What Are NFTs?

As a quick refresher, two main types of tokenized assets exist in crypto: non-fungible tokens (NFTs) and fungible tokens. Fungible tokens are digital assets like Bitcoin (BTC) or Wther (ETH) and are similar to traditional currencies but run on a blockchain. One Bitcoin is always equal to one Bitcoin, similarly to how one dollar is always equal to one dollar, regardless of the serial number on the bill.

This means that all fungible crypto assets can be exchanged for another type of crypto asset. For example, Bitcoin (BTC) can easily be exchanged for Ether (ETH) or Dogecoin (DOGE). This functionality is similar to how fiat currency from one country can be exchanged with another at a bank. On the other hand, a single NFT can't be directly exchanged for another NFT, and no two NFTs are identical.

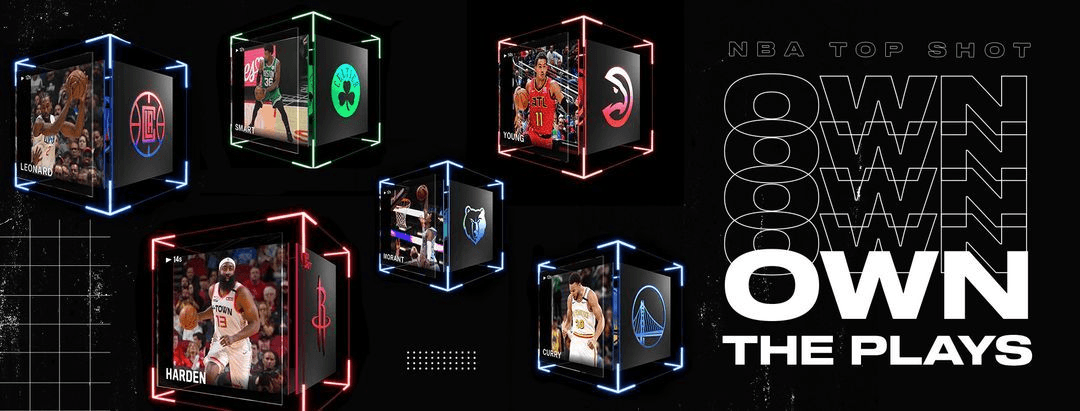

NFTs are one-of-a-kind and cannot be copied and provide exclusive ownership through the blockchain. Non-fungible tokens are used to represent unique digital assets, such as collectable fine art, digital trading cards (e.g., a Lebron James NBA Top Shot collectable), and even characters from animated films such as Toy Story.

NFTs can also represent a musical track created by an artist, or a plot of digital land (next to Snoop Dogg in The Sandbox for example) within a blockchain gaming metaverse. NFTs are as varied as the internet and their utility continues to grow with each passing day.

In many ways, the interest in NFTs has been quite cyclical over the last several years. With this uncertainty, many NFT- and consumer-focused projects have become a thing of the past. Nonetheless, Flow and its creators stand out as true leaders in the sector and have played a pivotal role in the popularization of NFTs in mainstream culture.

This leadership position is evidenced by recent achievements, such as Disney Pinnacle pins selling for $25,000 - $30,000, signaling the growing market for high value digital collectibles that Flow enables.

What is Flow Network?

Founded initially in 2018 by Vancouver Canada-based blockchain development lab Dapper Labs and its founders Dieter Shirley, Roham Gharegozlou, and Mikhael Naayem, Flow network is a Layer 1 blockchain that was developed through its parent entity Axiom Zen, creators of the ERC-721 token standard (the de facto industry standard for NFTs on Ethereum) and the infamous CryptoKitties NFT project.

Branded as a platform built for “a new generation of games, apps, and the digital assets that power them”, Flow is targeted towards a retail-focused audience because of its focus on these niches. As is clearly apparent, Flow is one of several projects at the forefront of consumer-facing products and services that are working hard to popularize NFTs and digital connectables globally.

More broadly, Flow is a Layer 1 Proof-of-Stake (PoS) blockchain that makes use of a modified form of the original Hotstuff Byzantine Fault Tolerant (BFT) consensus algorithm, offering a plethora of interactive products and services tailored to a highly consumer-focused manner.

Chief among its design constructs, is a platform geared towards user experience (UX) and account abstraction which is critical to realizing its wallet and user-focused interactivity with in-house NFT offerings such as NBA Top Shot, NFL All Day, UFC Strike and others.

Specifically, Flow is tailored for the next generation of digital interactions, especially in the gaming, decentralized finance (DeFi), and NFT and digital collectible niches. In order to accomplish these goals and more, Flow is designed utilizing several distinct characteristics.

Flow Design Characteristics

After experiencing numerous lessons building Web3 applications like CryptoKitties, Flow’s founders chose to build the platform to possess all-important characteristics sought after by everyday users and developers, including:

- Verifiability

- Predictability/reliability

- Equitable access for all

- Permissionless composability

- Interoperability

- Security

In addition, the Flow network’s foundational design leverages the following features:

- EVM equivalence: As one of the newly developed upgrades to be realized via Crescendo (more on Crescendo below), EVM equivalence allows the Cadence virtual machine (VM) to enable additional virtual machines to run within, allowing for full EVM interchangeability with Ethereum.

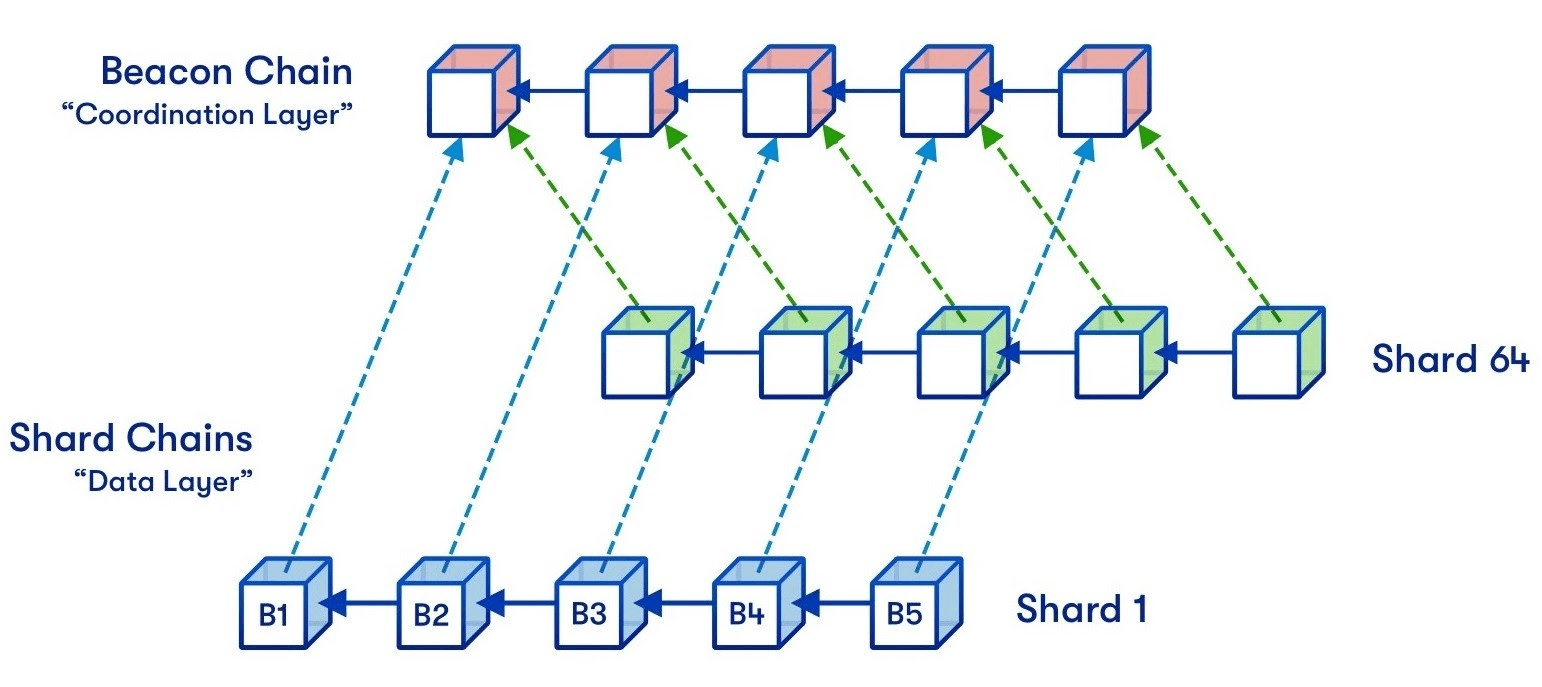

- Multi-role architecture: To dramatically improve system performance, Flow harnesses a multi-role node architecture that allows the network to scale without sharding in a manner that doesn’t impact decentralized consensus or verifiable security.

- Gas cost efficiency: By offering barely negligible gas fees by default, Flow network allows smart contract development, data storage, transaction processing, and other critical processes to be performed exponentially cheaper, ultimately dramatically reducing costs overall.

- True fast finality: Most networks take minutes or hours to achieve transaction irreversibility — or hard finality; on Flow this is achieved in less than 10 seconds.

- Native built-in VRF: To help ensure robust network security and integrity, Flow achieves on-chain randomness (via verifiable random function (VRF)) at the protocol level without complex setup processes and high fees, simply by calling a built-in function.

- Consumer onboarding: To help simplify mainstream consumer interaction, Flow exhibits out-of-box consumer onboarding, allowing users to access crypto through various on- and off-ramps, account linking and social login frameworks, various wallet types, and other systemization frameworks.

- Consensus/execution separation: Flow’s multi-node architecture helps allow the platform to separate execution (a deterministic process) from consensus (a non-deterministic process), markedly increasing overall network throughput without sacrificing decentralization.

Flow Network’s Crescendo Upgrade

Announced in January 2024 at a Flow Town Hall event, the Flow Crescendo upgrade launched for the first time on mainnet on September 4th, 2024.

The finalization of this milestone improved Flow remarkably by introducing EVM equivalence, a dramatically improved version of the Cadence programming language (Cadence 1.0), and numerous additional performance upgrades and utilities.

In addition to EVM equivalence and Cadence 1.0, Crescendo also brings improved core protocol performance, enhanced scalability (decreasing block time from 1.5s to 0.8s), increased interoperability (via a native VM token bridge that allows token transfers between Cadence and EVM environments), Atree register inlining (supporting 2x increased state storage efficiency and 40% memory reduction), and security improvements including the introduction of Dynamic Protocol State to improve node performance and increase Byzantine Fault Tolerance.

Crescendo also offers greater developer flexibility and functionality via integrations with EVM tooling, on-chain randomization, scriptable actions within transactions, and secure element-based key generation and other improvements. Moreover, through Crescendo, the network now offers support for both the native Cadence chain and the EVM-compatible chain, to dramatically increase smart contract development capacity.

Additionally, the upgrade brings multi-signature authentication, custom key management and account abstraction through Cadence Owned Accounts (COAs) and other related technologies. The above features collectively improve Flow's functionality, performance, and developer experience, while maintaining backward compatibility with existing standards (i.e., EVM, Solidity, and others).

Diving into Cadence 1.0

The Cadence programming language is inspired by Facebook’s Diem project (built using the infamous Move programming language). Designed for development on the Flow blockchain, Cadence was built to address the limitations of existing smart contract languages like Solidity (Ethereum and EVM chains) and Move (Sui, Aptos, Movement, and others).

As one of its main foundational premises, Cadence is built as a resource-oriented programming language, allowing the language to leverage a secure model for digital ownership of resource types which ensure assets are only able to exist in one location at time. This characteristic means it is impossible for assets to be duplicated or misplaced, dramatically enhancing security during smart contract development.

After an initial release in 2020, Cadence recently underwent a massive transformation with the release of Cadence 1.0. In particular, the newly released Cadence language exhibits numerous key features, including:

- Strong static type system - provides type safety while preventing common programming errors during compile-time

- Focus on safety and auditability prioritizes code verification and explicit intentions

- Support for digital asset management - optimized for handling digital assets in applications like blockchain games

- Interpreted language - differently than Solidity and Move, Cadence is interpreted rather than compiled

- Built-in pre-conditions and post-conditions enhances security related to transactions and functions

- Capability-based security enforces access control by restricting object access to owners and those with valid references

- Clear syntax - derived via languages such as Swift, Rust, and Kotlin, making it readable and approachable

- Configurable upgradeability allows newly developed platforms to test and iterate prior to making code immutable

In addition to the above design characteristics, Cadence allows for native account abstraction via smart accounts that support scripting, multi-signature transactions, and walletless onboarding.

Because of these characteristics and others, Cadence facilitates the creation of secure and efficient smart contracts, with its design emphasizing safety, developer productivity, clarity, and other features, making it especially suitable for managing digital assets and elaborate on-chain ownership structures.

EVM Equivalence via Crescendo

While Cadence individually is impressive in its own right, the launch of the Cadence 1.0 brought with it several critically important characteristics including full EVM equivalence.

In October 2023 a proposal to implement EVM compatibility was tabled via the Flow forum to offer full support for the Cadence-based chain and the EVM-based chain, meaning that Ethereum Virtual Machine (EVM) and Solidity smart contracts were likely on the way in short order. EVM equivalence allows all smart contracts and protocols operating atop Ethereum or EVM Layer 2 to be deployed on Flow without any code modifications or utilizing any complex connectivity infrastructure.

Because Ethereum is one of the largest chains in the industry, EVM equivalence is a big deal, offering unparalleled speed and cost-efficiency, along with transactions that achieve hard finality in less than 10 seconds. More importantly, EVM equivalence allows developers to bridge assets between Cadence and EVM environments, highlighting the need for full composability and interoperability between systems types.

In addition to its main features discussed above, Flow’s EVM equivalence offers several numerous additional characteristics. These include:

- Speed, cost, and compatibility: With Flow, EVM transactions typically cost less than a cent, dramatically increasing the execution of Solidity smart contracts. Further, the upgrade also allows the network to achieve rapid finality, resulting in transaction confirmation in matter of seconds, significantly faster than conventional Layer 2 solutions that can take up to a week or longer.

- Cross-chain bridging: EVM equivalence allows for the seamless transfer of tokenized assets from a host of chains directly to the Flow network, enabling value exchange with hundreds of asset types without limitations.

- VM token bridge: Flow EVM allows for unabated atomic asset transfers between Flow Cadence and Flow EVM environments within the same transaction, helping provide full compatibility between platforms.

- Accessibility to Cadence features: Ingeniously, developers are able to harness Cadence’s most prominent features and contracts atop Flow EVM, allowing engineers to utilize enhanced computation at a fraction of the cost along with accessibility to Flow native VRF and all assets within Cadence Flow.

Flow’s Multi-Role Node Architecture

Flow is built to address the often-seen challenges in blockchain systems related to performance and scalability. To help accomplish this, Flow leverages a multi-role node architecture that allows various node types to be responsible for independent network tasks (i.e., collection, consensus, execution, and verification). This design ultimately results in higher transaction throughput (sans sharding), enhanced security, higher throughput, lowered latency, and increased decentralization.

This structure makes use of four main node types, including:

- Execution Nodes - 1,250,000 FLOW minimum stake: As the most resource intensive nodes operating on the Flow network, execution nodes are responsible for executing (computing) the state of finalized blocks on the network. After consensus nodes reach consensus on the validity of a proposed block, execution nodes compute block transaction outputs to achieve soft finality. Next, these outputs take the form of submitted execution receipts which are split into separate chunks which are then used by verification nodes once each execution node’s output has been submitted on-chain.

- Consensus Nodes 500,000 FLOW minimum stake: Consensus nodes agree on the order of transactions and are responsible for block formation, ensuring a single consistent view of the blockchain state. This process makes use of a ‘collection guarantee’ that is signed by a supermajority of collection nodes and then a consensus node is selected to propose a block of transactions whereby the probability of selection is proportional to their stake (the amount of FLOW bonded within). Consensus nodes are also responsible for doling out network slashing penalties to ensure its integrity.

- Collection Nodes 250,000 FLOW minimum stake: Collection nodes are responsible for the selection and ordering of network transactions and allowing transaction data to be available for dApps building on the network. Collection nodes are synergistically connected together via randomized ‘clusters,’ meaning that each cluster is tasked with determining whether network transactions are valid prior to batching them into ‘collections.’ Finally, the cluster's collection nodes reach agreement on transaction ordering to achieve a ‘collection guarantee’ after being agreed upon and signed by a node supermajority. This process indicates that transaction data has been made available by the set of collection nodes until the block in question has been sealed via a set of verification nodes and ‘hard finality’ is achieved.

- Verification Nodes 135,000 FLOW minimum stake: Verification nodes are responsible for cryptographically verifying outputs submitted by execution nodes are in fact valid. In addition, Flow leverages a cryptographic primitive called a Specialized Proof of Confidential Knowledge (SPoCK) to ensure the integrity of outputs prior to their approval by verification nodes. Through the larger verification process, verification nodes verify chunk execution receipts with each individual chunk then signing a ‘result approval.’ Eventually, transactions achieve hard finality once a ‘block seal’ is submitted, meaning that the execution attestation result of a particular block has been verified and approved by the verification node quorum.

In addition to the above main validator node types, Flow allows employs the utility of two distinct non-validator nodes, including:

- Access Nodes: Access nodes are responsible for routing transactions to the proper collection node and routing queries to execution nodes. In order to operate an access node a minimum stake of 100 FLOW is required, although users do not earn incentivized rewards for providing this service.

- Observer Nodes: Observer nodes are tasked with providing a copy of block data that allow Flow’s Access API to operate correctly. Specifically, any network participant can run an observer node, although staking FLOW is not required and those that do so do not earn rewards for their efforts.

Key Features of Flow's MEV Resistance

- Separation of Duties: Flow divides responsibilities among different node types—Collection Nodes select transactions, Consensus Nodes determine ordering, and Execution Nodes execute transactions, and verification nodes validate the results. This separation helps ensure no single entity can manipulate transactions for MEV because no one entity can see the transaction details and transaction sequence at the same time.

- Strict Execution Rules: Execution Nodes must process transactions exactly as ordered by Consensus Nodes. Verification nodes independently validate the correctness of the order and results of the transactions and any deviation results in penalties, preventing manipulation.

-

Parallel Processing: Flow's pipelined execution model processes multiple blocks simultaneously, making it exceedingly difficult for attackers to predict and manipulate transaction outcomes.

By design, Flow ensures equitable access and minimizes the risks associated with MEV, providing a safer environment for users.

Unboxing the Flow Wallet and Flow Port Offerings

While Flow is mainly known for its NFT collectable offerings, to allow for the seamless usability and connectivity of its various products and services, several main middleware elements allow the platform to operate in a user-friendly, secure, and seamless manner.

Chief among these include:

Flow Wallet: Flow Wallet is a non-custodial wallet that allows users to trade, hold, stake, and exchange both NFTs (think NFL all Day, UFC Strike and NBA Top Shot assets) and traditional tokens. In particular, the Flow Wallet allows users to create accounts, manage private keys and interact with dApps on the Flow network in both browser extension and mobile versions. Like most wallets, Flow Wallet makes use of a back-up recovery phrase, multiple accounts from a single wallet interface, while also possessing smart contract connectivity and multi-sig support.

Flow Port: To complement the larger vision that is Flow, Flow Port is designed as a browser-based application that serves as a gateway between users and the Flow blockchain ecosystem. As a next-level account management tool designed to be easy-to-use, secure, and fast, Flow Port offers user account onboarding, asset management, staking and delegation, and on-chain connectivity to the larger Flow platform (to all dApps built within the ecosystem), along with multi-wallet compatibility.

Flow Use Cases Examined

Although Flow is built to support a wide range of uses and utilities in blockchain and crypto, its primary focus increasingly constitutes three main market segments, including:

- Non-Fungible Tokens (NFTs)

- Gaming and GameFi

- Decentralized Finance (DeFi)

Non-Fungible Tokens (NFTs)

Since inception, Flow’s main focus has been on the development of an ecosystem focused on digital collectables. To help keep its NFT ecosystem actively growing, Flow offers several Flow-native NFT marketplaces including Flowverse and Flowty, among others.

That said, Flow’s top NFT projects don't typically include traditional profile picture (PFP) projects. Instead, they include an ever-growing suite of collectables of all shapes and sizes, including those in the sports and gaming niches.

These collections and individual pieces range from officially licensed Mattel Hot Wheels and Barbie NFTs, to officially licensed Disney, Pixar, and Star Wars collectables via Disney Pinnacle, surely highlighting the fact the Flow NFT offerings continue to evolve.

As touched on above, professional sports collectables are a huge market segment for Flow. Overall, Flow has been feverishly focused on the development of numerous interactive professional sports league NFT collections that feature specific video clips of professional athletes executing sport-defining plays (called moments) for their respective teams.

The most prominent of these include the NBA Top Shot, NFL All Day, UFC Strike, LaLiga Golazos (Spanish football), and FanCraze (cricket) collections, where collectors are given the opportunity to purchase packs or individual trading cards in a manner analogous to buying packs of sports cards at your local grocery store.

Moments also allows collectors to compete in various challenges, tournaments, and competitions in their desired sport, further increasing interactivity for each participant collector and professional sports niche. It seems plausible that collections from the NHL, MLB, and the Premier League could soon follow, especially because numerous major professional sports leagues are already on board.

Because the Flow platform is designed to be scalable, safe, secure, and energy-efficient, Flow represents an ideal environment for creating and trading digital collectibles of all shapes and sizes. In addition to its collectable NFT offerings we touched on above, in August 2022 it was announced that Flow would become Ticketmaster’s official NFT services partner, offering NFT tickets for a plethora of events globally.

While the gaming niche atop Flow is nowhere near as prominent as its focus on NFTs and digital collectibles, the two are related. That said, it is critically important to continue to build out the gaming and GameFi elements and offerings within the Flow ecosystem. To support these developments, Flow allows for the interconnectedness of various software development kits.

Gaming and GameFi

In many ways, Flow is built to power the next-generation of Web3 gaming. This is highlighted by the fact the platform is designed to support high responsiveness, low transaction fees, seamless user onboarding, among other gaming-specific design characteristics. These design choices result in a gaming-focused environment that allows users to begin gameplay without the need to initially create or fund a wallet, allowing for a flexible user experience via app-custody, while ensuring unalterable verifiable ownership of in-game assets.

While Flow is mainly focused on NFT collectibles, it does host several gaming titles that have so far gained traction. These include the Metaverse Football League (MFL), a football management game that allows users to progress through various milestones, manage their individual teams, participate in tournaments, and level up their players akin to a traditional professional sports video game in season mode. Like some of its NFT connectable offerings, MFL allows players to purchase player card packs and trade players between clubs, allowing players to earn rewards and additional packs for their efforts.

Decentralized Finance (DeFi)

Flow is designed to facilitate the development of a suite of financial products and services that are accessible to a broad user base via the creation and development of a wide range of DeFi protocols, applications, and the like. Like any chain, this is more easily realized by offering an infrastructure focused on scalability, security, economic viability, and user-simplicity.

Because Flow is geared mainly toward NFTs collectibles, there are not a lot of DeFi platforms operating on top of the network as of this writing. That said, one such exception is Increment Finance, a DeFi platform offering lending/boring, liquid staking, yield farming, trading, and more. Furthermore, MORE Markets is gaining market share through their flexible Vault Framework, which enables distinct asset logic from the DeFi strategy layer, enabling superior UX for users.

Flow's DeFi ecosystem has experienced explosive growth in 2025, surging to become a top 50 network by Total Value Locked, recently hitting approximately $89M USD. The stablecoin market cap on Flow has increased 5x in 2025, from $10M to over $50M, with institutional-grade stablecoins from PayPal (PYUSD) and Circle (USDC) now live on the network. Flow is on track to be as well known for finance as it is for NFTs. As an important milestone in its continually-evolving roadmap, Crescendo went live on Flow on September 4th, 2024, bringing with it a new era for Flow that will support its continued development and focus on adoption and user connectivity. Along with its all-important gamut of protocol-shifting developments and upgrades, Crescendo also ensured a continued focus on supporting developers within the Flow ecosystem.

Flow Roadmap

Since launch, the Flow network development cycle has been conducted in numerous stages. Let’s examine a chronological overview of its evolution and roadmap:

- 2020 - Mainnet Launch: Leading up to mainnet launch, Flow conducted a community token sale, enabled prospective participants to operate nodes on the network, launched an interactive development playground for developers, and launched the Open Builders Program.

- 2021 - Performance Improvements: In 2021 the Flow platform initiated the launch of several of its most important products and services (including interactive NFT collection NBA Top Shot) and enabled network staking with the FLOW asset to help ensure the robustness of the platform.

- 2022: Permissionless Deployment: As the Flow network began to gain more traction, the focus turned to expanding its growing user base through the development of a wide range of applications and developer tools, while simultaneously enhancing the capabilities of the Cadence programming language.

- 2023 - Mobilizing Mainstream: While the focus of the platform has always been user-centric since inception, 2023 increasingly focused on the addition of new user-focused capabilities such as account abstraction and other. In addition to continuing to improve platform UX, the Flow Wallet was initially released (allowing users to store, buy, sell, and exchange their assets on Flow and between chains) and its mobile software development kit (SDK) was launched for the first time, enabling mobile application development on the network.

- 2024 - Crescendo: 2024 saw the initiation of the Crescendo upgrade, bringing with it extreme advances in performance and scalability. Of great significance, Crescendo enabled full compatibility with the Ethereum Virtual Machine (EVM) to realize increased interoperability with Ethereum and other EMV-compatible networks. Moreover, the upgrade also consisted of the launch of Cadence 1.0 (which we discussed in length above), a purpose-built version of the Cadence language that exponentially improved developer usability and functionality. Finally, the Crescendo phase consisted of the launch of the Flow World Tour (a series of events to promote Flow globally) and the initiation of the Flow Community Rewards program.

- 2025 and beyond - Future Aspirations: Moving forward, the Flow platform is focused on increasing adoption and improving the growth of its ecosystem and the capabilities of its network. Some of these goals include the transition to a fully permissionless =and enhancements which would allow the platform to one day conduct 1 million transactions per second (TPS). The upcoming Forte upgrade planned for October, brings also a new wave of features to Flow separated in two categories. “Flow Actions” brings the possibility to combine operations like swap, source, sink, flasher, and price oracle in one transaction. “Flow Agents” enables to automate certain behaviour invoked by a trigger like a signed transaction. This could be for example, an agent that runs every Friday to rebalance yield vaults across different protocols.

Flow Tokenomics and Governance

FLOW Token Utility

Flow’s native tokenized asset FLOW serves at least six main utilities within the larger Flow network ecosystem. These include:

- Medium of exchange: FLOW acts as medium of exchange, facilitating transactions within the Flow ecosystem to enable seamless interactions among users and applications.

- Incentivized staking rewards: Like all Proof of Stake networks, FLOW allows validators and delegators to earn incentivized staking rewards.

- Transaction gas fees: The FLOW asset helps allow users on the network to send and receive transactions on the network and acts as a medium for the payment of gas fees on the platform. FLOW also allows users and developers to pay fees for the deployment of smart contracts, creation of user accounts, and so on.

- Payment for storage: FLOW allows for the payment of on-chain storage fees that allows users to reserve storage space on the network, while ensuring proper data availability (DA).

- DeFi collateral: Similarly to all other chains offering DeFi, FLOW helps DeFi protocols in the ecosystem operate by acting as collateral for various uses such as ensuring the proper functionality of decentralized money markets, decentralized exchanges (DEXs) and other offerings.

- Protocol governance: The FLOW token helps provide accessibility to governance voting, proposal submission and more as a means to influence the network's future development trajectory and decision-making processes.

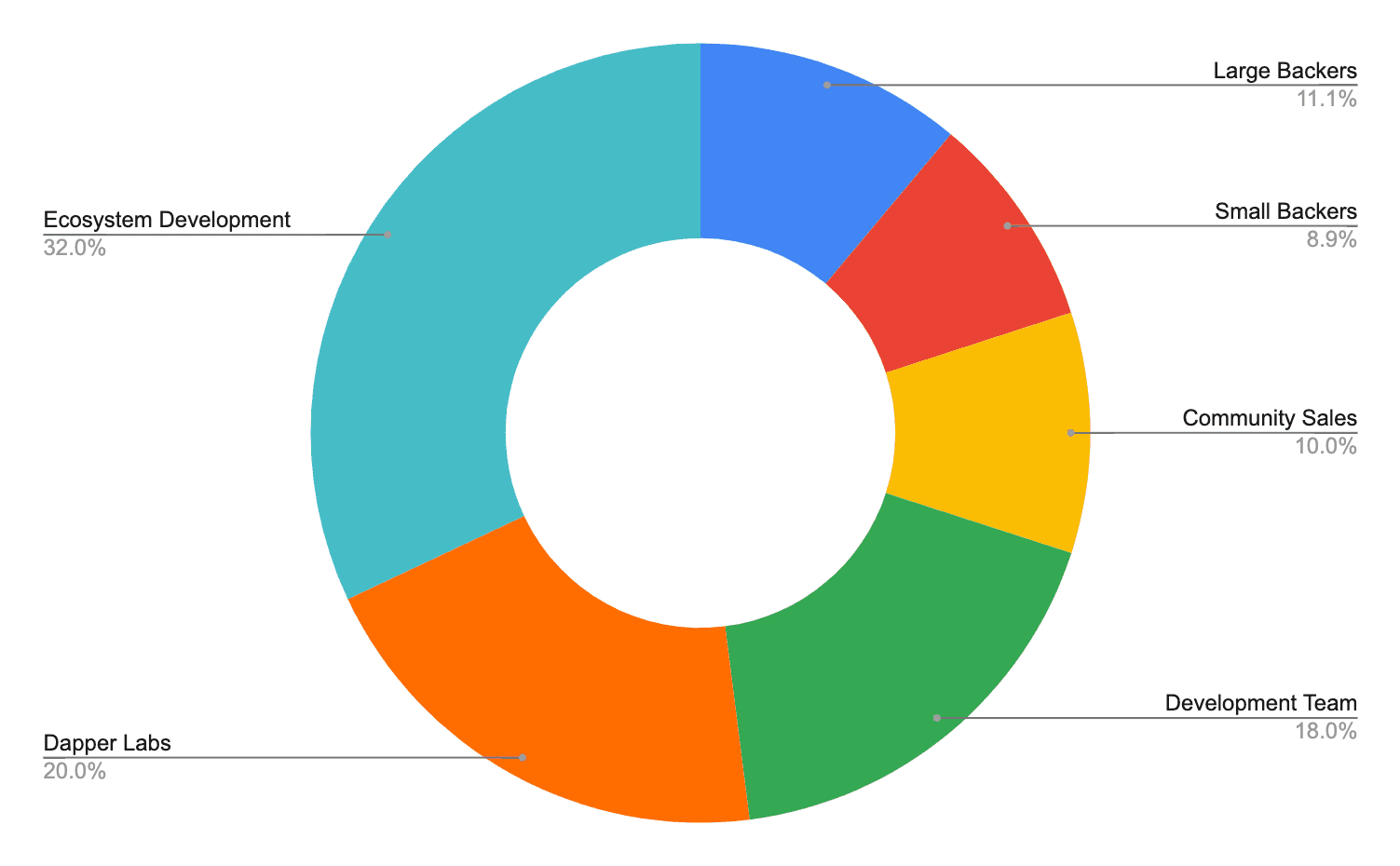

Initial FLOW Token Distribution

At the time of its October 2020 mainnet launch Flow allocated 1.25 billion FLOW as follows:

- Ecosystem Development (32%) 400 million tokens were allocated to support ecosystem development

- Dapper Labs (20%) - 250 million tokens were allocated to Dapper Labs (the founding entity behind Flow) to ensure the continued funding of protocol development and operations

- Pre-Launch Backers (20%) 250 million tokens were distributed to early investors and pre-launch backers

- Development Team (18%) - 225 million tokens were allocated to the core development team, with full vesting concluding in October 2023

- Community Sale (10%) 250 million tokens were distributed to early investors and community members

As of October 2023, all allocations to the ecosystem fund, pre-launch backers, and the community including Dapper Labs have been fully unlocked. No FLOW coins are now locked and thus the entire FLOW supply is now in circulation.

Resources

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.