The DeFi ecosystem is an open frontier of innovation in finances, full of opportunities for those who would dare go through its complexities. In this expanse, there exist a couple of different pathways such as staking and yield farming, each differing in the way it leverages blockchain technology to generate passive income. This exploration will act as your compass, guiding you through the complexities of these strategies and empowering you to move into DeFi with confidence.

Key Takeaways

- Staking and Yield Farming are two excellent strategies to make your crypto work for you.

- Staking contributes to blockchain networks, while Yield Farming focuses on liquidity provision in various DeFi protocols.

- Staking and Yield Farming possess potential returns, however, they come with different levels of risks.

- Reward distribution is automated through smart contracts in both strategies.

- Staking works best for long-term investors whose goal is consistent returns with relatively low risk.

- Yield farming is based on active portfolio management, needing awareness of market conditions.

Mechanism of Operation

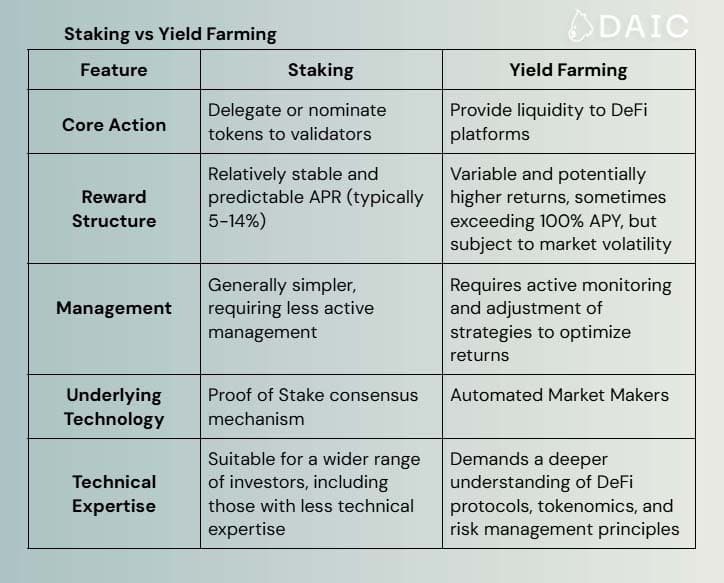

Staking is the core mechanism in Proof-of-Stake blockchains that allows token holders to be involved in network consensus and security while receiving rewards. By "staking" their tokens, investors basically delegate their voting rights to validators, who are responsible for maintaining the integrity of the blockchain. In return, stakers get some rewards from the network, typically in additional tokens. The process incentivizes users to support the network while attempting to decentralize and secure it by spreading the validation process over a network of stakeholders.

Staking facilitates a relatively predictable and stable source of income, with rewards often predetermined by a fixed annual percentage rate (APR). Depending on the blockchain, chosen validator and tokens in stake, the APR could change. Staking strategy is generally more passive, with minimal active management required. It becomes very attractive to long-term investors who would like to passively generate income and, at the same time, contribute to the growth and security of blockchain networks.

Yield farming, in contrast, is more complex and dynamic, involving providing liquidity to DeFi protocols such as DEXs and lending platforms. Investors supply tokens to liquidity pools in order to facilitate trading, lending, and borrowing activities on these platforms, receiving part of the fees that are generated from these actions. These yields can sometimes be quite impressive, above 100%, annual percentage yield APY, though they remain rather highly volatile and dependent on the overall performance of markets, platforms, and applied strategies.

This approach involves more activity compared to staking because an investor has to pay more attention to liquidity pools, adjusting the positions open and perhaps even moving to different platforms in the search for maximum return. It is a constantly changing landscape - new protocols and strategies are coming up all the time. Investors would need to stay informed of what is happening in the markets and adjust to such market dynamics.

APR vs. APY

How to navigate crypto rewards? There are two key metrics that can guide you: APR and APY. Both express returns, but with a key difference.

- APR, or Annual Percentage Rate, represents the yearly return without compounding. It is straightforward to calculate.

- APY stands for Annual Percentage Yield, which allows for compounding: that is, rewards earning rewards.

Understanding APR and APY will help you optimize your crypto journey.

Check out our article How to Calculate Staking Rewards: Tools and Tips to get more infos about staking rewards.

Liquidity and Flexibility

Most of the time, Staking entails some sort of commitment towards the network for a certain length of time, generally known as the "lock-up" or "bonding" period. In simple words, your assets are really "locked in" for that time while supporting the security and integrity of the network. Such a lock-up period may largely differ in various blockchain networks: from some days to even years.

Once your assets are staked, the process largely becomes a passive one. Rewards come automatically, based on the amount that one has staked and how that particular network rewards. This "set it and forget it" approach is a big lure for many investors looking for an easy way to create passive income. In return, the lack of instant access to your funds will limit your ability to quickly react to market fluctuations or capitalize on short-term opportunities.

On the other hand, yield farming offers better flexibility and liquidity. In general, you can withdraw your funds from a liquidity pool at any time without experiencing a lock-up period. In this way, you are able to change your position regarding market conditions, move assets across different platforms, or get out of a position if you foresee unfavorable market movements. This kind of agility is particularly priceless in the fast-paced world of DeFi, where opportunities and risks can shift in no time.

This flexibility comes with a trade-off, though: claiming your funds at the wrong time - in other words, during bad market conditions - means losses due to impermanent loss.

This happens if, within a liquidity pool, your tokens become very different in value from those you would have if they were outside the pool. The more the volatility of the market, the higher the chance of getting an impermanent loss. Consequently, while yield farming gives latitude in the quick movement of the owner's assets, it implies consistent watchfulness regarding market behavior and a calculated approach, so any kind of failures are minimized.

Investment Horizon

Staking aligns with the investment horizon of an investor looking for stable and predictable returns over an extended period. Investors that stake assets to contribute to the functioning of a blockchain network are engaging in long-term growth. This will be much more suitable for investors looking to preserve capital and generate passive income in a more consistent manner by accepting a lower risk profile for steady, predictable returns.

Yield farming is intended for investors with a very short-term investment horizon, willing to capitalize on dynamic market conditions and maximize returns in that compressed time frame. Because of this, active portfolio management will be necessary, along with constant monitoring of market trends and a readiness to quickly change positions. Greater opportunity for return is, as expected, offset by higher levels of risk, which involves a deeper understanding of DeFi protocols and an active attitude toward managing it.

Risk Profile

Staking, although being one of the less risky methods in DeFi, comes with some vulnerabilities. Events of slashing can punish the staked assets in the case of validator misbehavior or downtime. Choosing reputable validators responsibly reduces the risk. Market volatility can also hit the staked assets, but in staking impermanent loss, an important concern for conservative investors, is avoided.

Theoretically, Yield Farming may give higher returns, but investors also are highly exposed to risks. Further, impermanent loss based on fluctuating token values within liquidity pools requires careful selection and active management of a pool. Vulnerabilities of smart contracts might lead to funds lost, hence requiring extensive due diligence. What's more, the possibility of rug pulls means that the investor should carefully select an established platform with crystal clear governance.

The choice between staking and yield farming depends on the investor's risk tolerance and return requirements. The former is for more conservative investors seeking predictable, low-risk returns. Yield farming offers higher potential gains but requires a much greater risk tolerance and active management.

Empowering Investors in the DeFi Ecosystem

The DeFi ecosystem offers many possibilities, but understanding how everything works may seem very overwhelming. At DAIC Capital, we feel a strong passion for helping investors like you explore the DeFi landscape with confidence.

Our platform is built on ease and security, giving you the tools, resources, and support to make audacious strides in achieving financial goals. We have also set up a Slashing & Insurance Fund to protect your assets from risks. That protection allows you to not worry as you go for one of the fun aspects, that is staking.

Join us today and unlock the full potential of your digital assets!

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.