Key Takeaways

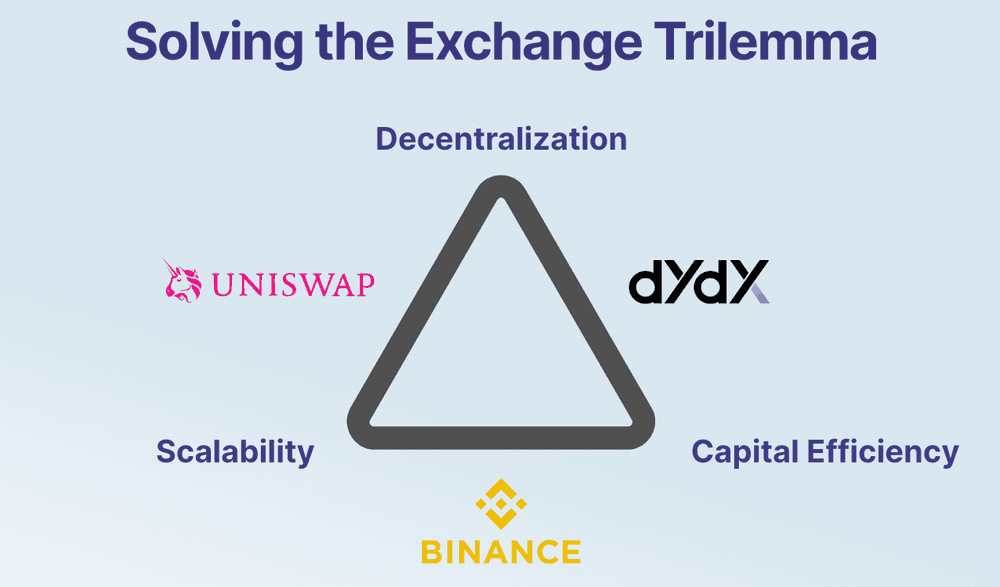

- Purpose-Built for DeFi: Sei is designed to tackle the DeFi "Exchange Trilemma" by optimizing scalability, decentralization, and capital efficiency.

- High-Speed Transactions: Features parallel processing and Twin-Turbo consensus, enabling instant block finality and enhanced trading efficiency.

- Interoperability: Built on Cosmos, Sei seamlessly integrates with IBC for cross-chain asset transfers.

- Native Order-Matching Engine: Supports complex trading activities while preventing frontrunning.

- Sustainable Growth: Committed to using renewable energy for network operations.

Decentralized finance (DeFi) promises a paradigm shift – a world where individuals have complete control over their financial destiny and assets are exchanged freely, free from the constraints of centralized control.

However, a significant obstacle stands in the way of DeFi evolution: the "Exchange Trilemma." This fundamental challenge forces developers to navigate a three-way balancing act – prioritizing decentralization, scalability, and capital efficiency – making it difficult to achieve all three simultaneously.

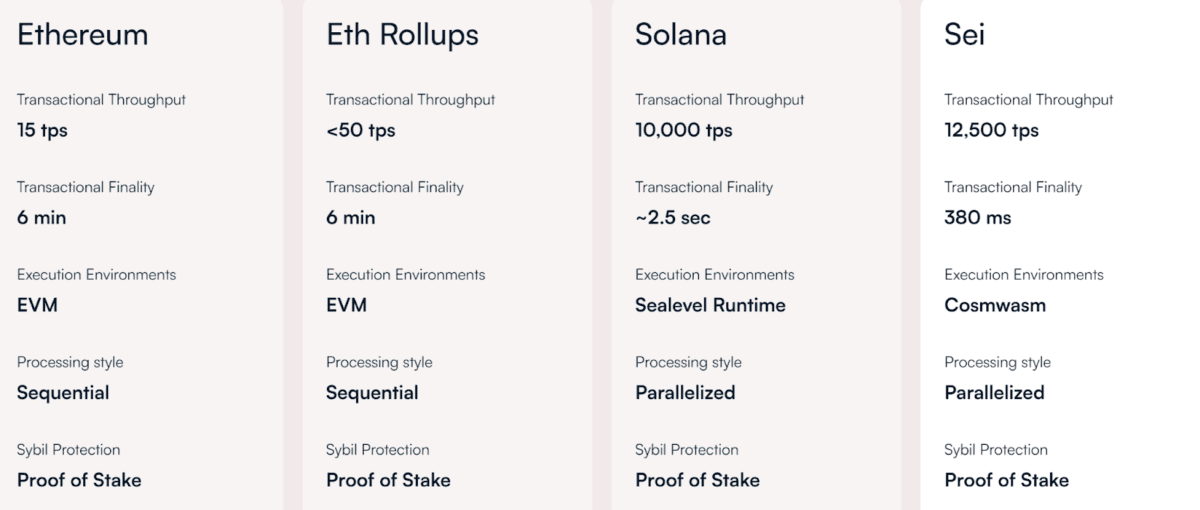

The explosive growth of DeFi has exposed a critical limitation within existing blockchains: their inability to handle the high volume and rapid pace of decentralized asset trading. This translates to sluggish transaction speeds, congested networks, and a user experience that falls short of expectations.

This is where Sei steps in, offering a solution specifically tailored to overcome these challenges. Built with cutting-edge technologies like parallel processing and with instant block finality, Sei blockchain boasts unmatched efficiency and performance.

And Sei solution isn't just about raw speed. Sei addresses the "Exchange Trilemma," optimizing network resources at every level of the stack and offer the best infrastructure for the exchange of digital assets.

This empowers developers to create applications that are not only decentralized and secure but also incredibly scalable and user-friendly, opening the door to a new generation of DeFi applications that offer a seamless, frictionless experience.

How Sei works

Sei stands apart from traditional blockchains as an open source, permissionless Layer-1 blockchain specifically designed to supercharge digital asset trading. The secret lies in its parallelized architecture. Imagine a multi-lane highway compared to a single lane – that's the power of parallelization.

This allows Sei to handle multiple transactions simultaneously, significantly boosting processing speed and transaction throughput. This focus on parallelization is a game-changer, effectively shattering the scalability limitations that have plagued many existing DeFi solutions.

Furthermore, Sei fosters seamless interaction with other blockchains within the Cosmos ecosystem through its compatibility with the Inter-Blockchain Communication (IBC) protocol. This interoperability allows for the transfer of assets between different networks, further enriching the overall DeFi experience for users.

At the heart of Sei lies the innovative Twin-Turbo consensus mechanism that streamlines the process by improving block propagation and transaction ordering, reducing the time it takes validators to reach consensus. Additionally, advanced parallelization techniques optimize both transaction and block processing for maximum efficiency.

This focus on efficiency extends beyond parallel execution. Sei boasts a Native Order-Matching engine, a powerful tool that facilitates complex trading activities. This feature supports single-block order execution, order bundling and frequent batch auctioning, all tailored to enhance the trading experience.

Frequent batch auctioning groups transactions within a block and executes them all at a single, fair price. This not only streamlines the trading process, but also actively combats frontrunning, a prevalent issue in many blockchain marketplaces.

By grouping transactions and executing them simultaneously, Sei eliminates the ability to manipulate order sequence and ensures a fair and secure trading environment for all participants.

The native token of the network, SEI, underpins the ecosystem. Validators stake SEI to validate transactions and create blocks, while tokenholders can delegate their SEI to validators, strengthening network security and earning rewards. This model incentivizes participation and fosters a secure, resilient Sei Network.

With the launch of Sei v2, the network now supports parallelized EVM (Ethereum Virtual Machine), expanding accessibility to Ethereum developers and enabling more innovative decentralized applications.

Sei also prioritizes renewable energy, ensuring growth that is both high-performance and environmentally sustainable.

By emphasizing speed, scalability, security, interoperability, and sustainability, Sei positions itself as the engine driving DeFi into a new era of seamless, eco-conscious decentralized finance.

History

Sei journey began with a vision – to revolutionize decentralized trading with a scalable solution. Initially, Sei Labs, the development team, set their sights on Ethereum to leverage Ethereum's established ecosystem as a springboard for scaling decentralized exchange (DEX) applications.

However, after careful consideration, Sei Labs identified inherent limitations associated with building Sei as a Layer 2 rollup solution on Ethereum. These limitations centered around two key issues.

Firstly, Layer 2 rollups often rely on a centralized sequencer, creating a single point of control for transaction validation and execution. This reliance on a central authority raised concerns about security, censorship resistance, and the overall liveness of the network. In a decentralized environment, a single point of failure poses a significant risk.

Secondly, the maximum transaction processing capacity of a Layer 2 rollup is ultimately limited by the underlying Layer 1 blockchain's blockspace availability. In the case of Ethereum, this translates to significant scaling challenges, which directly contradicted Sei's core objective of achieving high-performance trading capabilities.

Recognizing this, Sei Labs embarked on a new path – building a sovereign blockchain. Enter the Cosmos SDK and Comet BFT, powerful tools that laid the foundation for Sei's launch as a Layer-1 protocol.

Sei wasn't alone in its quest for a more scalable DEX landscape. In 2023, the project has attracted significant backing from major players in both traditional venture capital and the decentralized finance space. Heavyweights like Jump Crypto, Distributed Global, Multicoin Capital, Asymmetric, Flow Traders, and ForeSight Ventures have all participated in Sei's funding rounds, injecting a combined $30 million into the project. This impressive roster of investors underscores the confidence in Sei's potential to reshape the future of decentralized trading.

Token Economy

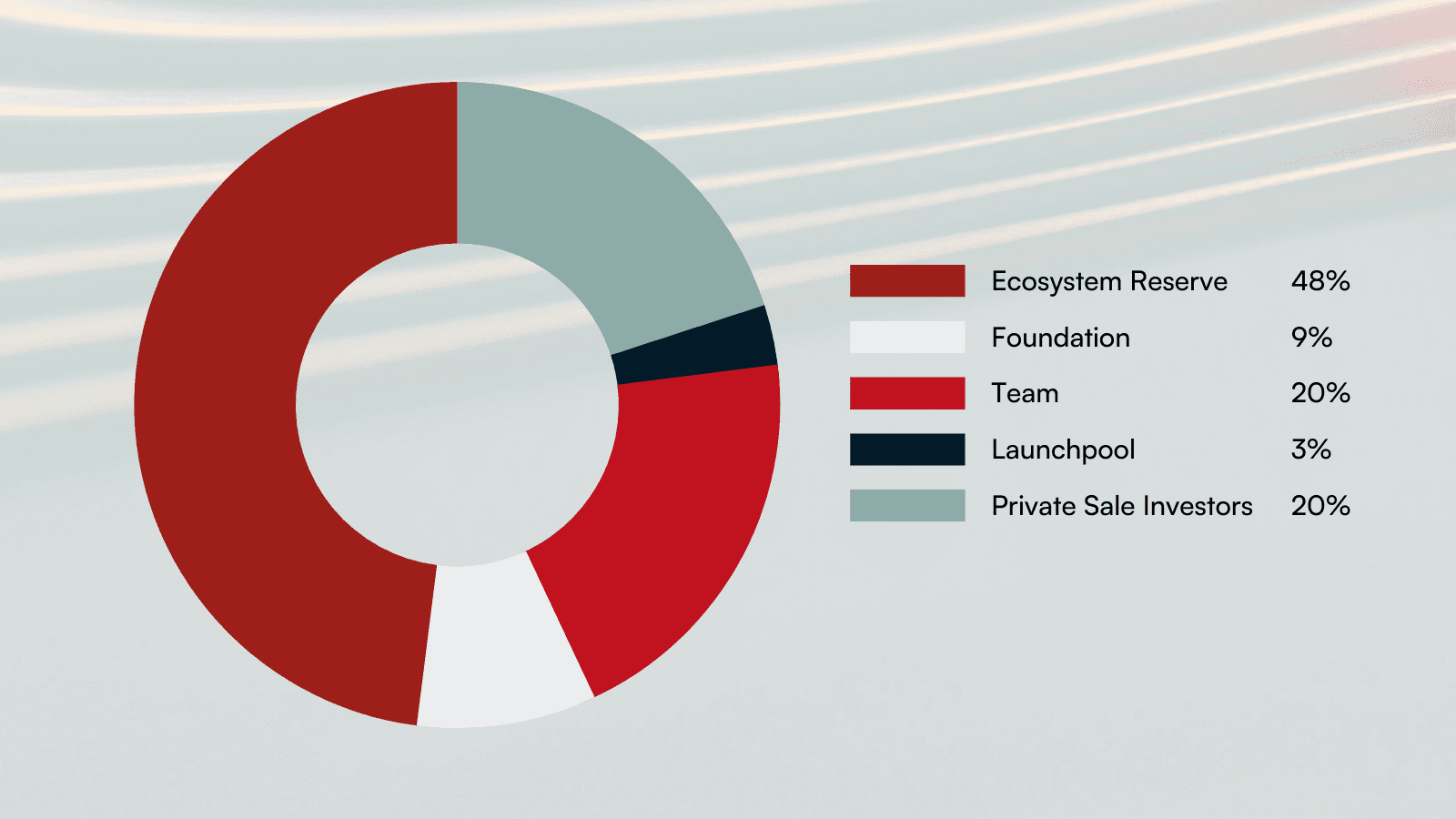

The SEI token serves as the essential utility token that underpins the network's operations and fosters a thriving ecosystem. With a capped total supply of 10 billion tokens, the SEI token distribution strategy prioritizes fostering a strong community and encouraging active participation.

The SEI token is essential to the Sei Network, providing power to various functions:

- Transaction Fees: Every interaction on the network, from basic transfers to complex DeFi activities, is fueled by SEI. This incentivizes network participation and ensures smooth operation.

- Network Security: SEI holders play a crucial role in safeguarding the network. They can delegate their tokens to validators, essentially entrusting them with transaction validation and security.

- Decentralized Governance: Sei empowers its holders with a voice in the network's future. They hold on-chain governance rights, allowing them to vote on critical proposals that shape the network's direction.

- DeFi Engine: SEI acts as native collateral within the ecosystem. Developers building decentralized applications (dApps) can leverage SEI as a form of asset liquidity or collateral within their creations. This fosters a more interconnected DeFi landscape and fuels innovation.

- Prioritized Transactions: For users requiring faster transaction processing, a dynamic fee market system comes into play. Users can incentivize validators with SEI tips, which are then shared with users who delegate their SEI to that validator. This system not only encourages network participation but also prioritizes transactions for those who need it most.

- Seamless Trading: Exchanges built on the Sei blockchain seamlessly utilize SEI as the primary trading fee. This streamlines the trading experience, eliminates the need for multiple token conversions, and incentivizes the use of SEI within the network, fostering a more cohesive and efficient ecosystem.

Supported Wallets

Secure storage is paramount when venturing into the world of cryptocurrency, and Sei Network offers a variety of compatible wallets to safeguard your SEI tokens.

Popular options within the Cosmos ecosystem include Keplr and Leap wallets, known for their user-friendly interfaces and staking capabilities. For those seeking a broader crypto-portfolio management solution, multichain wallets like Coin98 can be a convenient choice. Security-conscious users may gravitate towards Falcon wallets, renowned for their robust protection measures across various Cosmos zones.

Beyond these established options, additional wallets like Frontier or Bitkeep offer Sei support. Ultimately, the ideal wallet hinges on your individual needs. Prioritize security by choosing a reputable wallet with a proven track record. Consider your comfort level with user interfaces and the features most valuable to you, such as staking capabilities or multi-chain support.

How to Buy SEI

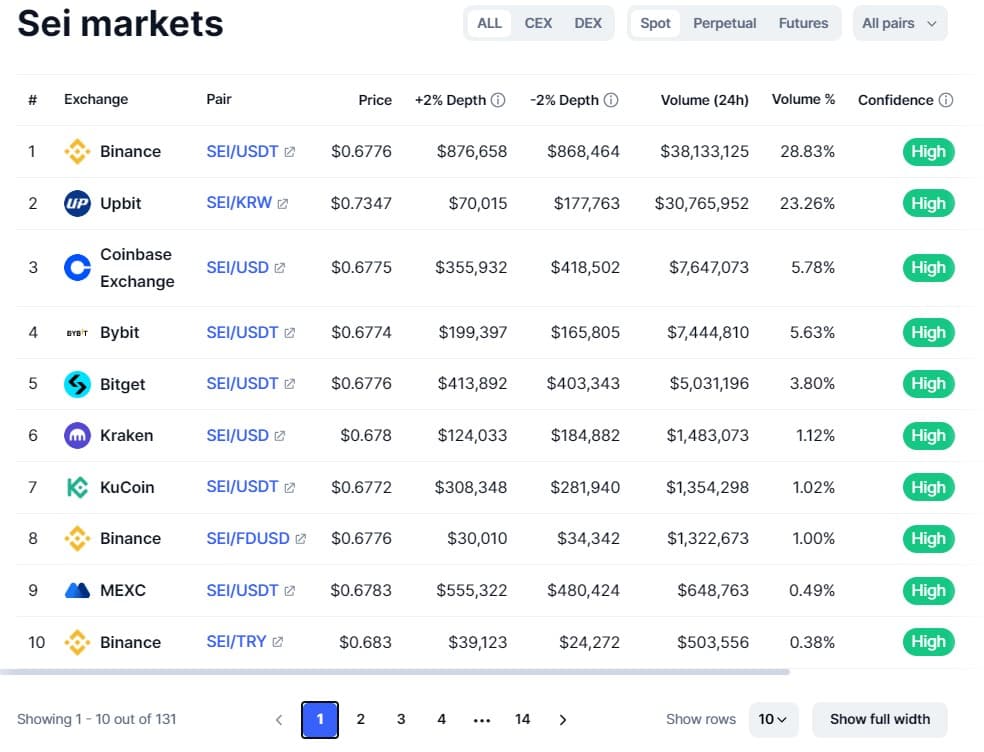

According to CoinMarketCap, token SEI is traded on over 50+ exchange platforms, giving you a vast selection. Whether you prefer user-friendly interfaces and fiat support offered by Centralized Exchanges (CEXs) or the security and control of Decentralized Exchanges (DEXs), there's a platform to suit your needs.

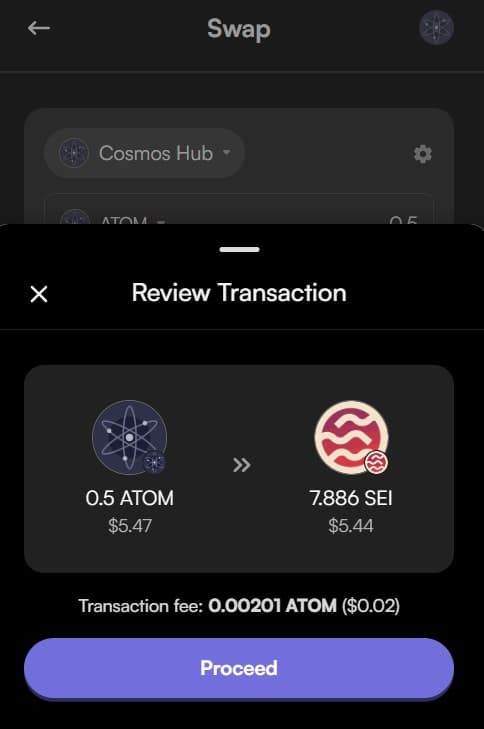

For users seeking a potentially simpler approach, there are two interesting options beyond traditional exchange platforms. Firstly, several wallets (like Keplr and Leap) support swapping Cosmos-based tokens directly for SEI. This approach leverages the established Cosmos network and eliminates the need for an intermediary exchange.

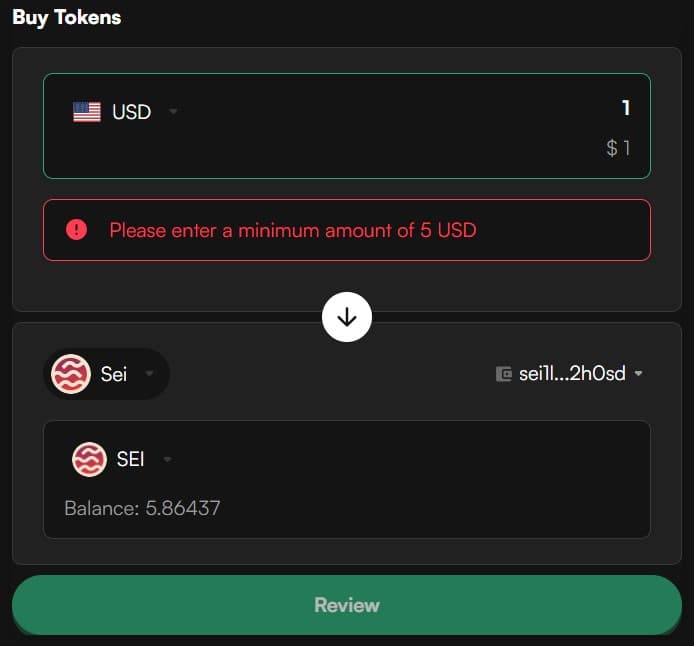

Alternatively, Leap Wallet offers a convenient entry point for smaller investments, allowing direct SEI purchases with a minimum deposit of $5.

How to Stake SEI

Sei leverages a Proof-of-Stake (PoS) system where users can contribute to network security by staking their SEI tokens with validators. These validators are responsible for validating transactions and securing the network. In return for their service, validators receive a portion of the transaction fees as staking rewards. Validators can even set a commission rate to further incentivize their participation.

However, it's important to note that validators never have access to your staked SEI tokens. Instead, they manage the stake on your behalf. To ensure validator accountability, the network implements a "slashing" mechanism. If a validator acts maliciously, a portion of the staked SEI associated with them is destroyed, deterring bad behavior and safeguarding the network.

According to Staking Rewards, Sei validator set consists of the 41 active validators with Estimated APR (Annual Percentage Rate) 4.8%.

Staking SEI via Leap Wallet

Leap Wallet offers a user-friendly experience for newcomers to the world of staking tokens in the Cosmos ecosystem. Here's a step-by-step guide to walk you through the process:

- Install the Leap Wallet, a browser extension, from the official website (make sure you download from a trusted source) and ensure you securely store your recovery phrase.

- Then purchase SEI tokens or swap other Cosmos-based tokens on SEI.

Follow these five-step instruction to stake your SEI tokens.

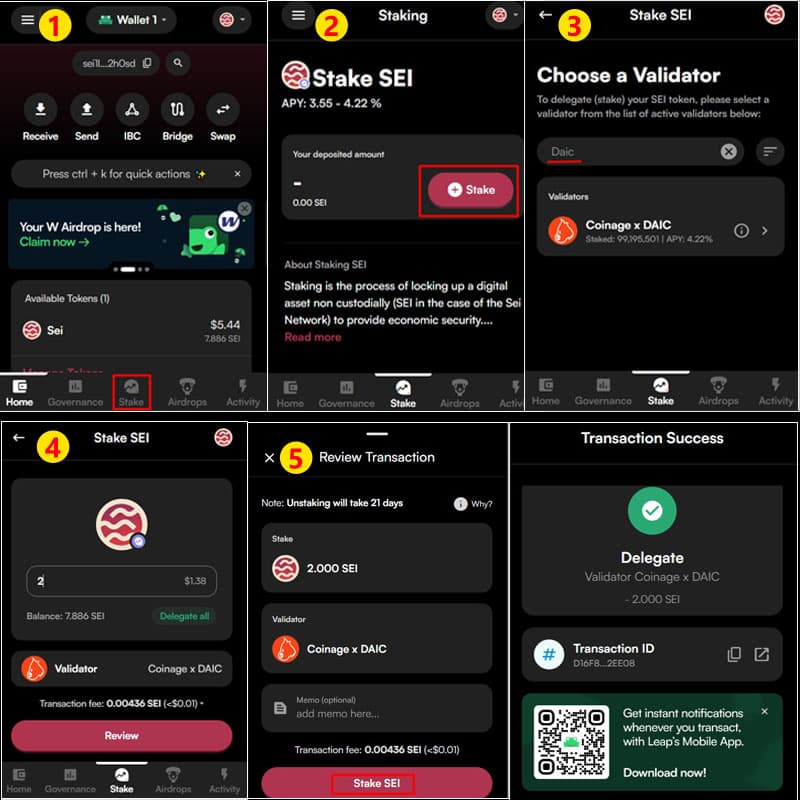

- Once you have installed the Leap wallet and got some SEI tokens, switch to the Stake tab at the bottom of the wallet menu.

- On a staking page, press a Stake button.

- In the Search bar, type Coinage x DAIC validator and click on it.

- On the next window, enter the amount of SEI tokens you want to delegate and press Review.

- Check if everything is correct and press Stake SEI.

Congratulations! You've successfully staked your tokens and are contributing to the network security while earning SEI rewards.

Team

Sei Labs was founded by Jeffrey Feng and Jayendra Jog in August 2022.

Jayendra Jog is a former software engineer at Robinhood and had previously interned at Facebook (Meta).

Jeffrey Feng worked as a venture investor at a crypto hedge fund and has also been a part of the Investment Banking team at Goldman Sachs.

Together they make the perfect team with the right amount of experience as an investor and a developer. They felt the need to have a blockchain specifically for trading and worked diligently to scale in that direction.

The Sei Network's leadership is complemented by a robust core team comprised of highly skilled professionals. These individuals possess extensive experience gained at leading companies across diverse fields, including blockchain technology, finance, software development, and business management. This blend of expertise allows the core team to provide invaluable strategic direction and operational excellence, ensuring the project's long-term success.

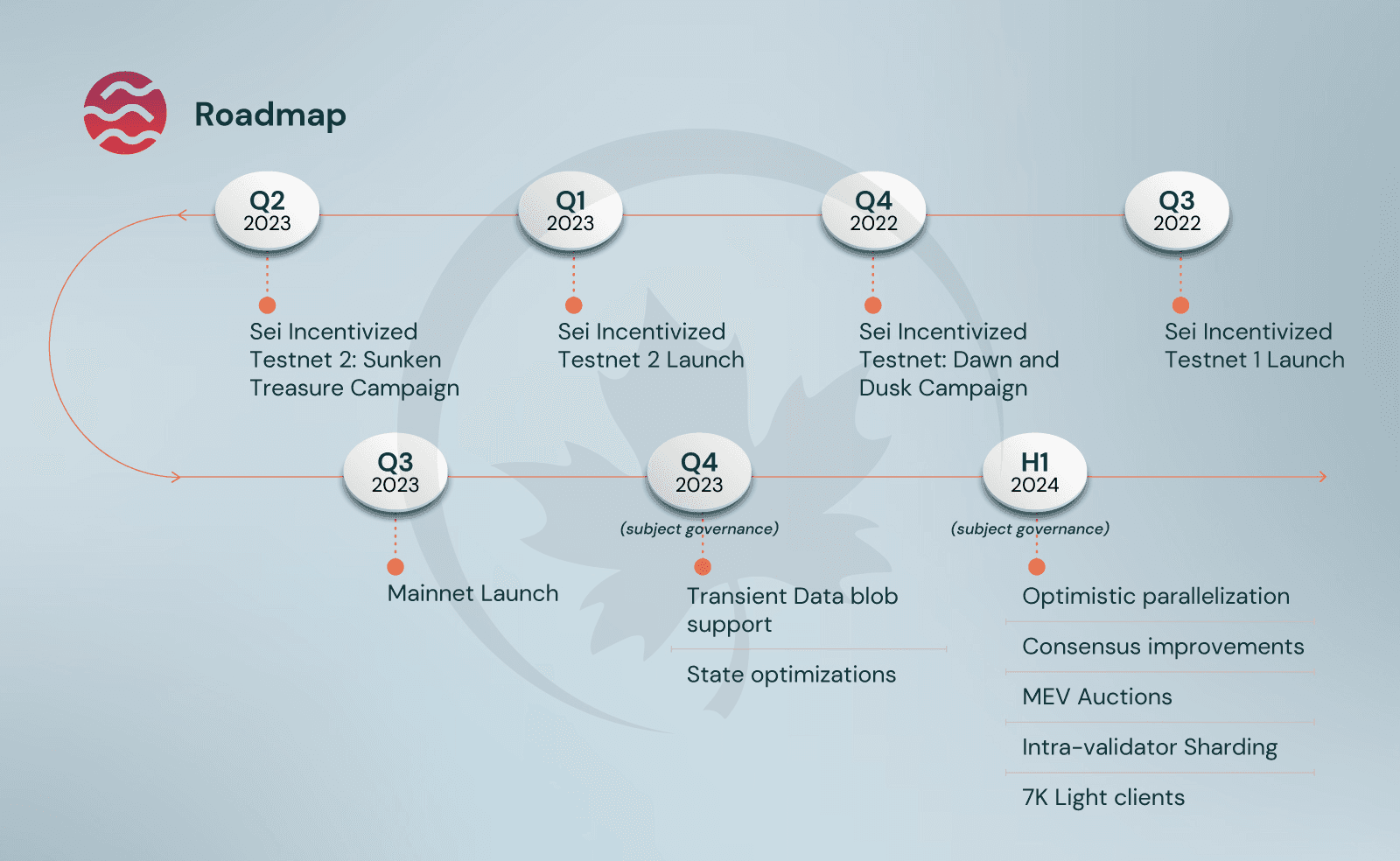

Roadmap

Conclusion

Sei presents a compelling case for reshaping the DeFi landscape. Its emphasis on high-throughput, low-latency transactions coupled with robust security mechanisms lays the groundwork for a new paradigm in decentralized finance. By offering a developer-centric environment optimized for DeFi applications, Sei fosters the creation of innovative financial instruments that have the potential to compete effectively with centralized alternatives.

As the network matures and its ecosystem expands, the project has the potential to emerge as a foundational pillar within a future where DeFi transactions are swift, secure, and readily accessible to a global audience. This isn't merely about expedited trading, it's about establishing a foundation for a more efficient, transparent, and user-oriented DeFi experience that holds the power to transform the financial ecosystem on a global scale.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.