Would you like to get more involved with the newly released Initia network? Staking your INIT tokens is a great way to do that! By staking, you help secure the network, you can vote on governance proposals, and you get rewarded for it. Initia offers some unique options right within its official application. We'll walk through the process step-by-step using the Initia App in this tutorial.

Key Takeaways

- Why Stake?: Earn rewards, secure the Initia network, and gain governance rights.

- Where?: Use the official Initia App.

- Two Ways: Stake native INIT directly (with an optional lock for VIP boost) or stake specific INIT-paired LP tokens (Enshrined Liquidity).

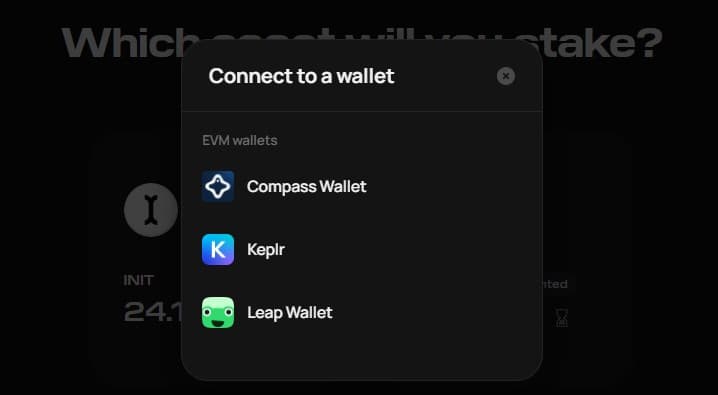

- Essentials: You'll need a compatible wallet (like Initia Wallet, Keplr, Leap, Compass) and INIT tokens for staking and gas fees.

- Remember: Choose validators carefully and be aware of the 21-day unbonding period.

What You'll Need Before Starting

Alright, before you can stake your INIT and start enjoying rewards, let's have the essentials in place for a hassle-free staking experience! Having these at hand in advance will save you time in the long run.

Above all, you'll require the INIT tokens. Set an amount you'll be willing to stake to support the network, plus a little extra of INIT for covering fees. Why? Because everything on the blockchain, even the staking process itself, getting rewards later, or unstaking in due time, incurs a small transaction fee (gas fee), and this is paid in INIT.

Up next is your crypto gateway - an Initia-compatible wallet. Examples found within the app are the official Keplr, Leap, and Compass Wallet. Whatever you decide, make sure it's installed, set up, and loaded with the INIT you're staking and that gas fee buffer.

Where to Get INIT Tokens? If you don't already hold INIT from the recent airdrop or other activities, you'll need to acquire some. Since the mainnet launch, INIT has become available for trading on major centralized exchanges. You can look for INIT on platforms like Binance, MEXC, Crypto.com, Kraken, HTX, Gate.io, Bitget, and KuCoin (always check the specific exchange for available trading pairs and regional availability). As the Initia ecosystem grows, swapping for INIT on native decentralized exchanges may also become an option.

Step 1: Go to the Initia App & Connect

Navigate only to the official Initia staking page: https://app.initia.xyz/stake.

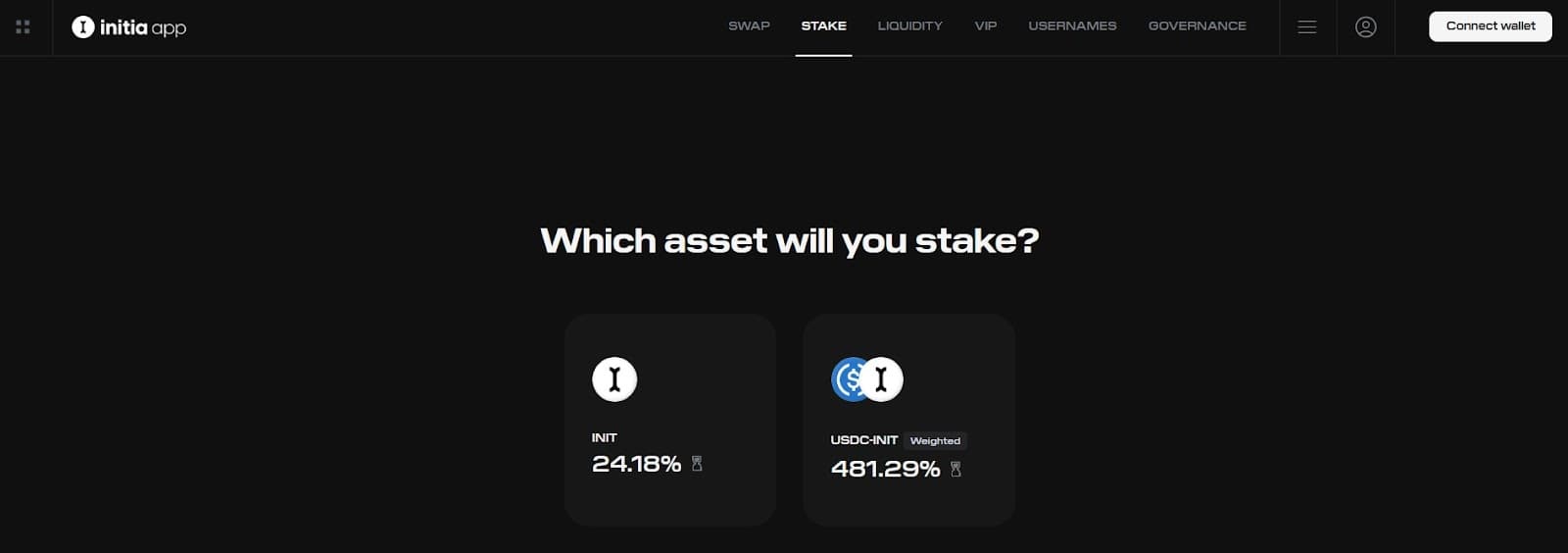

The app will first ask: "Which asset will you stake?"

You'll see options like:

- INIT: Choose this to stake your native INIT tokens directly.

- LP Tokens (e.g., USDC-INIT Weighted): Alternatively, the Initia App presents the option to stake specific LP Tokens (like the USDC-INIT Weighted option shown). To use this, you would first need to provide liquidity on InitiaDEX to obtain the required LP tokens.

In this guide, we will cover native INIT staking.

Before we start, you should connect your wallet to the Initia App platform. Click the "Connect Wallet" button (top-right) and select your preferred wallet (e.g., Keplr, Leap, Compass) from the pop-up list and approve the connection request in your wallet extension or app.

Step 2: Enter Details & Delegate

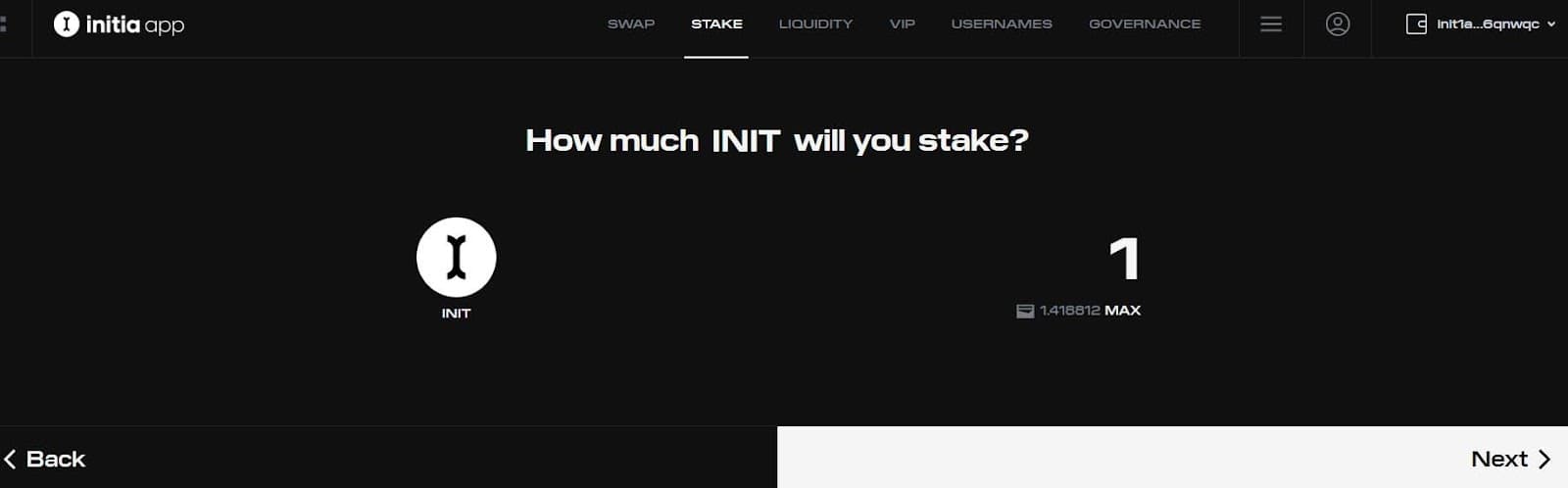

After connecting your wallet and choosing INIT token for staking, the app will ask "How much INIT will you stake?". Enter the amount or use the "MAX" button. Make sure to leave a tiny bit for gas! Then press the “Next” button below.

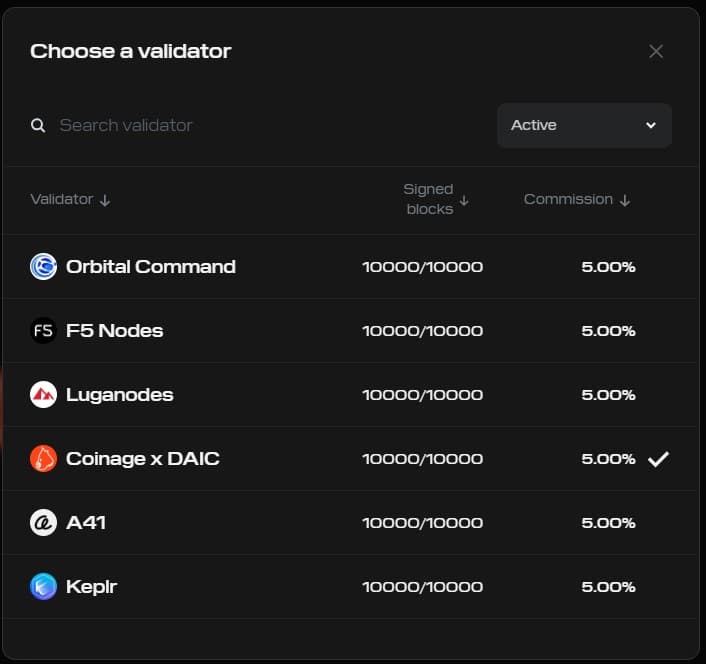

Next, "Which validator will you stake to?". Click the dropdown/field to "Choose a validator" from the list.

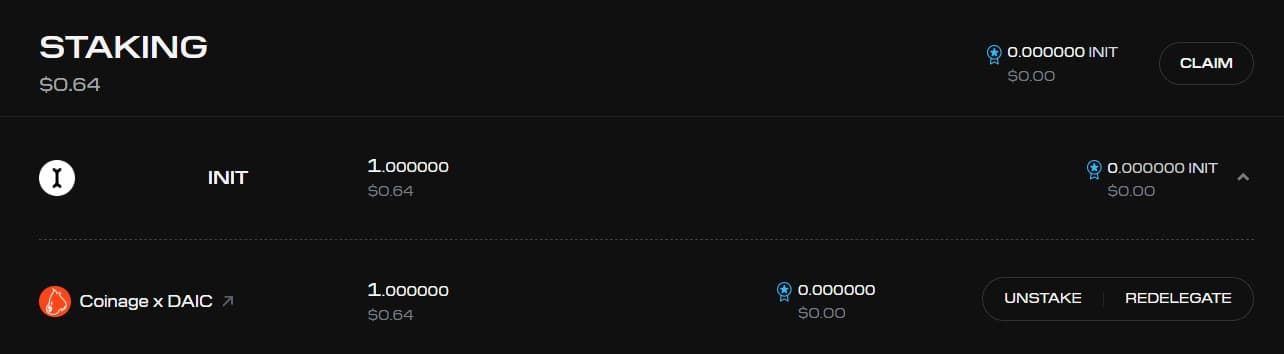

To make an objective decision, look at their commission rate and performance (signed blocks/uptime). DAIC Capital runs a validator on Initia (listed as “Coinage x DAIC”), focusing on stable performance for our delegators.

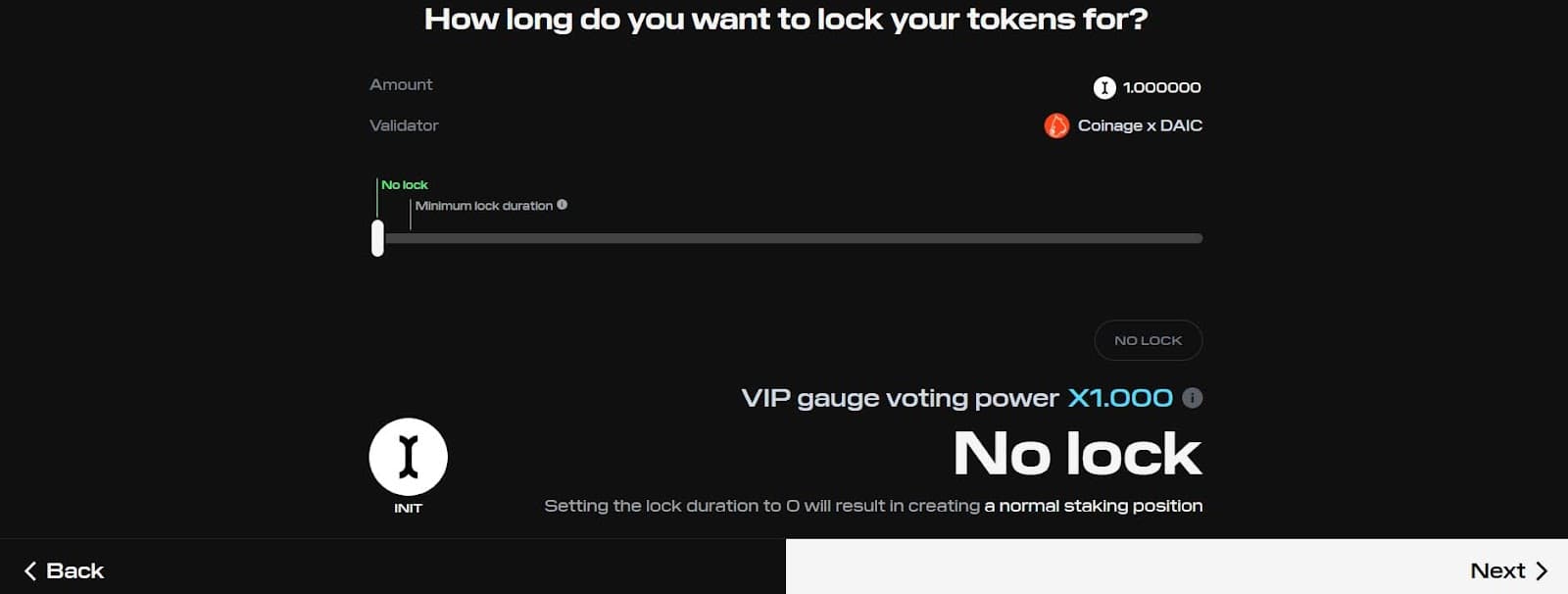

After choosing your validator and pressing “Next”, you'll see a screen asking "How long do you want to lock your tokens for?" Locking is optional, you can select "No lock". If you choose a duration (e.g., 30 days), it boosts your VIP gauge voting power with a multiplier. Consider the trade-off between this boost and having your tokens locked for longer.

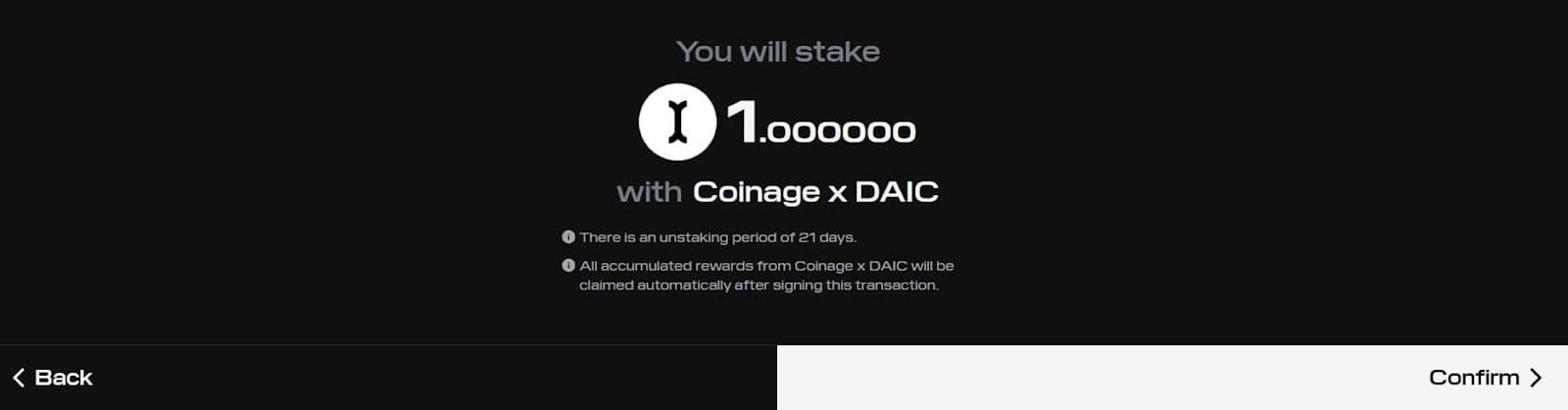

Click "Next" after setting the lock preference. Review the final confirmation screen showing the amount, validator, and lock end date (if any). It may also note that existing rewards from that validator are auto-claimed.

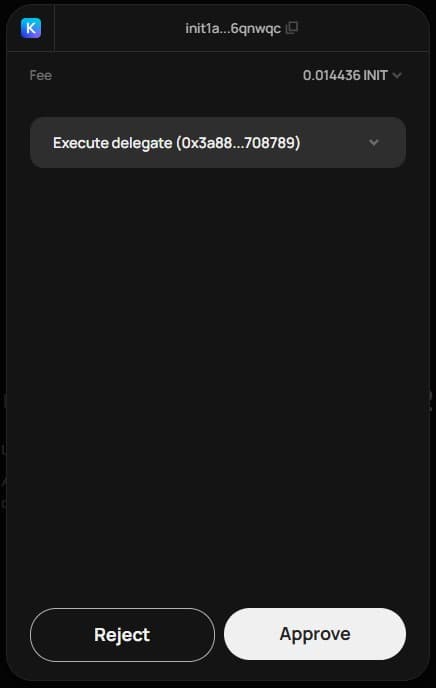

If correct, click the final confirmation button "Confirm". Then, Approve the "Execute delegate" transaction in your wallet pop-up, noting the small INIT gas fee.

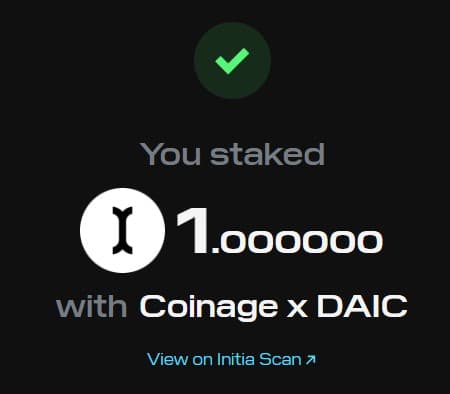

Once the transaction confirms on the blockchain, congratulations – you are now officially staking INIT and supporting the Initia network!

Step 3: Managing Your Stake

You can view your active delegations (both INIT and LP stakes), monitor rewards, and manage your positions within the Initia App's Stake section https://app.initia.xyz/my. Rewards typically need to be claimed manually via another transaction (requiring gas).

When you decide to withdraw your staked assets, you'll need to initiate the "unstake" process using the Initia App.

Once initiated, a mandatory 21-day unbonding period begins. It's important to note that your tokens will not earn rewards and cannot be moved during these 21 days. If you used the optional lock for staking INIT directly, that lock must expire first before the unbonding period commences. After the full 21 days have passed, your assets will be fully liquid and accessible in your wallet.

Remember the Risks!

Staking involves risks like validator slashing, potential validator downtime affecting rewards, market price fluctuations, the 21-day unbonding lock-up, and Impermanent Loss if staking LP tokens. Staking is generally considered lower risk than active trading, but is not risk-free.

Conclusion

So there you have it – staking on Initia offers compelling ways to earn rewards while supporting a next-generation blockchain. Make sure you understand the different methods available, research your validator choice thoroughly, and keep the unbonding period in mind. Welcome to the Initia staking community – participate wisely and enjoy being part of the interwoven future!

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.