Overview

Suilend is a decentralized finance (DeFi) protocol on the SUI blockchain, offering users the ability to lend, borrow, and stake assets efficiently. Developed by the team behind Solend, Suilend leverages SUI's high-speed and low-cost infrastructure to provide a seamless DeFi experience. Since its launch in March 2024, Suilend has rapidly become the top DeFi protocol on SUI by total value locked (TVL), reaching over $1 billion in combined TVL with its liquid staking component, SpringSui, by early 2025.

Key Features

- Dual Lending Pools: Suilend offers both main and isolated lending pools. Main pools consist of established cryptocurrencies, while isolated pools contain newer or more volatile assets, minimizing risk exposure across the platform.

- Integrated Swap Functionality: Users can seamlessly swap assets within the platform, enhancing liquidity and user experience.

- SpringSui Liquid Staking: Suilend introduces SpringSui, a liquid staking standard on SUI, allowing users to stake SUI tokens and receive sSUI, a liquid staking token, enabling further participation in DeFi activities.

- Superfluid AMM (STEAMM): Suilend integrates STEAMM, an automated market maker that combines deep liquidity with lending functionalities, optimizing capital efficiency.

- Zero Borrow Fees: Suilend currently offers 0% borrow fees, making it an attractive option for users seeking cost-effective lending solutions.

Tokenomics

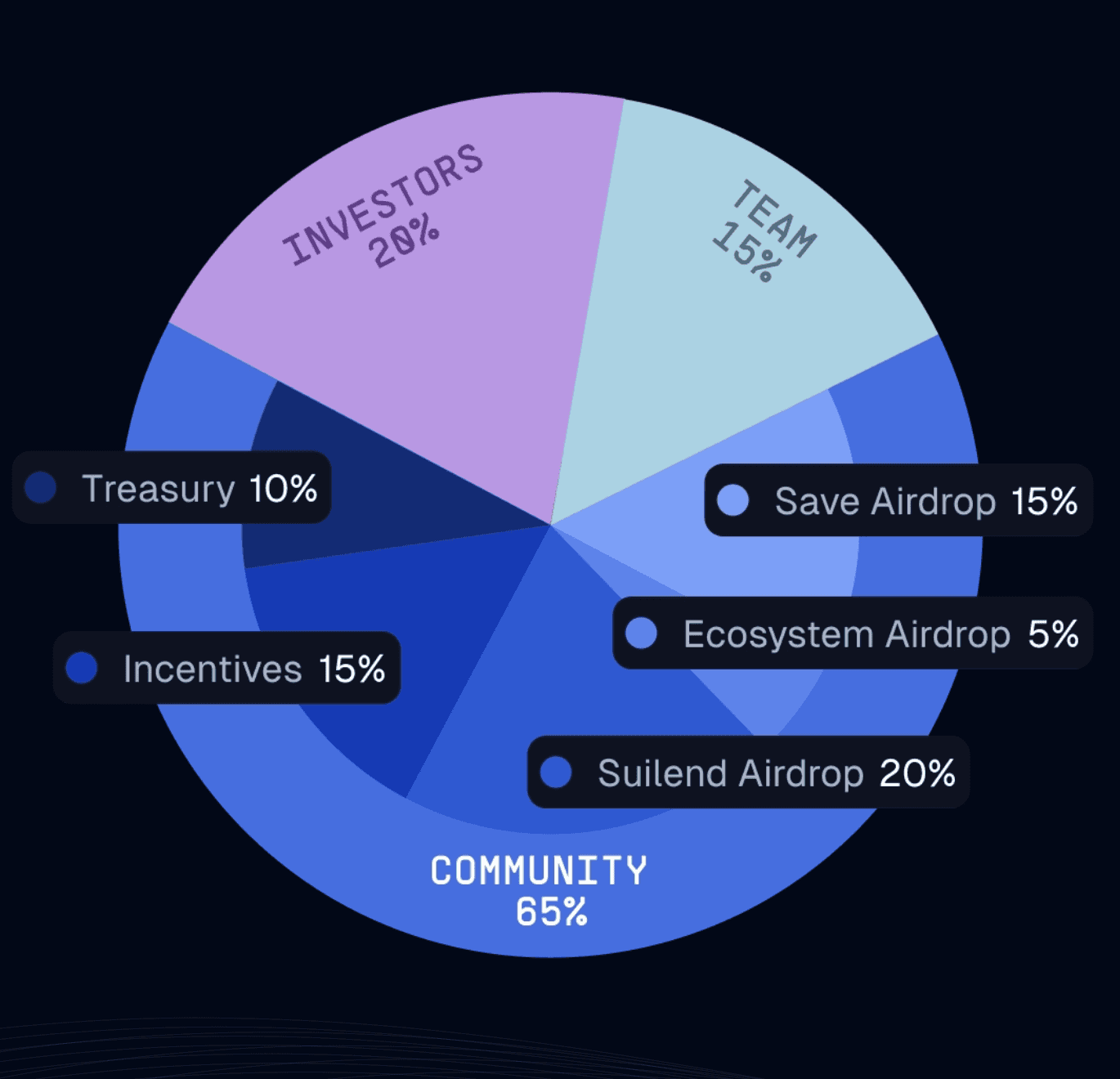

Suilend's native token, SEND, has a total supply of 100 million tokens. The distribution is as follows:

- Community: 65%

- Investors: 20%

- Team: 15%

Suilend employs an innovative token distribution model called "Mdrops." When users redeem their SEND allocation, they receive mSEND, which can be claimed for SEND tokens. Claiming SEND early incurs a penalty fee paid in SUI, which decreases linearly over time, encouraging long-term holding and reducing market volatility.

Why Choose Suilend

Suilend stands out in the DeFi landscape due to its comprehensive suite of features, user-centric design, and robust security measures. By combining lending, borrowing, liquid staking, and swapping functionalities within a single platform, Suilend offers unparalleled convenience and efficiency. Its innovative tokenomics and commitment to security make it a compelling choice for users seeking a reliable DeFi solution on the SUI blockchain.

FAQs

What is Suilend?

Suilend is a decentralized finance protocol on the SUI blockchain that enables users to lend, borrow, stake, and swap assets efficiently.

How does SpringSui work?

SpringSui is Suilend's liquid staking component, allowing users to stake SUI tokens and receive sSUI, a liquid staking token that can be used in other DeFi activities.

What are Mdrops?

Mdrops are Suilend's token distribution mechanism where users receive mSEND upon redeeming SEND allocations. Claiming SEND early incurs a penalty fee in SUI, which decreases over time.

Is Suilend secure?

Yes, Suilend has undergone audits by reputable firms like Zellic and OtterSec and has a bug bounty program offering up to $1 million for critical vulnerabilities.

What are isolated lending pools?

Isolated lending pools contain newer or more volatile assets, ensuring that risks associated with these assets do not affect the main lending pools.

Does Suilend charge borrow fees?

Currently, Suilend offers 0% borrow fees, making it cost-effective for users to borrow assets.

What is STEAMM?

STEAMM is Suilend's Superfluid Automated Market Maker that combines liquidity provision with lending functionalities, enhancing capital efficiency.

How can I participate in Suilend?

Users can connect their wallets on the Suilend platform to start lending, borrowing, staking, or swapping assets.