Key Takeaways

- Bitcoin Staking: Babylon enables decentralized Bitcoin staking on Cosmos, enhancing the security of PoS blockchains without centralized custody or token wrapping.

- Restaking Mechanism: Babylon allows Bitcoin restaking, offering stakers additional opportunities to earn rewards on PoS chains.

- Security as a Service: Babylon enhances blockchain security by leveraging Bitcoin’s decentralized nature.

- Rapid Withdrawal: Users can unbond staked Bitcoin in under 5 hours, ensuring liquidity.

- Wide Applicability: Babylon’s modular framework can be used across various PoS networks.

Babylon Chain: Decentralized Bitcoin Staking on Cosmos

For those unfamiliar, the Bitcoin blockchain launched for the first time in January 2009.

Bitcoin (BTC) is analogous to digital gold and should be held as a store of value to safeguard long-term wealth.

Bitcoin underpins the most censorship-resistant and decentralized computer network in the world, spawning the global crypto movement as a means to fight back against the antithesis of centralized power that seeks to disintermediate our greater society.

Throughout its entire history, the Bitcoin network has operated via Proof-of-Work (PoW) and will continue to do so for the foreseeable future barring a catastrophe of epic proportions where centralized entities forcefully take control of the network.

Because Bitcoin operates using PoW consensus, the protocol employs the use of miners as opposed to Proof of Stake (PoS), which makes use of staking whereby users deposit their tokenized assets as stake into validators operating on the platform.

In general, most current blockchain iterations employ a form of Proof of Stake. As a reminder, well-known PoS networks include Ethereum, Cosmos, Solana, NEAR, Sui, Aptos, and others.

Because Bitcoin doesn’t use Proof of Stake and instead employs Proof of Work, it is not possible to stake bitcoin (BTC) directly on the Bitcoin blockchain. The end result is the need for a paradigm that allows for decentralized bitcoin staking in a manner that doesn’t leverage a third-party custodian or token wrapping service. This is where Babylon comes in.

Restaking and Babylon’s Mission to Scale the Decentralized Economy

Babylon’s larger mission is to scale Bitcoin to secure the decentralized crypto economy. To realize this goal, Babylon makes use of three primary aspects of Bitcoin: its tokenized asset, its robust timestamping service, and its inherently censorship-resistant blockspace.

To harness these characteristics, Babylon is conceptualizing three state-of-the-art security-sharing protocols. These include: the Bitcoin Staking Protocol, the Bitcoin Data Availability Protocol, and the Bitcoin Timestamping Protocol. If you’d like to learn more about how these protocols work, consider reading our article on Babylon's technical architecture.

These pioneering platforms allow Babylon to provide accessibility to nearly any Proof of Stake Cosmos chain as a means to utilize bitcoin staking, data availability (DA), bitcoin timestamping, and bitcoin restaking.

As a reminder, restaking is a new paradigm in decentralized finance (DeFi) that allows previously staked assets to be simultaneously staked a second time within an alternative platform or protocol.

Essentially, blockchain-specific assets (such as ether (ETH) or others) are deposited and staked within a protocol operating on a mainchain. In return, the user receives specialized tokens called liquid restaking tokens (LRTs), which are then bonded and staked again within a separate platform.

In addition to typical Cosmos Layer 1’s, Babylon’s Bitcoin staking protocol allows non-Cosmos PoS chains, Layer 2’s, data availability (DA) networks, oracles, and more to harness staking capital from the Bitcoin protocol, the largest, decentralized blockchain network in the world.

This functionality greatly enhances the utility of the staked asset because it dramatically increases the potential rewards that can be accrued by both validators and nominators (i.e., delegators).

Babylon’s mission is to bring security-as-a-service to Proof of Stake blockchains through staking and restaking via the Bitcoin network.

Babylon Chain History and Founding

Babylon chain was founded in May 2022 by CEO David Tse and CTO Fisher Yu.

Dr. Tse obtained his PhD in electrical, electronics, and communications engineering at the MIT School of Engineering between 1989 and 1994. David also spent almost 2 decades (between 1995 and 2014) as an engineering professor at the University of California, Berkeley. Since leaving Berkeley in 2014, Dr. Tse has continued to work as an engineering professor at Stanford indefinitely.

In addition to being a long-time member of the U.S. Academy of Engineering, Professor Tse is the renowned inventor of the proportional-fair scheduling algorithm for wireless communication networks and the recipient of numerous prestigious engineering awards including the IEEE Claude E. Shannon Award and the IEEE Richard W. Hamming Medal.

Prior to his extensive experience in tech and various entrepreneurial ventures, Fisher Yu completed his bachelor's degree in engineering and telecommunications engineering at the Northwestern Polytechnical University in Xi’An, China between 2004 and 2008. After completing his studies in China, Mr. Yu moved to Australia and completed his master’s and PhD in philosophy and telecommunications engineering at the Australian National University between 2009 and 2016.

Before co-founding Babylon, Yu spent time as a lecturer and postdoctoral researcher at the Australian National University between 2015 and 2017 and later at the University of Southern California. In addition, Dr. Yu worked for InterfereX Communications between 2016 and 2017 as a senior system engineer before going on to work at Dolby Laboratories between 2018 and 2022 as a senior staff engineer.

In addition to Dr. Tse and Dr. Yu, the Babylon team encompasses members from a wide range of backgrounds and disciplines including consensus protocol researchers from Stanford and around the world. These include Head of Technology Strategy Xinshu Dong, Head of Product Strategy Sankha Banerjee, CMO Shalini Wood, Head of Community Spyros Kekos, and Lead Engineer Vitalis Salis.

The Babylon project also lists Cosmos OG’s Sunny Aggarwal (the co-founder of Osmosis) and Zaki Manian (the co-founder of Sommelier) as project advisors. As well, the founder of restaking protocol EigenLayer, Sreeram Kannan was an early contributor to the development of Babylon prior to focusing solely on EigenLayer.

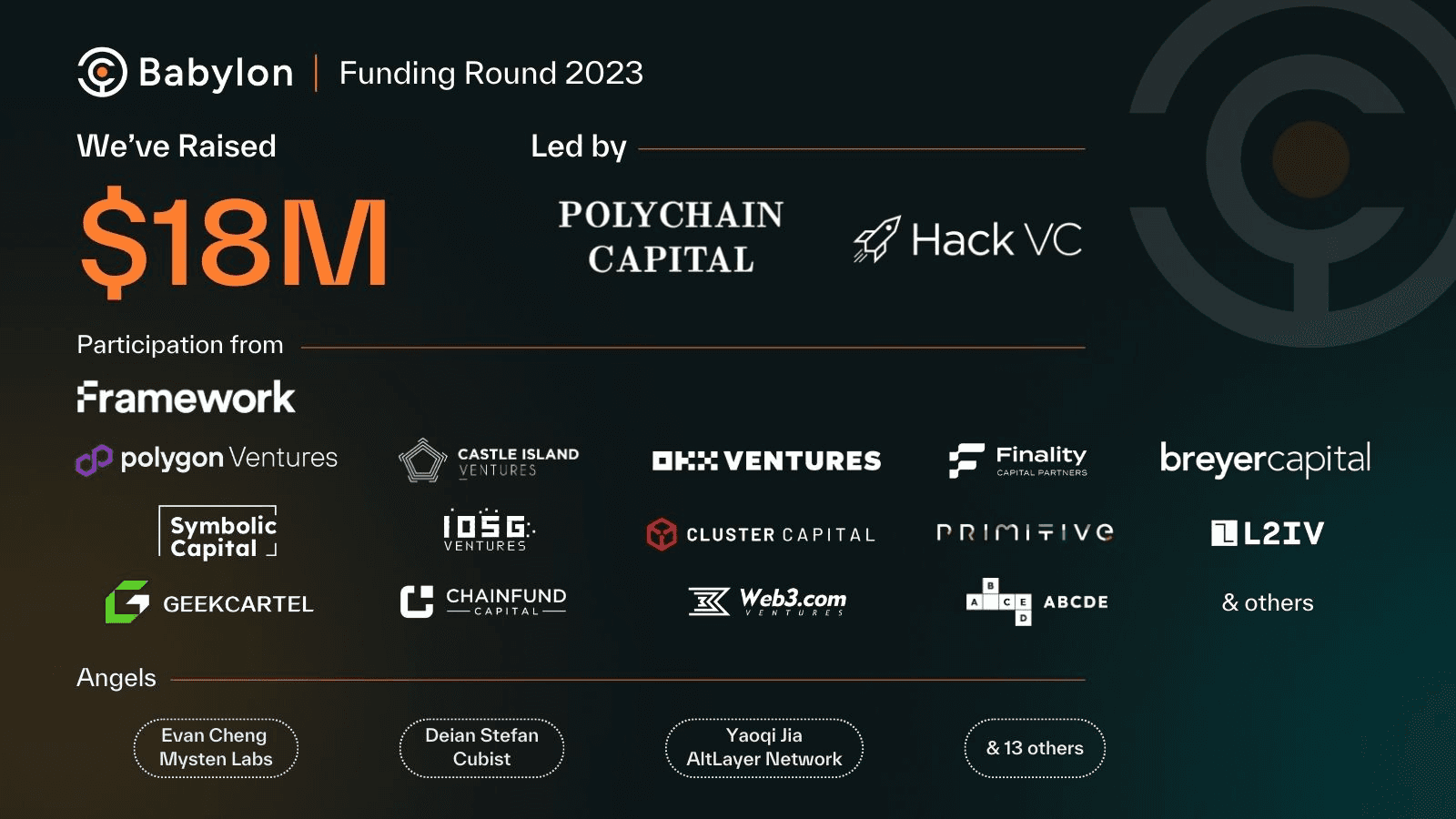

Initial Babylon Chain Funding Rounds

During January 2022, Babylon raised an undisclosed amount in its first seed round from notable VC crypto investors including IDG Capital, Frontiers Capital, Exponential Ventures, DHVC, Continue Capital, Breyer Labs, and Alumni Ventures.

Just over a year later, in March 2023, Babylon raised an additional 8.8 million in a seed funding round led by Breyer Capital and IDG Capital, with participation from numerous additional VC firms.

On December 7th, 2023, Babylon finalized a capital raise for an additional 18 million via a Series A funding round. The round was led by Polychain Capital and Hack VC, with participation from Polygon Ventures, OKX Ventures, Finality, Breyer Capital, Castle Island Ventures, Symbolic Capital, and others; along with Angels Evan Cheng (the founder of Mysten Labs and Sui) and Yaoqi Jia (the founder of AltLayer Network), among others.

Babylon’s Binance Funding Round

On February 27th, 2024, two months after the culmination of Babylon’s Series A round, it was announced that industry titan Binance had invested an undisclosed amount in the project. This capital allocation will be used to support the development of Babylon chain moving forward as a means to broaden the Babylon ecosystem and its vision to extend shared security and staking via the Bitcoin network. To familiarize yourself with the Babylon chain ecosystem, consider reading our ecosystem deep dive article.

Upon the partnership and funding announcement release, the co-founder of Binance and Head of Binance Labs, Yi He, noted that: "Bitcoin staking introduces a crucial new use case for the industry, marking a significant stride in the integration of Bitcoin with the Proof-of-Stake economy. Binance Labs’ investment in Babylon represents our commitment to supporting innovative projects leading the Bitcoin narrative and advancing its use cases.”

While David Tse, co-founder and CEO of Babylon stated: “The Bitcoin staking protocol unifies the entire blockchain industry, from Bitcoin to the PoS world. We are thrilled to have the support of Binance Labs in building such a broad-based Babylon ecosystem.”

Understanding the True Value Proposition of Babylon Chain

It's important to comprehend the problems Babylon chain solves and why the project contributes to the development of a more democratized global crypto economy.

Babylon is an independent middleware system that enhances the capabilities of non-Bitcoin-connected Proof of Stake blockchains on the greater Cosmos network. The network offers a means for all of us to participate in the greater bitcoin economy through the Keplr wallet and its multi-pronged non-custodial approach.

Challenges With Proof of Stake Blockchains

Most blockchains employing PoS are extremely capital intensive, requiring a significant amount of tokenized value to be bonded within their respective validators. For those unfamiliar, PoS chains are built to host validators on-chain which are then responsible for finalizing and auditing the legitimacy of blocks and ensuring correct network consensus in exchange for tokenized rewards.

Centralization issues often exist on Proof of Stake networks. Case and point, the larger the stake held by an entity, the more control they are theoretically able to garner over the network.

Wealthy validator infrastructure service providers can sometimes have a significant amount of capital at their disposable, meaning should they choose to, they are theoretically able to buy an exorbitant amount of a token, which they then use to run a validator node on the intended chain.

This results in a potentially dramatic increase in voting power for that specific validator over the entirety of the network. Historically, PoS chains have been anchored to their native assets to support their underlying security. Bootstrapping security is especially challenging for newly launched chains because of the highly volatile nature and lack of liquidity of new tokens.

Because of these reasons and others, highly inflationary rewards are often implemented and distributed post-launch to incentivize early network participant staking, potentially leading to unbalanced token economics and restrained token value accrual long-term.

The Babylon Chain Solution

Through Babylon chain, users are able to recalibrate the Bitcoin blockchain as an accessibility point to earn yield by staking the bitcoin asset on standalone Cosmos chains.

Over the last several years, bitcoin has been lauded as perhaps the best store of value in existence. Unfortunately, in many ways the utility of the bitcoin asset is quite limited. Babylon offers a solution to this problem by allowing bitcoin holders to stake their idle and unencumbered BTC to increase the security of PoS chains, while simultaneously earning staking yield.

This model solves the issues that centralized third-party staking services are susceptible to, while eliminating the need for token wrapping and other security-flawed alternatives.

Because Babylon offers seamless connectivity directly to Bitcoin, the protocol allows users to trustlessley stake their bitcoin without bridging their assets to a PoS chain, while at the same time, providing fully slashable security guarantees and rapid asset unbonding (it typically takes less than 5 hours to withdraw BTC on Babylon), maximizing liquidity for the end user.

Moreover, Babylon is designed as a modular plug-in framework that has the ability to be used as a control-plane between Bitcoin and a wide range of Proof-of-Stake blockchains and their underlying consensus algorithms, enabling a primitive that allows for the development of restaking protocols and other staking models.

This model creates an entirely new use case for Babylon chain, dramatically bolstering the economic security of Cosmos PoS chains and decentralized applications (dApps) built upon these individualized networks.

Differences Between Bitcoin and PoS Chains

The Bitcoin blockchain exhibits several important differences between itself and Proof of Stake chains, most notably:

- Unencumbered - because Bitcoin is secured by computational work, the bitcoin asset itself is not responsible for the security of the Bitcoin network. This is in stark contrast to Proof of Stake chains where the security guarantees of the network are cryptographically tied to the chain’s unit of value.

- More idle than PoS chains as a consequence of its network design, most bitcoin assets are idle (as they are typically held long-term) and not widely deployed. Since PoS chains accrue the majority of utility for DeFi yield-generating activities (think lending, borrowing, staking, and the like), bitcoin is typically bridged to other other chains or sent to a centralized third-party custodian as a means to accrue yield. Unfortunately, these providers often exhibit heightened risk for bitcoin holders.

- Highly decentralized - as the oldest blockchain in existence, Bitcoin possesses a more decentralized token holder set composed of miners, developers, early adopters, investors, project founders, exchanges, institutional investors, and others. In contrast, the assets provisioned through PoS chains are often concentrated in the hands of early investors, founders, early-stage team members, and foundations, especially in the early development stage. This wealth concentration exposes assets on PoS chains to centralization risks upon network staking validation.

- Reduced volatility - being the largest and most mature crypto asset, bitcoin has remarkably less volatility when compared to Proof of Stake assets. This is a bigger deal than many would think. Remember, PoS asset volatility is a critical issue to the security underpinning a PoS chain because it is directly correlated to the market capitalization of the staked asset, meaning a dramatic drop in the asset’s value can provide an opportune time for an attacker to strike.

Bitcoin Staking as a Two-Sided Marketplace

Babylon chain creates a two-sided marketplace for Bitcoin staking and acts as the control plane for the market.

On one side, Proof of Stake chains are incentivized to increase security within their respective networks and are willing to pay yields to stakers in order to do so. On the other side, bitcoin holders possess capital that could be put to better use by earning incentivized staking rewards. Therefore, this model addresses the needs of both participants equally.

A strong Bitcoin staking protocol should provide robust security guarantees to both consumer PoS zones (in order to pay for yield in exchange for increased network security) and bitcoin holders (as a means to incentivize them to stake).

This design allows bitcoin holders to lock their BTC into a Cosmos Proof of Stake chain of their choice to earn yields, while PoS chains and dApps are able to opt-in to bitcoin-backed security first-hand while also benefiting from healthier long term economics and broader adoption.

Resources

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.