Overview

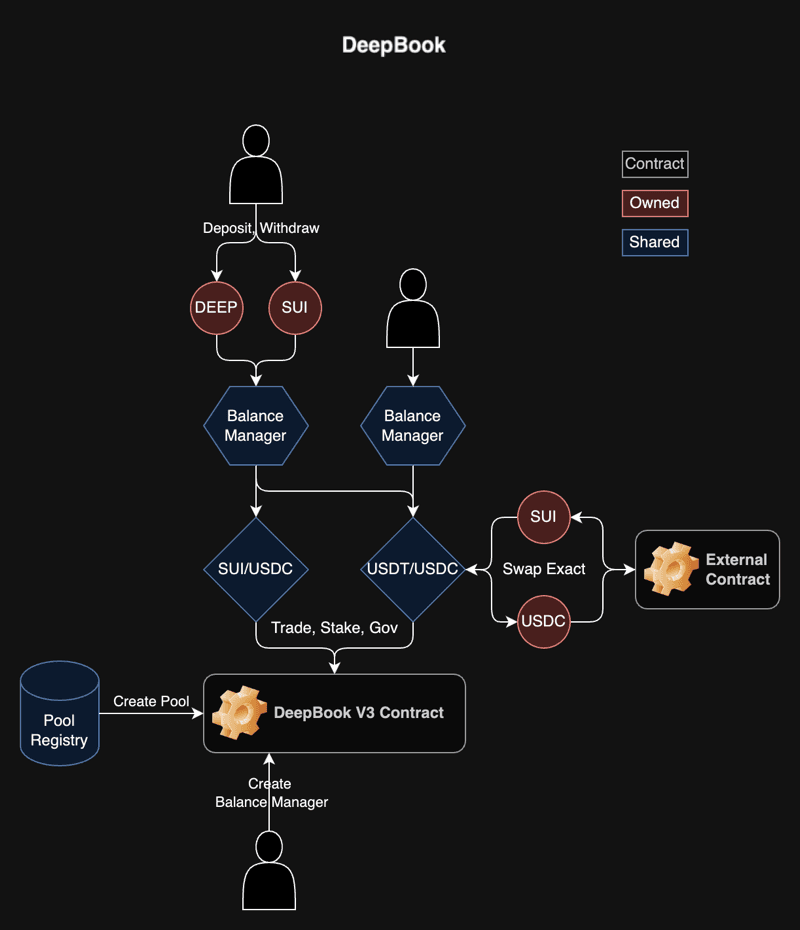

DeepBook is a decentralized central limit order book (CLOB) protocol built natively on the SUI blockchain. Designed to serve as the foundational liquidity layer for SUI's DeFi ecosystem, DeepBook offers high-performance, low-latency trading by leveraging SUI's parallel execution and low transaction fees. It supports advanced trading features such as limit and market orders, flash loans, and staking-based governance, providing developers and traders with a robust and composable infrastructure for decentralized finance.

Key Features

- High-Performance Trading Engine: DeepBook utilizes SUI's parallel execution model to deliver sub-second trade finality and minimal slippage, ensuring efficient and fair order matching.

- Composable Liquidity Layer: As a shared liquidity layer, DeepBook allows all SUI-based dApps to access and contribute to a unified order book, enhancing capital efficiency and reducing liquidity fragmentation.

- Flash Loans: DeepBook offers uncollateralized flash loans that must be borrowed and repaid within the same transaction, enabling complex trading strategies and arbitrage opportunities.

- Staking and Governance: Users can stake DEEP tokens to participate in governance, influencing parameters like maker and taker fees, and stake requirements for each pool. Governance decisions are made per epoch, allowing for dynamic adjustments.

- Transparent and Secure: All trades, orders, and governance actions are recorded on-chain, providing full transparency. DeepBook's open-source codebase and audited smart contracts ensure security and trustlessness.

Tokenomics

- Token Name: DEEP

- Utility: The DEEP token is used for paying trading fees, staking for governance participation, and earning trading fee rebates.

- Fee Structure: Trading fees collected in DEEP are burned, reducing the total supply and aligning incentives for token holders.

- Governance: Staked DEEP tokens grant users voting power to propose and vote on changes to pool parameters, such as fee rates and stake requirements.

- Incentives: Makers who stake DEEP tokens and contribute to liquidity can earn rebates on trading fees, incentivizing active participation in the ecosystem.

Why Choose DeepBook

DeepBook stands out as a premier liquidity solution within the SUI ecosystem, offering a blend of high-performance trading, composability, and decentralized governance. Its integration with SUI's architecture ensures scalability and low costs, while features like flash loans and staking provide additional utility for developers and traders. By serving as a shared liquidity layer, DeepBook fosters a more interconnected and efficient DeFi environment on SUI.

FAQs

What is DeepBook?

DeepBook is a decentralized central limit order book protocol built on the SUI blockchain, providing a high-performance, low-latency trading infrastructure for DeFi applications.

How does DeepBook leverage SUI's architecture?

By utilizing SUI's parallel execution and low transaction fees, DeepBook achieves sub-second trade finality and minimal slippage, enhancing the trading experience for users.

What are the benefits of staking DEEP tokens?

Staking DEEP tokens allows users to participate in governance, influence pool parameters, and earn trading fee rebates, aligning incentives within the ecosystem.

How do flash loans work in DeepBook?

Flash loans in DeepBook are uncollateralized loans that must be borrowed and repaid within the same transaction, enabling complex trading strategies and arbitrage opportunities.

Is DeepBook open-source?

Yes, DeepBook's codebase is open-source, allowing developers to audit, contribute to, and build upon the protocol, fostering transparency and community involvement.

How does DeepBook ensure security?

DeepBook's smart contracts have undergone audits, and its open-source nature allows for continuous community review, ensuring a secure and trustworthy trading environment.

Can any dApp integrate with DeepBook?

Yes, DeepBook is designed as a composable liquidity layer, enabling any SUI-based dApp to integrate and access its shared order book for enhanced liquidity and trading capabilities.

What types of orders does DeepBook support?

DeepBook supports both limit and market orders, providing traders with flexibility and control over their trading strategies.