Overview

NAVI Protocol is a decentralized liquidity platform operating on the SUI blockchain, designed to facilitate seamless lending and borrowing of digital assets. By leveraging the Move programming language and SUI's high-performance infrastructure, NAVI offers users a secure and efficient environment to manage their assets without intermediaries. The protocol's architecture supports a wide range of assets, including major cryptocurrencies and yield-bearing tokens, providing users with diverse opportunities to earn interest or access liquidity.

Key Features

- Diverse Asset Support: NAVI supports over 20 liquidity pools encompassing major cryptocurrencies like WBTC, WETH, and SUI, as well as stablecoins and yield-bearing tokens, enabling users to engage with a broad spectrum of assets.

- Advanced Risk Management: The protocol implements features such as Isolation Mode and Automatic Leverage Vaults to enhance capital efficiency while mitigating systemic risks, ensuring a secure lending and borrowing environment.

- User-Centric Tools: NAVI offers an intuitive dashboard with functionalities like one-click claim and compounding, as well as stablecoin position migration, simplifying asset management for users.

- Integration with DeepBook: By integrating with Sui's native order book, DeepBook, NAVI ensures deep liquidity and efficient trade execution, enhancing the overall user experience.

- Multi-Oracle Pricing: Utilizing data from multiple sources, including Supra and Pyth, NAVI provides robust and reliable price feeds, reducing the risk of price manipulation and enhancing protocol stability.

Tokenomics

The NAVX token serves as the native utility and governance token within the NAVI Protocol ecosystem. With a total supply capped at 1 billion tokens, NAVX is integral to the platform's operations and community governance.

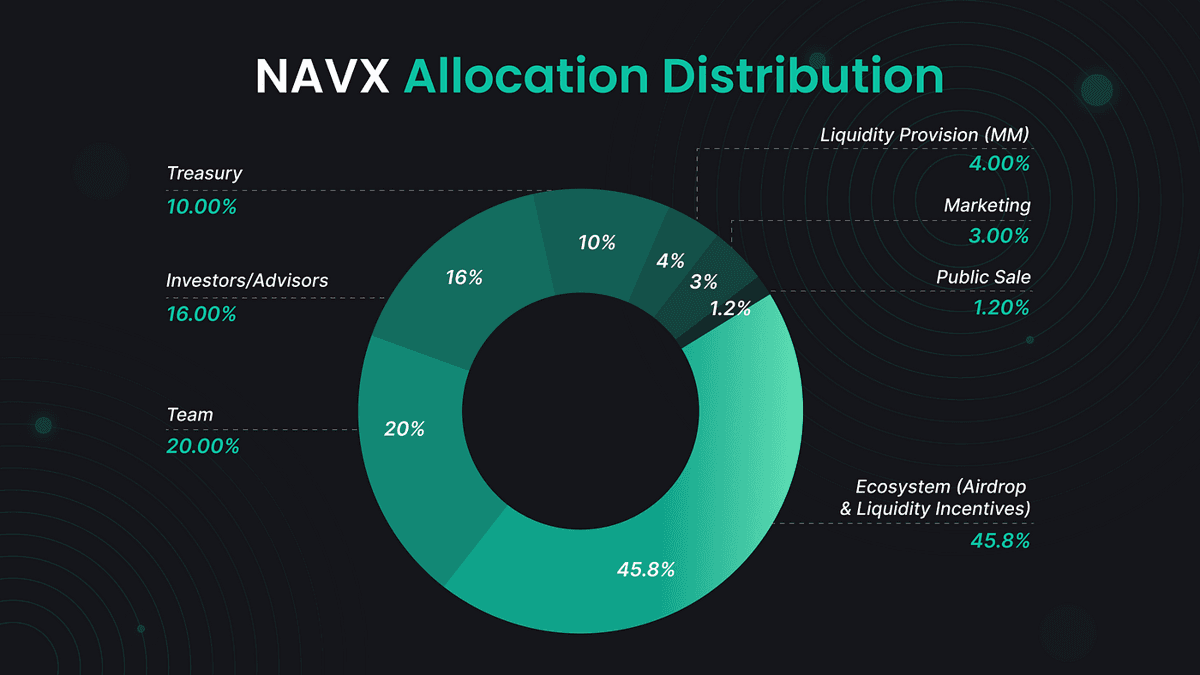

Token Distribution

- Team: 20%

- Treasury: 10%

- Investors: 16%

- Liquidity Provision: 4%

- Public Sale (IDO): 1.2%

- Marketing: 3%

- Ecosystem (Airdrop & Liquidity Incentives): 45.8%

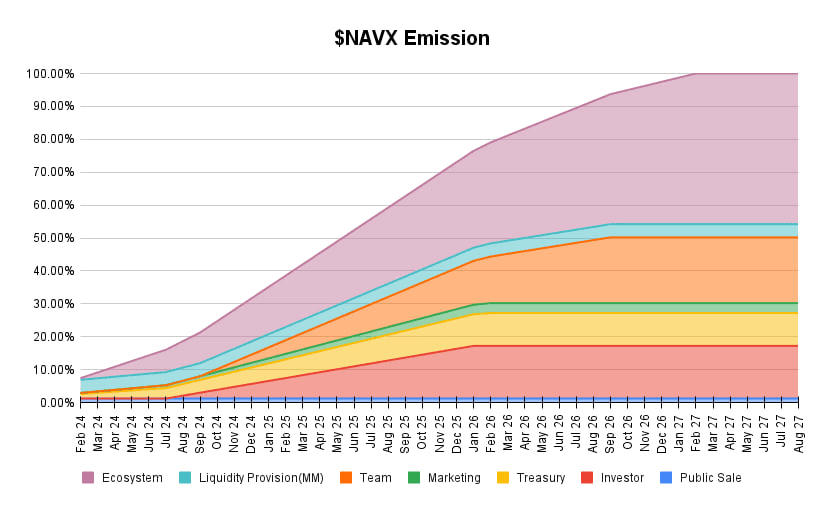

Token Emission

Detailed Token Emissions can be found in the picture bellow:

Utilities

- Governance: NAVX holders can participate in protocol governance, influencing decisions on platform upgrades and asset listings.

- Staking Rewards: Users can stake NAVX to earn a share of protocol fees and emissions.

- Liquidity Incentives: Providing liquidity in NAVX pairs can yield additional rewards and fee shares.

Why Choose NAVI Protocol

NAVI Protocol stands out in the DeFi landscape by offering a comprehensive and secure platform for asset lending and borrowing on the Sui blockchain. Its integration with Sui's scalable infrastructure and the Move programming language ensures high performance and security. With features like diverse asset support, advanced risk management tools, and user-friendly interfaces, NAVI provides users with the flexibility and confidence to manage their digital assets effectively.

FAQ

What is NAVI Protocol?

NAVI Protocol is a decentralized platform on the Sui blockchain that enables users to lend and borrow digital assets through a secure and efficient system.

How does NAVI ensure the security of user funds?

The protocol employs advanced risk management features, including Isolation Mode and multi-oracle pricing, to safeguard user assets and maintain platform stability.

What assets can I use on NAVI?

Users can interact with a variety of assets, including major cryptocurrencies like WBTC and WETH, stablecoins, and yield-bearing tokens.

How can I participate in NAVI's governance?

By holding NAVX tokens, users can vote on protocol proposals, influencing decisions on platform developments and asset integrations.

What are the benefits of staking NAVX?

Staking NAVX allows users to earn a portion of protocol fees and emissions, incentivizing active participation in the ecosystem.

Is there a minimum amount required to lend or borrow on NAVI?

NAVI does not impose minimum thresholds, allowing users to lend or borrow assets based on their individual preferences and strategies.

How does NAVI handle price feeds for assets?

The protocol integrates multiple oracle sources, such as Supra and Pyth, to provide accurate and reliable asset pricing, enhancing the security and reliability of lending and borrowing operations.

Can I use NAVI on mobile devices?

Yes, NAVI's platform is accessible via web browsers on mobile devices, ensuring users can manage their assets on-the-go.