Key Takeaways

- Liquid Staking: Persistence One unlocks liquidity for staked assets, allowing them to be used in DeFi while earning staking rewards.

- Cosmos-Based: Built on Cosmos, the platform supports cross-chain liquid staking and DeFi activities.

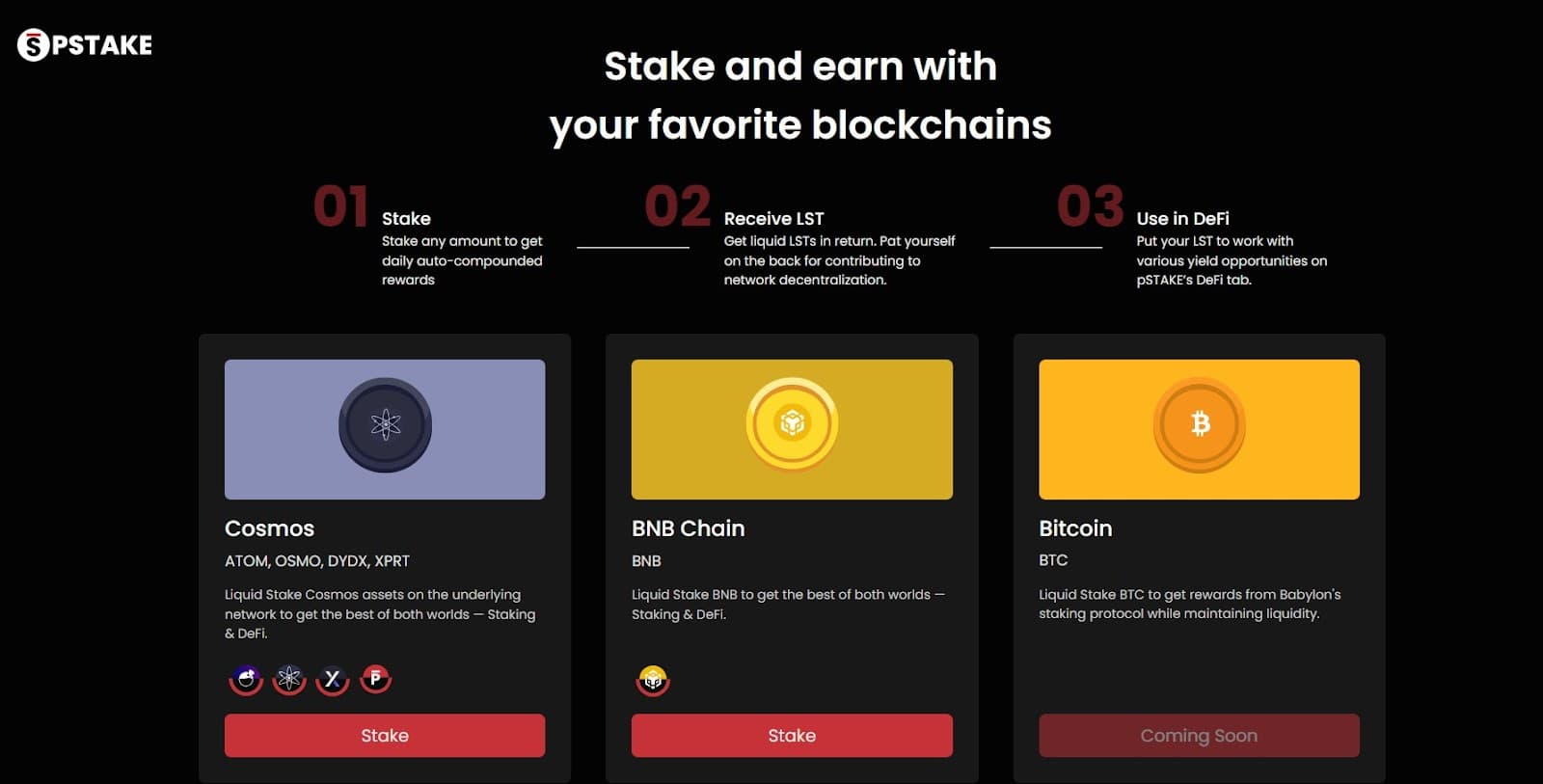

- pSTAKE Finance: A key dApp that enables staking across multiple PoS networks with liquid staking tokens (LSTs).

- Persistence DEX: Facilitates trading of LSTs and other assets within the ecosystem.

- Innovative Future: Plans to integrate with Bitcoin and explore restaking options.

Introduction

Imagine a financial ecosystem where you can earn attractive staking rewards without sacrificing the flexibility and utility of your assets within the vibrant DeFi landscape. This is no longer a distant dream, but a reality made possible by Liquid Staking.

Persistence One transcends traditional staking models by offering a dynamic ecosystem where staked assets actively contribute to network security and decentralization while simultaneously earning rewards for their holders. This innovative approach addresses the historical limitations of staking, where assets were often locked away, inaccessible for other financial activities.

In this article, we will delve into the intricacies of liquid staking, exploring its benefits, and the far-reaching implications it holds for the future of DeFi. Join us as we uncover the catalyst that is propelling DeFi into a new era of unprecedented growth and accessibility.

Deep Dive into Persistence One

Persistence One is a specialized blockchain platform built on Cosmos technology, dedicated to creating a decentralized liquid staking ecosystem. Liquid staking addresses the core challenge of Proof-of-Stake (PoS) blockchains: the trade-off between staking for network security and using tokens in decentralized finance (DeFi).

Persistence envisions a future where liquid staking tokens (LSTs) become the primary currency in DeFi landscape. The platform aims to facilitate the issuance and widespread adoption of LSTs from major PoS chains like Cosmos Hub, dYdX, Osmosis, and other, across various DeFi applications such as decentralized exchanges, lending platforms, and derivatives markets.

By focusing on LSTs solutions, Persistence is building a more flexible and accessible DeFi landscape for users and projects alike.

Protocol Overview

Persistence Core-1, the app-chain built on Cosmos SDK, stands as a testament to the burgeoning liquid staking DeFi (LSTfi) sector. Its advanced infrastructure, featuring Inter Blockchain Communication Protocol (IBC) and Interchain Accounts (ICA), enables seamless asset transfers across the Cosmos ecosystem, promoting interoperability and capital efficiency.

Persistence's native Liquid Staking Module (LSM) simplifies the process of issuing and managing liquid staked tokens (LSTs), allowing users to earn staking rewards while actively utilizing their assets in DeFi.

The chain's robust security is ensured by CometBFT, the PoS consensus mechanism, and 100 reputable validators who participate in block production and governance, reinforcing decentralization.

XPRT, the native token, serves as the backbone of network security and incentivizes participation in staking and governance activities. The XPRT bonded ratio, representing the percentage of the token supply staked, is a key indicator of the chain's economic security. Historically, Persistence has maintained a ~75%+ bonded ratio, one of the highest among all PoS chains in crypto.

Integration with the CosmWasm smart contract platform further enhances the chain's capabilities, opening up possibilities for developers to create a wide range of innovative LSTfi applications.

As of now, the Persistence chain boasts a total value locked (TVL) of ~$11 million, thanks to ecosystem dApps like pSTAKE Finance and Persistence DEX.

In tackling current challenges in the crypto space, Persistence addresses the opportunity cost of traditional staking, where locked-up assets miss out on potential DeFi yields. It enhances the liquidity and utility of staked assets, enabling them to be readily used across various applications.

Additionally, Persistence aims to simplify the fragmented and complex crypto ecosystem by facilitating interoperability and composability between different networks and applications. And its suite of native decentralized applications (dApps) offer users a variety of LSTfi services and features.

The following dApps are currently live and operational within the Persistence ecosystem.

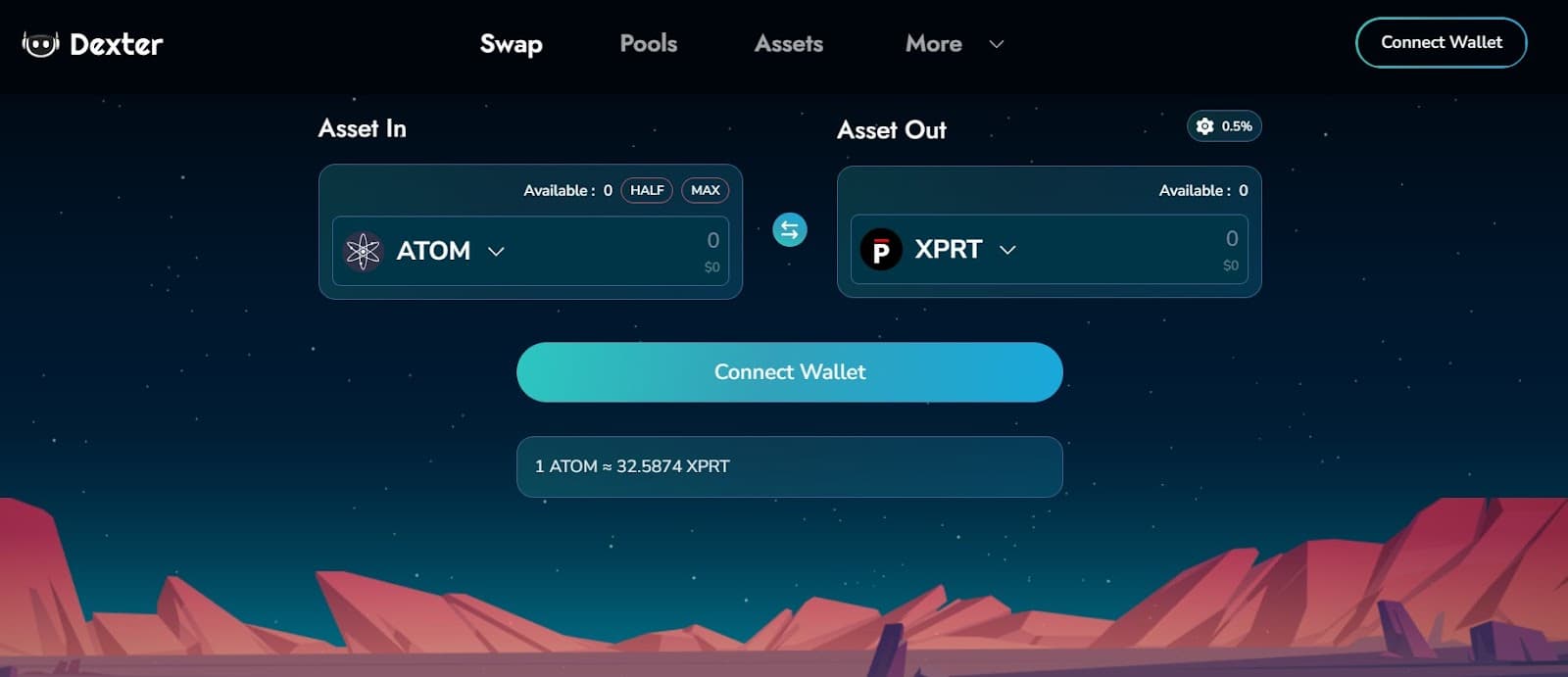

Persistence DEX (Formerly Dexter)

Persistence DEX is a premier decentralized exchange within the ecosystem, that designed to facilitate the trading of LSTs and other assets generated through pSTAKE Finance.

The recent rebranding of Dexter to Persistence DEX has brought with it a significant transformation, elevating the platform's position in the liquid staking and DeFi landscape. This strategic move not only consolidates the Persistence brand and streamlines operations but also unlocks a wealth of new opportunities for users.

Enhanced resource optimization, a community-centric revenue sharing model, and the potential for reduced XPRT inflation all contribute to a stronger foundation for future growth and new innovative solutions.

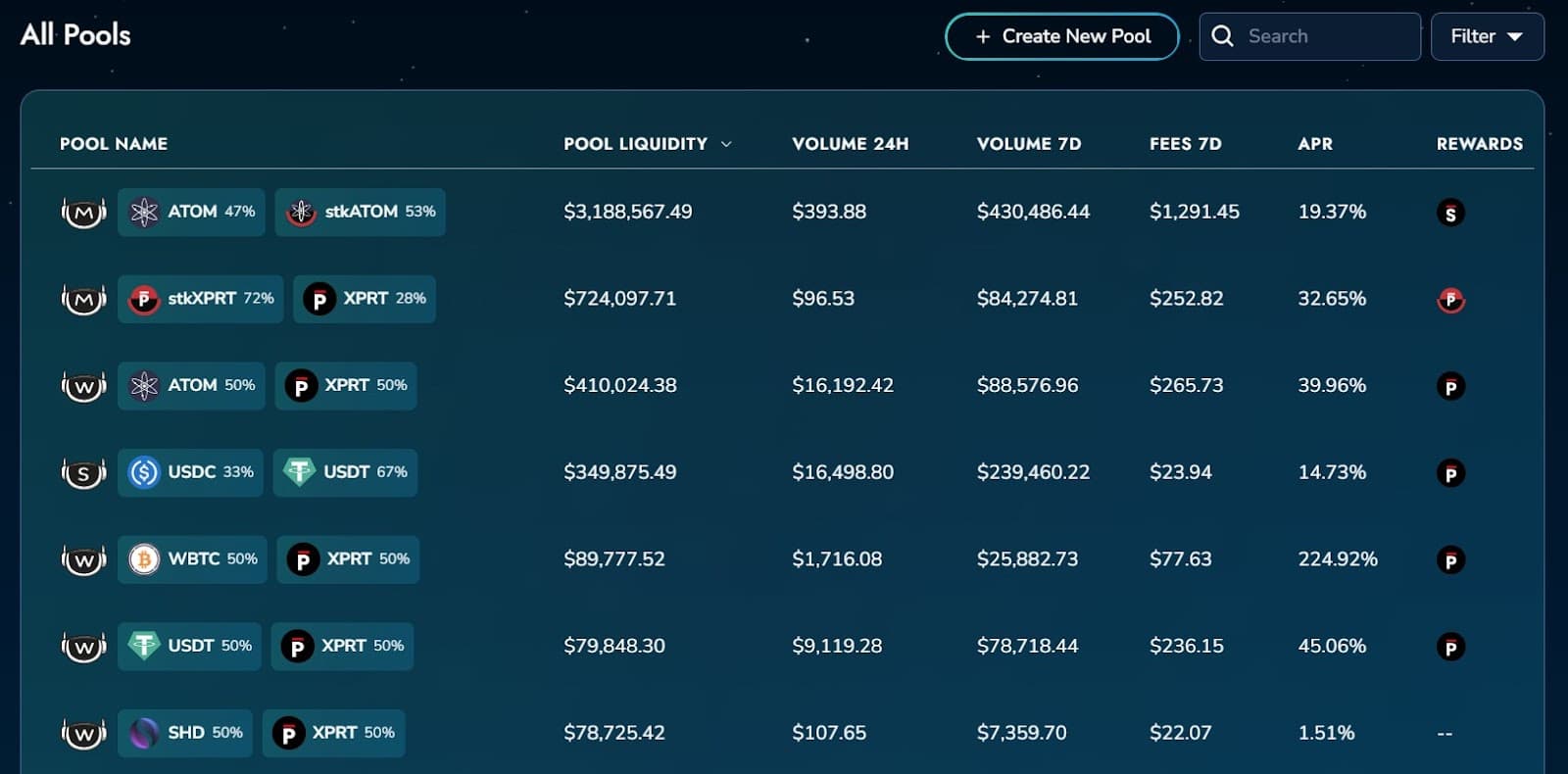

Beyond trading, Persistence DEX allows users to participate in pAsset pools, earning additional rewards and fees for their contributions.

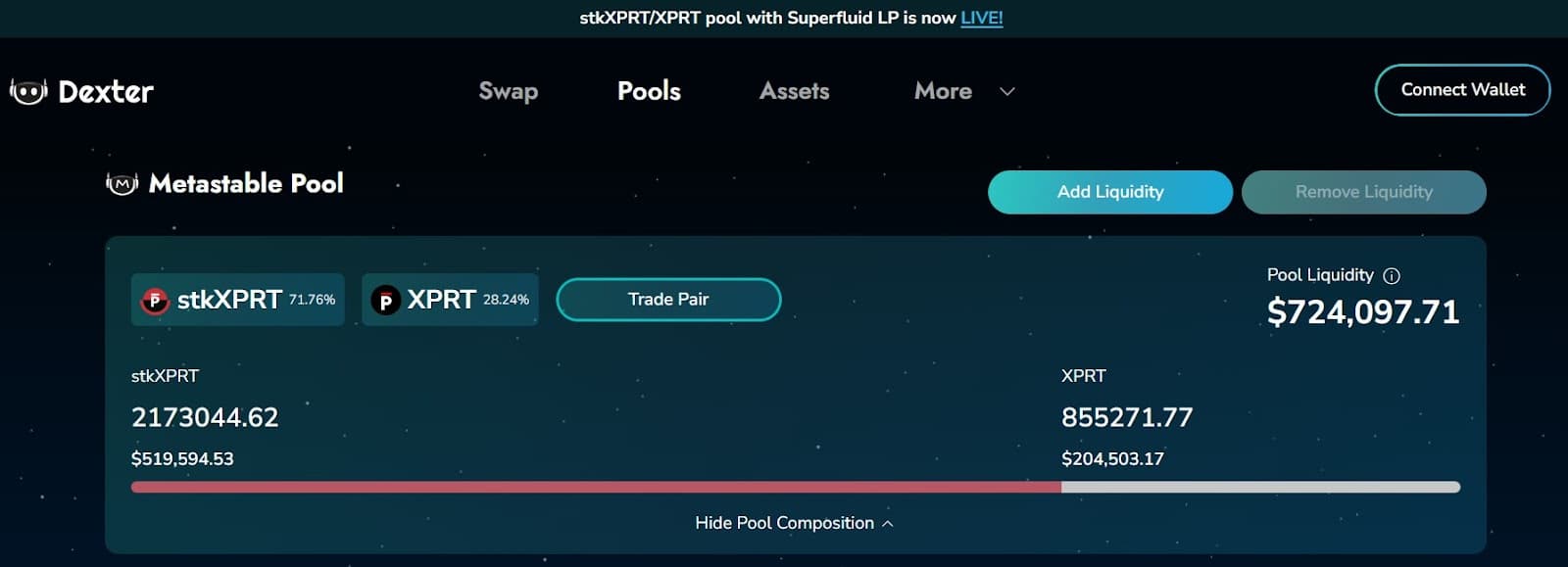

Moreover, the highly anticipated stkXPRT asset is now available to the Persistence One community, marking a significant milestone for the ecosystem. The asset not only fulfills a strong community demand but also enhances the platform's value proposition through the Persistence DEX Superfluid LP feature, allowing stkXPRT holders to become liquidity providers and earn both staking and liquidity provider rewards.

stkXPRT offers a multitude of advantages that strengthen the Persistence One ecosystem:

- Liberates Locked Liquidity: While XPRT's high staking ratio is crucial for network security, it traditionally locks up liquidity. stkXPRT unlocks this value by enabling staked XPRT to be utilized in DeFi through the Superfluid LP feature, eliminating the need for unbonding periods.

- Expands XPRT Utility: stkXPRT opens new doors for XPRT holders to actively participate in the DeFi ecosystem. They can provide liquidity to pools, trade on decentralized exchanges, engage in lending and borrowing, or even mint stablecoins, all while their original XPRT continues to secure the network.

- Enhances pSTAKE Offerings: stkXPRT enriches pSTAKE's diverse suite of Liquid Staked Tokens, attracting a broader user base and fostering cross-chain liquidity as well.

- Strengthens Decentralization: stkXPRT employs a Decentralized Validator Strategy, ensuring fair distribution across numerous validators. This reinforces the decentralization and resilience of the Persistence Core-1 chain, ultimately enhancing network security and building community trust.

- Optimizes Capital Efficiency: By maximizing yields through both staking and DeFi participation, stkXPRT promotes greater capital efficiency. Additionally, it reduces the reliance on high inflation rates, a common characteristic of Cosmos chains, as the need for incentivization through inflation diminishes.

This dual-reward mechanism optimizes capital efficiency and attracts a wider range of users to the platform. As of now, the total APR for providing liquidity in the stkXPRT/XPRT pool stands at an impressive 29.59%.

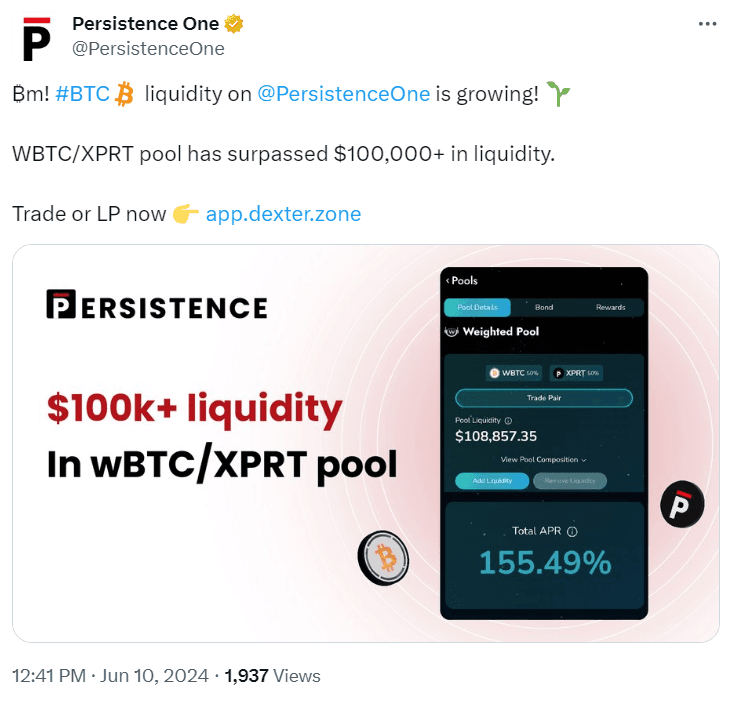

Another significant update is the brining Bitcoin into the Persistence One ecosystem and integration of wBTC, a popular wrapped version of the top ranked cryptocurrency. This enables wBTC holders to seamlessly earn yields and trade on Persistence DEX and Osmosis, boosting on-chain activity and creating new opportunities for both XPRT and wBTC holders.

pSTAKE Finance

pSTAKE Finance is a multichain liquid staking protocol that allows users to earn staking rewards while simultaneously participating in DeFi activities.

By staking their PoS tokens on various networks like Cosmos Hub, dYdX, Osmosis, Stargaze, and Chihuahua, users receive liquid staked tokens (LSTs), which can be freely used across a variety of DeFi applications, both within and beyond the Persistence ecosystem.

pSTAKE Finance on Persistence Network:

- DEX: Persistence DEX, Astroport, Osmosis, Crescent, Shade

- Borrowing/Lending: Umee, Mars Protocol, Nitron

- Vaults: Quasar

pSTAKE Finance on BNB Smart Chain:

- DEX: Pancakeswap V3, Thena, Wombat

- Yield Farming: Beefy Finance

- Margin Trading: OpenLeverage

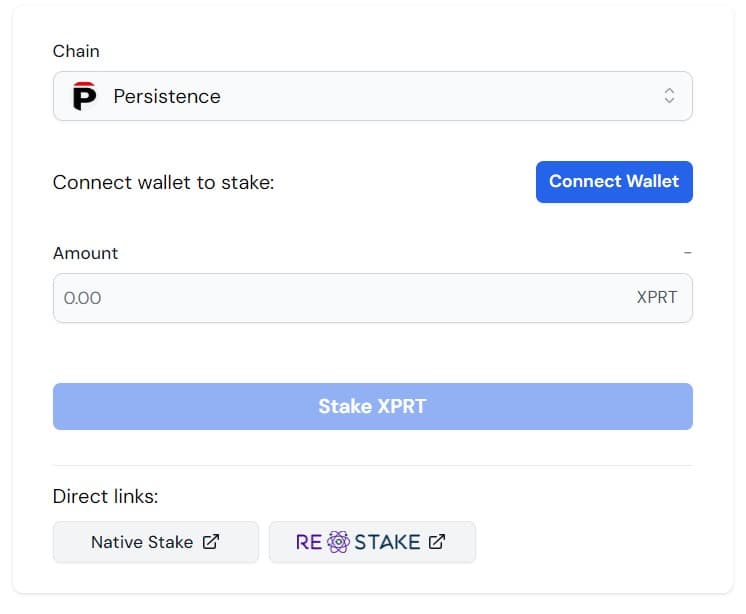

XPRT Staking

Persistence One offers a variety of convenient options for traditional XPRT staking. You can stake your XPRT directly through Keplr's online platform, using your Keplr Wallet, or utilize Persistence's native pWallet for a seamless experience.

If you want to keep it simple, our platform lets you stake with just a few clicks, no matter which wallet you use. On the same page, you will find a detailed instruction “How to Stake XPRT” to guide you through the process.

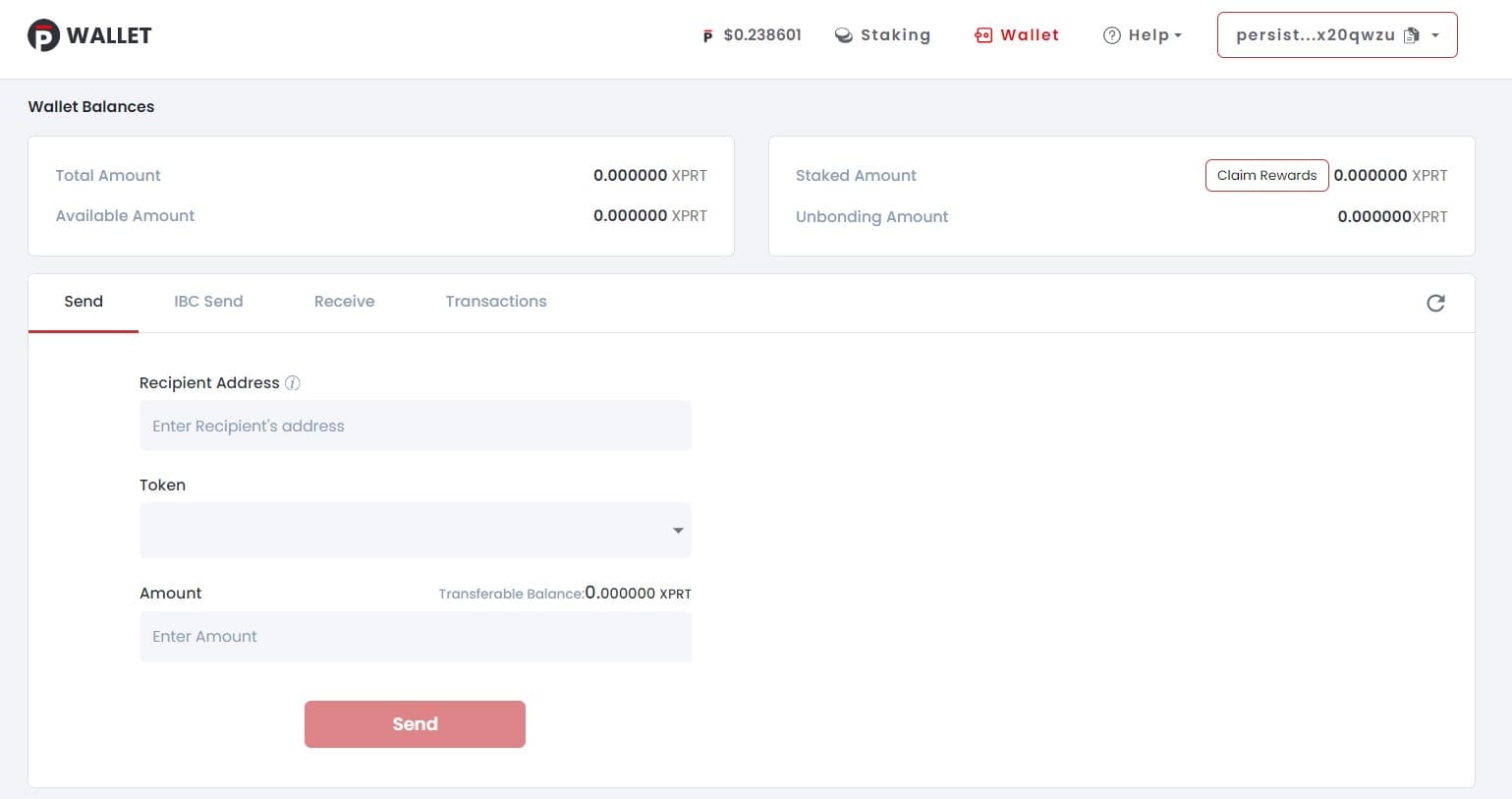

pWallet

The official Persistence wallet, designed for secure and efficient management of XPRT tokens. It provides a user-friendly interface for storing, sending and receiving XPRT, and offers an integrated staking function that allows users to easily participate in network security while earning rewards.

A complete overview of the pWallet, including detailed installation instructions, can be found here.

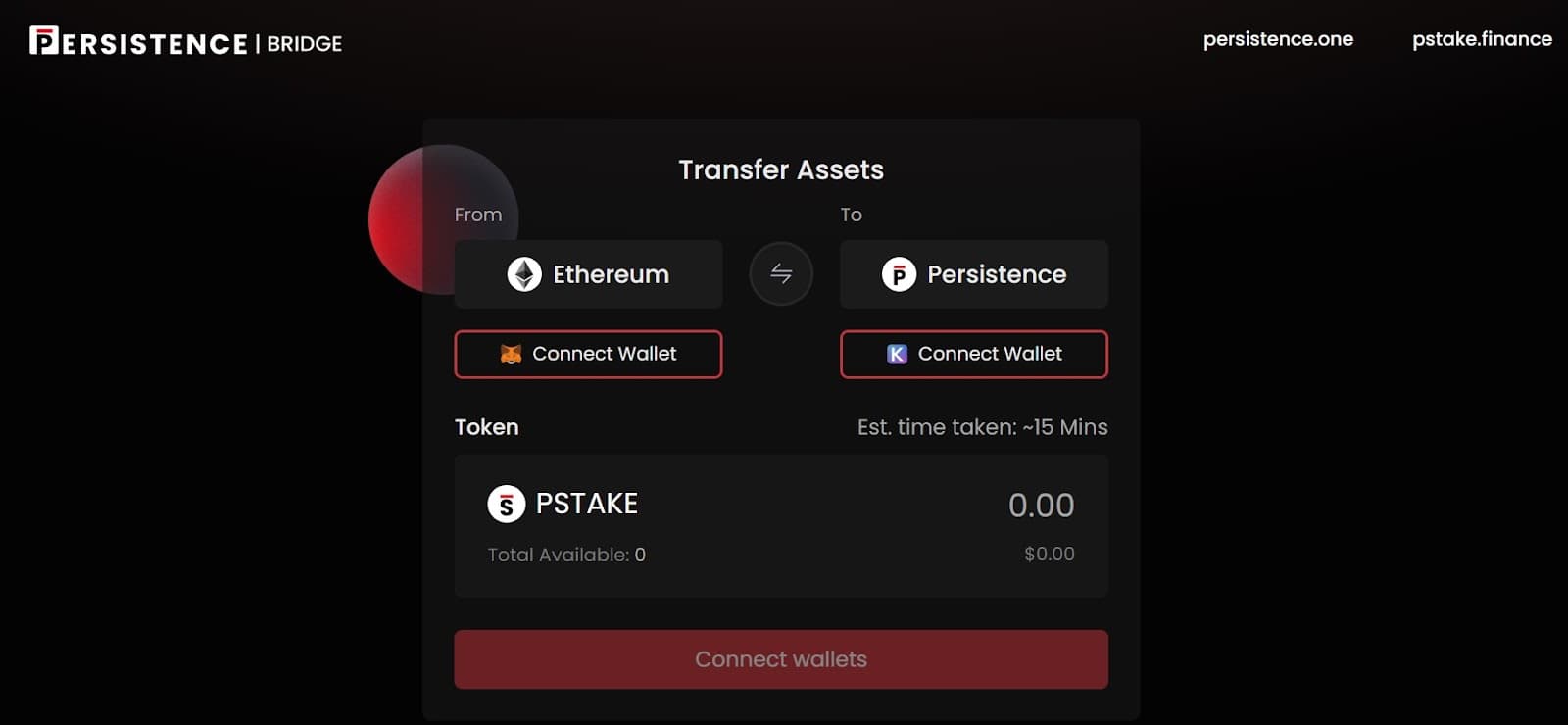

pBridge

pBridge serves as a secure bridge between Persistence and the Ethereum blockchain. This strategic connection empowers users to unlock the full potential of their staked assets by enabling the transfer of LSTs between the two leading blockchain ecosystems..

The modular design philosophy of Persistence fosters a highly scalable and interoperable ecosystem. This translates to seamless integration with additional PoS chains and DeFi platforms as they emerge.

Economy & Tokenomics

The Persistence ecosystem operates on the foundation laid by its native token, $XPRT. This crucial element serves a dual purpose: fueling network operations and incentivizing user participation.

$XPRT's primary utility lies in its role as the bedrock of a robust governance framework. Holders of $XPRT are entrusted with the responsibility of shaping Persistence's future. Through a clearly defined proposal and voting system, they have a direct say in critical decisions that impact the network, such as fee structures and protocol upgrades. This ensures the project's trajectory remains firmly aligned with the needs and aspirations of its invested community.

Beyond its governance function, $XPRT offers significant benefits to users. A strategic allocation of fees and rewards generated by Persistence products like pSTAKE and Persistence DEX is distributed back to $XPRT stakers. This incentivizes participation and rewards those who contribute to the ecosystem's economic vitality.

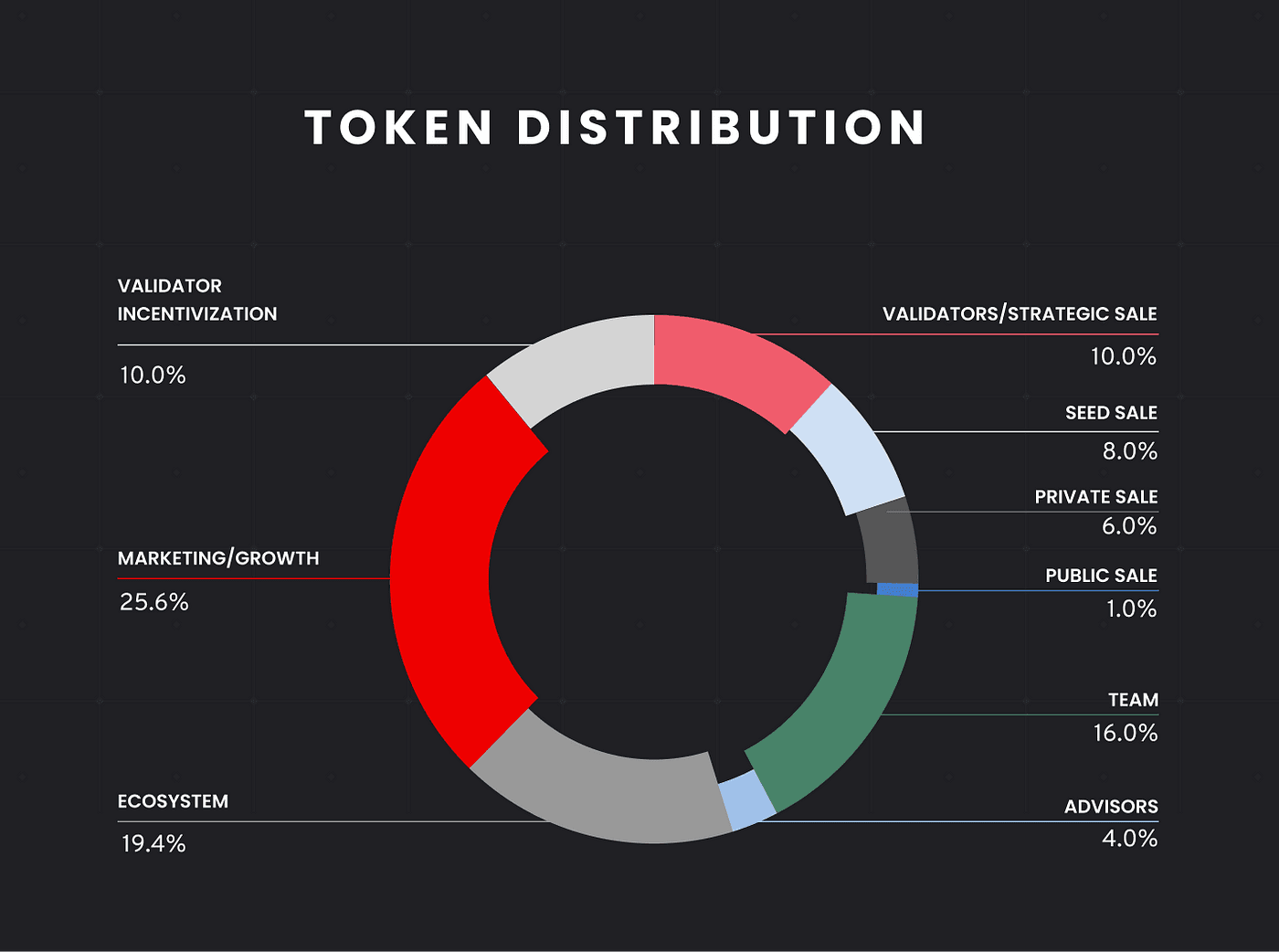

The initial distribution of 100 million $XPRT tokens followed a meticulously crafted plan designed to foster a diverse token holder base and a robust ecosystem from the outset.

The $XPRT token empowers the Persistence community to govern its own destiny. This commitment to a community-driven approach ensures that the project remains responsive to the evolving needs of its stakeholders. For ongoing discussions and updates, users are encouraged to visit the official Persistence forum.

The Team Behind Persistence

Persistence is fueled by a powerhouse team of developers and entrepreneurs. Each member brings a wealth of experience and knowledge in blockchain, DeFi, finance, and technology. This diverse expertise allows Persistence to tackle complex challenges and drive innovation within the DeFi landscape.

Leading the Charge:

- Tushar Aggarwal (CEO): Tushar co-founded Persistence and previously established Southeast Asia's first regulated crypto VC fund LuneX. He actively contributes to the blockchain discourse in Asia and has been deeply involved in the crypto space since 2016.

- Deepanshu Tripathi (CTO): Deepanshu co-founded Persistence and boasts an impressive track record, including creating a payment platform used by Reliance and facilitating the world's first inter-blockchain NFT transfer.

- Abhitej Singh (Head of Strategy & Community): Abhitej leverages his 5+ years of experience in community development and marketing to foster a thriving community around Persistence. He has a proven history of building strong communities with organizations like Google Developers Group and Facebook Developers Circle.

This core team, along with the broader Persistence team, represents a formidable force for innovation and growth within the DeFi ecosystem.

Last updates

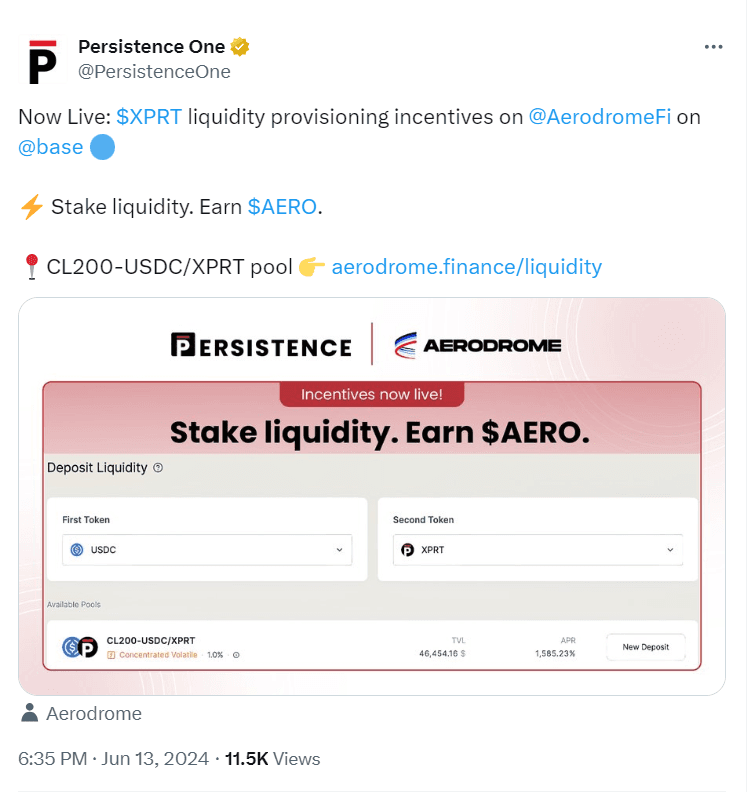

Persistence One is strategically expanding the reach of its native token, XPRT, by introducing it to the Base ecosystem. This move aims to build deeper liquidity reserves for XPRT holders and enhance accessibility for a larger global market.

Further integrations with high-activity chains like TON and Blast are also in the pipeline.

To enhance the security of its Core-1 chain, Persistence One is partnering with Babylon Chain to leverage Bitcoin's economic security. This pioneering strategy merges the robust security of Bitcoin's Proof-of-Work (PoW) algorithm with the energy efficiency of Persistence One's Proof-of-Stake (PoS) mechanism, creating a network that is both more secure and reliable.

Furthermore, the team is actively developing a Bitcoin Liquid Staking solution, empowering BTC holders to participate in staking and earn rewards while maintaining the liquidity of their assets.

The Future of Liquid Staking

In 2021, Persistence One embarked on a mission to revolutionize the staking landscape, envisioning a future where staking yields would become the cornerstone of the crypto economy, mirroring the role of fixed income in traditional finance.

Today, its ecosystem products, pSTAKE Finance and Persistence DEX, are thriving, solidifying the foundation of this economic layer. Looking ahead, the ecosystem is set to expand with the introduction of new financial primitives like Money Markets and Vaults, along with innovative concepts like Cosmos Restaking. These additions will not only maximize yield but also strengthen security within the ecosystem.

The team predicts that LSTs will become the preferred medium of exchange in the evolving crypto landscape, given their capital efficiency and utility. While the LSTfi (liquid staking finance) movement is currently gaining traction on Ethereum, it's only a matter of time before it makes waves in the Cosmos ecosystem. Persistence One's early adoption of secure infrastructure positions it as a leader, ready to capitalize on this emerging trend.

Security is a core tenet of Persistence One's philosophy. Its native token, XPRT, boasts a consistently high staking ratio (>75%), providing a secure foundation for economic activity on the chain. The development team prioritizes security at every step, implementing stringent measures, comprehensive code audits, and an active bug bounty program.

The platform is also actively working on integrations with Babylon and Ethos to adopt the security of Bitcoin and restaked ETH security. To go beyond single assets, Persistence One is also building the Restaking infrastructure for any chain to adopt security from any other chain.

Expanding the boundaries, the team announced Restaking to the Cosmos ecosystem. This solution will not only enhance yield potential, but also reinforce the security of PoS chains and dApps, creating a mutually beneficial ecosystem.

By developing additional features, Persistence One creates a secure environment for users and opens up the potential for new opportunities in the emerging Liquid Restaking Token Finance (LRTfi) space, further enriching the staking landscape.

Conclusion

The ability to unlock billions in additional liquidity through liquid staking presents a compelling value proposition and a wealth of opportunities.

Persistence One is committed to bringing this vision to fruition by fostering a comprehensive liquid staking platform that not only providing solutions for asset issuance and utilization within DeFi, but also fostering a more secure, resilient, and accessible financial ecosystem.

The unique approach to unlocking the liquidity of staked assets while enhancing network security is a testament to its commitment to innovation and its pivotal role in shaping the future of DeFi.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.