The Initia mainnet has launched, and maybe you snagged some tokens from the airdrop or Launchpool. But beyond the initial excitement, what actually makes the Initia economy tick? Many crypto projects struggle with incentives – often relying on short-term hype that fades fast. Initia aims to tackle this head-on with a thoughtful economic design. Understanding the roles of its two key tokens and the unique incentive system they power, is crucial to grasping Initia's long-term vision for a sustainable, interwoven multi-chain future. Let's break down the different pieces and why they matter.

Key Takeaways

- Two Core Tokens: Initia's economy revolves around INIT native token and esINIT token for long-term rewards.

- Utility Driven: INIT's value is tied to network usage, security (staking/Enshrined Liquidity), and governance participation.

- Sustainable Incentives: esINIT and the Vested Interest Program (VIP) aim to reward sustained user activity, fostering long-term ecosystem health over short-term hype.

- Distribution Focus: Roughly half the total supply is allocated to long-term community and ecosystem incentives (VIP & Staking/EL rewards) with extended vesting.

Setting the Stage: Initia's Economic Design

Before diving deep into the tokens themselves, it's helpful to understand why Initia's tokenomics is designed the way it is. Initia aims to solve the fragmentation plaguing the multi-chain world by building an 'Interwoven' network where Layer 1 and many Layer 2 application chains work together seamlessly. Achieving this requires more than just clever technology, it demands a well-thought-out economic model. This model is centered around the native INIT token, the escrowed esINIT reward token, and integrates two unique mechanisms designed to align incentives and foster sustainable growth.

The first is Enshrined Liquidity (EL), Initia's enhanced Delegated-Proof-of-Stake (dPos) system, which uniquely allows specific INIT-paired LP tokens (from the native DEX) to be staked alongside native INIT, letting capital simultaneously provide network security and DeFi liquidity. The second is the Vested Interest Program (VIP), the core long-term incentive engine that rewards ongoing, valuable user activity within applications using the special esINIT token, aiming for a truly engaged and sustainable ecosystem.

Traditional systems often force a difficult choice: staking assets means sacrificing potential trading fees from providing liquidity, while providing liquidity means missing out on staking rewards. Aiming for both often requires splitting capital across different positions, reducing overall efficiency. By enabling liquidity positions themselves to be used as staking assets, Initia eliminates this need to choose, you can now earn both staking rewards and trading fees from a single position. Let's explore how the INIT and esINIT tokens function within this economic design.

INIT: The Network's Core Utility Token

INIT is the main currency you'll use across the entire Initia ecosystem. It's the fuel that keeps everything running smoothly on both the main Layer 1 and all the connected application rollups. Here’s what it’s used for:

- Gas Fees: Need to send tokens, interact with a DeFi app, or claim rewards? You'll pay the small network fee using INIT. Simple as that.

- Staking & Security: INIT is key to keeping the network safe. You can stake INIT directly with validators like in many Proof-of-Stake systems. But Initia adds a twist with Enshrined Liquidity (EL) and lets you stake specific INIT-paired LP tokens. Why's that cool? Your capital works double-duty: securing the network and providing trading liquidity! This means potentially earning both staking rewards and trading fees – pretty neat for capital efficiency.

- Governance: Got an opinion on where Initia should go next? Holding and staking INIT gives you voting power in the on-chain governance system. You get a say in upgrades, network changes, and more.

- Core Liquidity & Fees: INIT is the main trading pair asset in the InitiaDEX and is important to the entire Initia liquidity ecosystem.

These diverse roles ensure INIT's utility is deeply embedded in the network's function and growth.

esINIT: The Escrowed Reward Token for Long-Term Engagement

Now for the other token: esINIT (escrowed INIT). This isn't your everyday token, it's the special reward currency handed out through Initia's main long-term incentive plan, the Vested Interest Program (VIP). It works by giving esINIT rewards based on valuable things you actually do within the different apps on Initia (influenced by staker votes and value flow).

Crucially, esINIT is initially non-transferable. It's "escrowed," meaning you need to unlock it, or "vest" it, over time. How? Generally by staying active in the app where you earned it – keep hitting those performance goals (KPIs) the app developers set! Alternatively, you might be able to convert your esINIT tokens into LP Lock-Staked Position and receive native staking rewards, swap fees and boosted reward rate.

Initia Token Distribution: The Big Picture

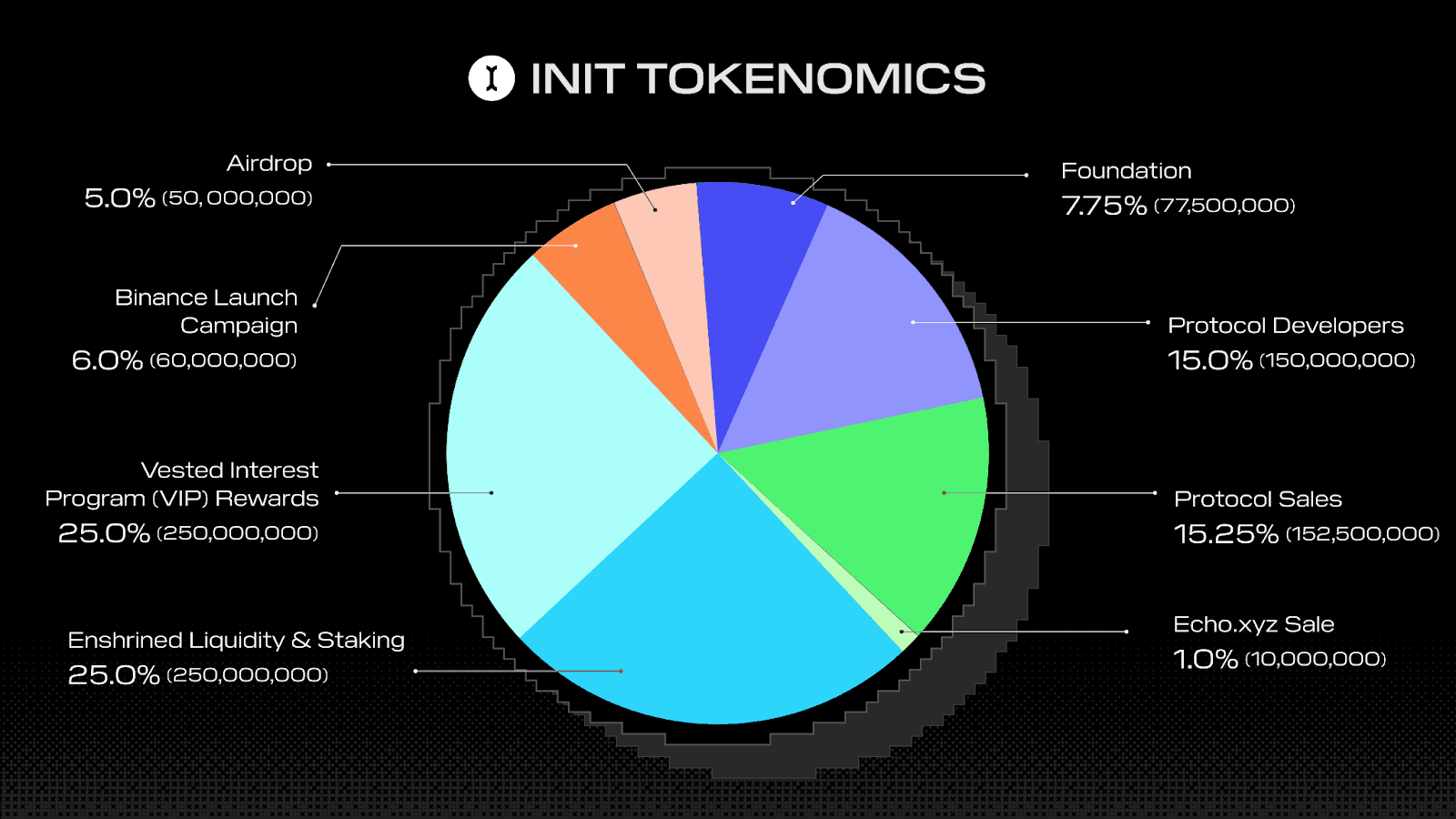

So, where did all the INIT tokens go? There's a fixed total of 1 Billion INIT.

Looking at the official breakdown (like the pie chart we saw), you can see a clear focus on the long game:

A massive 50% is earmarked for future Ecosystem Incentives. This is split between the VIP Rewards (25%) and Enshrined Liquidity & Staking Rewards (25%), designed to be released gradually over many years to keep the ecosystem healthy and growing.

The Team (Protocol Developers) gets 15% and Investors (Protocol Sales) get 15.25%. These folks are generally locked in for the long haul too, with multi-year vesting schedules (often 4 years with a 1-year wait). The Initia Foundation has 7.75% for strategic goals, and the Echo.xyz Community Sale was 1%.

That leaves about 11% for the initial kick-off: the Airdrop (5%) and the Binance Launch Campaign (6%). These were mostly unlocked early to get tokens into the hands of the community right away and build initial momentum. The initial circulating supply right after launch was around 14.88%.

Conclusion: Understanding Initia's Economic Engine

So, what this mean for you as a user? Ultimately, Initia's tokenomics are designed to create a better experience for you. INIT is your straightforward tool for interacting across the network and participating in its security and governance through staking, earning you rewards along the way. The unique esINIT system, powered by the VIP program, directly rewards your engagement with the applications you use, offering a path to value based on sustained participation. Features like Enshrined Liquidity even aim to make your assets work smarter by potentially earning dual yields. It's all part of Initia's strategy to build a sustainable ecosystem where users are central, valued, and rewarded for helping the interwoven network thrive.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.