading on decentralized exchange (DEX) protocols, as well as on centralized exchange (CEX) platforms that decide to list the token.

Since Plasma is fully compatible with the Ethereum Virtual Machine (EVM), the storage of XPL is possible using any EVM wallet like MetaMask and hardware wallets such as Ledger and Trezor. To interact with the tokens on the Plasma network, users will need to add Plasma's network details (like the RPC URL and Chain ID) to their chosen wallet.

Economic Model: Balancing Growth and Stability

The Plasma economic model is carefully crafted to preserve XPL token value, and at the same time provide strong incentives for network security. This is achieved through a thoughtfully planned balance of token supply, a deflationary mechanism, and an adaptive staking model.

To fund the incentives for validators that ensure network security, Plasma will use a controlled inflation schedule. The schedule starts at an annual level of 5% and is set to reduce by 0.5% every following year until reaching a long-term baseline of 3%. The inflation will only begin after stake delegation and external validators have been launched, thus guaranteeing a smooth launch.

To carry out this issuance, the model includes a powerful fee-burning mechanism, that follows Ethereum’s EIP-1559. Some transaction fee, in terms of XPL, is burned irreversibly, thus taking it out of circulation. This creates a deflationary force that grows stronger with increased use of the network, thus creating a direct relationship between token adoption within the platform and its future value.

The staking itself is designed to be adoption-friendly with risk reduction. Plasma implements reward slashing, as opposed to stake slashing, to penalize misbehaving actions. Malicious validator action or downtime means reward loss, but not in staked capital, which is important for institutional investors.

This focus on accessibility extends beyond risk management. In the future, XPL owners will also be able to delegate their tokens to validators and receive rewards without having to operate a node themselves. To ensure fairness, tokens held by the team and investors under vesting cannot be utilized for staking rewards, so only circulating XPL will be used to secure the network.

A Foundation for Future Growth

Plasma is an end-to-end system architecture where all the parts are intended to support each other. The end-user commercial layer built on top of deep USDT liquidity and pBTC security is intended to draw enormous scales of transaction activity by taking away traditional points of friction such as gas costs and native token requirements.

This move directly contributes to the main economic powerhouse of the XPL token. The balanced model of controlled inflation for security incentives and a deflationary fee-burning model ensure network expansion returns to its underlying asset value. Sensitive design with appropriate support by main industry players and a successful initial public offering give a solid foundation to its future.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.