Staking has grown into an integral mechanism of the cryptocurrency ecosystem and became a significant factor in how blockchain networks ensure their security and functionality. This article offers insights into staking from a multi-faceted perspective, its impact on network security, governance models, and the evolving DeFi landscape.

Key Takeaways

- Staking is one of the major parts needed to secure PoS blockchains and incentivize participation in the network.

- Staking decentralizes the power of validation by distributing it across the community.

- The reward mechanism opens numerous possibilities of passive income.

- Token holders can contribute to the decentralized governance of blockchain projects and shape their futures.

Staking: Engine of Blockchain Security

Security in PoS systems is directly related to the economic incentives and active participation of its stakeholders. Anyone who stakes their tokens can become a validator, tasked with the validation of transactions and the addition of new blocks to the chain. The more is a stake, the greater clout and potential rewards. But it is not only a question of personal benefits. Staking works to develop a sense of shared responsibility among its participants for the best interests of the network.

How Staking Enhances Network Security

- Two Sides of Economic Incentives: In the Proof of Stake systems, a validator has to stake some cryptocurrency as collateral. Besides the attractive rewards, there is also a deterrent. In case validators are involved in any dishonest practices, such as validating fraudulent transactions, they will lose their staked assets through slashing.

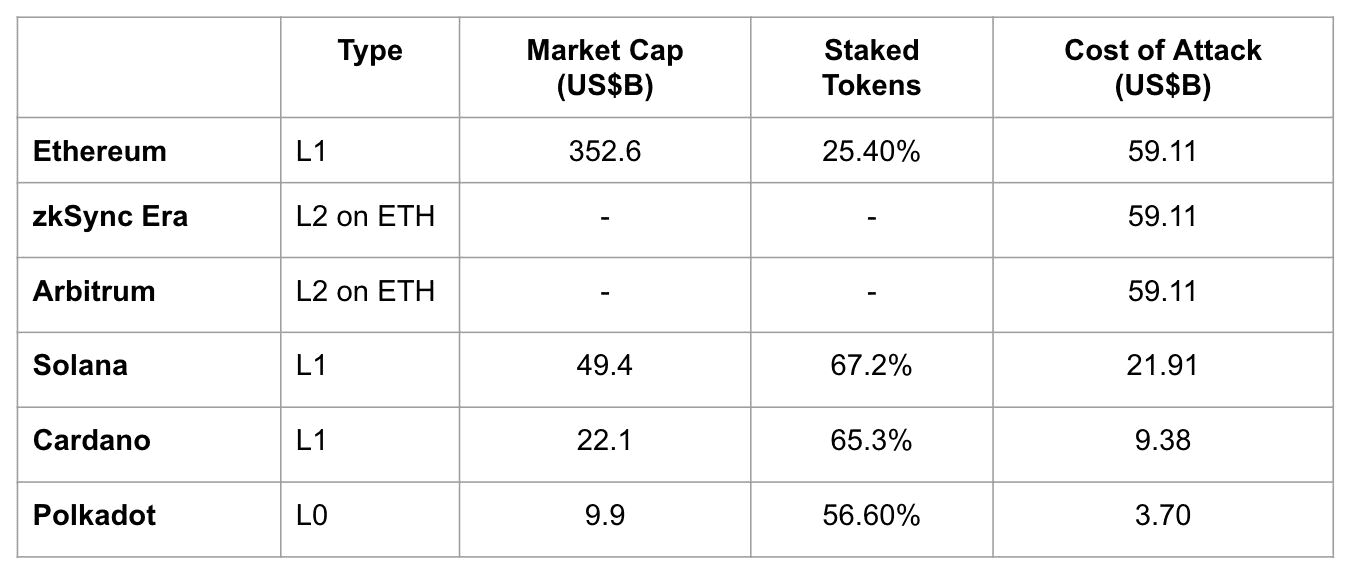

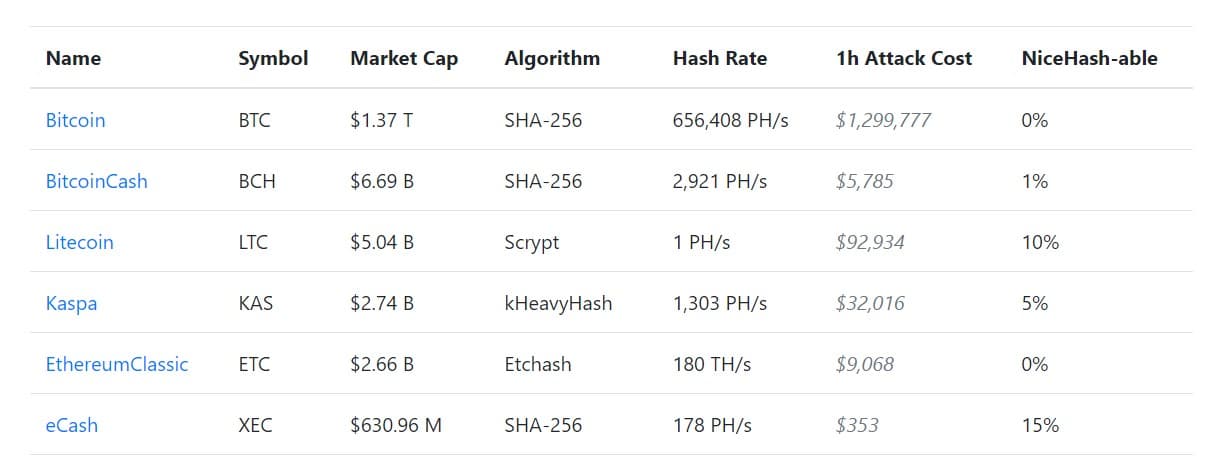

- Resistance to Attacks: A diverse pool of validators naturally increases decentralization, hence greatly making it hard for one entity to take control of the network or execute attacks, including 51% attack or Sybil attack. This means that the more validators in the network, the costlier such an attack will get, hence, the security of the network increases.

- Increased Staking Ratios: The general security of the PoS network is enhanced as the staking ratio, the proportion of the total tokens being staked, increases. After Ethereum switched to PoS and achieved a stake ratio of around 28%, this made it more resistant to attacks.

An attacker in a PoS system is highly discouraged from launching 51% attack because he would have to risk losing his entire stake amount to do so.

Cost of attack on PoS blockchains

As a comparison, the cost of a PoW blockchain attack

It means that staking turns the whole concept of security on its head. The external forces and/or centralized control are no longer a concern, but a self-regulated system whereby the community becomes a guardian to watch over the blockchain. With this comes a resilient and robust ecosystem, wherein the trust falls onto shared incentives with collective responsibility.

Staking: Decentralization Dilemma

Staking, being a cornerstone of many Proof-of-Stake blockchains, does seem to provide the most interesting paradoxes from a decentralization perspective.

On one hand, staking democratizes participation by making it possible for any user with a minimum amount of tokens to become a validator and participate in contributing to the security of the network and earning rewards. This aims to distribute power and prevent the concentration of influence that is all too common in Proof-of-Work systems, where mining pools dominate. But it is not quite so clear-cut.

In practice, the staking process may be a catalyst to the creation of new centers of power. Those with larger holdings naturally possess greater staking power, and risk creating a situation in which a small group of "whales" has disproportionate influence over the network. This is the very type of stake centralization that PoS is aiming to avoid.

Furthermore, technical challenges in operating a validator node could advantage those with broad resources and experience to manage such nodes efficiently, hence possibly excluding small stakeholders from active participation.

For instance, Lido is the most popular liquid staking solution and has emerged as a powerhouse in Ethereum's staking market. While it provides significant flexibility to users who wish to stake their ETH without necessarily having to lock up their assets, this rising dominance is raising centralization red flags. Lido currently accounts for nearly 30% of all staked ETH. The question, then, falls to single-point-of-failure risk and whether such a large stake in one platform would give it undue influence over the Ethereum network.

Therefore, it is about the design of the staking mechanism itself. Critical factors such as the minimum staking requirement, lock-up period, and reward distribution models can influence decentralization to a great degree: for instance, high entry barriers tend to favor rich individuals and institutional investors, while extremely attractive rewards for a few validators will inevitably lead to stake pooling and centralization.

In the end, true decentralization in PoS blockchains is not only about staking, but it is all about active community participation and well-thought-out governance mechanisms, including principles of inclusivity. The projects that nurture diverse participation, and build a culture of community involvement will easily leverage the democratizing potential of staking and avoid pitfalls leading to centralized power.

Staking: Decentralized Governance

As can be observed, staking more than just a technical mechanism. Decentralized governance through staking is a proof that the blockchain sphere is essentially the manifestations of one great collaboration. It's a mechanism that converts passive token holders into active participants in the governance process, giving them voice over proposed changes to the future paths of their chosen networks.

The Benefits of Stake-Based Governance

- Incentivized alignment: Users have to stake their tokens to participate in governance, this makes sure that people interested in the success of the network are contributing to decisions on its future. This effectively kills malicious leeway to take advantage of the system for one's own gain.

- Informed decision-making: Obviously, if users' tokens are put at stake, they then are more likely to research the issue and understand the implications of certain proposals. Thus, they make their choices more weighted and more profound, for the good of the whole ecosystem.

- Community-oriented mindset: When users have a voice in the directions of a project directly, they feel closer to it and believe in its success. Therefore, it creates a snowball effect: the more participatory the community, the greater the participation.

Expanding the Scope of Staking in Governance

In spite of voting on proposals is indeed a core part of stake-based governance, the potential of it goes far beyond this point.

- Development funding: Certain projects provide the possibility to reinvest part of the rewards toward funding specific development initiatives. This is one way to provide decentralized and democratic financing for the ongoing growth of the network.

- Content curation: In a decentralized content platform, the ability to stake can be used to reward users for highly valued content and punish those who would spread misinformation.

- Dispute resolution: The process of staking can be embedded in dispute resolution processes, where stakeholders can serve as jurors in finding resolutions to disputes on a network.

While blockchain technology is still evolving, we can only expect even more creative uses of staking in governance. With completely on-chain DAOs and prediction markets that use staking in incentivizing forecast accuracy, the possibilities are really endless.

Staking: Catalyst for Network Growth

The beauty of staking lies in its dynamic nature, where an increase in the staking ratio enhances network security and, in turn, attracts new investors. It is a virtuous circle feeding into the growth and stability of the whole.

Besides that, staking is hugely important in terms of attracting developers and fuelling innovation. Investors provide necessary resources and belief for the developers to build and grow out the potential of the ecosystem. As these developers create value in terms of features and applications, they grow the utility of the network, and attract more investment in return.

Staking serves as the catalyst, appealing to the sense of joint ownership among participants in organic growth and technological development. As a result, staking aligns incentives from token holders and developers to open ways to a strong and healthy blockchain ecosystem able to revolutionize industries.

But all this delicate balance requires quite a transparent governance and strong community involvement. Such a productive relationship calls for open lines of communication, well-defined decision-making processes, and the possibility for stakeholders to voice their opinions and standpoints. In such cases, all parties are heard and valued, and there comes up a collaborative atmosphere which will drive innovation and push the ecosystem into a bright future.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.