Key Takeaways

- Supra's Role in Blockchain Integration: Supra is a multi-chain Layer 1 blockchain and oracle service provider that enhances the usability of various protocols, networks, and decentralized applications (dApps) through a range of middleware products and services.

- Function of Oracles in Blockchain: Oracles serve as access points that allow Web3 applications to interact with both internal and external blockchain systems, as well as legacy systems. They enable smart contracts to perform actions based on real-world data, bridging the gap between on-chain and off-chain environments.

- Supra vs. Chainlink: While Chainlink is a well-established oracle network supporting numerous dApps and protocols, Supra offers a competitive alternative with its decentralized oracle services. Supra provides real-time price feed data for digital assets, emphasizing scalability, speed, and transparency in its operations.

If you want to learn more about Supra, check out our blog Post: Supra (SUPRA): A Next-Gen Blockchain Infrastructure Provider

Supra Oracles and the Larger Oracle Landscape

Supra is a multi-chain Layer 1 blockchain and oracle service provider that offers additional services that support blockchain infrastructures and networks of all shapes and sizes. As the Supra network has increasingly developed, the platform has continued to increase its usability for many protocols, networks, dApps, and related infrastructures via its wide range of middleware product and service offerings.

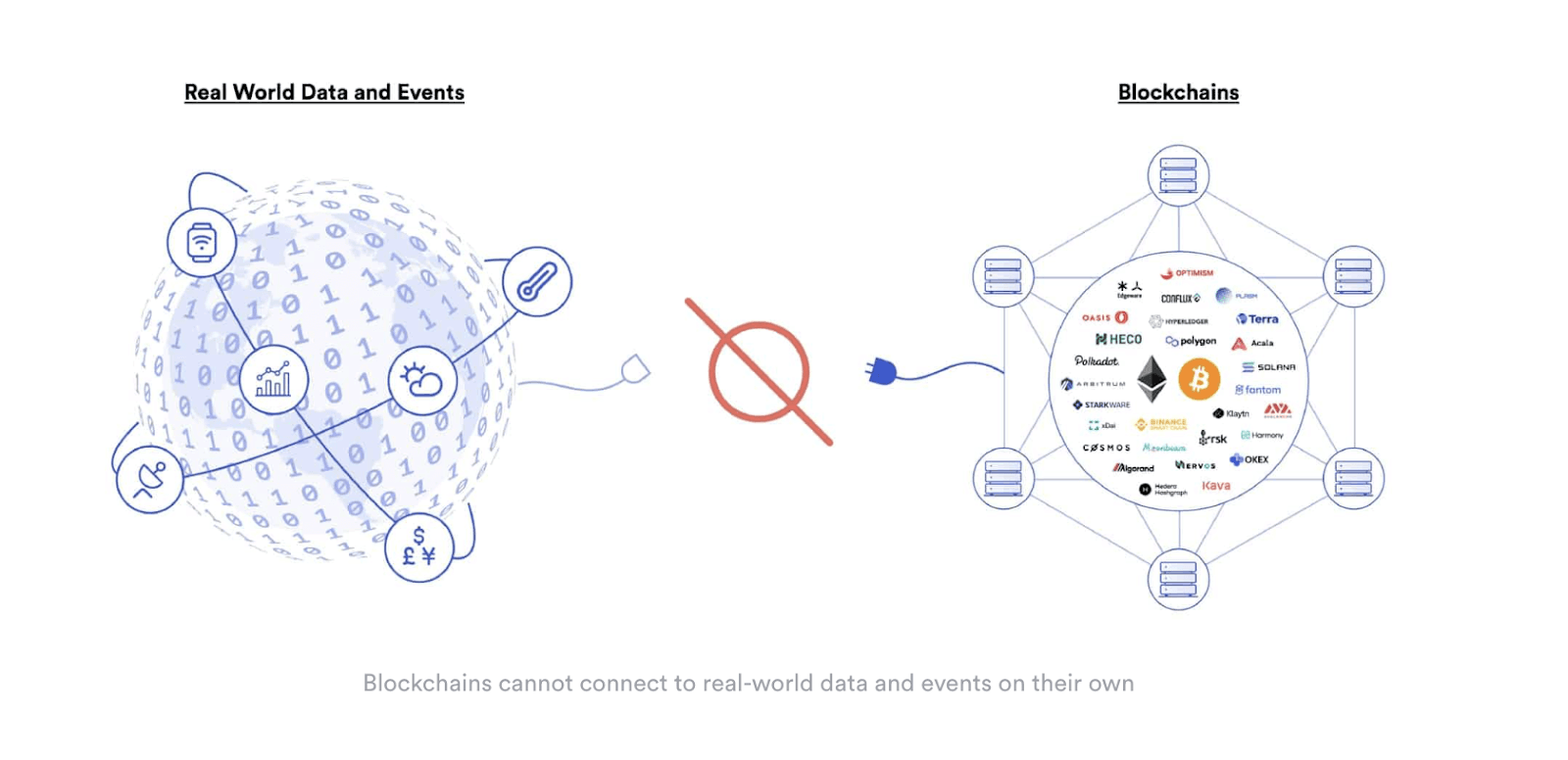

As many of you know, blockchains are designed to be contained systems, meaning at a specific instance their integrity is represented through a well-defined and immutable data set (i.e., in many ways they are confined on-chain at a protocol level). This means that because each block must be cryptographically linked to the previous one, it is impossible to modify the contents of a block once it has been finalized (i.e., finality) and committed on-chain.

Therefore, applications using the chain require access and egress points for data related to the utility of smart contracts. With a suitable infrastructure, which performs actions based on dynamic data sets, smart contracts can trigger different actions depending on the contents of the chain and the provided off-chain information.

These access points are typically called oracles. As a reminder, an oracle allows Web3 applications to interact with internal and external blockchain systems and legacy systems, sourcing information, compute resources, and financial systems such as SWIFT and others. By providing access to the outside off-chain world, oracles can assess real-world data, while smart contracts are then able to calculate corresponding actions on-chain as required conditions are met.

Decentralized applications (dApps) are powerful tools with chain-wide presence. However, they require the assistance of oracles (and at times, other middleware components) to assess the status of external real-world events, therefore allowing for the interaction with numerous off-chain applications. In essence, this means dApps must retrieve off-chain real-world data outside the on-chain blockchain environment to operate as intended.

David vs. Goliath: Chainlink and Supra Comparison

Supra is an oracle service provider in direct competition with well-established Chainlink. While founded in 2017 and only a year older than Supra, Chainlink has established itself as the de-facto industry standard oracle network responsible for supporting thousands of dApps, protocols, networks, and middleware platforms. Essentially, Chainlink oracles provide the infrastructure required to achieve real-world data connectivity for blockchains and other similar network types across the larger blockchain industry.

In 2021, Chainlink introduced Chainlink 2.0, as a framework designed to dramatically improve on its initial model to create a framework for the deployment and operation of numerous interoperable Decentralized Oracle Networks (DONs). Fundamentally, DONs are oracle subnets or shards that can be built to be fully modifiable depending on their preferred utility. Often referred to as the Metalayer, DONs allow oracles to be used for a nearly endless number of use cases including data feeds, Proof of Reserves (PoR), verifiable randomness, and so forth.

While Chainlink oracles are capable of addressing hundreds of various use cases, outside of its oracle framework, its most important service is its Cross-Chain Interoperability Protocol (CCIP). Specifically, CCIP is an interoperability framework designed to connect a host of blockchains and TradFi networks via the seamless sharing of data, tokenized assets, and other information types.

In August 2023, it was announced that Chainlink’s CCIP had integrated with the SWIFT global payment infrastructure system and several international financial institutions. These included BNP Paribas, Citi, Euroclear, and others as participants selected to try out a Proof of Concept (PoC) on the Ethereum Sepolia testnet using CCIP to facilitate cross-chain connectivity and asset transfers between TradFi institutions and the blockchain arena.

Alternatively, while provisioning similar cross-chain and oracle service offerings, Supra takes a different approach by providing a varied and comprehensive infrastructure framework on a new L1. With this new infrastructure, Supra will offer native access to oracle services, including dVRFs, as well as cross-chain and automation services to any application built on the platform. These services present on non-native chains will continue to offer an alternative to Chainlink and others. Comparatively, Chainlink’s overall adoption and maturity is disproportionately mammoth compared to Supra’s.

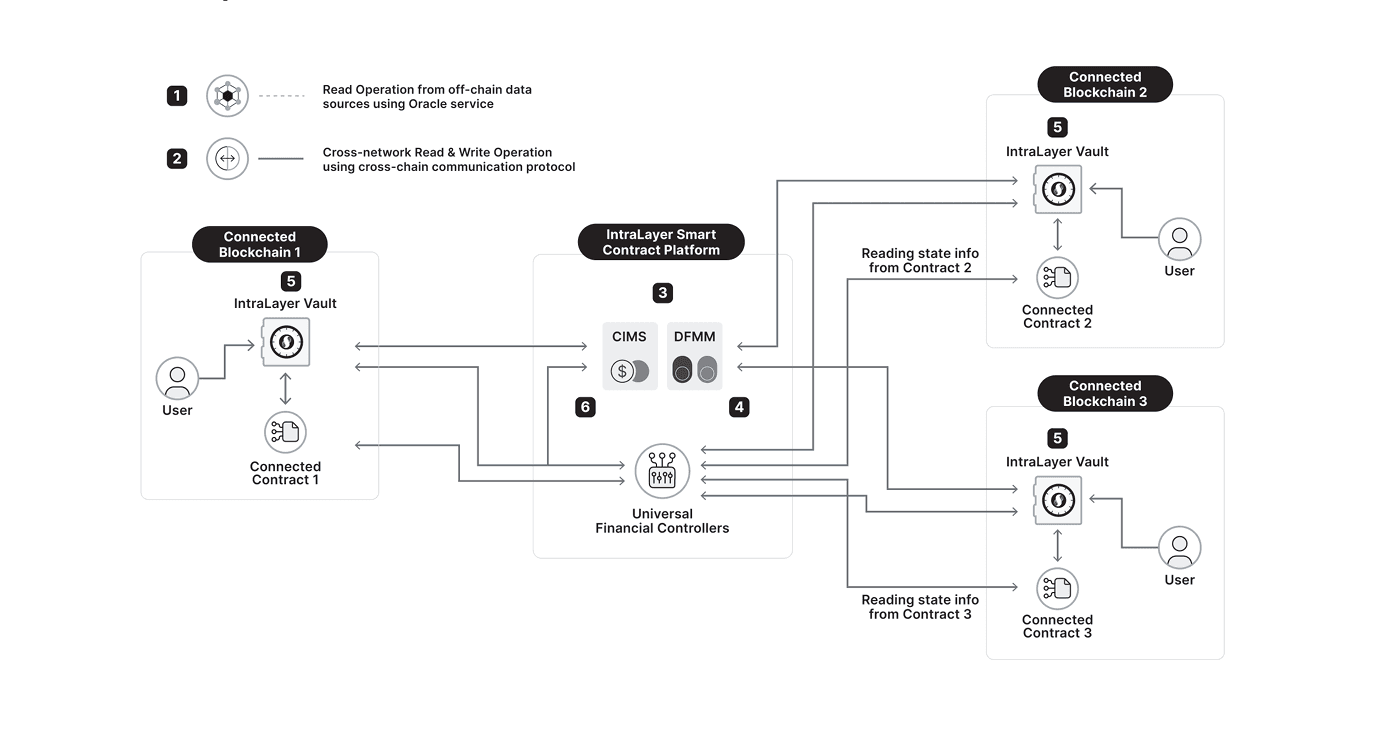

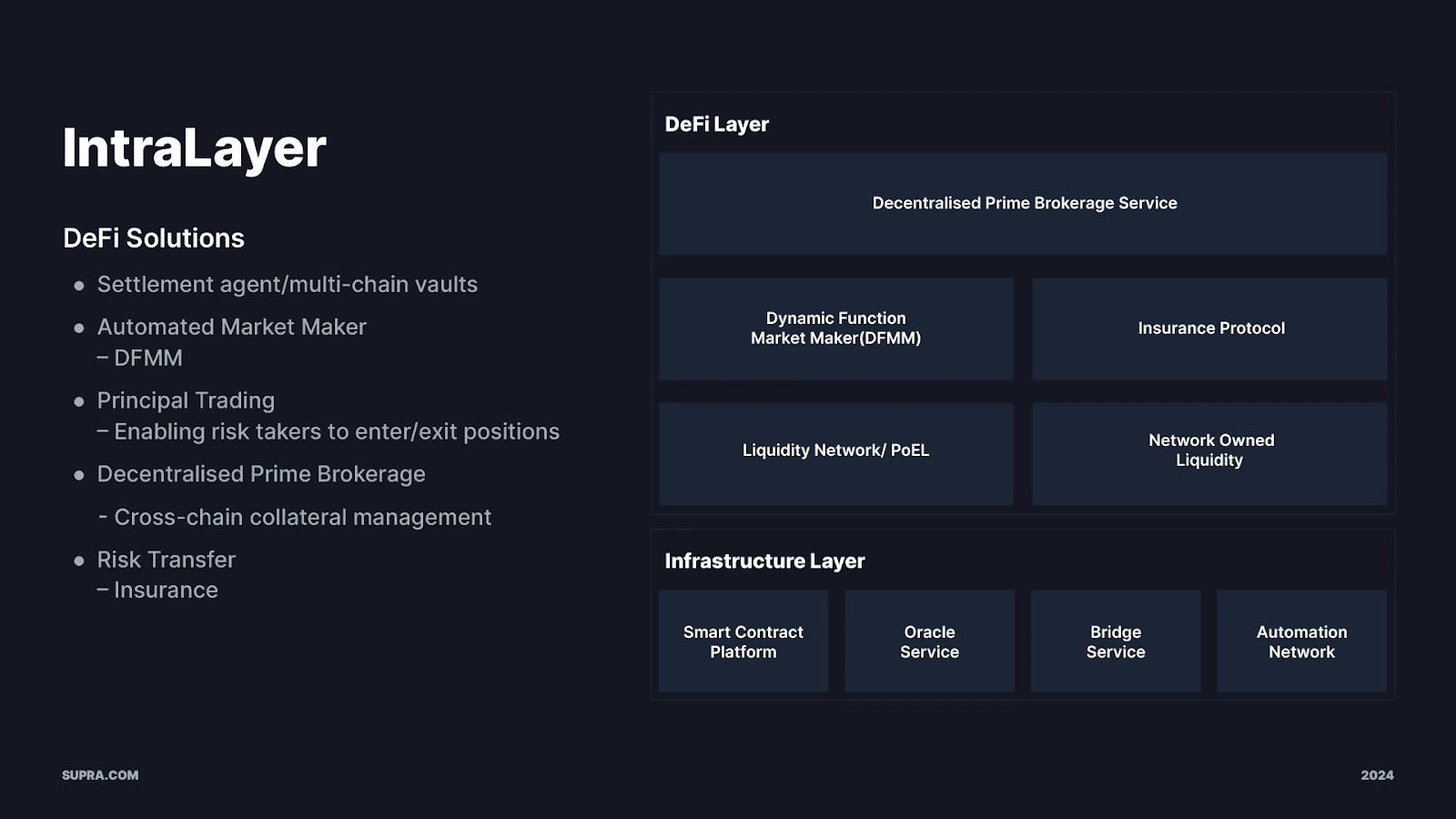

Supra IntraLayer

Supra’s IntraLayer is a modular interoperability layer designed to enable seamless cross-chain interactions for a wide range of products and services that represent some of the most critical elements of the larger Supra platform. Specifically, the IntraLayer is representative of a modern and advanced infrastructure particularly aimed at digital finance, both in the form of blockchain-based finance on multiple networks, and as a means to provide interconnectivity to traditional finance (TradFi) platforms such as SWIFT and others.

Key Features of Supra IntraLayer:

- The IntraLayer creates a "platform of platforms" offering natively integrated services amongst one another

- Ensures cross-chain interoperability for asset and data transfers between chains and various protocol types

- Provides native support for automated advanced smart contracts and related plug-and-play solutions

- Helps interconnect the larger Supra ecosystem and its various products and services to a achieve a more unified platform

The Supra IntraLayer is an advanced protocol suite designed to facilitate cross-chain communication and provide decentralized oracle services and other related offerings. Furthermore, the middleware elements that make up the IntraLayer allow for smart contract usability and efficient data verification across multiple blockchain ecosystems while offering numerous services as modifiable plug-and-play solutions.

The IntraLayer’s core technologies include its high-throughput Layer 1 blockchain providing low-latency and reliable native oracles (which supply accurate real-time off-chain data) along with the foundational systems needed to provide smart contract tooling paradigms such as Universal Financial Controllers (UFC), Dynamic Function Market Makers (DFMMs) in confluence with a Liquidity Network and a specialized Cross-chain Inventory Management System (CIMS).

The Supra IntraLayer is an integral part of the Supra L1 ecosystem, but its cross-chain modular design allows for parts of it to be adapted for use within other blockchains systems, particularly through its interoperability protocols HyperNova (a cross-chain relay protocol) and HyperLoop (a hyper robust pairwise bridge).

Supra has designed IntraLayer to include a multitude of key components aimed at optimizing cross-chain operations. Its HyperNova protocol is central to its interoperability capabilities, allowing seamless data and asset transfers between different blockchain networks. This enhances the accessibility of dApps across diverse ecosystems, supporting a wide range of DeFi, gaming, and Web3 applications that benefit from cross-chain data transfer and automation.

Additionally, IntraLayer's use of Supra Containers allows developers to create dedicated blockchain environments tailored to specific applications allowing engineers to modify their desired governance and tokenomics structures within an independent and secure container. This modular structure ensures scalability and offers an attractive alternative to launching full L2 rollup infrastructures. Simultaneously, this approach ensures that resource-intensive applications can run smoothly without impacting other network activities.

Overall, IntraLayer’s structure is focused on creating a robust, interoperable ecosystem that caters to complex, data-driven dApps. While an integral element of Supra’s larger ecosystem, its cross-chain focus and modular design offer lego block-like adaptability, though adjustments may be needed to ensure full compatibility with non-native networks.

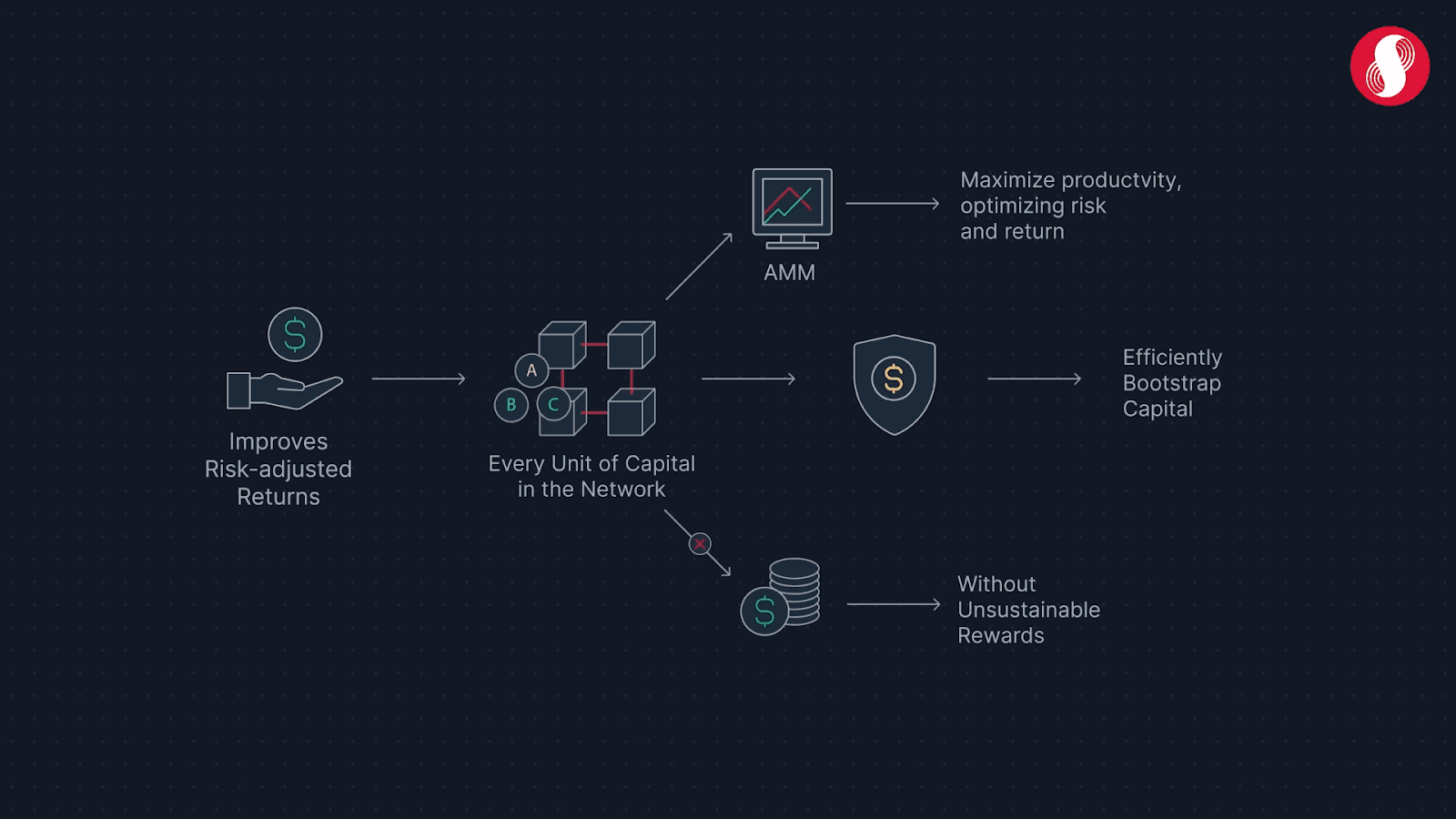

Proof of Efficient Liquidity (PoEL)

As one of Supra’s most important product offerings, Proof of Efficient Liquidity (PoEL) is a protocol designed to enhance the economic security and liquidity of DeFi-powered blockchains that employ Proof-of-Stake (PoS) consensus. It achieves this goal by sustaining liquidity within core DeFi applications, while simultaneously improving network security. More specifically, this is realized through an algorithmic incentive program that utilizes staking rewards to attract various types of risk capital to improve capital efficiency within liquidity pools.

Because users are incentivized to stake their assets in PoEL, the result is an interconnected framework that allows liquidity providers (LPs) to earn increased returns while enabling the network to dramatically increase its overall security. In particular, PoEL is tailored to PoS blockchains with burgeoning DeFi ecosystems and its adaptation outside of Supra is plausible.

Supra harnesses dynamic interest rates (a model that adjusts interest rates based on supply and demand dynamics) and collateral requirements to amplify liquidity without undermining security to attract long-term liquidity that upholds DeFi functionality while simultaneously reducing risks such as volatility and stake centralization. The end result is a dual-pronged approach that maximizes liquidity efficiency and network security, ultimately realizing a flywheel feedback mechanism that incentivizes long term capital attraction and engagement, risk balanced staking, and robust network integrity.

Dynamic Function Market Maker (DFMM)

Since the early days of DeFi prior to 2020’s DeFi Summer, decentralized exchanges (DEXs) have been a critically important offering within blockchain and crypto. Since the evolution of Uniswap’s automated market maker (AMM) model and others, numerous takes on the decentralized exchange have been achieved. However, increasingly in recent years, DEXs have become susceptible to their fair share of challenges.

Supra’s newly developed Dynamic Function Market Maker (DFMM) model is designed to address some of these weaknesses. Specifically, DFMM is built to increase liquidity, minimize slippage, and eliminate inventory risk that surfaces via features such as a data aggregator, virtual orderbook, and automated rebalancing frameworks. These newly developed solutions help guarantee synchronization with external markets to dramatically improve price efficiency and seamless cross-chain liquidy between different exchanges.

To help achieve these goals and others, DFMM utilizes containerization and native oracle price feed data to help ensure cross-chain trades are achieved faster and more securely, resulting in improved liquidity, reduced slippage, and less failed trades overall. To help reduce risk management for traders, DFMM makes use of proactive derivatives buffers along with an algorithmic accounting asset designed to support cross-pool liquidity management.

Furthermore, DFMM harnesses what is referred to as the Rebalancing Premium Function and the Algorithmic Accounting Asset. In particular, the Rebalancing Premium is designed to incentivize arbitrageurs to ensure inventory stabilization through the alignment of internal DFMM market prices with those from external ones, ultimately meaning less slippage and increased overall liquidity.

As a complementary feature, the Algorithmic Accounting Asset serves as a mechanism to create a standardized asset unit across liquidity pools with the end goal of ensuring reduced risk management and efficient liquidy distribution. When combined with DFMMs nonlinear financial instruments and decentralized design, the end goal of the above features is to dramatically increase the efficiency, functionality, and security of larger DeFi ecosystems.

In addition to these innovations and others, DFMM is designed out-of-box to not only be fully compatible with Supra’s L1 and underlying architecture, but to also be fully modifiable and compatible with additional systems that also leverage complex liquidity and risk management systems (i.e., it can be used in conjunction with other DEXs if necessary).

Supra Vertical Integration

A key aspect of Supra’s L1 design is its capacity for vertical integration at the blockchain level. Utlinalye, Supra provides access to a full suite of smart contract capabilities, oracle services, verifiable random functions (VRFs), and numerous other constructs within the same interconnected system. This design allows a plethora of services to be built-in and natively available on a single chain.

Furthermore, the system has been designed with integrated cross-chain capabilities and compartmentalization in mind. Generally as it relates to blockchain development, these functions are features that dApp developers must source from various platforms, making the required steps to achieve their desired outcome increasingly complex, especially as they relate to achieving proper communication and verification.

This not only increases the complexity of application development, but also increases costs (in gas fees) and taxes the efficiency of the system. Supra seeks to remedy this challenge by ensuring the wide range of required services are natively integrated out-of-box, resulting in reduced latency and cost, while greatly increasing overall dApp efficiency and responsiveness.

Potential Regulatory Considerations

Supra is an oracle service provider that offers two main services, one being live price feeds for DeFi applications and the other as verifiable randomness for decentralized gaming applications. Neither of these services may be legally regulated as such, but the applications they serve may be, although unlikely, this could present some challenges.

As we noted in our initial article on Supra, apart from Supra’s main oracle offering, additional oracle services provided by Supra come include decentralized verifiable random functions (dVRFs). Many of the uses for this service are related to gaming because random numbers are used in many game mechanics to add an element of uncertainty to gameplay. In some games, this random element is fully integrated into the core of the game and their corresponding gameplay, with games of luck falling into this category.

As many games can be configured to yield actual monetary gains and losses for a player, it is important to be aware of potential regulatory measures. Some jurisdictions require organizations that arrange games with cash winnings to acquire specific gambling licenses, and others forbid gambling entirely (this could also be in the form of play-to-earn (P2E) and GameFi though, and not necessarily be related to games focused on gambling).

As it relates to decentralized gaming, who is ultimately responsible or susceptible to various jurisdictional rules, can become unclear. Therefore, as Supra develops paid-for solutions providing core functionality, their service could potentially be targeted in some regional jurisdictions.

Crypto-based assets are increasingly recognized by regulatory bodies around the world as legitimate financial instruments. The logical consequence of this is that crypto markets will also be increasingly regulated. Similar requirements related to traditional financial institutions often apply to crypto-specific organizations such as centralized exchanges (CEXs).

Consequently, Supra must be cautious when drawing up service agreements with organizations providing financial services as well as entities providing gambling because both finance and gambling are heavily regulated in most geographical regions.

Requirements such as Know Your Customer (KYC) and taxation-related reporting have been imposed on blockchain actors for some time. Even though Supra provides financially relevant real-time price feeds, they do not provide the actual trading functionality on client networks.

When Supra’s mainnet and their vertically integrated blockchain system are fully realized, the situation may change somewhat, especially as Supra intends to provide automation services that can autonomously trade based on rule sets. Furthermore, the SUPRA token will likely be considered a financial instrument in some regions, requiring some regulatory action from Supra.

However, by maintaining a strict separation between the Supra products and their end users in various applications, Supra would likely not encounter any direct regulatory hindrance neither to their oracle suite nor to the rest of their service-focused ecosystem.

Supra Roadmap

Supra’s testnet has been live since August 2024 and in the near future, its long-awaited mainnet will be announced. As of this writing, Supra is currently hosting the Blast Off token claim event prior to full launch.

Blast Off takes the form of a drive promising airdrops to users as an incentivized bid to onboard new testnet users in preparation for mainnet. With an extensive and ever-growing ecosystem of integrations and partners, Supra constitutes an enviable launchpad for their new platform and a well-established suite of oracle services and other middleware and infrastructure services to stand on.

Supra is aiming not only to be a fast and dependable alternative to competitors within the oracle niche such as Chainlink and others, but to become a go-to solution for developers and end users of modern DeFi, dApps, and gaming, among others.

Supra Past Milestones

Supra has been active in some form since 2018 and has developed novel blockchain technology ever since. Several of Supra’s past milestones include:

- 2018: The core team responsible for the development of SupraOracles (now Supra) is assembled. In 2018, several core breakthroughs were achieved, specifically in the fields of random number generation and consensus protocol research and development.

- 2020: In 2020, Supra concludes their core research on various novel consensus mechanisms and establishes the Entropy Foundation. In addition, Supra Labs forms as the Entropy Foundation’s operational arm and the Supra project as we know it today takes shape.

- 2023: Key research on PoEL and DFMM are published as whitepapers, bringing with them a central portion of the newfound vision for interoperability and a multitude of newfound service offerings on the network.

- 2024: The IntraLayer whitepaper is published as one of the main foundational aspects of the project and after several years of painstaking development the final version of the Supra testnet is launched in August. Supra launched it’s mainnet on 27th November.

Resources

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.