Key Takeaways

- Modular Design: Initia is built with a modular architecture to support Layer 2 rollups and cross-chain interoperability.

- Customizable Rollups: Supports various virtual machines, including EVM, MoveVM, and WasmVM, offering flexibility for developers.

- Security Enhancements: Implements optimistic rollups with built-in fraud proofs, improving network security.

- Interoperability: Ensures seamless cross-chain transfers across Cosmos and other ecosystems.

- EVM-Compatible: Supports Ethereum-based dApps through parallelized rollup execution.

Initia Architecture Introduction

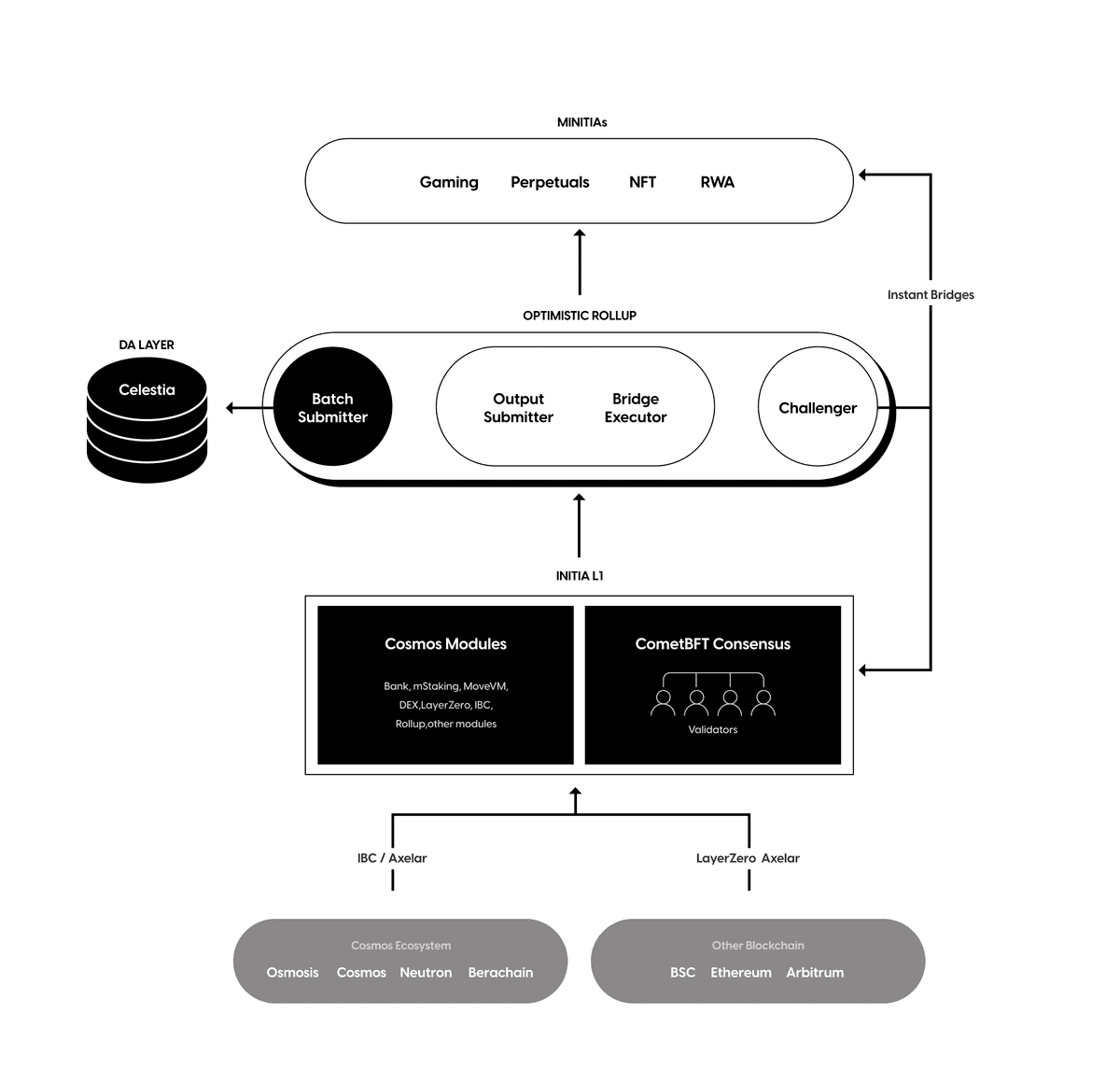

The Initia project constitutes a system for interwoven rollup deployment. More specifically, Initia fuses independent Layer 1 and Layer 2 architectures into a unified platform collectively referred to as Omnitia. The greater Omnitia framework makes use of four distinct elements, including:

- Initia Layer 1: The Initia L1 is the base blockchain layer and orchestration layer used to coordinate network security, consensus, interoperability, governance, liquidity, and cross-chain messaging for the larger Initia ecosystem.

- Minitia Layer 2 rollups: Minitias, or mini Initia’s, are L2 rollup protocols deployed via the Initia base chain. Minitias are custom-tailored rollups that are virtual machine agnostic, meaning they can be EVM-, WasmVM-, or MoveVM-compatible, while simultaneously built on the Cosmos SDK.

- Initia optimistic rollup stack: Combining ideas first conceptualized by Optimism, the OPinit Stack is Initia’s Cosmos SDK-enabled optimistic rollup development stack used to secure Initia rollups with rollbacks and fraud proofs.

- Interoperability and bridging middleware: The Initia L1 is designed to be fully interoperable with the larger network of Minitia L2’s to facilitate data and asset transfer between Initia chains and external networks such as Cosmos, Ethereum, and others. This connectivity is facilitated via the Inter-Blockchain Communication (IBC) protocol, Axelar, and other related infrastructure.

Omnitia represents the collective ecosystem of these components and is designed to offer a comprehensive and interoperable blockchain solution.

If you’d like to expand your knowledge outside of Initia’s technical architecture, we'd recommend having a look at our initial article in this series that goes over Initia’s history and founding and the ethos of the Initia project.

Initia: A Cosmos L1 for Interwoven Rollups

The Initia L1 is a modular Cosmos Layer 1 blockchain that integrates a Layer 2 application specific infrastructure system as a means to create a network for interwoven rollups (Minitias).

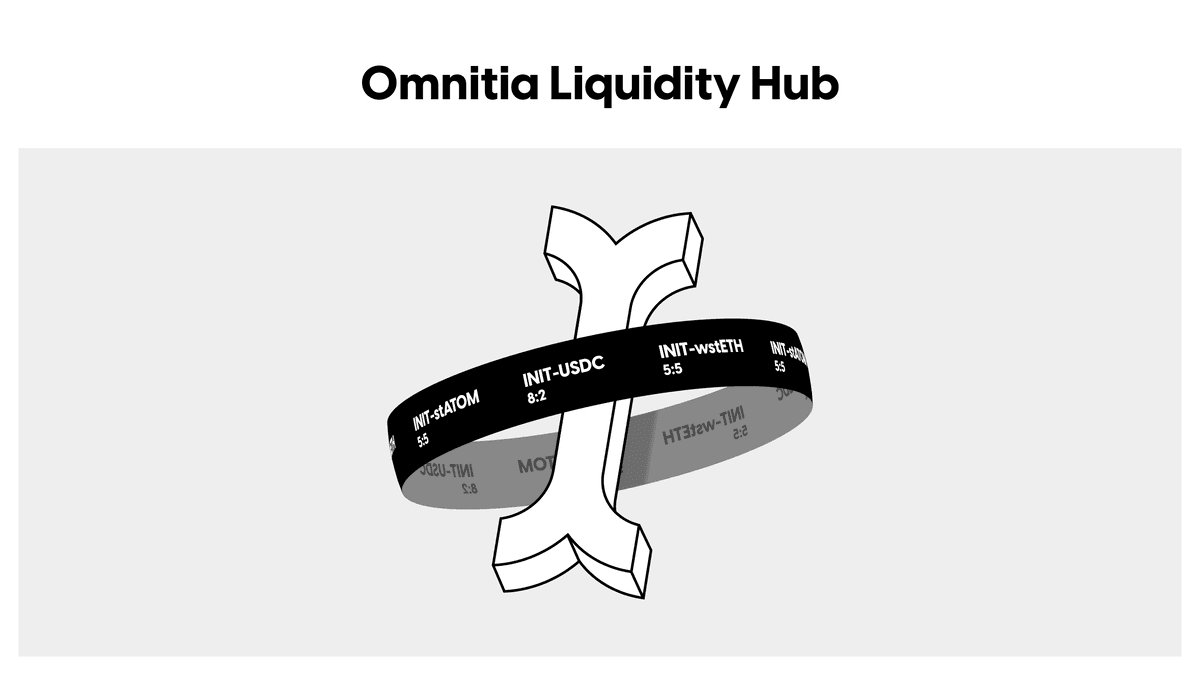

Initia utilizes CometBFT consensus and MoveVM as its smart contract development engine, positioning Initia as a permissionless, robust, and adaptable smart contract layer. Central to its feature-set are the Omnitia liquidity hub, enshrined liquidity module, the InitiaDEX, in-protocol validator staking, and Omnitia Shared Security (OSS).

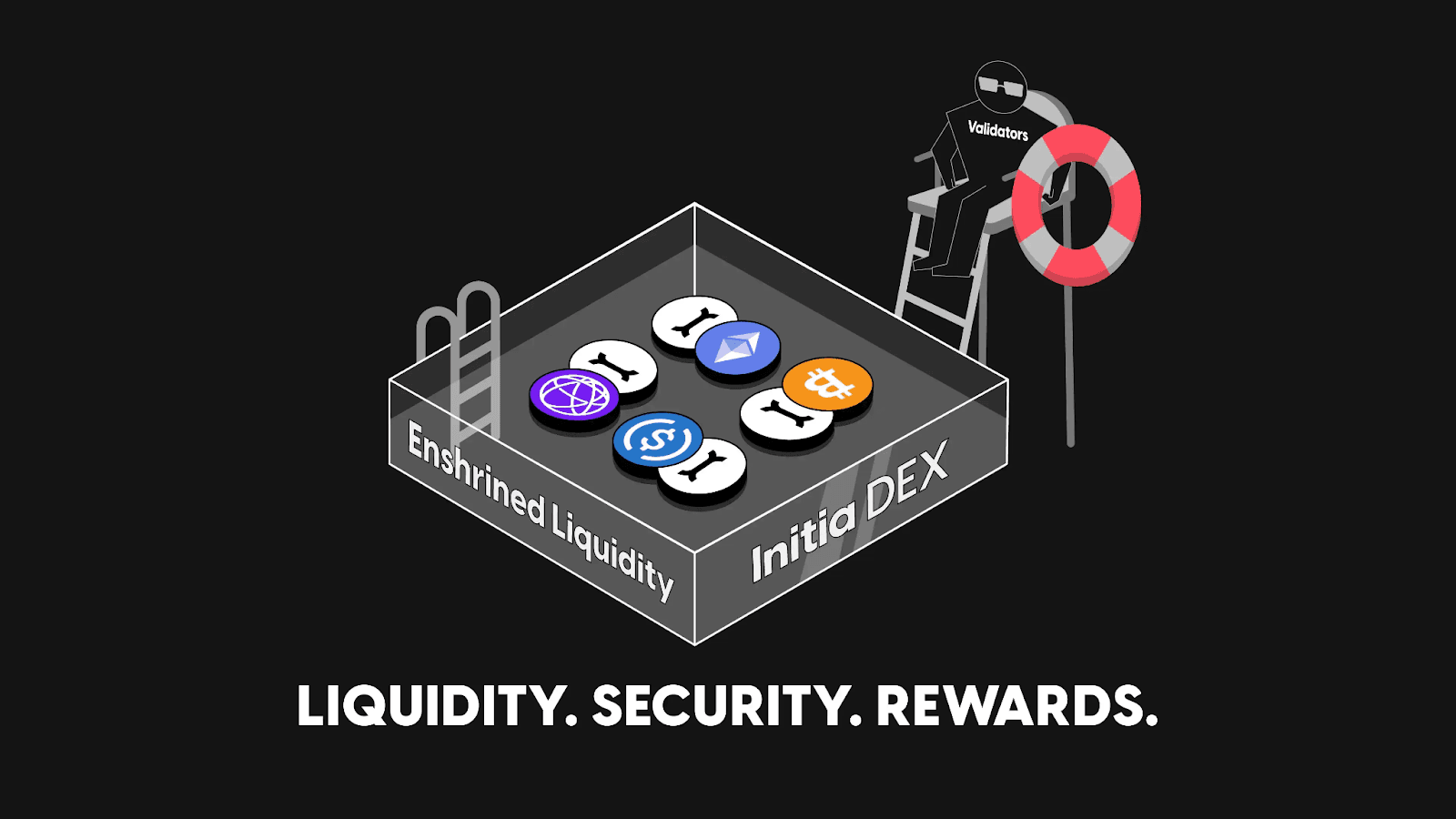

The Omnitia Liquidity Hub, InitiaDEX, Staking and Enshrined Liquidity

Most blockchain ecosystems build their own in-house decentralized exchange (DEX) because it provides a synergistic backbone that incorporates a plethora of services that are in high demand within the ecosystem.

This can include connectivity between decentralized money markets, perpetals swaps platforms, staking and governance systems, accessibility to various liquidity pools, and a nearly unlimited number of blockchain-based financial applications.

Initia is no different in this regard with the introduction of the L1-hosted InitiaDEX. Like most ecosystem-specific DEXs, the InitiaDEX is a critical component of the overall Initia ecosystem because it acts as a liquidity accrual point for all products, services, and dApps operating on the platform to help to realize interoperability between the foundational Layer 1 and all L2 Minitia’s operating on the network. The InitiaDEX is a Cosmos SDK-enabled DEX designed in a similar manner to Ethereum OG Balancer.

Like many DEXs in the industry, the InitiaDEX leverages the utility of various liquidity pools to operate. Particularly, the InitiaDEX makes use of several liquidity pool types including:

- Weighted Pools: Weighted Pools are designed to cater to the exchange of assets with varying price points to facilitate trades while preserving strong liquidity.

- StableSwaps: StableSwaps liquidity pools allow users to conduct low-slippage swaps between assets that possess a relatively stable value such as stablecoins and other assets with comparatively stable values.

- MinitSwap Pools: MinitSwap Pools are specifically designed as a means to initiate swaps for tokens that are bridged through IBC and their respective L1 counterparts, resulting in increased liquidity throughout the Omintia ecosystem.

Initia’s Layer 1 blockchain makes use of a Delegated Proof of Stake (DPoS) consensus mechanism that is supported by the x/mstaking module. Unlike most blockchains, this module allows for the staking of multiple token types within network validators to obtain voting power.

Supported tokens include solo INIT tokens or whitelisted INIT-X LP tokens (e.g., INIT-USDC, INIT-stATOM) from the InitiaDEX. This mechanism is called Enshrined Liquidity because the liquidity is directly integrated into the protocol on a continuous basis.

The DEX module also allows for the trading of the above asset types to ensure stakers and users are readily able to exchange from one asset to asset to another when required. Remember, unrestricted liquidity is extremely important for the adoption and longevity of all blockchain ecosystems.

The presence of the Ominita Liquidity Hub provides several advantages to the larger Omnitia network. These include:

- Liquidity moat provisions a strong foundation for liquidity on the L1 and within the greater Initia ecosystem to improve user experience for all involved.

- Reinforced staking yield - provides liquidity that would typically be locked within staking infrastructure to be actively used for yield generation and trading. Specifically, this includes supporting pairs such as INIT-LSD (INIT/liquid staking derivatives tokens), enabling users to earn staking yields, LSD yields, and trading fees.

- Inter-Minitia router - enables efficient token movement amongst a vast range of Minitias, allowing for seamless transactions across the larger Initia ecosystem and its proprietary L1.

- Just-in-time gas - allows users to convert their assets (for whitelisted liquidity providers) into gas for L2 operations via individual transactions, improving flexibility and accessibility in the process.

- Streamlined asset allocation diversifies protocol security by decreasing dependence on the INIT asset’s volatility while enhancing user staking rewards, given that LP stakers benefit from swapping fees, yield from additional tokens within the asset pair, and additional asset type exposure.

More on Initia Staking

As with all Proof of Stake (PoS) networks, on Initia tokens must be bonded (locked in) within a validator to earn block rewards. Consequently, when a validator on Initia unbonds their tokens, the tokens lose their voting power and no longer accrue block rewards for the 21-day unbonding phase, after which they are returned to the validator and become liquid.

For an LP token to be eligible to accrue rewards and be staked within an Initia L1 validator, it must undergo a whitelisting process via Initia governance, with one of the main prerequisites being that it must have INIT as part of its trading pair (e.g., INIT-USDC, INIT-stATOM). In particular, if the LP token is held within a weighted DEX pool (using a similar model to Balancer), the INIT weight within the pool must be at least 50%.

In order to initiate the whitelisting process to become a validator-supported asset, a whitelist proposal needs to be submitted that contains the LP token’s reward weight as a means to help determine the correct block reward distribution for that asset.

To determine the distribution of inflationary INIT block rewards to tokens staked within a validator, a specific inflation schedule is determined via a calculated rewards rate that is assigned to all solo INIT tokens and whitelisted LP tokens staked within the validator. Changes to these reward weights are continuous and will become more frequent overtime akin to mechanisms similar to the Curve Gauge weight voting system.

As it relates to governance, a staker's governance power on Initia is directly correlated to the number of INIT tokens staked, including both solo INIT tokens and Initia-LP tokens. However, the total governance voting power is quantified in INIT denomination whereby the total value of solo INIT tokens and LP tokens are aggregated as one unit.

To eliminate the effects of external assets on Initia’s governance, the total voting power of an LP token is equivalent to the number of INIT within the pair at the time of the snapshot for a particular proposal. Moreover, the governance power is not affected by the reward rate of a specific LP token.

This mechanism guarantees that potential swaps taking place within enshrined liquidity pools do not compromise the voting process of ongoing proposals and eliminates externalities from the INIT-paired asset (e.g., INIT-USDC, INIT-stATOM).

Omnitia Shared Security

Omnitia Shared Security (OSS) is a scalable security framework designed to protect assets across Initia’s ever-growing network of interwoven rollups (Minitias). In the event fraud challenges present themselves on L2, the L1’s validator set is summoned to resolve the issue.

This undertaking is typically streamlined via the integration of Celestia light nodes within network validators, enabling the verification of data across Minitias without requiring complete block download. Some of the main features of Omnitia Shared Security include:

- Collective data availability layer strengthens the Initia Layer 1 validator set, bridge operators, and challengers by providing accessibility to state data needed to develop fraud proofs against invalid rollup operators.

- Direct transaction posting to Celestia - allows Minitias to post transaction data directly to Celestia on-chain, realizing deterministic verification of the rollup chain's state transitions.

- Efficient data verification - leverages Celestia’s Data Availability Sampling (DAS) and Namespaced Merkle Tree (NMT) technology, providing the intended parties the means to download and verify only relevant transactions to optimize resource usage.

By making use of the above innovations and others, Initia’s L1 architecture provides a secure, efficient, and scalable backbone for the larger ecosystem, guaranteeing robustness and interoperability throughout its layered infrastructure.

Minitia: L2 Appchains Provisioned via Initia

Built using the Cosmos SDK and utilizing optimistic rollups for settlement, Minitias are Layer 2 application chains operating within the larger Initia ecosystem. As interwoven rollups, Minitias exhibit 500ms block times and the potential to process over 10,000 transactions per second, meaning they are perfectly tailored to support a vast range of real-world utilities.

The OPinit Stack: An Optimistic Rollup Framework on Cosmos

Conceived as the first optimistic rollup framework built specifically for the Cosmos ecosystem, OPinit Stack constitutes a cutting-edge rollup structure ideated from Optimism's Bedrock specification.

The OPinit Stack is a multifaceted framework built specifically for Cosmos SDK, enabling the development of virtual machine-agnostic optimistic rollups. This allows Initia’s network of interwoven rollups to support a wide range of virtual machine smart contract development environments including MoveVM, EVM, and WasmVM to greatly expand the overall interoperability and adaptability of the Initia network, allowing software engineers of all types to build on the platform.

OPinit facilitates the connection between the Initia L1 with Minitia rollup L2s operating on the network. This process is established via a relayer that connects OPinit’s optimistic rollup tech with Cosmos’ IBC protocol to realize full interoperability and connectivity between L2s and the mainchain.

To allow for the continued operational efficiency of the OPinit Stack, the platform is made of several main elements including two critical Cosmos modules: OPHost and OPChild, both of which are complemented by four L2-specific bot programs to guarantee a streamlined ecosystem for application development.

More specifically, the OPHost module is the OPinit Stack’s foundational backbone responsible for a wide range of functions. These include: enabling a bridge interface for the creation and management of the OP bridge, a means for governance integration, for the recording of transaction batches from L2, enabling the management of L2 output roots via the output oracle, and various operator and challenger address adjustments via governance messaging processes.

Conversely, the OPChild module is responsible for module replacement (for staking, governance, and distribution modules working in conjunction with CometBFT), L2 Sequencer generation for transaction processing, and increasing the efficiency of cross-chain communication via a specialized bridge interface.

Out-of-the-Box Developer Solutions

To combat the inefficiencies that blockchain developers face building Layer 2 optimistic rollup solutions, Initia is built to address many of the infrastructure challenges frequently faced in modular systems such as those related to fiat on- and off-ramps, data management, and exchange support, by providing these services innately on Layer 1.

This framework markedly reduces the complexity for Minitia application developers, allowing them to spend more time on the development of next-level products and services. More specifically, Minitia rollups provision an extensive developer suite of built-in features, including:

- Instant bridging support and full accessibility to native USDC via Circle’s CCTP

- Token interoperability/fungibility across a plethora of virtual machine environments

- Fiat gateways, tailored oracle interfaces, and a wide range of developer tools

- Frontend widgets focused on lowering the barrier to entry for end-users

Minitia Features and Specifications

Although possessing the wide-ranging feature set of Cosmos SDK chains, Minitias are designed to operate without their own consensus mechanism, instead relying on the Initia L1 for data settlement and security.

Ingeniously, this design allows for advanced rollup functionality and the application of standard Cosmos SDK modules such as AuthZ and Feegrant in addition to custom modules such as POB from Skip Protocol.

All transactions on Minitias are sequenced and settled collectively to the L1 and Celestia, furnishing a secure and transparent environment for verification and operation.

More generally, Minitias possess a wide range of features and technical specifications designed to provide the necessary infrastructure to support the operation of various applications built on the Initia platform. These include:

- High throughput capable of 10,000+ TPS and 500ms block times

- IBC compatibility for Cosmos interchain interoperability and Omnitia Shared Security

- MoveVM, WasmVM, EVM, and Celestia data availability support

- Innovative tooling systems including the InitiaSDK, WalletSDK, and 1-click deposit widget

- Third party middleware (e.g., oracles) integration for enhanced user experience and functionality

- Access to native features including vested interest programs, token kickbacks, and the Omnitia Messaging Module

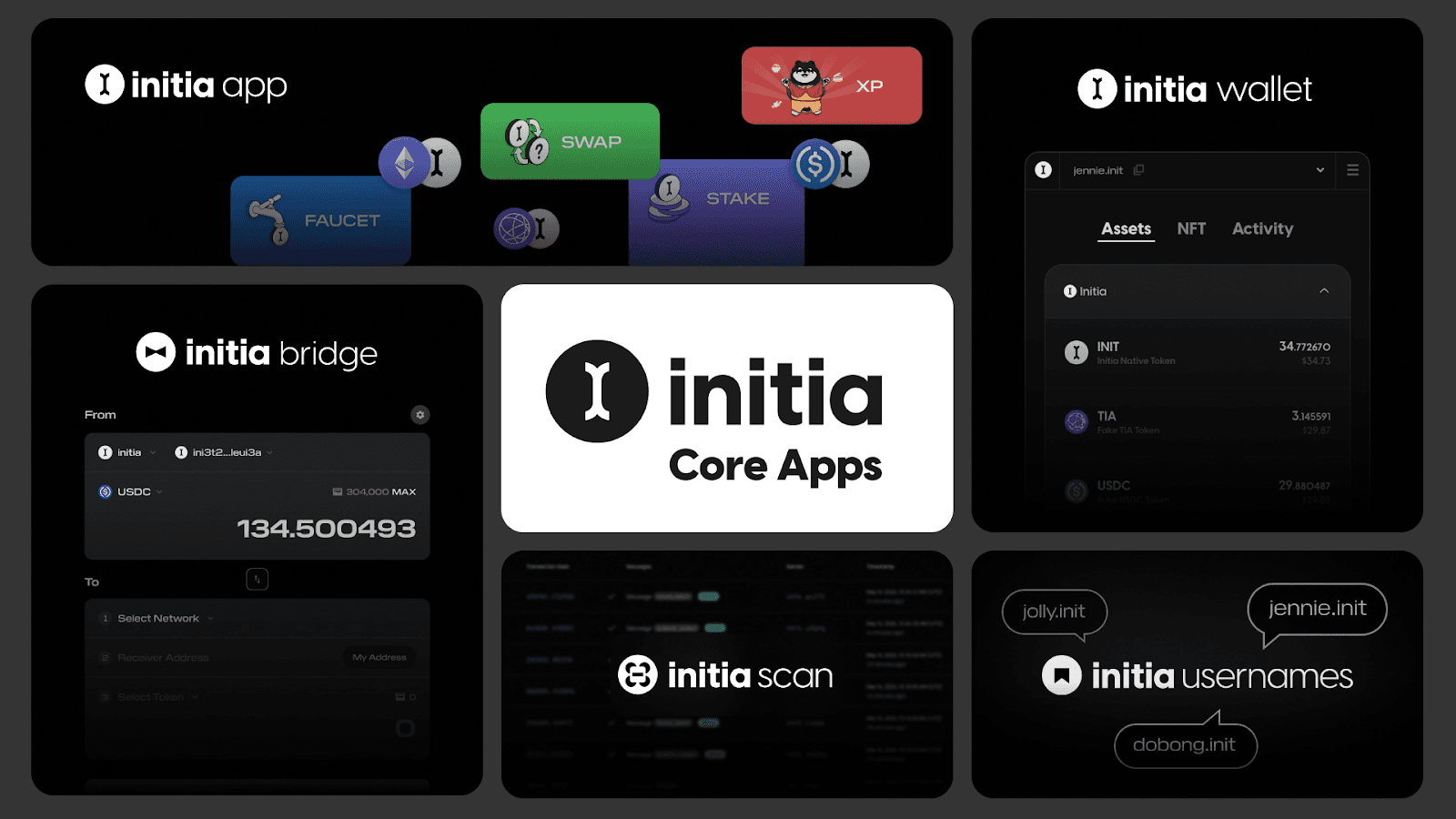

Intitia Core Applications

The Initia platform makes use of several core applications, including:

- Initia Wallet: Initia Wallet is Initia’s proprietary wallet, allowing users to interact with the larger Initia ecosystem (e.g., DEX connectivity, transaction signing, and asset transfer across Minitas).

- Initia Usernames: Initia Usernames are representative of an Omnitia-wide on-chain identity system for user accounts.

- InitiaScan: InitiaScan is a multi-chain block explorer with VM-specific tools and data, allowing users to track accounts, transactions, and blocks across Minitas and the larger Initia ecosystem.

- InitiaApp: Initia App is a platform that allows users to swap (through the InitiaDEX), stake, and earn experience points for their contributions to the network. It also leverages a testnet token faucet that allows users to use the testnet version of the INIT token.

- Wallet Widget: The wallet widget is designed to lower the barrier to entry for users by supporting Cosmos and EVM wallet signing and social account login.

The Vested Interest Program

With the Initia ecosystem focused on eventually developing thousands of rollups on the Initia Layer 1, it's critical to support the larger network with an economic system that aligns all participants equitably.

This system is known as the Initia Vested Interest Program (VIP), with its main aim to solve many of the conventional pitfalls of existing Layer 1s. These include:

- Misalignment of incentives for dApps that realize increasing levels of on-chain activity and value accrual

- Reduced utilization of the native token

- Limited distribution of protocol-level grants within the ecosystem

To solve these problems and further align the interests of all ecosystem participants, the Initia Vested Interest Program allows L2 economic activity to be fully aligned through the equitably programmed distribution of INIT to empower dApps built on the platform.

This allows Minitias and other participants to capture economic value directly from their users, while amplifying activity and increasing engagement with applications on Initia.

In addition, this economic system makes use of the Enshrined Liquidy module as a means to deepen on-chain protocol liquidity via the InitiaDEX and other intertwined components. After mainnet launch, additional info on the VIP program will be provided to prospective users within the Initia ecosystem.

Resources

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.