The Ethereum blockchain revolutionized digital assets with the introduction of the ERC-20 standard, enabling anyone to create fungible tokens for everything from DeFi to NFTs. Bitcoin, on the other hand, has long been seen as a more conservative platform focused on secure value storage and peer-to-peer payments. That all began to change with the advent of the Ordinals protocol, which laid the groundwork for new experimentation. One of the most notable innovations to emerge from this shift is the BRC-20 standard.

In this post, we’ll explore what BRC-20 is, how it works, and why it's generating buzz in the blockchain world. Whether you're a developer, investor, or just crypto-curious, understanding BRC-20 gives you insight into Bitcoin's expanding frontier.

Key Takeaways

- BRC-20 enables token creation on Bitcoin using the Ordinals protocol and simple JSON inscriptions, without needing smart contracts or changes to Bitcoin's core protocol.

- Indexers are essential infrastructure for tracking BRC-20 tokens, but their off-chain nature introduces risks like inconsistent data, service outages, and added trust assumptions.

- Transaction fees can be significant, especially during high network activity, making token interactions costly and limiting accessibility for broader adoption.

- BRC-20 expands Bitcoin’s utility, sparking interest in areas like DeFi, gaming, and digital communities—though it's still early-stage and largely experimental.

- Emerging alternatives like Layer 2s and VMs (e.g. Botanix) may offer more scalable and robust solutions for Bitcoin-native smart contracts and tokenization in the future.

Background: Token Standards and Bitcoin's Limitations

Before diving into BRC-20, it’s worth revisiting ERC-20, Ethereum’s widely adopted token standard. ERC-20 made it easy to create fungible tokens by defining a set of rules for how tokens behave. This standardization laid the foundation for the explosive growth of DeFi, ICOs, and stablecoins.

Bitcoin, in contrast, was not designed with such flexibility in mind. Its scripting language is intentionally limited, making it challenging to implement complex logic like token issuance or decentralized applications. Bitcoin Script is a stack-based, Forth-like language that supports basic operations like multisignature scripts, time locks, and payment conditions. However, it does not support loops or complex conditional logic, making it non-Turing complete. This design choice was intentional to maintain simplicity and enhance security but comes at the cost of reduced programmability compared to platforms like Ethereum.

For years, this meant Bitcoin remained focused on being a form of “digital gold”.

However, this began to shift with the introduction of Ordinals in early 2023. The Ordinals protocol allows individual satoshis (the smallest unit of bitcoin) to be inscribed with arbitrary data. This development effectively enabled Bitcoin-based NFTs and later made token standards like BRC-20 possible.

What is BRC-20?

BRC-20 is an experimental token standard for the Bitcoin blockchain, inspired by Ethereum’s ERC-20. It was created by an anonymous developer known as Domo in March 2023. BRC-20 allows users to deploy, mint, and transfer fungible tokens on Bitcoin.

Unlike ERC-20, BRC-20 does not use smart contracts. Instead, it relies on the Ordinals protocol to inscribe JSON-based metadata onto individual satoshis. This metadata defines the token’s name, supply, and behavior. Because Bitcoin doesn’t support on-chain logic in the same way Ethereum does, much of the BRC-20 ecosystem depends on off-chain infrastructure for indexing and validating token transactions.

One of the first and most well-known BRC-20 tokens is ORDI, which helped bring attention to the standard and its potential.

How BRC-20 Works Under the Hood

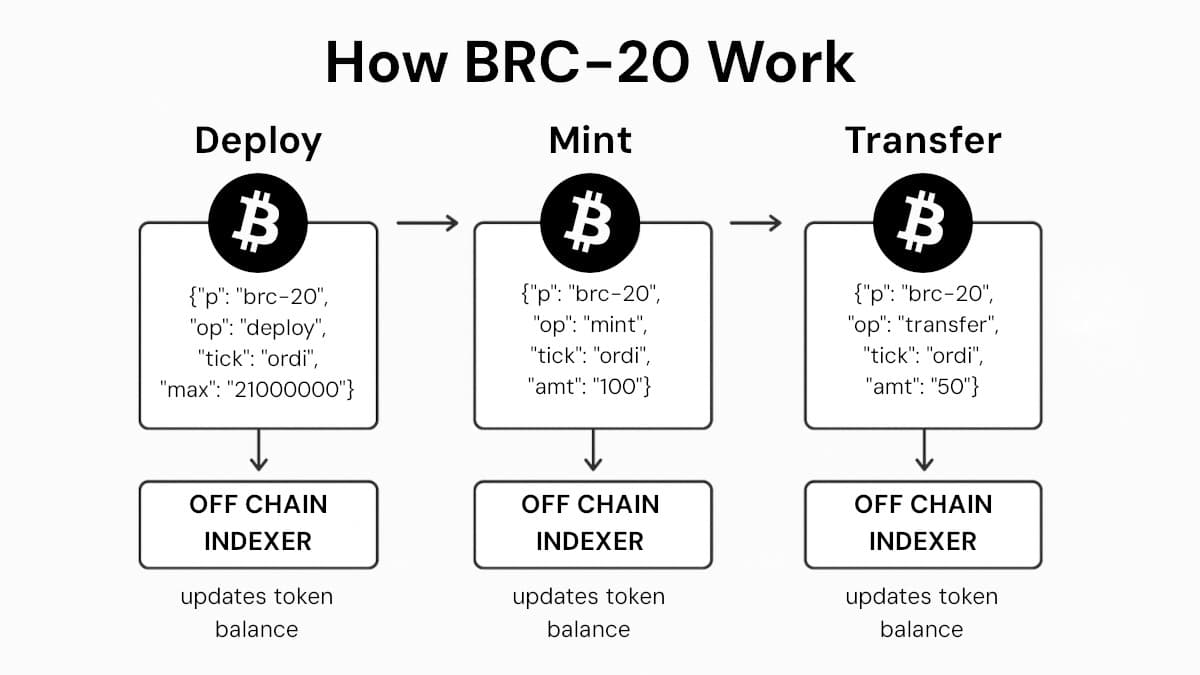

The core mechanism behind BRC-20 revolves around Ordinals inscriptions. These are text files, usually in JSON format, inscribed onto satoshis using Bitcoin transactions. A BRC-20 token is defined by three types of operations:

- Deploy: Creates a new token with parameters like name, max supply, and limit per mint.

- Mint: Generates new units of the deployed token, following the supply constraints.

- Transfer: Moves tokens between wallets using metadata inscriptions.

Because Bitcoin lacks a virtual machine to execute code, there is no smart contract enforcing these rules on-chain. Instead, BRC-20 wallets and marketplaces use indexers to read and interpret inscriptions, keeping track of token balances and valid transactions.

For example, to mint a BRC-20 token, you would inscribe a JSON file like:

{

"p": "brc-20",

"op": "mint",

"tick": "ordi",

"amt": "100"

}

This inscription doesn’t change the blockchain logic itself, but indexers interpret it and update token balances accordingly.

Benefits of BRC-20 Tokens

Despite its limitations, BRC-20 offers several compelling advantages that make it an exciting development within the Bitcoin ecosystem:

- Built on Bitcoin's Foundation: BRC-20 tokens inherit Bitcoin's unparalleled security, decentralization, and immutability. This makes them appealing for users who value a highly secure settlement layer.

- Minimal and Accessible Design: The use of simple JSON inscriptions instead of complex smart contracts makes BRC-20 easier for developers to implement and audit.

- No Changes to Bitcoin Protocol: Tokenization is enabled without any modifications to Bitcoin’s consensus mechanism, preserving the network's core principles.

- Ecosystem Expansion: BRC-20 has catalyzed the creation of new tooling, wallets, marketplaces, explorers - focused specifically on Bitcoin-based assets.

- Early Steps Toward Bitcoin DeFi: Though rudimentary, BRC-20 opens the door to DeFi on Bitcoin, especially with potential future enhancements and Layer 2 integration.

- New Asset Possibilities: Developers are experimenting with tokens for games, community engagement, governance, and more—extending Bitcoin's utility beyond peer-to-peer payments.

Limitations and Risks

Transaction Costs

A major consideration for BRC-20 tokens is transaction cost. Because the standard relies on Ordinals inscriptions, every action (whether it's deploying a token, minting units, or transferring tokens) requires a Bitcoin transaction. These inscriptions take up block space, and during times of high network activity, this can significantly drive up fees.

This has already led to fee spikes on the Bitcoin network, making interactions with BRC-20 tokens relatively expensive. Users may find it costly to mint or transfer tokens, and developers deploying new tokens could quickly incur high cumulative costs. This introduces a barrier to broader adoption, especially for those experimenting on a budget.

Dependency on Indexers

Indexers are essential to the functioning of BRC-20 tokens. These off-chain services monitor the Bitcoin blockchain, read Ordinals inscriptions, and interpret token-related metadata. Without them, the state and behavior of BRC-20 tokens cannot be tracked, as there is no on-chain logic enforcing token balances or validating operations.

If indexers go offline or experience bugs, wallet balances may display incorrect information, transactions could be missed, and users may be unable to mint or transfer tokens correctly. These problems can lead to confusion, loss of funds, or fragmented market experiences. Additionally, inconsistencies between indexers (each potentially interpreting inscriptions slightly differently) can lead to a lack of standardization across the ecosystem.

This reliance introduces trust assumptions in a system that traditionally aims to minimize them, which some see as a contradiction to Bitcoin's foundational principles.

General Limitations

BRC-20, while innovative, remains a very early-stage and experimental technology. Several key limitations remain:

- It adds significant data load to the blockchain, raising concerns about long-term scalability.

- Most BRC-20 infrastructure is off-chain and relatively fragile compared to more established ecosystems.

- Users unfamiliar with Ordinals or metadata inscriptions may find the standard confusing and error-prone.

- As with many new token standards, BRC-20 has fueled speculative behavior and attracted low-quality projects looking to capitalize on hype.

Some Bitcoin community members are wary of these trends and argue that BRC-20's popularity distracts from Bitcoin’s core mission as a decentralized currency.

Use Cases and Real-World Adoption

Despite its experimental nature, BRC-20 has already inspired a wave of activity. Tokens such as ORDI, PEPE, and MEME have attracted significant attention, with some even being listed on major exchanges.

Wallets like UniSat and Hiro are beginning to support BRC-20, while marketplaces and explorers now allow users to trade, mint, and view token metadata. The excitement has drawn in both developers and traders, echoing the early days of ERC-20.

Beyond meme coins, developers are also exploring practical uses such as community tokens, in-game currencies, and even stablecoins. Most of these applications are still in early stages, but they reflect growing interest in Bitcoin's programmability.

Future Outlook

As with any early-stage technology, the future of BRC-20 remains uncertain.

There is a growing interest in integrating BRC-20 with Bitcoin Layer 2 networks or sidechains. These alternatives aim to offer scalable environments for tokenization and smart contracts while still settling on Bitcoin. Solutions like the Lightning Network or Rootstock (RSK) provide smart contract functionality and higher throughput, potentially offering a more sustainable approach than using the Bitcoin base layer directly for inscriptions.

In addition, newer architectures like Botanix introduce virtual machine (VM) layers on top of Bitcoin, enabling smart contract execution natively through hybrid consensus models. These environments offer the programmability of Ethereum with the settlement security of Bitcoin, and could eventually surpass BRC-20 in terms of functionality, interoperability, and developer experience.

While BRC-20 has opened the door to Bitcoin-based tokenization, its long-term relevance may depend on whether it can evolve to meet the demands of users and developers. It may either remain a niche standard or serve as a conceptual bridge toward more robust and scalable Bitcoin-native solutions.

Whether BRC-20 becomes a lasting part of Bitcoin or serves as a stepping stone toward more robust solutions, it has reignited innovation in the ecosystem.

Final Thoughts

BRC-20 is a bold and creative experiment that challenges the traditional limits of what Bitcoin can do. By leveraging Ordinals and a lightweight metadata approach, it introduces a novel form of tokenization on the world’s most secure blockchain.

While not without its flaws, BRC-20 has opened new doors for developers, users, and investors. As the crypto space evolves, BRC-20 could play an important role in shaping Bitcoin’s next chapter.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.