Overview

Kai Finance is a next-generation leveraged yield platform built on the SUI blockchain. It offers innovative yield farming solutions tailored for both passive and active investors. By utilizing a dual-vault system, Kai Finance enables users to either earn steady returns through Single Asset Vaults or amplify their yields with up to 11x leverage via Liquidity Provider Vaults. This approach provides secure and transparent access to DeFi opportunities, optimizing capital efficiency for diverse investment strategies.

Key Features

- Dual-Vault System: Kai Finance offers Single Asset Vaults for passive income and Liquidity Provider Vaults for active, leveraged yield farming, catering to different investment preferences.

- High Leverage Options: Users can access up to 11x leverage in LP Vaults, enhancing potential returns while managing risk through customizable strategies.

- Auto-Compounding Rewards: Both vault types feature automated reward reinvestment every 30 minutes, maximizing yield without manual intervention.

- Beginner-Friendly Interface: The platform provides an intuitive interface, making it accessible for newcomers to DeFi while offering advanced tools for experienced users.

- Robust Risk Management: Kai Finance employs mechanisms like auto-deleveraging and real-time position health alerts to mitigate liquidation risks.

Why Choose Kai Finance

Kai Finance stands out in the DeFi landscape by seamlessly integrating high-yield farming with capital efficiency. Its dual-vault system allows users to select strategies that align with their risk tolerance and investment goals. Passive investors benefit from steady returns without active management, while active users can leverage their positions for higher yields. The platform's emphasis on security, transparency, and user experience makes it a compelling choice for both newcomers and seasoned DeFi participants.

FAQs

What is Kai Finance?

Kai Finance is a leveraged yield platform on the SUI blockchain, offering Single Asset and Liquidity Provider Vaults to cater to different investment strategies.

How do Single Asset Vaults work?

Single Asset Vaults allow users to deposit a single type of asset, earning passive income through interest paid by borrowers in the Liquidity Provider Vaults.

What are Liquidity Provider Vaults?

Liquidity Provider Vaults enable users to deposit pairs of tokens and borrow additional funds to increase their exposure, potentially amplifying returns through leveraged yield farming.

Is there a risk of impermanent loss?

While Single Asset Vaults mitigate impermanent loss by holding only one asset, Liquidity Provider Vaults involve paired assets and may be subject to impermanent loss, especially in volatile markets.

How are rewards distributed?

Rewards in both vault types are auto-compounded every 30 minutes, enhancing yield without requiring manual reinvestment.

Can I withdraw my funds at any time?

Kai Finance maintains a 10% liquidity buffer to support withdrawals. However, during periods of high utilization, immediate withdrawals may be temporarily constrained.

What assets are supported?

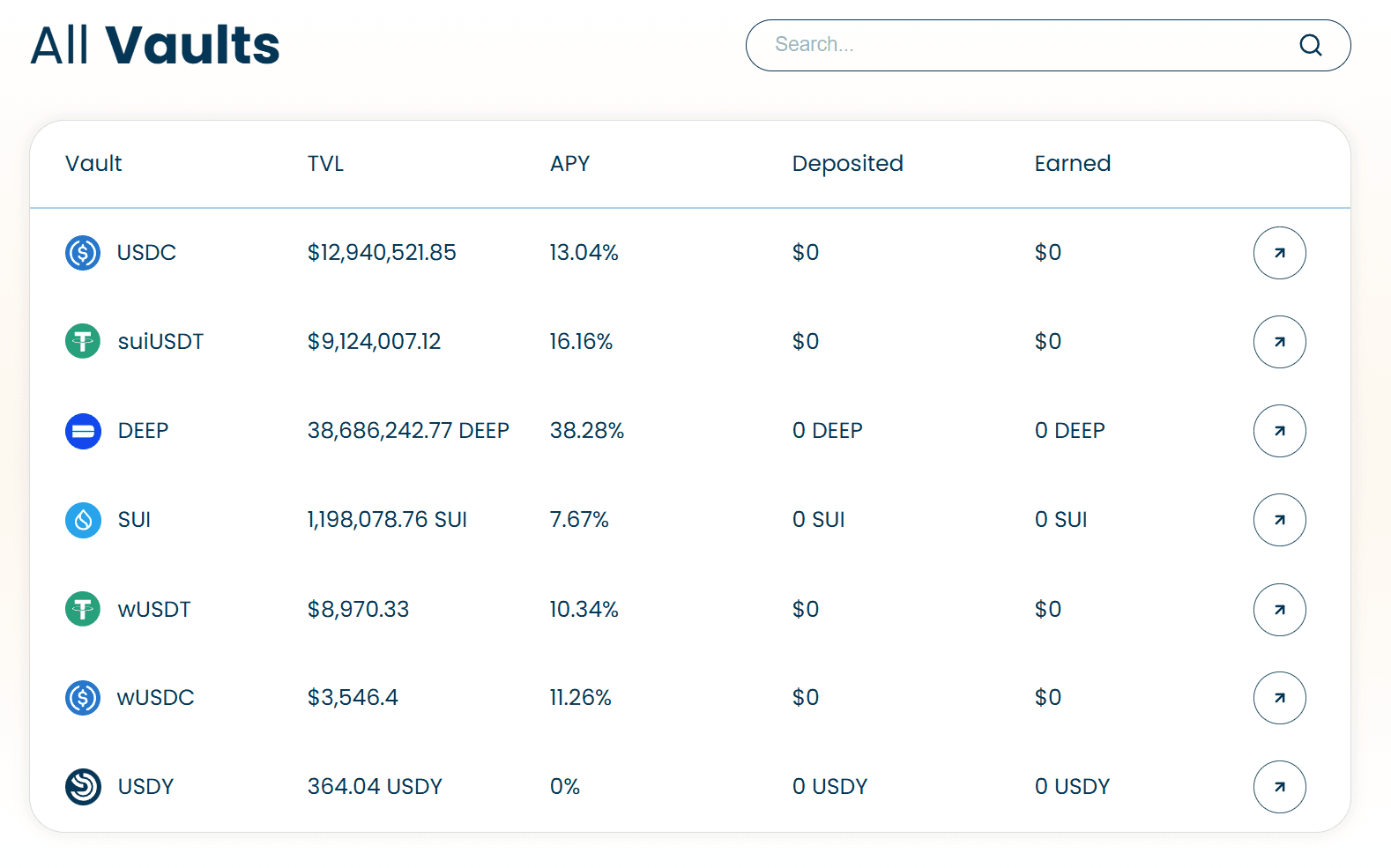

Kai Finance supports various assets, including SUI, USDC, USDT, and others, across its vault offerings.

How does Kai Finance ensure security?

The platform employs audited smart contracts, real-time monitoring, and risk management mechanisms like auto-deleveraging to enhance security and protect user funds.