If you've already learned the basics of Plasma (or read our beginner’s guide), you're ready to see how it all works under the hood. This guide looks at Plasma's unique architecture, which is built on a modular philosophy to boost performance and maintain full EVM compatibility. We will cover the key components that make Plasma a specialized infrastructure for stablecoins.

Key Takeaways

- Plasma separates its consensus layer from its execution layer using the standard Engine API for modularity and performance.

- The network is connected to the Bitcoin blockchain for security and censorship resistance.

- Native contracts support zero-fee transfers and custom gas tokens, reducing middleware requirements.

- The node architecture decouples core validators from the nodes that provide data, allowing applications to scale without impacting network security or performance.

The Core Architecture: The Story of Two Layers

Plasma's design is modular, and transaction execution and consensus are split into two roles. The two layers are connected through the standard Engine API, the same as post-merge in Ethereum, which has a clear separation of tasks. This enables us to have a high-performance system, which can also be secure and flexible.

Consensus Layer: PlasmaBFT

Plasma is secured and made fast by a specially designed protocol named PlasmaBFT. It’s based on a modern consensus model known as Fast HotStuff and is written in Rust for performance. HotStuff improves on earlier BFT models by reducing communication overhead and enabling greater responsiveness. The whole system is designed to be very resilient, it stays secure and runs smoothly even if up to one-third of its validators are offline or acting maliciously.

At its core, HotStuff operates in a leader-based round where one validator proposes a block and other validators vote upon the proposal. With enough votes collected, they are packaged, in the form of aggregated signatures, into a Quorum Certificate (QC) that prove consensus has been reached. QCs play a critical role in the high-performance consensus of Plasma to achieve fast finality and Byzantine fault tolerance.

Validators are chosen through a Proof of Stake (PoS) mechanism designed to be simple and predictable. To keep communication fast and efficient, only a small committee of validators is selected for each round through a cryptographically secure, stake-weighted random process. Validators are rewarded for participating in consensus and block signing.

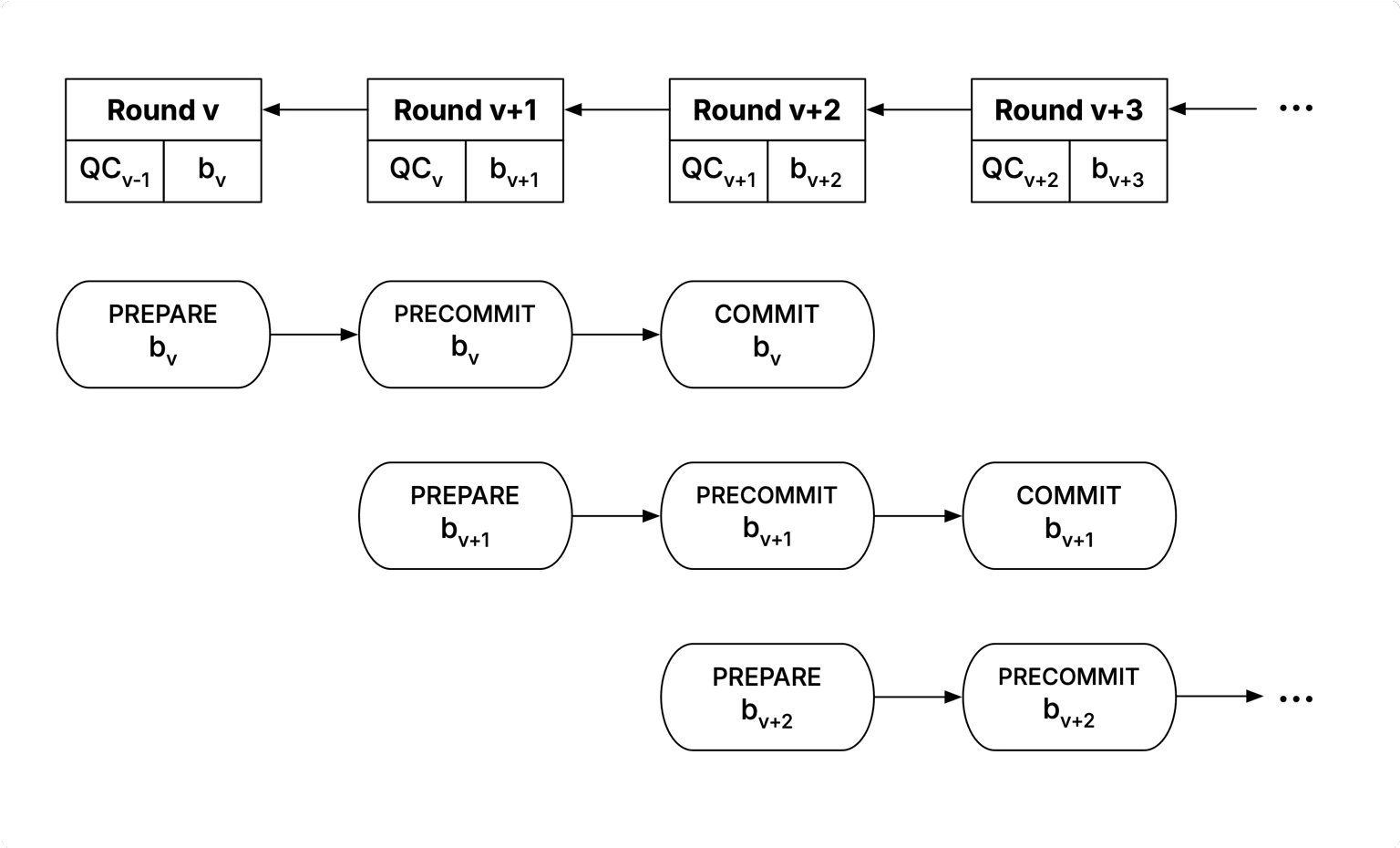

The secret to its speed is a clever approach called pipelining. PlasmaBFT is doing things a bit differently, moving through multiple parts of the consensus process all at once, instead of finishing one activity before moving on to the next.

Unlike traditional consensus designs that process each stage sequentially (first propose, then vote, then commit), Plasma's pipelined approach allows these stages to run in parallel.

Specifically, the protocol allows the proposal of a new block to begin while the previous block is still moving through its final commitment steps. This overlap has a significant impact on throughput and minimizes time to finality due to reduced latency between block generation and finalization. The end result includes faster, efficient block generation and faster, reliable confirmation times, even under heavy network load.

Execution Layer: The Reth EVM

Plasma’s execution environment is powered by Reth, a high-performance and modular Ethereum client written in Rust. Its most important feature is full EVM compatibility. Not hype: what that means is all opcodes, all precompiles, and all behavior function exactly as they would on Ethereum mainnet. Any smart contract written in Solidity or Vyper for Ethereum can be deployed on Plasma with no changes needed.

This compatibility means no learning of a new stack is needed on developers' part. All the standard tools and libraries they already use like Hardhat, Foundry, and Remix - work right out of the box. The underlying architecture is optimized as well for a plug-and-play experience. The Plasma execution layer connects to the consensus layer via the standard Engine API, the same one found in modern Ethereum. Such clean abstraction makes the platform easy to upgrade and reliable.

The execution logic is identical to Ethereum's, but Plasma adds one key upgrade: millisecond timestamp precision. Using more granular timestamps than Ethereum's standard second-based ones allows for better transaction ordering, which is ideal for high-speed payment applications. Looking ahead, the core Reth logic may be modified to support native features. One planned exploration is creating reserved blockspace for eligible USD₮ transfers, which would give sponsored transactions a dedicated fast lane into blocks so they don't have to compete on fees.

Node Architecture: Scaling Without Compromise

Plasma node structure can be horizontally scaled without compromising the security of the core consensus group. The nodes are divided within the network by function so that the validator set can be kept small and secure, while read/write access can be scaled separately. The network supports three primary ways to participate:

- Consensus Nodes (Validators) These are the central participants of the PlasmaBFT consensus layer. They make the network secure through proposing of blocks, transactions verification and voting. To participate in the network and earn rewards, these validators are required to stake Plasma's native token, XPL. Participation as a consensus node is not yet open to the public and will begin after the mainnet launch.

- Non-Validator Nodes These read-only nodes monitor the blockchain and respond to RPC requests but do not participate in consensus voting. Applications and RPC providers are thus able to scale their services to meet user demand without having to purchase additional validator seats, avoiding bloating of networks and compromising security. Running a non-validator node is open to third parties, but during the testnet phase, operators are required to submit a contact form.

- RPC Providers For applications and developers with production-level infrastructure needs, commercial RPC providers such as QuickNode provide high-uptime hosted endpoints and enterprise support. This enables teams to develop their applications without needing to self-maintain node infrastructure.

A key feature of Plasma's design is its forgiving staking model. The protocol does not employ stake slashing but reward slashing. In other words, if a validator behaves in bad faith or has persistent downtime, he loses block rewards he would have otherwise earned, but initial deposited capital is not at risk. The protocol does not punish validators actively for honest errors such as downtime or liveness failure, thereby reducing economic risk to parties and promoting increased participation in securing the chain.

The Bitcoin Bridge: Anchoring Security

A key feature setting Plasma apart is its deep connection to Bitcoin. Plasma operates as a Bitcoin sidechain, meaning it's an independent blockchain that is cryptographically linked to the Bitcoin network. The core of this connection is a process where Plasma periodically anchors its state roots (a summary of its transaction history) to the Bitcoin blockchain. Once this data is embedded in a Bitcoin block, Plasma's history inherits the security and finality of Bitcoin's proof-of-work consensus. This provides a strong guarantee of censorship resistance and a neutral, sound security base that institutions can rely on.

This connection is made possible by a native, trust-minimized bridge rather than a centralized or custodial one. That bridge allows users to move actual BTC directly into Plasma’s EVM environment. When a user deposits Bitcoin, a decentralized network of independent verifiers, composed of entities like stablecoin issuers and infrastructure providers, monitors the transaction using their own full Bitcoin nodes. Once the deposit is confirmed, the verifiers publish their attestations on-chain for public auditability before pBTC is minted on Plasma.

The pBTC token is based on LayerZero’s Omnichain Fungible Token (OFT) standard, which allows it to move across multiple connected chains as a single, native asset. That approach bypasses the liquidity fragmentation and increased trust demanded of conventional wrapped tokens such as WBTC. For withdrawals, the verifiers use a threshold signature scheme (TSS) or multi-party computation (MPC) to sign the transaction, releasing the BTC back to the user. This process ensures that no single verifier ever holds a full private key, giving users access to programmable Bitcoin with strong security guarantees.

Keep in mind, however, that the pBTC and Bitcoin bridge mechanism continues to be developed and set to be launched later after the launch of the mainnet beta.

Stablecoin-Native Features: A Frictionless Experience

Plasma's biggest strength is in its “stablecoin-native” contracts, a suite of protocol-controlled modules that ensures on-chain payment friction removal.

On most blockchains, stablecoins are treated like any other token, which creates user experience hurdles like needing a separate native token (like ETH) for gas fees or having no options for privacy. Plasma addresses this by having core payment infrastructure at the protocol level so that all applications can offer a more seamless experience to their users.

Zero-Fee USD₮ Transfers

For eligible users, Plasma offers gas-free USD₮ transfers. The functionality is built upon a paymaster contract controlled by the protocol and funded by the Plasma Foundation, which pays for gas on behalf of the user. Lightweight identity verification and rate limiting are offered to avoid spam. The entire flow is designed to be compatible with any EVM wallet and standards like EIP-4337, meaning users can send USD₮ without ever needing to hold the native XPL token.

Custom Gas Tokens

The network also supports paying in whitelisted ERC-20 tokens such as USD₮ or pBTC for any transaction. This is achieved through a native ERC-20 paymaster that uses trusted oracles, computes the gas prices and does internal converting, without markup fee. This method eliminates the trust issue and additional fees that normally come with third-party providers, making the user experience simpler, eliminating the need to hold a separate gas token.

Confidential Payments

Currently under active research, this is a planned opt-in module for use cases like payroll and B2B settlements where privacy is needed. The system aims to shield sensitive data like transfer amounts and recipient addresses using techniques like stealth addresses, while preserving auditability through verifiable proofs. It is being designed with clear goals in mind: it will be implemented in standard Solidity, remain optional for users, be fully composable with DeFi, and align with regulatory needs for compliance.

Below the specialized components, the fees of the Plasma network are determined by the underlying EVM gas model, which should be well known to any Ethereum developer. The total cost of a transaction is calculated the same way: Gas Used multiplied by the Gas Price. However, Plasma’s architecture is designed to maintain very low and predictable gas prices, with most standard transactions costing less than one cent. The stablecoin-born features, then, sit on top of the low-friction base to remove one last bit of friction for payment apps.

Building on Plasma: A Toolkit for Developers

With Plasma, programmers can begin developing right away using the same tools and experience they have had on Ethereum. Since the entire network is completely EVM-compatible, there is zero necessity for custom toolchains or modified contract patterns. That means less time learning a new environment and more time building solid payment applications.

To support development, Plasma is integrated with a full suite of infrastructure. Developers can get reliable node access through RPC providers like QuickNode and track on-chain activity using block explorers like Routescan. For bringing real-world data into smart contracts, Chainlink serves as the official oracle, while services like Goldsky provide data indexing. The network also supports advanced features like gasless transactions through Account Abstraction toolkits and interoperability via protocols like LayerZero, with many other integrations like Debridge and Hyperlane in progress.

Getting started on the public testnet is straightforward. Developers can add the network to an EVM wallet like MetaMask with the provided RPC and Chain ID, get free testnet XPL from a faucet like the one from Gas.zip, and begin deploying contracts immediately. The official documentation and the developer community on Discord offer full support for a smooth onboarding process.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.