Overview

AquaBera is a premier liquidity management platform within the Berachain ecosystem, offering specialized services designed to optimize liquidity provision for projects, automated market makers (AMMs), validators, and the broader DeFi community. By integrating advanced liquidity strategies and automated rebalancing, AquaBera aims to strengthen the entire Berachain network.

Key Features

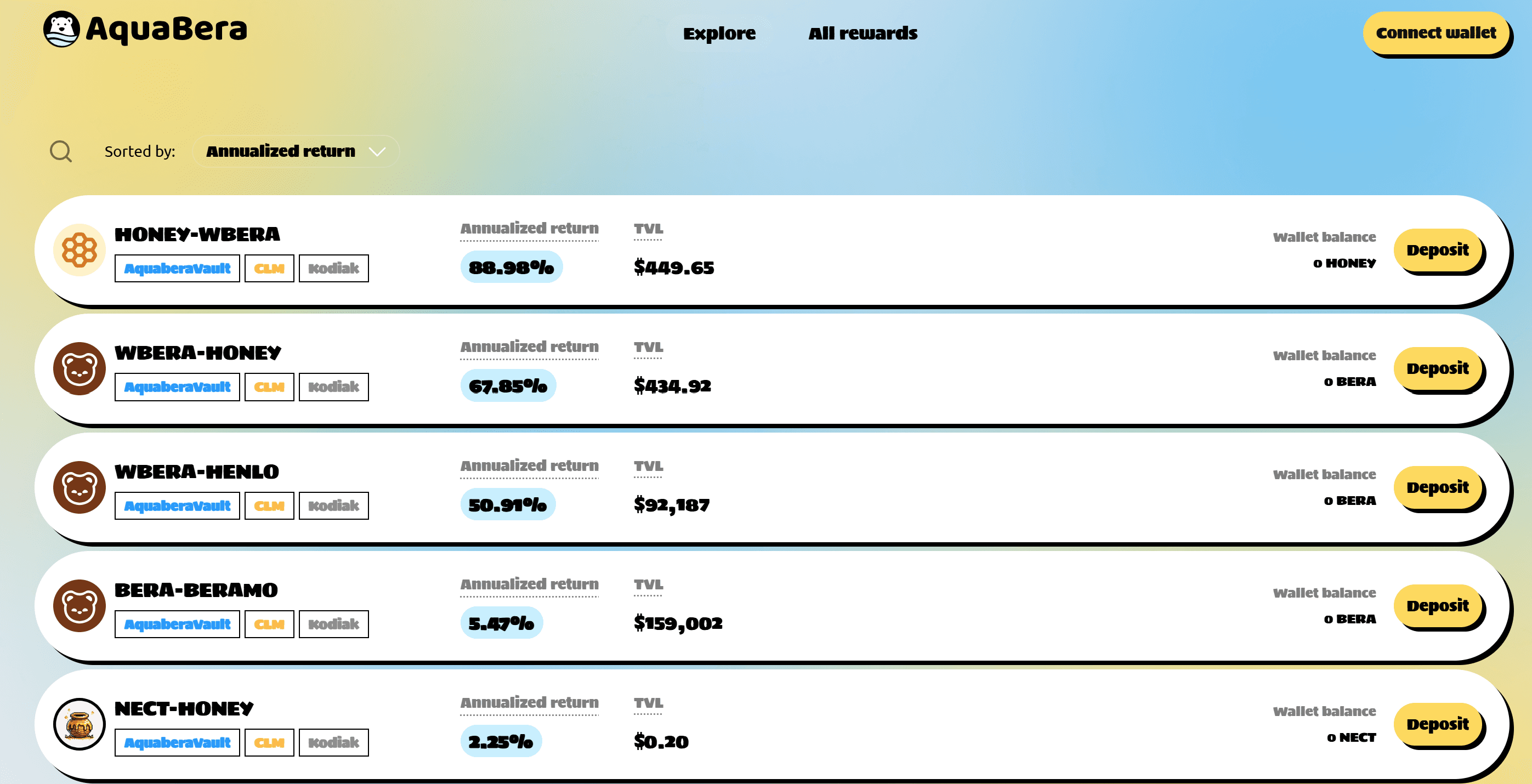

- Automated Liquidity Manager (ALM): AquaBera's ALM is a fully on-chain system that optimizes liquidity deployment across various AMMs in the Berachain ecosystem. It allows for single-token deposits, directional liquidity management, automated rebalancing, and seamless integration with Berachain's Proof-of-Liquidity (PoL) system.

- Launchpads: AquaBera provides a structured approach to token launches, ensuring fair fundraising, sustainable liquidity, and minimized risk for participants. The process includes phases like the Pot Phase (pre-DEX) and Pump Phase (DEX launch), leveraging the ALM to optimize liquidity from launch to DEX listing.

- Treasury Diversification with Aegis: AquaBera integrates with Aegis, a decentralized protocol that helps crypto projects transform idle treasury assets into stable, revenue-generating positions without creating unwanted sell pressure on their native tokens. This integration ensures optimal use of concentrated liquidity pools.

Why Choose AquaBera?

- Simplified Liquidity Management: AquaBera's ALM automates complex liquidity strategies, allowing users to manage their assets efficiently without constant oversight.

- Risk Mitigation: The platform's directional liquidity and inventory-based rebalancing minimize risks such as impermanent loss and unwanted asset accumulation.

- Ecosystem Integration: AquaBera's seamless integration with Berachain's PoL system and various AMMs ensures users can maximize rewards and contribute to the network's security and stability.

FAQs

What is AquaBera?

AquaBera is a liquidity management protocol within the Berachain ecosystem, designed to optimize liquidity provision for projects, automated market makers (AMMs), validators, and the broader DeFi community. It integrates advanced liquidity strategies and automated rebalancing to strengthen the Berachain network.

What is the Automated Liquidity Manager (ALM)?

The ALM is AquaBera's on-chain system that optimizes liquidity deployment across various AMMs in the Berachain ecosystem. It automates rebalancing, allows for single-token deposits, and manages directional liquidity to maximize returns and minimize risks.

How does AquaBera's Launchpad ensure fair token launches?

AquaBera's Launchpad features a structured two-phase process, Pot Phase and Pump Phase, to ensure fair fundraising, sustainable liquidity, and minimized risk for participants. This approach leverages the ALM to optimize liquidity from launch to DEX listing.

What is the role of Aegis in treasury diversification?

Aegis is a decentralized protocol that helps crypto projects transform idle treasury assets into stable, revenue-generating positions without creating unwanted sell pressure on their native tokens. On Berachain, Aegis relies exclusively on AquaBera for automated liquidity management, ensuring optimal use of concentrated liquidity pools.

How does AquaBera integrate with Berachain's Proof-of-Liquidity (PoL) system?

AquaBera's ALM is tightly integrated with Berachain's PoL system, allowing users to capture additional rewards, such as $BGT emissions, on top of trading fees. This integration ensures that liquidity providers are incentivized to contribute to the network's security and stability.

What are the benefits of single-token deposits in AquaBera's ALM?

Single-token deposits allow users to contribute liquidity without needing to manage a 50/50 token ratio. The ALM automatically handles liquidity without forcing users into a specific pair, streamlining the user experience and reducing swap costs.