Key Takeaways

- Protocol overview: Infrared (IRED) is a liquid staking protocol built on Berachain’s Proof of Liquidity (PoL) framework.

- Liquid staking tokens: On Infrared, users earn iBGT and iBERA tokens through liquidity deposits, ultimately maximizing yield opportunities.

- Flywheel growth: The Infrared protocol creates a compounding flywheel effect that sustains liquidity growth, ensures emissions are distributed appropriately, while achieving a balanced governance voting structure.

- Ecosystem impact: The continued growth of the Berachain and Infrared ecosystems promotes deep liquidity and protocol-owned assets, while aligning incentives across users and existing protocols.

- Flexible yield strategies: Infrared’s customizable yield-bearing framework allows users to benefit from diverse staking rewards and increased governance influence.

If you're interested in Berachain, explore our dedicated section filled with blog posts and comprehensive guides: https://daic.capital/blog/category/Berachain

A Refresher on Berachain’s Proof of Liquidity

As a solution to the many inefficiencies of Proof of Stake (PoS) blockchains and the unbalanced economic incentivization structures of these chains, Berachain developed a newfound consensus mechanism called Proof of Liquidity (PoL).

Specifically, Proof of Liquidity is designed to benefit all ecosystem participants that make use of Berachain by distributing network-level incentives in a synergistic manner to all platform users. These include network validators, delegators, protocols/applications building on the chain, and liquidity depositors/users of the protocol.

Two main token types help create the reciprocal PoL flywheel effect that benefits the above participants: 1.) the Berachain Governance Token (BGT) and 2.) the BERA gas token.

Although BGT is typically is earned by users who deposit liquidity and make use of the Berachain’s suite of DeFi products and services (its DEX, lending platform, and perps markets etc.), it can also be earned by users who make use of various protocol within the larger Berachain ecosystem (such as Kodiak DEX and others).

This means BGT cannot be bought on the open market and therefore incentivizes users to continue to use Berachain ecosystem dApps. In general however, BGT emissions are only available to vaults whitelisted by Berachain governance, though Berachain’s own dapps (BeraSwap, BEND, BERPS etc.) receive BGT by default.

Typically during this process, a user interacts with an ecosystem dApp and receives a receipt token, which can then be deposited into an Infrared reward vault which is issuing iBGT to the owner of the receipt token.

In addition, BGT plays a critical role in protocol governance and can be delegated to network validators which can vote on users behalf if a vault should get whitelisted or not.

This design helps allow for the continued flow of users to applications/protocols built on top of Berachain helps bootstrap the success of their endeavors by providing them with regular users and liquidity. Thus, the Proof of Liquidity model benefits all network participants by incentivizing each participant role on a continuous basis.

Infrared: An Advanced Berachain Liquid Staking Platform

Infrared is a liquid staking infrastructure protocol built to operate as a liquid staking platform atop the Berachain network. As one of the first newly developed protocols incubated via Berachain’s Build-A-Bera program, Infrared was founded last year as one of the early projects that will soon operate upon Berachain’s mainnet in Q1 of 2025.

In many respects, Infrared is the most innovative liquid staking protocol built atop the Berachain platform. Essentially, Infrared is designed to complement Proof of Liquidity by provisioning sovereign chains, protocols, and applications building on the Berachain network to make use of their liquid staking services.

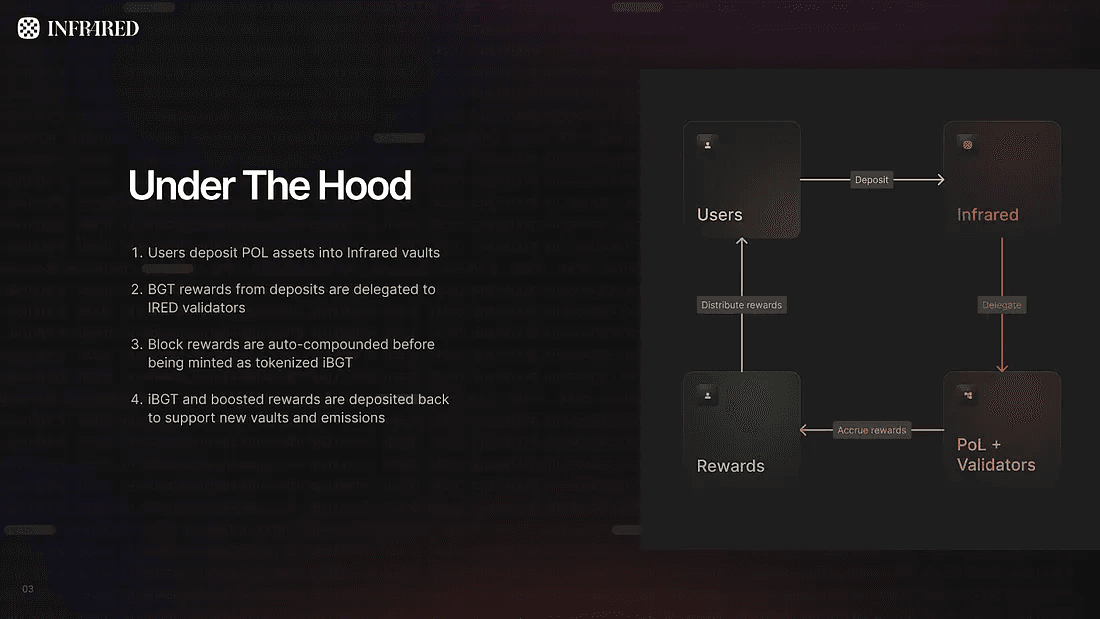

This is accomplished by providing the means for users to deposit liquidity through various Infrared vaults (liquidity pools). In particular, Infrared makes use of two individual liquid staking tokens (LSTs) called iBGT and iBERA that are generally (though not always guaranteed due to numerous variables) designed to provide access to the yield of the underlying asset (i.e., Berachain’s BGT governance token and Berachain’s BERA gas token) on a 1:1 ratio.

iBGT is a composable and flexible liquid asset that is liquid and transferable, meaning it allows users to earn yield in two ways while providing novel exposure to BGT, specifically: 1.) users are able to participate in DeFi by depositing their iBGT into liquidity pools, money markets, or other financial protocols atop Berachain, and 2.) they are able to stake their iBGT to earn yield directly from the underlying BGT. This dual approach allows for the customizability of a user’s potential yield generation strategies and risk appetite.

Let’s say a HONEY/BERA liquidity pool exists on Berachain’s BeraSwap DEX that is receiving BGT emissions and a vault is created on the top of that pool and it is possible to deposit liquidity through the Infrared vault. The earned BGT block rewards are subsequently delegated to Infrared and iBGT is emitted back to the users for their efforts.

In the background, the BGT earned from deposits is used to stake and run the Infrared validator set, positioning Infrared as a key actor in Berachain’s governance and a significant influence over BGT emissions. This governance power is distributed via Infrared’s governance token. Let’s explain below.

Introduction to the Infrared Emissions Flywheel

The presence of deep liquidity is pivotal to the success of any DeFi project. Therefore, it is crucial for all projects building on Berachain to strive to build up Protocol Owned Liquidity in their treasuries to ensure their project’s liquidity isn’t short-term capital and to encourage continued treasury growth.

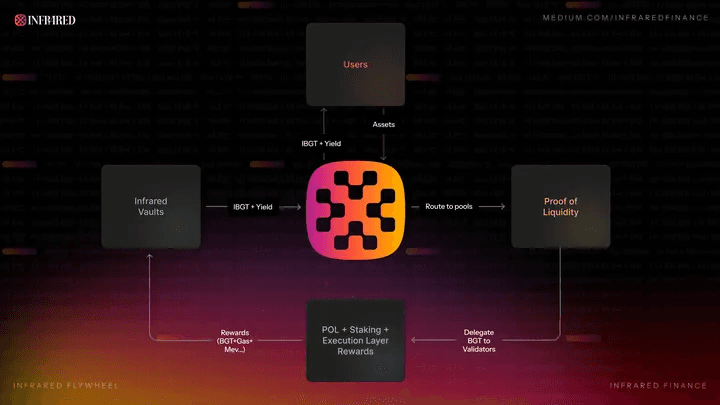

In time, projects with Protocol Owned Liquidity will seek to get their liquidity pools approved for BGT emissions to accrue additional rewards and realize increased governance influence. This is largely realized via Infrared’s emissions flywheel. Upon their pool(s) being approved for emissions (through the submission of a governance proposal where BGT can be used as a voting mechanism), users are able to deposit liquidity to earn iBGT and Infrared’s token emissions. iBGT offers a yield bearing liquid asset for their treasury, while Infrared’s token enables coveted governance control in addition to earnings from Infrared’s protocol fees and incentives.

It seems plausible that protocols will strive to boost their BGT emissions as much as possible to help them earn more iBGT to continue to increase the pool's liquidity. In this instance, it will be critical to incentivize the Infrared validator set to direct continued emissions towards their pool. This is realized via Infrared’s token.

Infrared’s token is a proxy that is able to influence Infrared’s BGT votes and validator set. By making use of Infrared’s token bribes (a system that incentives users to delegate their BGT to a specific validator within the set), protocols strive to incentivize Infrared validators to direct emissions to their pools. Next, these bribes are directed to Infrared’s token holders. This means that when protocols accumulate larger positions of Infrared’s token, they receive a proportional amount of their individual bribes back (meaning the more Infrared token they hold, the higher their incentivized rewards) via their existing Infrared token holding. In this way, the Infrared flywheel is realized.

Infrared Flywheel: Increasing Adoption and Benefiting Users

By leveraging the synergistic relationship realized via the Infrared flywheel effect, users and protocols benefit remarkably. The system streamlines how protocols operating on Berachain offer deep liquidity to increasingly benefit users by providing them with more confidence and flexibility in the platforms they choose to interact with.

Moreover, by enabling projects to build and more easily maintain robust treasures, there is a higher probability that projects using this model will survive over the long-term, escaping the pitfalls of limited liquidity and narrowed governance influence.

This renewed confidence and increased stability helps eliminate the potential negative consequences that could result in the absence of these critical elements within any DeFi protocol. Finally, the Infrared model continuously allows users to earn rewards emissions in iBGT and Infrared token for their ongoing efforts to create a platform that benefits all ecosystem participants in a balanced and effective manner.

For these reasons and others, as the Infrared ecosystem grows, its strong position as an aggregator for staking and governance power through iBGT will allow the protocol to become a foundational platform within the larger Berachain ecosystem.

The information provided by DAIC, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. DAIC does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.