Key Takeaways

- DeFi Suite: Berachain offers a comprehensive DeFi ecosystem, including a decentralized exchange (BEX), lending platform (BEND), and perpetual futures platform (BERPS).

- Liquidity Models: Utilizes innovative pool models like Balanced Pools and MetaPools for greater capital efficiency.

- Governance: The Bera Hub (former BGT Station) enables governance participation and staking.

- Stablecoin Platform: HONEY, Berachain's stablecoin, is central to its ecosystem for swaps and liquidity.

If you're interested in Berachain, explore our dedicated section filled with blog posts and comprehensive guides: https://daic.capital/blog/category/Berachain

Berachain DeFi: A Decentralized Non-Custodial Financial Platform For Anyone

The Berachain platform leverages BeaconKit-enabled modular architecture that connects execution with consensus in EVM-compatible environments along with a governance and economic system tied to the network’s Proof of Liquidity (PoL) consensus model.

To bootstrap its ecosystem, accrue liquidity, and grow its user base long-term, the Berachain protocol is largely focused on decentralized finance (DeFi). To enable this functionality, Berachain has worked hard to develop several service offerings that make up the greater Berachain DeFi ecosystem. These include:

- Berachain Exchange (BEX) - a decentralized exchange

- Berachain Lend (BEND) - a lending and borrowing platform

- BERPS - a perpetual swap futures marketplace

- Honey - a stablecoin exchange platform

- Bera Hub - a BGT staking and governance dashboard

To enable the utility of these services, Berachain supports wallet connectivity for numerous non-custodial wallets including MetaMask, Coinbase Wallet, Ledger, and Frame, with more to follow as the ecosystem matures.

Similarly to most DeFi protocols, it is possible to connect your wallet to the Berachain DeFi suite by clicking on the “Connect Wallet” button on the top right-hand side of your computer screen.

To complement Berachain’s DeFi suite, Berachain also created the Berachain token faucet that previously ran on its Artio testnet, which allowed users to make use of testnet tokens to test out the functionalities of Berachain’s DeFi suite.

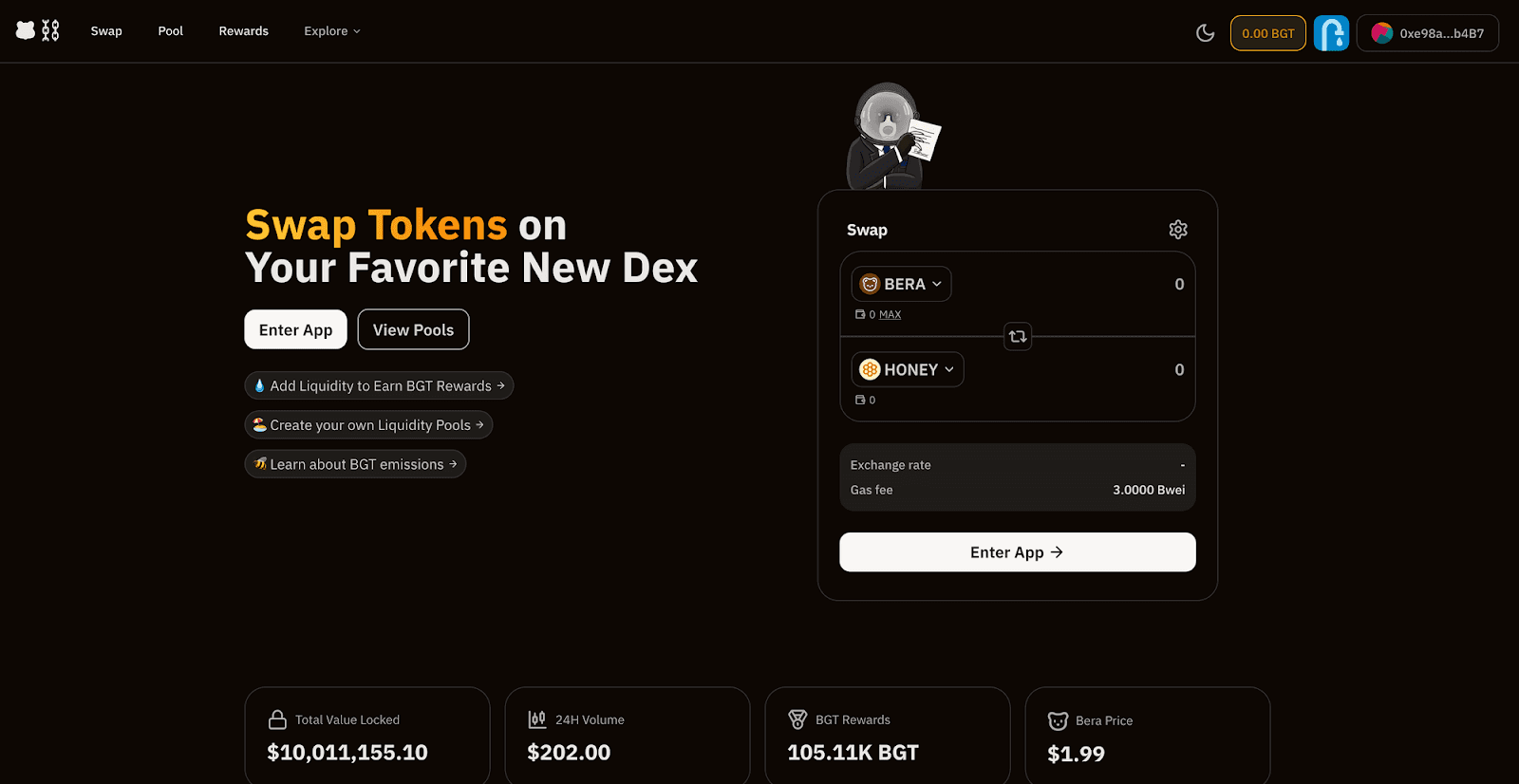

Berachain Exchange (BEX)

First and foremost, the Berachain ecosystem leverages a decentralized exchange (DEX) called the Berachain Exchange, or BEX. The Berachain Exchange is meant to onboard users and increase liquidity within the Berachain ecosystem by offering a self-sovereign decentralized protocol for user interaction.

The native BEX supports numerous functionalities, including:

- A swap feature that allows for the exchange of various supported assets

- As a means to provide liquidity (by depositing tokens) to the Berachain Exchange

- The ability to earn BGT token rewards in exchange for providing liquidity

- As a way of monitoring numerous performance metrics related to different liquidity pool and token types

In addition to its services listed above, the Berachain Exchange also allows users to create and make use of various liquidity pool types. In this way, the BEX represents an integral component of the greater Berachain DeFi ecosystem, ensuring the long-term viability of the protocol as a user-focused capital-efficient platform.

Moreover, the Berachain Exchange furnishes a flexible pool type that allows for the use of various swapping paradigms such as the x*y=k model, a system of weighted pools (that is modifiable in proportion to the percentage of each token within the pool), and other iterations. All live pools on the BEX employ a specific pool interface so they are user-friendly and the corresponding module works as intended.

Pool creation on the Berachain Exchange is fully permissionless (meaning users don't need permission to use the service) and can be carried out by any user should they fill the proper criteria for deployment. Similarly to most liquidity pools in DeFi, the main criteria to create a liquidity pool on the Berachain Exchange is simply to provide the initial liquidity required to launch the pool (these guidelines are modifiable via a successful governance vote). This means the user must deposit the token corresponding to the pool they have chosen to create (e.g., if they are deploying a BGT pool, a deposit of BGT is required).

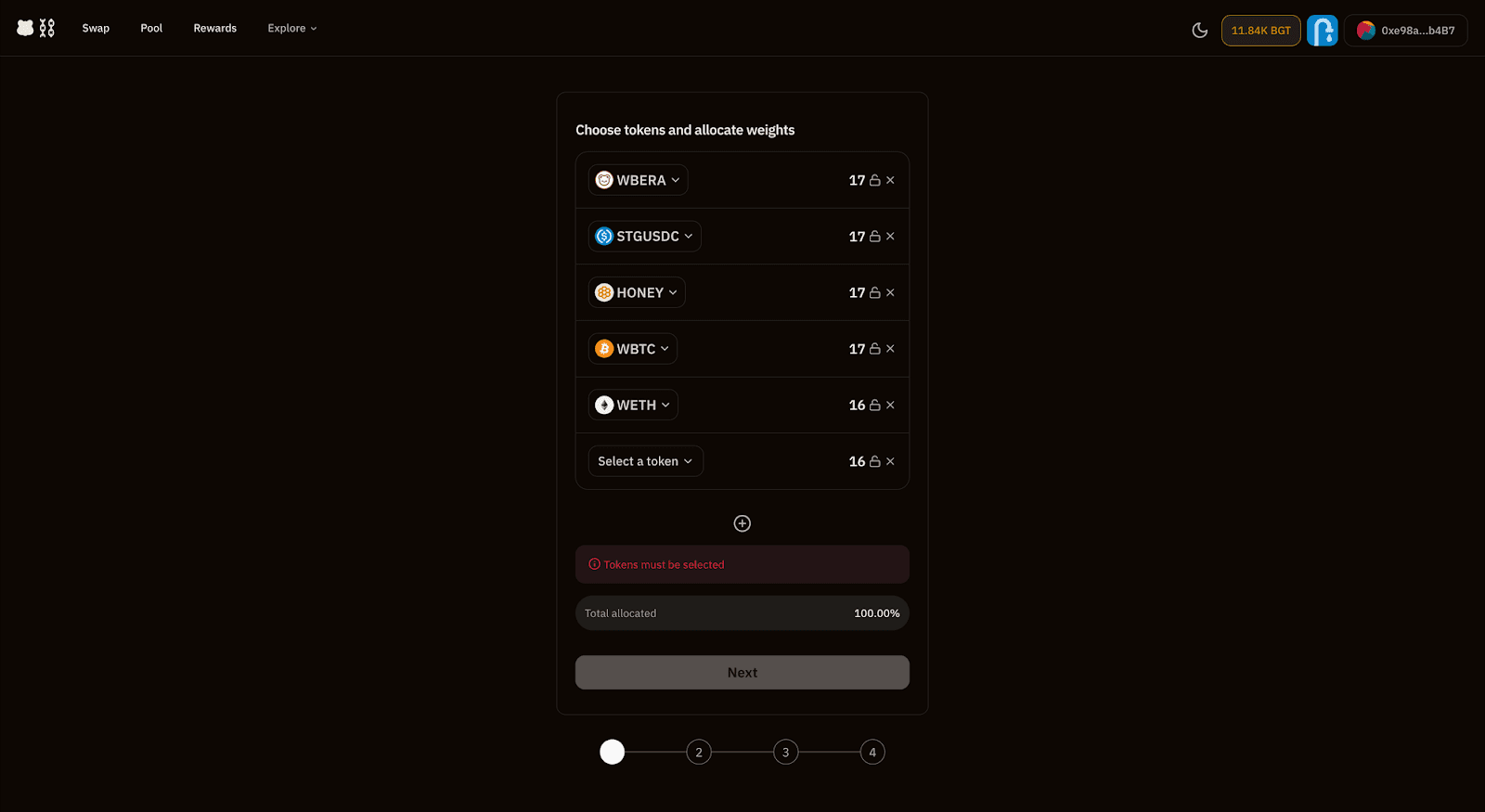

The second step is to determine what type of pool they’d like to deploy. As of this writing, there are two main liquidity pool types deployable on BEX including Balanced Pools and House Pools (which are typically realized as MetaPools).

Let's explain each of these liquidity pool types:

Balanced Pools

Balanced Pools typically feature an evenly weighted pool of assets. In order to successfully launch a Balanced Pool, the following criteria must be configured at outset:

- Token set which tokens will make up the pool (e.g., BERA, BGT, HONEY, ETH, BTC)

- Number of tokens within the set how many tokens will be included in the pool (there must be between 2 and 8 distinct asset types)

- Initial deposit liquidity - the amount of each specific token (e.g., 20 ETH, 0.2992 BTC, 32,00 HONEY, 20,000 BGT, and 15,000 BERA) that will be deposited to bootstrap pool creation

- Initial weighting of each token within the pool - the percentage of each token that is initially deposited into the pool (e.g. 10% BERA, 15% BGT, 25% HONEY, 40% ETH, 10% BTC)

- Liquidity provider swap fee - the percentage of each token swap that is redistributed back to liquidity pool providers (e.g. 0.5%; note: higher fee distribution is given to the largest LPs, while less is given to the lowest LPs)

House Pools

The Bearchain platform launched with an initial set of liquidity pools called House Pools (meaning they are built in-house by the project's founders).

Their primary function is to exhibit deep liquidity and improve capital efficiency as an ideal medium for the creation of MetaPools on the native DEX. In addition to dramatically improving capital efficiency, House Pools are the default pools used by validators to collect BGT emissions when validators choose not to customize their emissions.

This means it is reasonable to expect that House Pools will receive a significant amount of liquidy, therefore positioning themselves as an ideal environment for the operation of MetaPools (note: MetaPools are the only type of House Pool currently available on the platform).

MetaPools

MetaPools are liquidity pools made up of at least 1 LP token (a token that represents shares of another liquidity pool). MetaPools are designed to facilitate greater capital efficiency within the entire system instead of distributing the same amount of tokens (liquidity) across multiple liquidity pools, meaning the same tokens are able to provide liquidity in numerous pools simultaneously.

Let’s provide an example that details the differences between traditional pools and MetaPools related to the context touched on above:

Suppose $100 exists on Berachain; this HONEY (Bera’s stablecoin) must be paired against both bera (BERA) and stargate USDC (stgUSDC) separately.

Traditional Pools

Without the use of the MetaPool framework, it seems likely that the following liquidity pools would be created:

- $50 of HONEY paired with $50 of BERA

- $50 of HONEY paired with $50 of stgUSDC

MetaPools

In contrast, by alternatively deploying a MetaPool, it is possible to dramatically improve the liquidity depth of the pools using the same tokens as follows:

- $100 of HONEY paired with $100 of stgUSDC

- $100 of HONEY/stgUSDC LP tokens paired with $100 of BERA

In this scenario, it could make sense to simply create a liquidy pool consisting of all 3 assets in equal ratios (33.3% for each token). The important distinction in this example is that not all liquidity providers are willing to accept exposure to the volatility of BERA. Fortunately, this is possible because 50% of the LP token providers actually need to provide their tokens to the 2nd liquidity pool as a means to provide liquidity to the above pool (the pool with only 50$ worth of each asset instead of $100 of each asset).

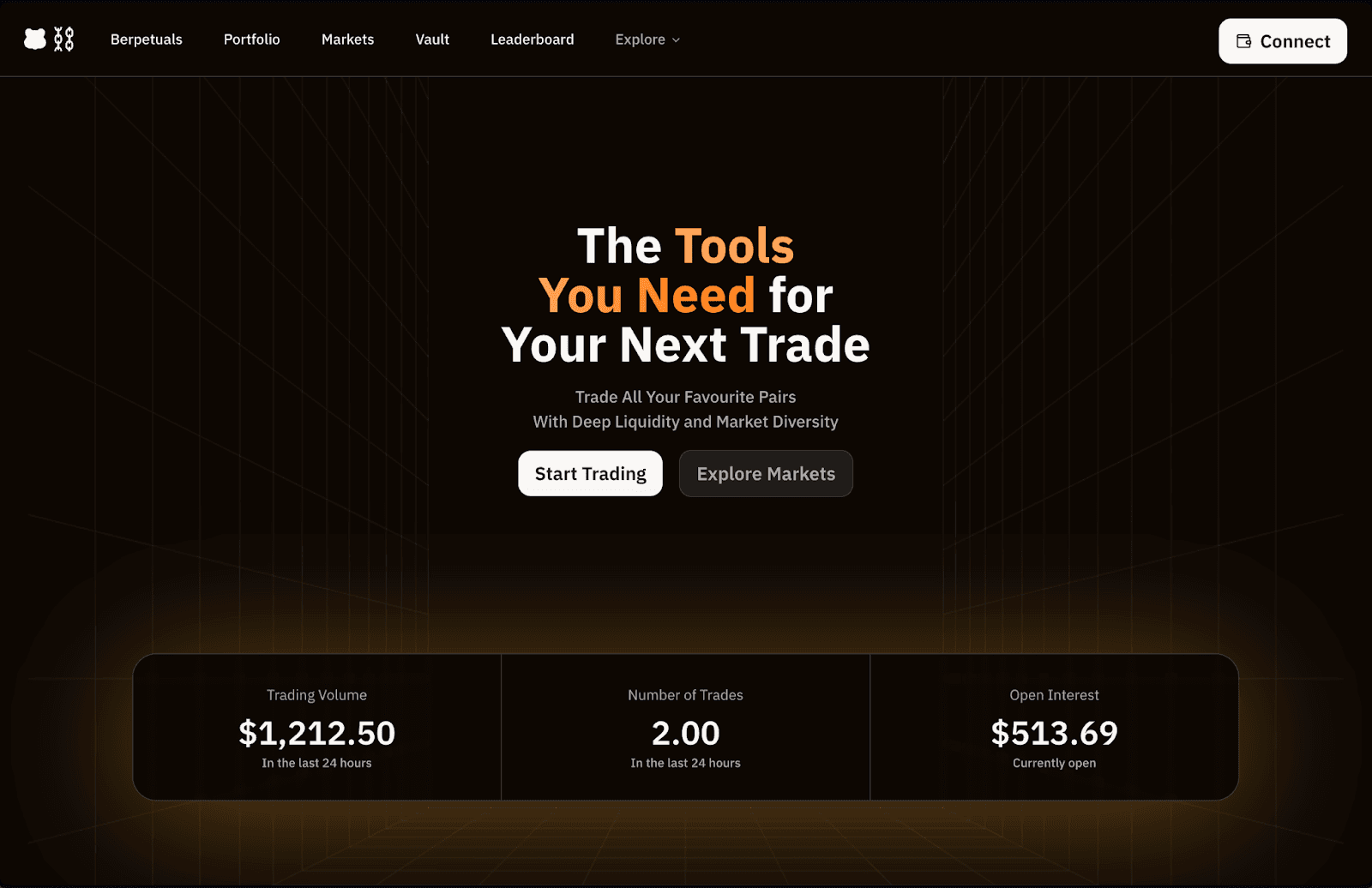

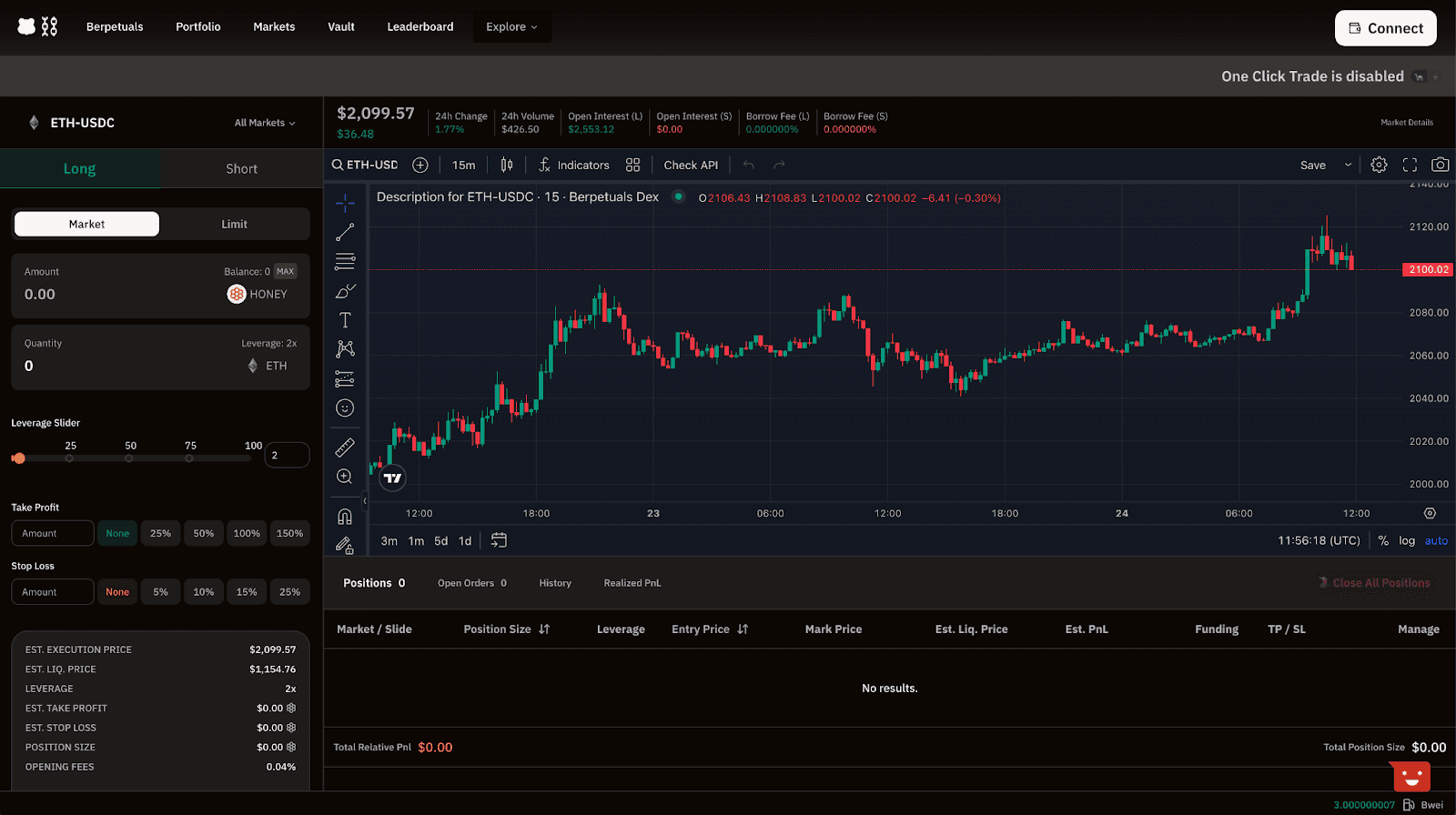

BERPS: Berachain’s Perpetual Futures Platform

Berachain also offers its own liquidity-efficient, robust, and easy-to-use perpetual futures platform, BERPS. The BERPS protocol was built in-house to allow users to trade leveraged positions with up to 100x leverage, enabling betting on the future price of supported assets, all in a low-fee manner that supports a wide range of trading pairs.

Specifically, BERPS allows users to long (open a position speculating on an increase in price) or short (open a position decrease in price) numerous Berachain-supported assets. Furthermore, the platform makes use of the ERC-20 HONEY stablecoin as the base currency to trade against other cryptocurrencies (e.g., HONEY/BERA, HONEY/BTC, HONEY/ETH etc.).

Overall, the Berps platform offers numerous features that make its futures trading experience excellent for all parties. These include:

- Non-Custodial no signups, no asset custody provider, and no KYC requirement means users control their funds at all times during platform use, enhancing security and privacy for all involved

- Median Spot Prices - enabling a more stable and fair training experience by eliminating the prevalence of malicious artificial intelligence and sudden price manipulation

- Zero Slippage Order Execution - zero slippage on all order types means that all trades are executed at their exact specified price without price deviation, enabling exact pricing control while entering or exiting trades

- Accessibility to First-Tier Crypto Assets - offering some of the best assets for trading in the industry, complimented by Bera’s proprietary oracle price feed service

- Minimal Trading Fees - offering some of the lowest trading fees in the space

- Decentralized and Transparent - all trading execution is 100% on-chan, meaning users can always ensure that the platform is secure and trustless

- Inherently User-Friendly displays a strong user interface, providing a seamless trading experience that allows users to simply and efficiently close and open positions as needed

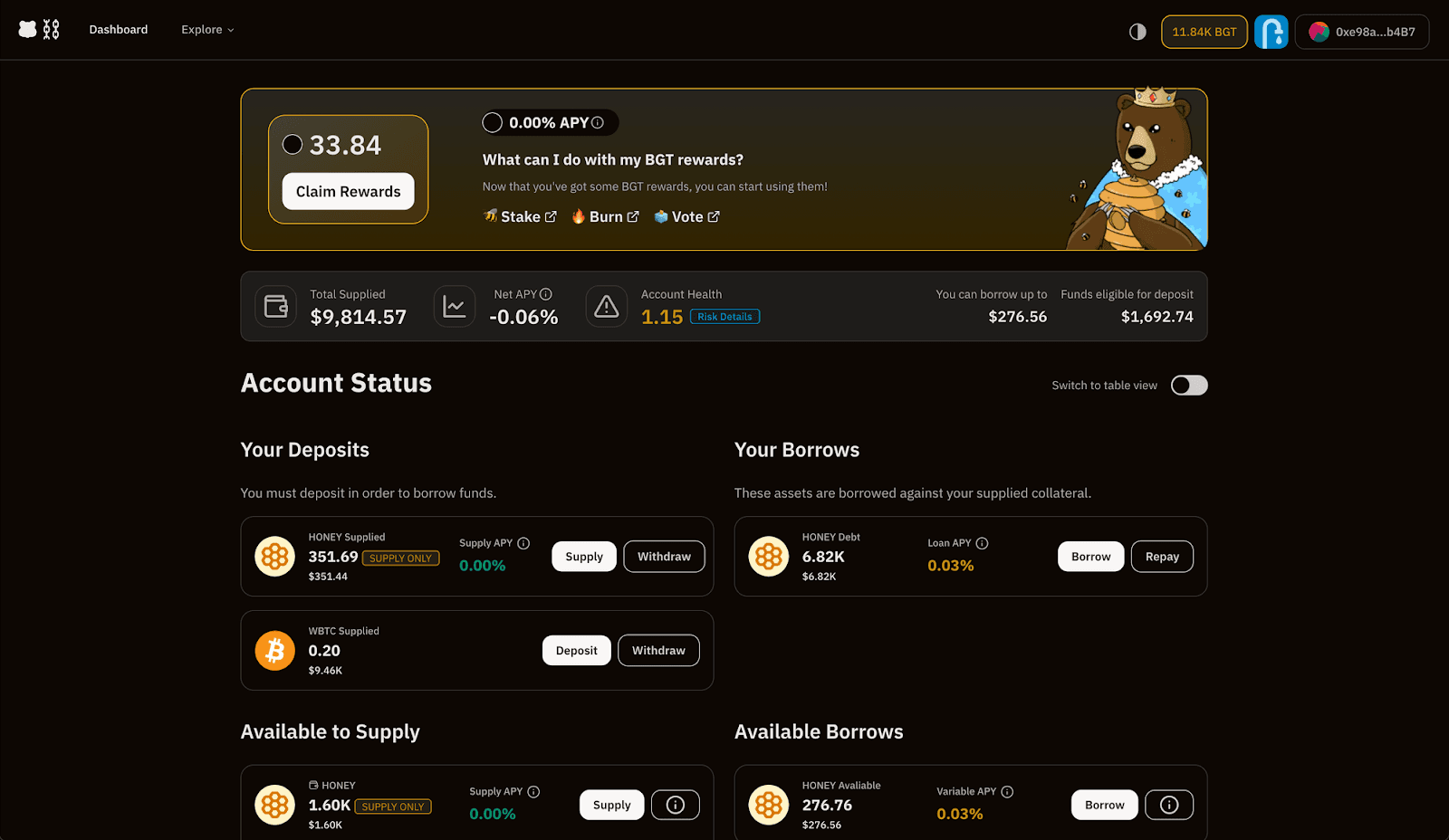

Berachain Lend (BEND)

As a foundational component of the Berachain ecosystem, Berachain Lend, or Bend (often stylized as BEND), is a protocol operating on Berachain that allows users to lend or borrow various types of tokenized assets, resulting in the continued accrual of BGT rewards for all involved.

Bend is a liquid staking and yield farming protocol that allows users to accrue additional assets in exchange for supplying liquidity to the platform. On Bend, protocol use constitutes three main steps, notably:

- Supplying Tokenized Assets - supplying assets such as BERA, HONEY, BTC, and ETH on Bend is necessary to begin generating yield on the platform.

- Receiving Interest Bearing Tokens - after assets have been supplied to the protocol, the user receives interest-bearing liquid receipt tokens that denote their stake in the corresponding lending pool.

- Leveraging Interest Bearing Tokens in DeFi - finally, after receiving interest-bearing tokens the user is then able to use these to carry out various DeFi utilities across the Berachain DeFi ecosystem.

As of End January 2024, some of the existing lending and borrowing markets on BEND include wrapped bitcoin (wBTC), wrapped ethereum (wETH), and honey (HONEY).

To ensure the Bend platform operates as intended, the protocol makes use of two distinct token types:

- aTokens liquid staking tokens pegged 1:1 to the value of the supplied collateralized asset (e.g., for each BERA deposited, the user is given 1 aBERA in return). Like all liquid staking tokens, aTokens can be safely stored, transferred, used, and traded on BEND while earning rewards in-protocol. During this process, tokens are minted or burned upon supply or withdrawal, while all yield (staking rewards) collected via aToken reserves is distributed to aToken holders at regular intervals to continuously increase their wallet balance.

- Debt Tokens - interest-accruing tokens that are minted and burned during borrow or repayment are representative of the debt owed by the token holder. At this time, Variable Debt tokens are supported that represent debt to the protocol with a variable interest rate. However, of note, debt tokens are not transferable.

Like all DeFi offerings on Berachain, BEND is non-custodial and allows users to connect their own wallet to interact with the platform (e.g., via MetaMask, Coinbase Wallet, Keplr Wallet, and others).

In the bigger picture, Bend was initially conceptualized to help incentivize the greater Berachain community through the introduction of the HONEY stablecoin.

Bend allows users to deposit HONEY and other blue-chip assets (such as wBTC, wETH, and others) into the protocol to borrow HONEY. All transactions on Bend are settled in HONEY because it is a stable form of value pegged 1:1 to the US dollar. In a larger context, the Bend platform allows users to:

- Lend stablecoins

- Borrow HONEY

- Earn incentivized BGT in exchange for borrowing HONEY

- Repay tokenized loans

The Bend protocol utilizes several different smart contracts to ensure its operational efficiency. These include:

- Bend Pool Contract the main contract responsible for user interaction on Bend, the pool contract is responsible for programmatically tracking and executing all processes on the platform. This includes verifying, tracking, and facilitating the execution of all transactions/assets that are supplied, withdrawn, borrowed, repaid, and liquidated on the protocol. The pool contract is also responsible for enabling and disabling user-supplied collateralized assets to rebalance the equilibrium of borrowing positions when required.

- Bend Data Provider Contract a peripheral smart contract used to collect and pre-process the required data from its corresponding liquidity pool.

- Pool Address Provider Contract a specialized smart contract that shares and exchanges various types of address data (including Bend market ID, pool ID, address identifier, pool proxy address identifier, and oracle address identifier contracts), to allow the protocol to operate as intended.

- Bend Oracle Contract a smart contract that ensures that Bend manages and makes use of all correct oracle pricing data for all assets/users on the protocol.

- Pool Configurator Contract - a contract that ensures proper liquidity pool configuration, allowing the system’s various liquidity pools to connect with other system components to operate as desired.

Bend is meant to drive capital efficiency at a protocol-level, allowing users to optimize their assets for yield generation and borrowing power. The platform is also meant to offer participation in risk averse DeFi, while protecting against protocol insolvency needed to provision the equitability of the Berachain ecosystem and its various products and services.

In addition to measures aimed at optimizing capital efficiency and risk management, the Bend protocol implements granular borrowing power control, supply and borrow caps, a price oracle sentinel feature, and a variable liquidation mechanism. Let’s touch on each one below:

On Bend, supply and borrowing caps are configurable via Bend governance to ensure users don’t expose themselves to extreme risk (by limiting how much of a certain asset can be borrowed or supplied during a specific time-frame), while eliminating the possibility of in-protocol attacks such as infinite minting (where new tokens cannot be minted continuously, therefore rendering the protocol unusable) or price oracle manipulation.

The granular borrowing power control system makes it possible to lower the borrowing power of any assets to as low as 0% without impacting existing borrowers; at the same time however, it's still possible to liquidate existing users if necessary.

The oracle sentinel feature provisions a grace period for liquidation and disables borrowing during specific circumstances. This feature is specifically designed for Layer 2’s in the event of sequencer downtime (the sequencer is the main system that ensures the Layer 2 operates as intended). In time, this element will be extended to other cases and even for Layer 1’s in the future.

Bend’s liquidation mechanism has been enhanced to allow positions to be fully liquidated as it approaches insolvency via a variable liquidation close factor (i.e., HF < 0.95). In the past, only half the position could be liquidated at a single point in time.

Honey: Stablecoin Swaps on Berachain

The Honey platform is essentially a stablecoin exchange platform that allows users to exchange different types of stablecoins (including stgUSDC) to and from Bera’s HONEY stablecoin. In testnet form, it also allowed for the minting of HONEY so user’s could use HONEY throughout the Beachain DeFi suite (for use with BEX, BEND, BERPS, and others). Like most DeFi applications, the HONEY platform allows users to connect a non-custodial wallet to interact with the platform.

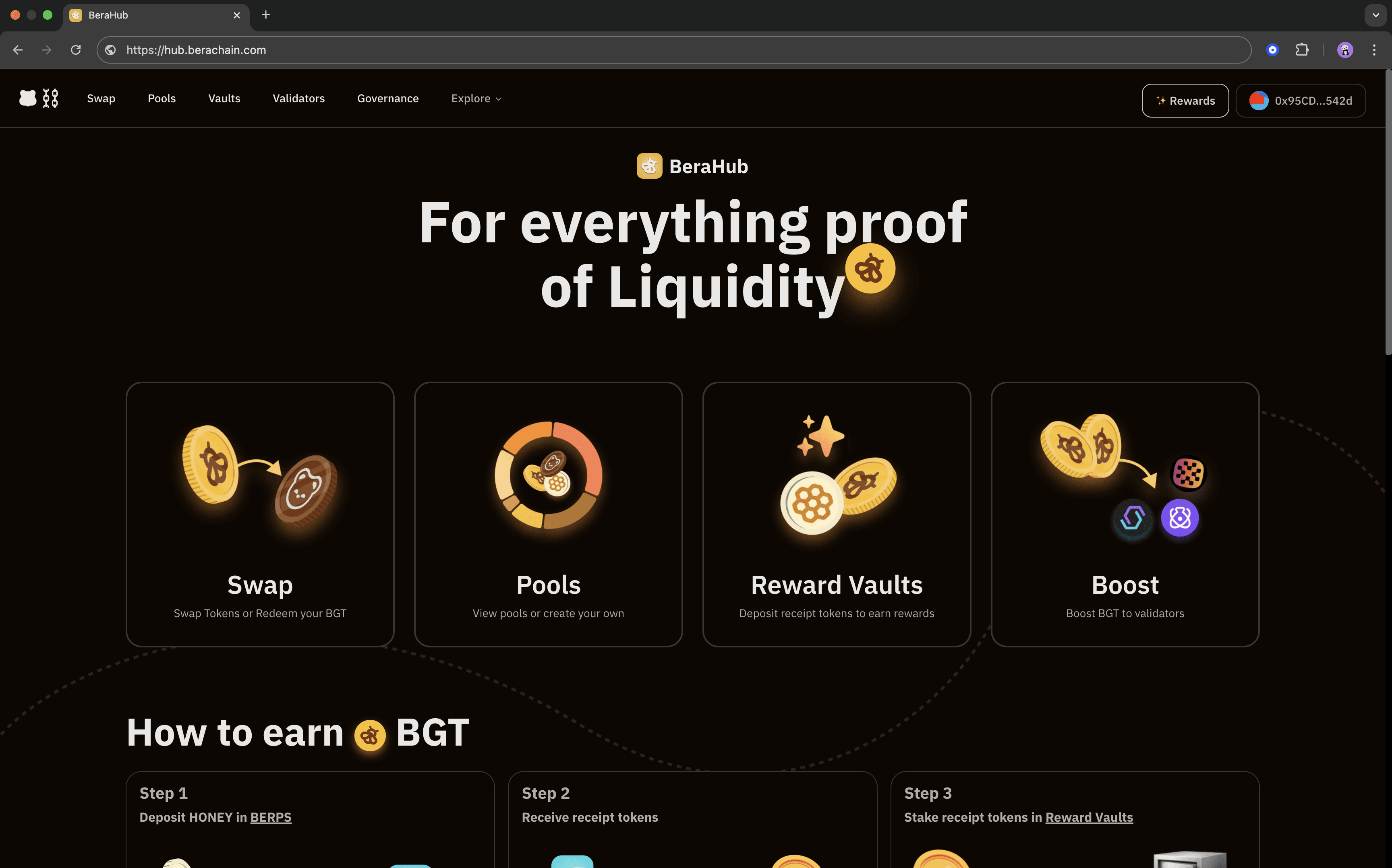

Bera Hub

Bera Hub (former BGT Station) is one of the main aspects of Berachain’s governance model because it works as a mechanism to allow ecosystem participants to engage with a multitude of Berachain governance processes.

This service helps users realize a host of on-chain BGT uses via its on-screen desktop-interface, such as:

- As a means to provision voting on various governance proposals

- Allows users to review existing validator information

- As a way to delegate BGT to existing operational validators

- For the exchange of BGT into BERA (this is a one-way service, during this process BGT is burned and removed from circulation permanently)

In more detail, Bera Hub presents as a dashboard that displays which liquidity pools and validator addresses are offering an incentivization-focused framework through a gauge-weighted system that displays the total weight in total BGT holding percentage terms of all validators currently live on the network.

It also shows a menu of all network validators currently live in the network (and their yearly APY earnings rates), allowing users to connect their wallets to the validator of their choice, which then also allows users to delegate (stake), redelegate (stake if previously unstaked), or unbond (unstake) their BGT.

💬

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.