Overview

Arbera is a decentralized protocol on the Berachain network that facilitates permissionless volatility farming and yield generation. It enables users to create secondary markets for liquid digital assets, capitalize on arbitrage opportunities, and earn consistent real yields without relying on third-party price feeds or oracles.

Key Features

- Volatility Farming: Arbera leverages market volatility through a mechanism known as volatility farming. By exploiting price differences between assets and their synthetic counterparts (Den tokens), the protocol allows users to profit from market inefficiencies. This strategy remains effective regardless of market conditions, providing continuous opportunities for yield generation.

- Dens (Synthetic Asset Wrappers): Dens are ERC-20 tokens representing wrapped versions of underlying assets within the Arbera ecosystem. Each Den token (brTOKEN) is fully collateralized 1:1 by its corresponding original asset, ensuring value stability. Users can wrap their assets into brTOKENS, participate in liquidity provision, and engage in arbitrage activities to earn rewards.

- Arbitrage Opportunities: Arbera's design creates numerous arbitrage opportunities by allowing price discrepancies between original assets and their synthetic counterparts. Arbitrageurs and MEV bots can exploit these differences, buying low in one market and selling high in another, thereby generating profits and contributing to the protocol's fee generation mechanism.

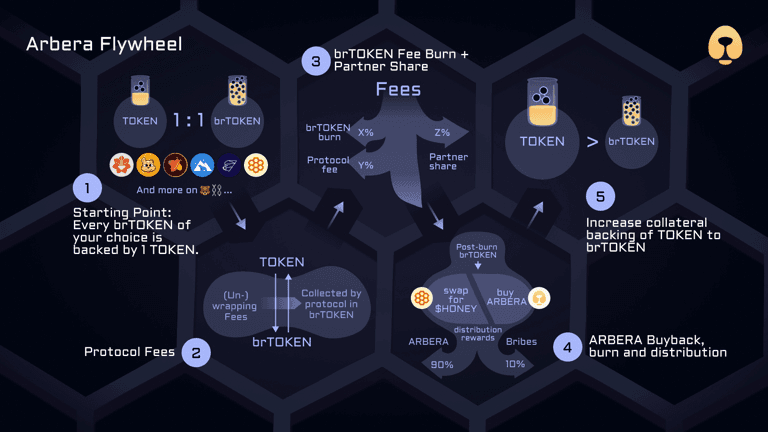

- Arbera Flywheel: The Arbera Flywheel is a self-reinforcing mechanism designed to generate continuous arbitrage opportunities. As users engage in wrapping, unwrapping, buying, and selling activities, fees are collected and used for ARBERA token buybacks. These buybacks create upward pressure on the ARBERA token's value, benefiting Den LP stakers and fostering a sustainable ecosystem.

Tokenomics

ARBERA Token

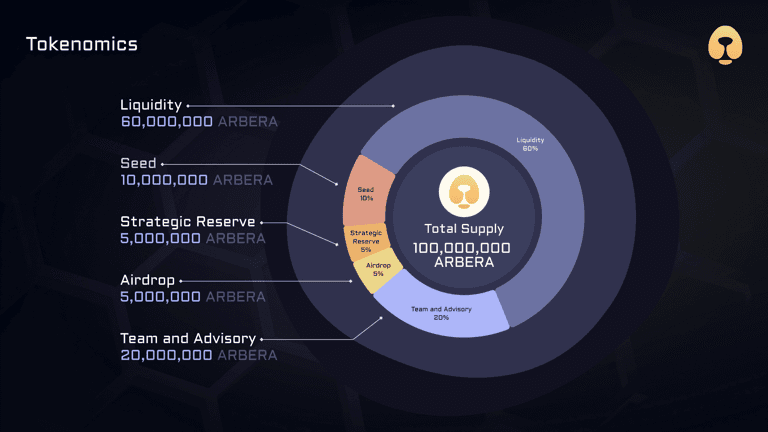

The ARBERA token serves as the core of the Arbera ecosystem. Unlike protocols that rely on continuous token emissions, Arbera has a fixed supply of 100,000,000 ARBERA tokens, all minted at the contract's inception. This approach prevents inflation and dilution, ensuring sustainable value for token holders. ARBERA tokens are distributed as follows:

FAQs

What is Arbera?

Arbera is a decentralized protocol on the Berachain network that facilitates permissionless volatility farming and yield generation. It enables users to create secondary markets for liquid digital assets, capitalize on arbitrage opportunities, and earn consistent real yields without relying on third-party price feeds or oracles.

How does volatility farming work in Arbera?

Volatility farming in Arbera involves exploiting price differences between original assets and their synthetic counterparts, known as brTOKENS. Arbitrageurs capitalize on these discrepancies, generating profits and contributing to the protocol's fee structure.

What are Dens in Arbera?

Dens are synthetic asset wrappers represented as ERC-20 tokens (brTOKENS) fully collateralized by their corresponding original assets. Users can wrap their assets into brTOKENS, participate in liquidity provision, and engage in arbitrage activities to earn rewards.

How does the Arbera Flywheel mechanism function?

The Arbera Flywheel is a self-reinforcing mechanism designed to generate continuous arbitrage opportunities. As users engage in wrapping, unwrapping, buying, and selling activities, fees are collected and used for ARBERA token buybacks. These buybacks create upward pressure on the ARBERA token's value, benefiting Den LP stakers and fostering a sustainable ecosystem.

What is the ARBERA token's supply model?

The ARBERA token has a fixed supply of 100,000,000 tokens, all minted at the contract's inception. This approach prevents inflation and dilution, ensuring sustainable value for token holders.

How can users earn yields with Arbera?

Users can earn yields by participating in liquidity provision, engaging in arbitrage activities between original assets and brTOKENS, and benefiting from the protocol's fee generation mechanism, which includes ARBERA token buybacks.