Key Takeaways

- Decentralized Data Access: Lava provides decentralized RPC services, optimizing blockchain data retrieval across multiple chains.

- Cosmos-Based Infrastructure: Built on the Cosmos SDK, Lava enhances scalability and ensures data reliability.

- Incentivized Ecosystem: Introduces a competitive marketplace for data providers, rewarding them based on quality of service.

- Multi-Chain Support: Lava currently supports over 30 blockchains and handles billions of RPC requests daily.

- LAVA Token: Powers the network for transaction fees, staking, and governance.

Introduction

The Web3 ecosystem is experiencing rapid growth, placing increasing demands on the efficiency and reliability of blockchain data access. Traditional methods often fall short in meeting these requirements, necessitating innovative solutions. Lava Network emerges as a decentralized infrastructure designed to address these challenges and optimize data retrieval processes.

This article delves into the core concepts of Lava Network, examining its architecture, economic incentives, and potential impact on the development of scalable and robust decentralized applications.

What is Lava Network?

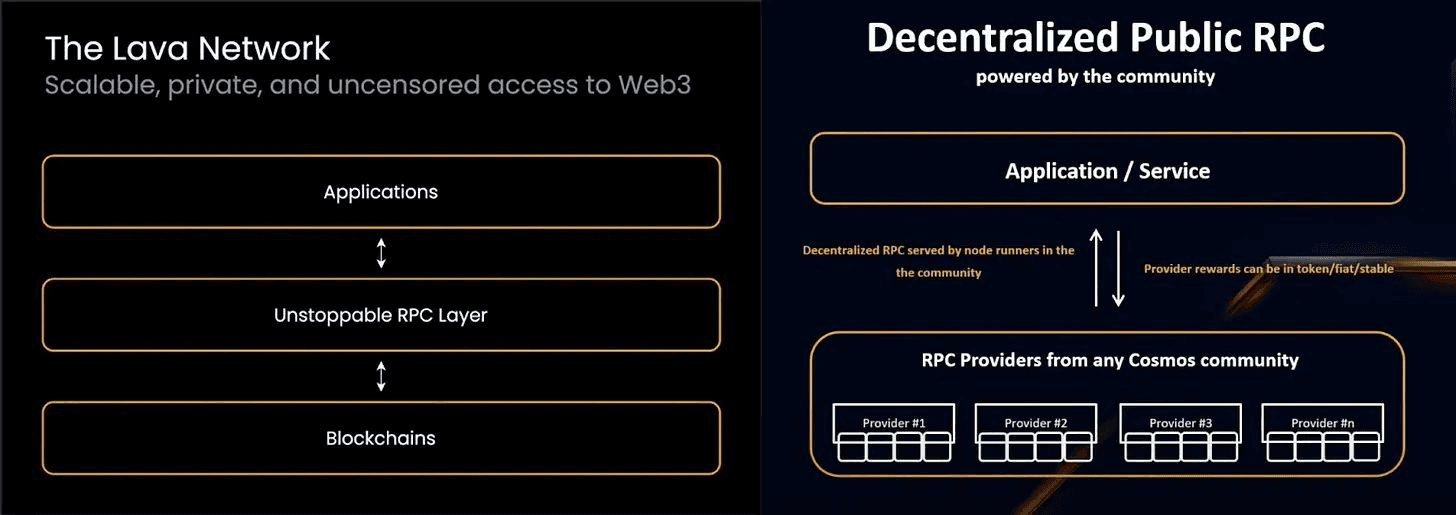

Lava Network stands as a cornerstone in the evolution of blockchain infrastructure, addressing the critical bottleneck of data accessibility. By establishing a competitive marketplace for essential blockchain services, Lava addresses the fundamental challenges hindering the growth of the Web3 field. Unlike traditional centralized models, Lava distributes data provision across a network of independent nodes, fostering a robust, scalable, and multichain ecosystem.

At the core of Lava Network lies the Lava Chain, a governance Delegated-Proof-of-Stake layer built on the Cosmos SDK, and Lava Nodes, which provide essential services such as Remote Procedure Calls (RPC) and indexing. This modular decentralized architecture empowers developers by offering fast, reliable, and secure access to blockchain data, facilitating the creation of robust and scalable applications.

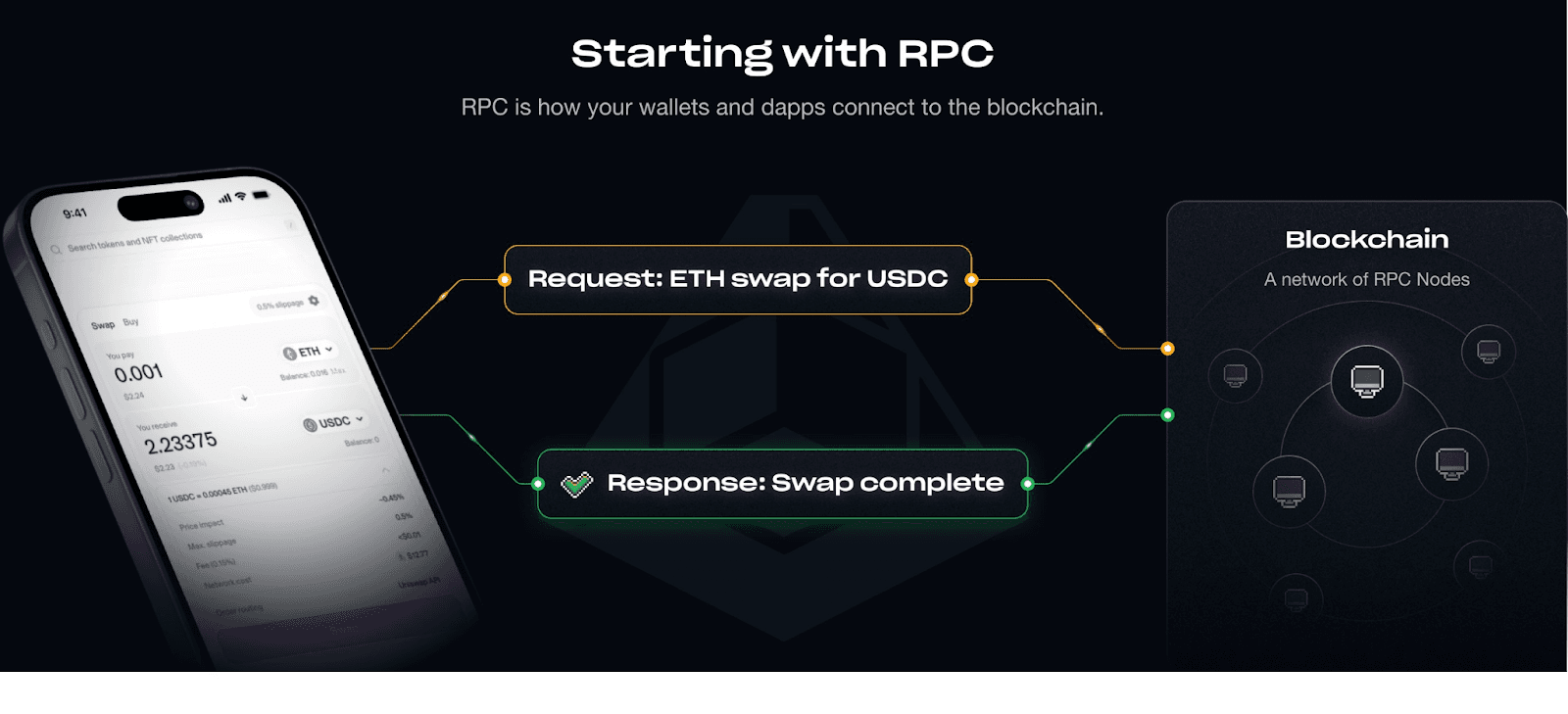

Almost all blockchain interactions, such as swapping tokens, staking assets, and minting NFTs, rely heavily on RPCs to function seamlessly. However, the traditional model for providing these essential RPC services has been complex and resource-intensive, often leading to centralization among a limited number of providers. This concentration of power not only creates vulnerabilities within the system but also raises concerns regarding data manipulation, censorship, and privacy breaches.

Lava Network recognizes these inherent flaws in the current model and aims to revolutionize the landscape by decentralizing the provision of RPCs, distributing control, improving security, and creating a more transparent and fair ecosystem for all Web3 users.

Lava's economic model incentivizes high-quality service through a competitive marketplace, ensuring users have the best possible access to blockchain data. Users can easily retrieve data from the network, with each node provider's service quality transparently tracked on-chain. By making it easier for node operators to participate, the network cultivates a diverse and competitive environment, enhancing data reliability, security, and affordability for all users.

This thriving market is powered by the Lava Protocol, which governs the interactions between data consumers, node providers, and network validators. The protocol introduces a fundamental building block called "specs". Specs are modules that define APIs, which can be served by the network to fulfill the diverse data needs of users. Lava envisions a modular economy for data infrastructure, extending its benefits beyond the Web3 space.

Lava's Multi-Chain RPC solution offers seamless functionality through:

- Quality of Service (QoS): Users actively monitor, and rate providers based on response time, availability, and data freshness. Providers are rewarded based on their QoS score, ensuring optimal performance.

- Data Reliability: Rigorous fraud and fault detection mechanisms are in place. The network employs statistical inference and random sampling to compare provider responses, identifying and penalizing any discrepancies or malicious behavior.

- Privacy & Anonymity: Relays are randomly distributed among a dynamic group of top-performing providers, minimizing the chance of repeated interactions with the same provider. Communication between users and providers is direct, and identities are not linked to Lava Wallets.

- Scalability: Lava is designed for scalability at every level. Efficient reward mechanisms, aggregation, direct communication, and staking incentives work together to alleviate network strain and optimize performance.

- Decentralized Access: Users are encouraged to interact with the network in a fully decentralized manner, with all relays conducted peer-to-peer (P2P).

- Open Source: Lava embraces open-source principles and modularity. Developers have full access to the codebase for both the blockchain and any implemented specs, fostering transparency and collaboration.

With the goal of supporting all networks, Lava already supports RPC modules for more than 30 blockchains. The network has served over 40 billion RPC requests, and 2 billion requests daily.

LAVA's Economic Model

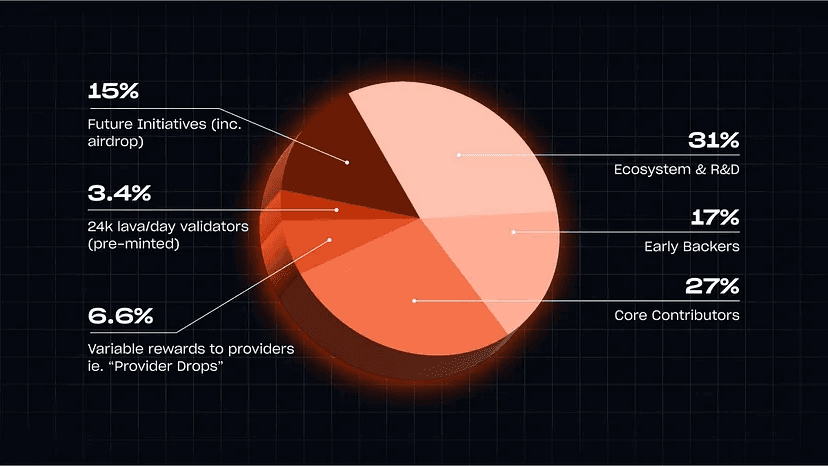

The essence of Lava Network is captured in its economic model, where the distribution of LAVA tokens reflects a meticulous balance between immediate growth and long-term vision.

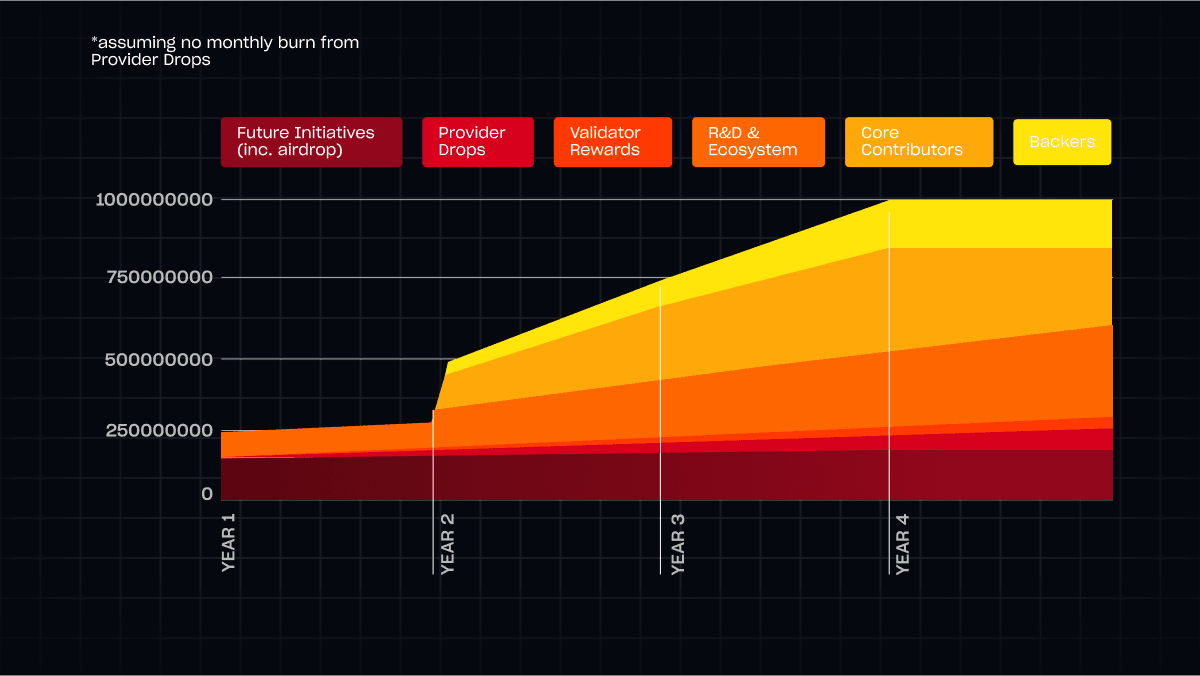

The distribution mechanism is carefully crafted with a fixed supply of 1 billion LAVA tokens.

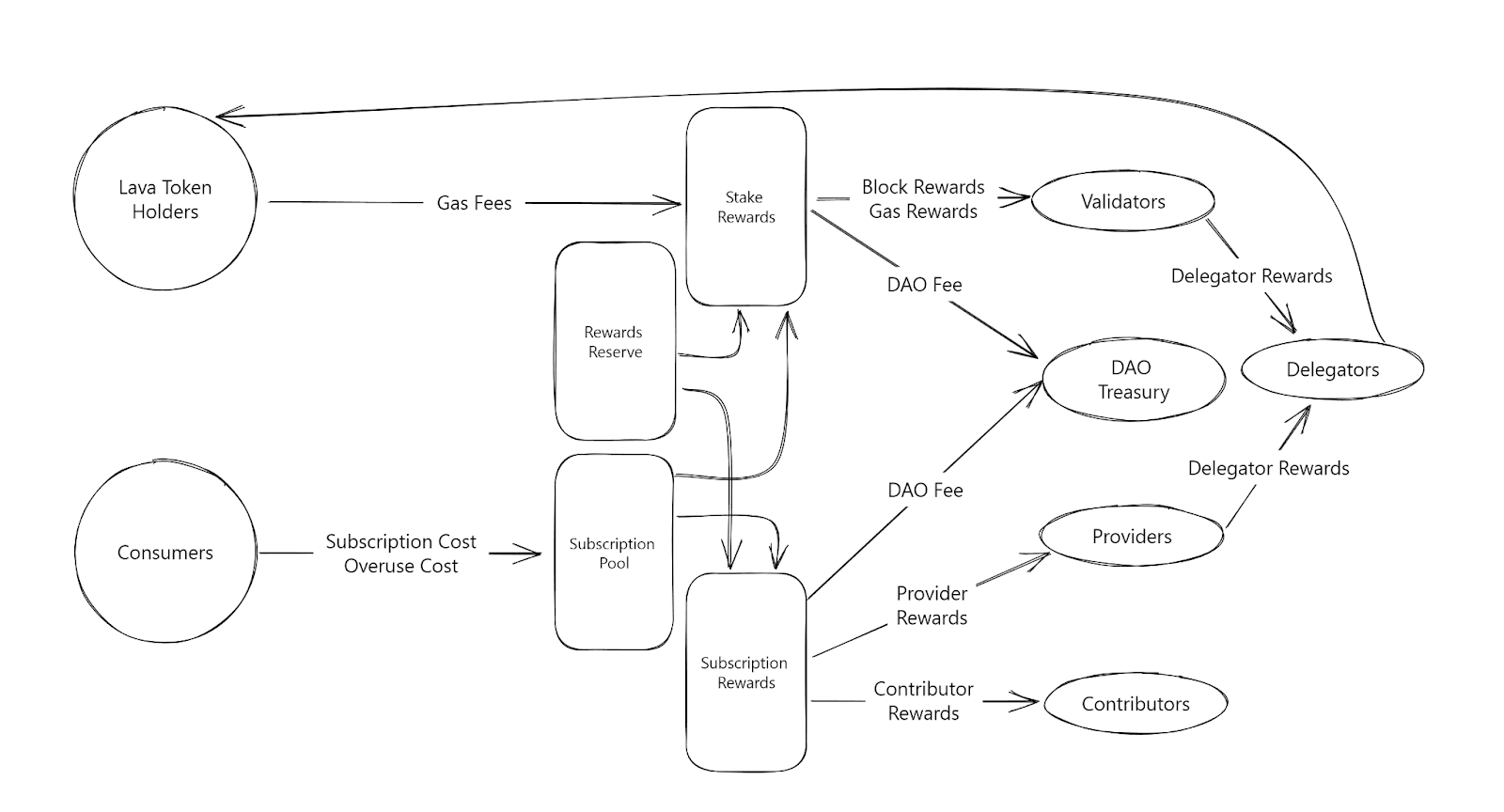

The LAVA token is deeply integrated into the Lava Network, serving multiple purposes:

- Transaction Fees: LAVA is used to pay gas fees for transactions and operations on the network.

- Validator Staking: Validators secure the network and participate in governance by staking LAVA.

- Provider Staking: Providers stake LAVA to influence their pairing frequency with consumers.

- Delegation and Restaking: Token holders can delegate their LAVA to validators and providers, earning rewards.

- Initial Bootstrapping: LAVA tokens are used for initial provider rewards ("Provider Drops") to attract early participation.

- Subscription Payments: Consumers purchase subscriptions using LAVA.

- Provider Rewards: Providers are rewarded monthly in LAVA, proportionate to the LAVA used for subscriptions in the previous month.

Reward Mechanisms

Lava Network offers five distinct reward types, each distributed among different actors based on percentages determined by DAO governance.

Ecosystem Growth Initiatives

Lava Network employs various strategies to stimulate ecosystem growth:

- Magma Points: A separate reward system for loyal community members, distributed by the Lava Foundation or chains using Lava's Incentivized RPC Pools.

- Incentivized RPC Pools: Chains incentivize providers to scale their RPC infrastructure by depositing their native tokens into these pools.

- Lava Drop Seasons: Strategic airdrops to boost network participation and engagement.

- Provider Drops: A dedicated 6.6% of the total supply is allocated for initial provider rewards, distributed monthly based on demand for Lava services.

- Community Pool: A 2% allocation from block rewards, along with 0.1% from subscription and Incentivized RPC Pool rewards, is dedicated to community initiatives.

LAVA Supply and Deflation

Lava's fixed supply and deflationary mechanisms are crucial for long-term value:

- Provider Drops: Designed to incentivize early provider participation, these rewards decrease as paid demand increases.

- Validator Rewards: Rewards decrease as the percentage of staked LAVA increases.

- Token Burns: At 80% staked LAVA, half of the subscription fee taxes and any undistributed validator rewards are burned, reducing circulating supply.

Unlock Schedule

These combined measures make LAVA a deflationary asset with a strong value proposition, driving long-term growth and stability for the Lava Network ecosystem.

Team

Lava Network's foundation lies in the combined expertise of its co-founders, Yair Cleper and Gil Binder. These seasoned entrepreneurs, with a proven track record in the Web2 space, embarked on a journey to build a multichain NFT marketplace. However, their ambitious project quickly highlighted a critical gap in the blockchain infrastructure landscape – the lack of efficient and scalable access to blockchain data across various networks.

Faced with the resource-intensive nature of running their own nodes for each blockchain, Yair and Gil explored existing node provider solutions. Yet, they encountered limitations and reliability issues, particularly with chains like Cosmos. Even focusing on the well-established Ethereum network presented its own set of challenges, with API restrictions and the need to rely on multiple providers.

These real-world challenges served as the catalyst for the creation of Lava Network. The co-founders recognized the fragmented, complex, and sluggish nature of accessing blockchain data. This realization fueled their determination to develop a comprehensive solution that would streamline data access, enhance reliability, and empower developers and users across the blockchain ecosystem.

With a deep understanding of the challenges and opportunities of the blockchain space, it was decided to assemble a team of experienced engineers, blockchain experts and business strategists. This collective expertise, combined with their passion for innovation and problem-solving, has propelled Lava Network forward.

Roadmap

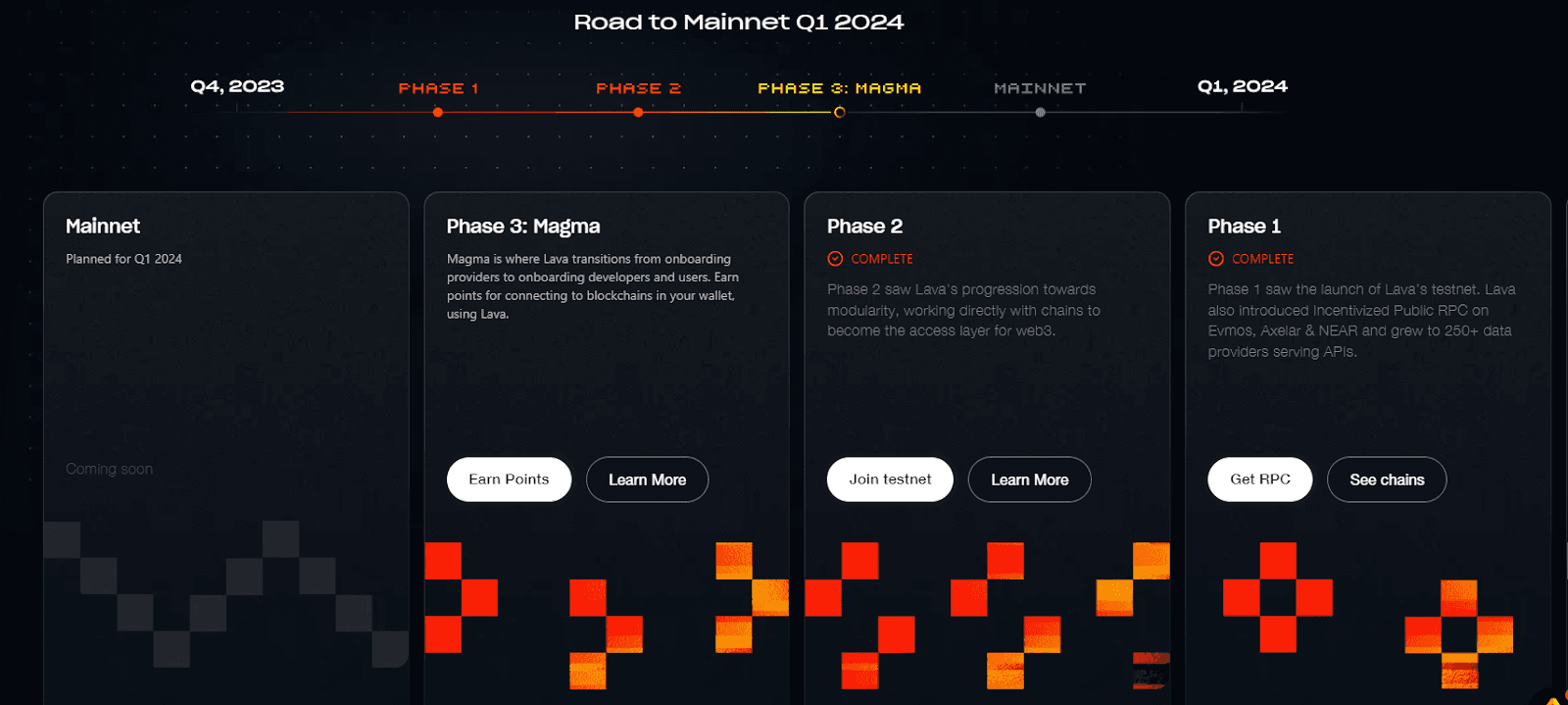

Lava Network's journey has been marked by significant milestones and promising developments.

The journey began with a successful seed funding round, raising an impressive $15 million from prominent investors. Led by Jump Capital, Hashkey Capital, and Tribe Capital, the seed round also saw participation from other key players like Alliance, Node, North Island, Quiet, Finality, Dispersion Capital, and Interop Ventures.

Building upon this strong financial foundation, Lava Network launched its first testnet in February 2023, marking a significant milestone in the development process.

In the third phase, Lava Network has introduced the MAGMA initiative, a unique program designed to encourage wallet users to connect to blockchains through Lava by earning points. This initiative not only boosts community engagement but also contributes to the network's growth and adoption.

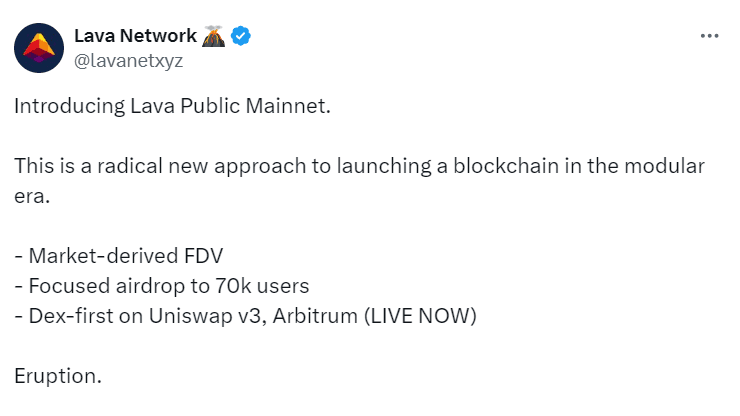

Finally, Lava Network has officially launched its public Mainnet with backing from major players like Filecoin Network, Starknet Foundation, and Cosmos Hub. To incentivize participation, a substantial $2 million in pools has been allocated for mainnet users and infrastructure providers, rewarding them for reliable service provision.

This launch also marks the debut of the LAVA token, prioritizing community involvement through a massive airdrop of 55 million LAVA. This approach underscores Lava Network's commitment to decentralization and broad participation within the ecosystem.

Conclusion

By addressing the critical challenge of fragmented and inefficient blockchain data access, Lava Network lays the groundwork for a more interconnected and accessible blockchain ecosystem.

Within the financial sector, Lava Network has the potential to revolutionize DeFi applications by providing a reliable and scalable infrastructure for accessing real-time data across multiple blockchains. By abstracting the complexities of interacting with diverse blockchain networks, developers can now focus on creating sophisticated DeFi products and services that leverage cross-chain liquidity and functionality, ultimately enhancing user experiences and expanding the possibilities within the decentralized financial landscape.

Furthermore, Lava Network's decentralized architecture and emphasis on security make it an attractive solution for enterprise blockchain applications. Businesses can leverage Lava Network's infrastructure to seamlessly integrate blockchain technology into their existing workflows, optimizing data security, efficiency, and scalability while unlocking new avenues for innovation and growth.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.