Overview

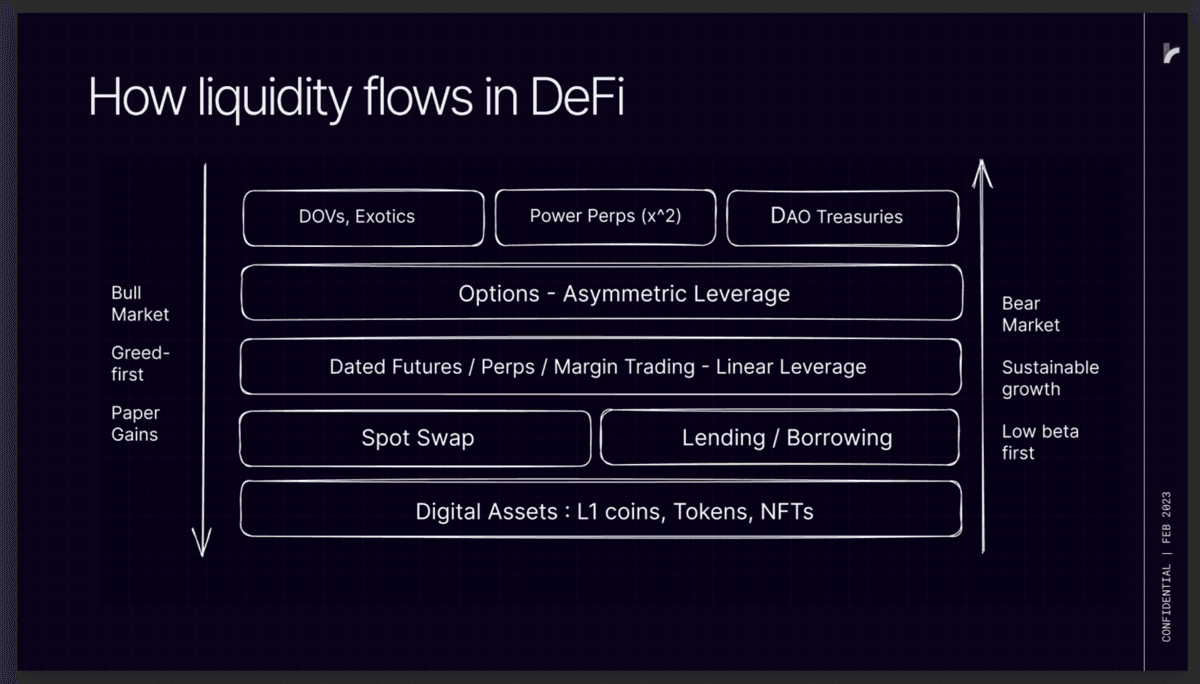

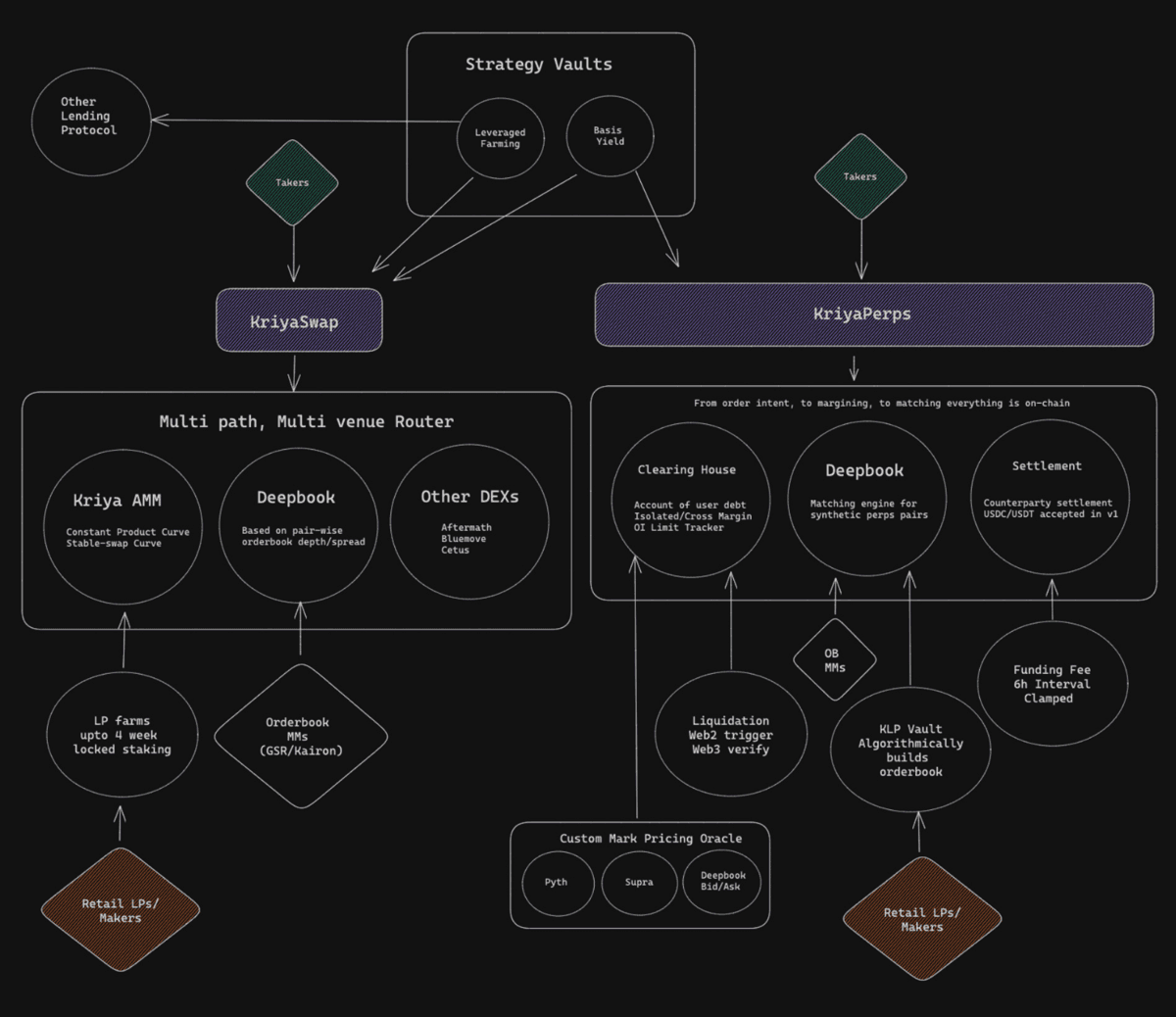

Kriya Finance is a comprehensive decentralized finance (DeFi) protocol built on the SUI blockchain, designed to offer a suite of financial products and services. It integrates various DeFi functionalities, including automated market making (AMM), limit orders, strategy vaults, and leveraged perpetual contracts, aiming to provide users with efficient and low-cost trading services. Kriya's infrastructure is tailored to enhance capital efficiency and deliver a user experience comparable to centralized finance platforms.

Key Features

- Integrated DeFi Suite: Kriya combines AMM swaps, limit orders, strategy vaults, and perpetual contracts into a unified platform, streamlining user interaction with DeFi services.

- Advanced Trading Capabilities: The platform supports orderbook-based trading with up to 20x leverage on perpetual contracts, catering to both retail and institutional traders.

- Strategy Vaults: Kriya offers automated strategy vaults, including leverage lending vaults and CLMM LP optimizer vaults, enabling users to maximize yields and manage risks effectively

- Low-Cost Transactions: Built on the SUI blockchain, Kriya ensures fast and cost-effective transactions, with gas fees as low as $0.001 and transaction finality in approximately 400ms.

- User-Centric Design: The platform emphasizes a user-friendly interface and experience, aiming to reduce the DeFi learning curve and attract a broader user base.

Tokenomics

- Token Name: KDX

- Total Supply: 100 million tokens

- Distribution:

- Airdrop Program: Kriya has implemented a generous airdrop strategy, distributing 50% of the total supply at the Token Generation Event (TGE), with specific allocations for Chakra NFT holders and point-based distributions.

Why Choose Kriya Finance

Kriya Finance stands out in the DeFi landscape by offering a comprehensive suite of financial tools within a single platform. Its integration of various DeFi services simplifies user experience, while its focus on low-cost, high-speed transactions enhances accessibility. The platform's commitment to community engagement through substantial token allocations and airdrop programs further solidifies its position as a user-centric DeFi solution.

FAQs

What is Kriya Finance?

Kriya Finance is a decentralized finance protocol on the SUI blockchain that offers integrated services such as AMM swaps, limit orders, strategy vaults, and leveraged perpetual contracts.

How does Kriya ensure low transaction costs

By leveraging the SUI blockchain's architecture, Kriya achieves fast transaction finality and minimal gas fees, approximately $0.001 per transaction.

What are Kriya's strategy vaults?

Kriya's strategy vaults are automated investment strategies that include leverage lending and CLMM LP optimization, designed to maximize user yields and manage risks.

How is the KDX token distributed?

The KDX token has a total supply of 100 million, with 80% allocated to the community through airdrops and incentives, and 20% reserved for the Kriya team.

What is the purpose of the Chakra NFT in Kriya's ecosystem?

Chakra NFTs are part of Kriya's airdrop program, where holders receive specific allocations of KDX tokens and other benefits within the platform.

Can users trade with leverage on Kriya?

Yes, Kriya offers orderbook-based trading with up to 20x leverage on perpetual contracts, catering to both retail and institutional traders.

Is Kriya suitable for institutional investors?

Kriya is designed to provide a user experience comparable to centralized finance platforms, making it suitable for institutional investors seeking efficient DeFi solutions.

How does Kriya support community engagement?

Through substantial token allocations, airdrop programs, and user-friendly interfaces, Kriya actively engages its community and encourages participation in its ecosystem.