Key Takeaways

- Decentralization Focus: Kujira aims to democratize DeFi by offering tools and products accessible to both retail and institutional investors, promoting fairness in decentralized markets.

- Ecosystem of Products: Kujira's suite includes ORCA for liquidation, FIN for decentralized trading, and BLUE for cross-chain functionality and staking, all integrated into the Cosmos ecosystem.

- Liquidity Solutions: Kujira enhances market liquidity through BOW, its on-chain market-making engine, without relying on traditional liquidity pools.

- Sustainability: Kujira prioritizes long-term revenue generation for its participants via decentralized governance and non-inflationary tokenomics.

Intro to Kujira

In the current market saturated with Bitcoin, Ethereum, Solana, and many other projects, Kujira is gaining traction. The decentralized Kujira ecosystem is set to reshape the DeFi landscape by offering revenue-generating products with exceptional user experience, democratizing opportunities for retail investors.

While some experts consider Kujira as a promising long-term investment, it is important to base your investment decisions on a deep understanding of the project's potential for success and its use cases, rather than on speculation.

Let's take a closer look at the project and find out what makes it stand out among other projects.

Key Points

- Sustainable and decentralized Level 1 Blockchain

- FinTech solutions for Web3 protocols, builders, and users

- A variety of innovative and revenue-generating products

- Tailored for all crypto experience levels, including the general public

- Opportunities to generate income in any market environment

- Covering all blockchains and networks

Overview

In Japanese, Kujira means "whale". The name of the project accurately describes its purpose - to provide an opportunity for all people to become whales financially.

Kujira functions as a decentralized ecosystem on a Cosmos SDK with a clear goal – transforming payment infrastructure and delivering sustainable FinTech solutions to protocols, builders, and Web3 users. This innovation allows retail investors to seize opportunities that were once exclusive to the wealthy and elite.

Initially, the Kujira project was conceived as a set of decentralized applications (dApps) within the Terra network. The first dApp, ORCA, made its debut in Q4 2021.

However, the narrative took a turn on May 2022, when the Terra blockchain abruptly ceased operation after a period of uncertainty. This unfortunate event triggered a cascade of setbacks, burying many projects. Today, our focal point is Kujira, a project that not only endured but thrived by transitioning to its autonomous network, growing even more resilient.

Kujira introduces a range of innovative features:

- Revenue-Generating Products: The suite of products within the ecosystem, including ORCA, FIN, BLUE, FINDER, and others, demonstrates a commitment to generating revenue and enhancing the network’s value proposition.

- Staking and Cross-Chain Functionality: Kujira’s stake-based network incentivizes user participation, while its integration with Cosmos via IBC allows for seamless cross-chain interactions, offering a unique advantage in the decentralized finance space.

- Community Governance: The ecosystem’s community-driven approach, where contract launches are subject to community votes, fosters quality control and sustainability.

- Efficiency and Native Token Generation: Implementing an on-chain scheduler and native Cosmos token generation contributes to network efficiency and simplifies contract entry points, streamlining user experiences.

- Robust Oracle and Randomness: Kujira’s price oracle, maintained by all active validators, ensures reliable and stable price data.

History

Kujira's story began in May 2021 when a cascade of liquidations hit the Anchor platform and the price of Terra LUNA dropped from $16 to $4 in a week. Retail investors faced substantial liquidation. A small group of elites capitalized on this by purchasing liquidated assets at huge discounts through high-priced bots. This liquidation, which wiped out over a billion dollars worth of LUNA, highlighted weaknesses in the DeFi markets, emphasizing the need for a stable foundation that can withstand market movements.

In reaction to this crucial incident, Team Kujira developed the first decentralized liquidations platform. It welcomed both retail and institutional investors, ensuring a fair playing field by avoiding the payment of higher prices for quicker or superior liquidations. In just four months, Anchor liquidations were made available to more than 50,000 users, removing the necessity for intricate bots or coding skills.

In 2022, the cryptocurrency market faced other challenges. From the beginning of the crypto winter, the tightening of monetary policy in the US, the bankruptcy of Celsius Network and Voyager Digital, the collapse of the Terra project to the fall of the FTX exchange. This set off a domino effect that indirectly led to the closure of many projects. According to Coingecko about 60% of the projects listed on the platform have been closed.

Nevertheless, the project Kujira managed to survive despite all these events, unfavorable market conditions, and the fact that it was originally launched on the Terra blockchain.

Since Terra itself was based on Cosmos, Kujira team went on to launch their own semi-permissioned Cosmos sovereign chain, and because all of Kujira's applications and infrastructure were portable, this allowed for a quick restart.

“2022 was a wake-up call for the DeFi space, with multiple high-profile failures and collapses. It's clear that we need a new approach to DeFi that prioritizes sustainability and long-term value. At Kujira, we are committed to building the foundation for the Grown-Up DeFi revolution”

How Does Kujira Work?

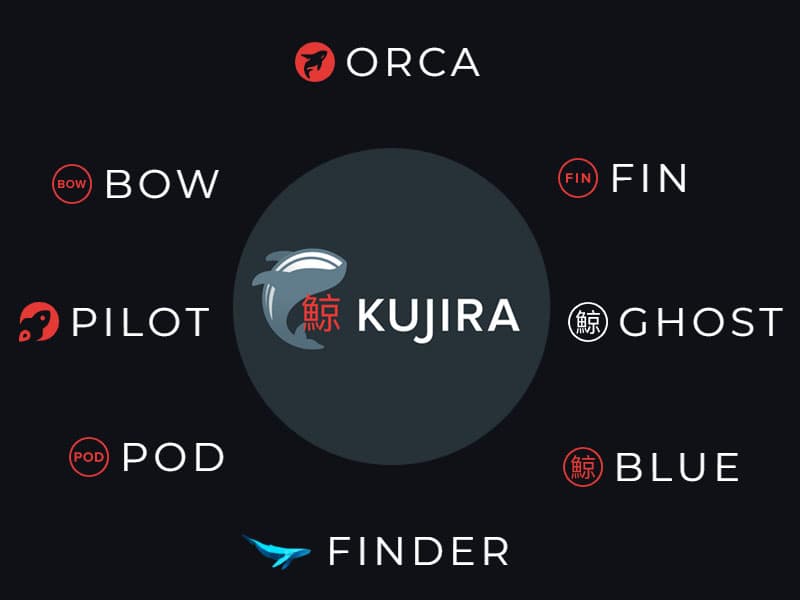

For now, the Kujira ecosystem is a dynamic suite of decentralized applications integrated in a common Layer 1 infrastructure that designed with the Cosmos SDK.

Kujira operates on a semi-permissioned model, new dApps undergo an approval phase by the protocol governance, which allows maintaining a high level of quality and security, ensuring that harmful applications won't appear on the network.

Furthermore, Kujira provides an entire pool of its in-house interconnected DeFi solutions that can cover the needs of even the most sophisticated crypto-enthusiast.

The main purpose is crystal clear: to create a level playing field for all market participants. All users, whether institutional giants or retail enthusiasts, have unlimited access to significant funds, allowing them to capitalize on strategic market insights. This visionary initiative finds its strength in the network of interconnected dApps within the ecosystem. These apps not only provide comprehensive analytics, but also automated solutions that serve as robust tools to empower DeFi investors on their financial journey.

Kujira In-House Services

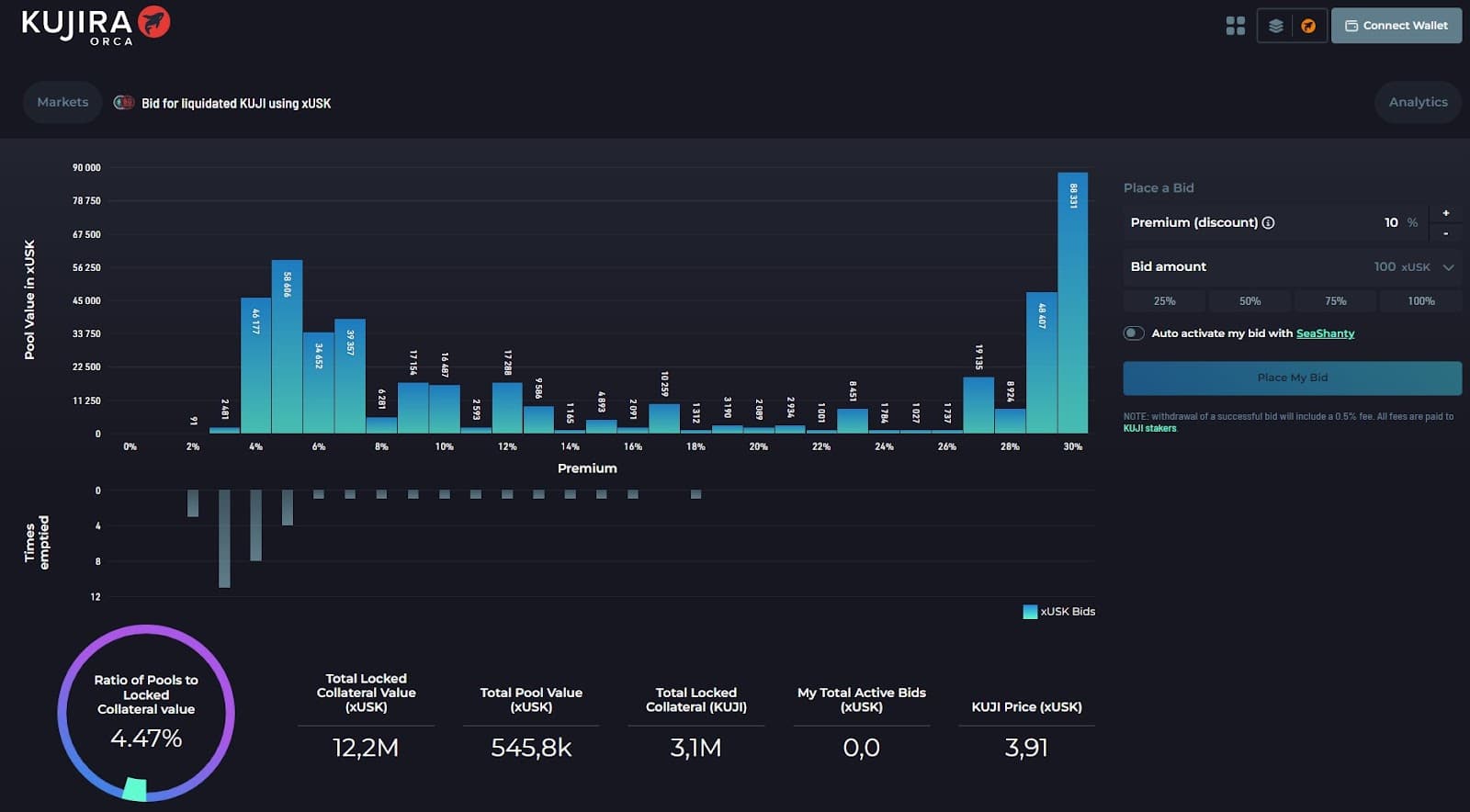

ORCA (Liquidations)

ORCA is an innovative marketplace tailored for bidding on liquidated collateral. With a user-friendly interface, ORCA democratizes the liquidations marketplace by enabling participants to bid on liquidated collateral without the need for bots or code.

Liquidation, a process involving the sale of a borrower’s collateralized assets to repay their debt, is often automated on blockchains through smart contracts.

ORCA's strategic approach employs a queue-based system, filling bids from the smallest to the largest discount, effectively neutralizing the speed advantage of bots attempting to outbid one another. This not only ensures fairness but also minimizes gas spikes for Kujira users.

Utilizing a Dutch auction mechanism, ORCA progressively lowers the liquidation asking price until bids are filled, enabling users to acquire collateral at a discount.

Dutch auction is a type of auction in which the auctioneer starts with a very high price and gradually lowers the price until someone bids. The first bid wins the auction (assuming the price is above the reserve price), avoiding any bidding wars.

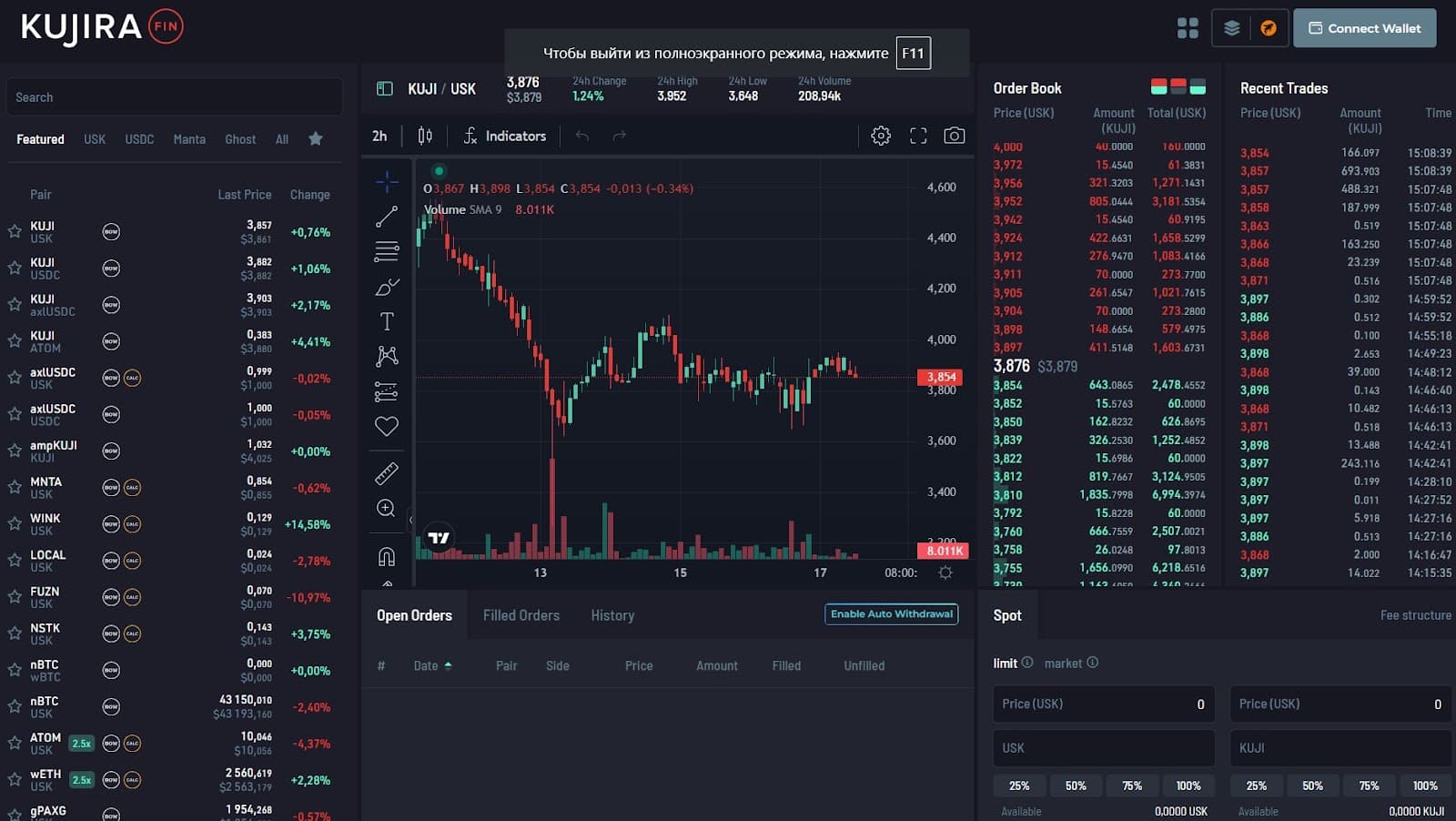

FIN (DEX)

FIN is the first decentralized, 100% on-chain, order book-style DEX on Cosmos. While AMM exchanges rely on liquidity pools to determine token prices based on ratios within the pool, FIN, operating as an order book-style exchange, matches buyers and sellers of a specific currency based on their specified bid prices.

This distinctive approach allows FIN to function efficiently without the reliance on liquidity pools, optimizing capital allocation within the network.

Making the most of the Cosmos infrastructure, FIN empowers users to seamlessly trade assets from diverse blockchains on a unified platform. Its user-friendly interface facilitates the placement of market or limit orders. To address potential situations of insufficient market liquidity affecting the trading experience, FIN integrates BOW, a dedicated platform designed to augment liquidity for the FIN exchange.

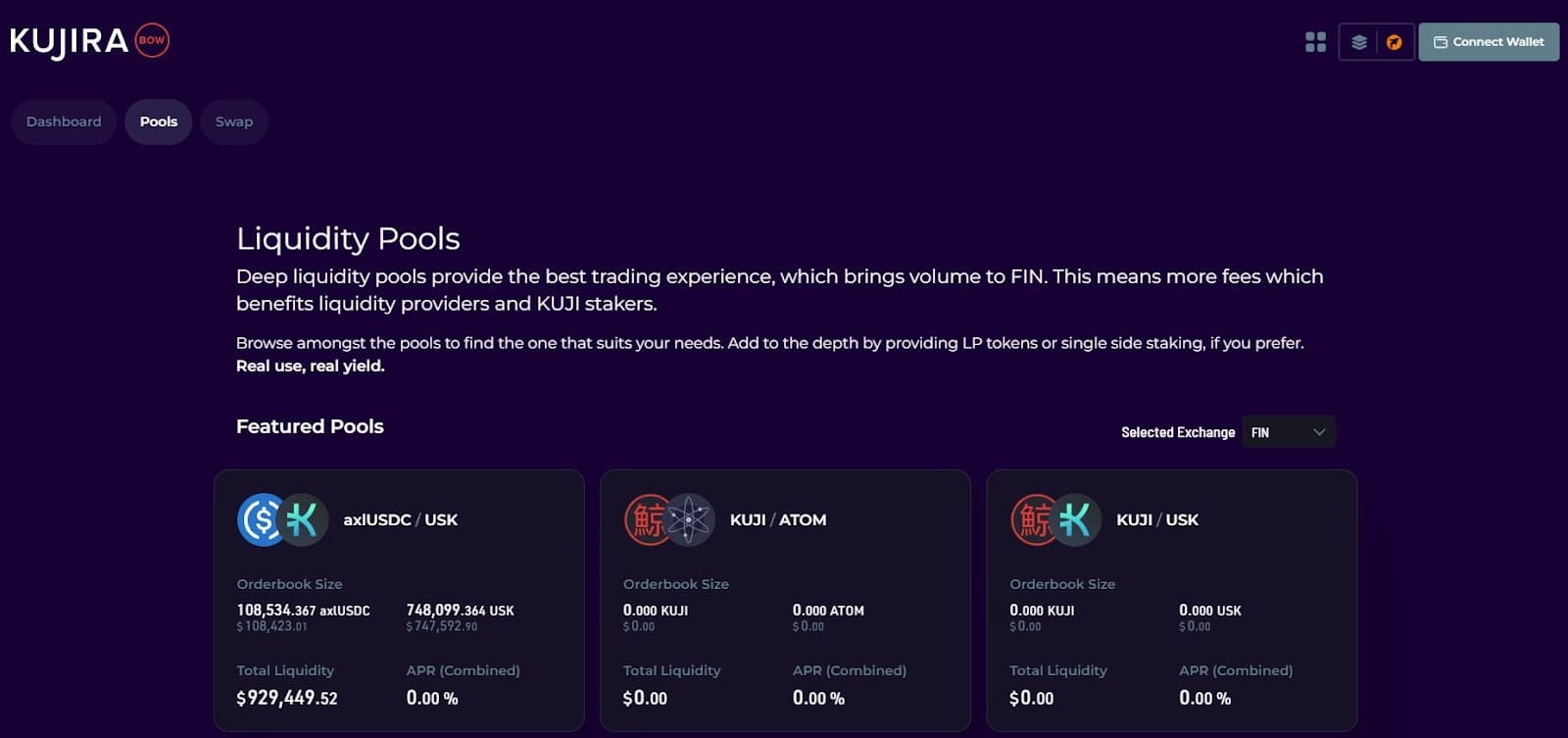

BOW (Liquidity Engine)

BOW is a framework designed to optimize trading conditions on FIN by enticing liquidity providers. Functioning as an on-chain market maker within the FIN exchange, BOW plays a crucial role in expediting the matching of buy and sell orders on the order book.

BOW stands out as a prime example of a DEX market maker implementation, injecting liquidity into the market and rewarding providers without relying on conventional liquidity pools.

Operating based on its proprietary algorithm, BOW analyzes token balances and strategically places orders on FIN pairs, effectively fulfilling market buy and sell orders. By narrowing price spreads and enhancing liquidity, BOW elevates the depth of the FIN exchange.

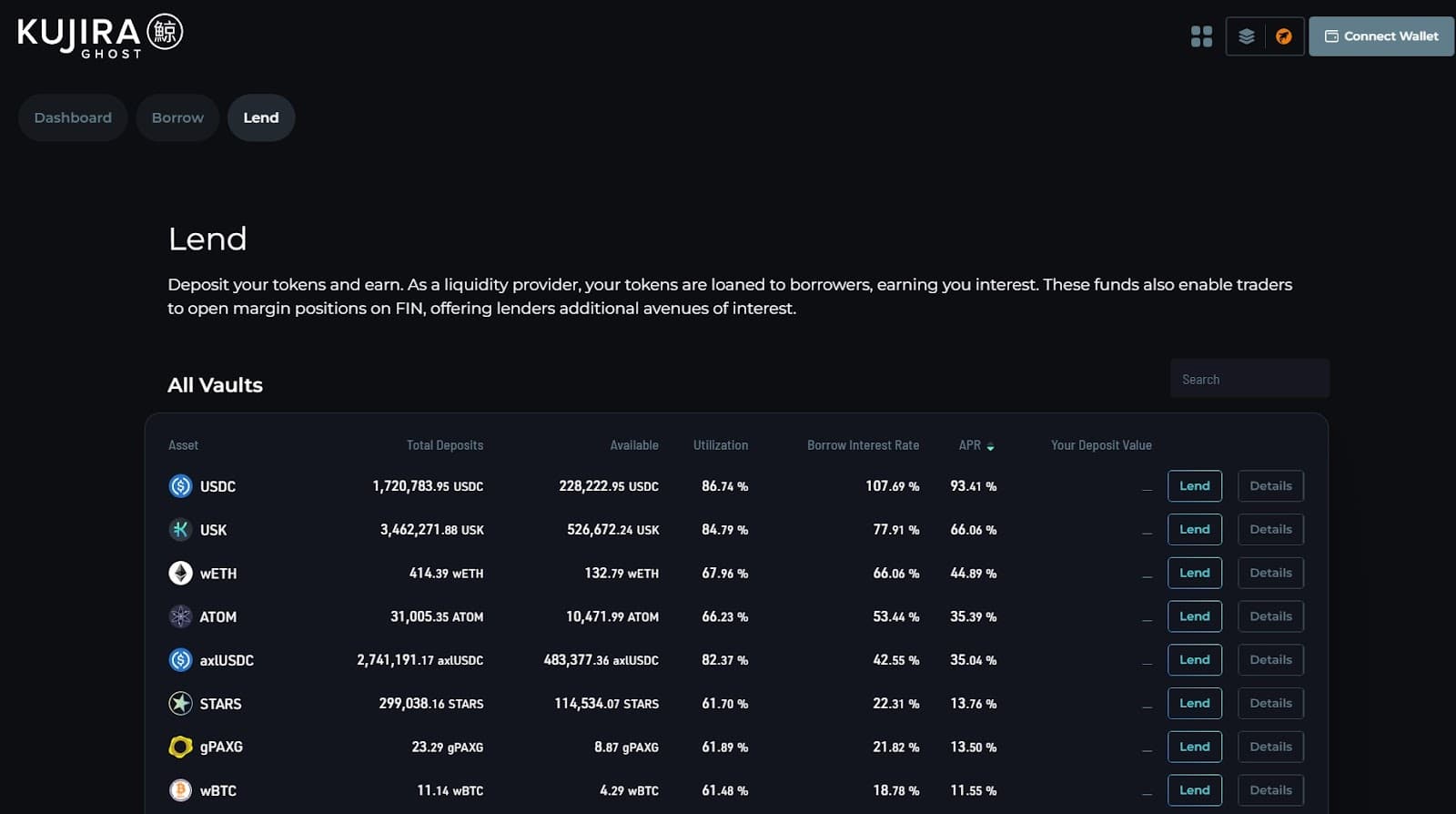

GHOST (Money Market)

GHOST is a standout Money Market in the expansive Kujira universe. Functioning as a decentralized money market, GHOST seamlessly connects lenders and borrowers, establishing a user-friendly supply-demand framework that generates enticing returns for participants without artificial incentives.

In the realm of GHOST, decentralized principles reign supreme, ensuring suppliers are shielded even in scenarios where borrowers falter in repaying loans. The beauty lies in the overcollateralized nature of all GHOST loans, eliminating the need for loan applications or credit checks for borrowers. The processes of opening, closing loans, and managing supplied assets are nearly instantaneous, operating seamlessly around the clock.

Suppliers contribute assets to GHOST, reaping variable interest based on overall utilization by borrowers. On the flip side, borrowers tap into assets provided by others on GHOST for financial speculation or loans without liquidating their underlying assets. The floating interest rate that borrowers incur fluctuate based on overall asset utilization, responding dynamically to market demand within GHOST's robust framework.

BLUE (Central Hub)

BLUE is the central hub of the Kujira ecosystem, bringing together functionality for staking, bonds, swaps, cross-chain transfers and asset management. Key analytical data from the Kujira blockchain is displayed on a comprehensive BLUE dashboard. This dashboard includes an interface to Cosmos IBC and a proprietary cross-chain bridge that enables asset transfers between different chains.

The built-in wallet has advanced functionality, allowing tokens to be sent to multiple recipients with specified vesting periods. This is useful for protocols, DAOs, and anyone who wants to make payments with custom sending periods without having to design their own vesting contracts.

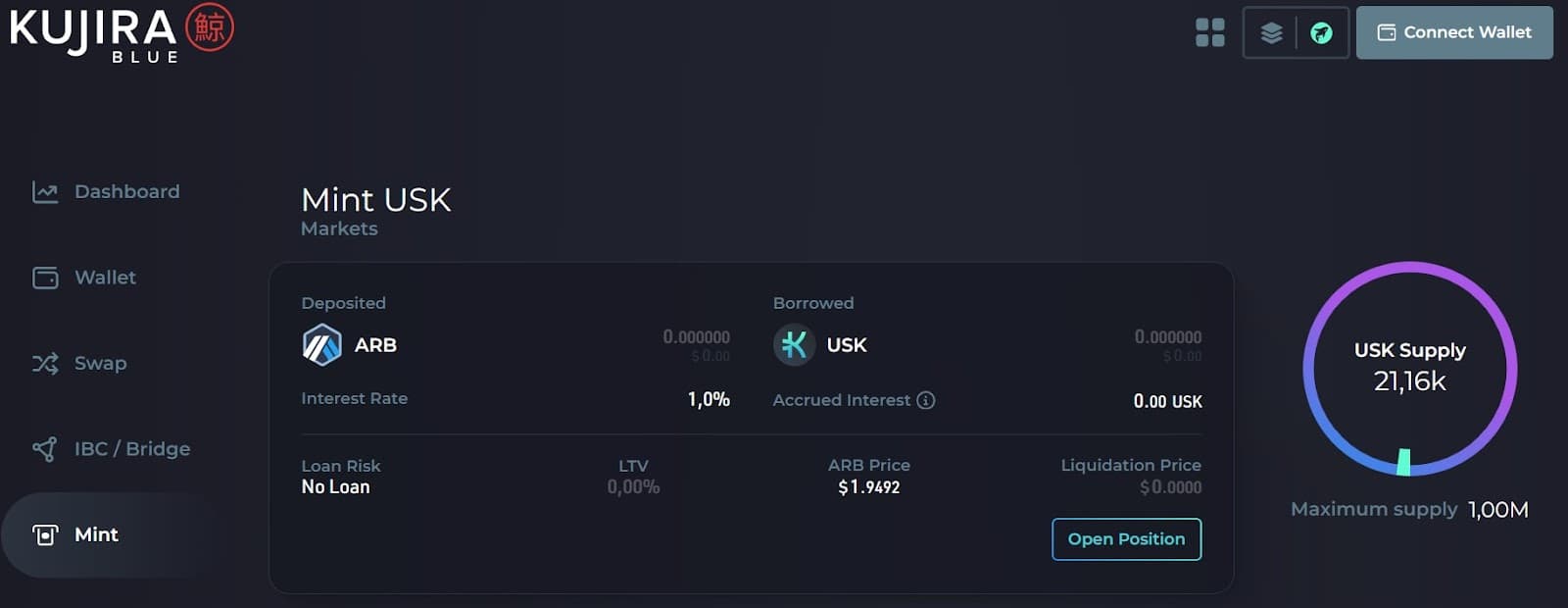

Importantly, BLUE also provides the ability for users to deposit collateral and mint the USK stablecoin.

The Swap interface on BLUE is similar to the basic swap user interface available on AMM DEX. This provides an alternative frontend for users not familiar with the more complex trading interface offered by FIN.

FINDER (Explorer)

FINDER is an official blockchain explorer for the Kujira, functioning as a vital piece of infrastructure that empowers users to delve into the intricacies of addresses, transactions, validators, and beyond within the Kujira Network.

It is applicable to the mainnet, testnet and pond (local network). While mainnet serves the majority, testnet and pond become the playground for developers, offering a space to validate transactions and explore critical information.

FINDER includes an array of features such as bookmarking and saving, which streamline the user’s experience when attempting to track a specific address or transaction.

PILOT (Launchpad)

PILOT is a launchpad platform created by Fuzion and Kujira in collaboration. The project utilizes a unique sale method based on ORCA’s revolutionary bid process, and has the objective of launching tokens in a fair and equitable manner, as well as providing benefits and equal access to all participants.

The platform offers various mechanisms for token introduction, which can be configured based on the priorities and target audience of each project.

This innovative approach removes the stress of "First Come, First Served" and the randomness of lottery systems, making PILOT a potential gold standard for token launches.

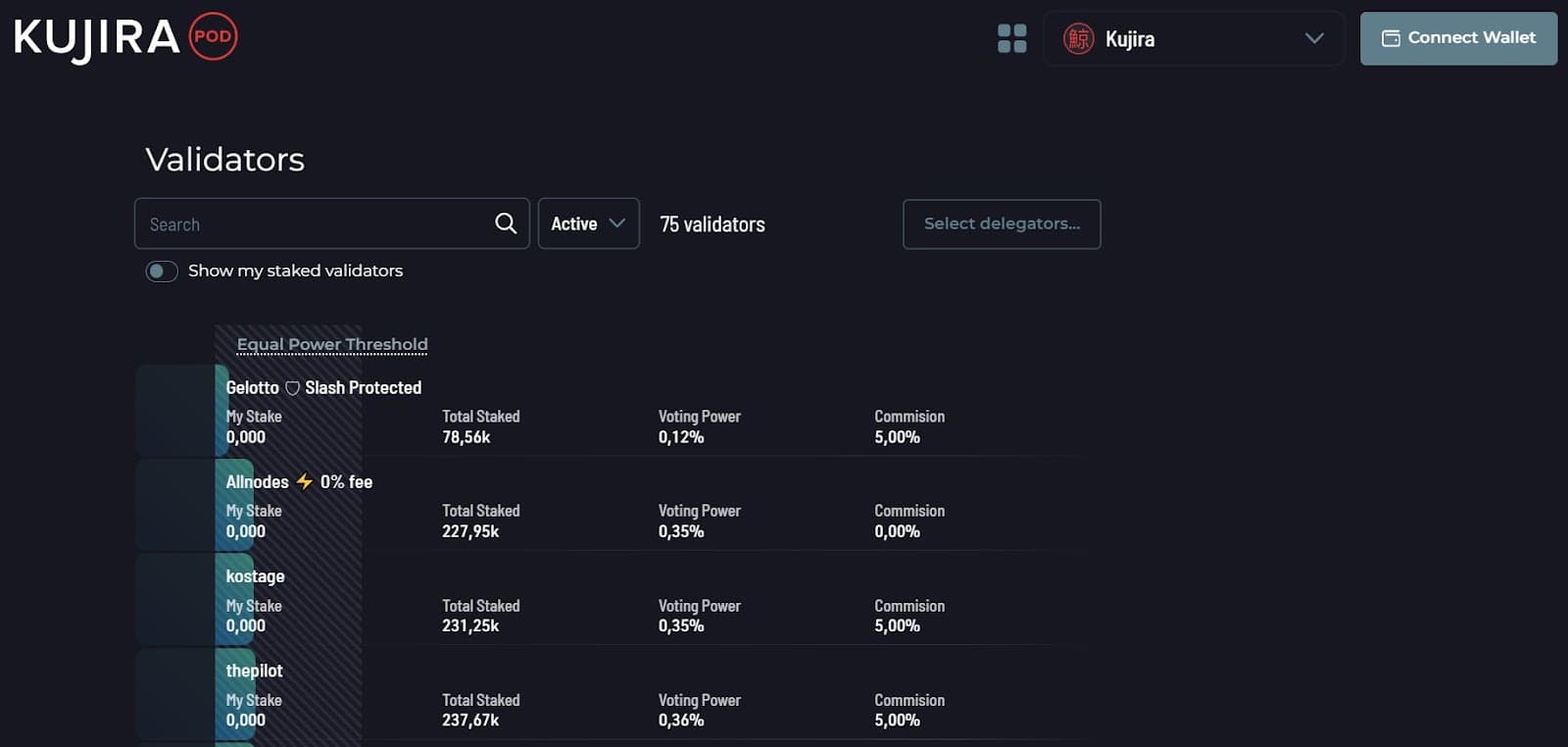

POD (Cross-chain Staking)

In an effort to promote the decentralization of the network, Kujira provides an innovative dashboard for staking - POD.

In addition to a user-friendly interface for searching and selecting validators, cross-chain staking, potential delegates have access to another important information displayed on the screen - the "Equal Power Threshold".

The "Equal Power Threshold" is calculated as the total stake divided by the number of active validators.

Validators with voting power above the Equal Power Threshold are shown in red color with a bar showing their percentage of total votes. Validators with average voting power above the threshold are highlighted in yellow, and validators with voting power below the threshold are highlighted in blue.

The new staking interface clearly displays how the voting power of an individual validator relates to the equal voting power that is often characteristic of an optimally decentralized Proof of Stake network setup. This tool allows users to distribute their stake based on the weight of the validators, ensuring an optimal level of decentralization.

USK (Stablecoin)

USK - Kujira's decentralized over-collateralized stablecoin that is soft-pegged to the US dollar and backed by a variety of collaterals including ATOM, wBTC, wETH, wBNB, MNTA, DOT, and others (a full list can be found here).

Soft-pegged means that the value of USK is generally pegged to the US dollar, but some fluctuation in the value of the coin within a certain range is allowed.

Minting USK involves depositing collateral, with the pledge being at least 166%, reducing the risk of price fluctuations during market volatility. In case of liquidation, the liquidated collateral is auctioned by ORCA.

Find out more about Kujira’s DeFi ecosystem in our blog post Inside Kujira's DeFi Universe.

Audits

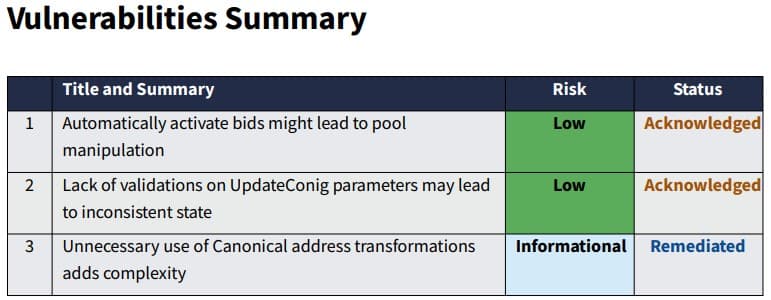

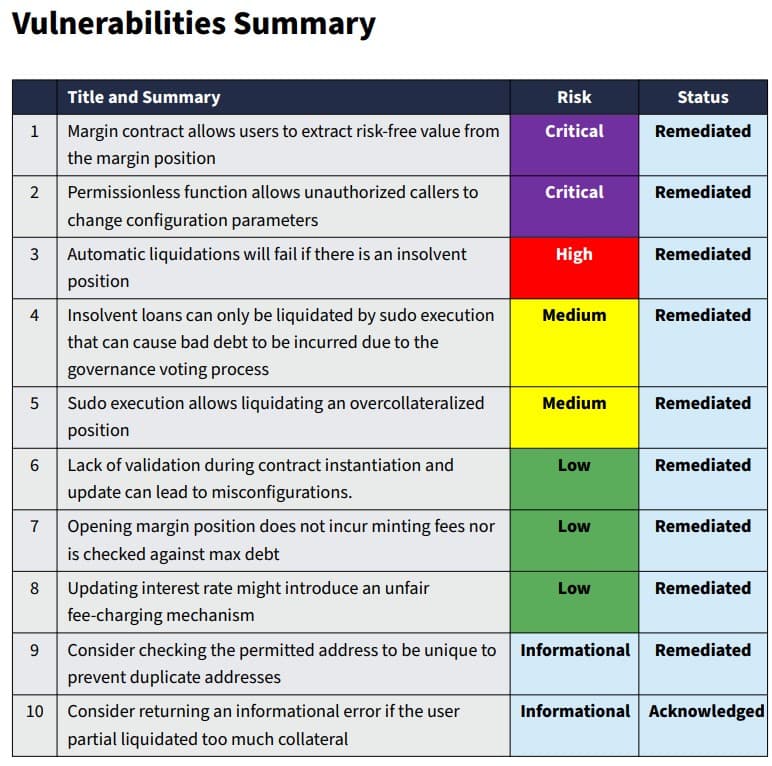

USK and ORCA contracts have undergone thorough audits.

Kujira USK Stablecoin Contracts Audit by SCV

Functioning of the Kujira Chain

Before launching the network, the Kujira team carefully designed all solutions, implementing various enhancements to improve the efficiency of their ecosystem.

The Kujira utilizes Cosmos infrastructure including Comet BFT consensus, Cosmos SDK with PoS (Proof-of-Stake) framework and WASM-based smart-contracts layer. With the integration of third-party applications and software solutions, the entire Kujira system has been optimized and modified for its unique features.

In the fast and dynamic world of DeFi, where every second counts, the Kujira team improved the Cosmos SDK transaction framework, reducing block time to 2.2 seconds and optimizing transaction processing. This not only reduces load and improves service levels, but also meets the requirements of high-frequency trading strategies by providing the necessary speed for intensive transactions.

Moreover, Kujira's philosophy centers on efficient collaboration between its decentralized applications (DApps). Notable examples include FIN utilizing BOW for liquidity without traditional incentives and BLUE, ORCA, and USK forming an interconnected system to mitigate risks.

Kujira's ecosystem-wide interoperability extends beyond specific cases of integration. All native apps and the broader ecosystem share a degree of connectivity, fostering a network effect where the blockchain's utility grows with the expanding ecosystem.

Token Economy

The native token of the Kujira Network is KUJI, which operates on a non-inflationary model. Unlike inflationary assets, KUJI derives its value from the adoption of its dApps and products, generating fees that reward stakers directly from protocol revenue.

In contrast to traditional networks like Ethereum, where stakers rely on transaction fees for incentives, the Kujira network prioritizes economic activity within its ecosystem. Here, the primary driver for the value of the KUJI token extends beyond transaction fees to encompass the overall economic activity within the Kujira ecosystem. This innovative approach not only bolsters the token's value but also contributes to securing the network and its associated funds.

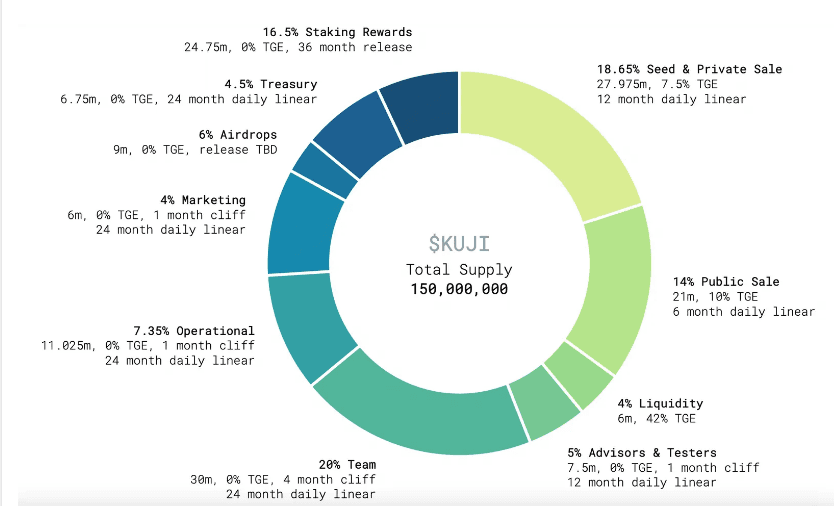

Token generation started in November 2021 with the following issuance schedule:

The original 150 million coins was reduced after a community vote, which led to the burning of rewards from the liquidity pools.

KUJI serves as a utility token to pay for network services and dApps, and all related payments are distributed to KUJI stakers. In addition, the KUJI token provides governance capabilities, allowing holders to actively participate in forming the future course of the network.

Supported Wallets

- Sonar (BETA) - native mobile wallet of Kujira ecosystem

- Keprl - the widely used wallet for the Cosmos network

- Leap - great wallet for managing cryptocurrencies within the Cosmos ecosystem

- MetaMask - a crypto wallet available as a browser extension and as a mobile app, with support over 25+ chains

- Ledger Nano X - The most widely used hardware wallet (HW) on the market.

The list of supported wallets can be much longer as the network evolves and integrates with other projects

Where to Buy KUJI

According to CoinMarketCap, the KUJI token is traded on two CEX exchanges - MEXC and CoinEX - and on about 20 DEX platforms, including the services of the Kujira project, that we've already met earlier.

At the moment, here are two of the easiest ways to get into Kujira's network.

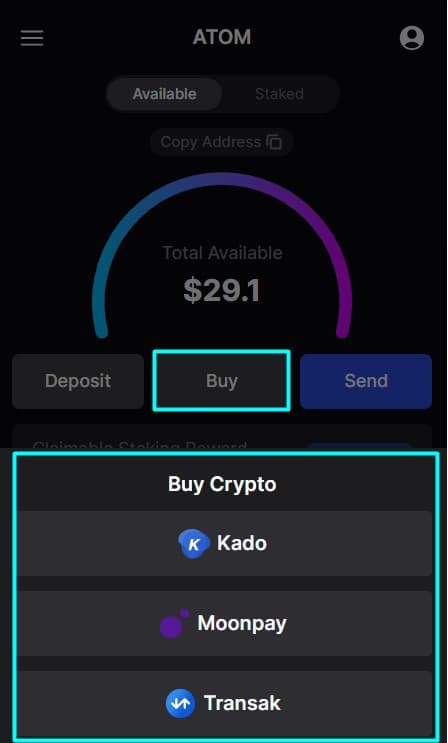

- Through ATOM, Cosmos' native token. ATOM is traded on almost all major exchanges. Alternatively, ATOM can be purchased directly from the Keprl wallet. After buying ATOM tokens, you can swap them on KUJI tokens in the wallet.

- You can buy KUJI tokens directly from the Leap Wallet. (min $5)

Below, we'll cover one of these methods in a quick staking guide

How to Stake KUJI

Step 1. Install Keplr Wallet and Buy or Deposit ATOM tokens

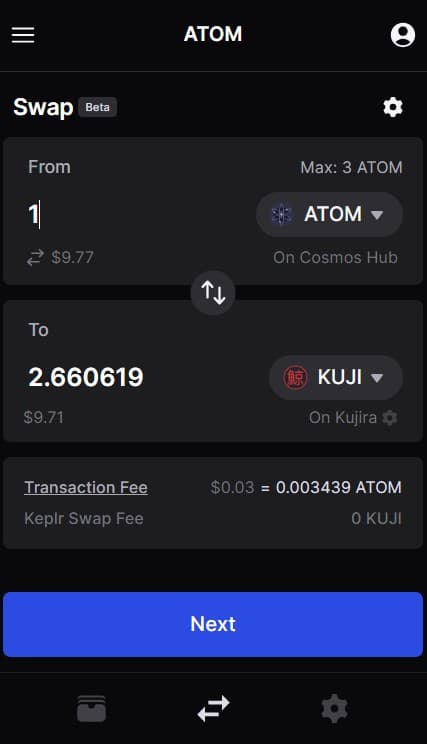

Step 2. After tokens purchased, find the button of bidirectional arrows on the bottom of the wallet and click to Swap ATOM tokens.

Step 3. From the list of tokens, select ATOM and KUJI and set the number of tokens you want to swap to KUJI. Press Next button.

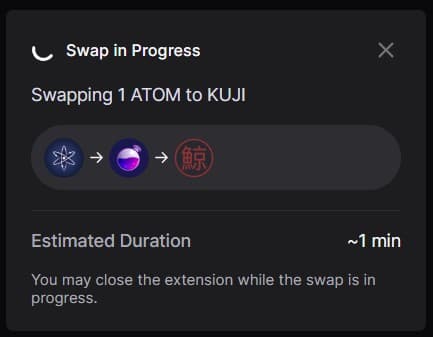

After a while, the tokens will be successfully swapped.

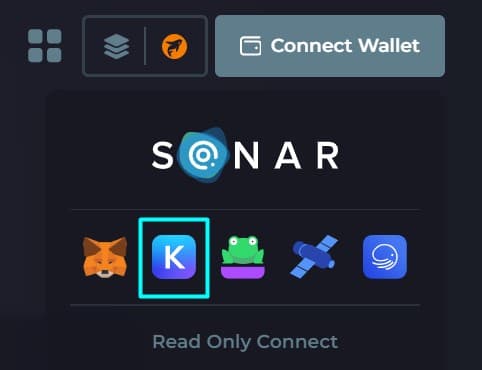

Step 4. Go to the Kujira BLUE service and connect your Keplr wallet.

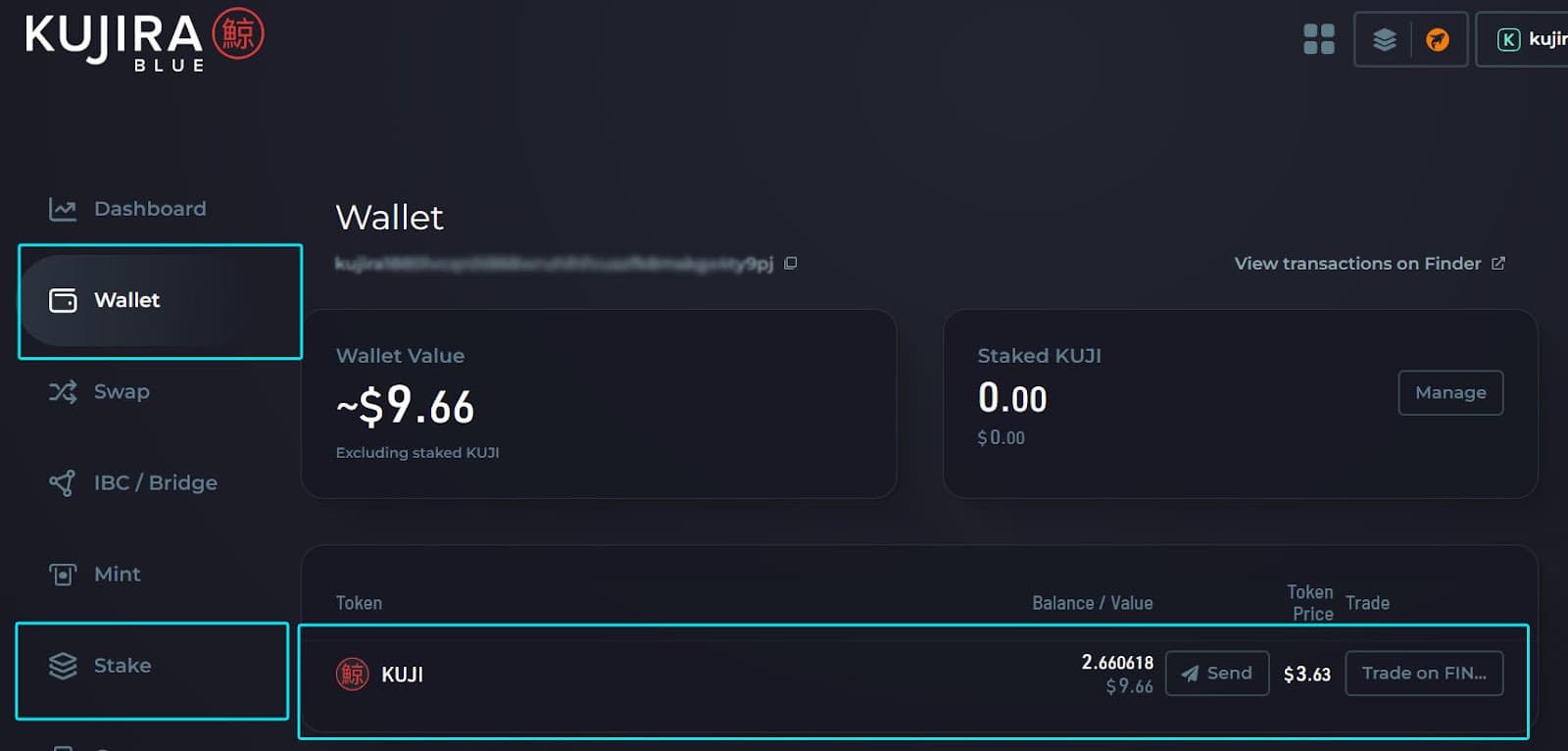

Step 5. Once your wallet is connected, you will see your KUJI token balance under the Wallet tab. Below you will see the Stake tab, press on it.

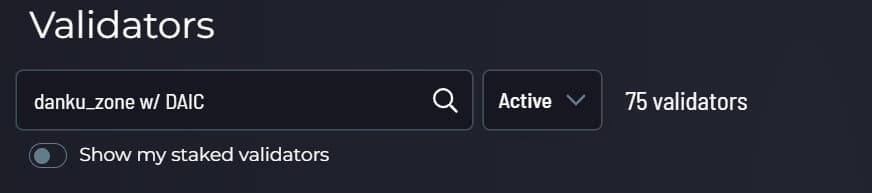

Step 6. In the search bar, type danku_zone w/ DAIC or click the link for choosing validator.

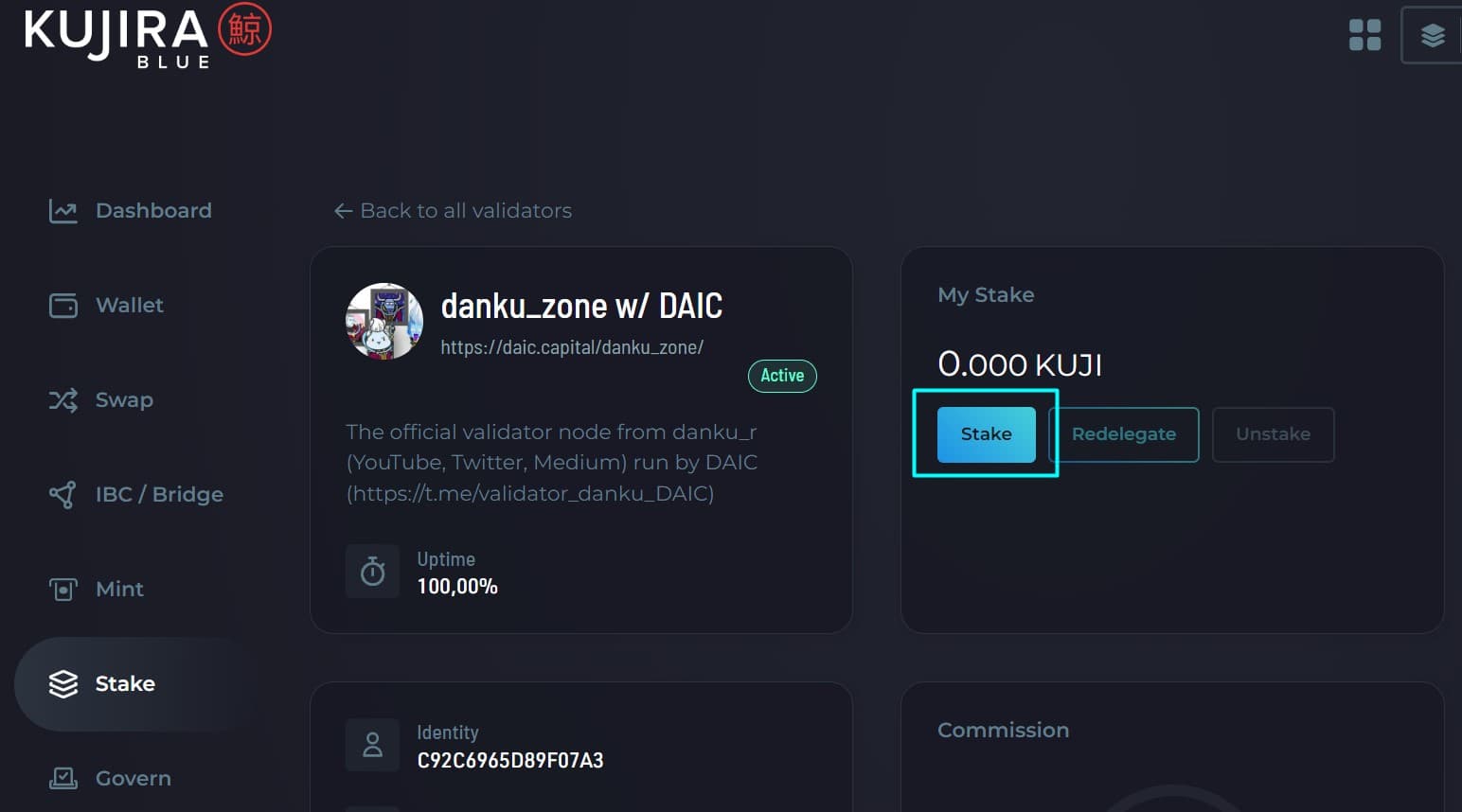

Step 7. On the validator page, click the Stake button.

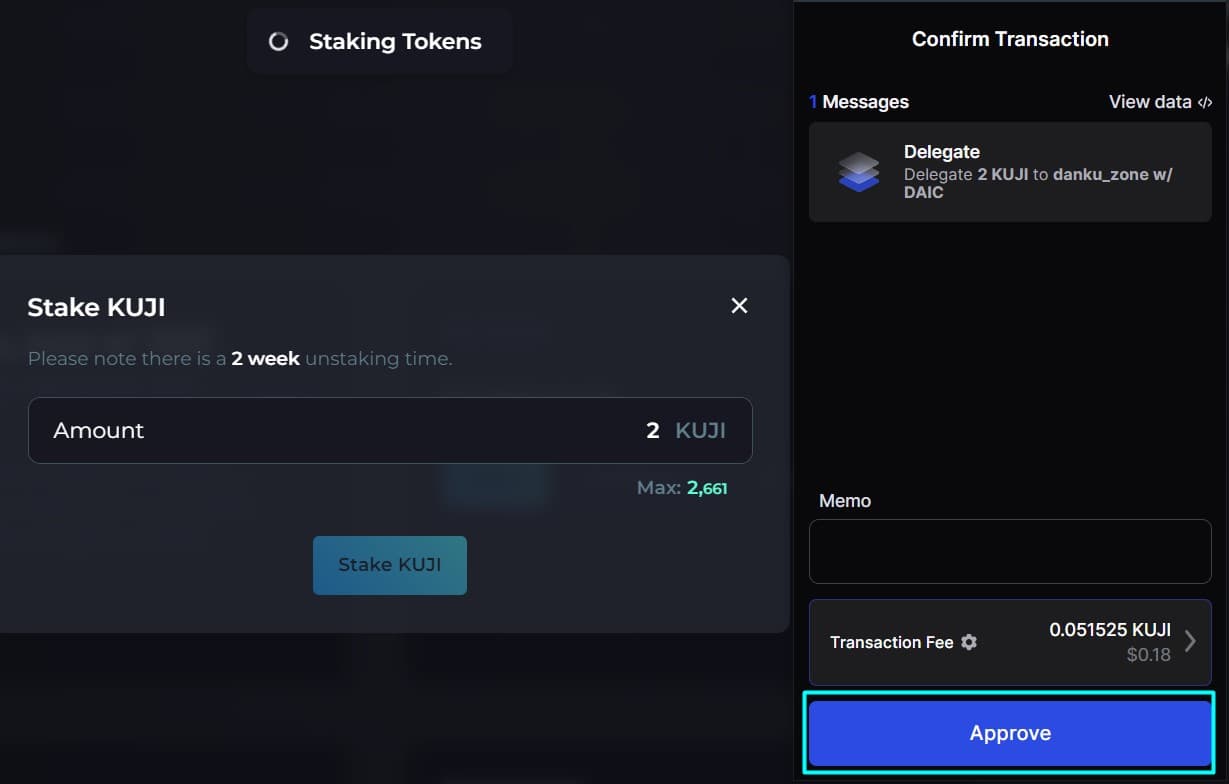

Step 8. Enter the number of KUJI tokens and confirm the transaction in your wallet by clicking Approve button. Please note there is a 2 week unstaking time.

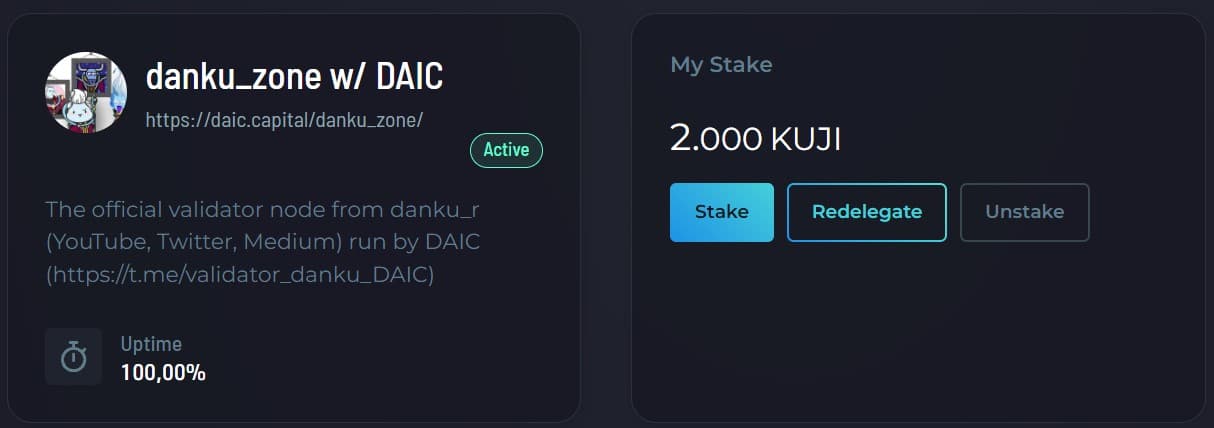

Once the transaction is validated, you will see your tokens in the stake of the selected validator.

Team

While maintaining anonymity, the Kujira team has demonstrated commendable expertise and performance throughout their endeavors.

Founders

Brett @Cryptoslang1 | Golden retriever, central front-end developer for Kujira

Dove @Deadrightdove | Dove, CEO and public face of Kujira

Hans @Codehans1 | Hen, central back-end & smart contract developer for Kujira

Core Team

Alex @Unconumb | Community manager and runs the Rorcual validator with a partner

Amit @Const_amit | Core team Smart Contract Wizard

Dan Tanaka @Dantanakakujira | Growth lead and head biz dev

Daniel Lux @Thuxo_Lux | Research & writing | building WinkHUB | KujiDAO cofounder

Dave @Brinstar_Kuji | CFA Charterholder, moderator, advisor

Jan @JPTG119 | Responsible for media and community

KP @KPeruggi | Content and Outreach

Roadmap

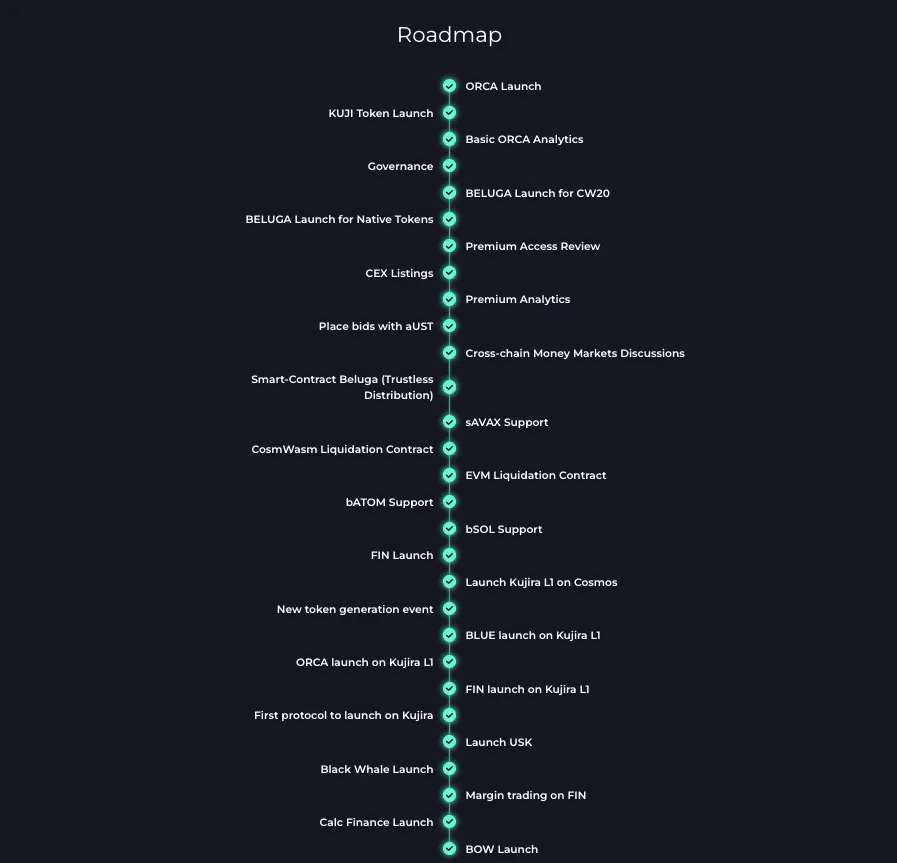

Implemented features

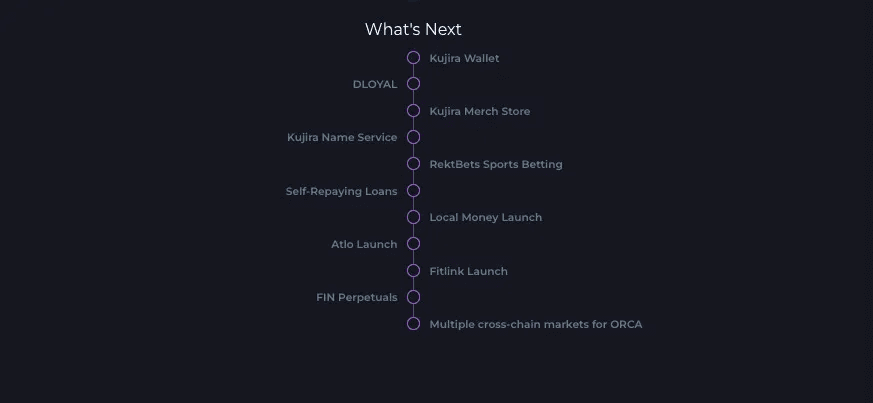

Upcoming features

Conclusion

Kujira emerges as a promising project in the decentralized FinTech landscape, boasting innovative features, a resilient foundation, and a diverse product roadmap.

The expansion of its ecosystem and DEX-oriented strategy reflect a forward-thinking approach, aligning with the evolving dynamics of the crypto space. In the face of global regulatory uncertainties, the shift towards DEX presents a compelling opportunity, and Kujira seems poised to navigate these challenges successfully.

While the ultimate outcome remains uncertain, Kujira's dedication to innovation and community building positions it as a project worth monitoring and holds promise for future achievements.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.