Key Takeaways

- Stroom Ethereum Bridge: Allows users to mint stBTC or bstBTC from Bitcoin, facilitating integration into Ethereum's DeFi ecosystem.

- Lightning Network Integration: Stroom-enabled Lightning nodes support decentralized liquidity routing, ensuring efficient BTC transactions.

- Multisig Federation: Validating nodes operate with a K-of-N multisig mechanism for secure transaction validation.

- stBTC and bstBTC Tokens: Provide liquid staking opportunities for BTC, enabling yield generation through DeFi protocols.

- DAO Governance: Stroom is managed by a community-driven DAO, ensuring decentralized control over platform updates and operations.

Introduction to Stroom’s Technical Architecture

The Stroom DAO is responsible for handling the processing of Bitcoin deposits into Lightning Network channels and the subsequent distribution of tokenized rewards. To enable this serviceability, the Stroom Network is made up of three main architectural components:

- Stroom Ethereum Bridge

- Stroom-enabled Lightning Network nodes/hubs

- Stroom validating nodes

Stroom Bridge

Stroom Network will begin by employing Ethereum bridge connectivity because Ethereum is the largest and most widely adopted DeFi chain in existence. In time, more chain integrations will be added as the Stroom platform matures.

In the event a user sends BTC to Stroom, it is credited to the Stroom DAO treasury. At this time, users are given the opportunity to choose whether they’d like to mint the corresponding amount in either stBTC or bstBTC via Ethereum through a bridging process. Both stBTC and bstBTC tokens are fully usable within the larger Ethereum DeFi ecosystem in a comparable manner to other Ethereum assets such as Lido Finance’s stETH.

The DAO treasury and bridge leverage a K-of-N multisig federation (where multiple keys are required for authorization instead of a single one-key signature, where k is the threshold and n is the total voting weight of all participating members) where all federation members (i.e., the larger set of validating nodes) are required to monitor both the Ethereum and Bitcoin blockchains.

In such circumstances, the K-of-N validating nodes approve all individual processes constituting InBTC (Ordinals Inscription BTC) minting, redemption, or LN channel opening and closing, while dividends from LN routing are distributed in InBTC.

To maintain the 1:1 peg of InBTC to BTC, Stroom provides the ability for users to redeem their stBTC directly for BTC. In addition, a portion of the BTC liquidity staked within the protocol is kept idle within the BTC treasury where reserves are allocated to carry out redemption processes (i.e., slight redemption fees are deducted from the balance to pay for related transaction costs).

Stroom-Enabled Lightning Network Hubs

All routing LN nodes (also called LN hubs) that connect to the Stroom Network must operate employing the network’s predetermined criteria. It's important to understand that these nodes do not have access to the BTC within their associated channels and that any action that alters the channel’s state requires authorization from validating nodes.

In order to manage the channel side of the hub, a K-of-N federation multisig script must be utilized as opposed to relying on a single private key as is typically customary in traditional LN setups. This implementation is realized by making use of Taproot-compatible LN channels that leverage Schnorr threshold signatures.

Along with delegating private keys to the federation, it is compulsory for LN nodes to submit all rescinded channel states signed by the associated channel counterparty to Stroom validating node databases. As a result, the Stroom-enabled hub acts as connection proxy to the federated Lightning Network node operated by validating nodes.

Importantly, this structure provides an innate Stroom Watchtower (an entity tasked with safeguarding the network and its funds) functionality that autonomously monitors the channel’s state. In the event a LN node unsuccessfully complies with the rule-set established by the federation, the federation will take the necessary action by terminating all channels affiliated with the specific non-compliant LN, while simultaneously removing it from the system.

Stroom Validating Node Consensus

On Stroom, a Schnorr signature signing algorithm called Flexible Round-Optimized Schnorr Threshold Signatures (FROST) is used by the network’s validating nodes to generate approvals for numerous operations. Nonetheless, it is critical to note that each validating node separately validates each individual event that demands approval without relying on additional nodes. In order to finalize an approval, a minimum of 2/3 +1 (meaning at least 66.6% of nodes must agree) votes from the validating nodes is needed.

Stroom validating nodes are responsible for storing current channel states and revocation keys along with updating LN status signatures. For example, all multi-party signatures required for redemption and minting are generated and stored within the validating nodes’ local database which is fully accessible by LN-enabled nodes.

These local databases carry out synchronization in a similar manner to a pBFT-style consensus blockchain where each Stroom validating node within the network is able to access one another to guarantee censorship resistance.

In order to support bridging, each full node is also required to integrate with both Bitcoin and Ethereum full nodes to collectively serve as a DAO-managed LN watchtower because of the fact that validating nodes are able to monitor LN channels through Bitcoin nodes. In addition, Stroom validating nodes and their balanced consensus are required to conduct proper DAO operations, while the necessary revocation keys are stored with local databases.

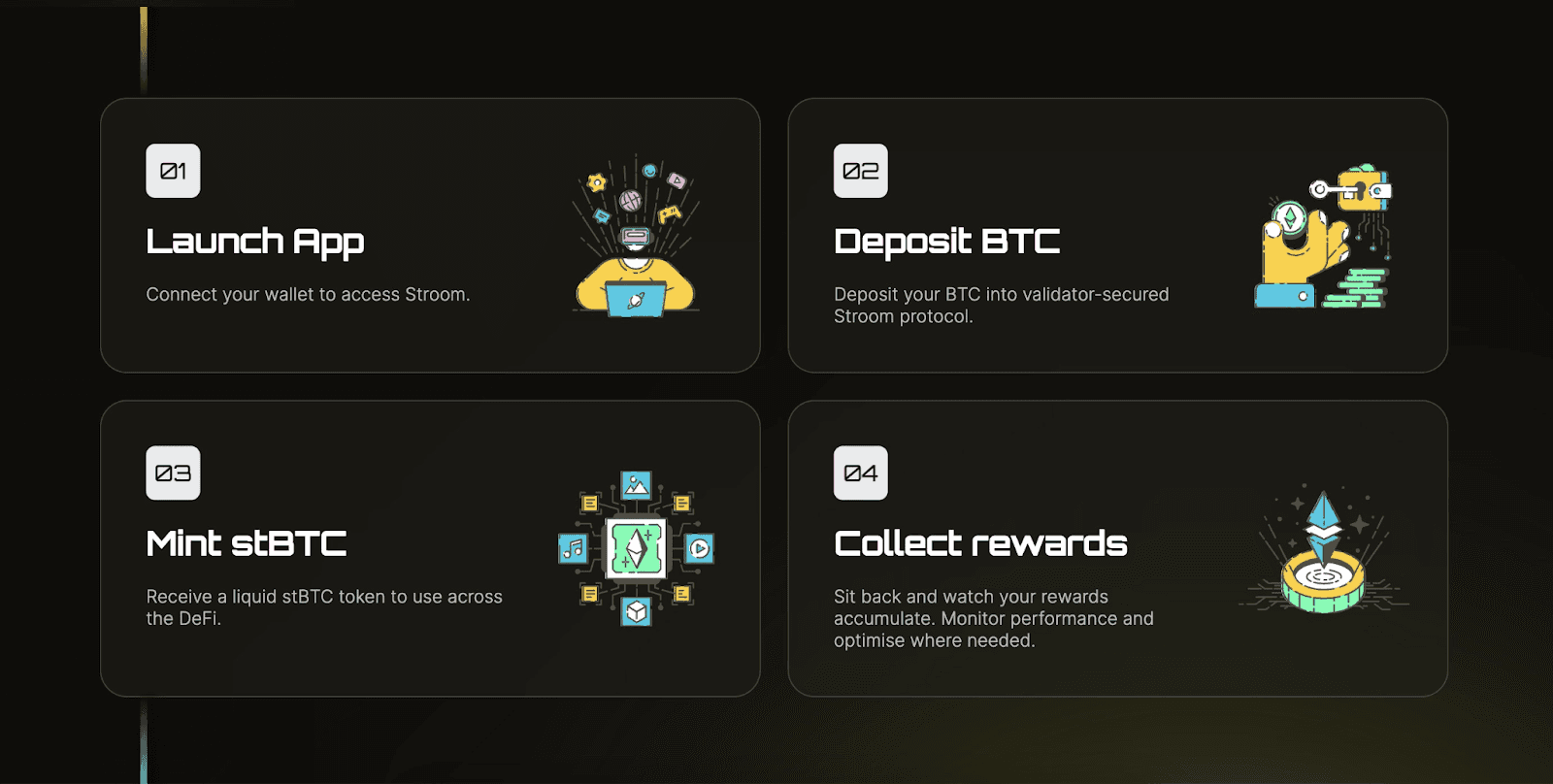

Basic Overview of Using Stroom

To utilize the Stroom liquid staking protocol, users are required to conduct the following steps in order:

- Connect your wallet to the Stroom Network dApp

- Deposit your BTC within the Stroom DAO treasury (atop the Lightning Network)

- Mint stBTC on top of the Ethereum blockchain

- Earn network fees and use your stBTC across the DeFi ecosystem while monitoring performance and optimizing your investments when needed

Stroom Network DAO Structure

To realize its intended purposes, the Stroom Network operates atop three continuously evolving protocols:

1.) Bitcoin,

2.) Ethereum, and

3.) the Lightning Network.

To operate in a trustless secure manner, it is critical that Stroom is able to communicate reliably between all three protocols.

In today's blockchain landscape, many Bitcoin-Ethereum bridges that are secure and trustless exist as multisig DAOs (such as RenBTC and others). Conversely, many Bitcoin-Ethereum bridges exist that are robustly secure and fully trustless (such as wBTC) but organized as multisig vaults that are managed by centralized custodians.

As a means to stake liquidity in LN channels trustlessly, it is necessary to employ a multi-party signature computation (MPC) to safeguard user funds. In decentralized and equitable DAO governance structures it is important to implement a community-governed decision-making process (via on-chain voting mechanisms) to increase transparency.

Through Stroom’s DAO structure, the community is able to:

- Institute and adjust incentives so signature holders behave honestly

- Replace a validating node if necessary (should they act maliciously)

- Upgrade the Stroom platform by proposing and approving changes within underlying protocols

- Fund the development and core functionality of the protocol with funds from the DAO treasury

- Govern funds collected via protocol service fees

Stroom Network Token Utility

Because of its design and intended capabilities, Stroom Network makes use of three distinct token types: stBTC, bstBTC, and STROOM. The STROOM token is the platform’s governance and utility token, while stBTC and bstBTC are Lightning Network-staked Bitcoin wrapped on the Ethereum blockchain (they are in fact liquid staking tokens or LSTs).

STROOM

As the native cryptocurrency of the Stroom Network, STROOM grants token holders governance voting power through the Stroom DAO which contribute to the network’s evolving parameters and the future direction of the platform. On Stroom, the voting power of DAO participants is proportional to the number of STROOM tokens staked with the voting contract.

Moreover, the STROOM governance and utility token plays a critical role in the network’s staking mechanism. To take part in network staking, employing both validator nodes and Stroom-provisioned hubs are required to stake STROOM tokens as collateral. Therefore, ensuring active network participation and vested interest in the ecosystem.

As it relates to staking slashing penalization, DAO governance proposals can be used to vote on the acceptance of upgrades to the network’s validating node and routing hub slashing mechanisms.

stBTC and bstBTC

stBTC (staked bitcoin) and bstBTC (bonded staked bitcoin) are liquid versions of BTC that are staked within the Lightning Network designed to generate native Bitcoin yield in the form of LN routing fees. Both tokens are designed to be used as liquid staking mechanism that allows users to maximize their returns within the Bitcoin ecosystem

In time, stBTC and bstBTC will be fully integrated within leading-edge DeFi platforms across the Ethereum ecosystem similar to Lido Finance’s stETH. That said, bstBTC is specifically designed to allow users to earn yield on native BTC, while simultaneously allowing for the ability to instantly convert bstBTC back into BTC should the need arise. This flexibility is particularly important because it lets users adjust their staking strategy and be in control of their funds at all times.

As a mechanism to ensure the liquid staking protocol is available to all network participants, BTC that is deposited during the minting of stBTC and bstBTC is deposited into Lightning Network channels via Stroom-enabled LN hubs as a means to generate rewards. Hub balances are monitored at all times while their revenues are redistributed to token holders on a daily basis similar to how Lido Finance distributes its staking rewards to its users (minus service fees).

At outset, to use the Stroom protocol, users will be required to deposit a minimum BTC amount of 0.01 BTC. In addition, the minting of stBTC and bstBTC must be approved via the federation of network validating nodes.

Relatedly, when a user wishes to redeem their bstBTC, the redemption of BTC to the user’s Bitcoin address must be fully approved by the federation of network validating nodes. When executed properly, the above operations should be processed by the network’s validators because the behavior is inherently ingrained within the protocol.

Potential stBTC and bstBTC DeFi Uses Cases

In addition to continuing the ongoing development of the Stroom platform, the Stroom team is working hard to forge partnerships within the DeFi landscape that will allow for Stroom’s integration in a host of DeFi platforms of all types within the Ethereum ecosystem.

The primary objective of this initiative is to exponentially increase the overall utility, adoption, and reach of Stroom and its stBTC and bstBTC liquid staking derivative tokens.

Let’s have a look at several main ways that both tokens can be potentially used within the Ethereum and Bitcoin ecosystems and beyond:

Lending Protocols

One of the main mechanisms stBTC and bstBTC can be used is within DeFi lending protocols. More specifically, they can be used for:

- Collateralization: stBTC and bstBTC can be used as a collateralized asset within DeFi lending protocols to secure loans within platforms such as MakerDAO, Aave, or Compound. By making use of collateralization tokens, users are able to access liquidity without being required to sell their initially collateralized assets (such as BTC or ETH, or a variety of stablecoins), therefore maintaining their long-term investment portfolios provided they pay back their initial loans as required.

- Yield Generation: By depositing stBTC and bstBTC within a lending pool, users are able to generate recurring interest. Like most lending protocols employing liquid staking tokens, when LSTs (i.e., stBTC and bstBTC) are deposited, the yield earned is in addition to the native yields (in BTC) earned from staking, meaning additional compounding returns for users.

Liquidity Provision

Like all tokens that liquidity providers (LPs) hold for DeFi protocol interaction, stBTC and bstBTC can be used as LP tokens within decentralized exchanges (DEXs) such as Uniswap, SushiSwap, and others. Generally, this utility involves:

- Liquidity Pools: By adding stBTC or bstBTC to liquidity pools within different DEX environments, users are able to take part in trading within a DEX to then earn a share of transaction fees for their efforts. By leveraging Stroom’s derivative liquid staking tokens for this use, liquidity within the Bitcoin ecosystem is enhanced and the LP is able to earn a continued income stream.

- Yield Farming: Users are also able to harness stBTC and bstBTC within yield farming platforms to earn additional rewards on their assets by making use of different types of yield farming pools.

Staking and Yield Optimization

Like many LSTs, by employing the serviceability of Stroom’s stBTC and bstBTC, users are able to earn increased rewards by making use of the following:

- Yield Optimization: By harnessing platforms such as Yearn Finance and others, users are able to optimize the potential for yields on stBTC and bstBTC. Platforms like Yearn allow users to leverage advanced yield generation strategies that have the potential to dramatically increase the returns generated on their staked assets.

- Governance Participation: Staking stBTC and bstBTC within DeFi protocols can give users the ability to participate in network governance on a host of platforms, while simultaneously allowing them to shape the future direction of a protocol (while earning yields for their efforts).

Restaking for Increased Yields

Since the introduction of EigenLayer last fall (see our initial EigenLayer blog post), restaking has become an emerging trend in the DeFi landscape. On Stroom, the protocol is able to take advantage of this mechanism through:

- Stacking Yields: On Stroom specifically, users are able to restake their stBTC or bstBTC to stack numerous layers of yield generation, ultimately compounding their potential rewards.

- Interoperability: Restaking allows users to “restake” their assets by bonding their tokens within a specific protocol, to then receive a liquid restaking token (LRT) which they can use in DeFi to earn additional rewards.

Outside of EigenLayer, another example of a protocol that employs the restaking paradigm is Babylon (see our introductory Babylon blog post).

Resources

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.